Buy BT/Bund Spread wideningAfter Equity Option expiry today and into Month end, the technical rally induced by January effect could be fading.

Commodities recent spike (on China reopening/inflationary) will certainly have an knock on seasonal effect in next Inflation data,

Technically speaking BTP/Bund spread has done a doubl

Related indices

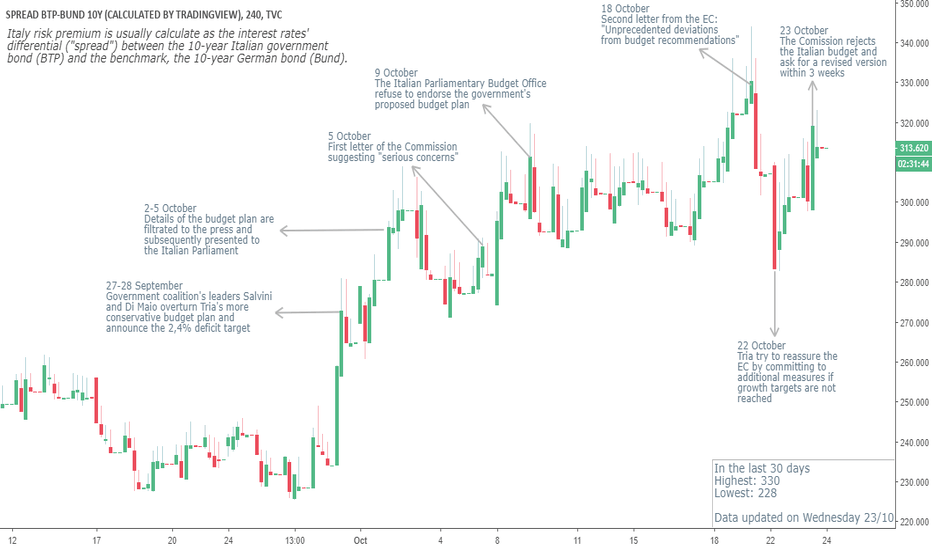

EUR/USD Ignoring the "Canary in the Coal Mine" (BTP/BUND Spread)Admittedly, the EUR/USD is off of last week's highs, but it is nonetheless, still trading above 1.1400, despite the continued blow-out of Italian bond spreads to Bunds.

This has not traditionally ended well!

In previous published ideas, I highlighted technical reasons why I've been short EUR, in add

EUR/USD…the main roadblock to a hawkish ECB policy may be ItalyThe BTP/Bund spread is likely to be a key roadblock to the ECB pivoting too hawkish. Italy’s fiscal health remains the Achilles Heel of EU stability. Recent EUR strength is understandable given LaGarde’s hawkish presser, but BTP vulnerability ought to be a mitigating factor.

BTP BUND SPREAD - A MACRO INDICATIONThe effects of the spread on the national deficit and public debt are not immediate, but they are seen when the next BTP is issued. If the spread is high when a new BTP is issued, the new bonds will probably adapt to the performance of the secondary market, costing the Government more.

A BTP-Bund s

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.