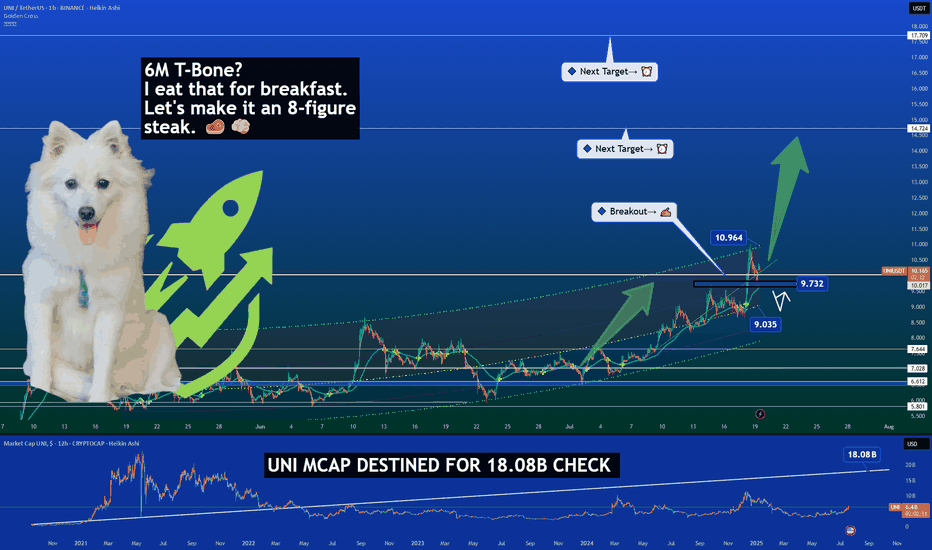

UNI Market Cap Breakout Signals Major Repricing Ahead 🚀📈 UNI Market Cap Breakout Signals Major Repricing Ahead 💥💹

Forget the December highs. That spike? It came with a bloated market cap and little real growth. T oday, it’s different.

UNI has reclaimed the key $10 level, but more importantly, its market cap structure is breaking out after years of

Related pairs

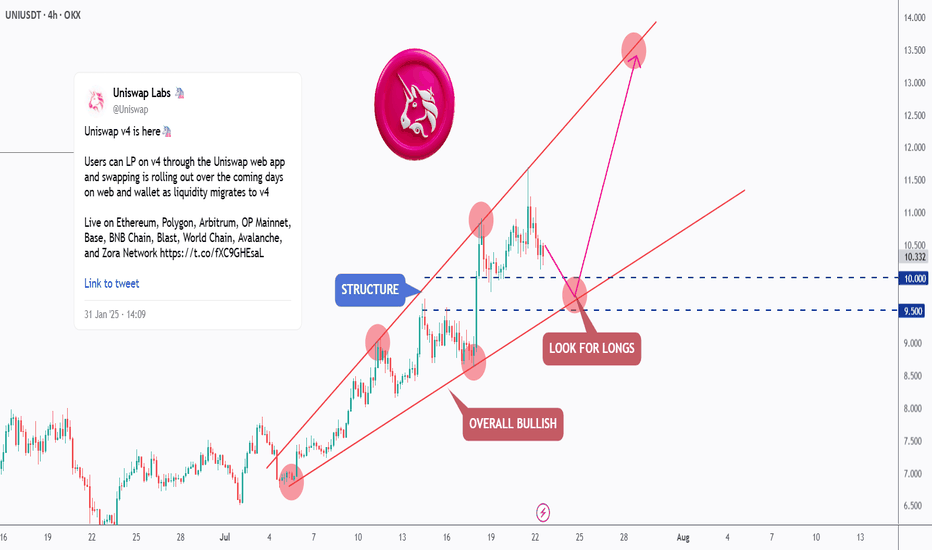

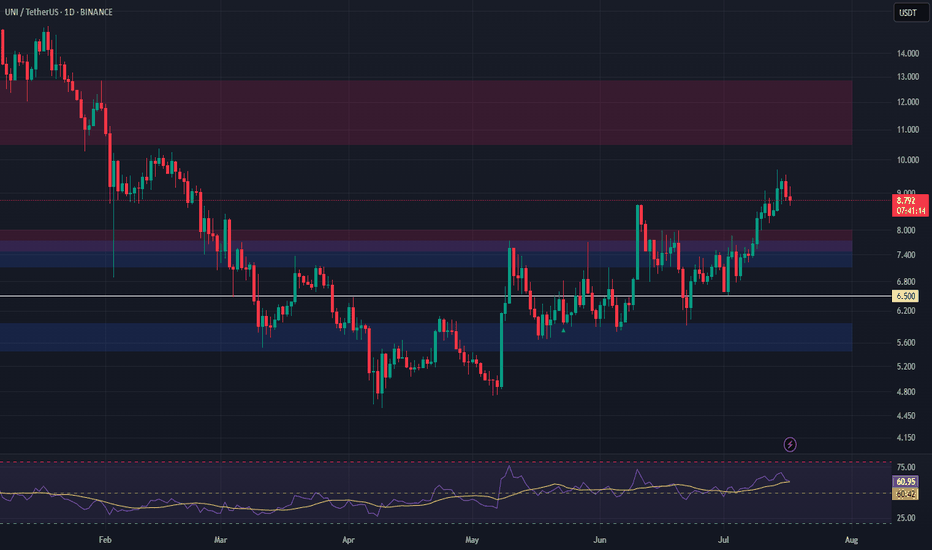

[Deep Dive] UNI – Edition 1: Retest. Reload. Rally?Uniswap (UNI) has been trading within a well-respected rising channel, showing consistent bullish structure across the 4H timeframe.

After a strong rally from the $7.50 region, price is now undergoing a healthy correction — retesting the lower boundary of the channel, which intersects with the $9.5

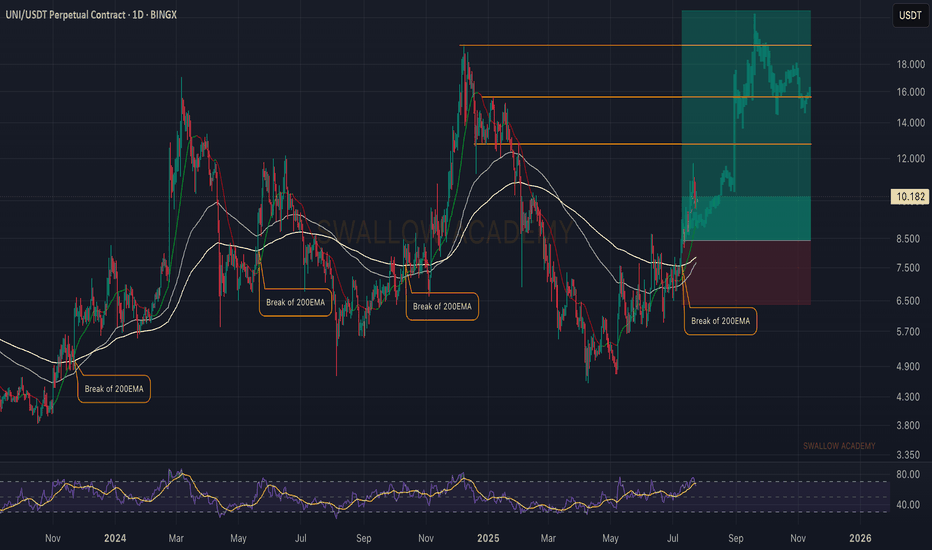

Uniswap (UNI): 200EMA Has Been Broken | We Are About To FlyUniswap is doing well;we have broken once again the EMA that has been in our attention since last week, and since then we have had a decent movement.

But this is not yet the full potential that we are looking for so we want to see even bigger movement to upper zones, buckle up.

Swallow Academy

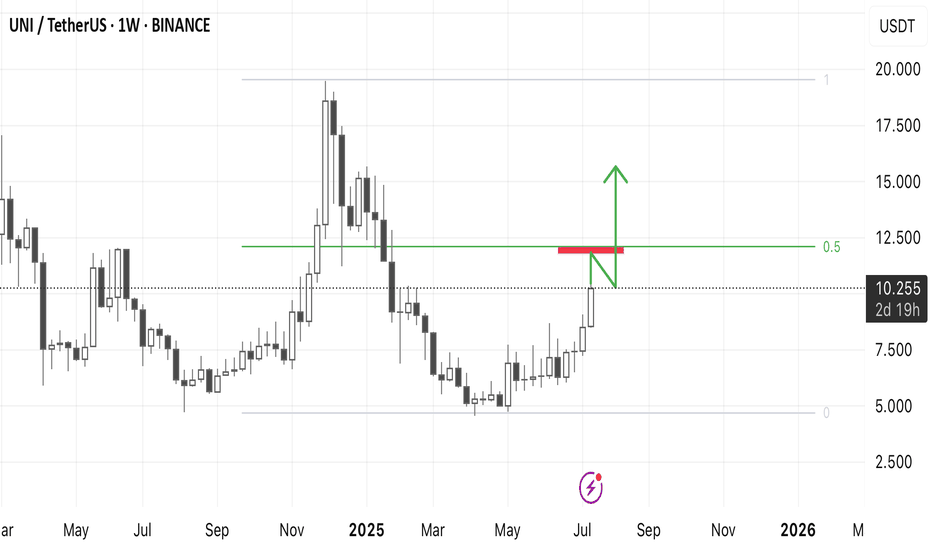

UNI up 13% – is $10 the next stop?Hello✌

let’s dive into a full analysis of the upcoming price potential for Uniswap 📈.

BINANCE:UNIUSDT has maintained solid bullish structure within a well-formed ascending channel and is now approaching a key daily support zone. Recent volume spikes and a 13% price increase indicate growing buyi

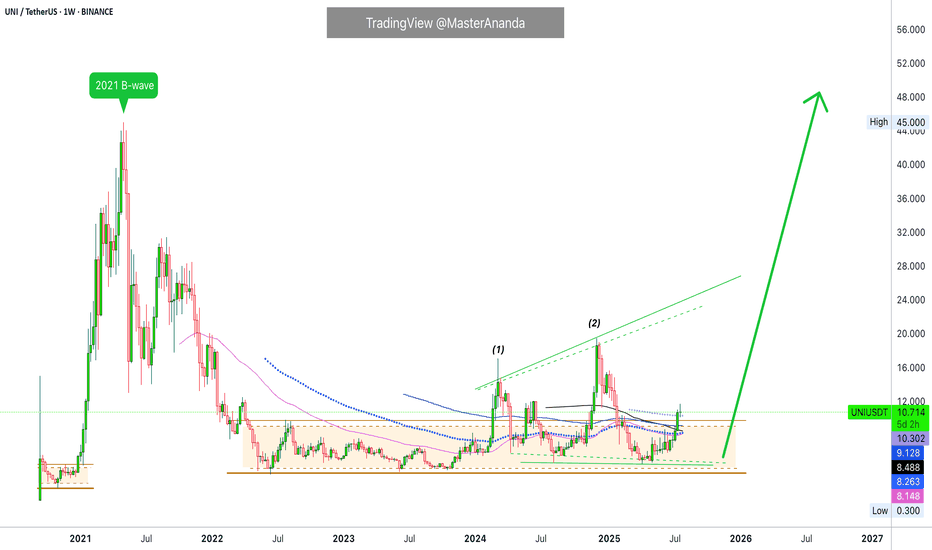

Uniswap Exits Opportunity Buy Zone · $73 & $118 2025 ATH TargetUniswap is finally out of its long-term opportunity buy zone, a trading range that was activated first in 2022 and remained valid for a long time.

After October 2023, UNIUSDT produced two bullish moves but each time fell back into this zone. Orange/brown on the chart. Notice how this zone matches p

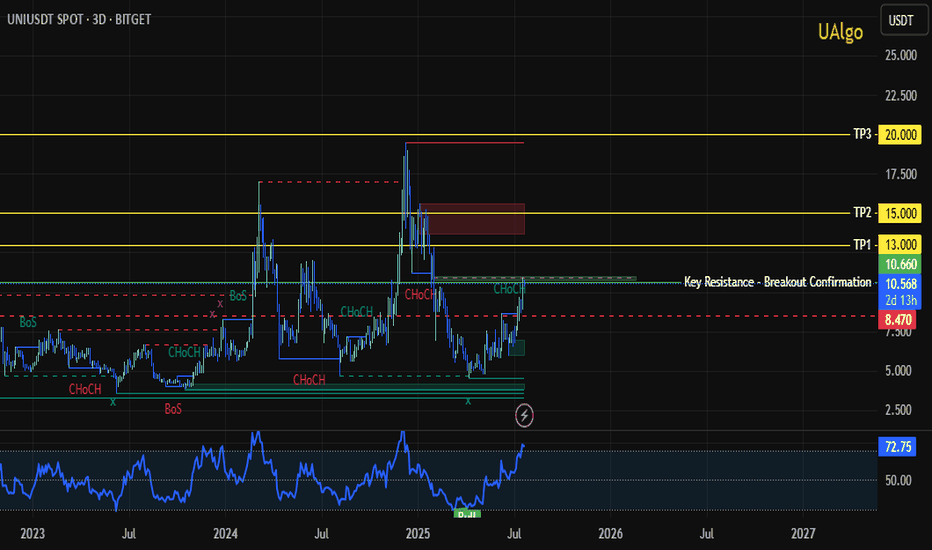

UNI/USDT – Technical Analysis (3D)Confirmed Structural Breakout – Swing Targets + Fibonacci Extensions - With alignment across technical structure, product roadmap, on-chain adoption and regulatory tailwinds, UNI has a clear path to re-test its ATH around $45—assuming the market stays bullish and upcoming catalysts deliver.

🔍 The a

UNIUSDT UPDATE

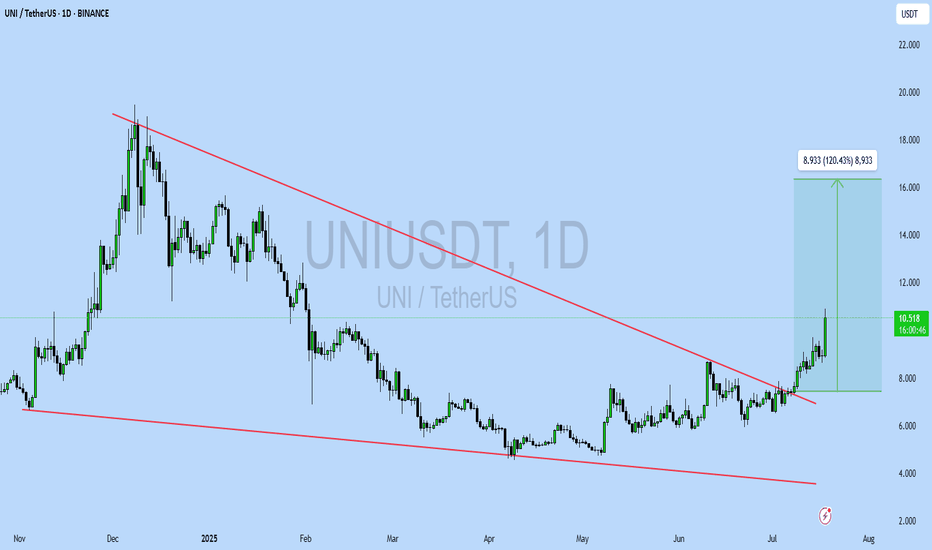

Pattern: Falling Wedge Breakout

Current Price: \$10.545

Target Price: \$16

Target % Gain: 52%

Technical Analysis: UNI has broken out of a long-term falling wedge on the 1D chart with a strong bullish candle and 18% daily gain. Volume spike confirms breakout momentum with upside potential toward \$

UNI Long Setup – Breakout Retest into High-Confluence SupportUniswap (UNI) has broken out of resistance and is now pulling back into a high-confluence zone, forming a strong bullish structure. The $7.13–$7.73 area presents a favorable entry on the retest.

📌 Trade Setup:

• Entry Zone Around: $7.13 – $7.73

• Take Profit Targets:

o 🥇 $10.50 – $12.85

• Stop Lo

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of UNI / TetherUS (UNI) is 10.407 USDT — it has fallen −2.08% in the past 24 hours. Try placing this info into the context by checking out what coins are also gaining and losing at the moment and seeing UNI price chart.

UNI / TetherUS price has risen by 10.93% over the last week, its month performance shows a 40.33% increase, and as for the last year, UNI / TetherUS has increased by 40.16%. See more dynamics on UNI price chart.

Keep track of coins' changes with our Crypto Coins Heatmap.

Keep track of coins' changes with our Crypto Coins Heatmap.

UNI / TetherUS (UNI) reached its highest price on May 3, 2021 — it amounted to 45.000 USDT. Find more insights on the UNI price chart.

See the list of crypto gainers and choose what best fits your strategy.

See the list of crypto gainers and choose what best fits your strategy.

UNI / TetherUS (UNI) reached the lowest price of 0.300 USDT on Sep 17, 2020. View more UNI / TetherUS dynamics on the price chart.

See the list of crypto losers to find unexpected opportunities.

See the list of crypto losers to find unexpected opportunities.

The safest choice when buying UNI is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade UNI right from TradingView charts — just choose a broker and connect to your account.

Crypto markets are famous for their volatility, so one should study all the available stats before adding crypto assets to their portfolio. Very often it's technical analysis that comes in handy. We prepared technical ratings for UNI / TetherUS (UNI): today its technical analysis shows the strong buy signal, and according to the 1 week rating UNI shows the buy signal. And you'd better dig deeper and study 1 month rating too — it's strong buy. Find inspiration in UNI / TetherUS trading ideas and keep track of what's moving crypto markets with our crypto news feed.

UNI / TetherUS (UNI) is just as reliable as any other crypto asset — this corner of the world market is highly volatile. Today, for instance, UNI / TetherUS is estimated as 9.25% volatile. The only thing it means is that you must prepare and examine all available information before making a decision. And if you're not sure about UNI / TetherUS, you can find more inspiration in our curated watchlists.

You can discuss UNI / TetherUS (UNI) with other users in our public chats, Minds or in the comments to Ideas.