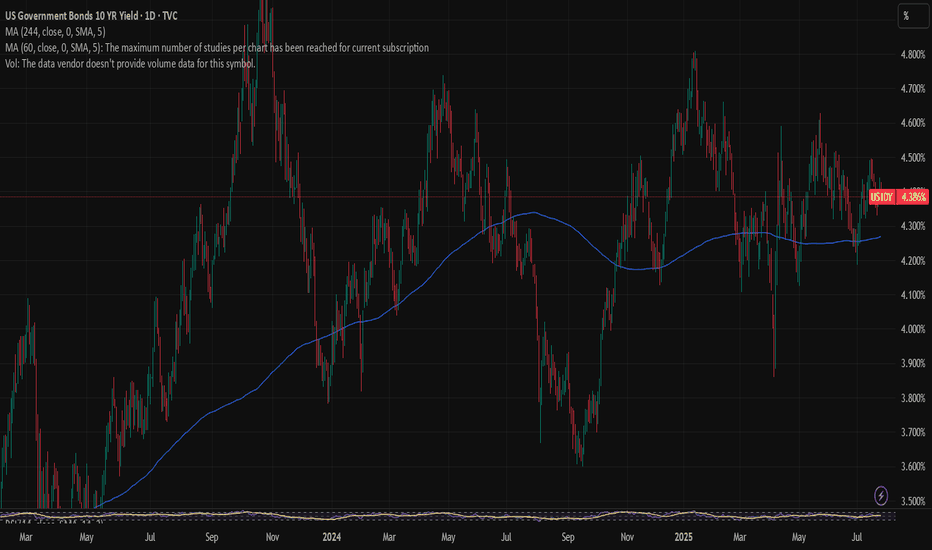

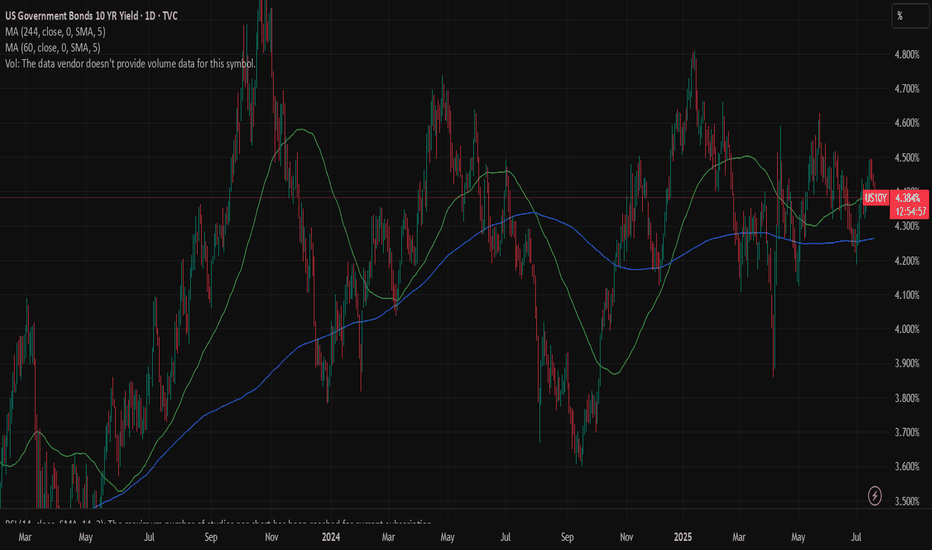

US 10Y TREASURY: FOMC week During the previous week investors were digesting the latest macro data aiming to set expectations for the forthcoming FOMC meeting, which is scheduled for Wednesday, July 30th. The 10Y Treasury yields were moving between 4,32% and 4,44%, closing the week at 4,38%. The drop in yields during the second half of the week was impacted with a trade deal between the US and Japan. Negotiations with the EU are taking place during the weekend in Scotland, whose outcome will be known at the start of the week ahead.

Regardless of trade negotiations, the week ahead will bring a lot of currently important US macro data, as well as the FOMC meeting. Current expectations with 95% odds is that the Fed will keep interest rates unchanged in July. Also, it is expected that Fed Chair Powell will inform the public about the latest Feds members view on the US economic developments. In case of any information that the market still has not priced, the higher volatility will take place. For the week ahead, there is both probability for a further modest relaxation in yields, at least till the level of 4,35%, and also potential for testing of 4,4% for one more time.

US10Y trade ideas

US10Y1. Labor Market Data

Average Hourly Earnings m/m:

Actual: 0.3%

Forecast: 0.3%

Previous: 0.2%

Interpretation: In-line with forecast and slightly above the prior period, indicating stable wage growth. This suggests inflationary pressures from labor costs remain steady, not accelerating unexpectedly.

Non-Farm Employment Change:

Actual: 73,000

Forecast: 106,000

Previous: 14,000

Interpretation: A clear downside surprise; job gains are well below expectations, and while up from a low previous period, this points to softening labor demand—an early sign of slack in the job market.

Unemployment Rate:

Actual: 4.2%

Forecast: 4.2%

Previous: 4.1%

Interpretation: Matches the forecast but marks a slight uptick, reinforcing mild labor market weakness.

Fed View: The Fed will interpret softer than expected job growth and a higher unemployment rate as evidence of easing labor market pressures—a dovish signal that could support future policy easing if the trend continues.

2. Manufacturing and Industry

Final Manufacturing PMI (S&P Global):

Actual: 49.8

Forecast: 49.7

Previous: 49.5

Interpretation: Slightly above forecast but still below the 50 threshold, indicating contraction persists but is less severe.

ISM Manufacturing PMI:

Actual: 48.0

Forecast: 49.5

Previous: 49.0

Interpretation: Below both forecast and prior; contraction in the manufacturing sector is deepening.

ISM Manufacturing Prices:

Actual: 64.8

Forecast: 69.9

Previous: 69.7

Interpretation: Lower than both forecast and previous, signaling input price pressures are easing—positive for the Fed’s inflation outlook.

Fed View: Ongoing contraction in manufacturing and lower input prices support the argument that inflation risks are cooling from the supply side, allowing for a more dovish stance.

3. Consumer and Construction

Revised UoM Consumer Sentiment:

Actual: 61.7

Forecast: 62.0

Previous: 61.8

Interpretation: Slightly below forecast, little change—consumer confidence remains relatively subdued.

Construction Spending m/m:

Actual: -0.4%

Forecast: 0.0%

Previous: -0.4%

Interpretation: Same as previous, misses forecast—ongoing weakness in construction and real estate investment.

Fed View: Weak consumer sentiment and persistent soft construction data reinforce slower demand-side dynamics, an argument in favor of pausing or even cutting rates.

4. Inflation Expectations

Revised UoM Inflation Expectations:

Actual: 4.5%

Forecast: Not directly listed (prior 4.4%)

Interpretation: Ticks up slightly, indicating that consumers expect inflation to remain higher. This could temper the Fed’s willingness to cut rates too soon—if expectations become unanchored, the Fed may have to stay hawkish.

Overall Fed Interpretation

Labor market: Softer than forecast, unemployment up—dovish for rates.

Manufacturing/industry: Slight improvement in PMI, but ISM shows contraction; input prices are easing—dovish.

Consumer/construction: Little improvement, still weak—dovish.

Inflation expectations: Up slightly—potential hawkish caution.

Net result: The data is mostly dovish—except for the higher inflation expectation which remains a concern. The Fed will likely see this data as supporting a “watchful pause” and adopt a more flexible stance: no immediate rate cut, but the case for easing is growing unless inflation expectations keep drifting higher. Sustained weak jobs or further easing in prices would increase the chances of a rate cut in coming months. Elevated inflation expectations will keep the Fed cautious about acting too quickly.

#DOLLAR #US10Y #STOCKS #BONDS #YIELD

US Treasury 10Y Technical Outlook for the week July 28-Aug 1 US Treasury 10Y Technical Outlook for the week July 28-Aug 1 (updated daily)

Overnight

Overnight, U.S. Treasury yields reversed their upward trend and traded lower as investors awaited key developments from the Federal Reserve’s upcoming policy meeting and ongoing U.S.-China trade talks. The benchmark 10-year Treasury note yield fell to 4.35%, a decrease of 2 basis points, while the 30-year bond yield dropped to 4.92%, down 3 basis points. This shift followed a period of elevated yields driven by concerns over potential inflationary pressures from proposed U.S. tariffs. Market participants were particularly focused on the Federal Reserve’s stance on interest rates, with futures markets indicating a likely rate cut in September. Additionally, trade negotiations in London between U.S. and Chinese officials added uncertainty, as economists anticipated that tariff-related disruptions could push the Consumer Price Index higher, potentially impacting future Fed decisions. The market’s cautious mood was reflected in a light economic data calendar, leaving room for yields to react to trade and Fed-related headlines.

Economic Release for the Week www.myfxbook.com

Weekly Bias

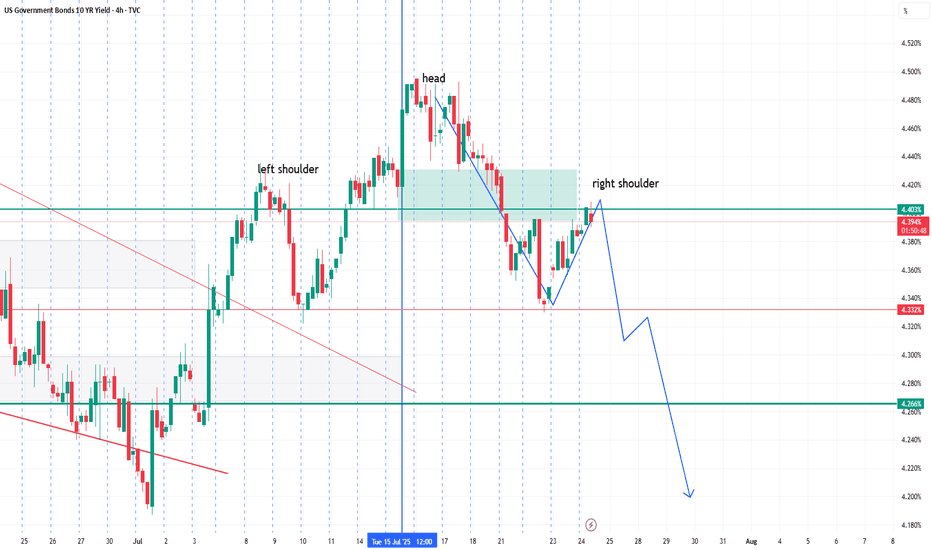

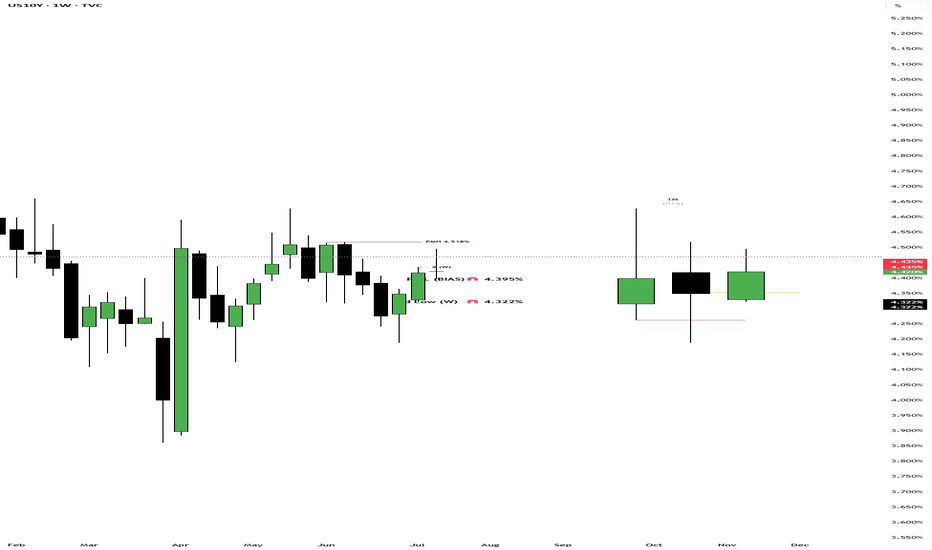

As expected last Monday we were anticipated that 4.395% will be mitigated. Basing on how the market moved last week and the week closing through below previous week low I am anticipating a continuation to target 4.33% to 4.322%. Bear in mind though that this week’s FOMC meeting could generate a significant volatility and become a catalyst to our projection.

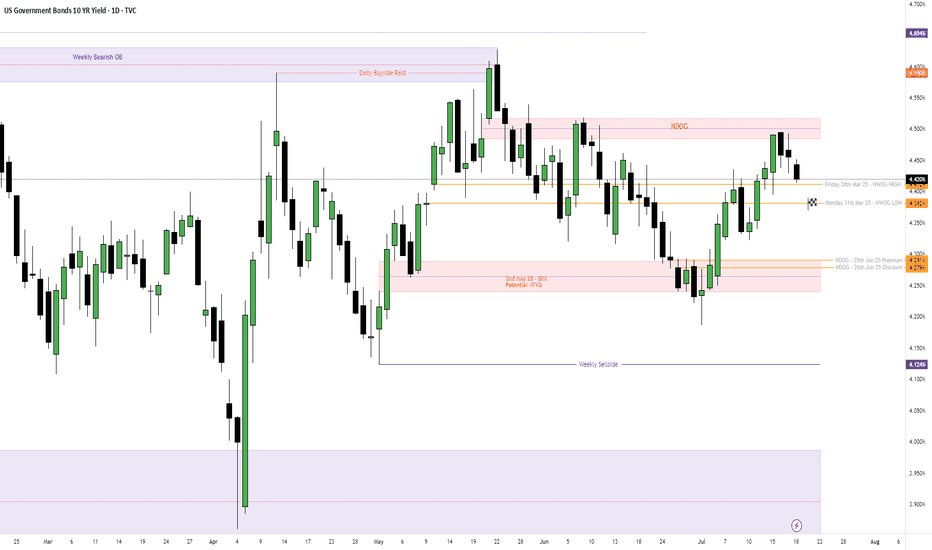

Daily Bias UST 10y July 29

Overnight

The yield on the 10-year US Treasury note remained steady at approximately 4.39% for the third consecutive session as investors awaited a critical week of monetary policy and economic data. The Federal Reserve is expected to maintain current interest rates at its Wednesday meeting, with markets keenly observing for indications of a potential rate cut in September. Investors are also focused on the upcoming Personal Consumption Expenditures report, the Fed’s preferred inflation measure, which may reveal the impact of tariffs on price dynamics. Additionally, a series of labor market data releases, culminating in Friday’s closely watched monthly jobs report, will draw significant attention. On the trade front, a recent US-EU agreement has reduced tariffs on most EU exports to 15%, down from a previously threatened 30%, alleviating some trade-related uncertainty.

Economic Release July 29 www.myfxbook.com

Daily Bias

Basing on price action I am anticipating market to test the previous day high of 4.42%. Market is also waiting for the start of the FED meeting which could contribute to low volatility for the meantime. Although market is expecting no move but any deviation from policy expectation could create high volatility.

Daily Bias UST 10y July 30

Overnight

Overnight, U.S. stock markets experienced a downturn, with major indices like the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite declining ahead of anticipated Federal Reserve announcements. The drop was primarily driven by uncertainty surrounding potential interest rate decisions and ongoing trade tensions, particularly following President Trump’s recent tariff policies. Concurrently, U.S. Treasury yields, including the 10-year note, fell to 4.28% from 4.35% the previous day, reflecting investor caution and a shift toward safer assets amid economic concerns. This market reaction underscores heightened sensitivity to Federal Reserve actions and the broader implications of trade disruptions on global economic growth.

Economic release July 30 www.myfxbook.com

Daily Bias

Cautious positioning kicks in and all our anticipated targets were all missed instead market moved to our weekly bias of 4.33% and old week low of 4.322%. This is expected on an FOMC week due on Thursday morning. With how the market moved yesterday I am anticipating a further test on the low side of previous day range but don’t discount any volatility with GDP due to be released later tonight . www.tradingview.com

Daily Bias UST 10y July 31

Overnight

The yield on the 10-year US Treasury note rose to 4.35% on Wednesday, rebounding from a near-one-month low of 4.32%, as markets evaluated the Federal Reserve’s decision to maintain interest rates and its neutral stance on future policy moves. Strong US GDP growth of 3% in Q2, exceeding market expectations, was tempered by distortions from net foreign demand due to import front-loading. Volatile trade data reflected new tariffs imposed by President Trump on India and Brazil. The Treasury announced stable issuance volumes for notes and bonds but plans to double long-end nominal buybacks and increase TIPS buybacks, aligning with efforts to manage long-end yields, as outlined by Secretary Bessent.

Economic Release July 31 www.myfxbook.com

Daily Bias

Prior to FOMC decision the yield moved higher (price lower) and retraced to the 50% range of the prior day’s range (Tuesday). Today I would like to wait if the market would continue the bullish move of Tuesday. We are on an inside candle pattern so I would like more confirmation for the next move.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Crude Oil Spikes - Russia / Ukraine / USA sanction? Concerns about the possibility of tighter global oil supplies are supporting crude prices after President Trump warned of "secondary sanctions" if Russia fails to reach a ceasefire in Ukraine within 10 to 12 days.

These sanctions have absolutely burned the shorts in oil and can cause a 3 bar surge on the daily chart if crude breaks this channel.

Keep you eye on the daily 200 MA...if it holds above we should push higher on crude.

FOMC RATE DECISION TOMORROW - Tune into our live stream.

U.S. homebuilders tumble as rate cut bets decrease after Powell'** Shares of U.S. homebuilders slide on Weds after Fed chair Powell says no decision yet on rate cuts

** Markets now pointing to odds dropping below 50% that the Fed will cut rates at its next meeting in Sept, as benchmark U.S. 10-year yield

US10Y

extends rise

** Rising yields can potentially lead to higher mortgage rates, which could negatively impact homebuilders by making homes less affordable for consumers

** PHLX Housing Index

HGX

dropping >2% on the session

** Among biggest HGX fallers are: LGI Homes

LGIH

5%, DR Horton

DHI

>2%, Lennar

LEN

nearly 3%, Pultegroup

PHM

>3%

** In S&P 500

SPX

, building products maker Builders FirstSource

BLDR

down 5%, and home improvement retailers Home Depot

HD

and Lowe's

LOW

both off nearly 2%

** With moves on Weds, HGX down ~2% YTD vs 8% advance in SPX

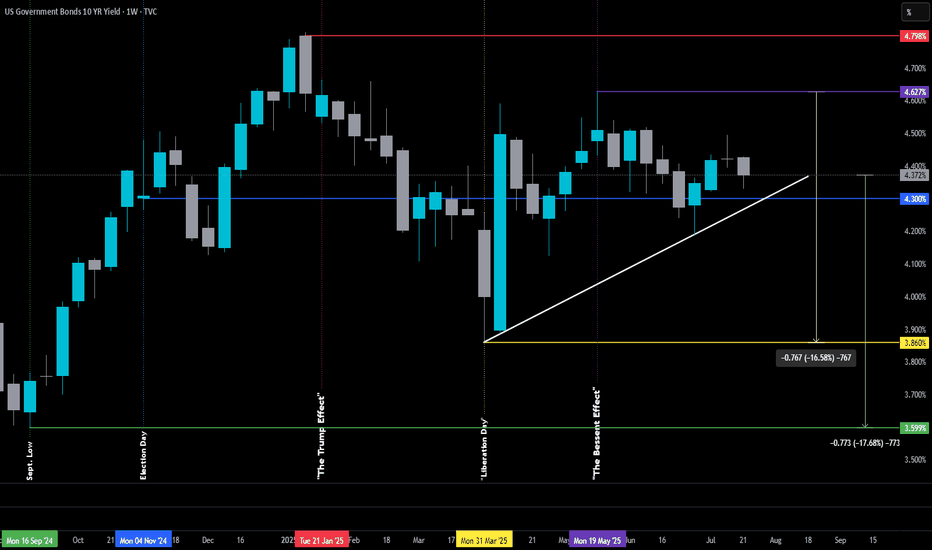

The Bessent Effect: Part I-Challenge the FedThe Bessent Effect: Part I-Challenge the Fed

Originally posted on June 30th, 2025, but it was removed by a moderator — I misinterpreted the posting guidelines (I tend to read a little too deep between the lines sometimes).

For context, the original version didn’t include the White or Green lines.

June 30th post:

The 10-year Treasury yield is the heartbeat of commercial lending — it’s what sets the tone for everything from real estate financing to economic sentiment. And interestingly, it’s now hovering right around the same level it was on Election Day 2024 (Blue Line), which feels like a lifetime ago in policy terms.

So what’s happened since then? Quite a bit.

Yields peaked the week before Inauguration Day (Red Line), then began a steady decline — until we were hit with what can only be described as "Liberation Day Tariff Whiplash."

The tariffs, announced in early April (Yellow Line), spooked the markets — particularly the ever-watchful Real Money Investors (think central banks, pension funds, and the ruthless whales). Their reaction? A spike in the 10-year, as they scrambled to reassess risk and reposition.

Plot twist: Trump’s unleashing of Scott Bessent.

Since stepping into the role of Treasury Secretary, Bessent has taken the reins of U.S. economic diplomacy. By late May (Purple Line), he was already deep in talks at the G7 meeting in Banff, hashing out trade dynamics and currency cooperation with global finance leaders. And — perhaps not so coincidentally — since then, the 10-year has been on the decline again, even as the Fed remains firm in its refusal to cut rates.

Here’s the big takeaway: there's a strong chance we could see rates — the ones that actually move the real estate market and reflect how the “real players” feel — drift back down to their pre-tariff levels. That is, before Tariff Derangement Syndrome set in. And probably before they shoot back up to the peaks we saw just as Trump returned to the White House.

In short: the 10-year might be hinting that the worst isn't over — but we could be in for a stretch of green pastures before we hit the next storm.

US 10Y TREASURY: June data cools rate cut hopesThe US inflation and jobs data shaped investors sentiment during the previous week, where 10Y US Treasury yields eased as of the end of the week. The US inflation remains relatively steady and in line with expectations, with 0,3% increase in June or 2,7% y/y. The producers price Index was holding at 0% in June, while the University of Michigan inflation expectations also eased to 4,4% for the year and 3,6% for a five years inflation expectations. June Retail Sales surprised the market with a 0,6% increase for the month.

At the start of the week, 10Y yields reached their highest weekly level at 4,49%, and took a downturn during the second part of the week. The lowest weekly level reached was 4,41% on Friday. As US macro data remains relatively robust, the current market expectations for a rate cut in July are almost diminished. Traders now expect any rate cuts to be delayed to September or later. As per CME FedWatch Tool, odds for September rate cut slipped from 70% down to current 50%. As the week ahead does not bring any currently significant macro data, it could be expected that also 10Y Treasury yields could have a relatively calmer week. It will be used for digesting current macro data and to gear up for the last week of July, when the next FOMC meeting is scheduled.

UST 10Y Technical Outlook for the week July 21-25 (updated dailyUS Treasury 10Y Technical Outlook for the week July 21-25 (updated daily)

Overnight

On Friday, the yield on the US 10-year Treasury note slightly declined to 4.44%, driven by investor reactions to the latest University of Michigan Consumer Sentiment data and remarks from Federal Reserve Governor Christopher Waller. The consumer sentiment index rose in July, accompanied by lower inflation expectations for both short- and long-term horizons. Waller expressed support for a potential rate cut in July, indicating he might dissent if the Federal Open Market Committee chooses to maintain current rates. However, market expectations remain focused on no rate changes this month, with two quarter-point cuts anticipated in September and December. Earlier data highlighted robust consumer spending through strong retail sales, alongside softer-than-expected core CPI and PPI figures.

Economic Release for the Week www.myfxbook.com

Weekly Bias

For the week I am expecting last weeks low of 4.395% to be mitigated to previous old low of 4.322%. I am basing this assumption based on the price action last week and how the weekly candle closed weekly (pin bar). Will start the analysis on daily bias on Tuesday.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

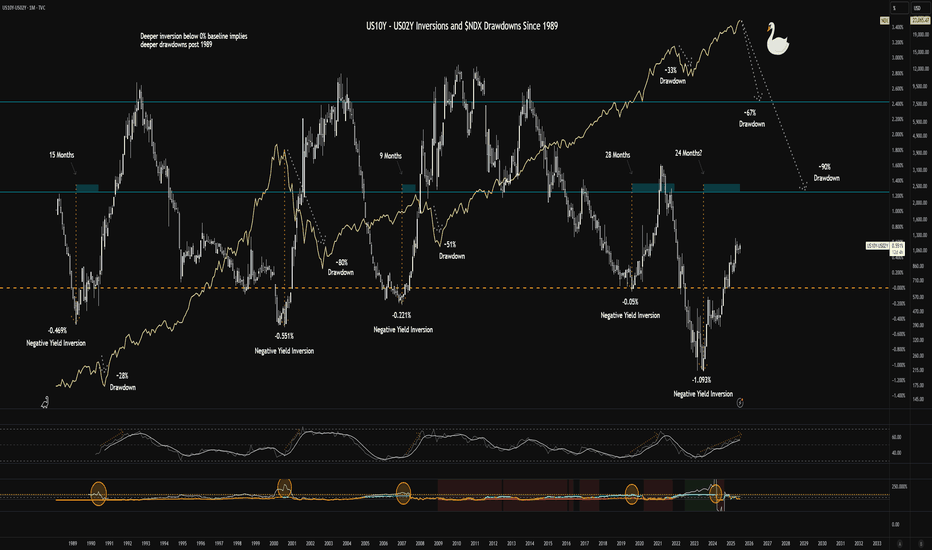

$US10Y - $US02Y Inversion and $NDX Drawdowns Since 1989I cleaned the chart a bit for readability.

The chart shows historical inversions in the TVC:US10Y and TVC:US02Y and the drawdowns in the NASDAQ:NDX that followed. The implication is that we should expect to see a >50% drawdown within 4 months. I'm not calling the "why" but only drawing parallels to historical price action following bond market environments.

My current interpretation is that we're headed for stagflation - interest rates will be stickier than consensus takes driven by market uncertainty and increasing energy prices. The Trump administration seems to be pushing for policies that would alleviate pain from stagflation. The next revolution in technology promises massive productivity gains with respect to efficiencies in money transfers and back-end business operations in general. Unemployment will continue to rise as automation begins to increase.

The market will take time to find its bearings (upskilling and learning curves for employees and employers).

The Ai boom requires energy - more than we currently have capacity for. Companies will have to finance this build-out with vast sums of money. The reward will take time to harvest. Pain in the real economy will dampen consumption for a while.

Price action in Ai and technology companies has outpaced realized gains - we are at the front-end of this curve, much like the dotcom bubble.

Speculative bubbles like BITSTAMP:BTCUSD represent a direct threat to control over monetary policy for the reserve currency and hegemony. I am still very long USA (Dollar Milkshake). CRYPTOCAP:BTC has real value for struggling economies eclipsed by the majors, but for holders of this asset in the western world, large gains in CRYPTOCAP:BTC would necessarily depend on the collapse of civilization as we know it, implying a logical paradox for people that expect outsized returns. CRYPTOCAP:BTC.D demonstrates the loss of share of market cap well.

I invite comments with legitimate rational criticism as I'm always looking to improve my thinking about this topic.

Long ideas (comment additional tickers):

Utility-driven tokens enabling this new paradigm - BITSTAMP:XRPUSD COINBASE:XLMUSD COINBASE:ICPUSD COINBASE:LINKUSD BITFINEX:XDCUSD COINBASE:HBARUSD etc.

Inelastic staples - NYSE:LLY NYSE:BUD NYSE:PM

Energy and Ai infra - NASDAQ:ABAT AMEX:WWR NASDAQ:ENVX NASDAQ:PLUG NYSE:LAC AMEX:LEU NYSE:SMR NYSE:CHPT NYSE:KMI NYSE:QS NASDAQ:ITRI NASDAQ:ENPH NASDAQ:FSLR NASDAQ:CLSK NASDAQ:TSLA KRAKEN:EWTUSD

Disruption Beneficiaries - NYSE:WU AMEX:UPW NASDAQ:OPEN BOATS:PYPL NYSE:FIS NYSE:XYZ NASDAQ:FIVN NASDAQ:BGM

Short ideas:

NASDAQ:MSTR NASDAQ:PLTR NASDAQ:META NYSE:ED NYSE:EIX NYSE:PCG BOATS:XOM NYSE:CVX

I am employing long-expiry, OTM verticals to improve costs of trades or synthetic longs on moonshot names if not holding shares outright.

Share your comments. Good luck to all!

$NDX Black Swan Correlation of Variance from 0% of $US10Y $US02YIt appears that since 1989, deeper inversions of the yield curve have led to deeper drawdowns in the $NDX. Relative strength always appears to be in a steeper move upward coupled with fuzzy signals in volatility before the drawdown. Based on the previous market crashes, anything from a 60% to 90% drawdown appears to be plausible.

Currently buying long-expiry OTM put verticals across tech meme names (think NASDAQ:PLTR ) and potentially on some stalwart Mag7 tickers (maybe NASDAQ:META ) for pennies for potentially massive risk/reward paydays. Nothing more than a few grand, but I'm also long exposure to battery materials, hydrogen, and other energy plays. NASDAQ:ABAT NASDAQ:PLUG AMEX:WWR NYSE:LAC NASDAQ:ENVX NYSE:CHPT AMEX:LEU NYSE:SMR

Best of luck.

US10Y UNITED STATES GOVERNMENT 10 YEAR BOND YIELD .US 10-Year Treasury Yield Reaction to July 15, 2025 Economic Data

Key Economic Data (July 15, 2025)

Indicator Actual Forecast Previous

Core CPI m/m 0.2% 0.3% 0.1%

CPI m/m 0.3% 0.3% 0.1%

CPI y/y 2.7% 2.6% 2.4%

Empire State Mfg Index 5.5 — -8.3

Market Reaction: US 10-Year Treasury Yield

Yield Movement:

The US 10-year Treasury yield rose sharply to 4.495% on July 15, 2025, up from 4.43% the previous market day—a gain of 7 basis points.

Immediate Cause:

This jump occurred as the inflation data, while showing softer core CPI than forecast, delivered a higher-than-expected annual CPI (2.7% y/y vs. 2.6% forecast) and robust CPI m/m. Additionally, the Empire State Manufacturing Index rebounded strongly, further supporting concerns over persistent price pressures and economic momentum.

Market Interpretation:

Investors increasingly scaled back expectations for near-term Federal Reserve rate cuts, causing a sell-off in Treasuries and pushing yields higher.

Persistent inflation—especially with annual CPI running above consensus—suggests the Fed may need to keep rates higher for longer, amplifying bond market volatility.

The improved manufacturing sentiment also fueled the belief that the US economy remains resilient, reinforcing the hawkish read on interest rates.

Summary Table: US 10-Year Yield

Date Yield Daily Change

July 15, 2025 4.495% +0.07%

July 14, 2025 4.43% —

Key Takeaways

US10Y jumped by 7 bps to its highest level in five weeks after the mixed inflation report and strong manufacturing data.

Investor sentiment shifted toward fewer and later Fed rate cuts as inflation proved more stubborn than forecast.

The yield reaction underscores ongoing sensitivity to inflation surprises and economic resilience in 2025.

The bond market’s move highlights that even minor upsets to the inflation outlook can quickly ripple through rates, especially when compounded by positive growth signals.

#US10Y

US Treasury 10Y Technical Outlook July 14-18 (updated daily)US Treasury 10Y Technical Outlook for the week July 14-18 (updated daily)

Overnight

On Friday, the US 10-year Treasury note yield increased by nearly 4 basis points to approximately 4.39%, driven by market concerns over new tariff threats from President Trump. These include a proposed 35% tariff on Canadian imports starting August 1, 2025, and planned 15-20% tariffs on most other trading partners, up from the current 10%. Additional tariffs include 50% duties on Brazilian imports and copper, alongside formal notices to other key trading partners, intensifying trade tensions. Despite these developments, the US Treasury reported strong demand for its recent auctions, with $22 billion in 30-year bonds and $39 billion in 10-year notes. On monetary policy, markets anticipate the Federal Reserve will maintain current interest rates at its next meeting, with expectations of two 25-basis-point rate cuts by the end of 2025. Source: TradingView News (Trading Economics)

Economic News for the week www.myfxbook.com

Daily Technical Outlook

With the strong bearish (in price) close on Friday and the week, there’s a chance market will target 4.435% and for the week 4.462%. With the strong influence by fundamental please continue to watch the tariff updates and policy adjustments as this are the strong drivers of market moves the past week. This week will be inflation rate week due on Tuesday.

**Disclaimer:**

The technical analyses provided herein are based solely on my personal analysis and are intended for my own study and reference. They do not constitute a recommendation or solicitation to buy or sell any financial instruments. Any decision made by individuals based on this analysis is their own responsibility, and I assume no liability for any losses or damages incurred as a result of using this information. It is advisable to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

US 10Y TREASURY: tariff tensions rattle bonds During the previous week there has not been important US macro data scheduled for a release, however, news regarding tariffs has been the ones which shaped investors sentiment and also, US bond yields. It was indeed a no-clear-direction trading week when it comes to 10Y Treasury benchmark yields. The week started with a strong move to the upside, from 4,32% up to 4,39, then there was a push back, while yields ended the week at 4,41%. News regarding tariffs were the ones that shaped Friday's sentiment on the market.

Saturday brought news that the US Administration is implementing tariffs of 30% on goods imports from Europe and Mexico. This information is still not reflected in market yields, but will certainly be with the start of the trading week on Monday. Aside from tariffs news, the week ahead brings some important US macro data, like June inflation, PPI and University of Michigan Consumer Sentiment on Friday, implying that another volatile week is ahead.

UNITED STATE GOVERNMENT 10 YEAR BOND YIELD US10Y1. US 10-Year Treasury Yield (US10Y)

The 10-year Treasury yield is approximately 4.39%, up about 0.04 percentage points from the previous session (July 10, 2025).

Over the past month, the yield has edged up slightly by around 0.02 points and is about 0.20 points higher than a year ago.

Market expectations project the 10-year yield to average around 4.28% by the end of Q3 2025, with a gradual decline to about 4.06% in 12 months.

The yield increase reflects ongoing market pricing of Fed rate policy, inflation expectations, and economic growth prospects.

2. US Dollar Index (DXY)

The DXY is trading near 97.758, reflecting a modest decline over the year.

The index is influenced by Fed policy expectations, global risk sentiment, and interest rate differentials.

A stronger 10-year yield tends to support the dollar, but recent tariff uncertainties and geopolitical risks have contributed to some volatility.

3. Bond Prices and PIMCO Active Bond ETF (BOND)

Bond prices move inversely to yields; with yields rising slightly, bond prices have shown minor declines.

The PIMCO Active Bond Exchange-Traded Fund (BOND) is trading around $91.50, essentially flat on the day, reflecting a diversified portfolio of fixed income instruments.

This ETF invests mainly in investment-grade debt but can hold up to 30% in high-yield securities, providing exposure to a broad range of bonds.

4. Federal Reserve Chairman

The current Chairman of the Federal Reserve is Jerome H. Powell, serving since February 2018 and reappointed in 2022 for a term through 2026.

Powell’s leadership continues to focus on balancing inflation control with economic growth, navigating trade uncertainties, and signaling a cautious but data-driven approach to future rate changes.

Summary Table

Metric Latest Data (July 2025) Notes

US 10-Year Treasury Yield 4.39% Slight increase; reflects Fed policy pricing

US Dollar Index (DXY) 97.75 Modest decline YTD; sensitive to yields and tariffs

PIMCO Active Bond ETF (BOND) $91.50 Stable; diversified fixed income exposure

Fed Chairman Jerome H. Powell Leading Fed policy since 2018, reappointed 2022

Market Context

The modest rise in the 10-year Treasury yield signals market confidence in the US economy but also reflects inflation concerns and Fed policy expectations.

The DXY’s relative stability amid tariff uncertainty suggests balanced market sentiment toward the dollar.

Bond investors remain cautious, with diversified funds like PIMCO’s BOND ETF offering a buffer against volatility.

Fed Chair Powell’s guidance continues to emphasize data dependency, with markets watching closely for signals on rate adjustments.

#FEDS #DOLLAR

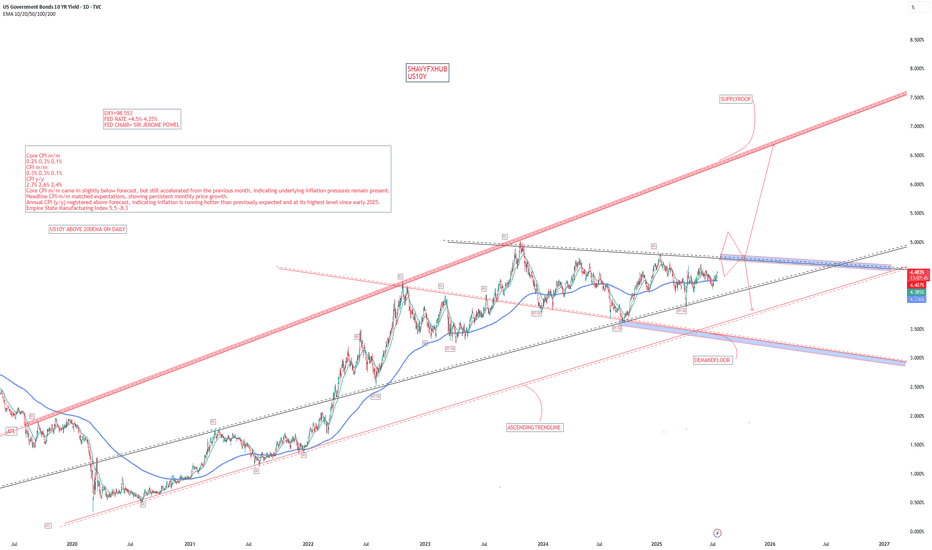

US10Y: New Multi Decade Highs are coming for Treasury Yields!📈 US10Y: Treasury Yields Are About to Explode Higher

Longing bonds was the consensus trade heading into 2025. Everyone expected a “flight to safety” as equities tanked, but guess what? Bonds have been a massive disappointment. Instead, Bitcoin and Gold have stolen that narrative—who saw that coming?

But here’s the real kicker…

The 10-Year Treasury Yield is now forming a textbook Wyckoff Distribution Schematic #2, and we’re entering Phase B with a potential Upthrust (UT) forming. That means yields could be gearing up for a massive breakout, putting serious pressure on leveraged bond bulls.

My projection?

We’re heading to the 2.272–2.414 Trend-Based Fib Extension, targeting 5.53% to 6.42%. That’s a multi-decade high in yields.

If you’re holding bonds with leverage...

🔥 You might want to sleep with one eye open.

And no—this isn’t about the Fed, or politics, or CPI print tea leaves. Fundamentals don’t lead—technicals do.

UNITED STATES 10 YEAR GOVERNMENT BOND YIELD US10YMarket Context

The yield reflects investor expectations for Federal Reserve policy, inflation trends, and US fiscal conditions.

Markets are pricing in potential Fed rate cuts later in 2025, but persistent inflation and fiscal concerns are keeping yields and pending a clear directional bias .

The US 10-year yield is a key benchmark for borrowing costs and is closely watched as a “risk-free” rate for global financial markets.

Summary

US10Y is currently at 4.35%-4.332%,

The yield awaiting further economic data and central bank signals.