CANADIAN GOVERNMENT 10 YEAR BOND YIELD CA10YCanada 10-Year Bond Yield CA10Y

The Canadian 10-year government bond yield is 3.43-3.419%% as of July 10, 2025, slightly up from the previous session and close to its level a year ago.

Trend: The yield has edged up by about 0.06 percentage points over the past month, but remains below its long-term average of 4.25%.

Economic Outlook

Growth Forecast: GDP growth for 2025 is now expected at 1.0%–1.25%, revised down from earlier forecasts due to trade tensions and a cooling labor market.

Risks: The outlook is tilted to the downside, with rising unemployment (7% in May, projected to reach 7.5% by year-end) and weakened consumer/business sentiment.

Monetary Policy: The Bank of Canada has held its policy rate at 2.75%, with expectations of a rate cut to 2.25% by year-end as growth headwinds persist.

Regional Performance: Some provinces, like Newfoundland and Labrador, are seeing upgrades due to resource production, but overall national performance is subdued.

Upcoming Economic News

July 15: New Motor Vehicle Sales (May data) and Monthly Survey of Manufacturing.

July 16: 30-Year Bond Auction.

July 17: CFIB Business Barometer, Foreign Securities Purchases.

July 21: Producer Price Index (PPI) MoM release.

Ongoing: Industrial production and retail sales data will provide further insight into growth trends.

US Tariff Effect

New Tariffs: The US announced a 35% tariff on Canadian imports effective August 1, 2025, escalating trade tensions.

Economic Impact:

These tariffs are expected to weigh heavily on Canadian exports, business investment, and employment, given Canada’s high trade exposure to the US.

The Canadian dollar fell in response to the tariff announcement, reflecting market concern over the impact on Canada’s export-dependent economy.

Sectoral Risks: Manufacturing and auto sectors are particularly vulnerable, with job losses already concentrated in trade-exposed regions.

Policy Response: The Bank of Canada has cited trade uncertainty as a key reason for maintaining a cautious monetary stance, with further easing likely if conditions deteriorate.

Summary Table

Indicator Latest Value / Outlook Notes

10-Year Bond Yield 3.43% Slightly up, below long-term average

GDP Growth (2025) 1.0%–1.25% Downgraded due to trade/labor headwinds

Unemployment Rate 7% (May), 7.5% (year-end est.) Rising, especially in trade-exposed sectors

BoC Policy Rate 2.75% (cut to 2.25% expected) Cautious, possible further easing

US Tariffs 35% from Aug 1, 2025 Significant downside risk

Key Economic News July 15–21: Sales, PPI, auctions Manufacturing, trade, and price data

In summary:

Canada’s 10-year bond yield remains stable but below historical averages. The economic outlook is subdued, with downside risks from rising US tariffs, a softening labor market, and weak business sentiment. Upcoming economic releases will be closely watched for further signs of stress, especially as new US tariffs threaten to further dampen growth and confidence.

#CA10Y #BOND #BONDYIELD

CA10Y trade ideas

CANADIAN GOVERNMENT 10 YEAR BOND YIELD. CA10YThe Canada 10-year government bond yield (CA10Y) plays a significant role in influencing the Canadian dollar (CAD) in the forex market.the following are key take home .

1. Interest Rate Expectations and Monetary Policy Signaling

The 10-year bond yield reflects market expectations of future interest rates and inflation.

When the CA10Y rises (currently around 3.35%–3.38% in May 2025), it signals expectations of tighter monetary policy or higher inflation, which tends to strengthen the CAD as investors anticipate higher returns on Canadian assets.

Conversely, falling yields suggest easing monetary policy or weaker growth, putting downward pressure on the CAD.

2. Impact on Capital Flows

Higher 10-year yields attract foreign investors seeking better returns on Canadian government debt, increasing demand for the CAD to purchase these bonds.

This inflow of capital supports the Canadian dollar’s value relative to other currencies.

3. Relationship with US Treasury Yields and Interest Rate Differentials

The CAD is sensitive to the yield differential between Canadian 10-year bonds and US 10-year Treasuries.

When Canadian yields rise relative to US yields, the CAD tends to appreciate due to the more attractive yield environment.

Currently, the Canadian 10-year yield is around 3.38%, while the US 10-year yield is higher (~4.5%), which partly explains USD strength over CAD but also highlights potential for CAD appreciation if the differential narrows.

4. Economic Growth and Inflation Signals

The CA10Y incorporates expectations about Canada’s economic growth and inflation.

Recent data shows mixed inflation signals: headline CPI falling to 1.7% YoY but core inflation rising to 3.1%, suggesting the Bank of Canada may maintain a restrictive stance, supporting bond yields and the CAD.

Trade tensions and tariffs create uncertainty, but a resilient Canadian economy and narrowing trade deficit also help support yields and the currency.

5. Bond Prices and Yield Movements

Bond prices move inversely to yields. When yields rise, bond prices fall, which can cause volatility in fixed income markets.

Rising yields may reflect concerns about inflation or fiscal sustainability, but also attract investors, supporting the CAD through increased demand for Canadian assets.

Summary

Factor Effect on CAD

Rising CA10Y Signals tighter policy, attracts capital → CAD appreciation

Falling CA10Y Signals easing or weaker growth → CAD depreciation

Yield differential vs. US Narrowing gap supports CAD; widening gap favors USD

Inflation and economic outlook Mixed inflation supports restrictive policy → supports CAD

Trade and fiscal risks Increase uncertainty, may weigh on CAD

Conclusion

The Canada 10-year bond yield is a key barometer of monetary policy expectations, inflation, and economic health, all of which influence the Canadian dollar’s value. Rising yields generally strengthen the CAD by attracting investment and signaling tighter policy, while falling yields suggest the opposite. The yield’s interaction with US Treasury yields and broader economic fundamentals shapes CAD movements in current times .

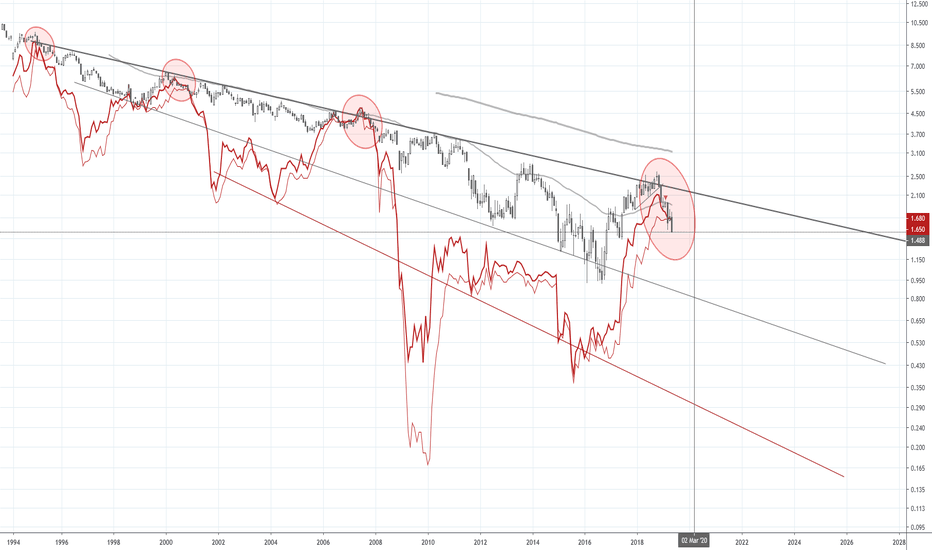

TSX and CA10Y-2Y CorrelationThis chart is crude and only correlates most of the time, but it does stand to reason based on the macro outlook we are staring down the barrel of a sizeable market crash. Now the 3 lines were 2 years after the red circles. That means the bottom is likely at the end of 2023 to 2024. The best way to play this is cash, but deflationary bets might also work. Use long-dated puts if you are a gambling addict and size them small. Bear markets aren't forgiving to anyone.

Cananda 10 Years Bond Canada Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Canada 10 Years Bond Canada Sun Storm Investment Trading Desk & NexGen Wealth Management Service Present's: SSITD & NexGen Portfolio of the Week Series

Focus: Worldwide

By Sun Storm Investment Research & NexGen Wealth Management Service

A Profit & Solutions Strategy & Research

Trading | Investment | Stocks | ETF | Mutual Funds | Crypto | Bonds | Options | Dividend | Futures |

USA | Canada | UK | Germany | France | Italy | Rest of Europe | Mexico | India

Disclaimer: Sun Storm Investment and NexGen are not registered financial advisors, so please do your own research before trading & investing anything. This is information is for only research purposes not for actual trading & investing decision.

#debadipb #profitsolutions

Are we building a ladder with the steps we just used?Today was quite an interesting, and most likely historical day following the shenanigans of $GME. For me, it was a day to sit back, contemplate, & construct questions into the future of the economy in Canada. Please bear with me as this is my first idea, and I am admittedly a new trader (One year so far).

Comparing 3 types of bond yields: 10Y, 2Y, and 3MO has been quite the staple for determining the direction of our economy. Our interest rates, the general market outlook, and also what the government is doing financially.

Like an electrical circuit, we can see that each time these 3 graphs begin to touch, the economy short circuits and is sent spiraling downwards.

I'd like to start where a lot of people start, and a lot of people groan as well when they hear this: the stock market crash of 2008. First, it would be ignorant to completely declare this fiasco as identical. However, there are many parts that are (and continue) to be similar. Some people say the stock market is just an irrational machine. Any sort of programmer would laugh at the idea of true randomness. I believe it is a system of gears that are controlled by millions of different entities and that it's our job to be able to understand which gear(s) are controlling each sector to formulate a decent idea, or fair percentage to make our predictions.

The first and most obvious similarity between these crashes is the level CORRA (Canadian Overnight Repo Rate Average). The Bank of Canada has taken control of the CORRA and it " will be further adopted across a wide range of financial products and could potentially become the dominant Canadian interest rate benchmark, particularly in derivatives markets". There's an obvious pattern of the market reacting violently to the CORRA rate and as of right now, they are at the same level as the 2008 stock market crash.

The very first sign of a stock market short circuit can be noticed with the 10 and 2 year bond yield rate. From almost December 2005 these rates were starting to close in together, leading to complete cross-under of the 3 month yield and shortly after - the great 2008 stock market crash. For our recent crash we had it play out almost exactly the same: tightening between 10Y & 2Y, and then a cross-under of the 3 month. Shortly after, the crash occurred.

Now, what's different?

Well only that the 3 month yield appropriately spaced itself from the 2Y from the 2008 market crash. I'm sure we all know but the main cause of the 2008 crash was from too many people defaulting on loans that they shouldn't have been given in the first place. However, when this crash occurred our different yields are took their respective position to comfortably restart. In our new crash the 3 month and 2 year yields are still confused while the 10 year is entering a parabolic increase. The last time something occurred similar to this (noted by the squares) we entered a bear market that took a hit to the real estate industry first.

So, what's the problem?

I believe we all got a little too worried about the result of this pandemic, but were saved by the technology industry. Most people in high-end jobs were able to continue working without much difference, and people in low-end jobs pretty much had to continue working - but were labelled as heroes. Additionally, there has been a lot of new faces (including mine) in the stock market world, stimulate bonuses were (and still are, I believe) given to everyone and their 14 year old kids (seriously). A lot of people have taken up online hobbies, stores, and especially jobs that they can do remotely. We are humans, we learn to adapt in every situation, and that's why we're the kings of this world. Despite the lovely recovery, there's echoes and signs that are increasing in strength.

In boxing, a fighter can be the best and be unmatched - only to have it all taken away from one loss and never recover again

I find the market to be a swinging pendulum. It goes up, it goes down. There's an invisible line of gravity that we accept and it swings depending on the uncertainty and volume. When we defeat our fears we need to stay humble before we start to believe we're invincible.

The biggest industry of Canada (that controls 13% of the GDP) is.... real estate. I'm sure every Canadian here that's looking to buy a house in wincing in pain, and everyone that already has a house has the biggest grin. I was reading that Toronto went up around 15% in real estate in January. What the heck is going on?? . My friend recently purchased a nice condo in Quebec which costed $430,000. Does my friend make the kind of money to justify a house that expensive? Heck no.

Can we just flip back to the 2008 market crash? We remember what caused it right? Ridiculous loans that were given out, and that were defaulted because they were ridiculous. Now, I'm not saying that this crash was similar, but I am trying to imply that we are on the verge of hitting that crash again. CERB has effectively given everyone who can fill out a form a bit over $10,000. Some people didn't even EARN $10,000 in a year but they still got it. It's still continuing under some new name so the amount is still increasing. Secondly, any new home buyers are eligible for a government loan that pretty much equates to 5 - 10% of the down deposit. So let's get this straight: Everyone and their child has received ATLEAST $10,000 (And won't have to give it back until they file this year's tax returns), first-time house buyers can get 5-10% loaned for the down deposit, and banks are giving mortgages with crazy low interest rates.

Anyone else see an issue?

A regular, decent house in my area would've been maybe $150,000 or $200,000 a year or two ago. Now, it's about $300,000 and steadily increasing. A minimum deposit is about 5% - the government is willing to do that and you already have $10k in the bank. A lot of people have lost, changed, or reduced their jobs to adapt to the new world. Our pay stubs from 2-3 years back IS NOT A HEALTHY INDICATOR . Our government is pushing the younger generation into buying houses that they honestly cannot afford. Almost everyone has been given all the tools to effectively place a down deposit on a house they probably cannot afford, and mortgage rates are so freaking low it seems like a no-brainer.

Houses are increasing way too fast in this economy as a result of government stimulation, and like any market with huge volatility: it will start to swing downwards at some point. The question is: will we be able to control it? Once taxes come in, the mortgages go back up, the stimulation ends, and the prices start to find their middle ground, will everyone be secure enough to handle it?

Final thoughts

Our economy is in a stage of mania with our insane house prices and market recovery. It's like being at the doctor but they give you methamphetamine instead of morphine.

- Will the come down be manageable or will it drive the economy into a huge fit?

- Are we teetering towards another financial crisis brought by ridiculous loans?

- Will we just continue this high until something else happens?

- What can we do to increase the odds for a clean and healthy recovery?

Thank you for reading. Near the middle point I let my mind wander. Please give me reasons that my logic is invalid as I am always trying to learn.

ridethepig | Breakout in Canadian 10Y YieldsWe are going to intentionally cycle through many Yield chart updates, which will be rolled out over the next few days. The game of currency speculation must include Yield analysis to have a compromising effect.

It is evident that the exchange in control at the 0.48x lows has lead to a change in momentum. Buyers have forced the technical break and negated the current downtrend, this is a loud warning sign that sellers need to start treading more skilfully. The directional change means buyers must now advance towards 0.85x and 1.07x and absorb the remaining pressure. Gaining tempo with the breakout cannot be dismissed with a quick shrug of the shoulders either!!

Buyers have shown courage, intentionally forming a basing pattern at the 0.48x lows and have completely outplayed late sellers. Look to target 0.85x and 1.07x for the second half of 2020. Depending on the handling of the recovery we can explode to the topside here and unlock 1.325 and 1.844. We can come back to this idea when our wheat blooms.

Good luck and thanks as usual for keeping the support coming with likes, comments, charts, questions and etc!

CA10Y: Next target is 0.8, can it rally?First off, please don't take anything I say seriously or as financial advice. As always, this is on an opinion based basis. That being said, the bonds market for Canada, especially for its government been quite bullish recently. The last close was at +7.07%. Although, some resistance seems to be on its way, I think the next target in price to look for milestone-wise would be at $0.8. Afterwards, one could then look at it carefully and see if it worth a long hold, risk mitigation, or reinvesting. Again, just my opinion.

Canada | Bond Yeilds and Recession WatchLooking at the chart we can see the 3 month yield inverted with the 10 year yield a few weeks ago so recession could be anywhere from 12-18 months out. The question is, where do we stabilize in this current down swing? Things will probably go sideways for a while before we break support and rates dive to zero. The catalyst will be nGDP figures and Bank of Canada policy.

Canada | Recession WatchThe 10 year Canadian yield is now below the 1 year and 3 month yield, which is a good indicator of a potential recession ahead. Rates follow economic growth, so we can interpret yields as a function of the economy. These interest rates also impact the price of money (CAD interest rates). One way to interpret lower interest rates in the Canadian economy is that economic activity is lower and cheap money indicates a discount on loans due to a lack of credit demand. Lack of credit demand could be an issue related to demand itself, access, or credit worthiness. So lower interest rates can quickly impact CAD valuations against other currencies in the FX market.

The trend is pretty clear going back to the early 90s; the 10 year provides a kind of ceiling for yields. There is a kind of megaphone pattern as well, which could indicate that rates will go sharply lower in the coming years, with short term rates bottoming out hard and perhaps even going negative.

Gov't Bond Yields & Bank StocksFollowing government bond yields can be crucial to understanding the underlying price action of banks stocks. Take this example of Canadian bonds and stocks. We can clearly see how, following a steady expansion in yields of various maturities, a trend break where bonds suddenly appreciated (yields go down when bond prices go up) the results were a change in trend for the bank stock (in this case CIBC). The inversion of the 3 month and 10 month yields resulted in a trend change confirmation on the smaller timeframes. This is not just a coincidence: bank business models are heavily influenced by their central bank regulator.

CA10Y | Rate Cuts Ahead for Canada. Watch the Banks!Back in November (2018) the yield on the 10 year Canadian treasury hit the upper boundary historical trendline and reversed sharply after briefly overshooting. Fundamentally, interest rates follow GDP figures so we can use these technicals to give us a bit of a prognoses for the financial and economic wellbeing of the country... and its not looking good.

Today the central bank confirmed the fears so expect Canadian rates to drop across the board (but I expect spreads to rise between safe paper and junk). It will be interesting to watch what happens to bank stocks over the next 12-18 months as the economy slows down. Will we see a credit crunch? How will this impact the Loonie versus the US dollar?

I am expecting trouble for Canadian banks as they are now dealing with a red hot housing market, the rout in commodities, and now, rising consumer delinquencies. Most importantly, bank capital (equity) will likely get squeezed, which will put tension on bank balance sheets and their eagerness to extend credit. A policy for negative interest rates is already primed and ready in the Bank of Canada's toolbox. But luckily Canada doesn't have "reserve requirements" for banks ;)

***This is not investment advice and is simply an educational analysis of the market and/or pair. By reading this post you acknowledge that you will use the information here at YOUR OWN RISK

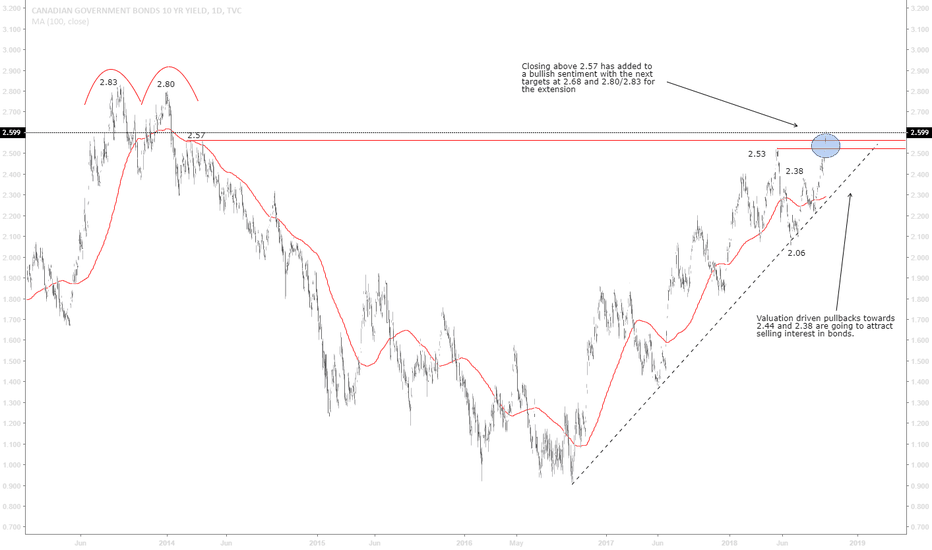

Canadian yields reaching new 4 year highs=> Global yields are on the move as we all know and have been expecting for since the beginning of the year.

=> Here in Canada we can see the same scenario playing out as we break above a 4 year high and unlock 2.80/2.83 for a test.

=> This is a major turning point for the global economy and we are witnessing it live here on tradingview. Highly recommended for all those wanting to dig deeper in these discussions to jump in and join the telegram channel as we are advancing the conversation in real-time.

=> Bookmark this chapter in your economic textbooks as we are in for a very active few quarters ahead.

=> GL those trading in Canadian equities