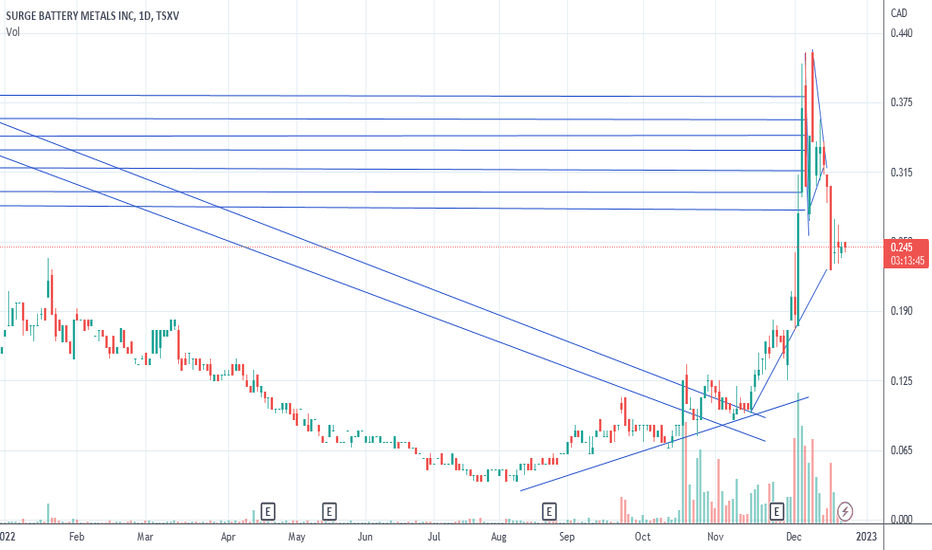

NILI.V Possible Trend Reversal & Entry - First AnalysisNILI.V (Surge Battery Metals)

Candlesticks:

This past week NILI.V closed Thursday with a dragonfly doji candle, followed by a bullish engulfing on friday. The last time a dragonfly doji appeared was on September 9th, which marked a trend reversal that resulted in a 90% in price over 45 days.

Technical Indicators:

MACD on the daily is about to crossover indicating a possible shift in momentum from bearish to bullish.

Possible Entry:

looking for a confirmation on the trend reversal on Monday with a candle closing above the downward channel that Nili has been trading in over the past couple weeks. If that happens I will take a long position and be looking for profit taking opportunities at .40, .45, and .50 cent price ranges.

I am new to trading and this is my first analysis. Let me know what you think and if I got anything wrong here, any feedback is appreciated!

NILI trade ideas

NILI.CA: Bullish Pennant, not confirmed (78%)Bullish pennant for NILI on TSX.

Not confirmed yet but metal for batteries is a hot topic right now.

Pros:

1- PPS above 50MA and 200MA

2- RS above 0 and climbing

3- R/R ratio above 5

4- 250RSI above 50 and climbing

5- 50MA above 200MA

6- Both 50MA and 200MA ascending

7- Golden cross circled in blue

8- ATR climbing

9- Post formed with volume

10- Descending volume during pennant forming

Cons:

1- Figure is not confirmed

2- No break out yet

Target price is 1,13$

Again, stay humble, have fun, make money!

MAAX!