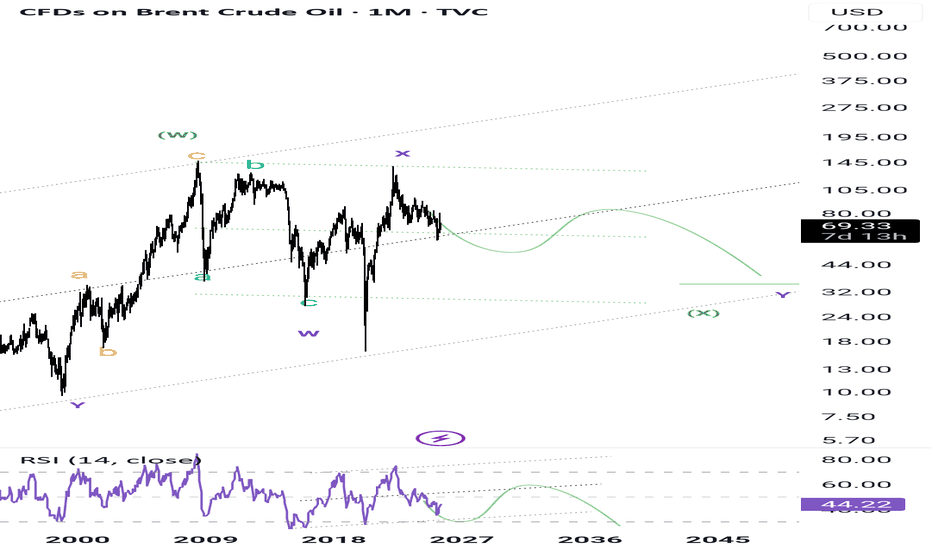

Oil surges on Russia sanction threats but long-term risks remainOil prices have climbed around 6% this week, driven by two key developments: a trade deal between the EU and the US, and Donald Trump’s warning that the US may impose sanctions on Russian oil buyers within 10 days unless progress is made toward ending the Russia-Ukraine war.

Russia accounts for abo

Brent: Crude Loses Its Shine Amid Mass Selloffs and Global FearsBy Ion Jauregui – Analyst at ActivTrades

Bearish pressure is intensifying in the oil market, with Brent crude leading the liquidation among major investment funds. The expiration of U.S. tariff exemptions on August 1st, combined with a global economic slowdown, has triggered a wave of risk aversio

WTI short in OPEC production hike and technical breakout Interesting chart for WTI with a nice daily downtrend and 4hr counter trendline + support level for a breakout. This is further supported by the OPEC production hike, would like to see a higher inventories reading too.

Things that could negatively effect this position are sanctions being put on R

Brent Crude corrective pullback support at 7133The Brent Crude remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 7133 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 7133 would confirm ong

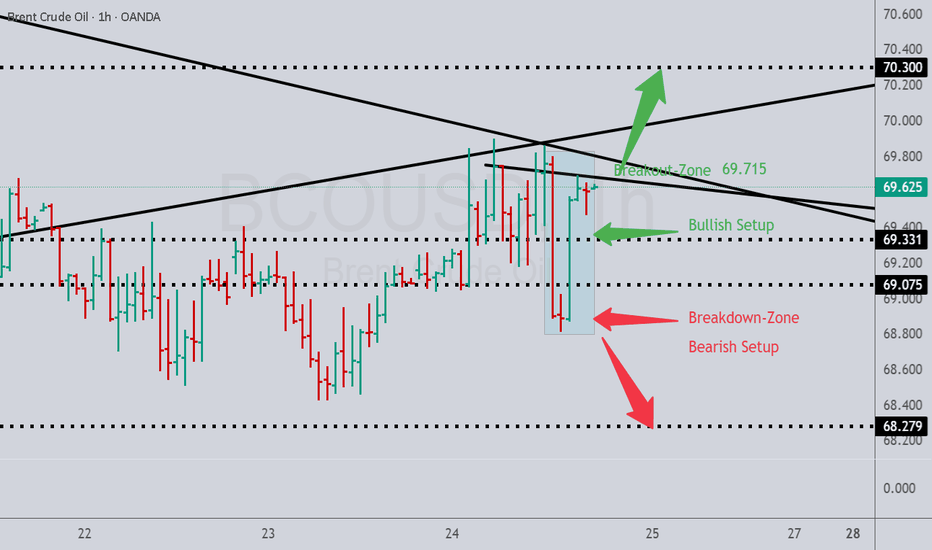

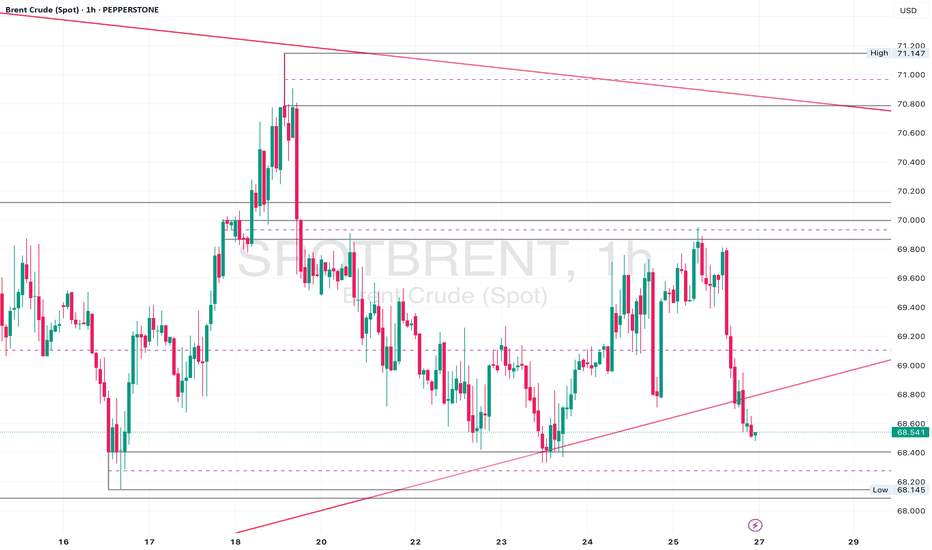

Brent Crude Sitting at Key Support – 69.20 Hold for a Rebound?Daily Analysis:

Price is holding above the ascending trendline and forming higher lows. Multiple rejections from the 68.00 region suggest strong demand. As long as we remain above the trendline, bulls stay in control.

4H Analysis:

Pullback after rejecting 71.00. Now sitting inside the 69.60–69.20 d

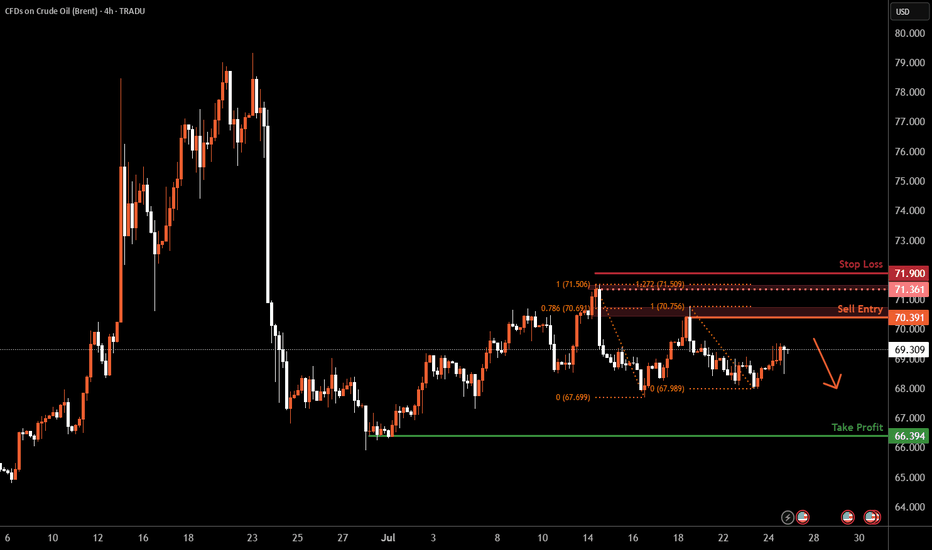

Brent Oil H4 | Heading into a swing-high resistanceBrent oil (UKOIL) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 70.39 which is a swing-high resistance that aligns closely with the 78.6% Fibonacci retracement.

Stop loss is at 71.90 which is a level that sits above the 127.2

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.