Related indices

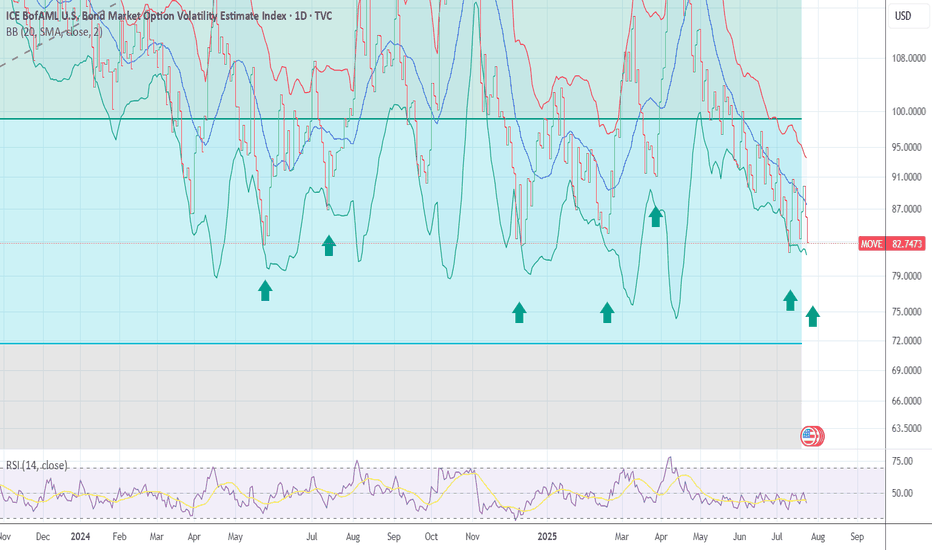

Move index saw a140 level this is a Panic short term bottom ONLYThe spreads loved like a failure was near ! So the move index reached a short term bottom Only in the High yield market so now everyone things it is safe to jump back to RISK ON . This is what we see in BEAR MARKETS sharp strong up thrusts to be followed By longer declines .Best of trades WAVE

TOP CALL but for how long who knows? Not me, but i'll bet on it.Willing to take a bet that unless we push this violently lower, its the temporary top in Tech and Equities, people seem to be moving to the shiny new thing (crypto) and I expect some nice volatility to work with, and I want to take it to the downside for the FUTURES LEAP COMP for FEB. This is what I

MOVE INDEX BONDS SET TO HAVE CRISIS The chart of the move index aka BOND VIX is showing a high level of Complacency as the bonds are in sharp decline phases The worst is yet to come as the Panic in the debt markets has not been seen. Inflation and deep recession is in my model and forecast for the next 18 plus months .

MOVE Buy +1.8% - 3.55% Target Price: 91.0371

Trend Analysis:

-Move Market @ Previous lower low area where it touched this same area last year Feb, 2023 (only touched this area once). Bearish trend looks to end expecting reversal (inclined) ... Expect 0.4% - 0.73% incline

Structure:

- Trend is already +0.24% (area of volatili

(SEIIV Studio's) Move - (-5.5% target) 19 mar 24Price:102.8660

Analysis

Trend Analysis:

Move market bullish @5.14% expect 0.3% - 0.6% incline due to 3/19/24 N & release's, expect (-5.5%) - (-6.1%) decline there-after may see resistance or pull back

@ (+/-) 1.7%)

Structure:

suggests buying @ current low state, but expect trend to continue

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of ICE BofAML U.S. Bond Market Option Volatility Estimate Index is 87.9481 USD — it has risen by 4.92% in the past 24 hours. Track the index more closely on the ICE BofAML U.S. Bond Market Option Volatility Estimate Index chart.

ICE BofAML U.S. Bond Market Option Volatility Estimate Index reached its highest quote on Oct 10, 2008 — 264.6000 USD. See more data on the ICE BofAML U.S. Bond Market Option Volatility Estimate Index chart.

The lowest ever quote of ICE BofAML U.S. Bond Market Option Volatility Estimate Index is 36.6162 USD. It was reached on Sep 29, 2020. See more data on the ICE BofAML U.S. Bond Market Option Volatility Estimate Index chart.

ICE BofAML U.S. Bond Market Option Volatility Estimate Index value has increased by 7.13% in the past week, since last month it has shown a −3.75% decrease, and over the year it's decreased by −13.62%. Keep track of all changes on the ICE BofAML U.S. Bond Market Option Volatility Estimate Index chart.

ICE BofAML U.S. Bond Market Option Volatility Estimate Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy ICE BofAML U.S. Bond Market Option Volatility Estimate Index futures or funds or invest in its components.