NAS100 Trade Idea: Liquidity Sweep & Bullish Reversal Potential📊 NASDAQ 100 (NAS100) Trade Outlook 📈

The NASDAQ 100 is holding a strong bullish trend on the higher timeframes 🟢. However, we’re currently seeing a notable pullback into a key support zone ⚠️ — price has dipped beneath previous lows, tapping into what appears to be an institutional accumulation range 🏦.

This move is likely targeting the liquidity resting below those lows 💧, where sell stops are positioned. Price is also reacting off a significant bullish order block 🧱 — a confluence area that could produce a strong reversal.

🎯 What to look for next:

Wait for a bullish break in market structure 🔁 to confirm a potential entry. If that occurs, consider a long setup with your stop loss below the swing low 🛑 and a 1:2 risk-to-reward target 🎯.

🚫 This is for educational purposes only and not financial advice.

NDQ trade ideas

SWING TRADE NASDAQIs this another case of Trump moving the markets so his buddies can get better entries? 👀

Not saying anything... but July candles were way too friendly in that yellow box. Institutions were loading up like it was Black Friday.

I jumped in too—snagged a clean 10RR 😎📈

Now, with seasonality (August 3.5% average past 10 years) + Commitment of traders data backing me up( July COT is heavy longs), I’m risking light for a tiny 27RR setup.

Will it work? No clue.

Will I be dramatic about it? Absolutely. 🎭📉📈

Market will crash in August 2025, some gurus said !There are no lack of experts and gurus coming out to say the market will crash because of blah blah blah.......Take it with a pinch of salt and it is more important to base your decisions from your own research.

Of course, if you are heavily concentrated in one geographical region say US market or sector eg IT/AI/COMs etc then you might want to rebalance your portfolio a bit. However, if you know what you are doing or have domain knowledge , then stick to it.

Assuming these gurus are right, the market is going on a RISK off mode, ie, going to CRASH, then safe haven assets like GOLD, SILVER should rightfully be bullish.

In that case, let's monitor this chart and see how the market behaves in this month. It will be exciting !

US100The US100 (Nasdaq 100) has shown a dramatic shift in trend, forming what appears to be a large-scale bearish harmonic pattern or potential M-top structure. After reaching its peak in mid-2025, the index has entered a sharp downward trajectory, shedding significant value in a short span.

This chart raises a critical question for long-term investors and traders:

Are we witnessing the early phase of a prolonged bear market that could stretch into 2026 and beyond?

🔻 Key Observations:

Bearish structure developing with aggressive selling pressure.

Potential breakdown from long-term support trendlines.

Momentum suggests institutional risk-off behavior.

Stay alert for macroeconomic cues, interest rate policy, and earnings season signals. A break below 13,000 could confirm a deeper bear cycle

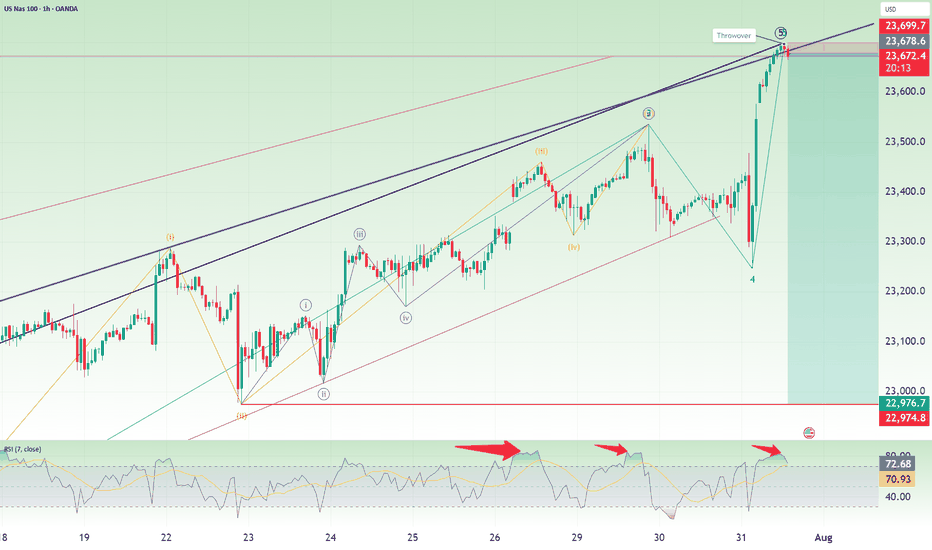

Nasdaq Short: multiple reasonsOver here, I present to you the Nasdaq short idea again. For my previous idea, it was stopped out at 23500. This time, I changed the wave counts again, mainly merging the previous wave 5 into wave 3, allowing for the new high to be a wave 5.

On top of that, here are the few other reasons for the short:

1. Fibonacci extension levels: Wave 5 is slightly more than Wave 1.

2. RSI overbought for the 3rd time on the hourly timeframe.

3. Rising wedge false breakout.

4. Head-and-shoulders on the 1-min timeframe.

As usual, the stop for this idea is slightly above the recent high, around 23700.

Thank you.

Nasdaq Index (US100 / NASDAQ) Technical Analysis:The Nasdaq Index showed improvement at the market open today and is currently trading near the $23,300 level, with price action building at a key resistance zone.

🔹 Bearish Scenario:

If the price retraces to $23,170 and breaks below it, a move toward $22,970 could follow as the next support target.

🔹 Bullish Scenario:

If the price breaks above $23,300 and holds, bullish momentum could drive the index toward $23,600.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

Trading update on NASDAQ 100

MEGA Cycle ended?

Greetings, traders!

The markets are at a critical juncture, and it's essential to prepare for what could be a significant correction in the NASDAQ 100 and, by extension, the broader stock market. Here's my analysis and outlook based on current price action, key levels, and technical indicators.

Potential for a 21% Decline in the NASDAQ 100

As I highlighted in the attached daily and weekly charts:

Elliott Wave Analysis:

The NASDAQ has completed its five-wave impulsive structure, signaling the potential end of a major bullish cycle. We are now in the midst of a corrective phase, which appears to be unfolding in the form of an ABC correction. This correction suggests that Wave C, the final leg down, is still in progress, with room for further downside.

Break of Structure (BOS):

A Break of Structure has occurred, confirming the bearish sentiment. Coupled with the presence of an unfilled gap overhead, it's clear that sellers are currently in control.

Key Fibonacci Levels:

The 0.618 Fibonacci retracement at 16,210 is a critical level to watch. A break below this support could open the door for a more extended drop to the 0.75 retracement at 13,200, representing a 21% decline from current levels.

Trendline at Risk:

The ascending trendline that has supported the NASDAQ since its 2022 lows is being tested. If this trendline breaks, it will likely trigger a cascade of selling pressure, accelerating the move to our projected downside targets.

Broader Market Implications

The NASDAQ often serves as a barometer for risk appetite in the financial markets. A sharp decline here could have ripple effects across other indices and sectors, particularly tech-heavy and growth-focused stocks. Watch for potential spillovers into the S&P 500 and Dow Jones Industrial Average, which could amplify market-wide volatility.

Key Levels to Watch

Resistance:

Gap area near 21,600–21,800.

This zone is likely to act as a supply area if the market attempts any retracement.

Support:

16,210 (0.618 retracement) – Initial target and a potential temporary bounce zone.

13,200 (0.75 retracement) – Ultimate target if bearish momentum persists.

Trading Strategy

For traders looking to capitalize on this potential move:

Short Positions:

Consider shorting retracements into resistance zones like the gap area or the 0.25 Fibonacci level.

Use 16,210 as a primary profit target, with a portion of the trade left to run toward 13,200 if bearish momentum accelerates.

Risk Management:

The markets remain volatile, so ensure you have clear stop-losses in place to protect against unexpected reversals.

Watch for Confirmations:

Monitor volume spikes, candlestick patterns (e.g., bearish engulfing), and breaks of key levels like the ascending trendline for additional entry confirmations.

Final Thoughts

The NASDAQ and broader markets are entering a critical phase. While the correction presents risks, it also provides opportunities for traders and investors who stay vigilant and disciplined.

Remember, patience and preparation are key to navigating volatile markets like these.

Stay sharp, stay informed, and trade smart.

Lord MEDZ

NAS100 - Stock Market Heading Down?!The index is trading in its medium-term ascending channel on the four-hour timeframe between the EMA200 and EMA50. However, if the index corrects upward towards the specified supply zone, it is possible to sell Nasdaq with better risk-reward.

In recent days and weeks, the Nasdaq Composite Index once again approached its historic highs, even setting a new all-time record. However, following the latest jobs data and the Federal Reserve meeting, the index experienced a price correction.

Unlike many previous bullish phases that were driven largely by short-term momentum or emotional reactions, the current upward trend in the Nasdaq reflects structural maturity and market stabilization. Institutional capital inflows and strong corporate earnings have together painted a picture of a more stable and predictable future for this index.

According to recent financial data, U.S. equity funds received over $6.3 billion in net inflows during the final week of July—marking the first positive inflow after three consecutive weeks of outflows.

The key engine behind this growth continues to be the robust performance of tech companies. Firms such as Meta, Microsoft, and AI-oriented companies like Nvidia and Broadcom posted exceptionally strong earnings reports. These results not only exceeded analysts’ expectations but also fueled significant gains in their stock prices, contributing to the Nasdaq’s momentum. Despite some sector-specific concerns—for instance, regarding Qualcomm in the semiconductor space—the broader tech sector has sustained its upward trajectory and even extended that momentum to adjacent industries, especially those involved in cloud and AI supply chains.

Meanwhile, advisors to Donald Trump revealed that he plans sweeping reforms at the U.S. Bureau of Labor Statistics (BLS). This announcement followed the July jobs report, which showed only 73,000 new jobs and sharp downward revisions to prior months’ figures.

On Truth Social, Trump accused the current BLS Commissioner, Erica McEnturfer, of politically manipulating employment data and ordered her immediate removal. Secretary of Labor Lori Chavez-DeRemer subsequently announced that Deputy Commissioner William Witrofsky would serve as acting head. Trump emphasized that economic data must be accurate, impartial, and trustworthy—and not politically skewed.

Following this leadership change, a broader debate has emerged around how employment statistics are collected and reported. While statistical revisions have long been a routine, non-political process since 1979, there are now growing questions about whether a better system for gathering and publishing this critical data could be developed.

As a nonpartisan branch of the Department of Labor, the BLS publishes its monthly employment report at 8:30 AM Eastern on the first Friday of each month. The data is gathered from surveys of around 629,000 business establishments.

Analysts have cited several reasons for the frequent need for revisions:

• Late responses from firms

• Delays from large corporations that distort preliminary figures

• Recalculations due to seasonal adjustments (e.g., holidays or weather)

• Demographic shifts impacted by immigration or deportation

• Annual revisions based on finalized tax records

With a relatively light economic calendar in the U.S. this week, traders have turned their focus to the latest developments in trade negotiations—particularly talks with countries that have yet to finalize trade agreements with Washington.

Although the U.S. has reached deals with key partners including the UK, EU, Japan, and South Korea, no formal agreement has yet been made with China to extend the current trade truce, which is set to expire on August 12.

The new U.S. tariff plan proposes a baseline 10% rate for most countries, but some—like India and Switzerland—face much higher rates of 25% and 39%, respectively. However, since implementation of the tariffs has been postponed until August 7, there’s still time for further negotiations and possible rate reductions. Sources close to the White House suggest the administration is eager to continue talks.

What’s now becoming clear is the sheer magnitude of the proposed tariff shifts—far beyond pre-trade-war averages. These changes could have more severe consequences than previously estimated, potentially pushing up U.S. inflation while simultaneously threatening global growth. As such, markets may be entering a fresh wave of volatility.

Compounding these concerns is the U.S. Treasury’s upcoming bond issuance schedule, which could add to market instability.

Also on the radar is the ISM Services PMI for July, due Tuesday. Its results will be closely watched for signs on the U.S. dollar’s direction and the Fed’s potential actions at its September meeting.

Notably, as of July 18, 2025, the widely-followed Buffett Indicator—measuring the ratio of market capitalization to GDP—was 2.3 standard deviations above its historical average. This level surpasses even the dot-com bubble era of the early 2000s. The indicator is now firmly in the “overvalued” zone, which often precedes market corrections or even crashes. For context, during the 2008 financial crisis, it was roughly 1.5 standard deviations below the historical norm.

A slight push to the upside - inboundWe're going to see a slight push to the upside, before NASley will do a proper drop for us to a position that has been support for a long time.

I'm of the opinion that she'll break that support, re-test it and then drop even further - motivated by the current political instability within the US and world in general.

Watch this move - It's going to be one for the books!

Nasdaq Index (US100 / NASDAQ) Technical Analysis:The Nasdaq index experienced a sharp drop last week, as expected, testing the 22,680$ level. Today, it's showing signs of a corrective move, currently trading around 22,950$.

🔹 Bearish Scenario:

If the price drops back to 22,680$ and breaks below it with confirmation, the next support could be 22,400$.

🔹 Bullish Scenario:

If buying momentum pushes the price above 23,000$, and it holds, we may see an extension toward 23,240$ and possibly 23,500$.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

Technical Analysis of US100 on TradingView A trader is analyzing the US100 (Nasdaq 100 Index) using a 4-hour chart on TradingView. The chart displays a clear upward channel, with price action bouncing off the lower boundary and heading toward the upper trendline. A blue arrow indicates a bullish prediction, anticipating further upward movement. Support and resistance zones are highlighted, and the setup suggests a continuation of the bullish trend.

📊 Chart Overview:

Timeframe: 4-hour (H4)

Instrument: US100 (Nasdaq 100 Index)

Platform: TradingView via Capital.com

Date/Time in Chart: 25th August, 10:00 (likely UTC)

---

📈 Trend Analysis:

The price is moving within an upward parallel channel, indicating a strong bullish trend.

The chart shows multiple touches of both the upper and lower bounds of the channel, confirming its validity.

---

🟩 Support and Resistance:

Support Zone: Around 22,850–23,050 (highlighted by the green rectangular box).

Price bounced sharply from this area, showing buyers are defending it.

Resistance Area (Projected): Upper bound of the channel, which aligns with the 24,000 level.

---

🕊️ Current Market Behavior:

The price recently bounced off the lower channel boundary and the key support zone.

A strong bullish candle broke through a mini pullback area, suggesting momentum is favoring buyers.

The blue arrow indicates an expected continuation upward toward the upper resistance line.

---

📌 Technical Implications:

Bullish Bias: As long as price remains inside the channel and above the support zone, the bullish trend is intact.

A retest of the upper channel line (~24,000) is a realistic target if momentum continues.

Invalidation Level: A clean break below the support zone (~22,850) and out of the channel could shift sentiment to bearish.

---

✅ Possible Trade Idea (for Educational Purposes):

Entry: Around 23,400–23,500 (already in motion)

Target: 23,900–24,000 (upper channel line)

Stop-loss: Below 22,850 (beneath the support zone)

Nasdaq Index Analysis (US100 / NASDAQ):The Nasdaq index saw a slight improvement with today’s market open and is currently trading near 23,000 USD. The short-term trend remains bearish.

1️⃣ A break and close below 22,960 USD may push the price toward 22,670 USD as an initial target.

📉 Holding below that level could open the path to 22,400 USD.

2️⃣ However, if strong buying momentum leads to a break above 23,160 USD and price holds, we could see a move toward 23,300 USD, followed by 23,600 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.