Some say bitcoin is an un-correlated asset. What about XRP ???This chart clearly shows how XRP is uncorrelated to the price of the S&P !!

Some experts in crypto say that Bitcoin is an un-correlated asset. However, if bitcoin is, XRP is even more so.

The chart moreover shows how the price of XRP broke out of an 7 YEAR BEAR FLAG !!!

It broke down decisevely in november 2024.

At the present moment it is making a halt, drawing a bear flag (n° 2) as it did after it broke down of a very similar bear flag in March of 2017 (n° 1).

How do you think this will resolve ?

Any more questions ?

This is a very bearish chart - for the SPX !!!

US500.F trade ideas

$S&P500 macro analysis , market approaching correction °•° $SPXHi 👋🏻 check out my previous analysis ⏰ on SP:SPX macro bullish analysis ⏰

As provided it went up up 🚀 completed my target's 🎯 💯💪🏻 ✅ ✔️

Click on it 👆🏻 just check out each and every time updates ☝🏻 ☺️

•••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••••

NOW I was completely 🐻 BEARISH on the market with in upcoming months SP:SPX

📌 Expecting liquidation pump $6500 - $6700

Invalid 🛑 when complete month close above $6700

¹support - $5500 ( 🎯 ¹ )

²support - $5130 ( 🎯 ² )

🎯 3 ... Will be updated based on market conditions by that time ☺️

📍 A wise 🦉 man said - always having patience " is " always gaining only /-

NASDAQ:TSLA ( i accumulate slowly until it cross above $400 )

rest of stocks i will follow index ☝🏻 i will invest based on market conditions ..... ✔️

VIX Hits 27-Year Extreme. Is the Market About to CRASH or SOAR?The Volatility Index (VIX displayed by the blue trend-line) has entered a level that has visited only another 5 times in the last 27 years (since August 1998)! That is what we've called the 'VIX Max Panic Resistance Zone'. As the name suggests that indicates ultimate panic for the stock markets, which was fueled by massive sell-offs, leading to extreme volatility and uncertainty.

So the obvious question arises: 'Is this Good or Bad for the market??'

The answer is pretty clear if you look at the chart objectively and with a clear perspective. In 4 out of those 5 times, the S&P500 (SPX) bottomed exactly on the month of the VIX Max Panic signal. It was only during the 2008 U.S. Housing Crisis that VIX hit the Max Panic Zone in October 2008 but bottomed 5 months late in March 2009.

As a result, this is historically a very strong opportunity for a multi-year buy position. If anything, today's VIX situation looks more similar to September 2011 or even the bottom of the previous U.S. - China Trade war in March 2020.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

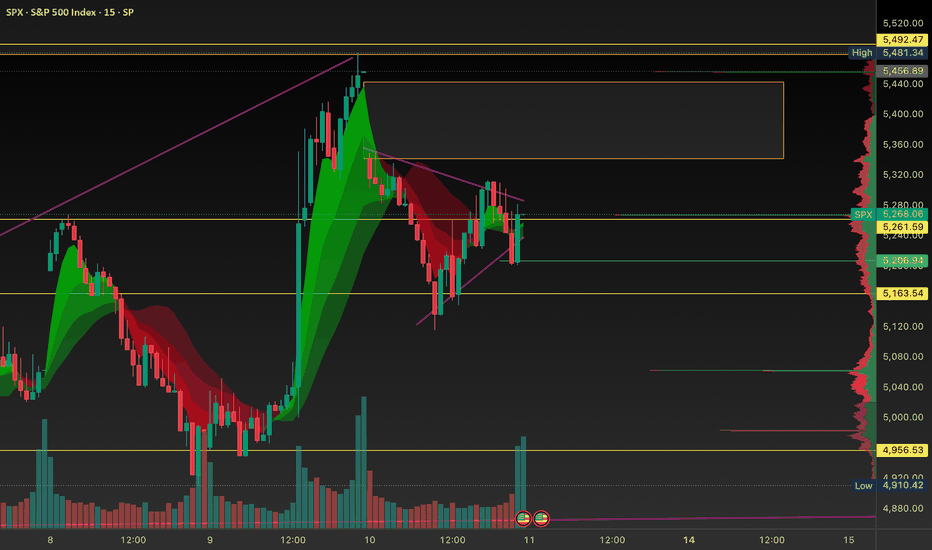

Just Let Me Cash Out Before the Weekend | SPX Analysis 11 April Let’s be honest…

This week has been ridiculous.

The market pumped harder than a spin class on espresso because of a rumour.

Then dumped.

Then teased a breakout.

Then decided against it mid-sentence.

It’s been a full-blown rollercoaster of overreactions, headline bait, and “wait, what did Trump say now?” moments.

But amidst the noise, the plan is still holding up.

5400?

Still resistance.

Still our pivot level.

Still doing its job.

---

👁️ Trader’s Eye View – Charting the Nonsense

Let’s recap what I’m seeing:

📉 Earlier this week, the 5400 bull trigger got pierced by an emotional market surge.

But there was no confirmation, no sustained breakout – and we’ve reversed since then.

Now?

We’re seeing the start of a rising channel – but every turn seems to align with a tweet, a walk-back, or a reaction to misread data.

It’s like price is drawing patterns using the tip of a headline.

That’s not conviction.

That’s chaos dressed as structure.

🧭 What I’m Doing Now

📌 Still bearish below 5400

📌 Watching for a move to 5000 or the rising channel low

📌 Will use Tag ‘n Turn, Pulse Bars, and GEX flips for entries

The ideal scenario?

Let my bear swing cash out before the close, pour something brown into a glass, and avoid blood pressure spikes over the weekend.

That’s the play.

---

🎯 Expert Insight – When the Chart's Not Lying, But the Headlines Are

Mistake:

Assuming a spike equals a breakout. Trading on headline strength instead of chart strength.

Fix:

Let the level prove itself.

5400 is my line in the sand – not because I said so, but because price keeps reacting to it.

That’s structure. That’s what we trade.

---

Fun Fact

In 2020, the average headline-related spike in SPX lasted under 37 minutes before mean-reverting.

This week?

We saw multiple trillion-dollar reactions last less than half an hour.

It’s not a breakout if it’s a sugar rush.

SPX500 on the Brink: Unveiling the Critical 4800 Gann Pivot ThatThe chart is drawn inside a Gann Square from the 2020 low (March COVID bottom) to a projected 2030 high, mapping both time (X-axis) and price (Y-axis) in 1:1 ratio (Square of Time & Price).

The blue ascending diagonal (45° line) represents the ideal balance of time and price (1 point per unit of time). A break of this line is often seen as a major trend reversal signal.

Colored zones:

Green zone (top-right triangle): bullish expansion territory.

Yellow zone (center): consolidation/transition.

Red zone (bottom-right): bearish decline/major correction zone.

🟢 Bullish Continuation - Bounce from current level or 4800 support - Next Target 5,800–6,200 - maximum by 4 2025–Q2 2026. (Bounce from 0.5 level means trend is intact and accelerating into green zone)

🟡 Sideways/Neutral - Holds between 4800–5400 - TP could be 6,400 ±200 pts range Until ~March 2026 (0.618 time). This Indicates market is digesting gains; triangle pattern may form!!

🔴 Bearish Breakdown - Break and close below 4,800 - TP could be 4,100 (Fib 0.382) then 3,200 (Gann 0.25) Through 2026.Fall into red zone begins if 0.5 support fails — major cyclical top in place

Warning: what can save us from a collapse: must read.⚠️This analysis isn’t purely chart-based, but in this macro environment, understanding the bigger picture is essential for predicting market movements. Hopefully, TradingView will allow this idea so that everyone can read it.

What Can Save Us?

Before looking for a solution, we must first acknowledge the problem—and then determine if and when a resolution is coming.

1. Trump’s Tariffs & Policies: A Market Shock

Trump’s economic strategy marks a radical departure from the policies of the past 30 years. However, previous administrations weakened U.S. global influence, shifting power in favor of China.

Since Trump's motto is "Make America Great Again", serious changes are inevitable. Until investors fully grasp these policies, uncertainty will persist.

Let’s break down the key areas of impact and Trump’s expected responses:

2.Monetary Policy & The Federal Reserve

The Federal Reserve (FED) and Jerome Powell are not aligned with the White House.

Powell is sticking to his monetary policy approach, but Trump needs 0% interest rates to implement his vision.

Markets hate uncertainty, and this is fueling volatility.

🔴 Trump's Response:

Expect a bombshell move—Trump will fire Jerome Powell and replace him with a Fed chairman who supports rate cuts to 0%. This will cause short-term chaos but ultimately fuel a massive market rally as:

✔️ The housing market recovers

✔️ Liquidity surges

✔️ Stocks skyrocket

3.U.S. Dependence on China & Russia for Raw Materials

The U.S. imports essential resources from China and Russia, making it vulnerable.

The BRICS alliance is strengthening, further threatening U.S. dominance.

🔴 Trump's Response:

Trump has openly expressed interest in acquiring Greenland, citing its rich natural resources. He will take it by military force if necessary, positioning the U.S. as a raw material powerhouse on par with Russia.

4.Lost Allies: Canada, Mexico & South America

Canada is aligning with Europe

Mexico & South America are leaning towards BRICS

🔴 Trump's Response:

To counter this:

Canada will be pressured into rejoining a U.S.-led trade bloc—or face potential annexation.

South American economies will be crippled by tariffs, forcing them to reintegrate under U.S. influence.

5.Geopolitical Conflicts: Middle East & Ukraine

Iran is aligned with Russia & China

Ukraine relies on Europe (France, UK, EU), rather than the U.S.

The U.S. is not benefiting from these wars

🔴 Trump's Response:

If Zelensky continues to align with Europe, Trump may order a full-scale U.S. bombing of Ukraine, flatten Kyiv, eliminate Zelensky live on TikTok, and then split Ukraine with Russia.

This move would:

✔️ Strengthen U.S.-Russia relations

✔️ Secure a deal on Greenland

✔️ Humble Europe

6.Conclusion: A Global Power Shift

Expect a period of chaos and fear. However, what investors must understand is that Trump is 100% serious about these moves—and he will execute them regardless of global opinion.

If Trump’s strategy works:

✅ The U.S. will regain dominance

✅ Markets will rally hard

✅ Confidence in the U.S. economy will be restored

If Trump fails:

🚨 A prolonged economic downturn (15-20 years of stagflation)

🚨 U.S. & Europe suffer major losses

🚨 Best move? Relocate to Asia or the Middle East before the crash.

So, even if Trump’s policies seem insane, the best-case scenario is that he succeeds.

💡 DYOR (Do Your Own Research)

#Bitcoin #Crypto #Trump #MAGA #Geopolitics #StockMarket #SPX500 #Trading #Investing #Economy #FederalReserve #RateCuts

SPX: Roller Coaster Fest. Looking for a possible short?Not FA*

A lot of set ups looking like flags. Missed the move up but caught puts today for good profit. Or decent profit. I have yet to conquer on how NOT to sell too early? Anyone have any tips?

Set up I’m seeing right now (SPY/SPX): Looks to be flagging.

Green Ray for a short entry

Overall sentiment still feels very bearish. Trump seemed to postpone the tariffs to prevent this market from tanking into near *recession* touches but some say it was a manipulative swing?

So thinking we sell off Friday - as China tariff deal still yet to solidify. A lot of uncertainty overall.

Also on the 1M, the set up looks like a bear flag.

Let me know what you guys think and any insight is welcome! Still new to TA and really wanting to get better at understanding charts/levels. Goal is to be consistent in trading and profitable, very profitable.

GLHF

The Yield Curve is NOT InvertedLately I've been seeing a lot of people incorrectly state that the Yield Curve is currently inverted.

IT IS NOT.

Easily measurable 10Y - 2Y.

Google the definition if you need to.

I laid out the impact of the yield curve inverting against the S&P 500.

In most cases, you can see SP:SPX sells off slightly after inverting.

The higher the spread, the healthier the market is.

You want funds buying longer dated securities for market stability and confidence.

The world is going crazy , who's to blame ?Unless you have been hiding in the rocks, most people would know what President Trump has done to the world at large. The social media is full of half truth, fake news and sensational news, to the advantage/motives of certain groups of people. That is why you always read it with a large dosage of salt, laugh it off and do your own critical thinking.

I know is hard, afterall, this has not happened before, at least not in the presidency of US government thus far. Most of us feel like stepping onto quick sand, a wrong move could land you much deeper than you were previously. Seeing your portfolio growing from nice chunks of profits to bloody red , oh my God ! Yes, on hindsight, we wish we could have listened to the wise guru, Warren Buffett.

Let's not get too far ahead and stay calm in this turmoil, volatile time. Deep breath........

And definitely do not lose sleep over money, health and family is more important !

Here, in the SPX 500 index, we are at a precarious position. After the 90 days pause, the market rally up but the fear remains and yesterday market proves itself. So, the first line of defence is the bullish trend line. If this breaks, then we are heading to the yellow support line. Now, this is no ordinary line, it is the weekly 200EMA indicator where in the past, each time it hits this level, the price action bounces up. Could President Trump knows TA, haha? Timing is near perfect !

Stay calm everyone ! Again, do not use margin to trade/invest no matter how attractive the market looks to you or you received a good tip from a friend. Stay with money you can afford to lose.

Don't Panic. Global Financial Crisis Relief RalliesThis is your daily reminder not to panic. No fear mongering here, friends. Take advantage of the relief rallies (aka "Bear Market Rallies").

What you see here is a chart of the Global Financial Crisis ('GFC'). I wanted to show that even in the GFC we had frequent relief rallies. I've highlighted a number of them in this chart.

Relief rallies are the times when you can unload garbage positions, take profits on swing trades during the descent, or just free up cash (to collect interest in money market while you wait the crisis out).

Also note that some of the relief rallies last multiple weeks. These are where "they" (yes, THE "THEY") try to draw you fully back in.

Relief rallies are frequent, and, unless society as we know it completely collapses, there will be a bottom.

Stick to your strategy! No panicking here.

SPX repeating 2022 patternI had said in a earlier post( see link to Related publication) that Vix is indicating we will be in 2022 style market and so far indeed it is, except for the breakdown from the wedge last week.

Expect the price to fluctuate within the wedge to consolidate before a breakout

The comparison shows close similarity of the wedge and path (except last week)

SPX: Market Reflexivity & Fractal PatternsIn this idea I would like to walk you through some principles which I use to find and relate historical complexities within rhyming cycles.

Market Reflexivity

Market reflexivity is a concept introduced by George Soros that defies the traditional TA notion of efficient markets by revealing that price movements do not merely reflect fundamentals — they actively shape them. As prices rise, optimism fuels further buying, creating a self-reinforcing loop inflating bubbles. Conversely, declining prices trigger fear, accelerating downturns. Reflexivity explains why trends persist and why reversals can be abrupt, as self-sustaining cycles eventually reach a exhaustion point.

To put it simply, there is a feedback loop between market participants’ perceptions and actual market conditions, suggesting that financial markets are not always in equilibrium because collective investor behavior actively drives price movements, which in turn influences future investor behavior.

Feedback Loops

Each massive rally eventually creates conditions that lead to overvaluation, resulting in sharp corrections.

Self-Fulfilling Expectations

Market participants, reacting to past price behavior, reinforce trends until a breaking point.

Structural Adaptation

Every major correction resets valuations, allowing for the next cycle to begin with renewed confidence and capital inflows.

Practical Application of Reflexivity

Compared to many tickers, SPX has exhibited relatively stable growth throughout history. Over the past 70 years, the most significant panic-driven decline occurred after its 2007 peak, with a 57% drop that defined a major cycle. Growth resumed in 2009, making this swing a key reference point for establishing historical relationships.

I see the Dotcom and Housing crisis-induced declines as part of a broader complexity, shaped by prior long-term growth. The two cycles appear as they do because they stem from an extended structural uptrend, not just the 250% surge from 1994 to the bubble top, which lacked a significant preceding decline. Cause-and-effect logic suggests that these crashes were a reaction to a much larger uptrend that began in 1974. A 2447% rally provides a more compelling reason for mass panic and selling, as corrections of such magnitude are rare.

Intuitively, the 2447% long-term upswing should have been preceded by a decline similar to the Dotcom and Housing crashes. This holds true, as the market experienced a nearly 50% drop after peaking in 1973 and 37% in 1968, following the same cyclical pattern of deep corrections leading to extended expansions. These corrections were relatively smaller than the Dotcom and Housing crashes because they are followed by a comparatively smaller 1452% rally from the end of WWII.

Multi-Fractals

Multifractals in market analysis describe the non-linear, self-similar nature of price movements, where volatility and risk vary across different scales. Unlike simple fractals with a constant fractal dimension, multifractals exhibit multiple fractal dimensions, creating varying levels of roughness. Benoit Mandelbrot introduced multifractal Time Series to refine the classic random walk theory, recognizing that price movements occur in bursts of volatility followed by calm periods. Instead of a single Hurst exponent, markets display a spectrum of exponents, reflecting diverse scaling behaviors and explaining why price action appears random at times but reveals structured patterns over different time horizons.

This justifies viewing price action within its structural cause-and-effect framework, where micro and macro cycles are interdependent, while oscillating at different frequencies. Therefore, we will apply the building blocks independently from boundaries of Full Fractal Cycle.

Since volatility varies, this reserves us the right to extract patterns with identical slope and roughness, and by method of exclusion relate to recent cycles starting from covid.

Update on my thoughts on long term fibs thesis I wanted to give an overview update for those who've followed my macro thesis over the years.

I've used various different things to support it but when it's come to my thoughts as to when the idea has failed I've always thought the only thing I really use for that is the big 4.23' of the 2008 crash.

Since 2019 I've used the thesis big fib levels will foretell big moves in SPX, and it's worked really well.

Inside the theory of trend formation through a fib swing I have been using, the 4.23 is the final boss. It's the biggest most important swing and at it everything is high stakes.

4.23 rejections can lead to 1.27 retracements. In the context of this chart, that would be a depression style move.

When this area was first hit in 2022 it made the high there. One of my known for 4.23's is they'll often bluff and then have some sort of spike out.

So if the 4.23 is actionable, we'd be in the end game now. Trying to work out exactly how much spike tolerance is very difficult but in the bear thesis this trading above the 4.23 should turn into a strong rejection. I'm talking conditions where weekly charts look like the 4 hour charts did in the original 10% break.

What would happen on a 4.23 reversal would be unspeakably bad with the size of these swings, and this 4.23 principle can be found time and time again marking the end of extreme moves (both up moves and crashes).

That's a concerning thing. If there's even a 5% chance of that happening I feel I have to think about it. Based on the odds of the fibs, the odds would be higher.

It'd be fair to say thinking a fib can affect such big things is irrational. But it would be honest to accept to ignore the fact they actually have right in front of us is all the more irrational.

But the 4.23 might break!

It's difficult for me to tell you the specific price at which I'd consider the 4.23 to have been broken but I can tell you the idea that it might break is something I deeply consider- because if that is going to happen, my bear thesis would never be correct inside a workable time/price move. This isn't a "Right eventually" sort of thing. The patterns have expectations.

If the 4.23 is not a top, then the plan totally changes. Because I know from my intraday / week trading that I really love to be fading 4.23s and 4.23 spikes regularly but if and when they fail the most exceptional of things happen. These are not all that notable intraday to anyone other than levels traders, but what if the same concept scaled up - I wondered.

I wondered this a while ago and noticed it was something I'd never really checked. As it happened, all the 4.23s I looked at in indices reversed.

Initially I found it tricky to find them but then I noticed the highest probability place to find them was heading into bubbles.

And this makes me super wary of the fact my bear thesis could be spectacularly wrong. Because around about this zone Nasdaq was getting into a 4.23 - and this looked quite bubble-like.

If I'd seen this in real time in the 4.23, I'd have thought that worth a fade.

1998. The Nasdaq did not make a high in 1998!

1998 was in fact a rather bad time to have a persistent bear thesis.

But you could have made money.

For a while there was a flux. During this you could have made some money. You'd just have to know when to stop doing that.

Inside a thesis such as this, when there is a drop you always have to consider we might be in a spot something like this.

From this move Nasdaq would go into a rally that literally changes the perspective of the chart. As you click through bar by bar the previous crash bars become hard to see.

Nothing but up.

Then sideways.

Nothing but up.

Then we're inside of the topping zone.

If you didn't decide before the fact, where do you drop the bear thesis there? It's tough. Because the rally section would seem like a blow off. Then we go sideways. Which feels like the steam has ran out. Then we go into the real blow off. Where to close your short would be handled for you if you didn't - but it's hard to know when you'd flip bull there.

For me, at least. Because I'd want to buy a crash move. And there really are not all that many of them. My style of trading is optimised for trading reversals (either of corrections or absolute) and steady and persistent pullback-less trends are trickier for me. I need to have a really good idea of where I'd want to switch to that style and my failure conditions (because all that momentum trading with no stops stuff isn't for me - I could not sleep at night - being someone who's benefited from so many major trend reversals and seeing how fast they happen).

Looking through different examples of 4.23 breaks (which really are mostly found before bubble like moves or crashes if inverted) I have come to conclusion that the best thing to have done would have probably been to buy the low of the last crash before the bubble.

Just buy the low before the bubble. That's it. Thanks for reading!

Of course, on a more practical level - we actually have to try to do that. Now...if the break was coming, we'd maybe actually be AT that spot.

I think to give the bearish 4.23 thesis its full fair chance we have to accept some sort of stop running above this recent high.

Stuff like that is totally fail game. Even something a bit more spikey would be fine if it rejected. But if we trend up here, break highs and then continue to trend up, I really do think that would be the conditions where I would stop generating bear short levels. I'd switch my methods to generating bear risk areas but main using these for bullish trail/breakout decisions.

I first came into indices in 2019 with my bear thesis on SPX. Which was spectacularly half right. But I'd forecast a two leg crash. Fortunately enough for me, when the high was broken I became disinterested in SPX and went back to Forex. Only setting an alert for the next big level, which triggered 2021. This is when I setup the "HoleyProfit" username.

This period of time has been the best time to be a bear inside of my trading lifetime. But I believe if we're not somewhere deep inside the end game for this bull market we could head into conditions where if you trade flawlessly as a bear you can perhaps scrape breakeven eventually. Which are not good times to be a bear. They'd be good times to be a bull.

If I don't think about this, we could have a move that looks like an obvious blow off in SPX to me.

And ends up looking like this.

Which I don't want to be short into. And realistically I'm not. I'd hit stops well before any of that madness affected me. But I don't want anyone who's followed my ideas and seen these having the big previous successes thinking it's a slam dunk sort of thing. I do believe if my bear thesis failed it would be spectacularly.

I believe we're in a bubble. Whether we're late or mid bubble I am open minded to.

Being mid bubble and being aware of it would be INCREDIBLE. Some people think I am determined to be a bear just because I want to be. I'd be happy with massively awesome markets. A trend one way or the other pay just as much to me. It's better to make money in conditions your broker and bank are not going out of business.

I really don't mind being bullish. It's just sketchy doing it at major resistance levels with all the other weird confluences (like interest rate patterns etc).

We are somewhat close to crux in this thesis. Hopefully you can easily understand how it's not practical to put a price on specifically but I do want to note that while I have plans to short different bull trap levels / spike outs on this rally - we are getting the point where my net thesis may be proven wrong on the large reversal.

If that happens, my option and style will be become polar opposite. For me to continue to be bearish above the 4.23 would be me just wandering off into a jungle of random for trying to have an overall plan. And in fact, for me to not switch my bias from bear to hyper bullish on a 4.23 would be intellectually dishonest and directly fading the edges that the original idea bet on.

Markets may make big reversals at major resistances, but if they break- can be much different.

I wanted to be clear and thorough on this while while are still generally low. While I've discussed some different bear plans into a rally, it is also one of my considerations that this rally could end up spelling out the end of my bear thesis if we made new highs and were persistent.

The net bear thesis will be right or wrong inside a specific zone. That zone is big and tricky to define, but it's specific. Specific in the fact that I'm saying we're specifically in that zone.

There's potentially for setups that could take a lot of time to complete, but in terms of the zone and conditions what's accepted is getting narrower and narrower.

It is entirely placeable within the next 6 months my entire macro swing bias will have changed.

Or this might all just be the bull trap taking. We'll see how it goes.

The moment of truth for ETH has comeThe moment of truth for ETH has come, either Ethereum is going to be a worthless asset or it will retest the December highs, 2025 is only at the beginning...

Pectra 07 may bullish for eth!? doesn't it?

ETH at 1500 is a buying opportunity... tariffs are distractions

S&P500 Vast Support from previous High. New 2 year Bull started.The S&P500 / US500 has reached a bottom and is rebounding.

The rebound is taking place just over the 1week MA200 but also the key pivot line that was previously a Cycle High and now turned Support.

We have seen this another 2 times in the last 10 years and both time caused a massive rally.

This puts an end to the tariff war correction and based on the chart starts a new 2 year Bull Cycle.

Minimum rise before was +58%. Target 7600.

Follow us, like the idea and leave a comment below!!

SP500: Optimism in the markets !! No Fear !!Mr. Trump MANIPULATES THE WORLD as he pleases, and WE AS ANALYSTS have to BE COLD and be VERY ATTENTIVE to the news MORE THAN EVER!! And of course, NO FEAR.

--> What does the SP500 and the rest of the indices and stocks look like?

From my point of view, yesterday's news of granting a 90-DAY TRUCE on tariffs GIVES US THE POSSIBILITY OF UPSIDES for at least the next 2 months (ALWAYS with Trump's permission). Furthermore, we've also learned that US inflation fell to 2.4% in March, and the core rate to 2.8%, below expectations, which is VERY GOOD for the markets.

With this data and the SHARP FALLS accumulated so far this year!!, UPSIDES ARE COMING!!

Yesterday, the indices rose by nearly 10%, and it's normal for them to be falling by 5% today. If we observe the H1 chart above, the price has fallen to the 50% Fibonacci zone, meaning we are already in a good entry zone.

--> We can do 2 things:

When the price in lower timeframes (M15 chart below) shows us a bullish signal (Bull), make the long entry.

Go long in the zone between the 50%-61.8% Fibonacci (current zone).

--------------------------------------------------------------------

Strategy to follow:

ENTRY: We will open 2 long positions when the price enters the Fibonacci zone (50% - 61.8%) or when a lower timeframe chart gives us the bullish signal (Bull).

POSITION 1 (TP1): We close the first position in the 5,490 zone (+5.8%)

--> Stop Loss at 4,900 (-3.5%).

POSITION 2 (TP2): We open a Trailing Stop type position.

--> Initial dynamic Stop Loss at (-3.5%) (coinciding with the 4,900 of position 1).

--> We modify the dynamic Stop Loss to (-1%) when the price reaches TP1 (5,490).

SETUP CLARIFICATIONS

*** How to know which 2 long positions to open? Let's take an example: If we want to invest 2,000 euros in the stock, we divide that amount by 2, and instead of opening 1 position of 2,000, we will open 2 positions of 1,000 each.

*** What is a Trailing Stop? A Trailing Stop allows a trade to continue gaining value when the market price moves in a favorable direction, but automatically closes the trade if the market price suddenly moves in an unfavorable direction by 1 a determined distance. That determined distance is the dynamic Stop Loss.

--> Example: If the dynamic Stop Loss is at -1%, it means that if the price falls by -1%, the position will close. If the price rises, the Stop Loss also rises to maintain that -1% on the upside, therefore, the risk becomes lower and lower until the position becomes profitable. This way, very solid and stable trends in the price can be taken advantage of, maximizing profits

SPX500 Long - Bounce of 5200 key psychological level

Tariffs are paused. CPI data was good, coming in at 2.4 instead of 2.5, indicating room for Fed to lower interest rates if economy gets worse. I expect prices to climb back up instead of getting pulled down by just China trade war.

Entry: 5200

SL: 5160

TP: 5500

Results of ideas thus far:

Number of trades: 4

WR: 25%

Profit: 0.9R

Notes: This is currently for personal practice to write out trade ideas. Feedback is welcome, and please don't mind if none of this makes sense.