UNIUSDT 1D#UNI is currently trading within a descending channel on the daily timeframe, but it's holding above the Ichimoku cloud, which is a bullish sign. If the price successfully bounces from the Ichimoku support and breaks above the channel resistance, it could lead to a bullish rally.

Upside targets on breakout:

🎯 $8.039

🎯 $10.057

🎯 $11.689

🎯 $13.320

⚠️ Use a tight stop-loss.

UNIUST trade ideas

UNIUSDT | Long Bias | Altseason Play | (May 12, 2025)UNIUSDT | Long Bias | Altseason Play + Pullback Entry Setup | (May 12, 2025)

1️⃣ Short Insight Summary:

Uniswap is showing signs of broader correlation with the altcoin season rotation. While short-term money is flowing out, the macro structure remains bullish—making this dip a potential long opportunity into the next major leg.

2️⃣ Trade Parameters:

Bias: Long

Entry Zone: $6.00–$5.69

Stop Loss: Below $5.50 (to protect against deeper breakdown)

TP1: $9.63

TP2: $17.86

Final TP: $28.44 (only for high-conviction holds or macro trend continuation)

Partial Exits: Around $9.00, $17.00, and $28.00+, with 95% of position closed before the final TP for safety

3️⃣ Key Notes:

✅ On-chain and macro altseason narrative is growing, which benefits tokens like UNI with high beta to DeFi trends.

✅ UNI still tracks closely with overall altcoin rotations, and this correction looks like a healthy pullback, not a breakdown.

✅ 30-minute order flow shows money leaving the market, aligning with the corrective dip—but creates an attractive re-entry for long-term positioning.

✅ Fundamentally, Uniswap continues evolving, and any developments around L2 integrations or governance votes could spike attention again.

❌ Be patient—don't chase. Wait for confirmation near the $6–5.69 zone before engaging.

4️⃣ Optional Follow-up Note:

This setup will be updated if the market reacts sooner or volume confirms the bounce. Will casually monitor for continuation through $9.63 and beyond.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

Uniswap Perfect Bullish Chart With New ATH Potential Late 2025Uniswap has a chart with perfect symmetry. It is a beautiful chart, well organized, and it shows a very strong potential for a new All-Time High to be hit later this year or in early 2026.

The market bottom happened in November 2020 for UNIUSDT. This bottom low marked the start of the 2021 bull market which is clearly visible on the chart.

The bull market in 2021 produced a wave totaling 2,462% growth, that's more than 25X.

The same low/level/support that was activated in November 2020 and launched the previous bull market wave was again activated in June 2022. This low marked the 2022 bear market bottom and from this point a long-term consolidation period (sideways market) developed, with higher highs and higher lows.

There was a major low in August 2024 and the last one, April/May 2025. The current low can be equated to something similar to November 2020, from this point on, we will not see small waves as in the past three years but a major bull market. Like 2021 but much bigger. It will be huge.

A new All-Time High is not only possible but very easy for this pair, very easy...

The action will push prices beyond what is shown on this chart.

Timing is great. Prices are great. This is an easy buy and hold.

After you buy, the market will grow for months and months and months before peaking. You can't go wrong with bottom prices. The time to buy is now, when prices are low.

Namaste.

UNI Uniswap Breakdown. Support Hit but is there More Downside?🔎 I'm currently analyzing UNI/USDT (Uniswap paired with Tether) and observing a clear bearish trend 📉 on the daily timeframe. Price has recently tapped into a key support zone 🟦, and we’re now seeing a short-term retracement from that level.

However, with Bitcoin currently overextended ⚠️ and showing signs it may pull back, there's a strong possibility that UNI could continue to drop if BTC rolls over. Correlation plays a major role here. 📊

In this video, I break down essential elements of the chart:

📌 Market Structure

📌 Price Action

📌 The prevailing Trend

📌 Key Support & Resistance Zones

You'll also hear my personal take on a potential trade setup — if price action continues to unfold in line with the criteria discussed.

📚 This content is for educational purposes only and is not to be considered financial advice. 🚫💼

UNI Price Action Breakdown. Support Hit but is there More Downside?

Uniswap short to $5.522Recently opened a long on uniswap but later on flipped short as I realized the supply was coming in heavy.

Was tough decision but seems like it might be the right one.

Can probably still get 2RR from it if anyone following me closely. I had updated the change under prior idea but thought I made a new separate idea for it to keep things cleaner.

Short trade

5min TF overview

Trade Entry – UNIUSDT

📅 Date: Wednesday, 23rd April 2025

🕓 Time: 00:40 AM (NY to Tokyo Session – AM)

🗂 Structure: Daily

📈 Entry Timeframe: 1 Hour

🔻 Trade Direction: Sellside

Trade Details:

Entry: 6.089

🎯 Target (Profit Level): 5.788 (4.94%)

🛑 Stop Loss: 6.100 (0.18%)

💹 Risk-Reward Ratio: 27.36

Market Context:

Price showed signs of exhaustion at a key resistance level on the 1Hr structure, with the RSI aligning with the overall bearish sentiment during the NY to Tokyo transition.

1Hr TF

Structure & Confirmation:

Observed on the 1h timeframe, a clear sweep of NY High formed the direction bias, aligning with a significant daily structure point.

UNIUSDTshort selling set up 📉

DISCLAIMER:

what I share here is just personal research, all based on my hobby and love of speculation intelligence.

The data I share does not come from financial advice.

Use controlled risk, not an invitation to buy and sell certain assets, because it all comes back to each individual.

Uniswap Coin (UNI): Possible Correction Incoming | (+30-40%)Uniswap coin has been on a rough path where price has dumped pretty hard since it's local highs.

As we have been monitoring this coin on different timeframes, we noticed how far the daily timeframe EMAs are from market price, which gave us the first sign of possible upcoming upward movement.

Now what we are seeing is the volume is building up on a 4-hour timeframe where we are mostly going to test the 100EMA and we are going to look for a break of that EMA as well. There are a lot of uncertainties on the markets right now so we are keeping the stops pretty tight!

Swallow Team

Uniswap Coin (UNI): 2 Ways To Go | Good Risk:Reward TradesUniswap coin is at a crucial zone where we are going to wait for further confirmations. We have spotted 2 good trades that can be taken on a daily timeframe so we are now going to wait for either a breakout in the form of BoS or a breakdown!

More in-depth info is in the video—enjoy!

Swallow Team

UNI — Time to Accumulate? A Clean Long-Term SetupUNI is the native token of the Uniswap DEX — and it's finally back in our interest zone.

After a brutal 70% correction from previous highs, price has retraced into a key accumulation range between $3.60 – $6.76.

This isn’t just another alt — UNI is a fundamental token that arguably deserves a place in every long-term portfolio.

Spot entry around $5.50 looks reasonable, with higher timeframe targets at $10.35, $17.03, and $19.47.

No overtrading here — just a clean long-term thesis. Accumulate, sit back, and let the narrative unfold.

More thoughts in my profile @93balaclava

Personally I trade on a platform that offers low fees and strong execution. DM me if you're interested.

Short-Term Short Position UNI/USDT🔥 UNI/USDT – Approaching Key Short Zone

Uniswap (UNI) has formed a rising wedge structure after rebounding from local lows. Price is now nearing a critical short zone around 5.762 – 5.804, where sellers could potentially step in if UNI fails to break above with conviction.

🟣 Zone to Watch

“Possible Short Zone” (in purple) — a high-probability entry area for short trades given the overhead resistance and wedge convergence.

🔴 Entry Points:

Entry 1: ~5.762 (initial level)

Entry 2: ~5.804 (upper boundary)

📉 Momentum & Setup

Chart Formation: The rising wedge often suggests bullish exhaustion; a decisive break below wedge support can signal a bearish shift.

Volume Consideration: Look for a sell-volume uptick or a clear rejection around 5.70 – 6.2 to confirm the short setup.

🟢 Take-Profit Zones

✅ TP1: ~5.549

✅ TP2: ~5.315

✅ TP3: ~4.957

✅ TP4: ~4.244 (Extended downside if momentum persists)

❌ Invalidation Level: 6.265+

(A strong close above this level indicates a bullish breakout from the short window.)

🧠 Narrative

This setup highlights a possible bearish retest, as UNI’s rebound has propelled price into a narrowing wedge near major resistance. Should buyers fail to push beyond 5.70, aggressive sellers may anticipate a correction. A volume-backed rejection here could see UNI retrace to lower support levels.

🎲 Market Context

Monitor broader crypto sentiment and Bitcoin’s performance; strong market momentum could negate the bearish bias, while a market-wide pullback may accelerate downside.

📌 Risk Management

Position Sizing: Adjust to your risk tolerance and never overexpose.

Stop-Loss: Place it above 6.265+ to avoid unexpected breakouts.

Remain flexible and reevaluate if price action shows continued strength above the wedge.

UNI Trade Setup - Strength After Liquidity SweepUNI has swept underside liquidity and is now holding strong. If price consolidates above $7, we’ll be looking for local lows to form, setting up a medium-term move higher as broader markets push into resistance.

🛠 Trade Details:

Entry: Around $7 zone

Take Profit Targets:

$10.50 – $11.00 (First Target)

$14.50 – $15.00 (Extended Target)

Stop Loss: Daily close below $5.5

Waiting for market confirmation before positioning for the next leg up! 📈🚀

#UNI/USDT#UNI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 5.50.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 6.20

First target: 6.75

Second target: 7.28

Third target: 7.92

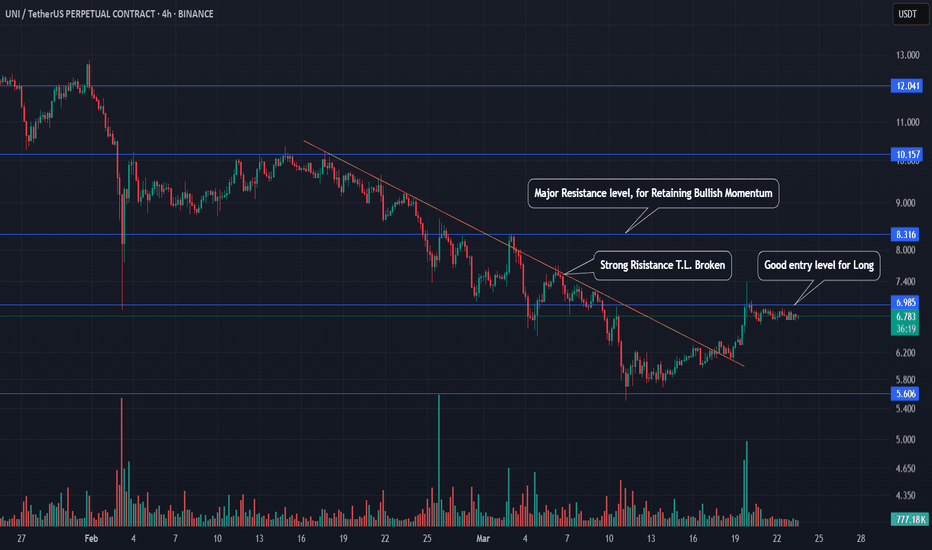

UNI/USDT 4H ANALYSISHi guys, today we want to analyze UNI/USDT in 4 hour time frame.

As we can see that it had a strong downtrend followed by a resistant trend line which in the recent days it has broken the resistance trend line and also we have the huge volume in the two 4H candles for now we can have an opportunity of long after the price tag of $6.985.

Buy UNIUSDT: Weekly Support & golden Fib pocket!!Join our community and start your crypto journey today for:

In-depth market analysis

Accurate trade setups

Early access to trending altcoins

Life-changing profit potential

Let's analyze UNIUSDT:

UNIUSDT has plummeted nearly 70% in 90 days but now holds above crucial weekly support. Historically, rebounds from this level have been significant. Notably, a minor bounce is occurring at the weekly chart's golden Fibonacci pocket, suggesting strong potential for a reversal. This confluence of support and Fibonacci retracement indicates a likely, powerful recovery from this zone.

Closely accumulate here!!

Accumulation zone:

CMP to $5.50

Target levels:

$11.9

$19

$45.7

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments and feel free to request any specific chart analysis you’d like to see.

Happy Trading!!