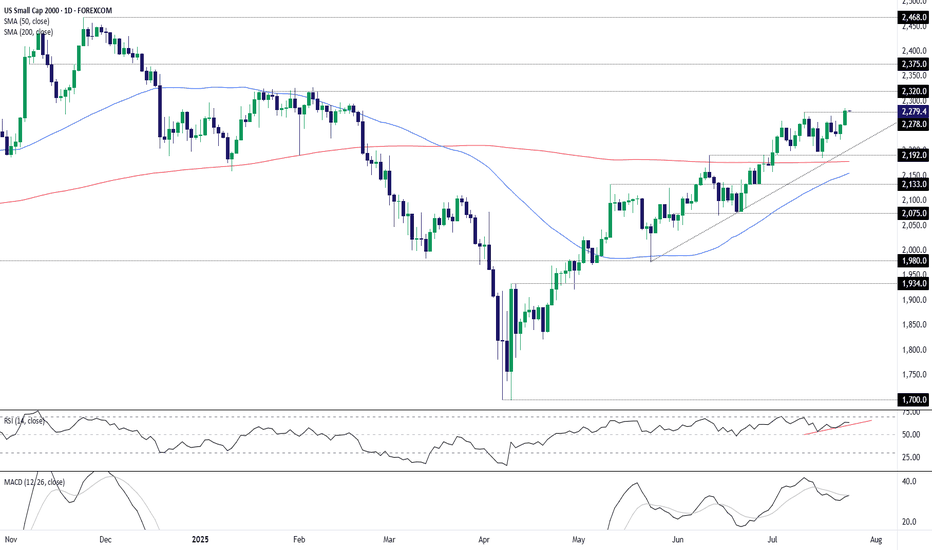

U.S. Small Caps Break Out: Dash for Trash Gathers SteamSitting in an obvious uptrend with momentum indicators skewing increasingly bullish, it looks like the U.S. small cap 2000 contract wants to go higher. The dash for trash is on!

Having just cleared the July 10 high of 2278, it’s provided a decent setup to initiate fresh longs, allowing for a stop beneath that level for protection against a reversal.

2320 screens as an initial target given the contract consistently struggled to break above it earlier this year. Beyond that, 2375 and the record high of 2468 are the levels to watch.

Good luck!

DS

RUT trade ideas

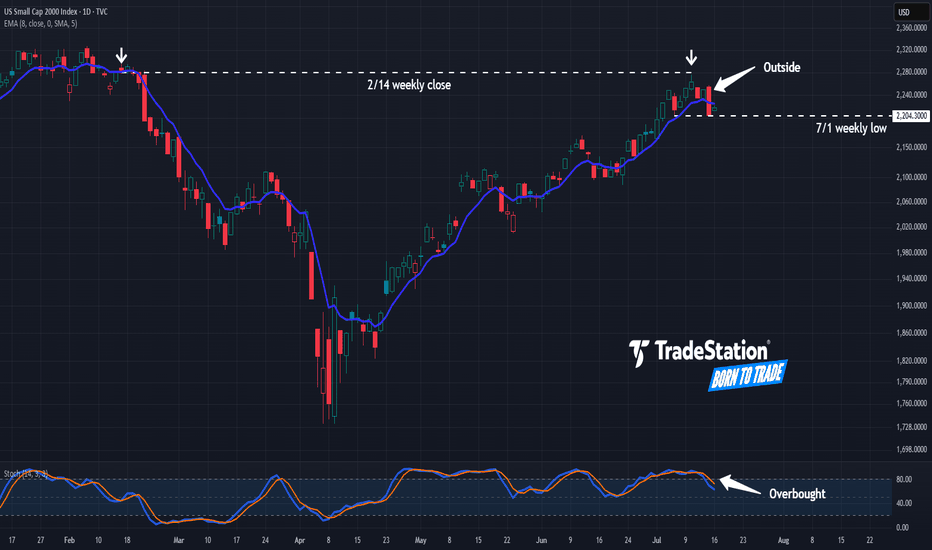

Have Small Caps Hit a Wall?The Russell 2000 has lagged the broader market for years, and now some traders may think it’s stalling again.

The first pattern on today’s chart is the February 14 weekly close of 2,280. The small cap index approached that level last Thursday but couldn’t hold. The resulting “shooting star” candlestick pattern, near a weekly level, may confirm that old resistance remains in place.

Second, RUT made a higher high yesterday and a lower low. That kind of bearish outside day is a potential reversal pattern.

Third, prices returned to a weekly low from July 1. Crossing below it could suggest support is breaking.

Fourth, stochastics are dipping from an overbought condition.

Finally, small caps are sensitive to borrowing costs. The 10-year Treasury yield has been making higher highs and higher lows on its weekly chart. Could further upside keep weighing on small caps?

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

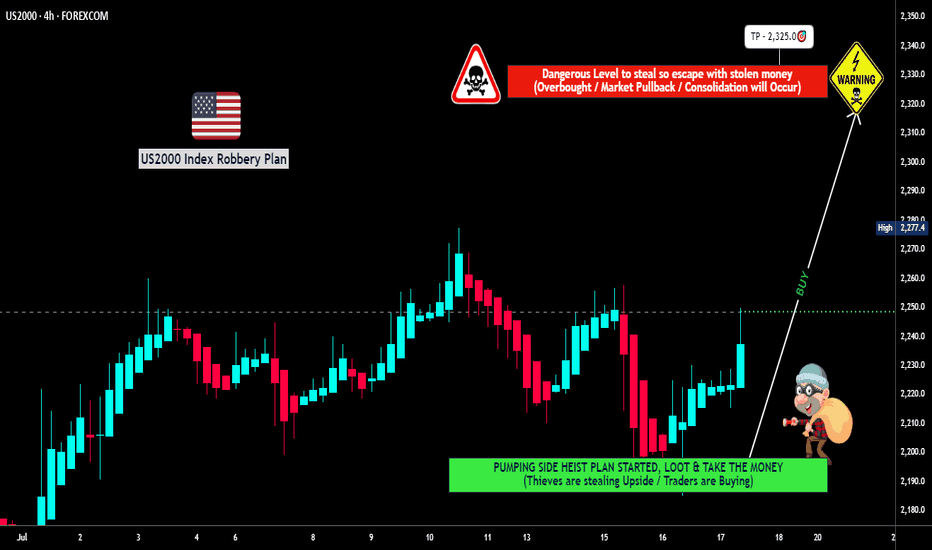

"US2000 THIEF TRADE: SWIPE & ESCAPE BEFORE BEARS!"🔥💰 "RUSSELL 2000 HEIST" – THIEF TRADING STYLE (BULLISH LOOTING IN PROGRESS!) 💰🔥

🚨 ATTENTION, MARKET ROBBERS & MONEY MAKERS! 🚨

(Thief Trading Strategy – High-Reward, Low-Risk Escape Plan!)

🎯 MISSION: US2000 / RUSSELL 2000 INDEX

(Current Market Status: Bullish Heist in Progress!)

🔓 ENTRY POINT: "THE VAULT IS OPEN!"

"SWIPE THE BULLISH LOOT AT ANY PRICE!" 🏦💨

Pro Thief Move: Use Buy Limit Orders (15-30min TF) near recent swing lows/highs for sneaky pullback entries.

Advanced Heist Tactics: Layered DCA entries (multiple limit orders) for maximum stealth & profit.

🛑 STOP-LOSS (ESCAPE ROUTE):

SL @ Nearest Swing Low (4H TF – 2200.0)

Risk Management Tip: Adjust SL based on your loot size (position sizing) & number of orders.

🏴☠️ TARGET: 2325.0 (OR ESCAPE BEFORE THE BEARS CATCH YOU!)

Scalpers Alert! 🚨 Only LONG-side scalp – if you’re rich, go all-in. If not, join the swing heist & use Trailing SL to lock profits!

💥 WHY THIS HEIST WILL WORK:

✔ Bullish Momentum Fueling the Rally

✔ Weak Bears Trapped Near Resistance

✔ Smart Money Accumulating Before Breakout

✔ Institutional Flow & Macro Trends Aligned (Check COT Report & News!)

📰 THIEF’S NEWS ALERT:

🚨 Beware of High-Impact News! (Avoid new trades during volatility.)

🚨 Use Trailing SL to Protect Your Loot!

💖 SUPPORT THE HEIST SQUAD!

👉 SMASH THAT "LIKE" & "BOOST" BUTTON! 👈

(More heists = More profits for all!)

🎭 DISCLAIMER:

This is NOT financial advice – just a Thief Trading Strategy! Trade at your own risk. Market conditions change fast, so stay sharp!

🚀 NEXT HEIST COMING SOON… STAY TUNED, ROBBERS! 🤑

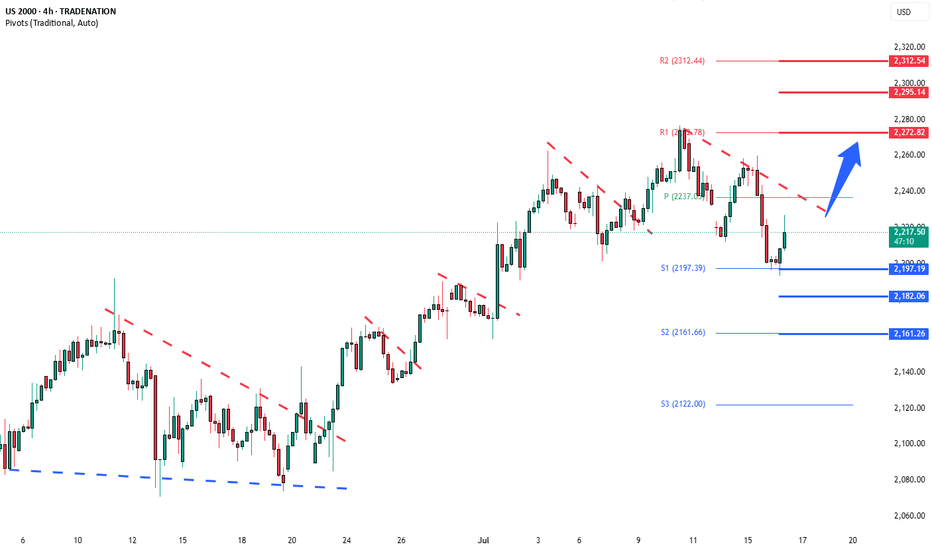

Russell2000 corrective pullback supported at 2197Key Support and Resistance Levels

Resistance Level 1: 2270

Resistance Level 2: 2295

Resistance Level 3: 2313

Support Level 1: 2197

Support Level 2: 2180

Support Level 3: 2160

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

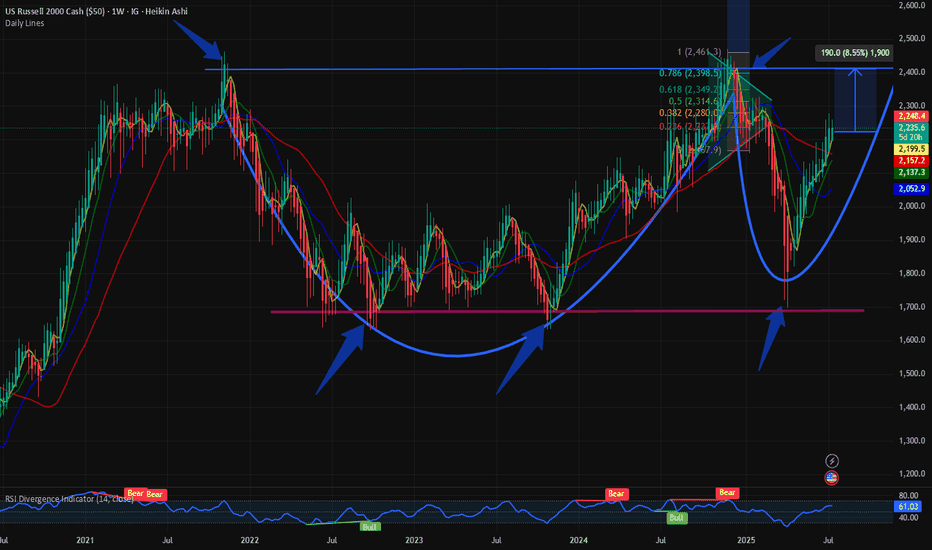

$RUSSEL: Completion of Cup and Handle formation or higher?The small cap index $RUSSEL has had a good past couple of months and has bounced back from its lows. We visited the small cap index on May 1st when we identified the trend reversal. The $RUSSEL was in the recovery mode after the Liberation Day capitulation.

IG:RUSSELL in a bounce back mode. But upside is capped @ 2400 for IG:RUSSELL by RabishankarBiswal — TradingView

This cup and handle pattern is still on hold, and I also predicted that the upside is capped @ 2400. Currently the $RUSSEL is @ 2222.

So how much upside can we expect from here with TVC:DXY making new lows? My assumption is that $RUSSEL will fail to break above 2400, and the handle part will not break out of the reverse neckline. So, the upside in the small caps is capped @ 2400 which seems to be a major resistance indicating a 9% upside from here.

Verdict : $RUSSEL Cup and handle pattern nearing completion. 2400 is the upper resistance. Still some more room to run.

US Small Caps: Evening star pattern flags reversal riskThe U.S. Small Cap contract often generates reliable reversal signals, meaning the three-candle evening star pattern completed Friday should be of interest to traders, especially with bullish price momentum also showing signs of rolling over.

Should the price push back towards Monday’s opening level, shorts could be established beneath the level with a stop above for protection. 2192 looms as an initial target, having acted as both support and resistance in the recent past, although the 200-day moving average found at 2176.7 screens as a more appealing target given its importance for longer-term directional moves in the past.

If the price were to close beneath the 200DMA, it may act as a catalyst to spark a deeper unwind towards 2133 or 2075.

Good luck!

DS

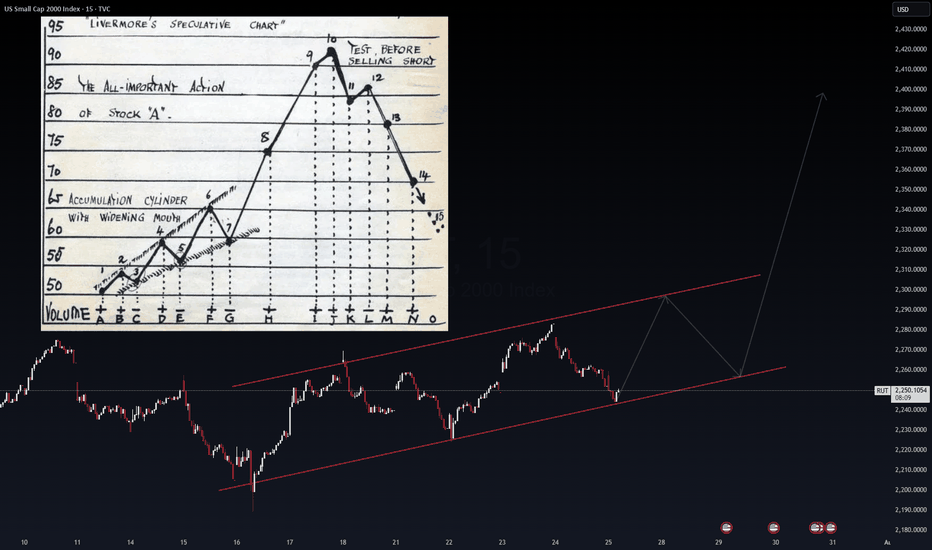

RUT Echoes IWM – The Livermore Playbook?The Russell 2000 (RUT) is painting a structure that mirrors the IWM ETF – a widening accumulation channel, setting up for a potential breakout. The VolanX protocol flags this as a classic Livermore Speculative Chart pattern, where phases of quiet accumulation lead to an explosive markup.

Channel Support: ~2,245 is holding as the battleground for bulls.

Short-Term Projection: Expect a possible ping-pong move between 2,260 – 2,300 before the real momentum ignites.

Breakout Level: Above 2,310, the price could rip toward 2,390–2,400 (Livermore’s “point 10” territory).

VolanX suggests that this structure is not random – IWM and RUT are moving in tandem, with mid-cap risk appetite quietly building. If liquidity inflows continue, this setup could fuel a sharp vertical rally into August.

"Are you seeing the same Livermore-style accumulation in IWM as VolanX does?"

#RUT #IWM #VolanX #Livermore #Accumulation #BreakoutWatch #TradingView

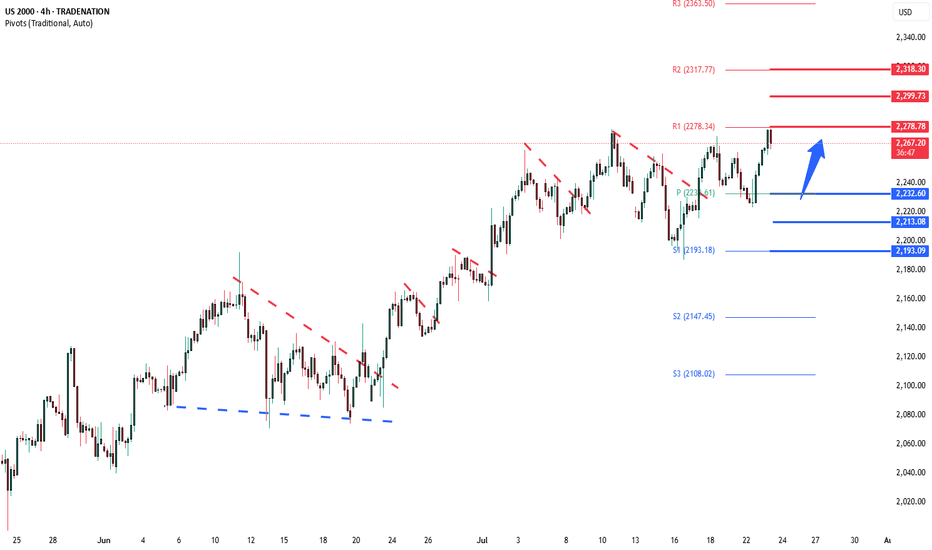

Russell2000 Bullish continuation supported at 2232.60Key Support and Resistance Levels

Resistance Level 1: 2278.80

Resistance Level 2: 2299.70

Resistance Level 3: 2318.30

Support Level 1: 2232.60

Support Level 2: 2213.00

Support Level 3: 2193.00

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Russell2000 bullish continuation breakoutKey Support and Resistance Levels

Resistance Level 1: 2278.80

Resistance Level 2: 2299.70

Resistance Level 3: 2318.30

Support Level 1: 2232.60

Support Level 2: 2213.00

Support Level 3: 2193.00

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

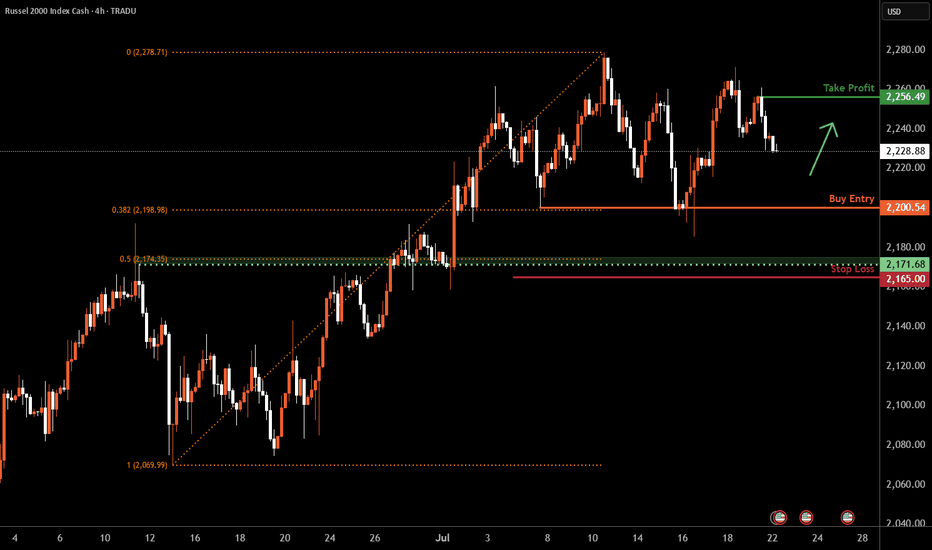

Russell 2000 H4 | Falling toward a multi-swing-low supportThe Russell 2000 (US2000) is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 2,200.54 which is a multi-swing-low support that aligns with the 38.2% Fibonacci retracement.

Stop loss is at 2,165.00 which is a level that lies underneath an overlap support and the 50% Fibonacci retracement.

Take profit is at 2,256.49 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Russell 2000 H4 | Potential bounce off a swing-low support?The Russell 2000 (US2000) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 2,210.84 which is a swing-low support that aligns closely with the 38.2% Fibonacci retracement.

Stop loss is at 2,155.00 which is a level that lies underneath an overlap support and the 50% Fibonacci retracement.

Take profit is at 2,276.04 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

"US2000 Technical Play: Long Entry at Key Support"RUSSELL 2000 BULLISH BREAKOUT STRATEGY

*(High-Probability Swing Trade Setup on RUT/US2000)*

TRADE EXECUTION PLAN

ENTRY STRATEGY

Preferred Entry: Wait for pullback to 2170 support zone (15M/30M charts)

Confirmation Entry: Valid breakout above 2170 resistance (1H closing basis)

Order Placement: Use limit orders near support or stop orders above resistance

RISK PROTOCOLS

Stop Loss Placement: 2130 (swing low on 3H/4H timeframe)

Position Sizing: Maximum 1-3% risk per trade

Key Reminder: Strict risk management is essential for long-term success

PROFIT TARGETS

Primary Objective: 2230 resistance level

Alternative Approach: Trail stop loss if momentum weakens prematurely

Scalping Note: Focus exclusively on long-side opportunities in current market conditions

MARKET ANALYSIS

Technical Factors: Emerging higher low pattern, strengthening momentum

Fundamental Drivers: Supportive environment for small-cap equities

Sentiment Indicators: Retail positioning suggests room for upside

IMPORTANT WARNING

News Event Protocol: Avoid trading during high-impact announcements

Position Management: Adjust stops accordingly during volatile periods

Trading Discipline: No new entries when major news is pending

TRADING PSYCHOLOGY NOTE

This swing trade requires patience and discipline. Wait for proper confirmation signals before execution and maintain strict risk parameters throughout the trade duration.

ENGAGEMENT REQUEST

If you find this analysis valuable, please like and follow for more trade ideas. Share your perspective in the comments section.

(Disclaimer: This content is for educational purposes only. Trading involves substantial risk.)

NEXT MARKET ANALYSIS COMING SOON

Russell 2000 H4 | Falling toward a swing-low supportThe Russell 2000 (US2000) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 2,210.84 which is a swing-low support.

Stop loss is at 2,155.00 which is a level that lies underneath an overlap support and the 50% Fibonacci retracement.

Take profit is at 2,278.39 which is a resistance that aligns with the 127.2% Fibonacci extension.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Russell2000 uptrend continuation supported at 2200Key Support and Resistance Levels

Resistance Level 1: 2270

Resistance Level 2: 2295

Resistance Level 3: 2320

Support Level 1: 2200

Support Level 2: 2190

Support Level 3: 2170

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US2000 – Holding Above 2200, Eyes on 2315 US2000 is consolidating just above the key breakout level at 2,200.0, showing signs of strength after a clean rally. As long as price holds above this zone, bullish continuation toward 2,315.0 remains likely.

Support at: 2,200.0 🔽 | 2,110.0 🔽

Resistance at: 2,315.0 🔼 | 2,450.0 🔼

🔎 Bias:

🔼 Bullish: Continued support above 2,200.0 sets the stage for a move toward 2,315.0.

🔽 Bearish: A break below 2,200.0 would weaken momentum and expose 2,110.0 as the next downside target.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

US2000 (Russell 2000 Index) Technical AnalysisiUS2000 rallied into the 2,200.0 resistance and is now pulling back slightly. If buyers hold this level, 2,200.0 could flip into strong support, setting up for a continuation toward 2,315.0. Price action remains bullish as long as the structure holds.

Support at: 2,200.0 🔽 | 2,110.0 🔽

Resistance at: 2,315.0 🔼 | 2,450.0 🔼

🔎 Bias:

🔼 Bullish: If 2,200.0 holds as new support, price may continue toward 2,315.0.

🔽 Bearish: A break back below 2,200.0 and then 2,110.0 could lead to deeper pullbacks toward 2,027.6.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

Russell 2000 will start outperforming NasdaqIMO the reversal is here for technology companies. Smaller companies will start outperforming Mega Caps. This will be because investors are looking for higher returns by taking more risk.

Smaller companies have a higher potential stock price appreciation but are more risky.

In 2000, this RUT/NASDAQ ratio reversal marked the top in the Nasdaq. I think we are close but might still have room to grow.

Oct-Nov 2025 Top?

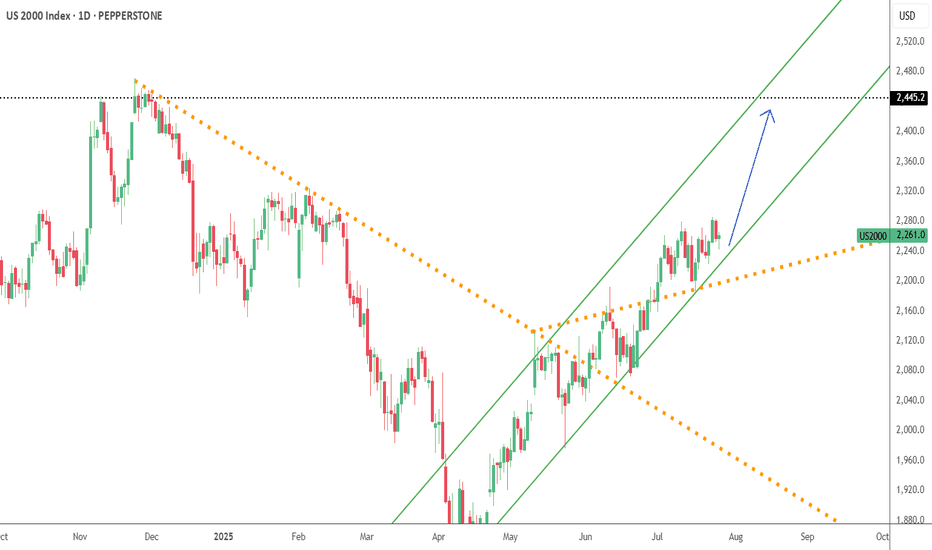

Go Russel - Strong upside for the small fry to 2,506First analysis ever done on the Russell 2000.

And the reason is because there is MAJOR upside to come for the first time in a LONG time.

So why now?

🧨 1. Rate Cuts = Small-Cap Lifeline

Small-cap stocks love lower interest rates — and the Fed's softening tone is a green light for upside.

💥 2. Breakout Setup After Long Chop

The US2000 has been stuck in a sideways range — now it's building energy for a potential breakout.

🏦 3. Regional Banks Bouncing

Regional financials (big weight in US2000) are showing signs of life — that’s a major boost to the index.

🧠 4. Under the Radar = Big Move Potential

While everyone’s chasing Nasdaq and S&P, smart money is quietly positioning in small caps before the crowd catches on.

📊 5. Economic Resilience Helps the Little Guys

US economy staying stronger than expected = tailwind for smaller domestic-focused businesses in the Russell 2000.

Cup and Handle

Price> 20 and 200MA

Target 2,506

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Russell2000 bullish breakout supported at 2167Key Support and Resistance Levels

Resistance Level 1: 2225

Resistance Level 2: 2240

Resistance Level 3: 2255

Support Level 1: 2167

Support Level 2: 2150

Support Level 3: 2134

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.