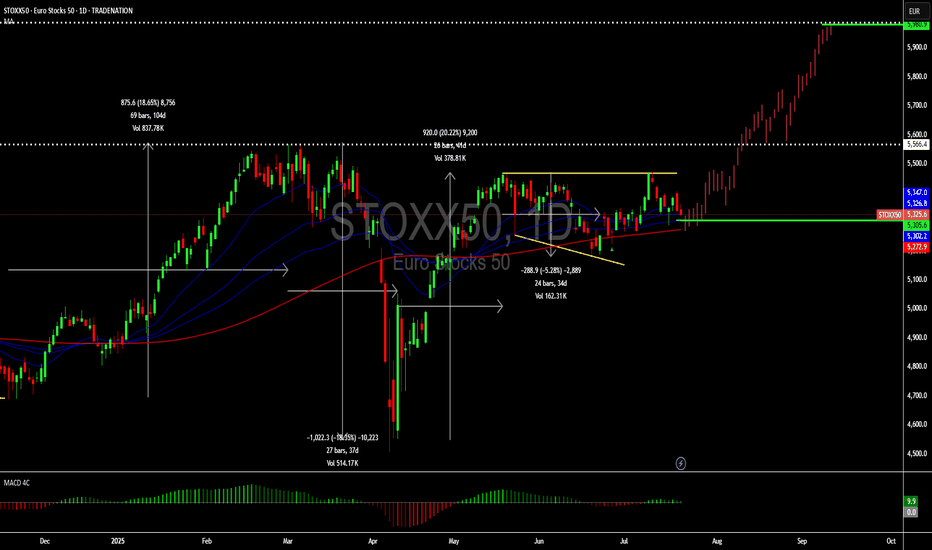

STOXX50: Still at good place for buysHello,

The Eurostocks 50 is in a bullish correction forming an expanding triangle pattern. We still see an opportunity for investors who missed the entry at the bottom of the correction to join the risk averse trade once we have a strong breakout of the corrective pattern. The STOXX50 is coming clo

About Euro Stoxx 50 Index

A market capitalization-weighted stock index of 50 large, blue-chip European companies operating within eurozone nations. The universe for selection is found within the 18 Dow Jones EURO STOXX Supersector indexes, from which members are ranked by size and placed on a selection list.

STOXX50: A great short term buyHello,

I see a short-term buying opportunity with a target of 6,000 for the Euro stocks 50. The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by the Deutsche Börse Group. The index is composed of 50 stocks from 11 countries in the Eurozone.

EURO STOXX

STOXX "Double Top" resistance retest at 5335The SOXX50 remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 5200 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 5200 would confirm ongoing u

Stoxx50 Bearish reversal resistance at 5,325The Stoxx50 equity index is exhibiting bearish price action sentiment, consistent with the prevailing downtrend. Recent movements show signs of a corrective pullback, suggesting temporary relief within a broader downward structure.

Key Technical Levels:

Resistance:

5,325 – Critical resistance lev

STOXX50 INTRADAY Bullish sideways consolidationTrend: Overall trend remains bullish, supported by rising price action.

Recent Movement: Price is in a sideways consolidation phase after a strong uptrend.

Key Levels

Support:

5310 – Key level from prior consolidation.

5275, then 5230 – Next supports if 5310 breaks.

Resistance:

5480 – First upsid

STOXX INTRADAY consolidation key support at 5310Trend: Overall trend remains bullish, supported by rising price action.

Recent Movement: Price is in a sideways consolidation phase after a strong uptrend.

Key Levels

Support:

5310 – Key level from prior consolidation.

5275, then 5230 – Next supports if 5310 breaks.

Resistance:

5480 – First upsid

"STOXX50/EURO50" Trading Plan: Ride the Wave or Get Trapped?🚨 EUROPEAN INDEX HEIST: STOXX50 Breakout Robbery Plan (Long Setup) 🚨

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Attention Market Bandits & Index Robbers! 🏦💶💸

Using 🔥Thief Trading tactics🔥, we're targeting the STOXX50/EURO50 for a clean breakout heist. The plan? Go long and escape before the MA tr

STOXX INTRADAY uptrend continuation supported at 5310Trend: Overall trend remains bullish, supported by rising price action.

Recent Movement: Price is in a sideways consolidation phase after a strong uptrend.

Key Levels

Support:

5310 – Key level from prior consolidation.

5275, then 5230 – Next supports if 5310 breaks.

Resistance:

5480 – First upsid

"STOXX50/EURO50" Index Market Money Heist (Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "STOXX50/EURO50" Index Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry.

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current value of Euro Stoxx 50 Index is 5,352.17 EUR — it has fallen by −0.06% in the past 24 hours. Track the index more closely on the Euro Stoxx 50 Index chart.

Euro Stoxx 50 Index reached its highest quote on Mar 3, 2025 — 5,568.19 EUR. See more data on the Euro Stoxx 50 Index chart.

The lowest ever quote of Euro Stoxx 50 Index is 615.90 EUR. It was reached on Nov 10, 1987. See more data on the Euro Stoxx 50 Index chart.

Euro Stoxx 50 Index value has decreased by −0.62% in the past week, since last month it has shown a 0.93% increase, and over the year it's increased by 10.75%. Keep track of all changes on the Euro Stoxx 50 Index chart.

The top companies of Euro Stoxx 50 Index are XETR:SAP, EURONEXT:RMS, and EURONEXT:MC — they can boast market cap of 335.89 B EUR, 293.17 B EUR, and 286.77 B EUR accordingly.

The highest-priced instruments on Euro Stoxx 50 Index are EURONEXT:RMS, EURONEXT:ADYEN, and EURONEXT:ASML — they'll cost you 2,385.00 EUR, 1,559.20 EUR, and 604.90 EUR accordingly.

The champion of Euro Stoxx 50 Index is EURONEXT:PRX — it's gained 64.29% over the year.

The weakest component of Euro Stoxx 50 Index is MIL:STLAM — it's lost −48.95% over the year.

Euro Stoxx 50 Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly. But you can buy Euro Stoxx 50 Index futures or funds or invest in its components.

The Euro Stoxx 50 Index is comprised of 50 instruments including XETR:SAP, EURONEXT:RMS, EURONEXT:MC and others. See the full list of Euro Stoxx 50 Index components to find more opportunities.