About GOLD/SILVER RATIO

The Gold-Silver Ratio represents how many ounces of silver it takes to buy a single ounce of gold. Today the ratio floats, since gold and silver prices are adjusted daily by market forces, but this wasn't always the case. The ratio has been permanently set at different times in history - and at different places - by governments seeking monetary stability.

Trading the Gold-Silver Ratio makes sense for those worried about devaluation, deflation and currency replacement. Precious metals have a proven record of maintaining their value in the face of any contingency that might threaten the worth of a nation's fiat currency.

Trading the Gold-Silver Ratio makes sense for those worried about devaluation, deflation and currency replacement. Precious metals have a proven record of maintaining their value in the face of any contingency that might threaten the worth of a nation's fiat currency.

Gold/Silver Ratio to 72 Minimum - Imminent Silver BreakoutGoldSilver Ratio is following a clear pattern of behavior. We can expect a return to mean conservatively hitting 72 at a minimum. This puts silver at $46-58 if Gold doesn't move higher. I think we will see silver 5-10X over the next few years. Easy 25-50% in the short term (6-12 months).

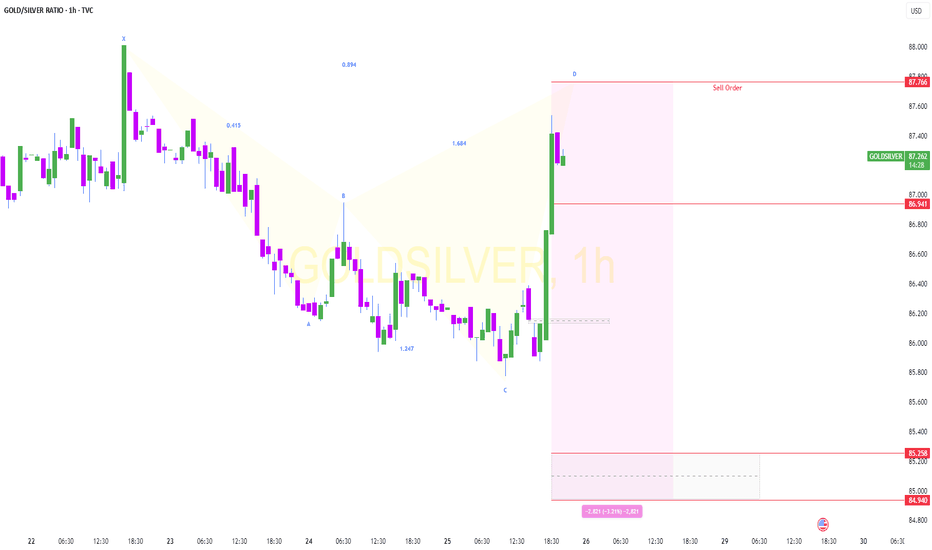

GSR Update July 8th 2025I am expecting the GSR to return to the medium doted line in the near future with the divergence of the short term FIB time zone 3 coinciding with the long term FIB time zone 3. This will bring the silver chart at the bottom up closer to the medium dotted line. Fingers Crossed!

GOLD/SIlver Ratio Signals Risk On Gold/Silver ratio represents the appetite for risk

Stronger gold means risk off and vice versa

In spring, the ratio had hit the target for leg 2 (blue) within

large consolidation that took over 4 years to emerge

It travelled the equal distance of leg 1 (blue) and then reversed.

The next step migh

3-Year Range Broken — Gold/Silver Ratio Retesting Critical ZoneContext:

For more than three years, the Gold/Silver ratio traded within a predictable range between approximately 79 and 92. This provided consistent opportunities to rotate between metals: buying Gold when the ratio approached the bottom of the range, and favoring Silver when Gold became relativel

Gold Silver trade updateHello,

So, the case remains unchanged; buy silver when the gold to silver ratio is above 80:1. But, now silver is out-performing gold significantly and the ratio is strongly trending towards a lower gold to silver ratio.

If the previous steep drop is extended from the recent high, then it could im

Dive into the Wild Waves of Gold and Silver!treasure hunters! Ever feel like the gold and silver markets are like surfing big waves?

The fluctuations in precious metal prices are often likened to the contrasting behaviors of wild crabs; gold prices soar upward, akin to a crab climbing, while silver prices plunge into the depths, reminiscent

This is the Gold Silver Ratio, FIB Time ZonesThis is my comparison tracking the divergence in the gold and silver prices since 2006 prior to the Global Financial Crisis.

I noticed that both prices in USD and tracking in the same upward channel. I have inserted two FIB time zones that seem to be playing out with a move about to play out here on

Important breakdown in the Gold & Silver ratio !!!This is a heads up that concerns the PM sector as well as all other assets.

An important breakdown just happened in the Gold & Silver ratio. This means precious metals bull resumes and SILVER will now overperform gold !! We are now in back test mode !

For the other asset classses this is good news

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.