S&P INTRADAY oversold bounce backUS stock futures dropped and the dollar weakened as concerns grew that the trade war could cause lasting economic damage. This came despite a surge in European and Asian equities, which followed a major rally on Wall Street after President Trump unexpectedly paused most of his tariffs. The move lifted global risk sentiment temporarily, but also isolated China as the primary target of Trump’s trade offensive, limiting Beijing’s options for near-term de-escalation. In response, Chinese leaders are meeting today to consider additional economic stimulus.

Meanwhile, U.S. Treasuries gained as investors sought safety following a volatile session. The Federal Reserve, for its part, signalled it plans to keep interest rates steady, aiming to prevent tariff-driven inflation even if the labour market weakens. Officials have publicly downplayed the need for rate cuts, choosing to prioritize stability over pre-emptive easing.

Key Support and Resistance Levels

Resistance Level 1: 5509

Resistance Level 2: 5660

Resistance Level 3: 5787

Support Level 1: 4815

Support Level 2: 4700

Support Level 3: 4585

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USA500 trade ideas

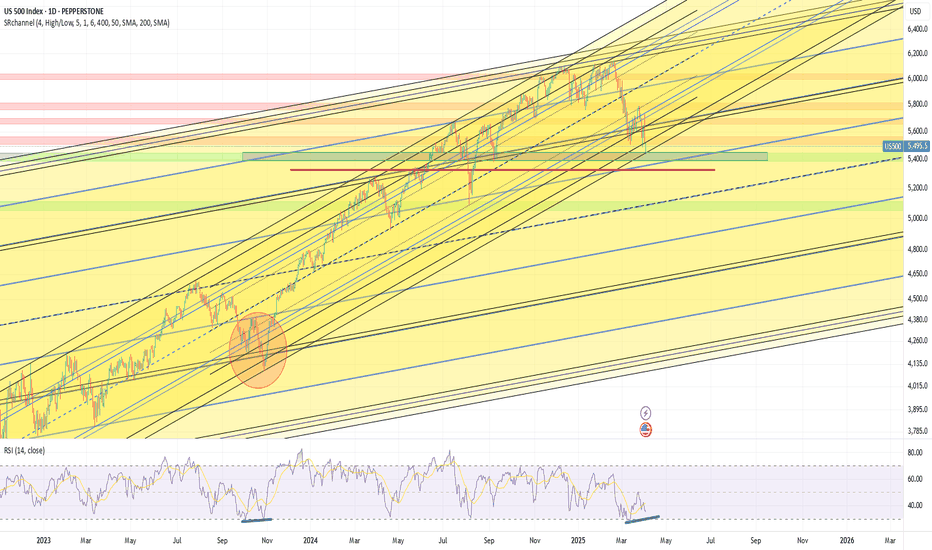

US500 Historical Rallies & Pullbacks with a Potential ProjectionI’ve observed the US500’s performance over the years, marking rallies with a blue line and pullbacks with a yellow line. Looking at the chart, a systematic repetition of these movements emerges, which, at first glance, seems to follow a recognizable pattern.

Specifically, I’ve cloned the blue line from the rally that started on 03/23/2020 and ended on 12/20/2021, now represented by a green line, to hypothesize a potential future rally. This clone is based on the duration of previous pullbacks:

The first pullback, before the 2020 rally, began on 02/20/2020 and ended on 03/23/2020.

The second pullback, the current one, started on 02/17/2025 and might conclude around 04/07/2025, potentially paving the way for a new rally.

the angle of those pullbacks is almost identic

This "snapshot" observation suggests we could be nearing a turning point. Of course, this is just a hypothesis based on historical patterns, and I encourage cross-referencing it with other indicators or analyses. What are your thoughts?

Bear Pattern Often Would Spike One More Time The swings of the week so far have created a giant pending butterfly- which may be the most important setup we've seen in SPX for a long long time - certainly the most important during this drop.

A butterfly here in its book context is a bearish pattern, but if you follow my work you'll know I always say harmonics are binary decision levels. If they work, the accurately forecast the reversal zone and then often the implied swing to follow- when they fail, they tend to indicate strong moves in the other direction.

Off a setup like this, a failure of the butterfly would be failure of the downtrend.

A successful butterfly would be a failure of the bigger overall uptrend.

It's a high stakes moment.

But bears should be aware we could be 98% right here and still face a brutal stop run.

Protecting profits from higher entries now. Ideally want to size up into a spike.

S&P500 Tariff comeback may be starting a whole new Bull Cycle!The S&P500 index (SPX) is making a remarkable comeback following the non-stop sell-off since mid-February as, following the tariff 90-day pause, it is staging a massive rebound just before touching the 1W MA200 (orange trend-line).

Since that was almost at the bottom of its bullish channel while the 2W RSI hit its own Higher Lows trend-line, this can technically initiate a 2-year Bull Cycle similar to those that started on the October 2022 and March 2020 bottoms (green circles).

The fact that the current correction has been almost as quick as the March 2020 COVID crash, may indicate that the recovery could be just as strong. In any event, it appears that a 7200 Target on a 2-year horizon is quite plausible, being close to he top of the bullish channel, while also under the 2.0 Fibonacci extension, which got hit during both previous Bullish Legs.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

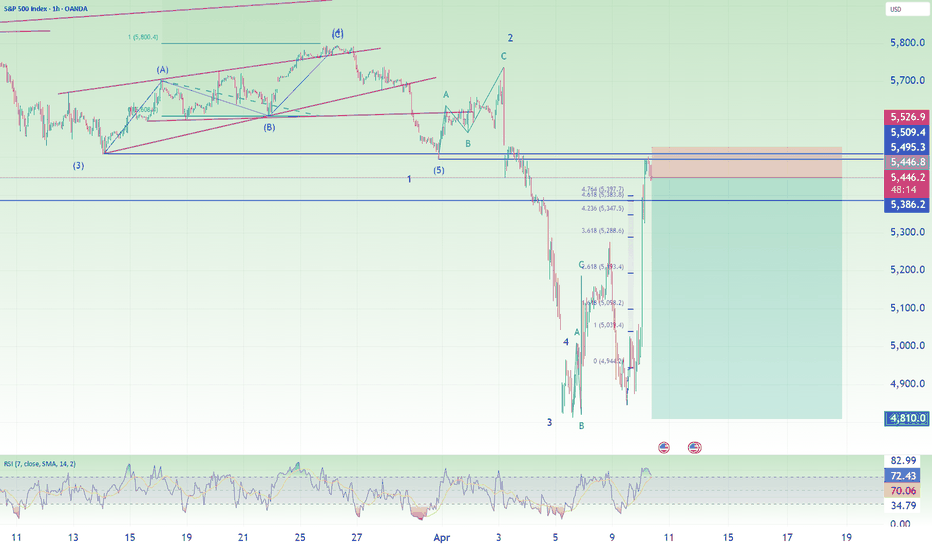

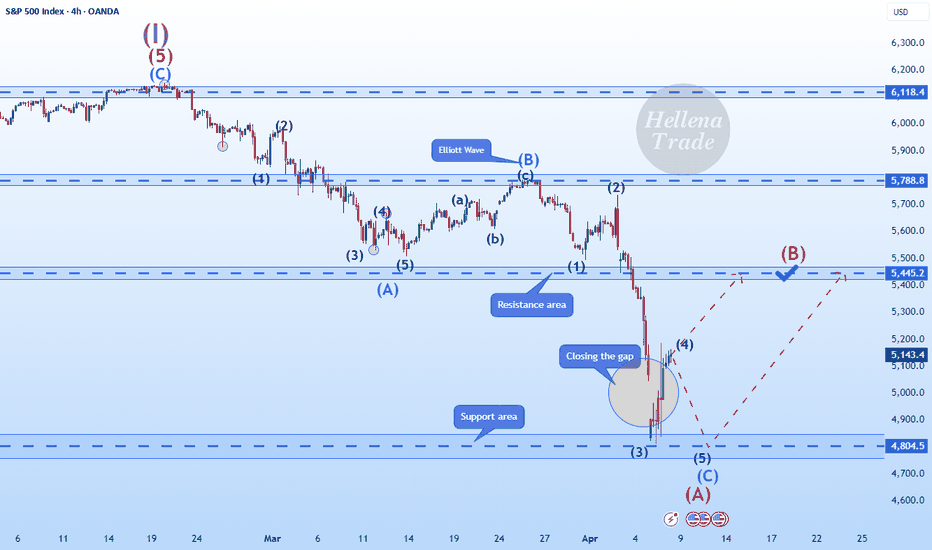

Correction has begun in SPXWe can almost say that 4800 has been touched and given that the downward movement was very fast, this wave is most likely the A-wave of a triangle and the upward waves that are forming after the 90-day suspension of the stalls are considered as a corrective wave.

Previous SPX Analysis

Trump Pump Just Broke the Charts12% Up in a Day. Now What?

What a difference a headline makes.

Monday:

Markets dump. Panic. Retail sells the low.

We hit our bearish targets like clockwork.

Wednesday:

Markets explode like they found a cheat code.

SPX rallies 9.5% in a day.

Nasdaq? A completely unhinged 12% up.

All because… tariffs might be paused again.

You can’t make this stuff up.

But you can trade it.

When Euphoria and Edge Collide

The Trump Pump Parade

After last week’s fake-news-induced dump, we now have headline euphoria.

No earnings beat. No rate cut. No macro shift.

Just one rumour:

“Trump might pause tariffs.”

Cue the biggest one-day rally since 1933.

Nasdaq: +12%

SPX: +9.5%

SPX now kissing the 5400 bull trigger level

Financial media?

Throwing a rave.

Retail?

FOMOing back into the top.

It’s madness.

But it’s not structure.

The System Trader’s Reality

Meanwhile, in the AntiVestor camp…

The bear swing is still on but under review.

Why? Because we trade levels, not vibes.

And 5400 has always been our pivot.

We’re now sitting right on it, with overnight futures starting to drift lower – like the market just realised it left the oven on.

The decision zone is here.

Hold 5400?

It’s time to shift gears.

Bull thesis activates. Tag ‘n Turn setups. Bull Pulse Bars. GEX Bulls Eye trades.

Lose 5400?

We go right back to feeding the bears.

It’s not emotional. It’s mechanical.

This is what system trading looks like.

---

Expert Insights: The Market Owes You Nothing

Mistake:

Getting emotional after missing a rally or overstaying a short.

Fix:

Use a system with defined levels.

5400 was always the line.

You don’t need to guess the pivot. You just need to trade it when it confirms.

This rally may be overblown.

But until the market proves otherwise, you don’t fight the tape – you ride it with structure.

---

Fun Fact

The last time the Nasdaq moved more than 10% in a day?

March 13th, 2020 – the height of COVID panic buying.

That rally was followed by… a further drop.

Then a V-bottom.

Then a massive bull market.

So… is this the start of something new?

Or just another overcaffeinated bounce?

History says: Don’t decide early. Let price confirm.

Nasdaq and S&p500 short: Completion of B waveI mentioned in my previous analysis that we are waiting for a short (the previous one was a long-then-short linked with this idea). I did not post any short idea yesterday after that NOT because I am good and recognize a double combination. It's really because I was too busy with work and I am glad my last was a long-then-short.

Back to this, remember that the huge volatility has caused the points in the chart to compress and thus even though the stop loss looks small, it is actually still quite a number of points away. So my suggestion is to manage your size and keep it small relative to your account.

Good luck!

Fear and Greed: How Extreme Emotions Can Wreck Your TradesThere’s an old saying on Wall Street: Markets are driven by just two emotions — fear and greed. It’s been quoted so many times it’s practically cliché, but like most clichés, it’s got a thick slice of truth baked in.

Fear makes you sell the bottom. Greed makes you buy the top. Together, they’re the dysfunctional couple that wrecks your portfolio, sets your confidence on fire, and leaves you staring at your trading screen, wallowing in disappointment.

But here’s the good news: you’re not alone. Everyone — from the newbie scalper with a $500 account to the fund manager with a Bloomberg terminal and a caffeine drip — fights these exact same emotional demons.

Let’s break down how fear and greed mess with your trades, and more importantly, what to do about it.

The Greed Trap: From Champagne Dreams to Margin Calls

Add some more to this one… this one’s going to the moon . Suddenly, you’re maxing out leverage on a hot altcoin because your cousin’s barber said it's “the next Solana.”

This is how traders end up buying tops. Not because they lack information — we’ve got more charts, market data , and indicators than ever before — but because they chase the feeling. The high. The fantasy of catching a once-in-a-lifetime move. Safe to say that’s not investing, that’s fantasy trading.

Greed doesn’t show up in your P&L right away. At first, it may reward you. You get a few wins. Maybe you double your account in a week. You start browsing the million-dollar houses. You post a couple of wins on X. You’re unstoppable… until you’re not.

Then comes the inevitable slap. The market reverses. You didn’t take profits because “it’s just a pullback.” Your unrealized gains evaporate. You panic. You sell the bottom. And just like that, you’re back where you started — only now with a bruised ego and fewer chips on the table.

The Fear Spiral: Paralysis, Panic, and the Art of Missing Every Rally

Fear doesn’t need a market crash to show up. Sometimes all it takes is a bad night’s sleep and a red candle.

Fear tells you to cut winners early — just in case. Fear reminds you of every losing trade you’ve ever taken, every blown stop loss, every time you told yourself, “I knew I should’ve stayed out.”

It’s what makes you exit a long position at break-even, only to watch it rip 20% after you’re out. It’s what keeps you on the sidelines during the best days of the year. It’s what turns potential gains into chronic hesitation.

And the worst part? Fear disguises itself as “discipline.” You think you’re being cautious, but you’re really just self-sabotaging under the banner of risk management. Yes, there's a difference between being prudent and being petrified. One saves your capital. The other strangles it.

The Greed-Fear Cycle: The Emotional Roundabout That Never Ends

Here’s how the emotional hamster wheel usually goes:

You start with greed. You chase something because it looks like easy money.

You get smacked by the market. Now you’re afraid.

You hesitate. You miss the recovery.

You get FOMO. You jump back in… late.

The cycle repeats. Only now your account is lighter, and your confidence is shot.

Wash. Rinse. Regret. Repeat.

This cycle is what turns many promising traders into burnt-out bagholders. It’s not a lack of intelligence or strategy — it’s the inability to manage emotions in a game where emotions are everything.

The Emotional Gym

You can’t eliminate fear and greed — they’re wired into our monkey brain. But you can train your emotional responses the same way you train a muscle.

How? Structure, repetition, and brutal honesty.

Start with a trading journal . Not a Dear Diary, but a cold, clinical log of what you did and why. Include your emotional state. Were you excited? Anxious? Overconfident? Bored? (Yes, boredom is a silent killer. It’s how people end up revenge trading gold futures at 2AM.)

Review it weekly. Look for patterns. Did you always overtrade after three green trades in a row? Did your losses happen when you broke your own rules? Bingo. Now you have something to fix.

The Rules Are the Ritual

Every seasoned trader eventually realizes this: rules are freedom. The more emotion you remove from the decision-making process, the more consistent your results.

Set rules for:

Entry criteria

Risk per trade

Stop placement

When to sit out

Then — and this is key — follow them even when you don’t feel like it. Especially when you don’t feel like it. If it feels uncomfortable, that’s usually a sign you’re on the right path. You’re breaking your old habits.

And if you break a rule? Cool. Own it. Log it. Learn from it. No need to self-flagellate, but don’t pretend it didn’t happen. This is the emotional weightlifting that builds your trading spine.

Story Time: The Trader Who Cried “Breakout”

Let me tell you about Dave. Dave loved breakouts. He’d buy every single one, no matter the volume, structure, or trend. His logic? If it breaks the line, it’s going up. Simple.

One week, Dave hit it big on a meme stock that doubled in a day. His greed kicked in hard. He started adding leverage, sizing up, swinging for the fences.

You can guess what happened. Three fakeouts later, Dave blew half his account. So he stopped trading. Fear took over.

Weeks passed. He watched from the sidelines as clean setups came and went. When he finally got back in, he was so timid he under-sized every position and exited too early. He made nothing — but the emotional damage cost him more than the red trades ever did.

Dave didn’t lose because he lacked a strategy. He lost because he was letting emotions drive. And when fear and greed are in the driver’s seat, they don’t use the brakes.

Be the Trader Your Future Self Will Thank (Not Tank)

Markets may sometimes be chaos wrapped in noise wrapped in hype (as we’ve seen with the recent drama around Trump’s tariffs ). There will always be something to fear, and always something to chase. But if you can stay calm while others are panic-buying Nike stock NYSE:NKE or rage-selling the S&P 500 SP:SPX , you’ve already got an edge.

The best traders aren’t fearless or greedless. They’re just better at recognizing when those emotions show up — and they don’t let them steer the ship. They’ve built processes to trade through uncertainty, not react to it.

So next time you feel that itch to click “Buy” at the top or “Sell” at the bottom, pause. Ask yourself: Is this my setup — or is this just emotion pretending to be insight? Take another look at the Screener , scroll through the latest News , and take a minute to think it over.

Final Thoughts: Feelings Aren’t Signals

Trading is emotional — but trading on emotion is a fast track to regret.

Fear will always be there. So will greed. But you don’t have to let them wreck your trades. Build systems. Log your trades. Know yourself. That’s how you survive the jungle with your capital — and sanity — intact.

And if nothing else, remember this: Warren Buffett didn’t get rich by panic-buying breakouts on a Tuesday morning.

Let's hear it from you now — how do you deal with fear and greed in your trades? Or are you still fighting them in the wild?

Trump Delays Tariffs for 90 Days. The S&P 500 Rebounds SharplyTrump Delays Tariffs for 90 Days. The S&P 500 Rebounds Sharply

As shown in the chart of the S&P 500 (US SPX 500 mini on FXOpen), the index is currently trading near the 5,500 level.

This result is highly encouraging, considering that as recently as yesterday morning, the index was hovering around 4,900.

Why Have Stocks Risen?

The strong rebound seen yesterday evening was triggered by a statement from the US President — he announced a 90-day delay in the implementation of wide-ranging global trade tariffs, which had originally been unveiled on 2 April and led to a sharp drop in the index (as indicated by the arrow).

However, this does not apply to China, for which tariffs were not delayed but increased. "Due to the lack of respect China has shown towards global markets, I am raising the tariff imposed on China by the United States of America to 125%, effective immediately," said Donald Trump, according to media reports.

Overall, US stock markets responded positively to the news, and Goldman Sachs economists have withdrawn their US recession forecasts.

Technical Analysis of the S&P 500 Chart (US SPX 500 mini on FXOpen)

Despite yesterday’s sharp rebound, the stock market remains in a downtrend (as indicated by the red channel).

From a bullish perspective:

→ A Double Bottom pattern (A–B) has formed around the 4,900 level;

→ Price has moved into the upper half of the channel.

From a bearish perspective:

→ Bulls must overcome key resistance near the psychological 5,000 level;

→ While tariffs have been delayed, they have not been cancelled. As such, the risk of an escalating trade war is likely to continue putting pressure on the S&P 500 index (US SPX 500 mini on FXOpen) in the coming months.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

SPX Aiming Lower LowsHi there,

The S&P 500 has pushed below the significant resistance level of 5821.54, with an immediate target at 5370.17 before reaching major support around the 5218 region. We could potentially see a further drop to 4500, with 4719.87 on the way.

It will require monitoring, and the bias is at 4026.79.

Happy Trading,

K.

Not trading advice

Hellena | SPX500 (4H): LONG to resistance area of 5445.2.Explaining what is happening in terms of wave theory is quite difficult, but always possible. Of course, geopolitics has been affecting the price a lot lately, but even in this chaos there are regularities.

Let's take a look at the wave markup. I believe that there is a big correction going on at the moment. Most likely it is not finished yet and has just started to form wave “B”, which means that wave “C” is coming, but I still want to see an upward movement to the resistance area at 5445.2. The price has been in a downtrend for too long and I think a correction is very likely. Well, let's see.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Potential Short Move to 5000This idea is in accordance with the Price slipping out of the cloud but closes below it and with strong downwards trends over a few months, price has retraced to the golden ratio zone so it may be a good opportunity to sell right now after confirmation of a downwards trend due to this price being a key level. Hence it could be a potential short position, I'm not in the trade but this is a likely outcome from the technicals and fundamentals

SPX....An interestng observation!10/4/25

spx....an interesting observation..

index has been travelling between the blue median which is a very strong support and the red median which is a very strong resistance.............this travel started s0me time in 2009....and is still ongoing!

only during 2008/2009 lehman collapse and 2020 covid did the index go below the blue median....

will it slip the blue median again or move north again to retest the red median? only time will tell..

but we have the contours to monitor!

Logarithmic channelsThe price has reached a support area at the bottom of the long-term logarithmic channel. If this area will not hold the price I see a possible spike to 5330 level which is 1.618 retracement of March 13 bottom - March 25 top. The price did the same retracement in October 2023. Pay attention that we have 1d positive divergence forming on RSI. We are bottoming, a crash is unlikely right now. The reversal will most likely happen this week.

Black Monday is Coming – Time to Short This Beast!Alright, listen up, traders! The storm is brewing, the signs are clear, and if you haven't noticed yet—wake up! Black Monday is knocking, and the market is looking ripe for a proper dump.

Now, I'm not saying sell your grandma’s jewelry and go all-in, but if you're looking for a juicy short entry, this might just be it. Ideally, you want to get in around that sweet spot in the yellow zone (check the chart) or even from the current levels if you're feeling extra spicy.

Risk? What Risk? (Just Kidding, Manage It!)

Stop-loss? Yeah, slap that bad boy above $6,150 on the 4-hour close. If price secures above that level, it's a no-go—cut it and move on.

Take profits? Scale out as price nosedives. No need to be greedy; let the market pay you in chunks.

The Big Picture

This ain't financial advice—just a battle plan from someone who's seen enough bloodbaths in the markets to smell the fear. High risk? Absolutely. But hey, no risk, no champagne.

Remember, risk management is king. Play it smart, lock in profits, and let the market do the heavy lifting-because when the dust settles, only disciplined traders will be left standing.

SP500 may have already hit the low In the video I have shown an interesting relationship between past crashes on SP500 which shows we might have already hit the low are very close to it before we start next major rally.

Note: Even though the relationship I have shown holds true so far doesn't Guarantee it will in future as well as all patterns no matter how convincing get invalidated at some point.

SPX - Have we bottomed ?History often repeats itself. SPX just bounced off a key level the 2022 high and the long-term channel support which has historically triggered strong reversals (red circles), and we’re seeing the same setup again. MACD is deep in bearish territory but showing signs of flattening. Volume is elevated — likely signaling a washout or institutional accumulation.

If bulls defend this level, a bounce toward the 0.5 and 0.382 Fibs (5,493 – 5,649) is on the cards. Break below 5,114 and it’s lights out again — signalling that this bounce perhaps may just have been a gap and bull trap ? I’m neutral and acting as per technical hints, waiting for signs of confirmation. Although Risk/reward is solid here if momentum shifts.

Would love to hear any thoughts or different opinions. All the best as always !

S&P 500 - Analysis and Rebound levels! 4/7/2025S&P 500 just pulled off a slick rebound at 4835.04 - Let's hope it's legit. A close above the 50-week SMA keeps momentum alive. If not, eyes on the next landing zones at 4754.17 and 4699.43. No panic! Don’t let the noise rattle your game plan! 😎

#SP500 AMEX:SPY SP:SPX

The Stock Market (SPX) Will Also RecoverGreat news my dear friends, reader and followers, truly great news.

The S&P 500 Index (SPX) is now reversing after challenging a strong support level. This level is the 0.618 Fib. retracement for the bullish wave that started after the October 2023 market low. A strong bounce is visible as soon as this level was hit.

The correction is a classic ABC and the C wave is very steep. When a move is really strong, great force, it can't last that long. So the drop happened all at once, fast, and this means a fast end as well as a strong reversal, but the reversal will not be the same.

We are more likely than not to experience a long drawn out recovery, higher highs and higher lows long-term. Higher prices next.

This is the main support level, 0.618 around 4885. If this level breaks, the next strong support sits at 4540. We are going up.

It is not only Bitcoin and the Altcoins, the stock market will also grow.

The correction is over.

Total drop amounts to a little more than 21%.

This is huge and more than enough.

The bears are satisfied. The bears are done. A bearish wave is followed by a bullish wave.

Short bearish action, long bullish action.

Thank you for reading.

Namaste.

Buckle Up for the Next Part of the Huffy CycleAs everyone knows, indices move on a predictable 4 month cycle - known as the "Huffy cycle", and this is programmatically built into markets are Donald Trump switches from being "Huffy" (Down moves) to "Less Huffy" (Parabolic organic growth moves). Donald has been huffy lately ... so we ALL KNOW what comes next ...!

Are you mentally prepared for the next glorious breakout of the Huffy cycle?

I'm sure everyone has noticed the 4 month huffy cycle which can be extensively studied, understood and used to forecast the future flawlessly because if we look at markets over 12 months we can see it looks a little bit kinda like a pattern - so long as you just ignore or remove the parts that are not a pattern. Which is how market cycles work.

If you see something a few times, you can be sure it will happen again forever. And if it doesn't you can be sure at worst it can only go down 70% and then it's probably a buy from there.

So the huffy cycle is basically risk free, if you look at it in the right way.

"But what about all the the things happening" I hear you ask.

Lol.

NGMI!

If you're too stupid to understand the huffy cycle, that's your problem. Not mine! HFSP.

Now, of course we all know SPX is not where near gambley for us to generate our birth right generational wealth from the markets. It could take literally YEARS to make money in SPX. Who has time for that? Of course, we want to be looking at the most stupid and speculative things we can - because those are the ones the savvy investors are buying.

That's right folks .... "Squeeze season" is upon us.

It's been 4 years since we seen anything make any truly irrational hyper parabolic moves in stocks. As we all know, this is too long. Stonks are not allowed to go this long without there being a squeeze cycle. Some doomers out there are even saying squeeze season has been cancelled (lmao ok boomer) - but we know the truth.

Squeeze season has just BEEN DELAYED and it being delayed actually means it will just be BIGGER THAN EVER!

I don't really have any logic or ideas to back up why it was delayed and why this means it will be an even bigger move, but if I say the word "Whales" I think that covers everything.

There are some idiots who are sceptical of the huffy cycle, but I am only writing my post for the future billionaires who are not too bothered about checking the details.

And we all know what comes next!!!

WGMI, fam.