US500 trade ideas

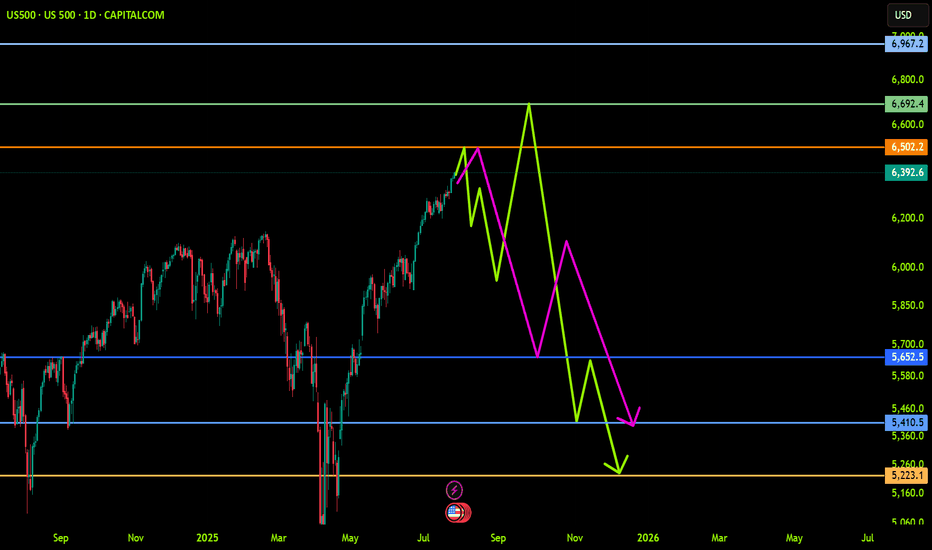

Here is WHY SP500 WILL SINK and you should SELL!I already made a techincal analysis on SP500 last week. Here i am again trying to warn you. I have a big convinction that SP500 will sink, and pretty hard. Lot of techincal indicator are showing weakness on the daily timeframe (RSI, MACD, AO, OBV), the political situation is getting complicated day by day, and our frind Powell will proably help to start this big moves soon. Checking the seasonality, it's also clear that a drop like that isn't new, and SP500 is following perfectly the average of previous years, and if history is going to repeat (and usually happens) we will see an exit liquidity from the markets in coming days. If you don't want to go short, at least consider to keep in safe your profits with the longs.

What do you guys think about SP500? Are you bullish on it? Let me know in the commnts, i will be happy to read your ideas!

Is This the Start of a Market Drop?So, is the drop beginning? It kind of looks that way, but there’s still no solid setup for entering a short position — and there hasn’t been so far.

The trend is still upward for now, and this current pullback might just be temporary.

What I like about the short idea is that August is traditionally a weak month for stocks .

Could this be the start of a big correction on the market? Yes, it’s possible.

It’s just a pity there’s no clean setup for a short. I’d like to enter, but I’d prefer to see a bit more confirmation on the chart itself.

In general, trading the index off of chart setups isn’t easy — perfect entries are rare. That’s exactly the case now. I’m watching and wondering how and when to catch the downside. Maybe I’ll end up sitting through the entire drop without a position :)

Overall, I’m in favor of the short — but for now, I just don’t see a clear entry point.

US500 (S&P): Trend in daily time frameThe color levels are very accurate levels of support and resistance in different time frames, and we have to wait for their reaction in these areas.

So, Please pay special attention to the very accurate trends, colored levels,

and you must know that SETUP is very sensitive.

Be careful

BEST

MT

$SPX Analysis, Key Levels & TargetsThis is how last night’s members chart played out and it was amazing. We opened at the top of the implied move and all of the spreads at the top paid as we dropped back to the 30in 200MA

The spreads I took at 6420/6435 but every spread shown here would have done well.

Unlocking the Power of ORB (Opening Range Breakout)Unlocking the Power of ORB (Opening Range Breakout): A Proven Strategy for Intraday Traders

In the fast-paced world of intraday trading, simplicity and structure can often outperform complexity. One such time-tested strategy is the Opening Range Breakout (ORB) — a method favored by both discretionary and system traders for its clarity and adaptability.

📌 What is ORB (Opening Range Breakout)?

ORB refers to the price range (high and low) formed during the first few minutes (typically 5, 15, or 30) after the market opens. Traders look for a breakout above or below this range, anticipating strong momentum in that direction.

🧠 Why ORB Works

Volume Surge: The opening minutes see high institutional activity, creating genuine demand/supply signals.

Market Psychology: ORB captures trader sentiment as news digests overnight and is priced in at the open.

Defined Risk: The high/low of the range becomes a natural stop-loss area, allowing clean setups.

✅ Entry and Exit Rules for the ORB Strategy

Having a consistent framework helps you avoid emotional decisions. Here’s how you can structure your trades using ORB:

🔹 Entry Criteria:

Timeframe: Define your ORB window — e.g., first 15-minute candle.

Bullish Breakout Entry:

Enter long when price closes above the ORB high with volume confirmation.

Bearish Breakdown Entry:

Enter short when price closes below the ORB low with volume confirmation.

⚠️ Avoid entering on the first breakout candle. Wait for a close and retest, or a strong momentum candle for higher confidence.

🔹 Stop-Loss Placement:

For Long Trades: Place SL just below ORB low

For Short Trades: Place SL just above ORB high

🔹 Target/Exit Options:

Fixed RR Target: Aim for 1.5–2x your risk as initial target.

Mid/Outer Bands: Use indicator-drawn breakout bands (like those in LuxAlgo script) as profit zones.

Time-based Exit: Close position by end of session if price stalls or consolidates.

Trailing Exit: Trail your stop behind higher lows (long) or lower highs (short) after breakout.

📊 ORB in Action

You can explore this ready-to-use TradingView indicator to visualize ORB levels in real-time:

🔍 Indicator: Opening Range with Breakouts & Targets (by @LuxAlgo) Thanks to @LuxAlgo team to make this indicator available.

🛠️ Highlights:

Automatically marks the opening range

Plots breakout zones and targets

Ideal for intraday strategies

Works across indices, forex, and crypto

📓 Integrating ORB into Your Trading Journal App

If you're journaling ORB trades, consider logging:

✅ Symbol & timeframe

✅ ORB range (high/low)

✅ Breakout direction (long/short)

✅ Entry time & price

✅ Exit reason (target hit, SL hit, time-based exit)

✅ Notes: market sentiment, news drivers, volume confirmation

Over time, this data will help you:

🔍 Identify which assets respect ORB best

📈 Tune your RR ratio and stop placements

🧠 Reduce decision fatigue by automating setups

🧪 Want to Automate It?

Our trading journal app is ready with 🧠 AI-based journaling for feedback and refinement

🎯 Final Thoughts

ORB is a classic — not because it’s flashy, but because it offers structure, risk control, and repeatability. Whether you're a price action purist or using smart indicators, ORB can provide a disciplined edge — especially when integrated into a journaling and feedback loop.

📌 Start small. Track results. Tune your edge.

S&P 500 ETF & Index Hit Resistance – A Technical Warning Shot 📉⚠️ S&P 500 ETF & Index Hit Resistance – A Technical Warning Shot 🔍🧠

Following up on the video I just posted , I had to share this updated chart of the VOO ETF (Vanguard S&P 500) and US500 Index , now that both are testing key resistance levels.

On the left: AMEX:VOO has reached the very top of a multi-year ascending channel—a zone that has historically triggered sharp corrections. The level at 590.85 marks a major resistance zone.

On the right: The US500 Index is showing a similar technical overextension, trading just under 6,450, with 5,928.25 as the nearest support below.

🎯 Technicals at play:

VOO could retrace toward 526.17 and potentially 465.72, both of which are solid technical supports within this channel.

This setup doesn't mean panic—but it does argue for caution, especially after such an extended run.

🧠 And yes, the Buffett Indicator (Stocks-to-GDP) continues to point toward an overheated market . While it's not a timing tool, it adds macro weight to the technical signals.

In the video, I also touched on:

Taking profits on NASDAQ:NVDA after a near-perfect technical rejection at target.

Reviewing Rolls Royce nearing upper channel resistance.

Gold and Silver at inflection points—likely to be impacted if equities begin to unwind.

Rotational potential into Bitcoin and Ethereum, which may benefit from macro shifts.

This is how I trade: respect structure, stay proactive, and prepare before the move—not after. Let me know how you’re positioning or if you’re sitting on hands waiting for a dip.

One Love,

The FX PROFESSOR 💙

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

29-07-2025This chart contains my analysis and key observations for today's trading session. All drawings and indicators reflect my current view of the market as of today. The purpose of this publication is to keep a record of my analysis and review it later for learning and improvement. No investment advice is provided.

SPX500 Awaits Fed – Key Support at 6388 in FocusSPX500 Awaits Fed Decision – Breakdown Below 6365 Could Deepen Correction

Following the registration of a new all-time high at the beginning of the week, the price has started to decline. Also, investors await the Federal Reserve's policy statement later today for guidance on the future path of monetary policy.

The price is currently positioned below the 6388 level, which is a key zone in conjunction with the support line at 6365. This area signals the potential for a new downward correction if the price stabilizes below 6365.

A sustained move below 6365, confirmed by a 1H or 4H candle close, would open the door to a sharper decline toward 6341, followed by 6319, both considered critical support zones.

As for the bullish scenario: if the price finds support and manages to rebound today, the first step toward recovery would be a breakout above 6388, which may lead to a climb toward 6415. Breaking above 6415 would pave the way to retest the resistance zone at 6427, with the potential to reach a new all-time high at 6454.

Key Levels

• Support: 6365 - 6341 - 6319.

• Resistance: 6388 - 6415 - 6427.

Nasdaq and S&P 500 higher than ever. Crash incoming??The stock market is now more expensive than ever.

Some people are calling the top, saying that the market is overbought and too high.

There are indicators that show that the market is overheated, but NO ONE KNOWS whether it's going to crash next week or continue running up for months.

Since April, Nasdaq has gained 40%, which is a lot. Congrats if you bought some QLD and TQQQ back in April when I posted about it.

SP:SPX : All-time high. NASDAQ:NDX : All-time high. BITSTAMP:BTCUSD : All-time high. TVC:GOLD : All-time high HOME PRICES ( ECONOMICS:USSFHP ): All-time high. Sounds a bit like a bubble.

The S&P 500’s market cap now equals 28x real disposable personal income — a record.

The stock market Shiller PE ratio is at its highest in 20 years.

Nasdaq companies, especially the MAG7, are strongly outperforming small-cap companies. The last time this happened at this speed, we had the dot-com crash.

The top 10 stocks in the S&P 500 account for 40% of the index.

So, saying this, is the market going to crash?

I don't know, but I know that it's more likely to crash now than it was 3 months ago. It might continue running higher, too, as the FED is expected to cut rates. Really, no one knows. 😊

Here's what I'm doing:

I trimmed down some overpriced stocks from my portfolio: Lemonade, Coupang, Shopify, and Crowdstrike

I trimmed down some of my crypto, especially Bitcoin and Ethereum

I stopped DCA'ing into leveraged ETFs

I'm accumulating cash

I'm still investing (added more healthcare stocks to the portfolio)

Quick note: I'm just sharing my journey - not financial advice! 😊

S&P 500 as expensive as at the end of 2021 in valuation terms !Two weeks ago, I shared a technical analysis of the S&P 500 across all timeframes. This analysis outlines price targets for the end of 2025 based on technical and fundamental criteria. You can revisit this analysis by clicking the first chart below.

WARNING: A major bullish target I previously mentioned is close to being reached—6,475 points on the S&P 500 futures contract. The market may soon enter a consolidation phase.

Given this week's packed fundamentals, it's wise to start locking in your gains by moving up your stop-loss levels—especially as the S&P 500 has now returned to its end-2021 valuation peak.

Click on the table below to access details on this week's significant fundamental developments:

1. Caution: The S&P 500 has reached its end-2021 valuation record!

While technical market analysis is important, valuation metrics are even more so. The S&P 500 has just reached its previous valuation peak from the end of 2021—historically the starting point of the 2022 bear market. While the current macro context is different, this level could trigger a short-term market pause.

Chart showing S&P 500 valuation via the CAPE Ratio (Shiller PE):

2. S&P 500 seasonality is weaker in August and bearish in September

Another cautionary factor is seasonality. A statistical look at average S&P 500 performance by month highlights a weaker period in August and a typically negative one in September.

In summary, technical, fundamental, and seasonal analysis all point to securing gains as we approach August/September—without questioning the underlying long-term uptrend.

Chart showing S&P 500 seasonality since 1960:

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

S&P 500 Ascending Triangle Breakout SetupThe S&P 500 index is consolidating within an ascending triangle pattern, with strong support along the rising trendline. Price action suggests bullish momentum building towards a potential breakout above the resistance zone, targeting higher levels if confirmed

1. Previous Trend:

Strong bullish rally before the current consolidation phase, indicating momentum is on the buyers’ side.

2. Pattern Formation:

Horizontal resistance around 6,418–6,420 (marked by the grey line).

Rising support trendline connecting higher lows, showing buying pressure is increasing.

3. Volume (Not Shown Here):

If volume is decreasing inside the triangle and expected to spike on breakout, it supports a bullish case.

4. Breakout Expectation:

A confirmed close above 6,420 with strong volume could trigger a rally towards the next target zone of 6,470–6,500.

The arrow drawn on your chart aligns with this possible breakout scenario.

5. Invalidation Zone:

If price breaks below the rising trendline (~6,360), the bullish pattern would be invalidated, potentially pushing price back to 6,300–6,280.

SPX Sells 8/12Sells on SPX made sense because both 4h and 1h candles are currently Bearish, smaller timeframe structure was making LLs and LHs. Liquidity built right before 7am. The 1h hour actually showed the Unicorn setup, which is why I wait until Tuesdays to enter the market. The long upside wick ran the stops and closed below, Price broke structure and left imbalance. It did not fill it all the way.

I am getting better at watching the Liquidity set up first and then sweep. Also need to train my eyes to see the Bullish or Bearish orderflow.

SPX500 TECHNICAL ANALYSISSPX500 has broken above the recent range, reclaiming the 6,351.41 resistance. Price is now pushing into the 6,380.00 zone, with buyers showing control after a strong recovery from the 6,222.46 low.

Support at: 6,351.41 🔽 | 6,324.08 | 6,296.93

Resistance at: 6,380.00 🔼 | 6,409.21 | 6,438.44

🔎 Bias:

🔼 Bullish: Sustained trading above 6,351.41 opens the door toward 6,409.21 and higher.

🔽 Bearish: A close back below 6,351.41 may trigger a retest of 6,324.08 and 6,296.93.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

S&P Fibonacci based Accumulation/Distribution rangesFibonacci-Based Zones: The chart is structured around support and resistance zones derived from Fibonacci analysis, providing natural levels for market reaction.

Accumulation Zone: Lower price area (~4,133.94 and above) where buyers show interest and trend reversal is often seeded.

Trading Range: The broad mid-section where price is expected to oscillate, indicating indecision or equilibrium among buyers and sellers.

Distribution Zone: Upper price band near the Goldman Sachs 2025 target, as marked, where profit-taking and seller interest increases.

Potential for Parabolic Move: If price decisively breaks out above the distribution/resistance zone, it could trigger rapid, euphoric buying—a classic market melt-up.

Risk of Downside: Falling below the key Fibonacci support level could prompt a sharp correction,.

Historical Validation: Past price movements respect these zones.