USDAUD trade ideas

Australia faces a dilemma between inflation and labor slowdown

The RBA, in its latest meeting minutes, emphasized that the recent rate hold reflects a cautious and gradual approach toward achieving its inflation target. While the central bank noted the need for further data to confirm a decline in inflation, some Board members flagged rising unemployment as a signal of potential labor market softening. Bloomberg added that Australia’s export-driven economy remains vulnerable to tariff-related uncertainties, while private demand growth remains sluggish.

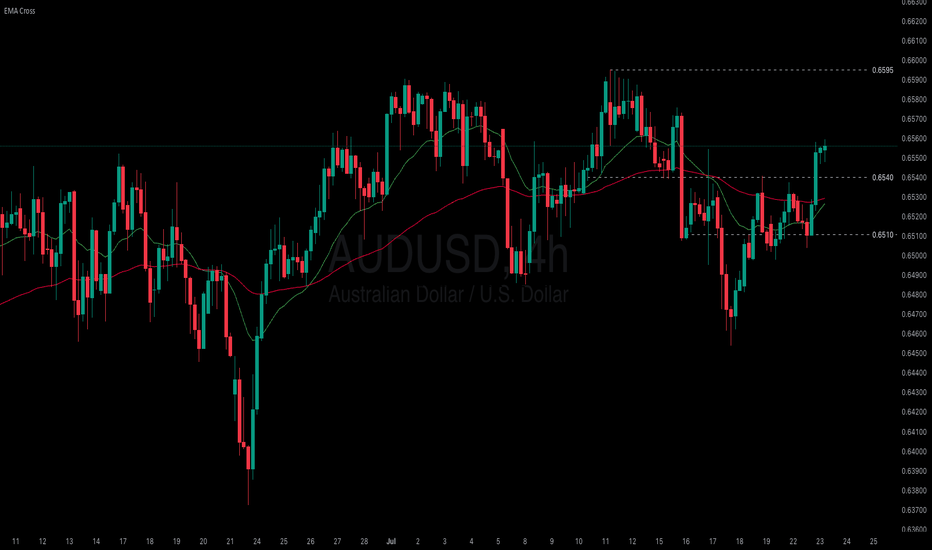

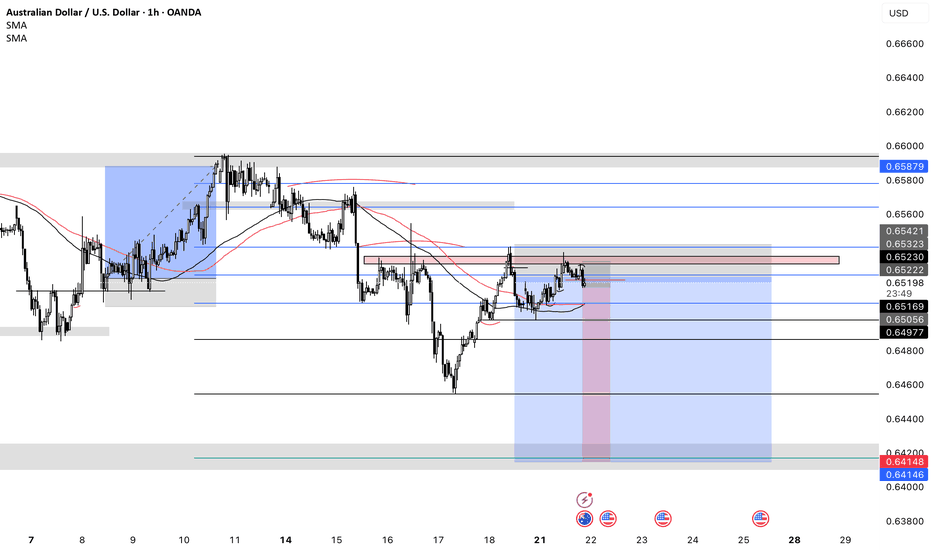

AUDUSD extended its uptrend after testing the low at 0.6455, reaching as high as 0.6560. Both EMAs narrow the gap, indicating a potential shift toward bullish momentum. If AUDUSD holds above both EMAs, the price could gain upward momentum toward the high at 0.6595. Conversely, if AUDUSD breaks below the support at 0.6540, the price may retreat toward 0.6510.

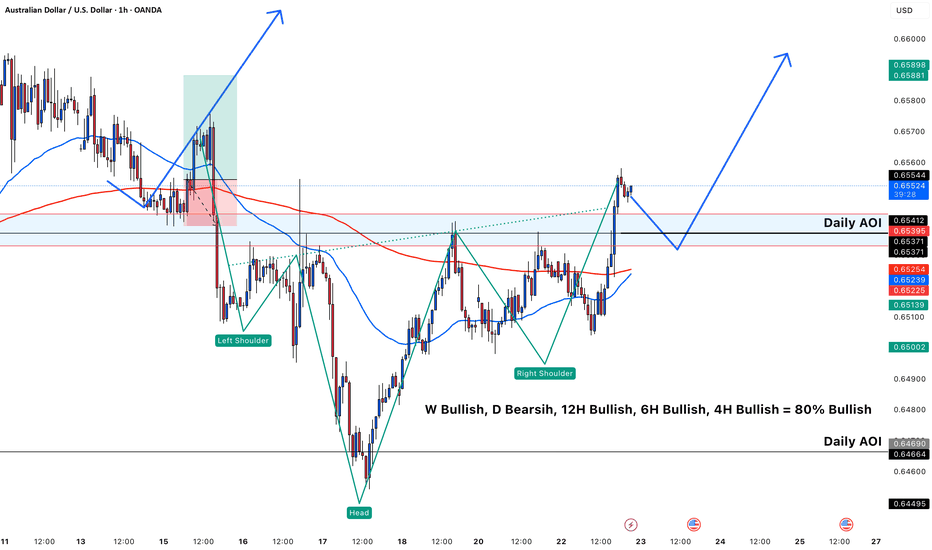

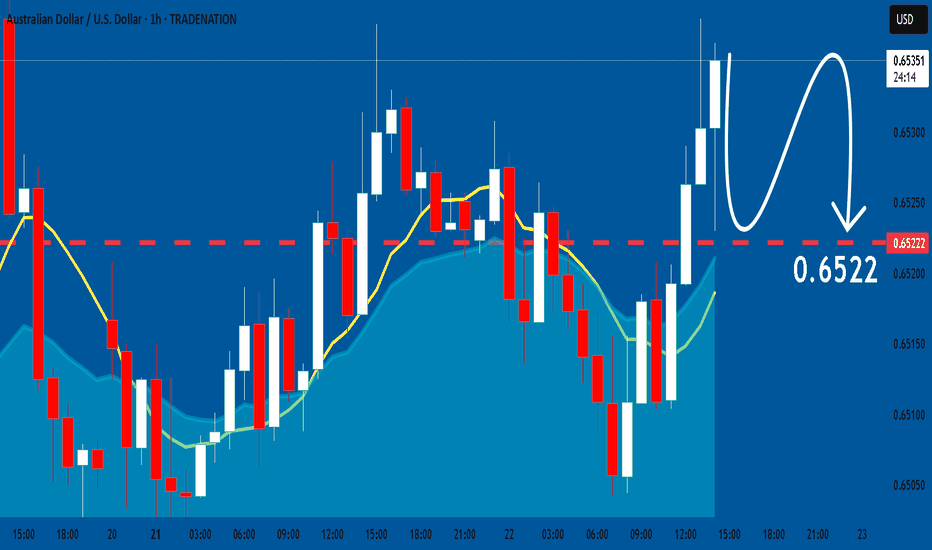

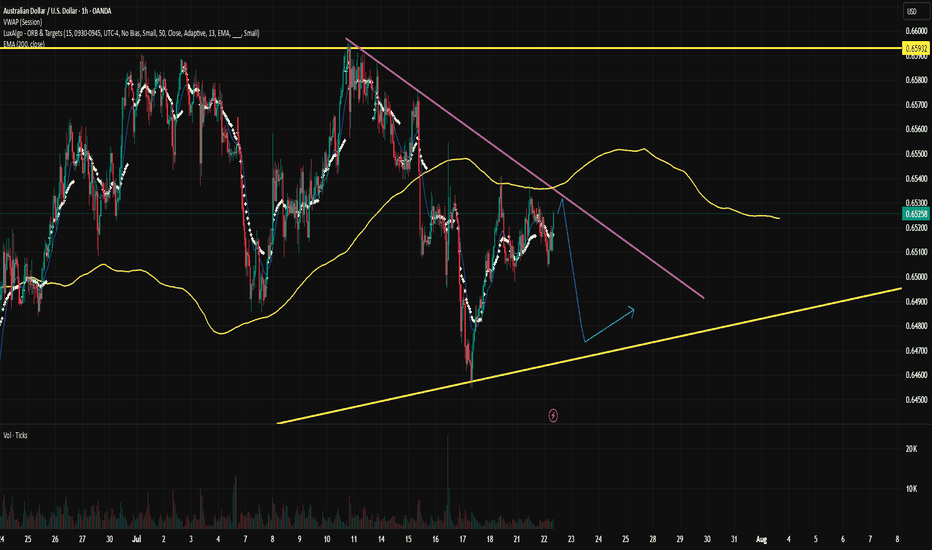

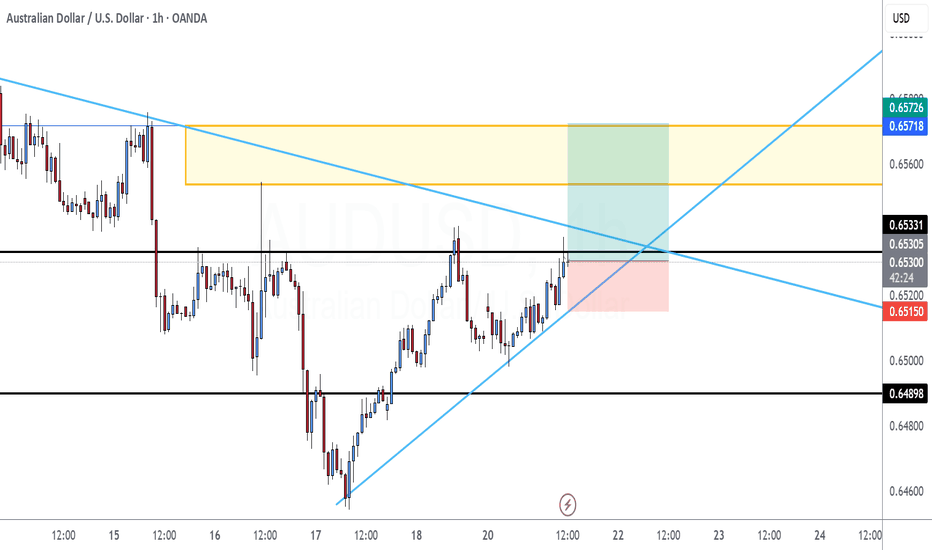

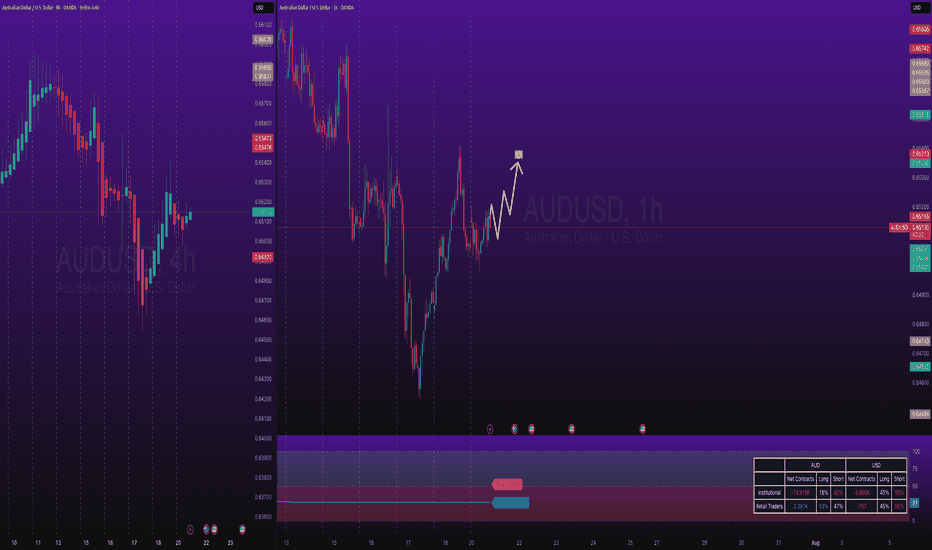

AUDUSD Ready to enter Buy?✅ **Market & Timeframe:**

AUD/USD, 1‑hour chart.

✅ **Overall Bias (multi‑timeframe):**

* Weekly: Bullish

* Daily: Bearish

* 12H: Bullish

* 6H: Bullish

* 4H: Bullish

➡️ **≈ 80% Bullish bias overall.**

✅ **Pattern & Structure:**

You’ve clearly highlighted an **Inverse Head and Shoulders**:

* Left Shoulder near 0.6520

* Head near 0.6500

* Right Shoulder near 0.6525

Price has broken above the neckline (\~0.6540 area).

✅ **Key Levels:**

* **Daily AOI (Area of Interest):** 0.6537–0.6541

(price currently above, expected to retest this zone)

* **Next upside target:** 0.6588–0.6590

* **Major support:** Lower Daily AOI around 0.6466–0.6490

✅ **Moving Averages:**

* Blue MA (shorter) is above red MA (longer) – showing upward momentum.

✅ **Price Action Plan (illustrated by your arrows):**

1. Price has just broken out above the neckline.

2. Expecting a **retest back into Daily AOI (\~0.6540)**.

3. Looking for bullish confirmation there (e.g., bullish candlestick pattern) to enter **long**.

4. Targeting the resistance zone around **0.6588–0.6590**.

---

📌 **Summary:**

Your chart signals an **80% bullish setup**.

✅ Inverse head & shoulders → breakout above neckline.

✅ Wait for price to pull back into Daily AOI (0.6537–0.6541).

✅ Look for bullish confirmation → then enter long.

🎯 Target: \~0.6588–0.6590.

AUDUSD: Bearish Continuation is Highly Probable! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the AUDUSD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

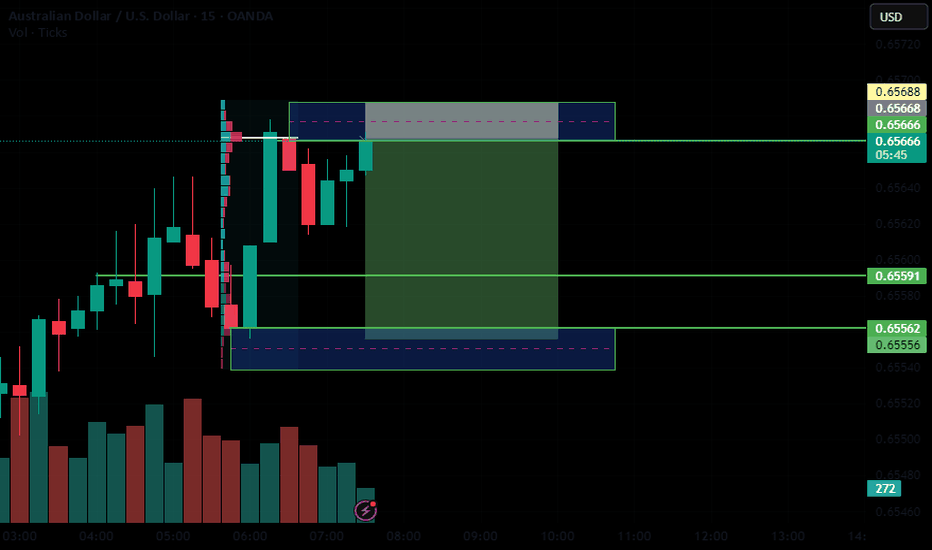

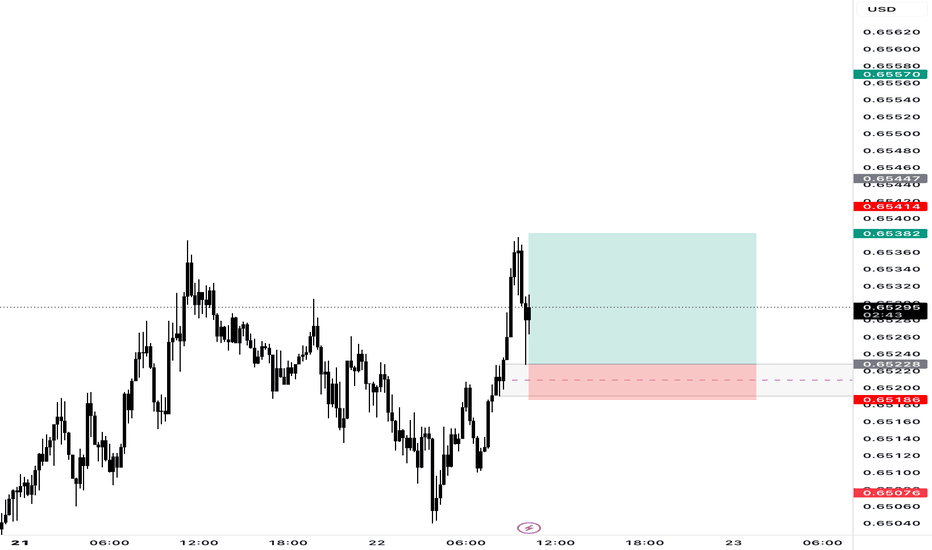

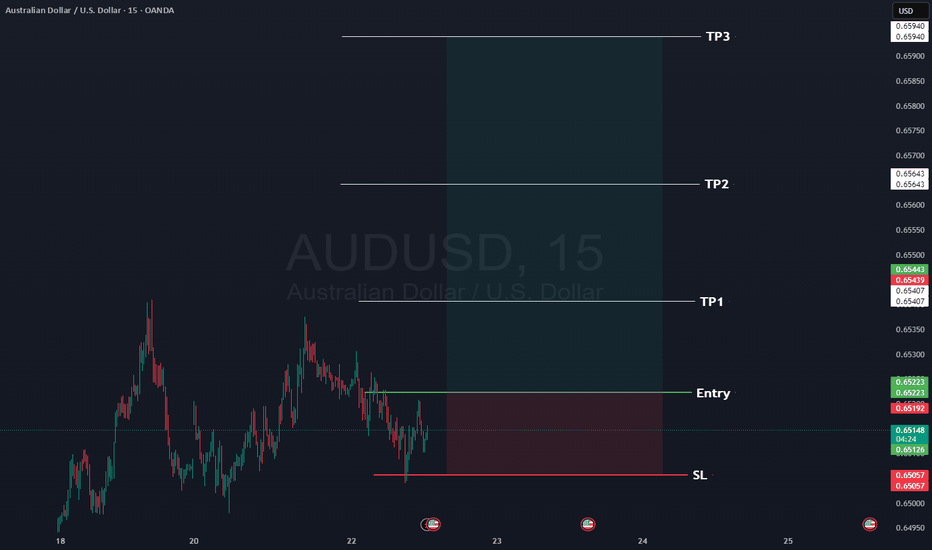

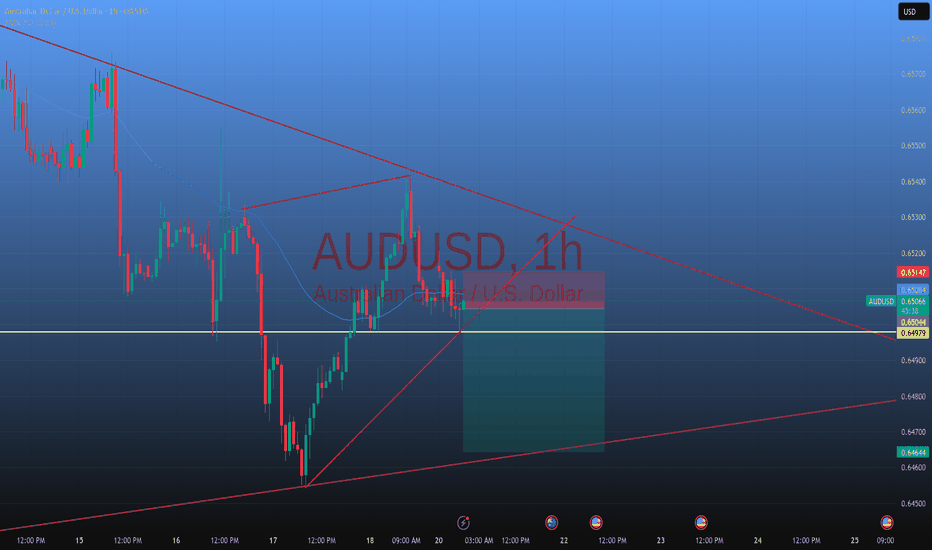

AUD/USD – 15m Demand📊 Trade Breakdown:

Pair: AUD/USD

Timeframe: 15 Minute

Bias: Bullish

Type: Demand Zone Rejection

Entry: 0.65264

Stop Loss: 0.65186

Take Profit: 0.65570

Risk-to-Reward: ~3R

⸻

📌 Key Confluences:

• Clean 15m demand zone formed after a sharp impulse move

• Strong bullish engulfing candle from demand

• Liquidity sweep to the left prior to demand forming

• Structure shift with higher highs and higher lows

• Previous resistance flipped to support at entry zone

• AUD strength showing on intraday sentiment across multiple pairs

⸻

⚙️ Trade Setup:

Entered long after price tapped into the refined 15m demand zone and printed a bullish rejection wick. SL placed just below the zone to avoid noise. TP set near a prior 15m supply area / liquidity sweep zone.

I’m watching for continuation on the next 15m-1h candle closures. If price breaks above 0.6544, expecting follow-through to 0.6557+.

⸻

🧠 Mindset:

Stayed patient waiting for price to come to me. No FOMO. Clear invalidation and clean R:R. Confidence in the setup due to structure, confluences, and reaction off the zone. Trusting the process and letting the trade breathe.

Trade Simple, Live Lavish

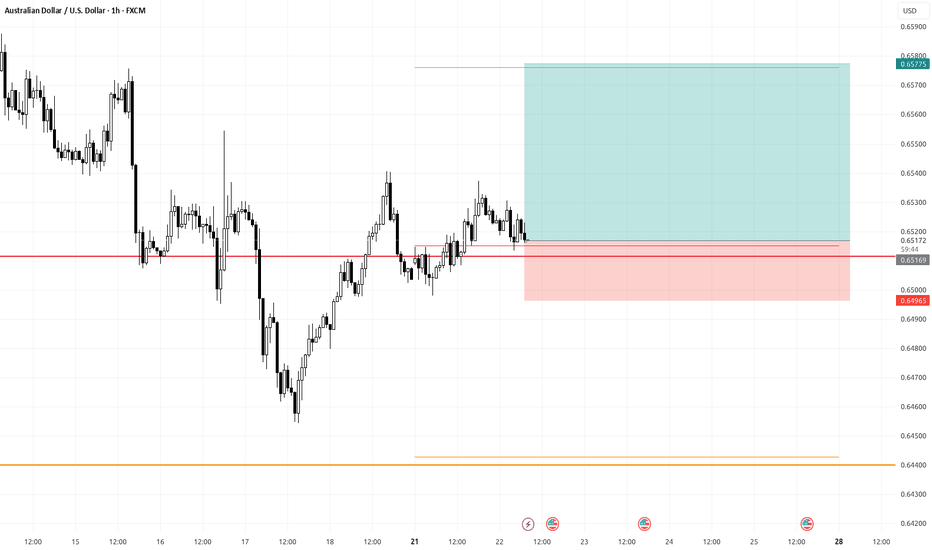

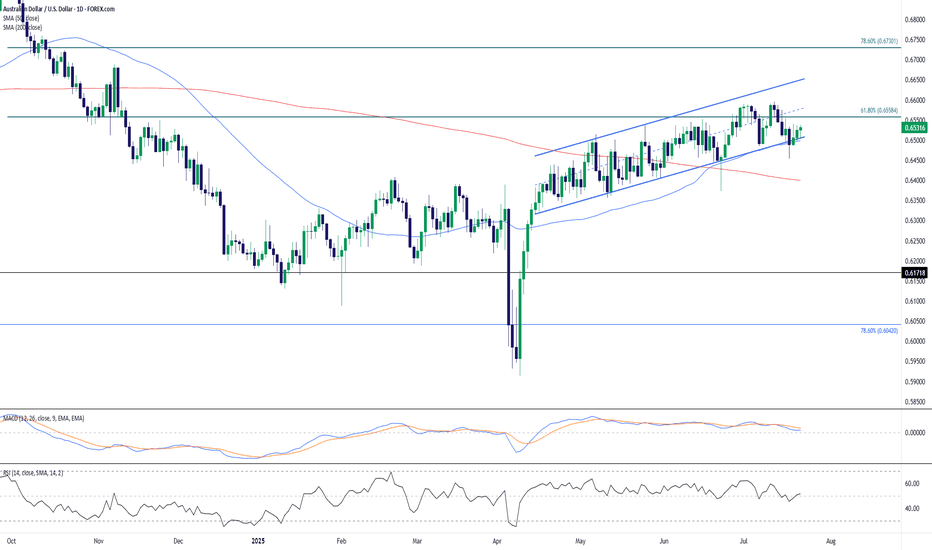

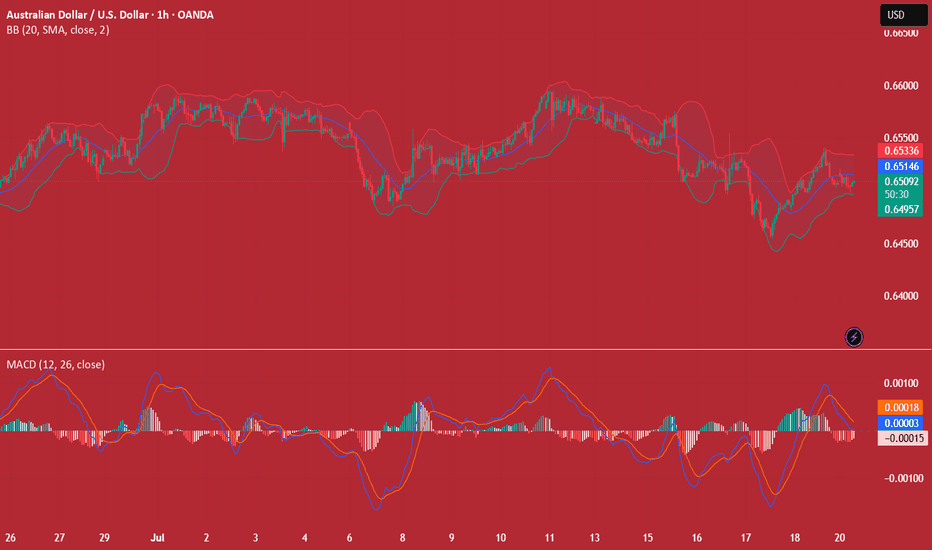

AUD/USD Channel Breakdown Could Threaten Bullish StructureAUD/USD is currently holding just above the 0.6500 psychological level after retreating from the 0.6558 Fibonacci resistance (61.8% retracement of the October–April decline). Price action has recently broken beneath the lower boundary of a rising wedge pattern—a traditionally bearish signal—raising the risk of deeper downside ahead.

The 50-day SMA (0.6498) and 200-day SMA (0.6399) are converging, with the former now acting as dynamic support following today’s bounce. However, momentum indicators offer limited bullish conviction: the RSI hovers near neutral at 51.5, and the MACD is flatlining just above zero, suggesting a pause in directional bias.

If bears push price back under 0.6500, the rising wedge breakdown could accelerate toward the 200-day SMA and potentially the horizontal support zone at 0.6178. On the flip side, a recovery above 0.6558 would invalidate the wedge and open the door for a run toward the 78.6% retracement near 0.6730.

Bias: Cautiously bearish while below 0.6558, especially if daily closes begin to settle under 0.6500. A loss of the 200-day SMA would confirm a trend reversal.

Time frame: Short- to medium-term (days to weeks)

-MW

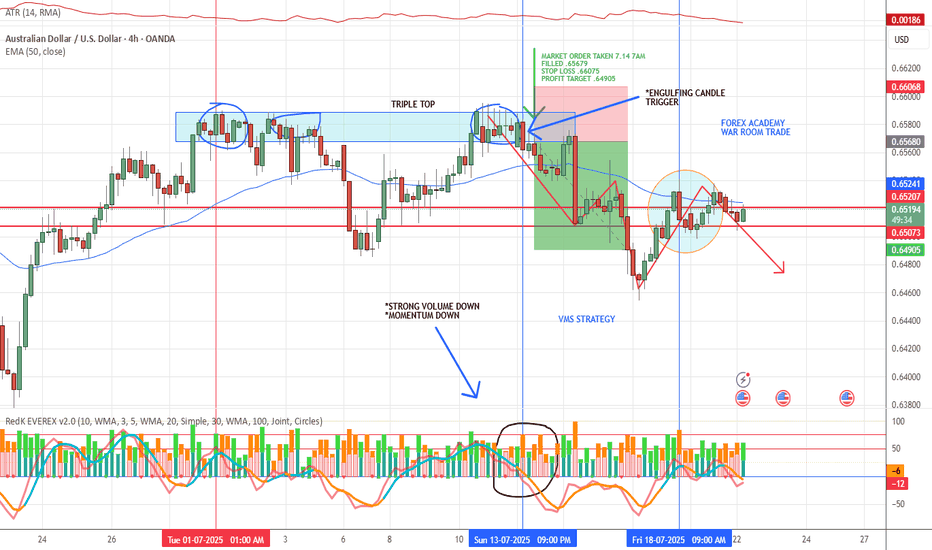

VMS STRATEGY APPLIED📈 VMS Strategy – Triple Top Win Example

We took this trade last Monday based on a textbook triple top reversal:

✅ Clean engulfing candle at resistance

✅ Strong downward volume

✅ Momentum clearly shifting in the trade direction

✅ Perfect timing with all elements aligning

On the 4-hour chart, we focus on specific reversal patterns within the VMS framework:

***Triple tops/bottoms

***Head & shoulders

***1-2-3 formations

***Hammer and shooting star reversals

Each setup must meet all VMS criteria before being considered.

A quick note on back testing:

We know traditional back testing can feel flawed—but here’s what works for us:

Start at the beginning of the month, hide future candles, and scan for VMS setups in real-time conditions. The trade either fits the rules—or it doesn’t. There’s no debate.

We’re not claiming perfection. This strategy does take losses—sometimes multiple in a row. But over time, through strict rule-following and patience, we’ve found consistency and success.

If this helps you, feel free to share it—or even just take a closer look.

With respect, always test it for yourself before trading live.

We’re here to share what’s working for us. We welcome thoughts and suggestions—but know this:

👉 This is a rules-based strategy rooted in discipline, not prediction.

🔒 Aligned Execution is the Edge.

AUDUSD Here is our signal for AUDUSD

Occasionally we give a free signal, so here's AUDUSD long.

Rules:

1- Wait for the 15 minute to close with momentum above the entry, ideally we want a re-test of the entry.

2- at TP1 move your SL to entry.

3- If you want to close at TP2 then do so.

📊Entry: 0.65223

⚠️SL: 0.65057

✔️TP1: 0.65407

✔️TP2: 0.65643

✔️TP3: 0.65940

Happy Trading,

Sarah

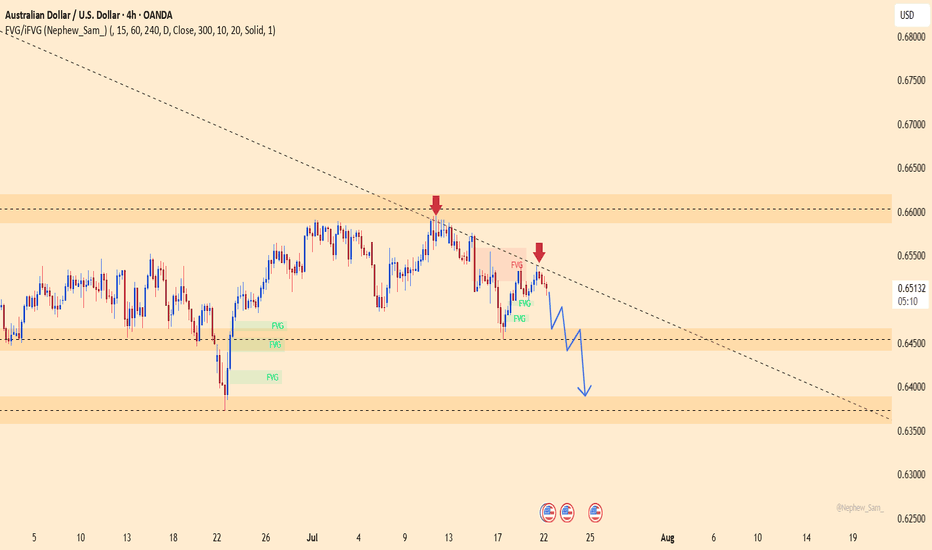

AUDUSD – Sellers taking over, the drop is on!This pair just got slapped hard at the descending trendline, right as it hit a familiar resistance zone. No more doubts – buyers are losing steam, and sellers are waiting to strike.

Market sentiment from Down Under is shaking, with weak economic signals piling up. Meanwhile, the mighty U.S. dollar is reclaiming the spotlight after gold’s flashy surge. The tide has turned!

Unless a miracle shows up, AUDUSD is set to dive deeper – and this is the perfect stage for traders who thrive on strong downtrends.

Sellers are in position – are you ready to join the ride?

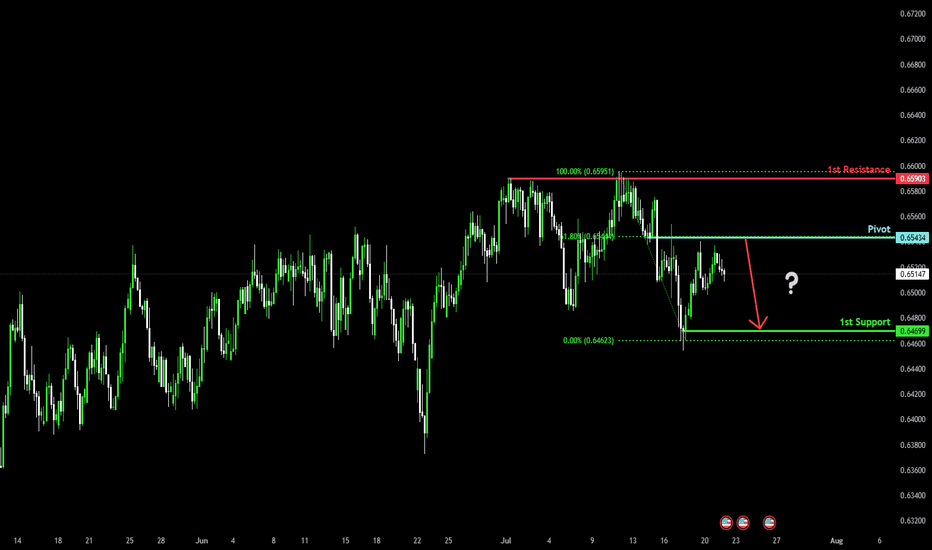

Bearish reversal off 61.8% Fibonacci resistance?AUD/USD is rising towards the pivot and could reverse to the 1st support, which acts as a pullback support.

Pivot: 0.6543

1st Support: 0.6469

1st Resistance: 0.6590

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

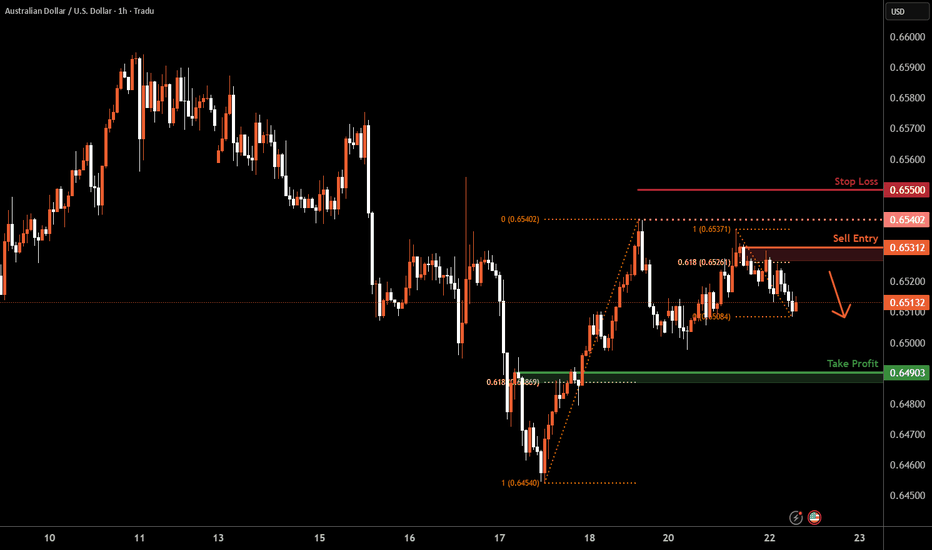

Aussie H1 | Swing-high resistance at a 61.8% Fibo retracementThe Aussie (AUD/USD) is rising towards a swing-high resistance and could potentially reverse off this level to drop lower.

Sell entry is at 0.6531 which is a swing-high resistance that aligns closely with the 61.8% Fibonacci retracement.

Stop loss is at 0.6550 which is a level that sits above a swing-high resistance.

Take profit is at 0.6490 which is a pullback support that aligns with the 61.8% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

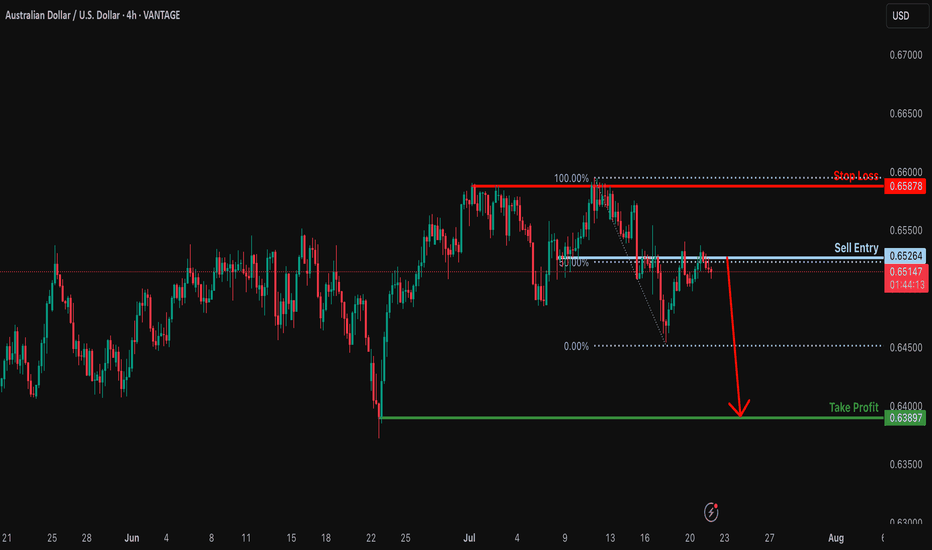

Could the Aussie drop from here?The price is reacting off the resistance level which is a pullback resistance that aligns with the 50% Fibonacci retracement and could drop from this level to our take profit.

Entry: 0.6526

Why we like it:

There is a pullback resistance that lines up with the 50% Fibonacci retracement.

Stop loss: 0.6587

Why we like it:

There is a multi swing high resistance.

Take profit: 0.6389

Why we like it:

There is a pullback support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

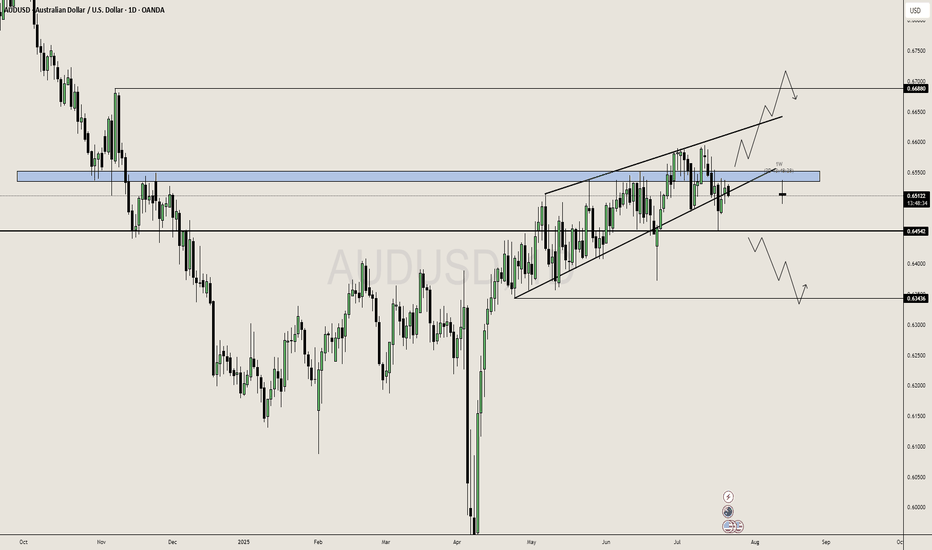

AUDUSD holding, Might Trigger a Upside MoveAUDUSD is still in Solid Sideways Range in Daily Chart. More Probabilities looking towards buy side, looking for liquidity at 0.66880.

It's in Range since 18 April, 2025 and hunting liquidity for both the buyers and sellers. Possibly it could trap seller and go in Buy Side.

In other case, The Sell Momentum can come if it breaks and holds below the 0.64500 Level. Then we can expect a sell momentum till the support level of 0.63400.

Daily is in Range so we can Predict the Price more clearly but if any of level from support or resistance breaks we can see a long-term Opportunity.

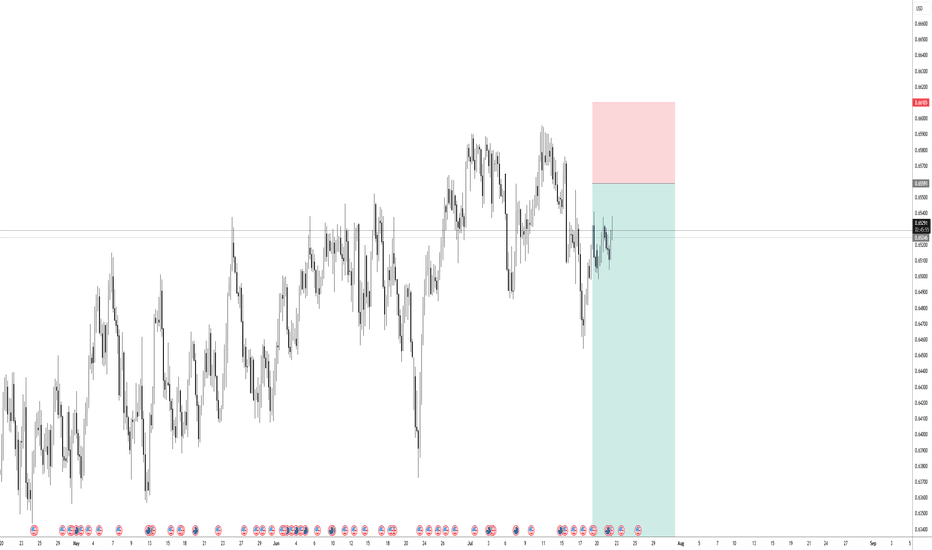

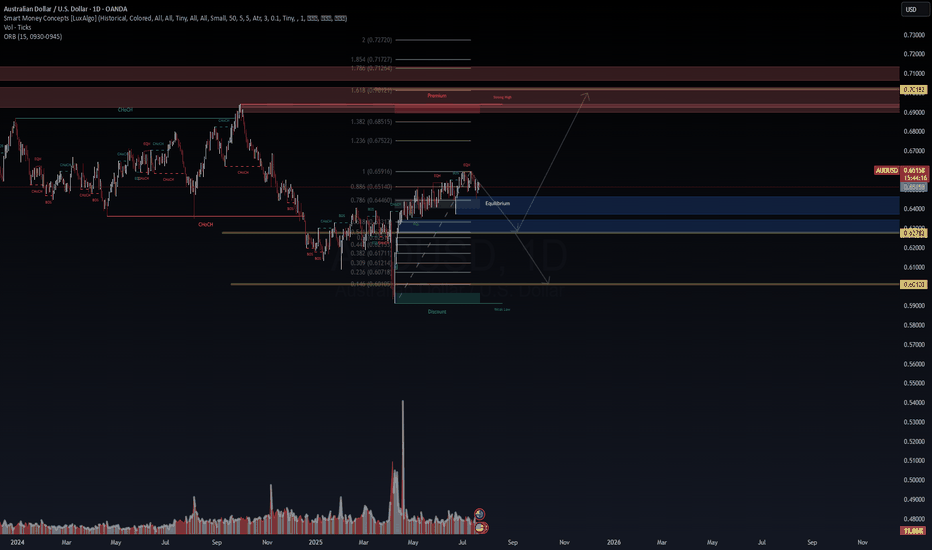

VolanX AUD/USD Tactical Short ThesisVolanX AUD/USD Tactical Short Thesis

The Aussie is showing signs of exhaustion near the 0.886 retracement and has swept major equal highs. Liquidity was engineered and harvested.

Now price is sliding into a vacuum—first target is the imbalance around 0.6440, with a deeper structural demand zone below at 0.6278.

We are positioned via /6AU5 put options, targeting this sweep as AUD re-aligns with declining China demand, copper softness, and USD firmness.

🎯 Trade Type: Long Put (0.6400P)

🎯 Target: 0.6278

🎯 Trigger: BOS below 0.6485

#VolanX #MacroTrading #SMC #AUDUSD #Options #Futures #TradingView #SmartMoney #InstitutionalLevels

AUDUSD Long PullbackOANDA:AUDUSD taking a pullback towards up, catching this pullback.

Note: I am not adding levels etc on chart because I am tired and need to go for breakfast first, simply sharing the what I see.

I manage trade on daily basis.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

AUDUSD(20250721)Today's AnalysisMarket news:

Waller refused to comment on whether he would dissent at the July meeting, saying that the private sector was not performing as well as people thought, and said that if the president asked him to be the chairman of the Federal Reserve, he would agree.

Technical analysis:

Today's buying and selling boundaries:

0.6506

Support and resistance levels:

0.6572

0.6547

0.6531

0.6481

0.6466

0.6441

Trading strategy:

If the price breaks through 0.6531, consider buying, and the first target price is 0.6547

If the price breaks through 0.6506, consider selling, and the first target price is 0.6481