Trump Delays Tariffs, but Trade Tensions with EU Are Heating UpDonald Trump is back in headline mode — and this time, the EU is in his crosshairs.

After weeks of relative calm, the US President reignited global trade tensions by announcing a 50% tariff on all EU imports. But in a surprise twist — and in true reality-TV fashion — he’s now pushed the start date from June 1 to July 9.

So Europe gets a five-week stay of execution. Lucky? Or just stuck in limbo?

Let’s dive into what it means for markets, why traders aren’t exactly panicking yet, and whether this is just another Trump bluff — or a prelude to Trade Wars, Season 2.

🍝 All EU Imports — Yes, Even the Pasta

Trump’s post-holiday bombshell would slap a sweeping 50% tariff on everything from French wine and Italian olive oil to German sedans and Spanish ham.

His reason? Brussels is “dragging its feet,” and Trump, never one to shy away from drama, says enough is enough.

Cue the “America First” soundtrack.

But with the tariff now rescheduled for July 9, markets are interpreting this as more of a pressure tactic than an immediate economic hammer. A cooling-off period? Or the calm before the tariff storm?

👀 Markets Blink — But Just Barely

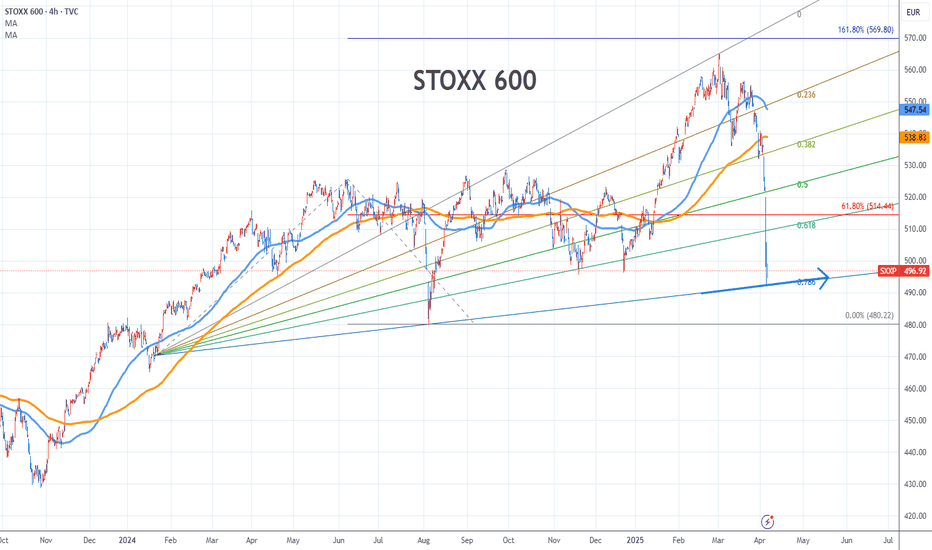

When the initial June 1 announcement hit Friday, Europe’s Stoxx 600 TVC:SXXP dropped about 1% — not exactly a meltdown, more like a “here we go again” shrug.

US stocks , which are closed for Memorial Day Monday, had already wrapped Friday in the red. Investors were digesting the potential for yet another trade war rerun — just when things were starting to feel a bit less chaotic.

The new July 9 date has offered some breathing room, but it hasn’t erased the risk. Instead, it’s created a countdown clock for volatility — one that traders can’t ignore.

⏳ Bluff or Battle Plan?

Trump’s tone this time is more poker table than podium.

“That’s the way it is,” he told reporters.

“Our discussions with them are going nowhere!” he posted on Truth Social.

“I’m not looking for a deal — we’ve set the deal: 50%.”

Still, the sudden five-week delay suggests there might be some wiggle room behind the scenes. Maybe it’s about giving Brussels time to blink. Or maybe it’s about giving voters time to rally.

🧐 Should Traders Be Freaking Out?

Short answer: No.

Slightly longer answer: Not yet.

While the tone feels sharper and the numbers bigger, traders have learned one thing about Trump: even the most dramatic threats often serve as negotiation leverage.

That said, this isn't 2018. The global economy is more fragile. Rates are higher. Consumer fatigue is real. And if this escalates into tit-for-tat tariffs, the recovery narrative could hit a speed bump — just in time for earnings season.

So traders should:

Keep an eye on EU-exposed sectors — autos, luxury goods, industrials

Monitor the FX space — especially EUR/USD volatility

Watch the earnings calendar for reports from multinationals with eurozone exposure

Stay alert for a potential 3 a.m. Trump pivot post

And maybe keep one tab open for the Brussels response

🌱 A New Deadline, Same Old Drama

So, is this real? Maybe. Is it priced in? Partially. Is it over? Definitely not.

The July 9 date might delay the fallout, but it also means the headlines — and market jitters — aren’t going anywhere. Investors now have five more weeks of speculation, positioning, and potential volatility as the transatlantic trade story unfolds.

And if you’re sitting on European exposure? Maybe don’t go full “buy-the-dip” mode just yet. More like a “watch the tape, prep your hedges, and don’t believe everything you read is final.”

Your turn: are you fading the noise or surfing the chaos? Let us know how you’re playing the next move in this global chess match.

SXXP trade ideas

SXXP (STOXX 600) - Europe Intraday (April 127 2025)STOXX 600 - Intraday Setup

April 17 2025

Decision making - using 15minutes candles & candle pattern formation

Meaning "Long Trade" = Market expected to move up

Meaning "Short Trade" = Market expected to move down

Meaning "PDH" = Previous day High

Meaning "PDL" = Previous day Low

mins = minutes

Long Trade scenario1:

1st criteria: Market must sustain above = 508.50

2nd criteria: Market has to break above = 509.10

Target = 515.30

Stop loss = 507.00

Long Trade scenario2:

1st criteria: Market must sustain above = 501.20

2nd criteria: Market has to break above = 501.75

Target = 507

Stop loss = 501.20

Short Trade scenario:

1st criteria: Market must sustain below = 501.80

2nd criteria: Market has to break below = 501.15

Target = 497.30

Stop loss = 503.20

Wishing you the very best and a safe trading.

Regards,

Uday

Disclaimer: I am not a registered analyst. The above information is only for educational purpose based on my years of experience. Please consult a financial advisor before investing.

Are Trump’s Tariffs More Bark Than Bite? What Markets Are SayingThe heated tariff drama is reverberating across global markets with a different impact depending on the region and the asset itself. Some markets, previously considered highly sensitive to extra tax charges, are actually doing better than the dominant stocks on Wall Street. Or maybe that’s just the calm before the storm? Let’s find out.

🌏 Are Europe's Stocks Great Again?

European stocks are leaving Wall Street equities in the dust, contrary to investor expectations ( contrarians, hat tip to you ). Since Donald Trump officially stepped into the top job in American politics (and started the whole tariff narrative) the Europe-wide Stoxx 600 index SXXP has gained roughly 6% to date. Its US counterpart, the S&P 500 SPX is up about 2.5% over the same time span.

Europe’s start-of-year spectacle is so good it prompted Bank of America analysts to dig into the archives and realize this is the old continent’s best opening since the 1980s. That is, while European countries struggle to power up their economies and the European Central Bank is dropping interest rates fast .

The tech-heavy Nasdaq Composite IXIC has fallen out of favor and is languishing around with a 2.2% increase since Trump took office. Moreover, the elite club called the Magnificent Seven is barely getting by. With the exception of Meta META , which is up more than 20% this year, all the others are either underwater or head above the water.

By the looks of it, Trump is gradually rolling out his punishing tariffs but European investors don’t seem too scared. Earlier this week, the US President revealed his intentions to slap the auto industry with a hefty 25% tariff starting April 2. Drugs and chips got picked on, too, with levies in the same neighborhood.

The auto space in Europe is bound to feel the weight of that auto tariff decision. Currently, Europe’s car manufacturers are taxed with a 2.5% levy on their way to the US. In the other direction, however, the US is obligated to pay a 10% duty when it imports cars into Europe.

The proposed auto tariffs knocked Asia’s automaker stocks during the Asian session on Thursday. The Nikkei 225 index NI225 was trading almost 2% lower with the auto sector dragging the broad performance.

👀 What’s Happening Elsewhere?

Gold XAUUSD is apparently the biggest winner of the tariff threat. As long as it doesn’t get slapped with one. The yellow metal has skyrocketed to levels near $3,000 with a Thursday session high of $2,955 per ounce, breaking its record made earlier in the week . What a bonanza for gold bugs as their main asset is up 15% since mid-December with no corrections and no signs of slowdown.

The US dollar has been taking blow after blow, giving rival currencies some much-needed reprieve . The dollar index DXY , measuring the buck’s strength against six forex rivals, is down about 3% from its two-year peak in early January.

Bitcoin BTCUSD , the fire-breathing volatility dragon, has actually been pretty tamed up as Trump’s crypto working group has stayed mostly tight-lipped over the prospects of crypto-friendly legislation. Prices of the orange coin celebrated inauguration day with an all-time record but have slipped 11% since then to dive back under $100,000.

Against that backdrop, what are you loading up on? Are you stacking up some European shares and shunning their US peers? Or you’re after that OG token under $100,000? Let us know in the comment section!

SXXP analysis Bull markets running on all markets with a new high looking to be set on the European index. We are however able to create a Fib Extension to the previous high set back in Jan 2022. The blue lines indicate a buy entry with each blue line signifying the next levels of TP in the case of a buy.

In the case of adding sell stops, we begin at 479.77 where we could see sells till atleast TP 1 of

471.44

Joe Gun2Head Trade - Month end buying to aid a correction? SXXPTrade Idea: Buying SXXP

Reasoning: Month end buying to aid a correction on SXXP

Entry Level: 387

Take Profit Level: 403

Stop Loss: 379

Risk/Reward: 2.03:1

Disclaimer – Signal Centre. Please be reminded – you alone are responsible for your trading – both gains and losses. There is a very high degree of risk involved in trading. The technical analysis , like all indicators, strategies, columns, articles and other features accessible on/though this site is for informational purposes only and should not be construed as investment advice by you. Your use of the technical analysis , as would also your use of all mentioned indicators, strategies, columns, articles and all other features, is entirely at your own risk and it is your sole responsibility to evaluate the accuracy, completeness and usefulness (including suitability) of the information. You should assess the risk of any trade with your financial adviser and make your own independent decision(s) regarding any tradable products which may be the subject matter of the technical analysis or any of the said indicators, strategies, columns, articles and all other features.