DXY Breaking Down?The US Dollar Index (DXY) may be entering a strong bearish wave. After completing wave B, the market has started impulsive wave C to the downside. Currently, wave 3 might be ending, with a potential short-term bounce for wave 4, followed by a drop into wave 5.

Key Bearish Outlook:

Resistance Zone (Wave 4): 104.924 – 104.932

Invalidation Level: 106.505

Final Wave 5 Target: Near 93.422

If price stays below the invalidation level, more downside is expected. Watch for shorting opportunities if wave 4 completes and reverses.

DXY trade ideas

DXY Technical Outlook📊 DXY (US Dollar Index) – Daily Analysis

Market Structure:

📉 DXY remains in a bearish structure on the daily, making lower highs and lower lows.

💥 Price is currently testing the key 102.812 support level.

-Previous Trend: The market had a strong bullish move from around October to late December 2024.

🌎 Ongoing tariff tensions between the US and other countries have increased market volatility.

📈 Bullish Scenario:

✅ If DXY sustains above 102.812, a push towards 104.223 resistance is possible.

🚀 A clean break and retest above 104.223 could open the way for continuation towards 105.67 and 107.170.

📉 Bearish Scenario:

⚠️ If DXY fails to hold above 102.812, expect a drop towards 101.500.

🔄 In this case, 102.812 could flip into new resistance, confirming bearish momentum.

📉 A breakdown below 101.500 would likely expose DXY to the 100.000 psychological support level.

🔻 Tariff-driven risk-off sentiment could accelerate the move lower.

⚠️ Risk Disclaimer:

This analysis is for informational purposes only and does not constitute financial advice or a trading signal. Market conditions can change rapidly, especially with ongoing tariff talks and geopolitical developments. Always confirm market conditions using your own strategy before making any trading decisions.

How Worrying is the Weakening Dollar? A Departure from TraditionThe value of a nation's currency is a critical barometer of its economic health and global standing.1 Typically, in times of international turmoil or economic uncertainty, the U.S. dollar, as the world's reserve currency, tends to strengthen.2 This "safe-haven" effect is driven by increased demand for the dollar as investors seek stability and liquidity. However, recent trends have seen the greenback exhibit a notable weakening, even amidst persistent global anxieties.3 This begs the crucial question: how worrying is this deviation from the norm, and what are the potential implications for the U.S. and the global economy?

To understand the significance of a weakening dollar, it's essential to first recognize the factors that typically influence its strength. These include interest rates set by the Federal Reserve, inflation levels, the overall performance of the U.S. economy relative to others, trade balances, and geopolitical stability.4 Higher interest rates tend to attract foreign investment, increasing demand for the dollar and thus its value.5 Strong economic growth similarly boosts confidence in the currency.6 Conversely, high inflation erodes the dollar's purchasing power, while a significant trade deficit (importing more than exporting) can indicate an oversupply of the currency in global markets, leading to depreciation.

Historically, during periods of global crisis, the dollar has often acted as a port in a storm. Events like geopolitical conflicts, financial market meltdowns in other regions, or global pandemics have typically triggered a "flight to safety," with investors flocking to the perceived security and liquidity of U.S. dollar-denominated assets, thereby strengthening the currency.7 This was evident during past crises, where the dollar often appreciated as investors sought refuge from volatility elsewhere.

The current weakening of the dollar, therefore, raises eyebrows precisely because it seemingly contradicts this established pattern. While global uncertainties persist – ranging from ongoing geopolitical tensions in various parts of the world to concerns about the pace of global economic growth – the dollar has not consistently exhibited its traditional strengthening behavior. This departure suggests that underlying factors might be at play, potentially signaling deeper concerns about the U.S. economic outlook or the dollar's long-term standing.

One potential reason for this weakening could be a shift in relative economic strength. If other major economies are perceived to be on a stronger growth trajectory or offering more attractive investment opportunities, capital might flow away from the dollar, putting downward pressure on its value. For instance, improvements in economic prospects in the Eurozone or emerging markets could lead investors to diversify their holdings, reducing their reliance on the dollar.

Furthermore, concerns about the U.S.'s fiscal health, including rising national debt and persistent budget deficits, could also contribute to dollar weakness. While the dollar's reserve currency status has historically provided a buffer, a sustained period of fiscal imbalance could eventually erode investor confidence in the long-term value of the currency.8

Another factor to consider is the Federal Reserve's monetary policy. While higher interest rates typically support a stronger dollar, expectations of future rate cuts or a more accommodative monetary stance could dampen investor enthusiasm for dollar-denominated assets. If the market anticipates that the Fed will need to lower rates to support economic growth or combat deflationary pressures, this could lead to a weakening of the dollar.9

The implications of a weakening dollar are multifaceted and can have both positive and negative consequences for the U.S. economy. On the positive side, a weaker dollar makes U.S. exports more competitive in international markets, as they become cheaper for foreign buyers.10 This could potentially boost U.S. manufacturing and help to narrow the trade deficit. Additionally, a weaker dollar can increase the value of earnings that U.S. multinational corporations generate in foreign currencies, as these earnings translate into more dollars when repatriated.

However, the downsides of a weakening dollar can be significant. Firstly, it makes imports more expensive for U.S. consumers and businesses.11 This can lead to higher prices for a wide range of goods, potentially fueling inflation.12 For businesses that rely on imported components or raw materials, a weaker dollar can increase their costs of production, which may eventually be passed on to consumers.

Secondly, a sustained weakening of the dollar could erode its status as the world's reserve currency. While this is a long-term prospect, a decline in the dollar's dominance could have significant implications for the U.S.'s ability to borrow cheaply and exert influence in the global financial system.13

Thirdly, a weakening dollar could lead to concerns among foreign investors holding U.S. assets, such as Treasury bonds. If they anticipate further depreciation of the dollar, they might become less inclined to hold these assets, potentially leading to higher U.S. borrowing costs in the future.

In conclusion, the current weakening of the dollar, particularly in the face of ongoing global uncertainties where it would typically strengthen, is a trend that warrants careful attention. While a moderate depreciation can have some benefits for U.S. exports, a sustained or significant weakening could signal underlying economic vulnerabilities or a shift in global investor sentiment towards the greenback. Factors such as relative economic performance, U.S. fiscal health, and the Federal Reserve's monetary policy will likely play a crucial role in determining the future trajectory of the dollar. The departure from its traditional safe-haven status serves as a reminder that the dollar's dominance is not immutable and underscores the importance of maintaining sound economic policies to underpin its long-term strength and stability. Monitoring these trends will be critical for understanding the evolving global economic landscape and its implications for the United States.

DXY TO REGAIN BULLISH STRENGTH!DXY has been moving in a local channel indicating a short term bearish trend. What next do we expect especially as we saw a BETTER THAN EXPECTED NFP OUTCOME

From the technical standpoint, I anticipate a bullish sentiment to continue to grow till 106.591. If we’d get a break above the upper resistance of the descending channel, a buy opportunity is envisaged.

Dollar index scenario Nfp day 04/04/2025English : According to our analysis, we anticipate THIS bullish scenario with an negative result of NFP .

Morocan Darija : kanchofo d'apres l'analyse reda Nfp aykherj Négative dakchi 3lach anchofo dollar bullish besabab Nfp ila kherj negative hadi sign positive 3la interest rate.

ATENTION : I only share my ideas, not signals.

PL Dot Shapes (Detailed Summary)This idea shall focus on the behavior and structure of PL Dot Shapes, which are crucial in identifying market trends, congestion phases, and potential reversals. Let's deep dive on how to interpret PL Dot formations and recognize patterns that signal market movements.

1. Understanding PL Dot Behavior

- Trend:

PL Dots form a straight line, indicating a clear market direction. A trend stops when the market enters congestion.

- Congestion:

PL Dots move horizontally or “snake” sideways, signaling indecision or balance between buyers and sellers.

- Higher Time Period (HTP) Influence:

PL Dots from the HTP influence those in the Lower Time Period (LTP). Inconsistencies between them may indicate no clear pattern.

- Dot Distance:

Refers to the vertical price difference between consecutive PL Dots.

- Increasing Dot Distance: Indicates trend continuation or strength.

- Decreasing Dot Distance: Suggests trend exhaustion or potential reversal.

2. Key PL Dot Patterns

✅ Yes Pattern (Energy Termination Pattern)

Indicates the end of a trend and potential reversal. This pattern is characterized by signs of exhaustion:

1. PL Dot Pullback: PL Dot moves off the main trend channel, and the angle starts sloping down.

2. Decreasing Dot Distance: Dots get closer together, signaling waning momentum.

3. Exhaustion Signs: The dot pulls within range, with closes moving towards the PL Dot, causing congestion entrance.

4. Block Occurrence: Price likely returns to the area of 2-3 dots back.

5. Crest Formation: A PL Dot crest forms, indicating a potential market top.

6. Directional Shift: Dot directions begin turning downward.

7. Challenges: Be alert to price challenging PL Dot crests and valleys.

---

❌ No Pattern (Non-Termination Pattern)

Indicates that the trend is likely to continue without exhaustion:

1. Similar early behavior to the Yes Pattern but lacks signs of exhaustion.

2. No Significant Pullback: PL Dot may pull within range, but no congestion entrance signs appear (bullish).

3. Price Holds: Prices do not return to the 2-3 dots back area.

4. Weak Crests: No strong crest formation, or it's shallow.

5. Stable Direction: Dot direction struggles to turn down.

6. No Challenges: No challenges to PL Dot crests or valleys, confirming trend strength.

---

3. Trend Pattern (Trend Continuation Pattern)

Describes the start or continuation of a trend, especially in the LTP:

1. Dot Opening: PL Dot opens up, with increasing distance between dots, signaling strong momentum.

2. No Exhaustion: Continuation without signs of exhaustion.

3. Energy Refresh: If price reaches the area of 2-3 dots back, expect high energy on any PL Dot refresh.

4. Dots Out of Range: PL Dots move outside the prior bar’s range, confirming a strong trend.

5. Strong Challenges: Challenges to crests only add momentum to the trend.

6. Stable Direction: Dot direction maintains strength with minimal reversals.

---

4. PL Dot Shapes in Congestion

When the market is in congestion, expect the following:

1. Sideways Dots: PL Dots snake sideways, indicating market indecision.

2. Support/Resistance Holding: The 6-1 lines hold both sides of the congestion area.

3. Congestion Exit Signs: Look for signs indicating the market is ready to break out of congestion.

---

Key Takeaways:

- Trend Continuation: Increasing dot distance and out-of-range dots suggest a strong trend.

- Trend Exhaustion (Yes Pattern): Decreasing dot distance, dot pullbacks, and crest formation signal potential reversals.

- No Pattern: Indicates no exhaustion, suggesting the trend will continue.

- Congestion Behavior: PL Dots snake sideways with key support/resistance levels holding firm.

Understanding these patterns helps traders anticipate market behavior, identify trend reversals early, and manage trades effectively.

Market Moves as Expected—Caution for a Potential ReversalDXY Update : The movement remains in line with my expectations, with the ongoing correction being held by the Fibonacci cluster. At this stage, DXY still has the potential to strengthen, testing the 102.791–103.150 area to form wave iv of wave (v).

However, caution is advised for a potential reversal toward the 100.462–100.946.

DOLLAR INDEX (DXY): Time To RecoverThe Dollar Index appears poised for a retreat after testing a key support area on a 4-hour chart.

A robust bullish engulfing candle indicates strong buying activity in that region.

As a confirmation, I see a cup and handle pattern on that and a breakout of its neckline.

I anticipate a bullish upswing to at least 102.79.

DXY:Today's trading strategyTrump's announced comprehensive tariff plan has triggered global attention. As for the U.S. Dollar Index, on Thursday, the price of the U.S. Dollar Index generally showed a significant downward trend. On that day, the price rose to a high of 103.931 at most, dropped to a low of 101.232, and closed at 101.937.

Looking back at the performance of the U.S. Dollar Index price on Thursday, after the opening in the morning, the price continued to decline in the short term. Subsequently, the price remained weak all the way with almost no rebound. It underwent short-term oscillatory consolidation and finally closed with a large bearish candlestick on the daily chart. For now, pay attention to the resistance in the 102.80 area and the level of 102.40, and keep a continuous watch for further bearish pressure.

Trading Strategy:

Sell@102.50-102.60

TP:101.50-101.30

Get daily trading signals that ensure continuous profits! With an astonishing 90% accuracy rate, I'm the record - holder of an 800% monthly return. Click the link below the article to obtain accurate signals now!

DXY reversal, Bullish for BTC, but 50 day chop is likelyGood Sunday, dear friend! I'm scribbling down some ideas I had. It's good to be back home after a week on a job project. TradingView on a phone is awesome, but I definitely prefer a bigger screen.

The chart was not as clean as I wished, but it just tells some history with the correlations between DXY and BTC. For instance:

Q4 2022 - DXY tops (BTC bottoms).

Trend reversal for DXY (BTC corrects ABC after W1 after bear market).

DXY declines to a WCL, BTC soars from 25k to 73k.

In the meantime, as BTC soared, DXY also inclined, which led to an extended correction of 7.5 months. DXY rolled over in June 2025, and there was a 60-day lag before BTC felt the boost from the DXY decline.

This leads us to today. DXY and BTC have gone up together. I believe the last leg up is a consequence of the June - September decline of DXY, and BTC went up with DXY, and BTC is now left to feel the consequences of the DXY upturn. Given DXY (most likely) topped 11 days ago, we might chop for 50 more days before BTC resumes upward.

In the last WCLs, DXY retraces a minimum to 0.786. In this case, the trendline suggests a March timeframe for a low in DXY. History suggests the BTC local top is in when DXY bottoms, or is soon to top in about 2 months.

DOLLAR INDEX (DXY): Long-Awaited Recover

It looks like Dollar Index is going to pullback

after a test of a significant support cluster on a daily.

A strong bullish imbalance candle that was formed on an hourly

time frame shows a strong buying interest from that zone.

I expect a bullish movement at least to 102.35

❤️Please, support my work with like, thank you!❤️

Dollar Index at Risk: Key Support Holds the Fate of the TrendThe U.S. Dollar Index (DXY) has broken down from a Head & Shoulders pattern, confirming a bearish reversal after a successful retest of the neckline. The price is currently near a key support area, and if it fails to hold, a drop toward the lower strong support zone is likely.

Additionally, RSI is showing bearish divergence and is below the neutral 50 level, indicating weakening momentum.

DYOR, NFA

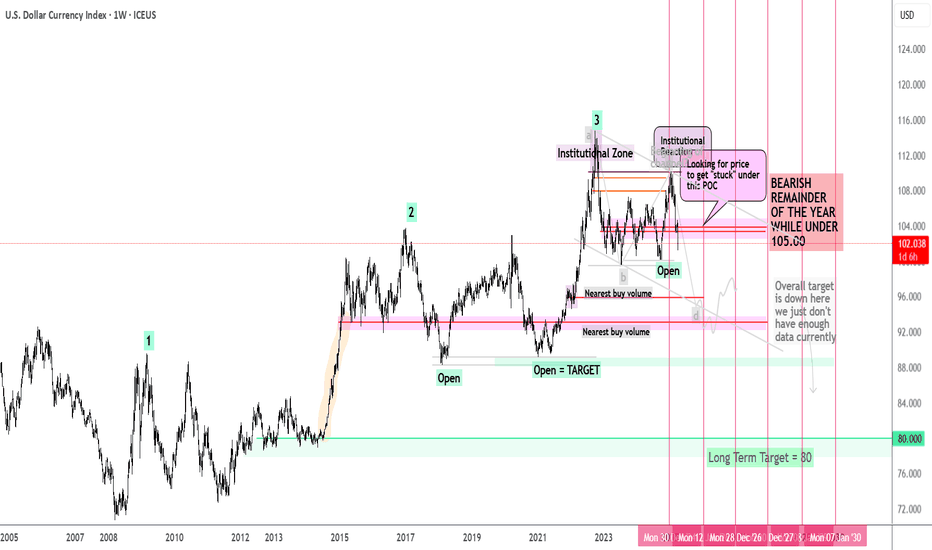

DXY to 80? ...Tariffs the First Domino in a Multi-Year Collapse?This is a pure technical walkthrough of the U.S. Dollar Index—no fluff, no indicators, no fundamentals. Just market structure, smart money, and liquidity concepts.

Back on January 14th , I posted about a potential 20%+ drop in the DXY — you can view it here . This video builds on that thesis and walks you through the full technical story from 1986 to today , including accumulation cycles, yearly trap zones, and my long-term target of 80. Am I crazy? Maybe. Let's see if I can convince you to be crazy too 😜

There is a video breakdown above, and a written breakdown below.

Here are timestamps if you want to jump around the video:

00:00 – The Case for $80: Not as Crazy as It Sounds

02:30 – The 0.786 Curse: Why the Dollar Keeps Faking Out

06:15 – How Smart Money Really Moves: The 4-Phase Playbook

12:30 – The Trap Is Set: Yearly Highs as Liquidity Bait

20:00 – Inside the Mind of the Market: 2010–2025 Unpacked

25:00 – The Bear Channel No One’s Talking About

36:00 – The First Domino: Is the Dollar’s Slide Just Beginning?

👇 If you're a visual learner, scroll down—each chart tells part of the story.

Chart: Monthly View – Three Highs, .786 Retraces, and Trendline Breaks

History doesn’t repeat, but it sure rhymes.

Each major DXY rally has formed a sequence of three swing highs right after a break of trendline structure. In both instances, price retraced to the .786 level on the yearly closes—an often overlooked fib level that institutional players respect.

We’re now sitting at a high again. You’ll notice price has already reversed from that zone. That doesn’t guarantee a collapse, but when we line it up with other confluences (next charts), the probability of a deeper markdown becomes hard to ignore.

I'd also like to note that all of the highlighted moves, are 2-3 year trend runs. Which means if we are bearish, this could be the exact start of a 2-3 bear market.

Market Phases Since 1986

This chart illustrates how DXY has moved through repeating cycles of:

🟡 Accumulation: Smart money building positions quietly.

🔵 Markup: Price accelerates with buy orders + media hype.

🟣 Distribution: Smart money sells to latecomers.

🔴 Markdown: Public panic → smart money reloads.

If we are indeed entering another markdown phase, this would align perfectly with the pattern seen over the past 40 years.

You’ll also notice the "Point of Control" (POC) zones—volume-based magnets that price often returns to. These spots often act as the origin of the move, and as such, they make for strong targets and areas of interest.

Liquidity Zones and Stop Loss Traps

This is where it gets juicy.

The majority of breakout traders placed long entries at the blue lines—above swing highs, thinking resistance was broken. But what’s under those highs? Stop loss clusters.

Institutions use these areas as liquidity harvests.

Several key levels are marked as “OPEN” in this chart, meaning price has yet to return to sweep those orders. That’s why I’m expecting price to begin seeking out that liquidity over the coming months.

There's also an imbalance gap (thin price action) around the 85–86 zone. If price falls into that trap door, there’s nothing to stop it until the 80s.

The 2025 Outlook

Here’s how I’m approaching this year:

✅ Bearish bias under 105

🎯 Targets at 100, 95, and 90

🚪 Trap door under 86 if volume is thin

Price is currently stuck under the recent point of control and showing signs of distribution. If that level continues to hold as resistance, we could see a multi-leg push downward, with the 100 and 95 zones acting as check-in points.

If we break under the 90s and enter the imbalance zone, 80 becomes more than just possible—it becomes probable.

🗣️ Let’s Sharpen Together

Do you see this unfolding the same way?

Do you disagree with the 80 target?

Drop a comment with your view or share your own markup—this is why we trade!

Stay safe,

⚠️ Risk Disclaimer

This post is for educational purposes only and reflects my personal analysis and opinions. It is not financial advice. Trading involves significant risk and may not be suitable for all investors. Always do your own research, manage your risk appropriately, and never trade money you can’t afford to lose.