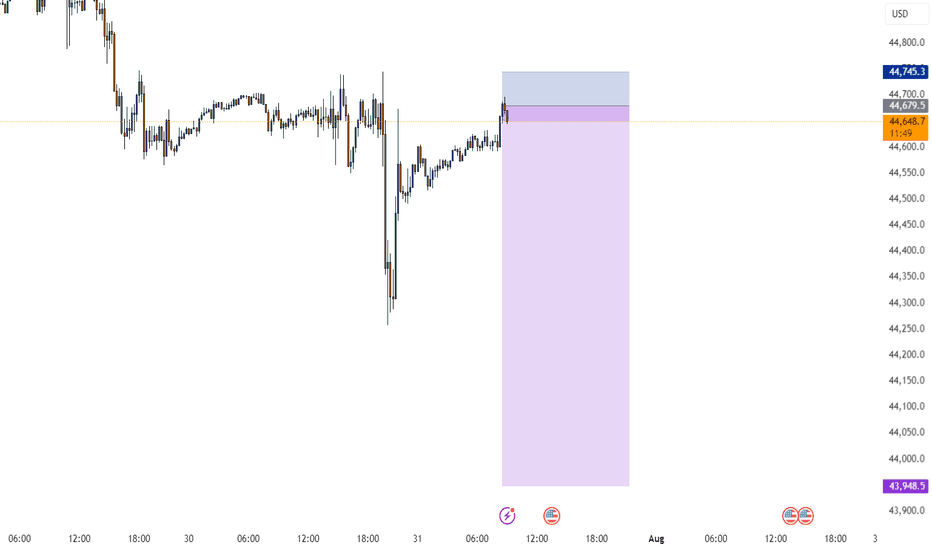

KOG - US30Moving on from the previous chart we shared on DOW you can see our red box worked well and gave us the move we wanted upside, however, we stopped just short of the ideal target level.

For that reason, and after looking at the liquidity indicator we will monitor the boxes here for a possible retrace

About Dow Jones Industrial Average Index

Dow Jones* often refers to the Dow Jones Industrial Average, which was one of the first stock indices and is one of the most commonly referred to barometers of equity performance in the United States. The Dow Jones Industrial Average, not to be confused with the Dow Jones Transportation index (which was the first index), is often called, "the Dow" or "DJIA," and consists of thirty stocks which traditionally were industrial-based. But in recent years as the US economy has become more consumer-oriented, the index has seen a change in composition that no longer has much to do with direct industrial investment.

Related indices

Bullish bounce off overlap support?Dow Jones (US30) is falling towards the pivot and could bounce to the 1st resistance which acts as a swing high resistance.

Pivot: 44,596.08

1st Support: 44,267.57

1st Resistance: 45,106.42

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trad

Dow Jones Potential DownsidesHey Traders, in today's trading session we are monitoring US30 for a selling opportunity around 44,300 zone, Dow Jones is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 44,300 support and resistance area.

Trade safe, Joe.

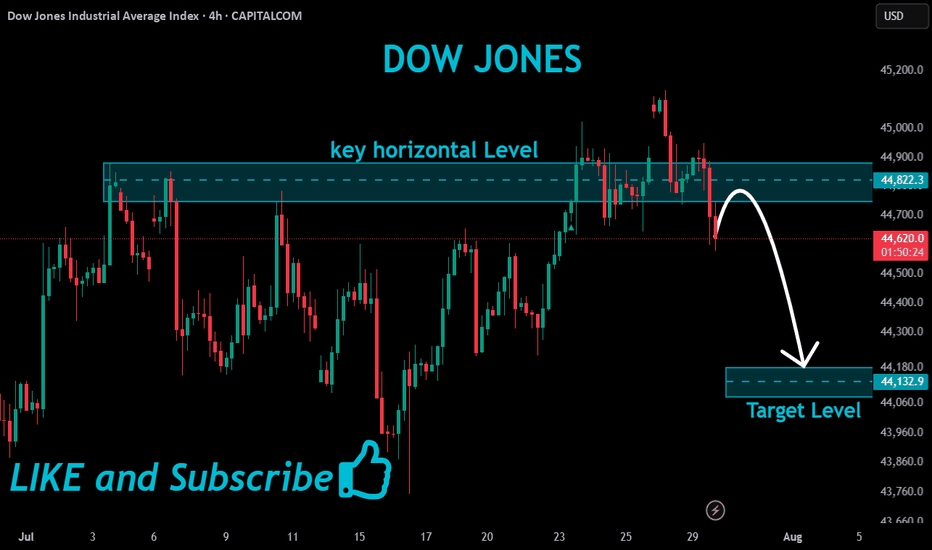

US30: Absolute Price Collapse Ahead! Short!

My dear friends,

Today we will analyse US30 together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 44,459.35 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmat

Dow Jones August GameplanNow that the first trading day of August has printed, can one reliably forecast the possible month based on just the first day? I am inclined to believe that one can with a small amount of accuracy. Not perfect.

There are two types of monthly cycles when the first traded day is a bearish cand

US30 (15M) – Bearish Reversal Setup, Short Opportunity📊 Analysis:

The US30 index on the 15-minute chart is showing signs of a bearish reversal after a recent upward push. Key technical observations:

1. Price Action & Structure

* US30 has been trading in a minor uptrend, but momentum is weakening.

* The latest 15M candles show lower highs form

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of Dow Jones Industrial Average Index is 44,173.64 USD — it has risen by 1.34% in the past 24 hours. Track the index more closely on the Dow Jones Industrial Average Index chart.

Dow Jones Industrial Average Index reached its highest quote on Dec 4, 2024 — 45,073.63 USD. See more data on the Dow Jones Industrial Average Index chart.

The lowest ever quote of Dow Jones Industrial Average Index is 28.48 USD. It was reached on Aug 8, 1896. See more data on the Dow Jones Industrial Average Index chart.

Dow Jones Industrial Average Index value has decreased by −1.72% in the past week, since last month it has shown a −0.88% decrease, and over the year it's increased by 10.23%. Keep track of all changes on the Dow Jones Industrial Average Index chart.

The top companies of Dow Jones Industrial Average Index are NASDAQ:NVDA, NASDAQ:MSFT, and NASDAQ:AAPL — they can boast market cap of 4.39 T USD, 3.98 T USD, and 3.04 T USD accordingly.

The highest-priced instruments on Dow Jones Industrial Average Index are NYSE:GS, NASDAQ:MSFT, and NYSE:CAT — they'll cost you 726.03 USD, 535.64 USD, and 433.70 USD accordingly.

The champion of Dow Jones Industrial Average Index is NASDAQ:NVDA — it's gained 73.48% over the year.

The weakest component of Dow Jones Industrial Average Index is NYSE:UNH — it's lost −58.62% over the year.

Dow Jones Industrial Average Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Dow Jones Industrial Average Index futures or funds or invest in its components.

The Dow Jones Industrial Average Index is comprised of 30 instruments including NASDAQ:NVDA, NASDAQ:MSFT, NASDAQ:AAPL and others. See the full list of Dow Jones Industrial Average Index components to find more opportunities.