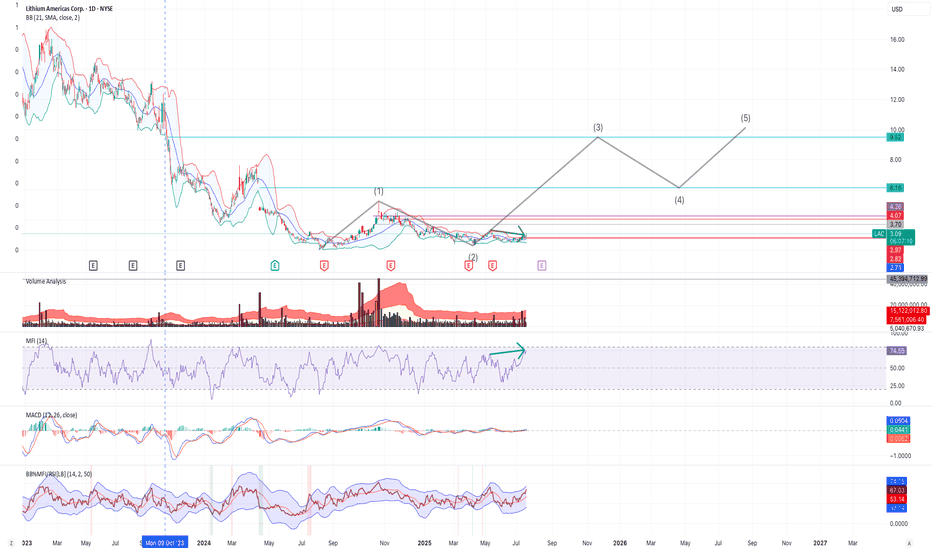

The 3rd Nevada Lithium Elliot WaveI believe LAC may have begun its 3rd elliot wave, with a bottom at $2.33. There also appears to be nice recent strong base support around $2.80. In addition, there appears to be a deviation between price and money flow, as shown with the green arrows - with a potential correction available to push price beyond $3.30 very soon.

I have entered and will watch its daily action and volume with an upside expectation limit around $9-10, then a 4th wave down, etc. Of course, I am not a financial advisor and I have been wrong before and will be wrong again. I trade within this reality and control my risk.

LAC trade ideas

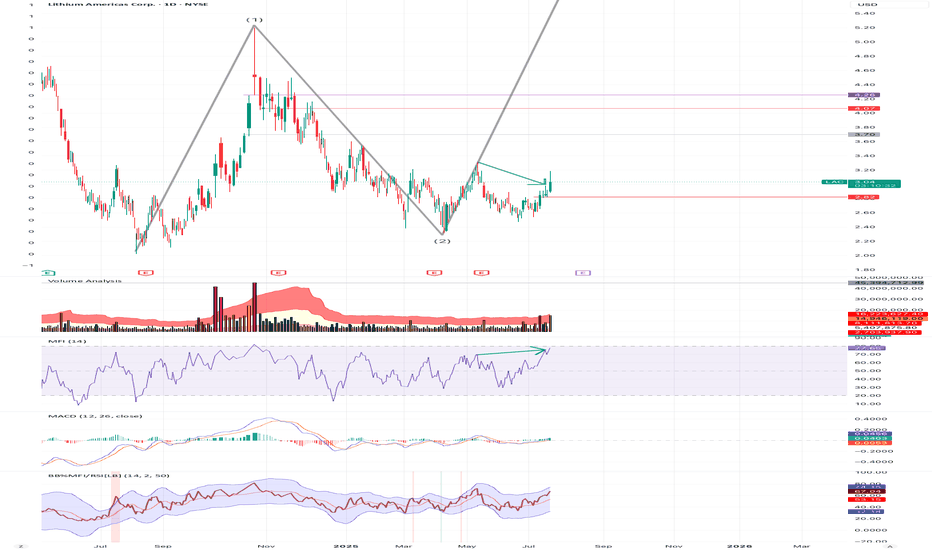

LAC (Lithium Americas Corp) – Bottom Reversal with Higher Low FoThe LAC stock chart suggests a confirmed bottom structure, supported by a clear higher low pattern—a strong technical signal that downward momentum has likely ended and a trend reversal may be underway.

After an extended downtrend, the price has formed a rounded bottom with two notable troughs, indicating accumulation and base building. The most recent low is higher than the previous one, marking a bullish higher low, which strengthens the case for a trend reversal.

Key Technical Signals:

Confirmed bottom: Rounded bottom pattern over the past several months.

Higher low: Recent price action has respected prior support and pushed higher, a bullish sign of strength.

Breakout zone: Price is currently challenging resistance in the ~$2.80–$3.00 range. A sustained move above this area would confirm bullish breakout momentum.

Upside targets:

First target: ~$4.49 (prior support turned resistance)

Second target: ~$5.19 (key historical resistance zone)

Trade Setup:

Entry: Current breakout attempt (~$2.85)

Stop-loss: Below recent higher low (~$2.43)

Risk-reward ratio: Favorable, targeting ~60–80% potential upside with limited downside risk.

Summary:

LAC is showing signs of a long-term trend reversal, with a confirmed bottom and bullish higher low. If momentum continues, a breakout rally toward previous resistance levels is likely. Traders may consider this a medium-term opportunity, with a solid technical foundation and clear upside targets.

$LAC up from here: support, elliot wave, price actionI believe LAC may have begun its 3rd elliot wave, with a bottom at $2.33. There also appears to be nice recent strong base support around $2.80. In addition, there appears to be a deviation between price and money flow, as shown with the green arrows - with a potential correction available to push price beyond $3.30 very soon.

I have entered and will watch its daily action and volume with an upside expectation limit around $9-10, then a 4th wave down, etc. Of course, I am not a financial advisor and I have been wrong before and will be wrong again. I trade within this reality and control my risk.

$LAC about to break out?I've been watching NYSE:LAC for a LONG time. I've traded this one in the past.

We fell all the way back to a major support zone from all time highs, and we also landed right on the long 13 year trend line for a 5th test.

Now, I typically dont take trades off trends that have been tested 4 times or more. But, in this case, our monthly trix is green, after hitting that trend and major support, and we also have volume capitulation showing up on the monthly chart, as well as the quarterly. (Not shown.)

As far as pattern, our initial break out move was a nice engulfing candle, and we did in face break the upper monthly band, the white moving averages that follow the tops and bottoms of the candles.

What you look for from here is a pull back to the opposite side of the bands, aka, the lower monthly band for a "first touch," this is where you enter, and is where I bought at $2.79.

First target is the upper quarterly band at $4.25. From there, you have the 1.27 Fib at $6.75, and the 1.61 at $9.25

I will likely exit 75% of my position at $6.25.

I feel like this one is worth watching. I will be really surprised to see this one fail from here.

Stay tuned.

LAC possible sequence ending? turnaround soon? Target 40+ usd?Following LAC for quiet a few years now; following its 3 count overall moves carefully, and waiting for a pullback. The Multi-year trend moving in a so called ABC structures, likely still forming an overall huge diagonal. It was roundabout at the 0.236 fib retracement for a possible wave 4, when fundamentals has been changed for LAC, primarly the company split and ongoing legal actions which made me wait for further draps, although a 0.236 retracement would have been acceptable.

Now, for the white scenario, it is possible we are ending the wave 4 pullback also as a big abc. Being an overall diagonal forming, for a wave 4 the 0.618 is also common, being said, it has almost reached it perfectly, so the risk-reward ratio is getting great for the very long term, to finish off wave 5 also as an abc to the upside, target would be primarly 40-55 usd, in a more bullish interpretation ~69 USD, LIKELY would take also several year (definetely not a few). Keep in mind with our current knowledge, the new mine's production likely ramping up in '26-'27.

fib support down at ~2.43, where the second small fib box upper support ~2.34 is an acceptable one IF there is no sustained, comfortable price actio break below.

For a bit more "bearish" scenario, we already finished of an "A" wave (orange route), either as a smaller diagonal, or I could make a case for a WXY as well, does not really matter. We are working now on orange circle B, which should be also an abc structure, in which we finished, or near to finish the (A) wave, and a correction should be imminent with a minimal upside target of 6.27 currently, but be aware it is a moving target, as price action evolves we might need to adjus that red resistance box. Standard support box is added for the orange route as well 0.9 usd being the last reliable support for a later evolving C wave.

On the 1h, 4h RSI and MACD has already built a nice divergence, on the daily it has started to built, early signs are there but not fully present. Weekly is coming up, towards ground levels. So far all the meaningful MA'S on the daily (9/21/50/52/180/200) was rejecting price action previously, currently trying to break above and close above the 9day SMA.

We do have a small head and shoulders pattern as well with a downtarget of ~2.29 which not neccessarly needs to be reached. This is the multi-year big picture, from this point forward switching from a weekly timeframe, to lower ones.

LAC & GM Team Up for Thacker Pass! Here I have NYSE:LAC on the Daily Chart!

NYSE:GM plans to contribute $625 Million and seeks to claim 38% of the Joint Venture!

This remarkable announcement this week seen the Price of NYSE:LAC hit 4-Month Highs after Breaking Above the Falling Resistance that was keeping it down.

The rally seems to be tamed by the Resistance Level and Low that was created in February but is now testing the Break of Falling Resistance for potential Support to keep pushing Price Higher!

If Price can Push through this area, we could see Price make a move for the Gap @ ( 4.9 - 6.37 ) then find Strong Resistane @ ( 6.83 - 7.65 )

Indicators:

- Price will need to test the 200 EMA in $4 range

- RSI is Above 50 (Bullish)

- Strong Bullish Volume with Breaking Candle suggests Valid Break

- BBTrend Printing Green Bars

LAC - Lithium is close for a reversalLithium Americas is a pure-play lithium producer. The firm owns one resource, Thacker Pass, that is located in northwest Nevada. Thacker Pass recently began construction and is expected to begin production in the mid- to late 2020s. Thacker Pass is one of the largest known lithium resources in the world. The project would be the first clay-based asset to enter production, and we estimate it will be in bottom half of the global cost curve. Management plans to develop Thacker Pass into a fully integrated lithium production site, with downstream refining capabilities on site, and will sell into the lithium chemical market.

Lithium has experienced a prolonged downphase, but a potential reversal is anticipated soon. This stock is viewed as a mid- to long-term hold.

Key Technical Levels:

Breakout Zone: $2.9 - 3.0

Action: If the stock breaks above this range with strong volume, it might signal a continuation of the upward trend.

Resistance Points:

$3.80

$4.50

$5.70

$6.50

$7.60

Surpassing these levels could signal a positive trend. Consider taking profits at these stages to realize gains.

Trading Strategy:

Take Profit (TP): Target 5.0 or at 10.80 to capitalize on the anticipated price gap closure.

Stop Loss (SL): Set at under $2.50 to mitigate potential losses.

Chart Analysis:

Please refer to the attached chart for detailed analysis of price trends and movements.

Trading Advisory:

Exercise caution and consider market conditions and your own risk tolerance when trading. It's advisable to conduct comprehensive research or consult with a financial advisor before engaging in trading activities.

Disclaimer: This content is for informational purposes only and should not be considered financial advice.

Lithium Americas ($LAC) Closed $4.73 on Friday's Session up 1.5%Lithium Americas ( NYSE:LAC ) has recently announced that it will raise $275 million to accelerate the development and construction of the Thacker Pass lithium project in Nevada. The company will offer 55 million shares for $5 per share, just a month after the US government disclosed its plans to lend $2.26 billion to support the project.

The Thacker Pass lithium project is expected to reach its full capacity in 2028, with an anticipated production of 80,000 metric tons per year. Lithium Americas ( NYSE:LAC ) aims to extract lithium from a large clay deposit at Thacker Pass, which has never been done before at a commercial scale.

The loan from the US government is a significant part of the Biden administration's strategy to reduce reliance on China for lithium supplies. The mine is expected to commence operations later in the decade and will play a crucial role in supplying General Motors.

In a statement, Vancouver-based Lithium Americas ( NYSE:LAC ) revealed that the underwriters of the public offering would be granted a 30-day option to purchase up to an additional 8.3 million shares.

Lithium Americas' US-listed shares closed at $6.63 on Wednesday, with post-market trading seeing a 19% drop. However, before the market closed on Friday, the stock surged 1.5%, setting the stage for a promising start during Monday's trading session.

The stock's recent crash could be attributed to two major factors. Firstly, the price of lithium has plummeted in recent months due to concerns of oversupply. Secondly, there is evidence that the demand for electric vehicles is on the decline. Many vehicle dealers in the US have reported that EVs are not selling as quickly as they did before, leading them to focus on Internal Combustion Engine (ICE) vehicles.

On a positive note, Lithium Americas ( NYSE:LAC ) has completed a spin-off of its operations into two separate companies: Lithium Argentina and Lithium Americas. This decision enabled the company to streamline its operations.

The company has also made a significant discovery in Nevada, which is set to become the largest lithium mine in the United States by 2026. It is currently developing the mine with the support of the Biden administration, which has agreed to provide $2.26 billion.

Investors of Lithium Americas ( NYSE:LAC ) believe that the company stands to benefit from the ongoing energy transition. As an American company, it will also profit from the favorable terms offered by the government through the Inflation Reduction Act (IRA).

However, there are still risks to this belief, particularly with the current era of lithium abundance. Countries like Australia, Chile, Argentina, China, and Brazil are all boosting their lithium production, with more countries expected to enter the market, resulting in oversupply.

The daily chart indicates that the NYSE:LAC share price hit its lowest point at $3.80 in February before rebounding to $7.73 this month, where it formed a double-top pattern. Currently, the stock has dropped below all moving averages and the 23.6% Fibonacci Retracement level, forming a down-gap. Therefore, it is likely to continue falling as sellers aim for the critical support level of $3.80, marking its lowest level for this year.

Lithium Americas (NYSE: $LAC) Plummeted 29.71% The stock price of Lithium Americas (NYSE: NYSE:LAC ) has experienced a sharp decline, plunging by over 27%, marking its biggest single-day drop since April 2022. This decline follows the announcement of a new fundraising plan by the company. Lithium Americas ( NYSE:LAC ) has been under significant pressure for some time, and as a result, its stock has plummeted by over 81% from its all-time high in November 2021.

This sharp decline in stock price coincides with two principal events. First, the price of lithium has taken a severe hit in recent months due to oversupply concerns. Second, there are indications that the demand for electric vehicles is on the decline. In the United States, many vehicle dealers have issued warnings that EVs are not selling as fast as they were previously. Consequently, many dealerships have shifted their focus back to Internal Combustion Engine (ICE) vehicles.

One positive development for Lithium Americas is the completion of a spin-off of its operations into two companies: Lithium Argentina and Lithium Americas ( NYSE:LAC ). This strategic move has enabled the company to streamline its operations. Additionally, the company has made a significant discovery in Nevada, which will become the largest lithium mine in the United States by 2026. The mine is currently being developed with the assistance of the Biden administration, which has committed to providing $2.26 billion.

However, the decision by Lithium Americas' management to raise $275 million to fund the development of the Thacker Mine in Nevada has resulted in a significant decline in the stock price. This move will dilute the shareholding of current investors. Despite this, Lithium America's investors remain optimistic that the company will benefit from the ongoing energy transition, and as an American company, it will enjoy favorable terms offered by the government through the Inflation Reduction Act (IRA).

Nevertheless, the current lithium abundance era presents risks to this optimistic outlook. Countries such as Australia, Chile, Argentina, China, and Brazil are all increasing their lithium production, with more countries expected to join the market, leading to an oversupply.

In terms of the stock price forecast, the Monthly chart shows that the NYSE:LAC share price hit a low of $3.80 in February, bounced back to $7.73 this month to form a double-top pattern, and has since fallen below all moving averages . The stock has formed a down-gap . As a result, it is expected to continue falling as sellers target the key support at $3.80, its lowest level this year.

U.S. Approves $2.26 Billion Loan for Nevada Lithium PlantThe Biden administration has greenlit a record-breaking $2.26-billion loan for Lithium Americas Corp., ( NYSE:LAC ) propelling the development of a Nevada lithium deposit—the largest of its kind in the United States.

The loan, extended by the U.S. Department of Energy, represents a significant milestone in efforts to advance sustainable energy infrastructure and reduce dependence on foreign sources of lithium—a crucial component in electric vehicle batteries, solar panels, and wind turbines.

Lithium Americas Corp., ( NYSE:LAC ) announced that the substantial loan will primarily fund the first phase of development, marking a pivotal moment in the company's journey to harness the potential of the Nevada lithium deposit. The project, spearheaded by the company's subsidiary, Lithium Nevada Corp., ( NYSE:LAC ) will see the construction of a state-of-the-art lithium carbonate processing plant adjacent to the Thacker Pass mine—a project valued at $2.2 billion.

With General Motors Co. investing $650 million in Lithium Americas, the Nevada lithium project is poised to become a cornerstone in the supply chain for electric vehicle manufacturers. As the automotive industry transitions towards electrification, securing a reliable source of lithium is paramount to meeting growing demand for sustainable transportation solutions.

The loan, described as the largest-ever to a mining company by the DOE's Loan Programs Office, underscores the government's commitment to bolstering domestic production of critical minerals. President Biden's climate agenda, coupled with increased focus on renewable energy, has catalyzed investments in projects like the Nevada lithium plant, positioning the United States as a global leader in sustainable energy technology.

Moreover, the loan comes amidst a broader push to revitalize the American manufacturing sector and create high-quality jobs in clean energy industries. By supporting projects like the Nevada lithium plant, the Biden administration aims to foster economic growth while addressing climate change and promoting energy independence.

Technical Outlook

NYSE:LAC stock is trading with a moderate Relative Strength Index (RSI) of 67 indicating a moderate bullish trend. Prior the news on the approval of the loan, NYSE:LAC surged by 9.16%.

Lithium stocks extremely oversold on weekly and Has bullish DivsLithium stocks in extreme oversold spots right now, these stocks like "LAC" in my opinion is very good long-term hold with at least 400% - 560% gains in upcoming year or two. You rarely see anything as cheap as this, possible we will never see these lows again in our life times.

When stocks like TSLA and other Electronics will rise Lithium stocks will skyrocket. I expect the bigger moves begin when the weather will start to get warmer as of now the EVs having trouble with their batteries dying because of the cold, this will issue will disapear in big part of the world at spring.

-------------

"Lithium" is a chemical element known for its use in rechargeable batteries, particularly in electric vehicles (EVs) and electronics. Its high energy density and lightweight properties make it crucial for the advancement of battery technology.

------------

Investing in lithium stocks at extreme lows could be worthwhile for several reasons:

Long-term Growth Potential: The demand for lithium is expected to surge as the shift towards clean energy and electric vehicles accelerates. This long-term growth potential could make lithium stocks attractive at low prices.

Supply and Demand Dynamics: Despite fluctuations, there's a general consensus that the demand for lithium will outpace supply in the coming years. This could drive prices up and benefit companies involved in lithium production and exploration.

Diversification: Including lithium stocks in a diversified investment portfolio can offer exposure to the rapidly growing electric vehicle market and the broader renewable energy sector.

Technological Advancements: Ongoing research and technological advancements in battery technology could further increase the demand for lithium, potentially benefiting lithium producers and related stocks.

LAC bullish continuationHello traders,

today we are looking on the price of LAC. Looking at the chart, it's clear we are at a crucial point where the direction is about to be determined. We expect the price to break out from the current pattern and head higher. It is worth noting that the price found support at weekly level, which also correspond with the golden pocket area on the Fibonacci retracement.

Good luck.