MOVE trade ideas

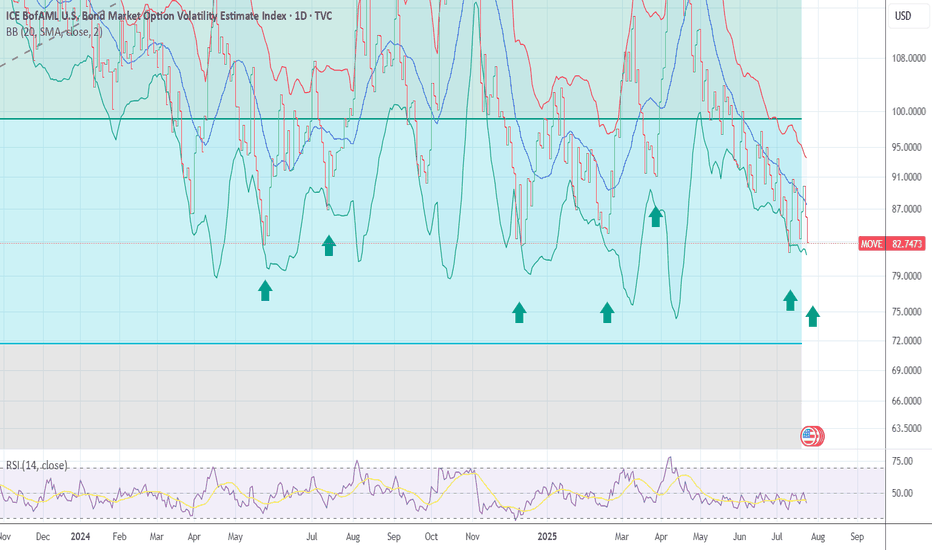

Move index saw a140 level this is a Panic short term bottom ONLYThe spreads loved like a failure was near ! So the move index reached a short term bottom Only in the High yield market so now everyone things it is safe to jump back to RISK ON . This is what we see in BEAR MARKETS sharp strong up thrusts to be followed By longer declines .Best of trades WAVETIMER . NOT A NEW BULL MARKET TRADERS

TOP CALL but for how long who knows? Not me, but i'll bet on it.Willing to take a bet that unless we push this violently lower, its the temporary top in Tech and Equities, people seem to be moving to the shiny new thing (crypto) and I expect some nice volatility to work with, and I want to take it to the downside for the FUTURES LEAP COMP for FEB. This is what I'm using to make that call. Looking to take swings at good entry points, while I day trade the micros for ideas on swing entries and scalps.

Oil moves down one more time, lower than the previous move. Equities go higher, sell, everything sells, crypto goes back faster and then up way quicker drawing in all of that money. I don't think this is the start of a prolonged bear, and IF I get my trade, I'll update after the event with my long entry when IT comes ;D

GOOD LUCK

MOVE INDEX BONDS SET TO HAVE CRISIS The chart of the move index aka BOND VIX is showing a high level of Complacency as the bonds are in sharp decline phases The worst is yet to come as the Panic in the debt markets has not been seen. Inflation and deep recession is in my model and forecast for the next 18 plus months .

MOVE Buy +1.8% - 3.55% Target Price: 91.0371

Trend Analysis:

-Move Market @ Previous lower low area where it touched this same area last year Feb, 2023 (only touched this area once). Bearish trend looks to end expecting reversal (inclined) ... Expect 0.4% - 0.73% incline

Structure:

- Trend is already +0.24% (area of volatility increase), with News & release This week expect to revert to (+3.55%) - (+4.5%) (inclined expectation)

Support & Resistance Levels:

Highs = 91.6918, 92.6549,94.8817, 95.8249

Lows = 90.3777, 89.4849, 86.3687

Crossovers & Moving Averages:

(-35% - (-40%) = Abort trade

News & Events: Expect release to allow market to conform to +4.5% incline over next few days or so or somewhere around 3.55% - 4.5%

PosibleScenario Analysis:

market continue to -0.73%, then jump 2.5% TP @ 92.6423, then incline another 2.2% Tp= 96.7823

Objective & Targets:

Follow incline to 3.55% TP @ 94.8817

(SEIIV Studio's) Move - (-5.5% target) 19 mar 24Price:102.8660

Analysis

Trend Analysis:

Move market bullish @5.14% expect 0.3% - 0.6% incline due to 3/19/24 N & release's, expect (-5.5%) - (-6.1%) decline there-after may see resistance or pull back

@ (+/-) 1.7%)

Structure:

suggests buying @ current low state, but expect trend to continue its downward momentum

Support & Resistance Levels:

Highs = 103.7823, 109.0178

Lows = 101.9801, 96.6218

Crossovers & Moving Averages:

0.4% - 0.9%,

Risk Management:

(+/-) 0.25% = abort trade

Move 3/11/24 1H & 5M TA/TC Strat Buy Conti/ Long-term SellTrend Analysis:

- Market Dropped (-8.37%) since last update on 5 Mar 24, sitting @(-4.34%)=100.875)

Structure:

- market smashed through all Highs, Lows, and targets, Expected target was achieved 7 mar 2024 market continued to decline since, smashing through the Long-term target 8 mar 2024a double bottom has now formed @ current price of 100.875. Expect buys due to structure, market being @ a lower point, double bottom,

Support & Resistance Levels:

Updated 3/11/24

Previous Low = 105.668, 95.977

Previous High = 107.5816, 114.134, 115.1695, 122.149

Risk Management:

- (+ volatility) @ 1H TP @114.1339 expect to push through would only push aout 0.7% -0.8% more to achieve expected 1.38% push left to target, shorted out due to 1H over bull signal @ +2.5% = target area @ 108.0109

Scenario Analysis:

Updated 3/11/24

- Market pullback (-0.4%), continues decline to 1HR low @ 99.116

- Mart continues 0.7% - 0.8% to target area may see high resistance with inclined momentum thereafter until target achieved

Objective & Targets:

-Follow the incline up to (+70%) - (+80%) to the target arear @ 108.011, Drop market by 1.1% after = 106.8117

($EIIV Studio's) Move - 1-28 Mar 24 TA/TCDO I even need to say much More?

Total Trend Length (TTL) 1-28 March

15.22% =1H

8.41% = 15M

4.64% = 5M

Bearish market strong push on the bulls side, keep bullish mentality

Standard deviation method = (.4%)

Momentum DTCC

27.3% - 1H

9.12% - 15M

27.4% - 5M

Volatility DTCC

79.92% - 1H

20% - 15M

59.04% - 5M

Devation DTCC

8.52% - 1H

34.1% - 15M

2.24% - 5M

EOM = End Of Month

Red Line=Potential buy/Sell Low/high EOM / resistance

TO Be continued:

SEIIV Studio's

Exploding MOVE/VIX Ratio: A Major Warning SignHey everyone 👋

Guess what? This post was created by two TradingView users! @SquishTrade and I collaborated on this post.

We wanted to share our thoughts about the MOVE/VIX ratio, which has been exploding recently, and which may be presenting a warning about the future movement of the S&P 500 ( SPX ).

Before we begin, here's a bit more about the MOVE index:

The MOVE Bond Market Volatility Index measures the expected volatility of the U.S. Treasury bond market. It is calculated based on the prices of options contracts on Treasury bonds. The higher the price of these options, the higher the expected volatility of the market. The MOVE index is widely used by investors, traders, and analysts as a measure of risk in the bond market, as changes in market volatility can have a significant impact on the prices of bonds and other financial instruments.

The above image shows a 10-year U.S. Treasury bond issued in 1976.

Here's a bit more about the VIX volatility index:

The VIX is a measure of volatility in the stock market. More specifically, the VIX measures volatility by using weighted prices of SPX index options with near-term expiration dates. When the VIX volatility index was created by the Chicago Board Options Exchange (CBOE) in 1993, it was calculated using at-the-money (ATM) options. In 2003, the calculation was modified to include a much wider range of ATM and out-of-the-money (OTM) strikes with a non-zero bid. The only SPX options that are considered by the volatility index calculation are those whose expiry period lies within more than 23 days and less than 37 days.

The above image shows the highest VIX ever recorded at the close of a trading day. It occurred near the start of the COVID-19 pandemic shutdown.

Recently, @SquishTrade discovered that the ratio between the MOVE bond volatility index and the VIX volatility index has been rising along a trend line (as shown below).

Indeed, since 2021, the MOVE/VIX ratio has been exploding higher and is now approaching the highest level ever.

@SquishTrade identified that the daily chart of the MOVE/VIX ratio has shown a moderately strong positive correlation to moves in the S&P 500, this correlation appears to be statistically significant.

Citing the above chart, @SquishTrade further explains that:

The peaks in MOVE/VIX seem to correlate with peaks in SPX, especially since late 2021 (exceptions in yellow circles). This makes sense. When a rise in MOVE occurs, but VIX stays low, this raises the ratio. Of course, when VIX stays low, it's almost always because SPX price has risen or remains supported. Overall, higher MOVE and lower VIX suggest underlying problems in broader bond markets / financial system / economy AND that this is not being reflected in implied volatility (IV) for SPX. In other words, for a variety of reasons, some of which may have to do with volatility players, equity volatility shows that equities don't care yet.

When the VIX rises, the ratio falls. The interesting thing is that the peaks in MOVE/VIX correspond with the peaks in the SPX. The other interesting thing is the general trend up in MOVE/VIX and the corresponding trend down in SPX since late 2021.

So when MOVE/VIX peaks, it is as if rates markets are flashing red, and SPX is rallying like all is well. That process continues until a top in both SPX and MOVE/VIX occurs, at which time SPX gets the memo, VIX rises, and the MOVE/VIX and SPX fall together.

My response to @SquishTrade's above analysis is that: It is my belief that the explosive move higher in the MOVE/VIX ratio relates to the capital dislocation hypothesis, which I explain in further detail in my TradingView post below:

In short, the capital dislocation hypothesis is that there is far too much capital in the stock market (SPX) for bond yields to be as high as they are (and while GDP growth is also as low as it currently is). Similarly, S&P 500 volatility (VIX) is far too low for bond volatility (MOVE) to be as high as it is, as @SquishTrade alludes above.

Exeter's inverted pyramid (shown below) ranks financial assets according to safety, with the safest assets at the bottom of the inverted pyramid. Whenever an asset lower down on the inverted pyramid becomes volatile, riskier assets above it tend to experience some greater degree of volatility. This often occurs on a lagging basis since macroeconomic processes are not instantaneous.

Therefore, we can extrapolate that the extreme volatility of U.S. Treasury bonds will likely precede extreme volatility in riskier asset classes, including stocks. Consequently, the exploding MOVE/VIX ratio is likely a warning that the VIX may move much higher soon. Chart analysis of the VIX, as shown below, potentially supports this conclusion.

Bond volatility, as measured by the MOVE index, has likely increased due to the market's extreme uncertainty about the future of interest rates and monetary policy. This extreme uncertainty underpins the stagflation paradox: persistently high inflation pulls the central bank toward monetary tightening (higher bond yields) while liquidity issues and slowing economic growth pull the central bank toward monetary easing (lower bond yields), thus resulting in bond volatility. The explosion of bond volatility is likely a sign of impending stagflation, which may be severe. For more of my stagflation analysis, you can read the below post:

Certain futures markets, such as the Eurodollar futures market, which typically guides the Federal Reserve's monetary policy, have been experiencing historically high volatility, as shown below.

The above futures chart suggests that the uncertainty about future interest rates stems directly from ambivalent market participants. Since the Federal Reserve generally follows the market, if there is extreme uncertainty and ambivalence about the future of interest rates among market participants then the result will likely be a period of whipsawing monetary policy (whereby the Fed hikes, cuts, hikes, and cuts interest rates in rapid succession). In the quarters and years to come, we will likely see extreme monetary policy whipsaw as the Federal Reserve grapples with the dueling high inflation and slowing economic growth crises that characterize stagflation.

Be sure to follow @SquishTrade on TradingView, and let us know in the comments below if you would like us to collaborate on additional posts! If you're interested in collaborating with us, also let us know!

Important Disclaimer

Nothing in this post should be considered financial advice. Trading and investing always involve risks and one should carefully review all such risks before making a trade or investment decision. Do not buy or sell any security based on anything in this post. Please consult with a financial advisor before making any financial decisions. This post is for educational purposes only.

Why we’re watching the Bond/Equity Volatility

With the action-packed week of global central bank meetings for September now behind us, we believe it's an appropriate time to review where we stand. The current phase, in our view, can be aptly summarized by the words of Huw Pill, the Bank of England’s Chief Economist: a ‘Table Mountain’ scenario rather than a ‘Matterhorn.’ Recent announcements have positioned the Swiss National Bank, the Bank of England, and the Federal Reserve as adopting a pause stance. Meanwhile, the ECB suggests that it is in the final stages of its hiking program, and Sweden’s Riksbank has just executed its final hike. While we remain slightly skeptical that these hikes may indeed be the final ones, let's entertain this thought and examine what transpires during periods of a defined pause.

Defined pause periods raise alerts for us, as highlighted in our previous piece on US Equities. In that article, we pointed out the impact of a Fed pause, as it has often preceded periods of equity drawdowns. This pattern becomes even more evident when we consider other variables like shifts in the dollar and interest rates.

Looking at the S&P 500 index —in 2000 and 2006—where a clear pause was observed, significant equity drawdowns followed thereafter.

Furthermore, the 10-Year, 2-Year, and 3-Month yields have just reached their highest levels since October 2007, June 2007, and January 2001, respectively. These yields mark the highest nominal interest rates seen in decades across the interest rate curve.

More significantly, this shift has brought real yields back to positive levels, something investors haven't seen for a while, all while the yield curve inverts to unprecedented levels. All of these factors have spill-over effects on investors accustomed to decades of low real interest rates.

Another observation worth noting is that the ratio of Bond to Equity volatility has proven to be a reliable indicator for predicting the next market regime. For instance, during the 2008 period, a break in this ratio was followed by significant moves lower in the market.

A similar phenomenon was observed in 2019, where a sharp break in the ratio of MOVE to VIX preceded the market's next downturn. What captures our interest now is a recent, significant break in this ratio, reinforcing our bearish outlook on equities.

In terms of daily charts, the recent gap down places the index at a precarious juncture as it grapples with both a sharp break of the 100-day moving average and trend support. Compared to the last two instances when the index broke lower, the current RSI stands at even lower levels. Adding to this, only 18% of S&P 500 stocks currently trade above their 50-day moving average.

Given the breakdown in the MOVE/VIX ratio, the global pause in interest rate policy, and supporting technical indicators, we are inclined to maintain a bearish stance on US equities. We can express this view via a short position on the CME E-mini S&P 500 Futures at the current level of 4347, with the take profit at 3800 and stop at 4500. Each 0.25 point move in the E-MINI S&P500 index Futures is equal to $12.5. We can also express this same view with the CME Micro E-mini S&P 500 Index. With each 0.25 point move equating to $1.25, its smaller tick size compared to the standard contract offers greater flexibility in position-building or averaging your entries.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.cmegroup.com

www.cmegroup.com

Predicting a short term increase in bond market volatility I found this cup and handle pattern on the move index RSI by accident. I'm just curious to see if it plays out. I don't know if it makes any sense and probably someone will say it's a waste of time. Maybe, maybe not. If price is what you should follow and if the why and the wherefore don't matter and it's the ticket or the tape that is important as Livermore said then it might be valid. What I'm looking for is a spike down to roughly 35.4 on RSI. Then an increase to 42, then 50, then 58, then 69, then 72. Using the cup and handle measurements would say that we are already at the lows now. This being half the distance from the top of the cup to the bottom for the handle. The full measured move is somewhat difficult to imagine. Just over 110 on RSI maybe. I'm not even sure if that's technically possible. I'm just going to play the handle. If the rest happens we will probably be busy saving our selves rather than trying to play the markets.

MACRO MONDAY 12 - Positive MOVE IndexMACRO MONDAY 12

A Positive MOVE Index - TVC:MOVE

The U.S. Bond Market Option Volatility Estimate Index – the “MOVE” is similar to the VIX volatility index that lets us know when volatility/uncertainty is high or low in the stock market by monitoring options contracts. Instead the MOVE measures how much investors expect bonds prices to fluctuate in the future. The bond market is particularly sensitive to changes in interest rates thus the MOVE also can also advise of expectations of future interest rate volatility.

The MOVE index calculates the implied volatility of U.S. Treasury options using a weighted average of option prices on Treasury futures across multiple maturities (2, 5, 10, and 30 years). It reflects the level of volatility in U.S. Treasury futures.

When the MOVE Index is high, it means investors are worried and expect big price swings, which can be a sign of uncertainty or instability in the financial markets. When it's low, it suggests that investors are more relaxed and don't anticipate significant price movements.

In essence, the MOVE Index helps us gauge how jittery or calm the financial markets are by looking at the expectations of future price changes.

The MOVE Index can help inform us of the following:

1. A potential flight to safety: When the MOVE or Bond Option Market Volatility increases this can be a signal of a flight to safety as people exit riskier assets positions such as stocks and reallocate funds to less riskier government backed assets such as Bonds.

- The chart illustrates that increases in bond volatility

negatively impact the S&P500.

2. Future Interest Rates: By capturing investors’ expectations of potential future fluctuations in interest rates, the index serves as a proxy for the bond market’s overall sentiment regarding future interest rate movements.

- The MOVE can provide insights into the bond

market’s expectations about future interest rate

volatility, thus providing a heads up of upcoming

change to future interest rates.

The importance of the MOVE index lies in its ability to provide insights into the bond market’s expectations about future interest rate volatility and market volatility.

The Chart

With an understanding of the MOVE Index we can now dive into the chart and the implications we can draw from it;

- Above the 85 level is above average bond market

volatility and below the 85 level is below average

bond market volatility.

- Historically when the MOVE Index increases higher

than the 126 level it has resulted in significant

S&P500 price decline (red on chart).

- Conversely when we are below the 126 level this

has corresponded with positive price action for the

S&P500 the majority of the time (green on the

chart). This makes sense as a MOVE below the 126

level would suggest the bond market volatility is

reaching down to the average 85 zone or under

suggesting stable financial markets with moderate

bond & interest rate volatility expected. Under such

circumstances there is certainty and an element of

calm in financial markets allowing for capital to flow

more freely into riskier assets (instead of the safer

bonds).

- When the MOVE Index falls back into the 126 – 100

zone (orange ) this zone has been a zone of

indecision with a potential increase and bounce

back out of the zone higher or a fall lower. I would

consider this a zone a wait to see what happens

next zone.

- At present we appear falling into 100 – 85 level

(green zone). Should we fall below the 85 level this

could be considered a confirmation signal of

stability returning to the bond market which could

lead to a flow of capital to riskier assets such as

those in the S&P500.

In the period from 2007 – 2009 during the Great Financial Crisis bond volatility remained elevated above the 126 level for approx. 23 months (in the red zone on the chart) and this consisted of three peaks in bond volatility that reached a high of 265 on the MOVE Index.

At present we have had 16 months of increased bond volatility reaching in and out of the 126 red zone. Similar to 2007 – 2009 period we have had three peaks in bond volatility however we only reached a high of 173 (in 2007-2009 it was a high of 265).

We are currently moving back down towards the 85 level and this appears to be positive for markets however I would remain cautious until we make a definitive move below the 85 level. We are aware that bond volatility can remain elevated for up to 23 months and we have only been elevated for 16 months and did not reach the highs of 265 like in the 2007 – 2009 period.

The chart does not have to play out the same, reach the same levels or follow a similar time pattern as the 2007 – 2009 period however we are aware that it can move higher and that it can remain elevated for longer therefore we can remain cautious until the volatility moves under the 85 level (below the historical average).

Its hard to ignore that this chart looks bullish for the market as we move down into the green zone and into lower bond market volatility. This creates a stark argument to some of the charts I shared in previous weeks. I would be more comfortable in confirming the bull thesis from this “one” chart should we move below the average 85 level. Furthermore, it is one chart and for me it would not be enough to rely on alone.

I was listening to market guru Raoul Pal this morning and he made an compelling argument to suggest that we are already in the deep trough of a recession and might be about to start climbing out of it. It’s worth considering as recessions are typically declared up to 8 months after they have started and with many countries having already established 2 quarters of negative GDP, we certainly could be in the trough. If there is one chart that would back up Raoul Pals thesis, it is the MOVE Index which is suggesting a move to lower than average bond volatility, suggesting we are potentially beginning to enter a period of stability and certainty which would allow for capital to feel more comfortable flowing towards riskier assets.

This chart will be a great chart to keep an eye on for those with a positive or negative market lens. You can press play on the chart on trading view and it will update and tell you if we are moving into low risk levels or high risk levels, you also have boundaries for the extremes.

This chart and the others I have completed on Macro Mondays are all designed so that you can revisit them at any point and press play and see if we are breaking new into higher or lower risk territory. I hope they all help towards your investing and trading frameworks.

PUKA

Cup and handle pattern on the move indexHere we are in the handle. It's playing out to perfection so far. My plan is to buy in to a bond volatility ETF as the handle reaches key levels as indicated by the horizontal lines. This will allow for a dollar cost averaged approach. So it's a long bond volatility play. If it plays out it could be huge. The handle alone is a move of about 30 from the current level and the full measured move is a peak of about 105 or there abouts. My plan is to take out 20% at intervals on the way to the 105 region unless it spikes to the peak in one go. Who knows. What would cause that to happen? Nuclear war maybe. Invasion of Taiwan and or Japan. Full blown cold war between China and the US. A debt crisis in the banking system. Time alone will tell. Hopefully I'm wrong. I'll put it on as a tail risk hedge for a black swan event at around the 1.5 to 3% size relative to my overall portfolio.

Cup and handle pattern on the move indexArc patterns are very powerful and it looks to me like we have a potential set up here where the move index could be gearing up for a big move up. If the cup and handle plays out as expected it would indicate that the move index will go up once the handle forms fully, by about 30 to reach the expected target. This is drawn on the rain of the move index. The price is another matter. It looks like it is in a descending expanding wedge which should break to the upside if traditional in nature. Arrows indicate my targets. Trade it as you see fit. It is bearish for bonds in my opinion but the movements up and down can possibly be traded. As with any volatility instrument it is difficult to use but high volatility indicates large movements in price. Traditional trading is to trade the range so go long on support lines and short at resistance. Other than that I can only wish you good luck!

MOVE/VIXUncharted waters as the caption suggests since we've closed monthly above the long term channel. What does it mean? A shift in monetary policy, hence the attractiveness in bonds or a potential peak during uncertain times. No hard convictions, but the odds are not looking great for high risk plays.

4/10/2023 (Monday) SPY Analysis and Market Macro Deep DiveIn this Video I discuss The technical analysis of the SPY ETF which is a proxy the S&P500 that is often a tell on general market movements. I also discuss broader market Macros I have been watching including last week's and next weeks economic events. We also discuss some recession indicators, and other charts that show headwinds and tailwinds to equities.

In the Trading View App, You can use the links below and hit play, so you can see the action from the dates the charts were published. I will keep this going so we can follow outcomes to analysis.

Please Like and Subscribe , or on Trading View, Follow and Boost!

See you Next Monday for the next Market analysis!