Current euphoria based on higher risk premium ... Patrick Artus affirms that European Markets should maybe be priced 25% higher from current levels based on a 3% risk premium differential.

US markets are mostly inflated by share buybacks because this is how the stockholders are remunerated, whereas in France for instance, dividends are on the order of 3.5%.

CAC40 trade ideas

MIF2: Fixing - High volume anomaly and manipulable dry market This is actually a concern. 41% of daily volumes take place toward the last 5 minutes of the trading day. This dries up liquidity and create weird patterns during the day. Price discovery is less efficient in many cases in my opinion. Algos follow last minute execution. Costs are supposedly reduced thanks to some tweaks but this probably leads to some imbalance in the markets.

This game should cease when the situation si reversed.

Document by the AMF (French "SEC") about this matter in French:

www.amf-france.org

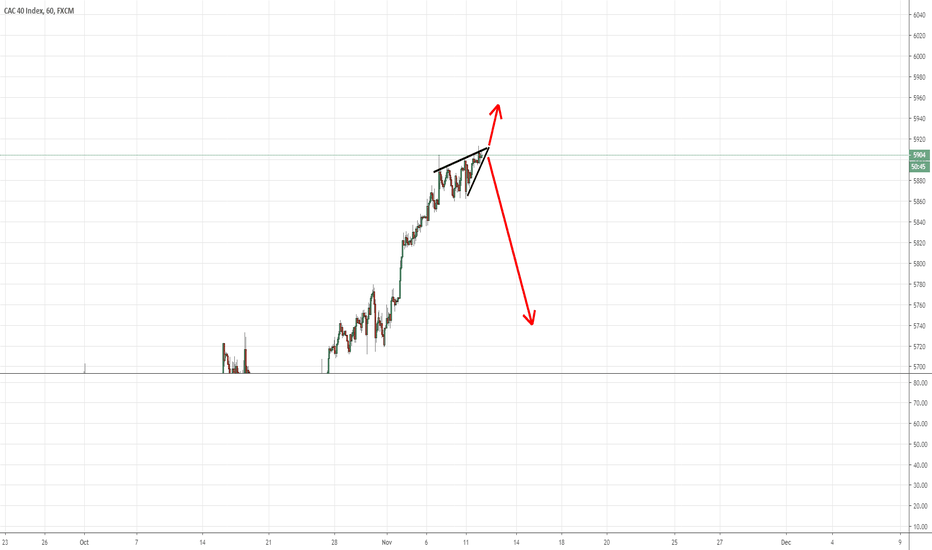

Short the 78.60% of the fractal pattern target - Island ReversalThis has been a new norm for momentum targets and some patterns. Flags keep overextending all the time though, so pay attention to weird handle patterns such as in overextended Cup and Handles, and potential Inverted Head and Shoulders. When this game of greed and short squeeze ceases, QE or not it will be down extremely atrociously in my humble opinion.

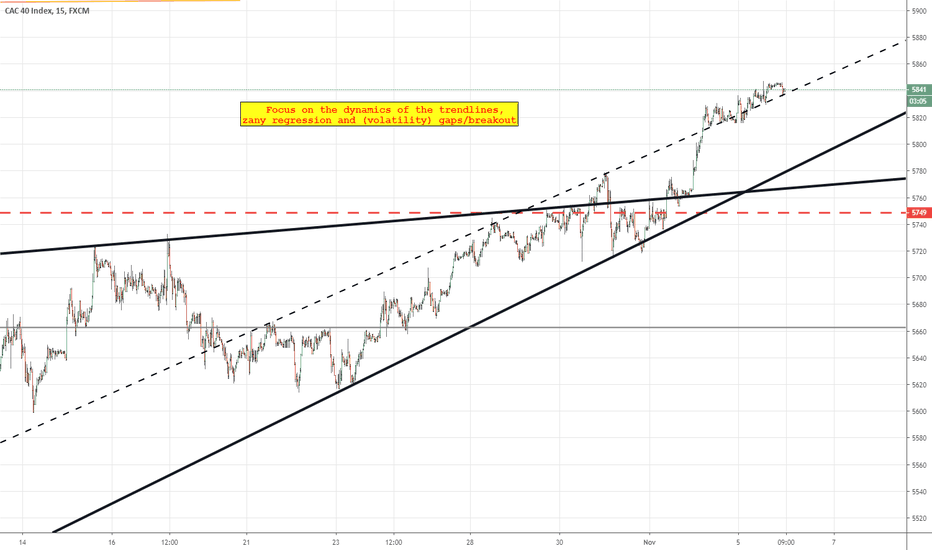

Machine Learning - Algos trying fractal Cup and handle patternsYou can clearly see the difference in terms of relative strength. The market is easy manipulable ... the algos in pattern recognition are squeezing shorts by creating and following previous patterns that are in "vogue" (Inverted IH&S), sort of bullish flag that are in fact a hidden handle in a Cup and Handle pattern and so forth.

Pay attention to the manipulators, do the opposite of your initial thoughts and see if the algos will squeeze by trying new (old) patterns out ....

The market then indeed went back to 5878 after it bounced back from the current low of the day (need to check smaller time frames)

CAC40 can go up to 10kStock market is still bullish we have breakout still above MA 200 european stock market is under valued we are still lower than 2000 and 2007 but got like at least 40% inflation. we can go up to 8400-10100. don't listen perma bear what we have right now is nothing, be ready for the real bubble..

red line = big bull market invalidation