SPX500USD | Bulls Lose Steam at 6,424.5 ResistanceThe S&P 500 Index showed strong bullish momentum but is now pulling back after tagging resistance at 6,424.5. Price is currently hovering near 6,374.6, where previous structure may act as support.

Support at: 6,374.6 / 6,340.0 🔽

Resistance at: 6,424.5 🔼

🔎 Bias:

🔼 Bullish: Bounce from 6,374.6 and reclaim of 6,424.5 signals continuation.

🔽 Bearish: Break below 6,374.6 exposes 6,340.0 and lower zones.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

US500AUD trade ideas

SPX....what goes up, must go downThis is long overdue. SPX has just crossed 9SMA, next 50SMA then 200SMA. Won't be surprised if it knocks each very soon. This will be a big week and tariffs are going to start hitting; even though this was mostly artificial and Americans are paying 90% of it! When in doubt, sell and park in money market! The next dip will hit hard and deep. Don't let the small wins overshadow the deep issues in the economy. Overpriced market and many lagging indicators will soon hit and default rates that are coming out are scary! Stay safe and don't get emotional over any stock. If it dips, you can always buy it cheaper.

American Exceptionalism - The End of an Era "The Eagle and the Fall"

O say can you see, from the towers so high,

A gleam in the steel and a spark in the sky?

The factories roared and the railways sang,

And liberty’s bell through the cities rang.

We rose from the soil, rough-handed and proud,

With faith forged in steel and heads unbowed.

The eagle soared on ambition's flame,

Each man in his dream, each street with a name.

From sea unto sea, we built and we bought,

In ticker tape winds, prosperity caught.

The market climbed like a hymn on the air—

A temple of glass, reflecting a prayer.

But greed wore a mask and danced in disguise,

A siren’s whisper in financier’s eyes.

And credit, like wine, flowed too freely at last,

While whispers of worry were buried in glass.

October arrived like a thief in the mist,

And struck with a silence too brutal to miss.

A breath, then a cry, then a plunge in the floor—

The numbers all bleeding, the dream no more.

Yet still in the ruins, beneath ash and flame,

Burned a stubborn belief in America’s name.

For even when mountains of fortune did crash,

The stars and the stripes held fast through the ash.

O nation of daring, of promise and pain,

You rise not once, but again and again.

Through boom and through bust, your story is spun—

A land still unfinished, still chasing the sun.

Rob the Rally SPX500: Enter Before Resistance Catches You🦹♂️💎 “SPX500 Vault Breach – Layered Robbery in Progress!” 💼📈

(Thief Trader's Multi-Limit Entry Bullish Blueprint – No Mercy, Just Money)

📍Asset: SPX500 / US500

🎯Plan: Bullish Heist

🧠Style: Layered Limit Orders | Thief Strategy Entry | Zero Mercy Execution

📈Target: 6600.00

🛑Stop Loss: 6200.00

💣Entry: Any level — thieves adapt, not wait!

🌍 Welcome to the Global Robbery Room, Traders!

It’s your boy Thief Trader, back in the vault with another plan to crack the SPX500 like a safe on Wall Street. This one’s for the bold bulls who like to rob with precision, not permission. 🎯💰

💼 The Setup – High Stakes, High Floors

SPX500 is lining up for a classic breakout breach. This isn’t just technical — it’s tactical warfare. Market noise? Ignore it. We operate on strategy and steel nerves. 🧠🔫

🔥 Entry Protocol – Layer Up or Miss Out

🧱 Multiple limit orders across price zones — like planting C4 charges on every door.

🎯 Enter wherever price dips — don’t wait for permission from retail traders.

🎯 No fixed entry — this is Thief Layering: get in where you fit in.

🚪 Escape Plan – Stop Loss Strategy

📍 SL: 6200.00

Why? That’s where the guards start showing up. If price drops below, we vanish.

💡 Be flexible — smart robbers don’t get caught, they regroup.

💎 Target Loot – The Golden Zone

📍 Primary TP: 6600.00

Once we breach the 6500+ resistance, it's a moonwalk. Lock gains or trail with confidence.

📢 Warning for Scalpers & Swing Thieves Alike:

Only play Long-side. Don’t try to rob both ends — that’s suicide.

Big wallet? Scale heavy. Small bag? Layer light but tight.

Always use trailing stops — never trust the market with your escape bag. 🎒💸

📊 Thief Intel – Why We’re Bullish

✅ Index rotation favors large-cap strength

✅ Macro sentiment + institutional bias points UP

✅ No bearish COT signals in sight

✅ Fed tone & economic backdrop: neutral to supportive

This isn’t hopium. It’s strategy.

🚨 NEWS FLASH – Stay Stealthy!

Do NOT enter during economic bombs 💣 (NFP, CPI, Fed minutes, etc.)

Market noise kills precision. We only move in silence and with SLs trailing tight.

💬 Smash that BOOST 💖 if you’re riding with the Thief Army.

Share this plan, spread the word, and let’s rob the markets the smart way.

📢 Tag your crew, stack your layers, and let’s hit 6600 like pros.

📌Disclaimer: Not financial advice — this is a market operation plan for educational use. Trade at your own risk. Smart thieves plan exits before entries. 💼📉📈

🦹♂️ Thief Trader out.

💸 Rob smart. Rob clean. Rob global.

US500 Pulls Back from 6,400– Correction or Trend Shift?The index has rejected the 6,400 🔼 resistance zone with a strong bearish candle, pulling back toward the 6,200 🔽 support region. Price is still trading within a bullish structure, but this drop may signal early signs of exhaustion.

Support Levels: 6,200 🔽, 6,100 🔽, 6,000 🔽

Resistance Levels: 6,300 🔼, 6,400 🔼

Bias:

🔼 Bullish: If price holds above 6,200 and reclaims 6,300, the uptrend remains intact and bulls may reattempt a push toward 6,400.

🔽 Bearish: A daily close below 6,200 could open a deeper retracement toward 6,100 or even 6,000.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

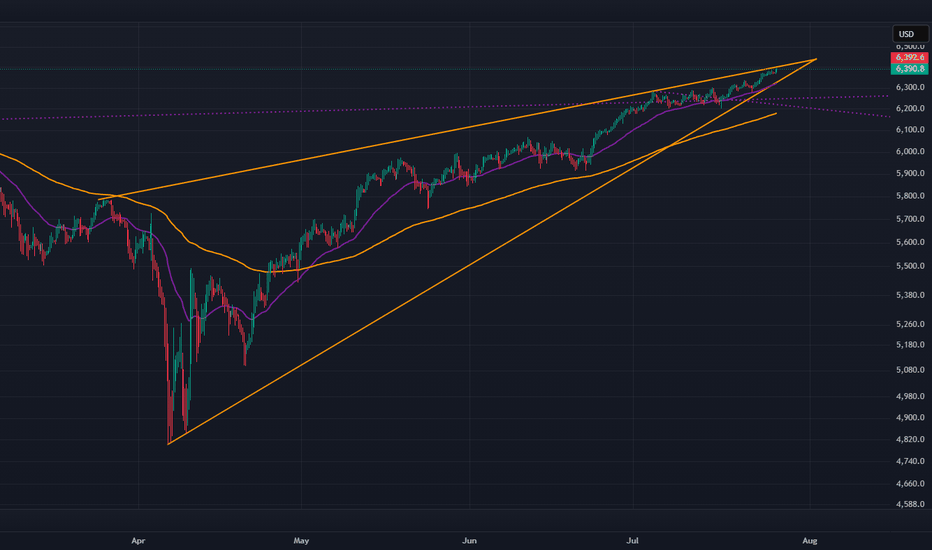

SPX: Investors` defensive positioning? The past week brought a flurry of important US macro data and a high market volatility in line with it. In addition, the FOMC meeting brought up increased nervousness regarding Fed's view on current and future macroeconomic developments. As Fed Chair Powell informed the public, the inflation is perceived to pick-up a bit as a reflection of imposed trade tariffs, but the Fed is not expecting that it will have a significant effect on increasing inflation, but only the one-off effect. Future Fed moves will continue to be data dependent and risk-assessed, in which sense, a direct answer to potential September rate cut was not provided by Fed Chair Powell.

Although Friday brought up some major market corrections in the S&P 500, Thursday's trading session was the one to bring major sentiment and indication over forthcoming correction. Namely, Thursday started in a positive manner, where the index reached a new all time highest level at 6.427, but soon after the market tumbled down, ending the trading day at 6.333. Futures were traded lower on Friday, where the S&P 500 was opened by 1,5% lower, ending the week at 6.238. These movements during the last two trading days are quite important because such strong moves in the value of index could be imposed only by institutional investors, showing their sentiment regarding the macro environment expectations at this moment.

Much of the negative market sentiment was driven by surprisingly weak non-farm payroll data of only 73K in July, which was below market estimate of 110K. At the same time, the unemployment rate modestly picked up in July to 4,2%, from 4,1% posted previously. Some analysts are noting that this could be a summer seasonal effect, however, investors are concerned that this could be a sign of a weakening US economy, due to implemented trade tariffs. During the time of writing this article, CNBC posted a news that the U.S. President Trump ordered immediate release of a duty of a Commissioner of labor statistics, due to continued posts of inaccurate labor data and its frequent revisions, also putting doubts that the July figure of 73K is accurate.

Regardless of actual accuracy of the US jobs data, investors continue to be concerned regarding the effects of implemented trade tariffs on earnings and growth of US companies. As analysts are noting, some of them are trying to lock in gains as earnings risks emerge, but with future uncertainties, a defensive positioning of investors might be wider in the coming period.

S&P 500 Futures Hold Ground After Tariffs Take EffectS&P 500 Futures Rise After New Tariffs Kick In

President Trump's sweeping tariffs officially took effect just after midnight, escalating trade tensions with dozens of countries. While negotiations are ongoing behind the scenes to secure exemptions and reduce tariff rates, market reactions are already underway.

Technical Outlook

S&P 500 Futures continue to show bullish momentum as long as price trades above 6289, with the potential to retest the All-Time High (ATH).

To confirm a move toward 6453, price must close above 6437 on the 1H chart.

🔻 However, if the price stabilizes below 6389, a correction toward 6365 becomes more likely.

Key Levels:

🔹 Resistance: 6424 – 6453

🔹 Support: 6365 – 6341

SPX 1W – Long-Term Breakout Holding, Can the Rally Sustain?The S&P 500 just printed a weekly breakout above historical highs, tapping into uncharted territory above 6,300 — but now the question is whether the trend can sustain or if a deeper retest is on the horizon.

🔹 Macro Structure

Multiple clean support levels exist below, each marking prior macro pivots — from the 2020 breakout to the 2022 base.

The most immediate zone of interest is 6,100–6,200, which could act as a bullish retest zone if this breakout is valid.

Deeper downside remains structurally healthy unless 4,250 or below is breached.

🔹 Trend Health

Price remains well above the EMA 50 and 100, showing no signs of structural weakness.

Pullbacks into the EMAs historically triggered trend continuation — and bulls will likely treat those zones as reload points.

🔹 Big Picture

As long as SPX holds above 5,400, the macro bull trend remains intact.

A drop to retest lower zones wouldn’t necessarily break the uptrend — but it would shake sentiment and invite reaccumulation.

Is this the beginning of a new macro leg — or the last shake before a deeper correction?

Let’s chart it out 👇

$XLV vs $SPY at multi year low. Is more downside expected? In this space we talk a lot about the market outperformance and how this has resulted in indexes at ATH. The SP:SPX and NASDAQ:NDX and their corresponding ETFs: NASDAQ:QQQ and AMEX:SPY have also made ATHs. But if peel under the surface we can observe that very few sectors have consistently outperformed the S&P 500. The Technology sector represented by AMEX:XLK has consistently outperformed the $SPY. The $XLK/ AMEX:SPY is in a upward channel depicted by the purple line. The SPDR select sector Technology sector has consistently increased its weightage on AMEX:SPY and the ratio $XLK/ AMEX:SPY is currently at 0.41 which is an ATH.

But the same cannot be told about the SPDR Healthcare Sector. The ratio between $XLV/ AMEX:SPY is making multi year low. With the ratio currently at 0.21 it is approaching its multi-year lows of 0.1975. The ratio was so low last in Sept 2000. Hence the question comes what should we expect the AMEX:XLV which is making new lows against the AMEX:SPY ? Will we visit the lows of 0.1975? If it happens then can we expect a upward momentum from his double bottom situation?

In my estimate in this bull market and Tech sector outperforming the AMEX:XLV will make new lows vs AMEX:SPY and the ratio will revisit the 2000 lows. But if on the macro front we have weak jobs numbers and recession risk rising then the AMEX:XLV can in fact draw inflows and outperform the index. Hence my estimate $XLV/ AMEX:SPY will sweep the multi-year low and then bounce back into 2026.

Verdict: Still more downside possible in $XLK/$SPY. Go long AMEX:XLV when the ratio is @ 0.1975 and into 2026.

S&P Market Update – Signs of a Short-Term Correction?Although the S&P remains in an uptrend, recent price action suggests that momentum may be fading.

📉 Key Observations:

A Key Day Reversal occurred at 6409 – a potential warning signal.

We're seeing RSI divergence: price made a new high, but RSI didn’t follow suit.

The market is grinding higher, but without conviction.

📊 What to Watch:

The 15-day EMA, currently at 6317, is acting as near-term support. A close below this level could trigger a short-term correction.

Initial downside targets: 6147–6100, the previous highs from late 2024 and early 2025.

✅ To negate this bearish bias, the market would need to break above 6409 and continue higher with stronger momentum.

Stay alert — the technicals are flashing red flags. Always manage risk accordingly.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

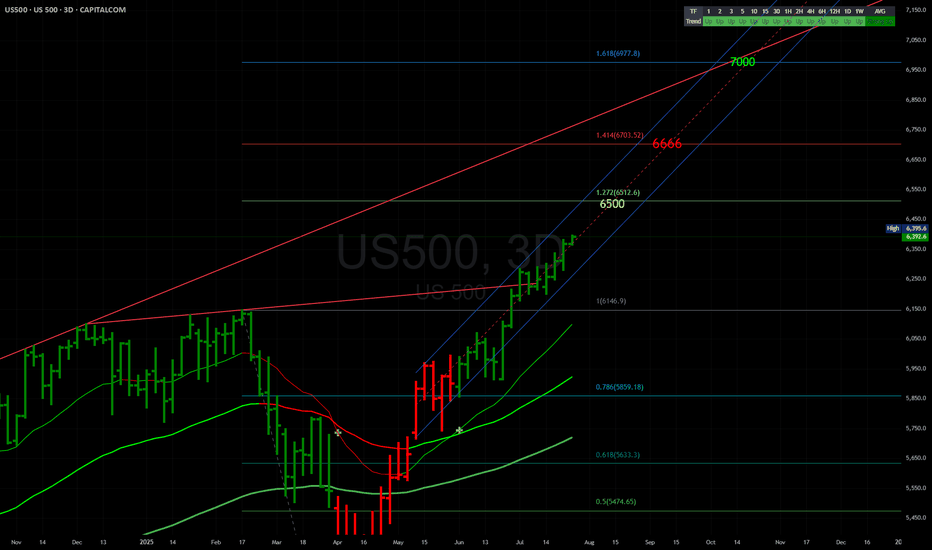

The Golden Age 7000 EOY SPXThe Golden Age (year) is here!

Have cash ready for May in April. Be heavy hedges going in to 26.

We're going to juice earnings with all the investments pouring in for just about every single industry. Once the injection is complete, we will reset while all the invested money completes projects.

GL!

Better Buy Bitcoin

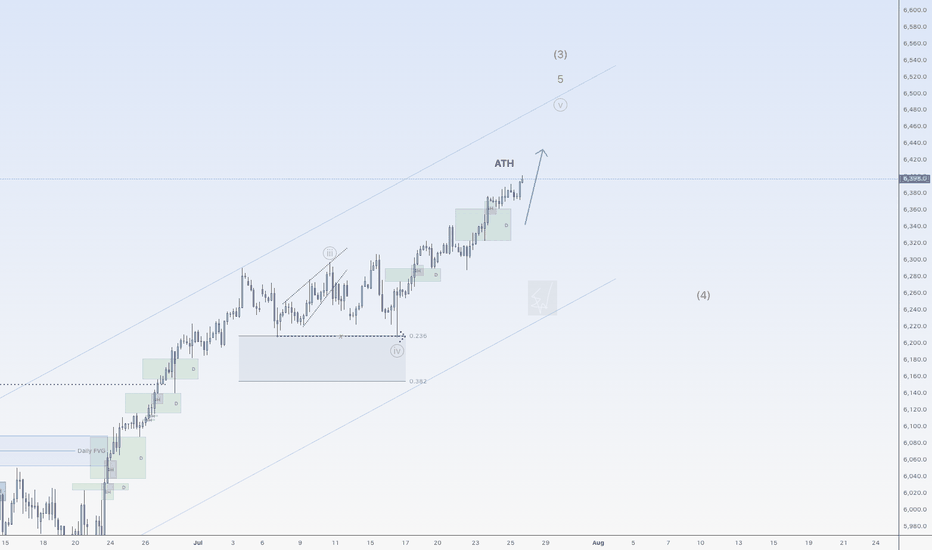

New All-Time Highs for S&P 500 – No Resistance AheadThe S&P 500 is officially in price discovery mode, printing new all-time highs with clean higher highs and higher lows.

Each old resistance flipped into strong support—textbook bullish market structure.

As long as this trend holds, there's no ceiling in sight. Bulls are fully in control.

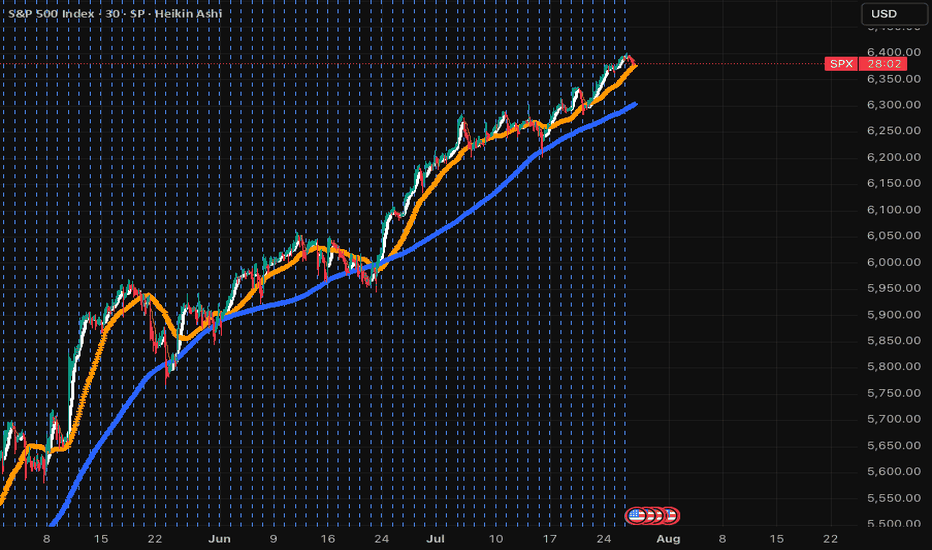

SPX500USD is on a riseHi traders,

Last week SPX500USD started the next impulse wave 5 (grey) as I've said in my outlook.

Next week we could see more upside for this pair.

Let's see what the market does and react.

Trade idea: Wait for a small pullback and a change in orderflow to bullish on a lower timeframe to trade longs.

NOTE: the next three weeks I'm on holiday so I will not post any outlook publicly.

If you want to learn more about trading FVG's & liquidity sweeps with Wave analysis, then please make sure to follow me.

This shared post is only my point of view on what could be the next move in this pair based on my technical analysis.

Don't be emotional, just trade your plan!

Eduwave

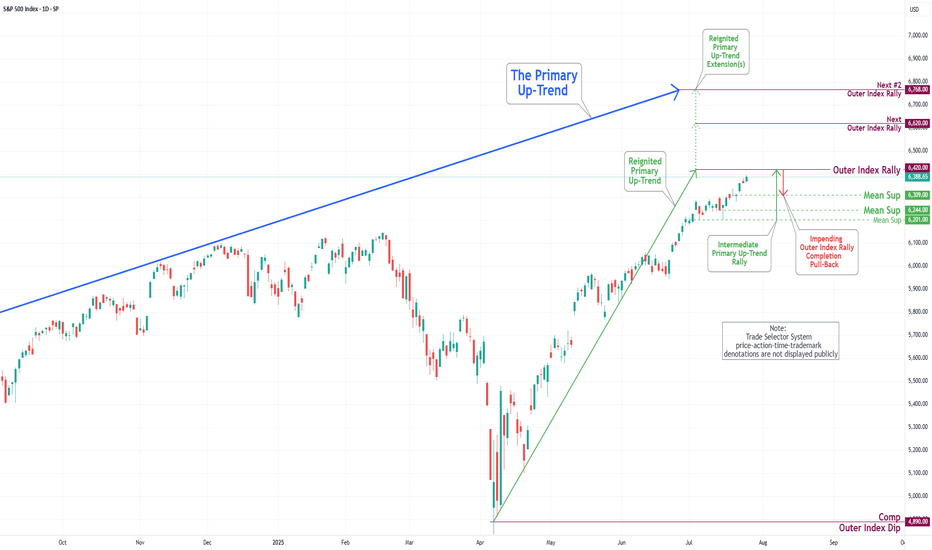

S&P 500 Daily Chart Analysis For Week of July 25, 2025Technical Analysis and Outlook:

In the trading activity observed last week, the S&P 500 Index exhibited a predominantly upward trajectory. It traded around the Key Resistance level of 6314. It successfully broke through this level, with the primary objective being to complete the Outer Index Rally at 6420, as outlined in the previous week's Daily Chart Analysis.

It is crucial to acknowledge that the current price movement may prompt a substantial pullback following the completion of the Outer Index Rally, with the main target identified as the Mean Support level of 6309. Following this potential downward adjustment, it is anticipated that the index will resume its upward trend, targeting a retest of the forthcoming completion of the Outer Index Rally at 6420.