US Small Cap 2000 Index forum

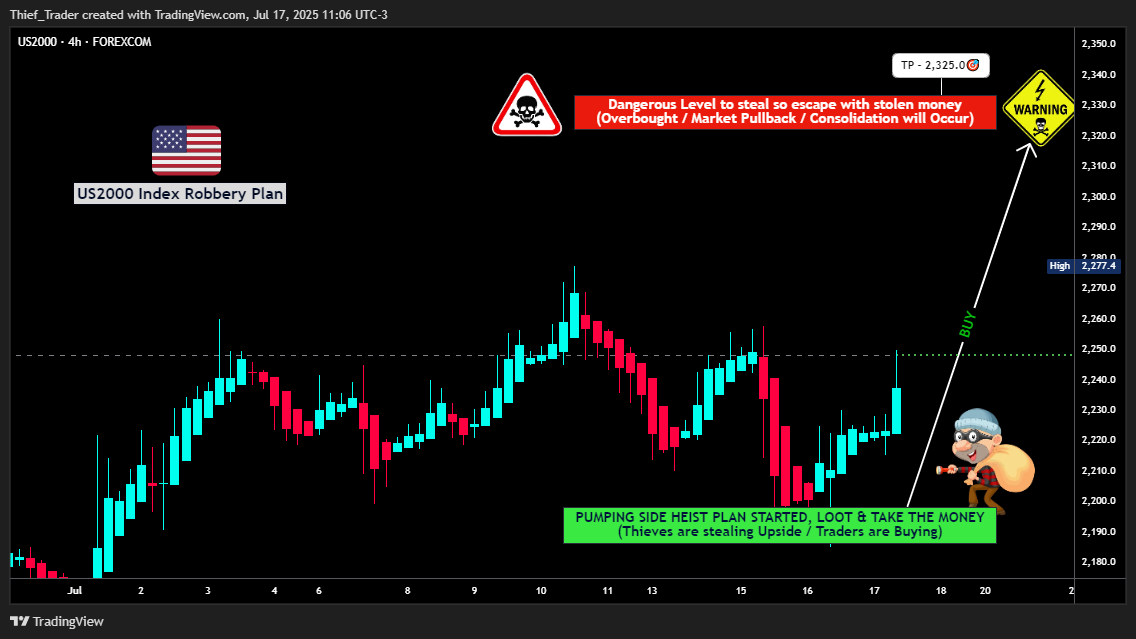

(Current Market Status: Bullish Heist in Progress!)

🔓 ENTRY POINT: "THE VAULT IS OPEN!"

"SWIPE THE BULLISH LOOT AT ANY PRICE!" 🏦💨

Pro Thief Move: Use Buy Limit Orders (15-30min TF) near recent swing lows/highs for sneaky pullback entries.

Advanced Heist Tactics: Layered DCA entries (multiple limit orders) for maximum stealth & profit.

🛑 STOP-LOSS (ESCAPE ROUTE):

SL @ Nearest Swing Low (4H TF – 2200.0)

Risk Management Tip: Adjust SL based on your loot size (position sizing) & number of orders.

🏴☠️ TARGET: 2325.0 (OR ESCAPE BEFORE THE BEARS CATCH YOU!)

Scalpers Alert! 🚨 Only LONG-side scalp – if you’re rich, go all-in. If not, join the swing heist & use Trailing SL to lock profits!

Preferred Entry: Wait for pullback to 2170 support zone (15M/30M charts)

Confirmation Entry: Valid breakout above 2170 resistance (1H closing basis)

Order Placement: Use limit orders near support or stop orders above resistance

RISK PROTOCOLS

Stop Loss Placement: 2130 (swing low on 3H/4H timeframe)

Position Sizing: Maximum 1-3% risk per trade

Key Reminder: Strict risk management is essential for long-term success

PROFIT TARGETS

Primary Objective: 2230 resistance level

Alternative Approach: Trail stop loss if momentum weakens prematurely

---

**🔑 Entry Signals: Strike Like a Thief!**

- **Bullish Ambush (Long)**: Enter on pullbacks near **Pullback Zone 1 (2060.00)** or **Pullback Zone 2 (1980.00)**. 🎯

- **Bearish Blitz (Short)**: Jump in if price breaks **below 2040.00**—ride the drop! 📉

- **Set an alert!** 🔔 Catch breakouts in real-time.

---

**🛑 Stop Loss Tricks: Protect Your Loot!**

- **Buy Stops**: Confirm breakout first! Place stops at **1980.00 (Zone 1)** or **1910.00 (Zone 2)**.

- **Adjust based on risk & lot size—stay sharp, not reckless!** ⚡

---

**🎯 Profit Targets: Cash Out & Celebrate!**

- **Bullish Thieves**: Aim for **2200.00** or exit early if momentum fades.

- **Bearish Raiders**: Target **1980.00** for quick steals.

- **Scalpers**: Stick to **long-side scalps**—big players swing, small traders trail stops!

Another great token only 2 cents now is $ NCT.X polyswarm, polyswarm this is going from 2 cents to a Dollar 💵 this summer! Rated a very strong Buy ASAP and Hold tight!