TSX trade ideas

TSX: May Be Looking for a Longer-Term Sell-off in Feb/MarchThe TSX has broken out of its range clearly, in early 2020 where the TSX has risen quite comfortably and has been one of the better performing indices thus far in 2020, around the world.

The TSX will likely fall at some point in the near future to roughly 17400, however, the reaction of whether it follows its current longitudinal channel and thus bounces off that level or sinks back to a secondary channel is possible and yet to be seen.

It appears Gold and Silver are close to breaking out and this will be at the expense of markets around the world falling likely due to the coronavirus that continues to ravage China's growth.

This is not the time to be buying large lots of equities on any index unless a correction happens and/or the virus is contained.

For those who still want to invest, Enbridge, TRP and Constellation Software and some of the more lower beta stocks when volatility hits.

- zSplit

S&P/TSX Composite Index can test Minor Resistance LevelsWhen we look at Canadian instruments during the Autonomous LSTM Adaptive period:

We see a cheapness in both stock markets and currency.

Even though I have a positive opinion about the target, let's try it out in small quantities and leave more position size in case of a second try on negative scenario.

This analysis can be more risk-free with the following parameters:

Position Size : %1 for Index Futures or Small percentage of Portfolio

Risk/Reward Ratio = 1/1.99

Stop-Loss : 16911.75

Goal : 18032

NOTE:

The unapproved short signal is the leading indicator of volatile movements.

So let's be careful.

Let's leave more room for the second attempt, which, when the circumstances are in our favor, let us gain much more of our loss.

Regards.

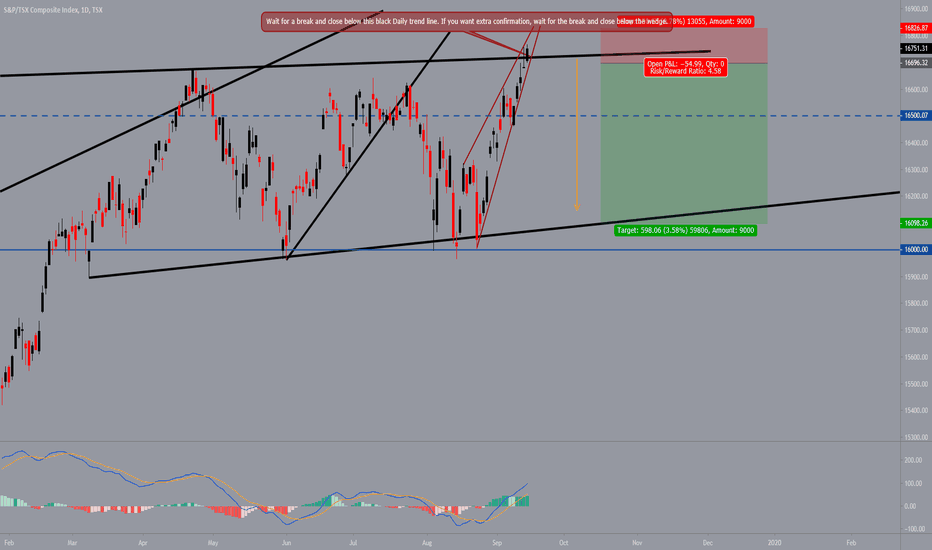

Short TSX - High probability OppurtunityFollow the instructions as mentioned in the text box. Once the price closes below the black trendline, put your stop loss a few points above the highest point and let your target be the bottom of the channel. This should provide you a very nice risk reward trade.

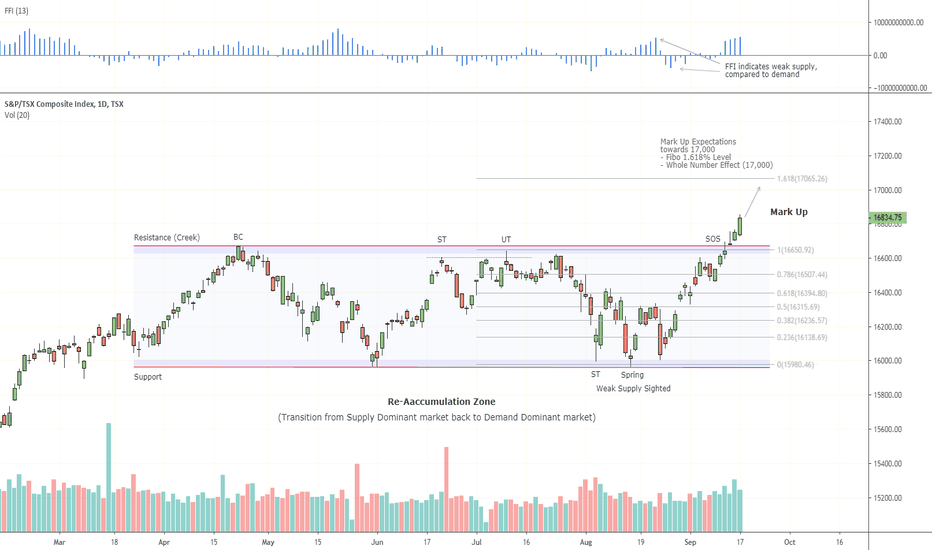

Canadian TSX Index Breaking ResistanceThe S&P 500 is heading toward its prior high, and the Canadian TSX index is already making a move through its.

The TSX has been a chronic under-performing relative to the S&P500, and despite the fact the Canadian is breaking out first, it is still lagging the S&P 500 overall.

The red line shows the TSX index versus a hedged S&P 500 index ETF (ZSP). This eliminates the currency differences/fluctuations for people who are in Canada but also invest in the S&P 500.

I don't mind the look of the Canadian market assuming the breakout holds. But it's hard to overlook that the Canadian market just has not done as well as the US market over the years. I continue to contribute more aggressively to US-focused funds within my retirement (long-term) account, than to Canadian-focused funds.

Gold looks to have kicked off a long-term bull market. That will be good for that sector of the Canadian economy, although that can be benefited from more directly by accumulating gold funds and gold stock funds.

Disclosure: Own ZSP as a long term hold and routinely add to the position.

TSX slanting down, EWC ETFLooks like TSX is in general slanting downwards. RSI is continuing to decrease and sets up possibility of large slip to downside similar to October November. In a options trade for Buying vertical put for debit of 0.30 and selling calendar Sept 20 and Oct 18 at debit 0.13. Reward/Risk 2/1.

I am afraid of what is ahead.I would only suggest that you be very very careful in the coming months.

TSX doesn't look too good in the past few months.

It is hovering within a range while A LOT of stocks is dropping like flies.

I am only holding Dividend paying stocks at the moment.

Some Gold helps.

Just gotta sit this one out.

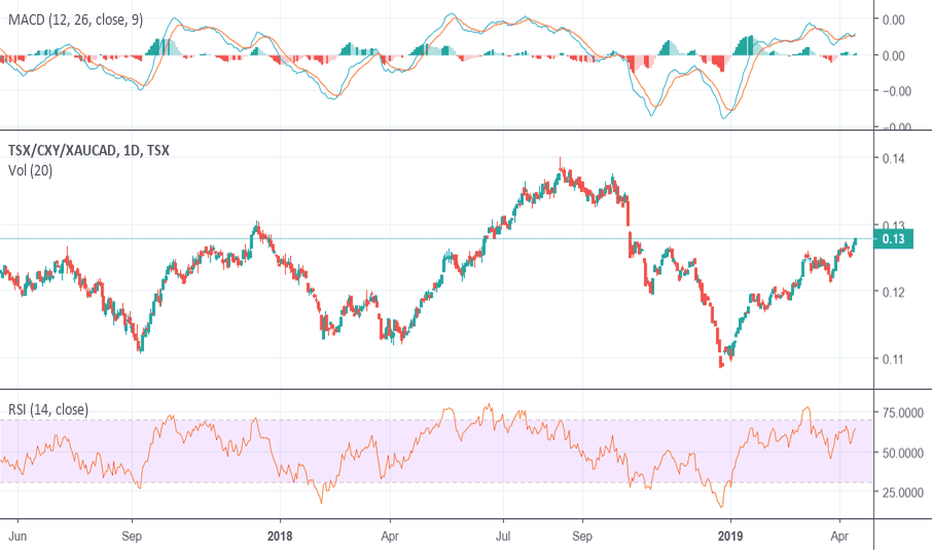

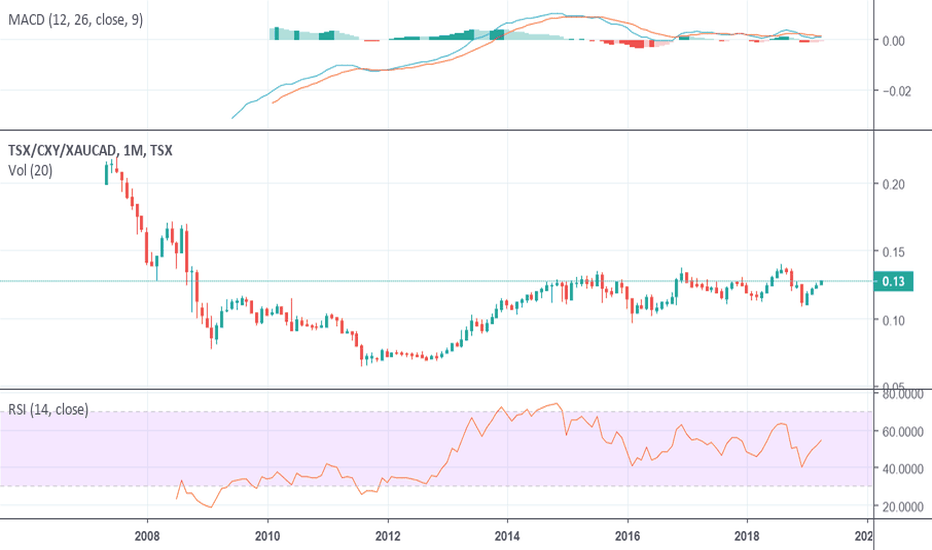

TSX: Slow Decline; CDN Dollar To Rise Noticeably through 2020As we continue to slowly tip-toe in a global recession likely sometime in 2020, with a bear market in the stock market set to happen at anytime within the next year, the TSX will only follow suit. As always, nothing goes up and down in a linear straight line. There will always be fake outs for bulls and bears, but the overall trend of markets around the world will be in the decline - even if we re-test ATHs at some point.

The TSX. compared to the USA indice counterparts are typically delayed by 3-6 months from troughing out, and losses are typically muted somewhat (comparatively speaking).

As history takes us back to 2008, the USA typically sets the bar between Canada and the USA for cutting interest rates. Because the USA cuts rates typically 2-4 quarters before Canada, usually the DXY falls, while the CXY rises. I would not be surprised before the end of Q1 2020 if the Canadian Dollar is back near 90 cents US. By Q4 2020 or Q1 2021 the CXY may be back on par and potentially worth more (again, temporarily) before falling in 2022.

As I have said in many of my ideas: long gold, long silver and buy and hold weed stocks (for now) as they are a sector guaranteed to rebound in the near-term. Which ones do I recommend? CWEB, VGW and Planet 13 for direct players; ENW and GRWG for auxiliary players. Always choose your entries wisely and never chase break-outs; wait for pullbacks.

It is important to hedge accordingly. The overall market has overextended and I would refrain from investing in the big stocks in the Dow, SP500 and Nas100. Pick your entries accordingly and I recommend 50-60% of your portfolio should encompass gold and silver with an additional 20% in weed/weed auxiliaries and 20% held for any potential entries on stocks set to rebound or for shorting leveraged funds like the HUV and TVIX.

- zSplit

Daily Canada S&P/TSX CAD stock market index forecast timing anal27-Jun

Price Forecast timing analysis by pretiming algorithm of Supply-Demand strength

Investing position about Supply-Demand(S&D) strength: In Falling section of high risk & low profit

Supply-Demand(S&D) strength Trend Analysis: In the midst of a downward trend of strong downward momentum price flow marked by temporary rises and strong falls.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

read more: www.pretiming.com

D+1 Candlestick Color forecast: RED Candlestick

%D+1 Range forecast: 0.0% (HIGH) ~ -0.2% (LOW), -0.1% (CLOSE)

%AVG in case of rising: 0.3% (HIGH) ~ -0.3% (LOW), 0.2% (CLOSE)

%AVG in case of falling: 0.2% (HIGH) ~ -0.5% (LOW), -0.3% (CLOSE)

Price Forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

Major Recession InboundTSX composite is showing signs of slowing down, three peak play showing market downtrend. The 10-year Treasury yield is at its lowest since October 2017.The yield curve inverted again on May 23. Recall from last year that this is often viewed as a reliable recession indicator.IHS Markit U.S. manufacturing PMI for May badly missed Wall Street estimates and fell month over month. Sentiment among manufacturers hit its lowest level in nine years.The April reading on durable goods softened across the board. Copper prices are down 8.9% the past four weeks.The Dow Transports and small-cap Russell 2000 have underperformed the S&P 500 and Dow the past month.

Similar to the domino effect, trumps trade war will have a compound effect on the markets. Medium term range - 6700 to 7800.

You heard it first,

Guru