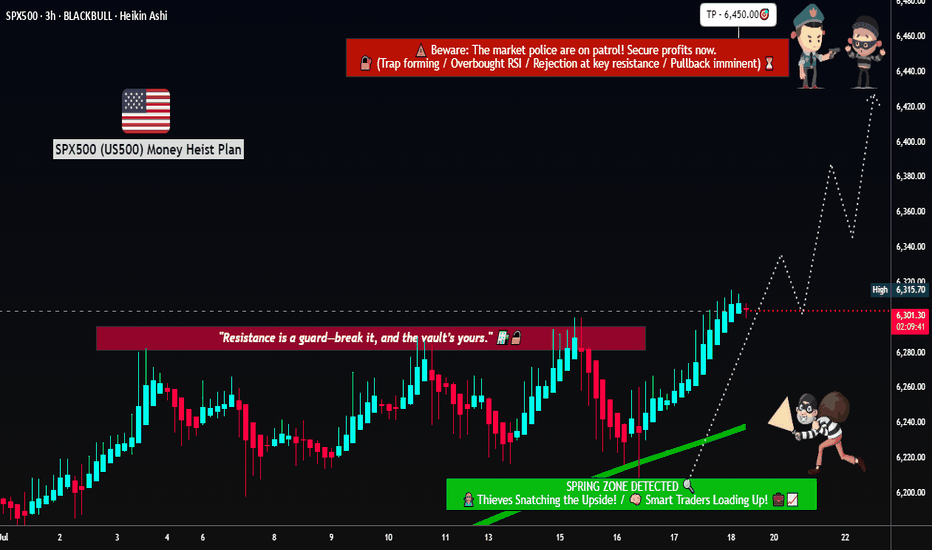

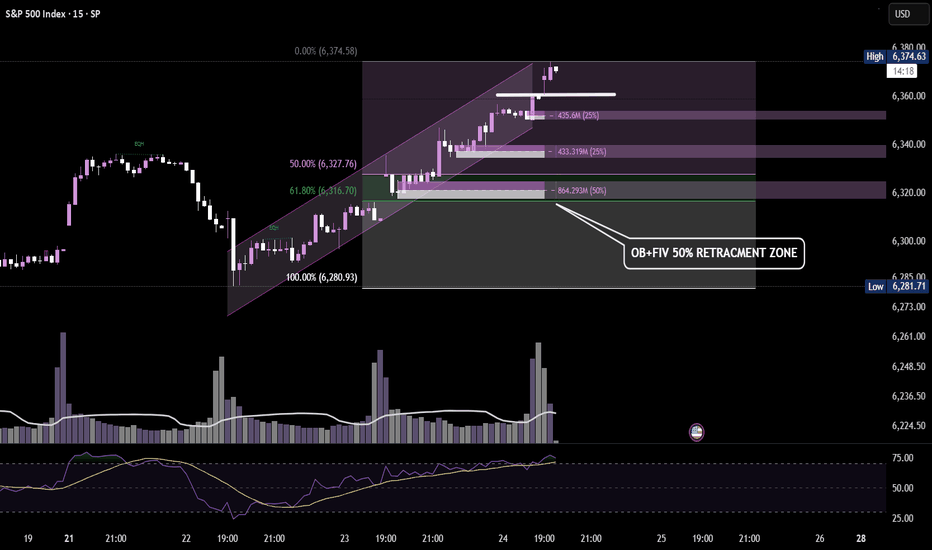

Rob the Rally SPX500: Enter Before Resistance Catches You🦹♂️💰**“SPX500 Street Heist” – Thief-Style Robbery Plan for Bulls!**📈💸

(Powered by Thief Trader's Market Robbing Tactics – Scalp | Swing | Day Trade Edition)

🌍Hello, Global Money Hunters!

📣 Salaam, Bonjour, Ola, Hola, Hallo, Marhaba & Welcome to the heist floor! 🎩💼

Thief Trader is back again with a loaded plan to rob the market clean — this time targeting the mighty SPX500 / US500 🎯. Based on a fusion of technical setups, macro sentiment, and the Thief Trading System, we’ve set our sights on the next breakout vault of Wall Street.

🎯 The Gameplan – Heist the Resistance Vault

The index is entering a high-risk resistance barricade — overbought, consolidated, and heavily guarded by bearish robbers (sellers). This is the zone where the market police lurk and trend reversals often get triggered. However, smart thieves always plan with precision.

Here’s the mission briefing:

🔓Entry Zone (Break-in Point)

💥 “The vault is open — grab the bullish loot!”

Enter Long anywhere close to market price or on pullbacks near recent swing lows/highs.

Preferred timeframes: 15-min to 30-min for sniper-level accuracy.

Deploy DCA-style limit orders (layered entries for maximum control).

🛑Stop Loss (Escape Hatch)

Base SL on recent swing low candle wicks on the 4H timeframe.

Suggested: ~6250.00 — but adapt based on your risk appetite, lot size, and position stacking.

📈Target / Loot Location

🎯 Primary Take-Profit: 6450.00

Or… pull out early if you spot resistance fighters guarding the vault.

Use trailing SL to secure gains and manage getaway.

⚡Scalper’s Notice

Only Long-side allowed!

Got big capital? Jump in now.

Running low? Tag along with swing traders and follow the robbery protocol.

Always protect your bag with dynamic trailing stops.

🧠Fundamental Fuel Behind the Plan

Bullish sentiment across major indices

Macro trends, COT positioning, sentiment outlook, and intermarket analysis all greenlit

Geopolitical and Fed tone supportive — tap into real data before entering

👉 Always analyze: News, Fundamentals, Sentiment, COT reports, and macro conditions.

🚨NEWS ZONE ALERT – No Loud Moves!

Avoid entry during major economic news drops

Use trailing SLs to guard profits

Don’t let your open trades get caught in the chaos of news releases!

💥Let’s Boost the Thief Army!

Smash the BOOST button 💖 to power up the robbery crew.

Support the strategy, share the love, and stay ahead of the game using Thief Trading Style. Every trade is a step closer to freedom from financial traps. 🚀💰🎉

📌Disclaimer: This is a general market analysis for educational purposes and should not be considered personal financial advice. Please evaluate your own risk management strategy before placing trades.

📌Markets shift fast — stay flexible, stay alert, and always rob smart.

🔥Stay locked in for the next heist plan — Thief Trader signing off for now…

💸💼📈 Trade smart. Rob harder. 🤑🦹♂️📊

US500AUD trade ideas

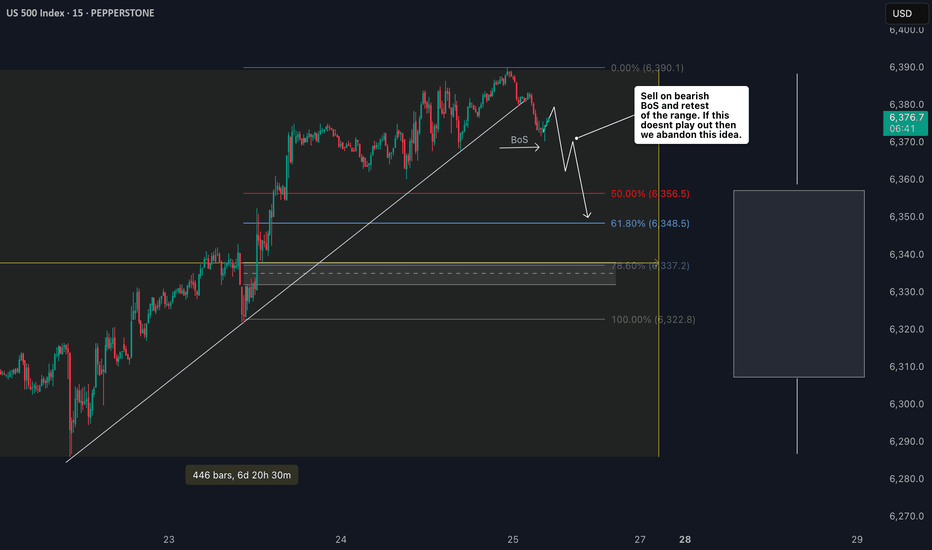

S&P 500 Counter-Trend Setup After Bullish Week US500Currently watching the S&P 500 (US500) closely 👀. The index has been in a strong bullish trend 📈, but I’m now evaluating a potential counter-trend opportunity.

Given the strength we’ve seen this week — possibly a “foolish rally” — there’s a chance we’ve either printed or are close to printing the high of the week 🧱. That opens the door for a retracement setup, particularly as we head into Monday’s open 🗓️.

🧠 Trade idea: If we get a bearish market structure break, I’ll be looking to enter short — targeting a 1R take profit initially, and holding a portion for a 2R–3R extension 🎯.

Friday sessions, especially after strong trends, often present clean intraday pullbacks — and when Monday’s low is set early, it can trap late buyers and fuel the move 📉.

⚠️ This is not financial advice — just sharing my thought process and trade plan.

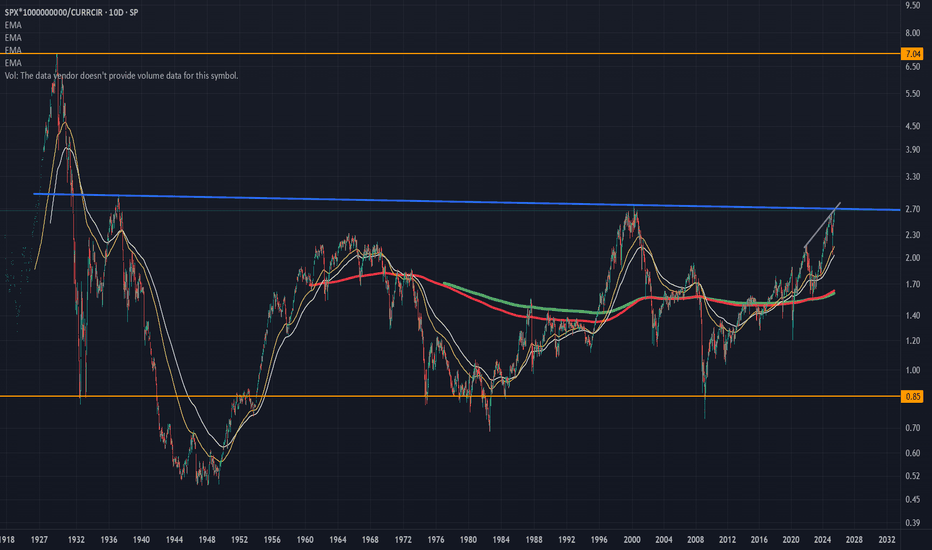

Entire S and P history in one chart. Approaching a neck-snapper!Here is a chart of the entire S and P history versus total currency in circulation.

This gives bubble periods (anytime the value is over 2) and times when the market crashed after being in a bubble.

If you notice we are fast approaching the line that broke the neck of the market in the 60s and 2000 dotcom bust.

If we clear that line, hold on to your hats because we are going into full blown speculative mania like just before the Great Depression!

In fact maybe the AI-crypto bubble will be exactly like the Great Depression, AI causing mass unemployment and global poverty.

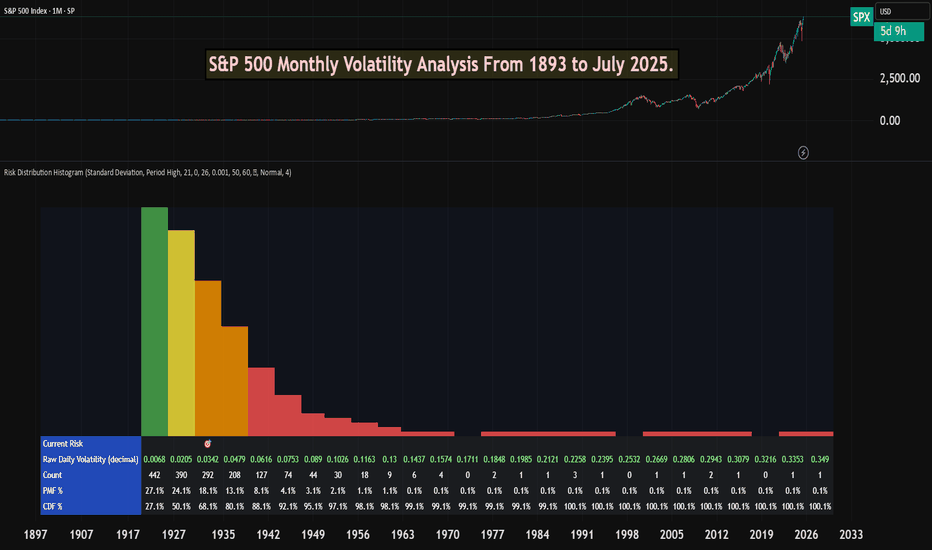

S&P 500 Monthly Volatility Analysis From 1893 to July 2025Most of the time, the S&P 500 is seen as a low-volatility index when compared to most individual stocks, small-cap indexes, or indexes from other countries.

However, most investors don't know exactly what volatility to expect from a statistical perspective.

The Risk Distribution Histogram allows us to understand exactly how risk is distributed.

S&P 500 Statistical Risk Distribution

Here are some highlights from what we get from the analysis. Some of this data might actually surprise investors. The data is monthly:

27% of all months have volatility under 0.68%

80% of all months' volatility was under 4.79%

5% of all months had a volatility of over 7%

If we can call a volatility over 25% a severe crash or "grey" swan, we had 7 of those events

3 months with extreme volatility over 30%

This allows us to understand tail risk and plan ahead. While most times the S&P 500 is in the low volatility zone, extreme events can happen.

What can we learn from this?

Prepare for rare but possible high-volatility events.

Understand the 80/20 rule. Most months are very low volatility, but 20% of them will have a volatility higher than 5% approximately.

Avoid overconfidence in stability

Plan for long-term horizons. High volatility tends to "dissipate" in the long term.

This is why it's important not to discard rare high-volatility events, especially when the investor is in need of liquidity.

This risk analysis can be done for any ticker.

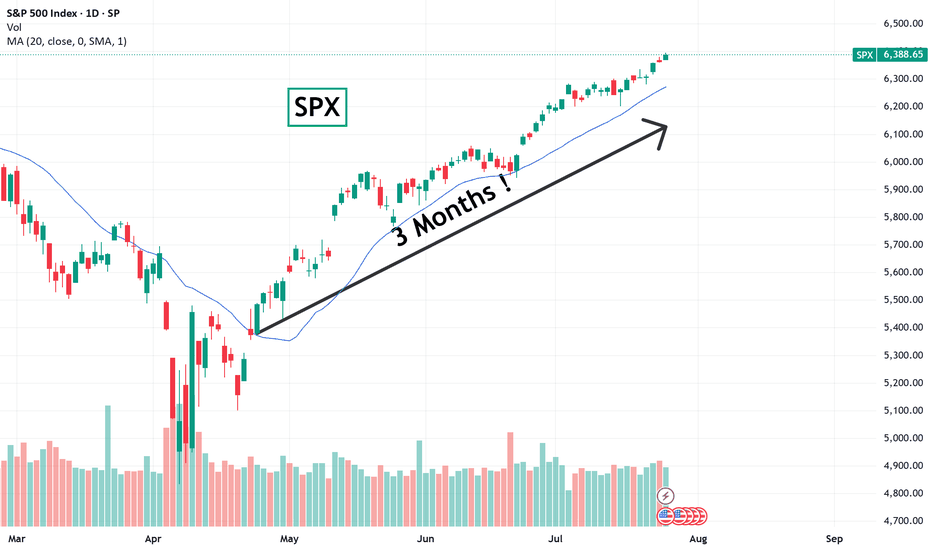

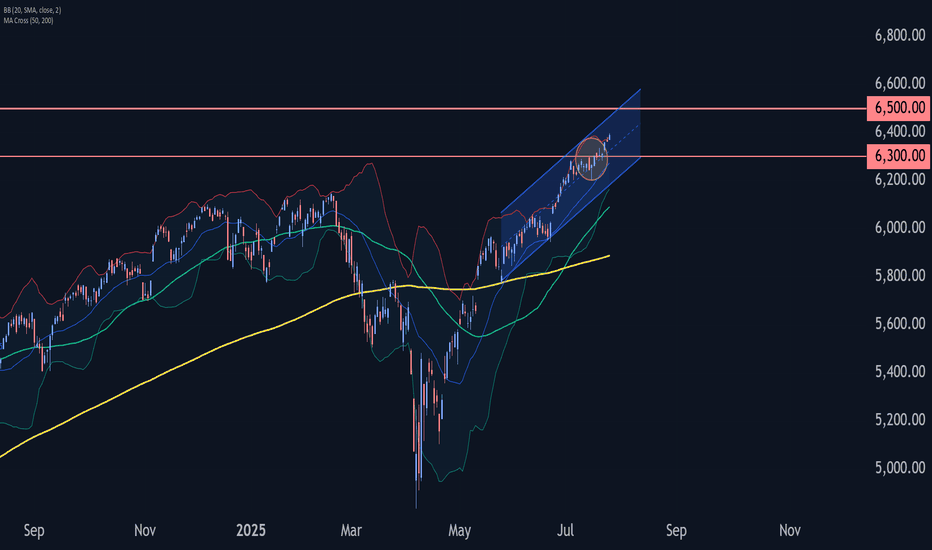

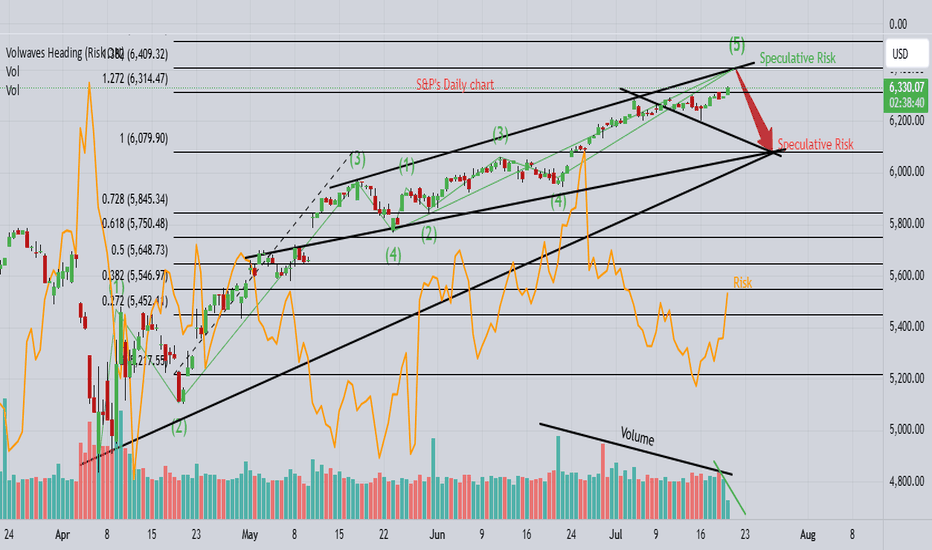

SPX chit chat... we're still up for nowAfter that crazy April 2025 crash, it feels like we should not be this high so fast... that's how I felt before too. But the rising channel is holding up right now. We are approaching the top. In previous times, the market grinded even higher (COVID pandemic was the last example).

Today we squeezed out new ATHs. The month ends next week and a new one begins. Less fear; more charts for the rest of the year.

See you in August!

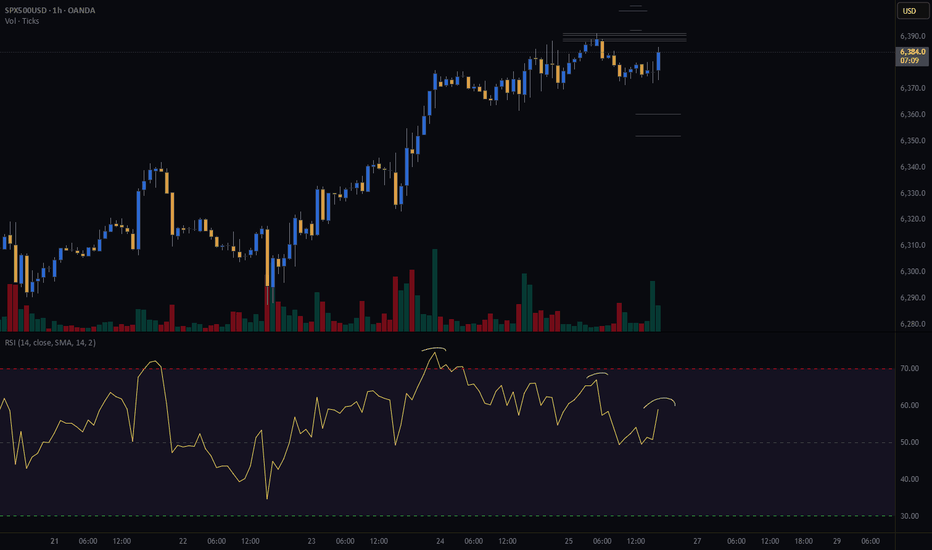

S&P 500 Index Wave Analysis – 25 July 2025

- S&P 500 Index broke key resistance level 6300.00

- Likely to rise to resistance level 6500.00

S&P 500 Index recently broke the key resistance level 6300.00 (which stopped the previous waves 5 and (B), as can be seen below).

The breakout of the resistance level 6300.00 continues the active intermediate impulse wave (5) from the middle of this month.

Given the strong daily uptrend, S&P 500 Index can be expected to rise to the next resistance level 6500.00 (coinciding with the daily up channel from May).

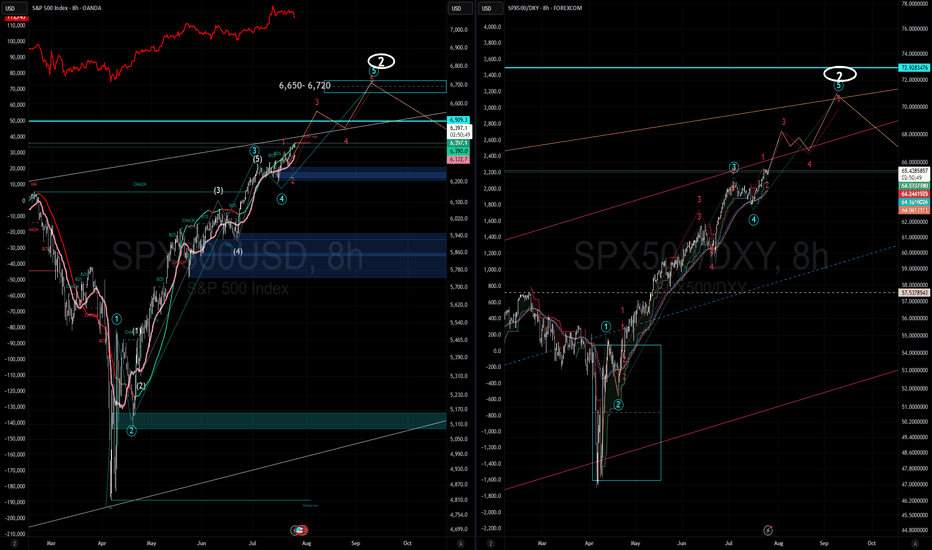

SPX More upside potentialI've revised my previous count based on recent price action. I now see a potential minor Wave 4 (of Intermediate Wave 5) forming around the 6,500 level. This could present a reasonable opportunity to take some % profits, (for the cautious or short term traders) though I recommend being prepared to re-enter, as I still believe we are ultimately headed toward the 6,650–6,720 range before a larger-scale correction sets in.

Taking some profits around 6,500 may be a prudent move, or alternatively, you can continue holding while adjusting your trailing stops accordingly.

Generally and in most cases its best to exhaust you bullish counts in Elliot .

On the right hand side i am showing SPX/ DXY which is typically a more accurate and discernable wave pattern then the SPX alone. FYI

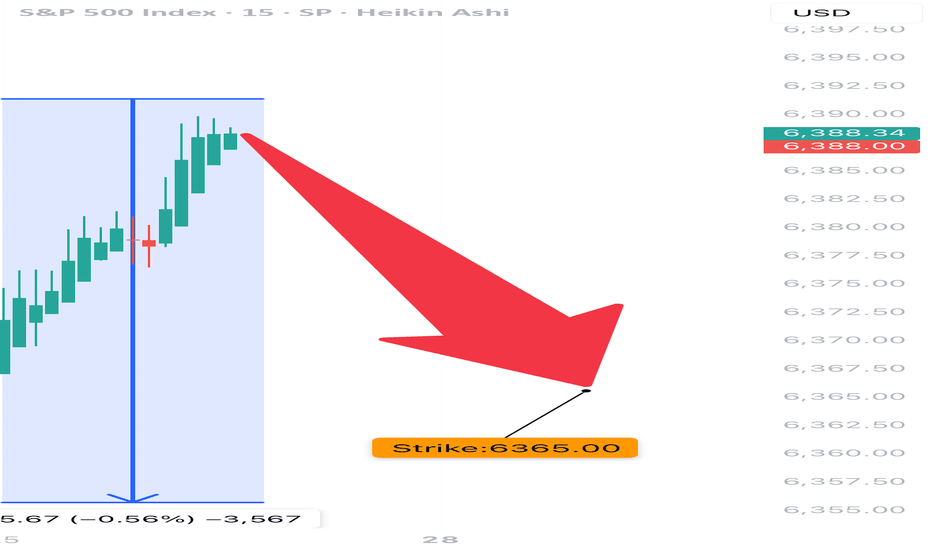

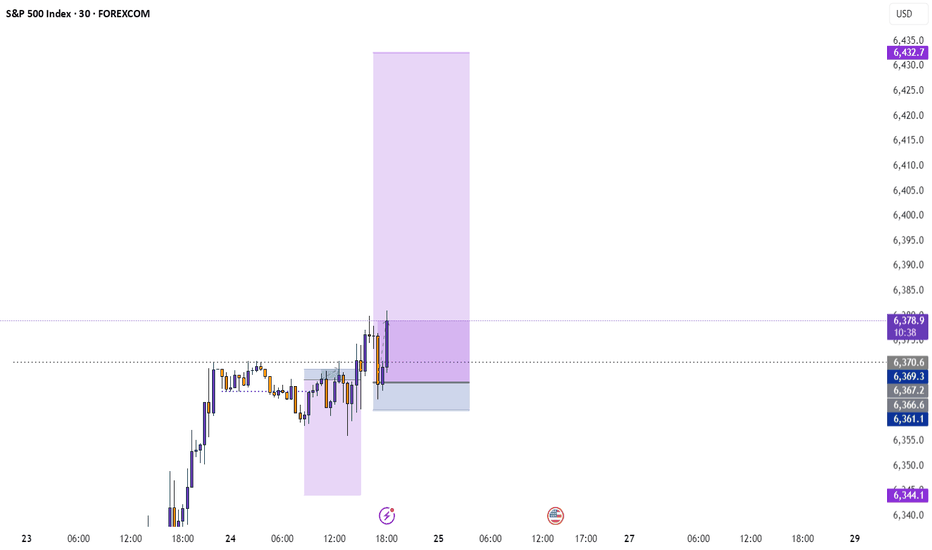

SPX 0DTE TRADE IDEA – JULY 25, 2025

⚠️ SPX 0DTE TRADE IDEA – JULY 25, 2025 ⚠️

🔻 Bearish Bias with Weak Volume – Max Pain Looming at 6325

⸻

📊 Quick Market Snapshot:

• 💥 Price below VWAP

• 🧊 Weak Volume

• 📉 Max Pain @ 6325 = downside pressure

• ⚖️ Mixed Options Flow = no clear bullish conviction

⸻

🤖 Model Breakdown:

• Grok/xAI: ❌ No trade – weak momentum

• Claude/Anthropic: ✅ Bearish lean, favors PUTS near highs

• Gemini: 🟡 Slightly bullish bias, BUT agrees on caution

• Llama: ⚪ Neutral → No action

• DeepSeek: ❌ Bearish → No trade

⸻

📌 TRADE IDEA:

🎯 SPX 6365 PUT (0DTE)

💵 Entry Price: $0.90

🎯 Profit Target: $1.80 (💥 2x return)

🛑 Stop Loss: $0.45

📆 Expires: Today

🕒 Exit by: 3:45 PM

📈 Confidence: 65%

⏰ Entry Timing: OPEN

⸻

⚠️ Risk Flags:

• Low volume = fragile conviction

• Possible reversal if SPX breaks above session highs

• Max pain magnet at 6325 could limit gains or induce a bounce

⸻

🧠 Strategy:

Scalp it quick. Get in early. Exit before the gamma games explode into close.

📈 Like this setup? Drop a 🔽 if you’re playing puts today!

#SPX #0DTE #PutOptions #OptionsTrading #MaxPain #SPY #MarketGamma #TradingSetup

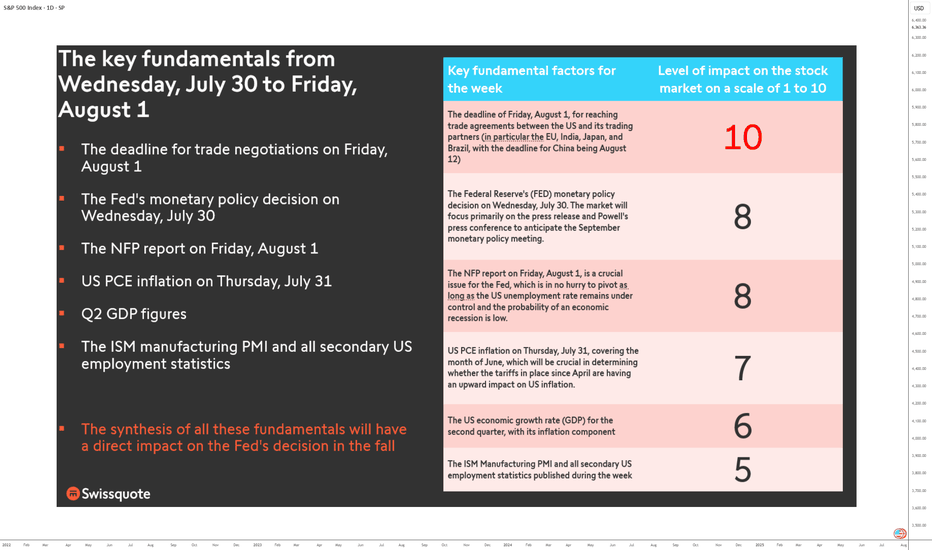

FUNDAMENTALS: THE WEEK OF TRUTH IS COMING!This is a high-stakes, high-pressure week for markets as the final days of July approach. Between Wednesday, July 30, and Friday, August 1, all the market-moving fundamentals are concentrated in a three-day window. It’s a stress test for the U.S. equity market: either it extends its bullish trend, or it enters a much-needed consolidation phase.

Three days. No more. Catalysts are so tightly packed they could shake even the steadiest traders. We’re looking at a full-spectrum stress test—monetary, economic, and geopolitical. Why so crucial? Because every major macro driver is converging in an ultra-condensed timeframe: the trade deal deadline with U.S. partners, the Fed’s policy decision, GAFAM earnings, PCE inflation, the NFP jobs report, Q2 GDP figures, and key technical barometers—all as we enter the seasonally weaker August-September period.

1) Wednesday, July 30 – The Monetary Moment of Truth

The week opens with a critical event: the Fed’s monetary policy meeting. It’s not just about rates, but forward guidance. The market stands at a crossroads. Either the Fed signals a dovish pivot for late 2025, and risk appetite returns—or it delays action, and the S&P 500, already stretched (Shiller PE Ratio back to end-2021 levels), enters a correction.

At the same time, GAFAM kick off their earnings season. U.S. tech remains the market’s beating heart. If these giants disappoint, the sector will drag down the entire market. Remember, tech accounts for 35% of the S&P 500’s weight.

2) Thursday, July 31 – PCE Inflation Decides the Direction

Next up is the Fed’s preferred inflation metric: core PCE. A critical indicator. If inflation ticks up, the autumn rate-cut narrative falls apart. Add in the second estimate of Q2 GDP and earnings from the next GAFAM batch, and Thursday becomes a pivotal day for the S&P 500. The key question: will core PCE inflation rebound, possibly influenced by tariff impacts?

3) Friday, August 1 – The Verdict: NFP and Trade Talks

NFP jobs report + trade negotiation deadline = explosive combo. By Friday, markets will have priced in the Fed, inflation, and earnings. What’s left? U.S. labor. Weak numbers could revive recession fears. Strong ones might push back the Fed’s easing timeline.

Also on the radar: trade talks. The August 1 deadline could spike volatility. And let’s not forget the China-specific deadline on Tuesday, August 12.

Conclusion: No Room for “TACO”

There’s no margin for error. No room for “TACO” (Trump Always Chickens Out). This market must deliver across the board—or the current overvaluation will be left with no safety net. The July 30 week is a true fundamental stress test. And the consequences will be swift.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Can the S&P 500's Ascent Continue?The S&P 500 recently achieved unprecedented highs, reflecting a multifaceted market surge. This remarkable performance stems primarily from a robust corporate earnings season. A significant majority of S&P 500 companies surpassed earnings expectations, indicating strong underlying financial health. The Communication Services and Information Technology sectors, in particular, demonstrated impressive growth, reinforcing investor confidence in the broader market's strength.

Geopolitical and geostrategic developments have also played a crucial role in bolstering market sentiment. Recent "massive" trade agreements, notably with Japan and a framework deal with Indonesia, have introduced greater predictability and positive economic exchanges. These deals, characterized by reciprocal tariffs and substantial investment commitments, have eased global trade tensions and fostered a more stable international economic environment, directly contributing to market optimism. Ongoing progress in trade discussions with the European Union further supports this positive trend.

Furthermore, resilient macroeconomic indicators underscore the market's upward trajectory. Despite a recent dip in existing home sales, key data points like stable interest rates, decreasing unemployment claims, and a rising manufacturing PMI collectively suggest an enduring economic strength. While technology and high-tech sectors, driven by AI advancements and strong earnings from industry leaders like Alphabet, remain primary growth engines, some segments, such as auto-related chipmakers, face challenges.

The S&P 500's climb is a testament to the powerful confluence of strong corporate performance, favorable geopolitical shifts, and a resilient economic backdrop. While the immediate rally wasn't directly driven by recent cybersecurity events, scientific breakthroughs, or patent analyses, these factors remain critical for long-term market stability and innovation. Investors continue to monitor these evolving dynamics to gauge the sustainability of the current market momentum.

S&P's "hugely overbought" towards 6375!1). Position Volume dropping! 2). Big institutions (Banks & Insurance) have backed off on higher Risk positions! 3). Huge resistance at .728 fib & trend! 4). Trump tariff talk is likely adding to a fall as well! 5). We're looking for a "SELL" trade @ 6375, since buying is too risky at the moment...Good Luck!

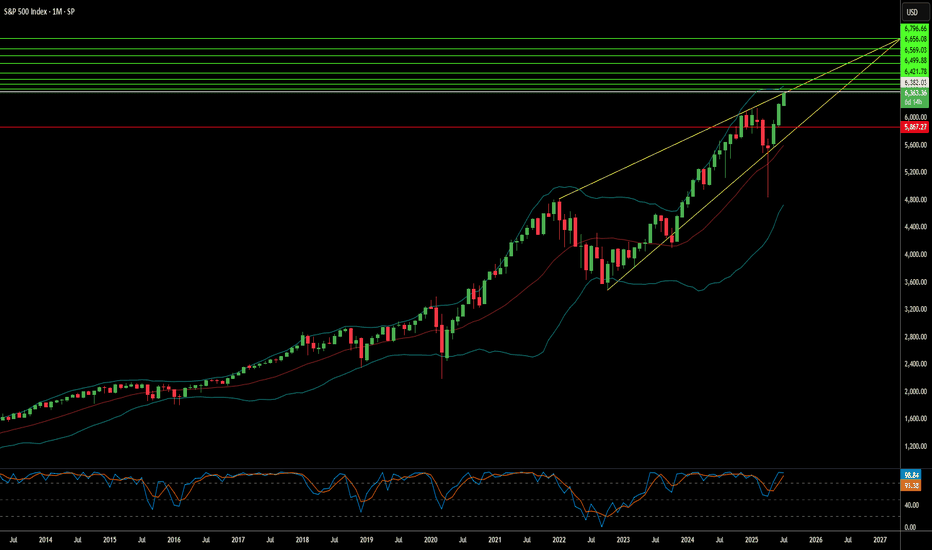

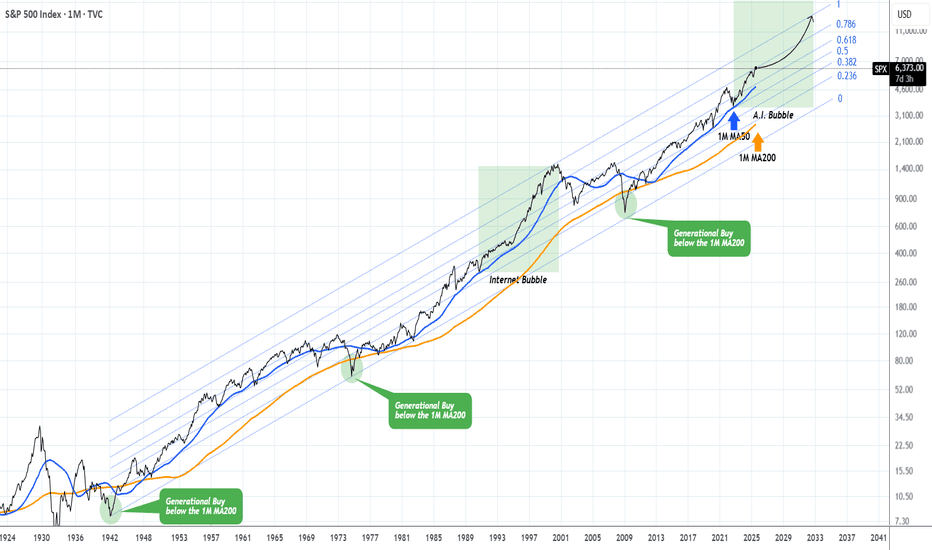

S&P500 This is why every CORRECTION is a GIFT.The S&P500 index (SPX) has been steadily rising since the April bottom to new All Time Highs (ATH). On the grand 100 year scale, the February - March tariff fueled correction, has been nothing significant. The last true technical correction has been the 2022 Inflation Crisis because it touched, and instantly rebounded on, the 1M MA50 (blue trend-line).

This is not the first time we bring forward our multi-decade perspective on stock and in particular this chart. But it serves well, keeping us into the meaningful long-term outlook of the market. This suggests that since the Great Depression and the first signs of recovery after the 1935 - 1941 Bear Cycle, the market has entered a multi-decade Channel Up, which is divided into long-term aggressive expansion periods (Bull Cycles) and shorter term depressions (Bear Cycles).

During a Bull Cycle, every test of the 1M MA50 is a instant cyclical buy opportunity and in fact that isn't presented very often. During a Bear Cycle, the market makes an initial aggressive correction below the 1M MA50, turns increasingly volatile for 5-7 years, trading sideways within the Channel Up with its second peak resulting into a 2nd correction that eventually breaks below the 1M MA200 (orange trend-line).

That is what we call a 'generational buy opportunity' as in the past 80 years, it has only been taken place 2 times.

Right now (again this is not something we mention for the first time), the market is at the start of the A.I. Bubble, with incredibly strong similarities with the Internet Bubble of the 1990s.

In fact, relative to the Internet Bubble, it appears that we are on a stage similar to 1993 - 1994, before the market turned parabolic to the eventual Dotcom Bust of 2000.

As a result, from a technical perspective, every 'small' correction such as the one we had this year, is a blessing in disguise (buy opportunity). As the index grew by 5 times during the Internet Bubble (300 to 1500), it is also very possible to see it approach this feat going from roughly 3500 (late 2022) to 14000 (by late 2032) and touch the top of the multi-decade Channel Up.

Are you willing to miss out on this generational wealth creation opportunity?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

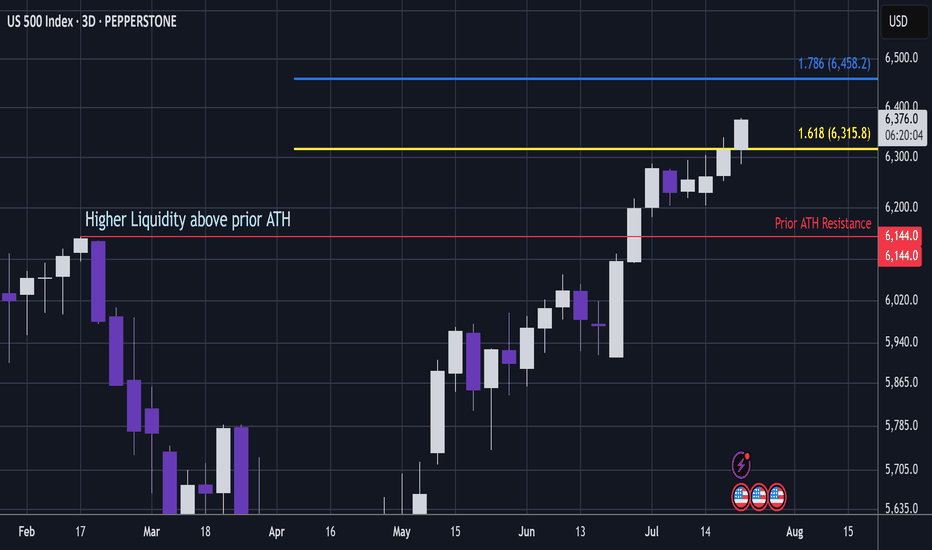

US500 - Can S&P Pass Critical Ratio / Liquidity ZoneS&P (Pepperstone CFD)

Price has popped above the 1.618 extension, which is a key ratio zone.

A bearish whipsaw in this area could be dangerous.

However, if price continues to push through this level, it signals that S&P is entering a very bullish phase.

The area above prior ATH resistance holds high liquidity.

If price moves beyond this ratio band, it will signal that a reversal in this zone is unlikely.

That said, if it’s still in this band when Trump tariffs are reinstated potentially on 1 August, then this is looking dangerous 🧐.

(Fib trendlines lower in the chart).

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

US500 Bulls Assemble | Breakout Heist Strategy📈🚨 MASTER HEIST PLAN: “SPX500 ROBBERY – THIEF TRADING STYLE 🔥💸” 🚨📈

(The Ultimate Long Strategy Blueprint for Smart Day/Swing Traders)

🌍 Greetings to All Market Bandits, Bullish Burglars, and Chart Snipers!

Hola! Bonjour! Ola! Hallo! Marhaba! 🙌

🦹♂️This is your friendly chart thief checking in with the latest SPX500/US500 masterplan!

This isn’t just a trade—it’s a heist 🎯. We’re not here to participate, we’re here to dominate! Welcome to the Thief Trading Style, where we map, trap, and snatch those pips with ruthless precision. 🧠🔍💰

🚀 THIEF TRADE SETUP - SPX500/US500

A mix of technical sniper entries + fundamental black ops analysis = 💸 Maximum Extraction. 💸

🎯 ENTRY PLAN: THE BREAKOUT HEIST

📍Buy Entry Zone: Wait for the clean breakout + candle close above 6270.00.

"The vault opens once we clear that wall. Let the bullish getaway begin!" 💥🚪📈

🛠️Thief Tips for Entry:

Use Buy Stop Orders above resistance levels.

OR layer in Buy Limit Orders near recent pullbacks (15/30m swing zones) using DCA Style (Dollar Cost Average layering like a pro).

Want stealth mode? Set that alert (alarm), and strike when the breakout sings. 🔔🎯

🛑 STOP LOSS – PROTECT THE LOOT

🧨Set your SL smart—beneath the nearest swing low using the 2H timeframe for stronger structure.

💬 “Look, don’t gamble. A thief knows when to run. Set that stop where I showed ya, or risk losin’ the bag.” 💼💣

❗Your SL should reflect your risk per trade, lot size, and number of entries. It’s your getaway plan—don’t mess it up.

💥 TARGETS – WHERE WE CASH OUT

🏴☠️Primary Take Profit (TP1): 6310.00

🏴☠️Secondary Take Profit (TP2): 6370.00

💹 Scalp Traders: Stick to the Long Side Only. Ride the momentum, but use trailing SL to lock it in.

🔍 THIEF FUNDAMENTAL INTEL: WHY THIS IS OUR MOMENT

Current SPX500 bullishness driven by:

✅ Positive macro & geopolitical tailwinds

✅ Institutional positioning (COT reports)

✅ Intermarket analysis showing strong correlations

✅ Momentum building with sentiment and volume

📌 Stay sharp—check all your fundamental reports, news catalysts, and sentiment tools before executing your move. Smart thieves plan every detail. 🎓📊

⚠️ NEWS RELEASE REMINDER

📢 News = Chaos. Don’t get caught in the spray:

🔒Avoid entering trades just before big announcements.

🚀 Use Trailing SL to secure profit if you're already in.

Stay agile. Stay smart. Stay rich. 💼🚁

❤️ SUPPORT THE HEIST – HIT THAT BOOST BUTTON!

👊 Liked the plan? Hit the Boost to join the elite robbery crew.

Every boost fuels the mission. Every like sharpens the strategy. Let's build a team of smart, profitable traders. 🚀💸🔥

🧠 Remember: This is general analysis – not financial advice. Manage your risk like a true thief. Stay updated. Adapt fast. Don't get caught. 🕵️♂️

🎉See you in the next Heist Plan! Keep your tools sharp, your charts cleaner, and your profit bags fatter. 🤑🔥

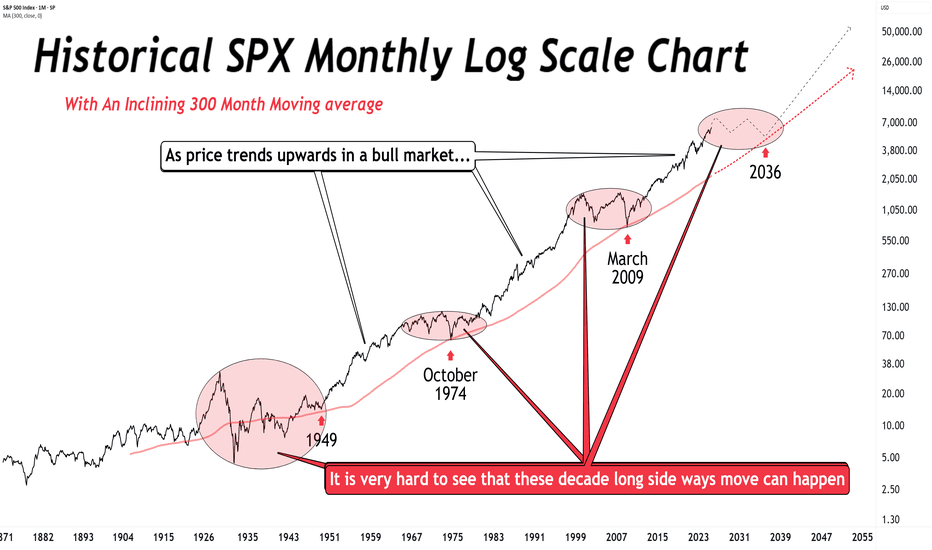

Before the perma-bulls go bonkers… Before the perma-bulls go bonkers… no, I’m not calling for a crash or bear market (yet).

But longer this bull runs, greater the odds of mean reversion.

Further we drift from 2009 without tagging the 300-month MA, more likely a sideways decade begins.

This will happen again.

You can't say we are "early" in the bull market. That simply is not true. Early is in the few years after the 2009 retouch of that very long term moving average. Can the indices still go up? Of course. But understand where you are in the cycle.

Quarterly Candle AnalysisQuarterly candle data going back to 1928 was exported and analyzed in Excel .

The purpose of doing so was to identify candles comparable to the candle we had in Q2 of 2025 (last quarter) in terms of scale and form.

Two properties of the candles were considered:

1. Candle Length as a % of Close (Column L)

2. Lower Wick as a % of Close minus Upper Wick as a % of Close (Column R)

The product of these properties (Column S) was considered as the primary quantitative metric for this analysis.

The two quarters determined to be most similar based on having green candles with forms similar to Q2 2025 were as follows:

Q4 1998

Q1 2016

Both quarters were followed by at least 4 more bullish quarters, hence, the result of this analysis is bullish, as should be expected with such a bullish candle.

S&P500 push to new ATH? Key Developments:

AI Drives Earnings Momentum

Alphabet reported strong results, but flagged surging AI infrastructure costs, signaling increased capex ahead.

SK Hynix posted record earnings and committed to expanding AI-related investments, reinforcing the sector’s critical growth role.

Investor sentiment remains AI-positive, with capital rotation favoring tech and semiconductors despite margin compression risks.

Banking Sector Boosted by Tariff-Driven Volatility

Deutsche Bank’s FIC (Fixed Income & Currencies) trading revenue jumped 11% to €2.28B, its best Q2 since 2007, aided by global trade uncertainty.

BNP Paribas also beat earnings estimates, continuing the strong showing from European banks amid market volatility.

Trade & Tariff Watch

The EU and US are nearing a deal on a 15% standard tariff rate, potentially stabilizing trade flows and market pricing.

Trump’s broader reciprocal tariff push remains in focus, especially after the US-Japan deal. Investors are watching for signs of escalation or resolution with other partners like the EU and Canada.

Fed in the Political Spotlight

Trump visited the Fed’s construction site, criticizing costs and maintaining pressure on Chair Jerome Powell.

Speculation about Fed leadership changes and political interference is unsettling, though markets have largely shrugged this off for now.

Meanwhile, House Republicans are drafting a follow-up tax-and-spending plan, which could shape future fiscal policy and market expectations.

Conclusion: S&P 500 Trading Outlook

The S&P 500 remains buoyed by strong earnings, particularly from AI-linked sectors and financials, while geopolitical risks and tariff volatility are being absorbed as catalysts for trading profits rather than panic.

Bullish factors: Strong corporate earnings (Alphabet, SK Hynix, Deutsche Bank), potential trade de-escalation (EU-US tariff deal), and AI momentum.

Risks to monitor: Rising AI capex (impact on margins), political tension around the Fed, and tariff uncertainty.

Key Support and Resistance Levels

Resistance Level 1: 6387

Resistance Level 2: 6457

Resistance Level 3: 6502

Support Level 1: 6272

Support Level 2: 6224

Support Level 3: 6156

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.