DXY trade ideas

My Thoughts #006My Thoughts

Are that we still continuing with the bullish trend still waiting for a choch on the 4h demand zone to take my trade as illustrated...

We need to see the pair move from bearish to bullish trend in line with the overall trend

The pair could sell

use proper risk management

Let's do the most

USD Week 3 of Gains - 23.6% Fibonacci RetracementThis week has been the third consecutive week of gains for DXY and this comes in stark contrast to the bearish trend that drove price in early-April trade. This week was of course a lift from the FOMC rate decision, and next week brings inflation back to center-stage with the Tuesday release of CPI.

In DXY, we've only seen a mere 23.6% retracement of the 2025 sell-off so this move is still very much in the early stages. We also can't rule out sellers taking another shot here, as the oversold RSI reading from a few weeks ago often doesn't mark the exact low - because trends can usually take some time before they actually turn.

What will probably weigh on the matter is EUR/USD and whether a larger pullback can show there, but for now, it's the 1.1200 handle that's led to a bounce for this week. In DXY, there's key support at 100.22, 100 and then 99.18 for bulls to defend into next week. And key resistance is around the 102.00 handle in DXY. - js

Bearish Crab Pattern Will Start from 100.7The dollar index has retreated from 100.7, a movement potentially correlated with a bearish crab pattern observed in market analysis.

Further observation is warranted to confirm the validity and predictive power of this pattern in forecasting future dollar index fluctuations.

EU SHORTS FOR TODAY___ Mount Olympus Capital says.I am looking for a short on the EURO. Price showing clear signs of bearish orderflow and structure with and signatures (accumulation manipulation and distribution).

Looking to target previous day and Asia session low!

LETS GET IT! and safe trading everyone.

DOLLAR INDEX (DXY): Bullish Reversal Confirmed?!

Dollar Index formed an inverted head and shoulders pattern on a daily.

Its neckline breakout is a strong bullish reversal signal.

The broken neckline of the pattern turns into a significant support now.

We can expect a growth from that at least to 101.25 resistance.

❤️Please, support my work with like, thank you!❤️

US DOLLAR INDEX(DXY): Bullish Outlook & BreakoutThe Dollar Index formed a significant inverted head and shoulders pattern on a 4-hour chart.

Following the release of yesterday's economic data, the market surged and broke through both the neckline and a strong downward trend line.

This created an expanding demand zone with two broken structures.

I plan to take long positions in anticipation of a bullish trend continuing to at least 102 support level.

Heading into 61.8% Fibonacci resistance?US Dollar Index (DXY) is rising towards the pivot which is a pullback resistance and could reverse to the 1st support.

Pivot: 101.39

1st Support: 99.91

1st Resistance: 102.58

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Dxy bullish idea for next week - MMBMThis is a bullish possibility for DXY price action for next week.

Monthly:

- Price took a swing low confluent with a bearish breaker in discount and closed above the level;

Weekly:

- Price Took a swing below monthly swing with a bullish reaction. If this week closes with above previous weeks high, it confirms a bullish weekly swing;

Daily:

- Monday printed the likelly low of the week

- A daily fair value gap is open allow with a volume imballance around monday open signalling bullish price action - a retrace to these levels would be a good buying opportunity.

4h:

- there is a market maker buy model in play.

- as of now, price already printed an intermidiate term low signalling that low risk buy myght have happened.

News forecast:

- I expect NFP to either retrace price to daily fvg or daily volume imbalance and leave a bullish reaction.

- FOMC next week might bring the volatility to complete the mmbm

Thank you for reading

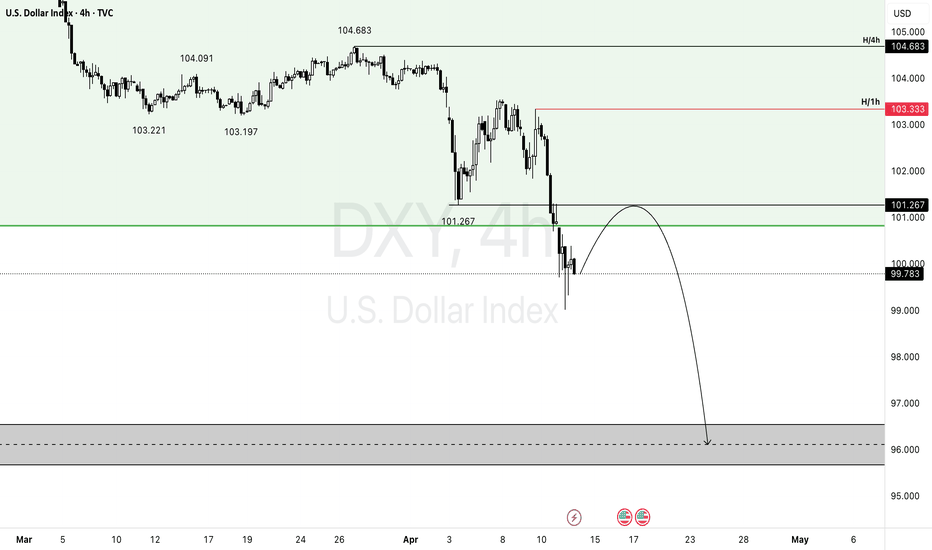

DXY - ANALYSIS👀 Observation:

Hello, everyone! I hope you're doing well. I’d like to share my analysis of DXY (Dollar Index) with you.

Looking at the DXY chart, I expect a price increase towards 101.267. After reaching this level, I anticipate a decline to around 96.00.

📉 Expectation:

Bullish Scenario: Price increases towards 101.267.

Bearish Scenario: After reaching 101.267, a decline to 96.00.

💡 Key Levels to Watch:

Resistance: 101.267

Support: 96.00

💬 What are your thoughts on DXY this week? Let me know in the comments!

Trade safe

Why I'm Bullish on the DXY: A Fundamental Approach!Powell continues to take a cautious tone, emphasizing a wait-and-see approach while acknowledging rising inflation risks, which suggests there's no urgency to cut rates. This leans slightly hawkish, especially compared to the market’s more dovish expectations, and could support some near-term Dollar strength. However, a more sustained move in the USD likely hinges on progress in upcoming trade discussions—particularly with China. Today's FOMC outcome is just one part of the broader picture; the next key signal may come with developments in the coming days. For now, the bias remains USD bullish heading into the London session.

Technically, the DXY has broken its downtrend, signaling a potential shift in momentum. I’ll be watching for a possible retracement toward the 99.700 area, which could serve as a key support level before any further upside continuation.

DXY is entering the Smart Money play — Are you ready Temporary selling pressure is unfolding, but a powerful bullish reversal zone is on the horizon! Don’t miss this key USD cycle setup

The US Dollar Index (DXY) is currently breaking down for a temporary selling phase, approaching a high-probability demand zone between 96.40–98.00.

According to the Smart Money Concept, institutional players are clearing liquidity before driving price back towards the higher supply zone (106–110).

Key Insights:

– Temporary Sell-Off: Price is moving toward the demand zone

– Bullish Reversal Expected: Watch for signs of accumulation around 96.40–98.00

– Next Target: Supply zone near 106+ levels

– Strategy: Monitor for bullish confirmation before longing

Stay ahead with clean Smart Money setups —

"DXY is building a textbook bullish flag — here’s exactly where For Traders (technical + confident)

DXY bulls gearing up for a double-leg rally”

1. Context & Market Structure:

After a sharp impulsive drop (green falling wedge), DXY has begun corrective accumulation in an ascending channel.

Current price 99.531 is consolidating inside a broadening bullish flag pattern.

Key Zones:

Major supply zone: 100.500 – 101.000 (highlighted yellow box)

Short-term resistance: 99.700

Short-term support: 98.8Projected Path (2 bullish legs):

First push (red path): Minor pullback → break to ~100.100

Second push (blue path): Consolidation → breakout towards 100.500–101.000 (target zone)

00–98.500

Bias:

Short-term bullish → Targeting supply zone around 100.5–101.0

Invalidation level: Clear break below 98.500 (would negate bullish setup)

>

Trade Idea:

Buy on dips within the ascending flag, targeting 100.100 and 100.500

Watch reaction near supply zone for possible reversal or continuation

DXY Analysis: Rising Dollar and Market ImplicationsAnalyzing the recent DXY chart, we observe a significant upward movement following a demand build-up. This article explores the implications of a rising U.S. Dollar Index (DXY) on currency pairs and major indices like the SP 500 and NASDAQ, aligning with current market dynamics.

DXY Chart Breakdown:

The chart highlights a strong weekly/daily demand level at 98,500, with an internal structural shift marking a pivot point. A demand build-up preceded a sharp rise, tapping the extreme level

of the last point of supply at 100.385, suggesting bullish momentum. The DXY currently

stands at 99.915, with potential to test previous supply levels around 101.850.

Impact on Currency Pairs:

A rising DXY typically strengthens the USD, influencing forex markets:

• XXXUSD Pairs (e.g., EURUSD, GBPUSD): These pairs are likely to decline

as fewer dollars are needed to purchase foreign currencies, reflecting the USD’s

increased value.

• USDXXX Pairs (e.g., USDJPY, USDCAD): These pairs are expected to

climb, as a stronger USD buys more of the counterpart currency.

Exceptions may arise due to region-specific economic data or central bank policies.

Effects on Major Indices:

The strengthening dollar has broader market implications:

• SP 500: Multinational companies may face pressure from reduced overseas earnings, while higher interest rates (often linked to a rising DXY) could lower valuations, potentially leading to declines.

• NASDAQ: Tech-heavy and growth-oriented, the NASDAQ may underperform due

to its sensitivity to a stronger USD and rising borrowing costs, especially for firms

with global revenue.

However, a risk-off sentiment or strong U.S. economic data could counter these effects,

supporting both indices.

Conclusion:

The DXY’s upward trajectory signals a robust USD, likely pressuring XXXUSD pairs

downward and lifting USDXXX pairs. For indices, the SP 500 and NASDAQ may face

headwinds, though context like economic releases or global sentiment will play a key role.

Traders should monitor these levels closely for strategic entries and exits.

Trump’s speech today may create short-term volatility for the DXY. A focus on tariffs could push it toward 101.850.

DOLLARThe Federal Reserve’s FOMC meeting on May 7, 2025, resulted in the decision to hold the federal funds rate steady at 4.25% to 4.50%, maintaining the current policy stance amid rising economic uncertainty primarily driven by trade tensions and tariff impacts.

Key Points from the FOMC Decision and Statement:

The Fed acknowledged that economic activity continues to expand at a solid pace, with the labor market remaining strong and unemployment stable at low levels.

Inflation remains somewhat elevated, with core inflation around 2.6%.

The Committee highlighted increased uncertainty about the economic outlook, especially due to the effects of President Trump’s tariffs, which could raise both inflation and unemployment risks.

The Fed is taking a data-dependent, wait-and-see approach, prepared to adjust policy as needed based on incoming economic information.

The Fed continues to reduce its holdings of Treasury and mortgage-backed securities as part of monetary policy normalization.

Chair Jerome Powell emphasized that the Fed does not plan preemptive rate cuts and will monitor how tariffs affect inflation and growth before making further moves.

Market and Economic Context:

Despite President Trump’s calls for rate cuts to stimulate growth amid tariff pressures, the Fed resisted, citing the need to balance its dual mandate of maximum employment and price stability.

The Fed noted the risk of stagflation-a combination of slowing growth and rising inflation-due to tariff-induced supply chain disruptions and pricing pressures.

Market expectations shifted after the meeting, with traders now pricing in a lower probability of near-term rate cuts, pushing the first likely cut to July or later in 2025

Summary of Geopolitical and Economic Risks Impacting the Fed’s Decision:

Trade tensions and tariffs between the U.S. and China remain a major source of uncertainty, affecting business confidence, supply chains, and inflation dynamics.

Inflation pressures from tariffs and supply disruptions complicate the Fed’s inflation targeting.

Labor market strength provides some support for the economy, but downside risks from trade policies are growing.

The Fed is navigating a delicate balance between controlling inflation and avoiding a sharp economic slowdown or rise in unemployment.

In brief:

The Fed’s decision to hold rates steady reflects caution amid mixed economic signals and geopolitical uncertainty, especially tariff-related risks. The central bank remains vigilant, ready to adjust policy as clearer data emerge on inflation, employment, and growth impacts from trade policies.

Impact on the US Dollar

The dollar stabilized and experienced a slight "micro bounce" ahead of the Fed meeting, partly due to optimism about upcoming U.S.-China trade talks.

However, broad skepticism remains about the dollar’s strength amid economic uncertainty and ongoing capital outflows from U.S. assets by major Asian investors.

Market consensus expects the dollar’s longer-term weakness to persist, as investors weigh the risks of slower growth and tariff-related disruptions.

Impact on Bond Markets

The Fed’s steady rate decision and cautious outlook have led to flattening or modest declines in Treasury yields, as investors price in delayed rate cuts and economic slowdown risks.

Uncertainty about trade policy and inflation is keeping bond markets volatile, with investors seeking safe-haven assets amid stagflation concerns.

Impact on Gold Prices

Gold prices have been supported by safe-haven demand amid geopolitical and trade tensions, rising inflation concerns, and a weaker dollar environment.

The Fed’s decision to hold rates steady without signaling imminent cuts keeps real yields low or negative, which is bullish for gold.

Tariff-related inflation and geopolitical risks (including U.S.-China tensions, Taiwan conflict risks, and Middle East instability) continue to underpin gold’s appeal as a hedge.

DOLLARThe Federal Reserve’s FOMC meeting on May 7, 2025, resulted in the decision to hold the federal funds rate steady at 4.25% to 4.50%, maintaining the current policy stance amid rising economic uncertainty primarily driven by trade tensions and tariff impacts.

Key Points from the FOMC Decision and Statement:

The Fed acknowledged that economic activity continues to expand at a solid pace, with the labor market remaining strong and unemployment stable at low levels.

Inflation remains somewhat elevated, with core inflation around 2.6%.

The Committee highlighted increased uncertainty about the economic outlook, especially due to the effects of President Trump’s tariffs, which could raise both inflation and unemployment risks.

The Fed is taking a data-dependent, wait-and-see approach, prepared to adjust policy as needed based on incoming economic information.

The Fed continues to reduce its holdings of Treasury and mortgage-backed securities as part of monetary policy normalization.

Chair Jerome Powell emphasized that the Fed does not plan preemptive rate cuts and will monitor how tariffs affect inflation and growth before making further moves.

Market and Economic Context:

Despite President Trump’s calls for rate cuts to stimulate growth amid tariff pressures, the Fed resisted, citing the need to balance its dual mandate of maximum employment and price stability.

The Fed noted the risk of stagflation-a combination of slowing growth and rising inflation-due to tariff-induced supply chain disruptions and pricing pressures.

Market expectations shifted after the meeting, with traders now pricing in a lower probability of near-term rate cuts, pushing the first likely cut to July or later in 2025

Summary of Geopolitical and Economic Risks Impacting the Fed’s Decision:

Trade tensions and tariffs between the U.S. and China remain a major source of uncertainty, affecting business confidence, supply chains, and inflation dynamics.

Inflation pressures from tariffs and supply disruptions complicate the Fed’s inflation targeting.

Labor market strength provides some support for the economy, but downside risks from trade policies are growing.

The Fed is navigating a delicate balance between controlling inflation and avoiding a sharp economic slowdown or rise in unemployment.

In brief:

The Fed’s decision to hold rates steady reflects caution amid mixed economic signals and geopolitical uncertainty, especially tariff-related risks. The central bank remains vigilant, ready to adjust policy as clearer data emerge on inflation, employment, and growth impacts from trade policies.

Impact on the US Dollar

The dollar stabilized and experienced a slight "micro bounce" ahead of the Fed meeting, partly due to optimism about upcoming U.S.-China trade talks.

However, broad skepticism remains about the dollar’s strength amid economic uncertainty and ongoing capital outflows from U.S. assets by major Asian investors.

Market consensus expects the dollar’s longer-term weakness to persist, as investors weigh the risks of slower growth and tariff-related disruptions.

Impact on Bond Markets

The Fed’s steady rate decision and cautious outlook have led to flattening or modest declines in Treasury yields, as investors price in delayed rate cuts and economic slowdown risks.

Uncertainty about trade policy and inflation is keeping bond markets volatile, with investors seeking safe-haven assets amid stagflation concerns.

Impact on Gold Prices

Gold prices have been supported by safe-haven demand amid geopolitical and trade tensions, rising inflation concerns, and a weaker dollar environment.

The Fed’s decision to hold rates steady without signaling imminent cuts keeps real yields low or negative, which is bullish for gold.

Tariff-related inflation and geopolitical risks (including U.S.-China tensions, Taiwan conflict risks, and Middle East instability) continue to underpin gold’s appeal as a hedge.

DXY Rebounds on Fed Pause and Trade Deal Hopes.Macro approach:

- DXY edged higher, recovering earlier losses as the Fed held rates and Powell was cautious.

- Jun cut hopes faded, though markets expect three cuts this year, potentially lifting DXY short-term.

- A potential US-UK trade deal also helps ease bearish sentiment on the dollar.

Technical approach:

- DXY is hovering around the key resistance at around 100.200, confluence with EMA21, indicating a potential short-term correction.

- If DXY closes above the resistance at 100.200, the price may continue to claim to retest the following resistance at 101.800.

- Conversely, closing below the current trendline may lead DXY to retest the swing low at around 98.000.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness