Trican TCWCA Short Weak Oil and InflationTrican Well Service Ltd. (“Trican”) released its Fourth Quarter 2022 results on Wednesday, February 22, 2023 after the close of the market. The Company hosted a conference call on Thursday, February 23, 2023 at 10:00 a.m. MT (12:00 p.m. ET) to discuss the Company’s results for the Fourth Quarter 2022.

Trican is oil sensitive.

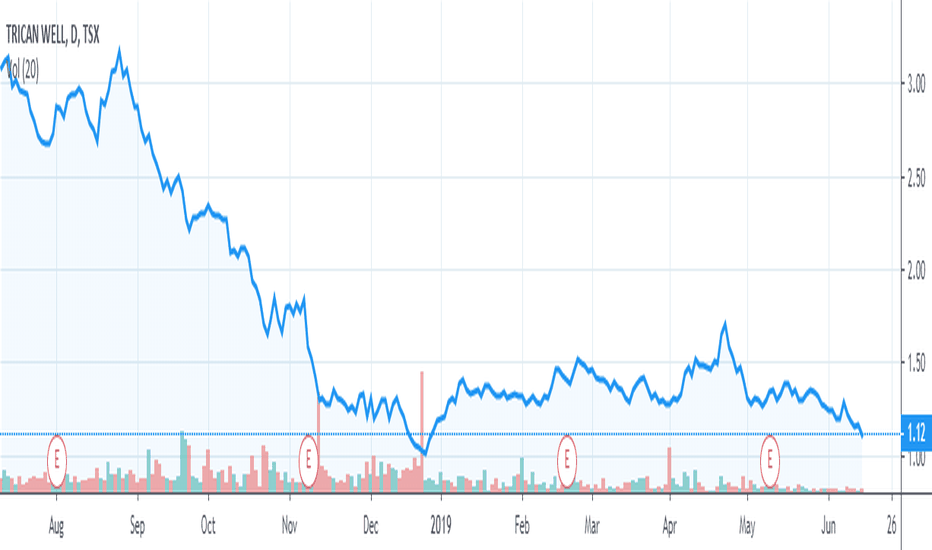

Trend Bearish

short

Possible pivots(See S+R on the chart)

Strategy: Trend Bearish

TCW trade ideas

TCW Trican Bullish thesis around this company revolves around the continuing pick up in drilling and well activities throughout alberta, saskatchewan leading to increases demand for their services which they have already talked about in most recent earnings filed.

They also highlighted having issues finding enough workers to fill all of the demand they are getting.

Trican, a compelling opportunity.Trican Well Service has come along way since they were last trading at lowly levels in 2016. The company has sold some overseas divisions and paid off mostly all their debt, acquired their largest Canadian competitor in 2017, Canyon Tech. For the past few years they have been re-purchasing their own shares thru an annual NCIB. Even during the most bearish times, the company has persevered and is positioned best for any uptick in activity in Canada. Trican's equipment is the best in Canada, able to facilitate high intensity plays which not all fracing equipment is up to task. Very shareholder friendly, tried, tested and true management under CEO Dale Dusterhoft.

Overall this is perfect stop to buy and hold. It could very well be trading towards $5 in 12-24 months if things turnaround.

Purchasing this stock now is at a time of peak bearishness, in Canada and also in the global energy sector.

$Oil rallies on positive API - Long order filled for $TCWA buy order that I placed months ago for Trican Well Services ($TCW) was triggered at today's open. API numbers for Oil appears to have been released. I have set my s/l around $3.00 for the time being. I plan to hold this trade for a few weeks, possibly longer. Parabolic SAR has turned Bullish but we are still below the kumo cloud. This stock ultimately will follow the price of $OIL. If the rally can continue, volume will increase and $TCW should advance. Buy and hold...just my thoughts, not financial advice.

TCW Counter Trend OpportunityThe price of this stock is inside a descending channel. The lower black line is the support while the 50 MA is the acting resistance level.

I think the price would hit around $2.83 being its support level. I will buy with 2 confirming candles and sell once it hits the resistance level which is the 50 MA.

This is another stock that has 50c profit/share. Risk is moderate. I would enter with only a few hundred dollars.