ASX on WatchLooking for entry after a break and retest of yesterday's high, $10.34

Why:

Even though yesterday's candle is high volume and red, if you drill into a smaller time interval, the candle where the volume was high is green.

Uptrend since April

Solid fundamentals (EPS Growth)

Target would be around $10.88, which is the 1.618 fib level

3711 trade ideas

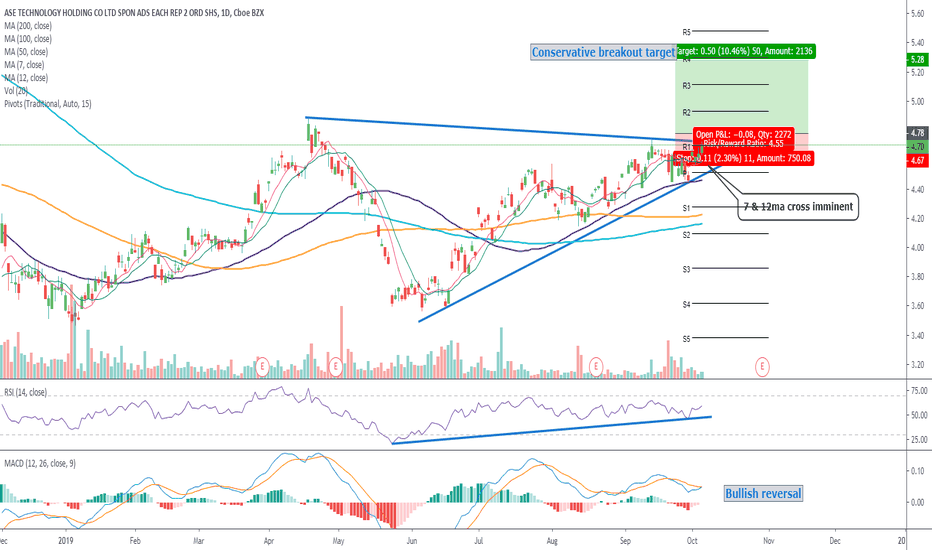

Ase technology -Corrective wave ended, upside resumingTWSE:3711 Ase Technology is looking at a possible end to its corrective wave and a bullish impulse wave is likely staging a return. From the price action perspective, there's a strong rebound previously at 123.6% expansion level of wave A-B. Furthermore, the stock has also formed an ascending triangle, which sees a potential break to the upside.

Momentum wise, long-term MACD's histogram just turned positive and stochastic oscillator has been rising steadily, giving a strong steady upside momentum.

As such, we are aiming a mid-term target of 187.00

ASX Approaching All-Time HighASX has been on a roll for the last nine weeks. If it can take out the resistance at 9.62 (The all-time high), then then this might go up much higher.

The VanEck Semiconductor ETF SMH has been in a nice uptrend, making the semiconductor sector an attractive market. Also, ASX has a good dividend - a good bonus for long-term holders.

ASXOn the daily chart, it looks like ASX has successfully bounced back from the support line.

It should be able to reach $9.62, the previous height (15%-20% gain), within a month.

I am putting 10% of my fund into this stock.

The stop loss is around the $7.66, the previous low.

This is just my personal view on this stock, and it does not intend to provide any investment recommendations.

ASX is ready to break outNYSE:ASX is showing some muscles and is ready to breakout. Long the breakout at 5.7$ to target 7.24$, 7.49$ and 8$. Stop level around 5.1$

Hit the like button please if you find this useful :)

This is only my own view and not a financial advice, do your own analysis before buying or selling

Happy Trading!

ASX follow: still longThis is a follow up from May 8 post (link below).

Still looks positive to me. Near term target box given. But if goes above the recent high of 5.7 then a move to 7 seems possible. Process your way.

This is a semiconductor company in Taiwan as is TSM which I also posted and has rocked up to the suspected target. Hope hope some of you profited from that.

Observation : Notice the beautiful "cup" formation from April to December 2019. Followed by a sharp drop. No one pattern works every time. There is an old saying: "Many a slip between the cup and the lip" I guess this one falls into that category.

Have a great day.

ASE TECH rides the SMH reversal.Shares of ASE Technology (NYSE:ASX) are rising to test the highs set in April and in the summer of 2018. The stock was recently upgraded by analysts at Goldman Sachs and Macquarie. The company provides a variety of packaging and testing services out of its headquarters in Taiwan. Watch for a breakout to the highs set in early 2018 which would be worth a rise of more than 50% from here.

Source Investorplace

Average analysts price target $2.56

Average analysts recommendation Overweight

P/E ratio 19

Yield 2.26

Short interest

ASE Technology Holding Co., Ltd. engages in the provision of semiconductor manufacturing services in assembly and test. The firm develops and offers turnkey solutions for the front-end engineering test, wafer probing and final test, as well IC packaging, materials and electronic manufactures services. It operates through the following segments: Packaging, Testing, Electronic Manufacturing Services (EMS), Estate, and Others. The Packaging segment offers a broad range of package types such as flip-chip BGA, flip-chip chip scale packages, advanced chip scale packages, quad flat packages, thin quad flat packages, bump chip carrier, quad flat no-lead packages, advanced quad flat no-lead packages, and plastic BGA. The Testing segment provides complete range of semiconductor testing services, including front-end engineering testing, wafer probing, final testing of logic/mixed-signal/RF/(2.5D/3D) module and SiP/ MEMS/Discrete and other test-related services. The EMS segment is comprised of the SMT assembly line which provides activities such as, solder paste stencil printing, component placement, and solder reflow. The company was founded in April 2018 and is headquartered in Kaoshiung, Taiwan.

ASX target $7 with (MA,2) crossing (MA,19)ASX

As the 2 days moving average is crossing the 19 days moving average, which shows it's good timing to catch the momentum.

Moreover, when we look into the regression with 1.96 S.D., that's represent the 95% confidence interval.

Which the current price is suitable to go in.

My target: $7

Profit taking: when 2 days moving average is falling below the 19 days moving average

Stop loss: $6

ASXASX has been Bullish with the last month. EMA(9) is above EMA(20)(50) and (200). Price has consolidated back into the Bollinger bands and price has bounced off EMA(50) resulting in price crossing over EMA(9) as of today. Volume is still considerable high. There does appear to be a resistance line, illustrated by the triangle. Breaking thru this resistance should offer a powerful move up to retest the high.