USDBRX trade ideas

Análise de compra e venda de dólarAnálise da valorização e desvalorização do real e do dólar para compreensão de momentos de compra e venda.

Na queda de braço entre o real e o dólar, quem manda é o dólar (a lei do mais forte). E nessa jogada, o valor "real" do real (tu-dum-tss) frente ao valor real do dólar tem momentos de delay e descolamento que podem ser aproveitados.

(variável corrigida)

Brazilians: Co-relation USD-BRL and Ibovespa (loss mitigation)Peguem investimentos em ações e vejam uma relação ainda maior (ex com fundos: bitly/fiaBRUS )... O Brasil é muito suscetível à economia global, o que não é de todo ruim. Saber conciliar investimentos externos (até mesmo câmbio de dólar) e internos balanceia as perdas e potencializa ganhos.

Brazilian Real continues to recover its spaceAfter the pension's reform approval in the Brazilian Congress, the price of the pair FX_IDC:USDBRL reacted in favor of the tropical country and is showing some signals that it's aiming to test the previous lows, around 3.64

Let's see how it'll progress...

Short USDBRL, some economic improvement with political change?Trade logic on Right wing move towards government after year of lefties in power.

Some economic reforms are expected, and Capital is eyeing transfer to Brazil as a consequence.

Technically, a head and shoulders pattern just finished forming, (can be seen clearly on daily chart), with any move downward likely to be quick,

TP just above 3.2 is suggested based on previous support and fiobonacci retracement from previous multi year lows and highs.

A second TP in the range of 2.4 to 2.5 is possible but likely to take some long time (at least 6 months and very possible more than a year from now); reasoning is to look at weekly chart, given the head and shoulders we hoped for finishes, a double top chart will form and price may head to next fib. retracement and previous resistance (between 2008 and 2014) that will act as support.

For now focus on first target

Long Brazil Real Short US DollarPlease check the following two indicator for Brazil Real : MACD and RSI

Even though the real has achieved a new low, MACD histogram got a lower maximum compared to September 2018.

A similar pattern could be seen in the RSI, which achieved a lower maximum while the real got a new low.

$USDBRL $EWZ $BVSP - Brazilian Real Under PressureAs market volatility has come back with a vengeance and the US Dollar continues to remain strong, one EM currency that has been hit particularly hard this year has been the Brazilian Real ($USDBRL).

Sluggish growth forecasts, coupled with waning support for the Brazilian President has sent the Brazilian Real to its lowest level of the year thus far. The sharp declines have also been fueled by uncertainty over the US-China trade talks on the macro level. The combination of the two forces, the external macro headwinds and feeble domestic economy, have been a perfect storm for the under-performance of the $USDBRL in 2019.

Further more, on a technical basis, the $USDBRL continues to show deterioration within the Brazilian Real, with the 10-day EMA being a strong support for the currency pair.

We believe if this continues, $USDBRL 4.25 is the next stop.

USDBRL is going to go downHello,Traders. In the USDBRL chart, we were expecting a regular flag formation for the price to keep pushing for downward. Now, it has broken the trendline, so the view has changed whereby we might see price testing the top and then reverse to the downside. Look out for any ipmulsive move tothe downside as itis not necessary for price to break the top and then reverse. Trade with care.

Happy trading, guys.

If u like the analysis and want future chart updates, please do help share the charts and like my page. There is more to come ;) , lets make money. Thank you.

IF you are interested in letting us manage your account for consistent profits, just PM to me or for copytrade head to fbsmy.com

We do manage investors accounts.

Thank you.

USDBRL - Dólar x RealDadas as informações que temos até o momento, acredito que o preço do dólar (USDBRL) está indo para a zona dos 3.5 Reais (BRL) e de lá continuará sua trajetoria de queda para a regiao dos 3.10 que é o target da figura de ombro, cabeca, ombro que se formou no grafico. No caminho, a zona dos 3.30 pode se mostrar um bom suporte, e eventualmente, segurar o preco por um tempo.

- EN - I do believe that the price is going to the region of the 3.5 reais, and then will take a decision, whether re-test the 3.8 or continue the path to 3.10 which is the target of the Headers and shoulders.

The region of 3.30 can be a good support on this path and hold the price for a while since it was a resistance region in the past.

For me, this is the most likely scenario.

BRL struggling right now. Next weeks are critical.All necessary information is on the chart.

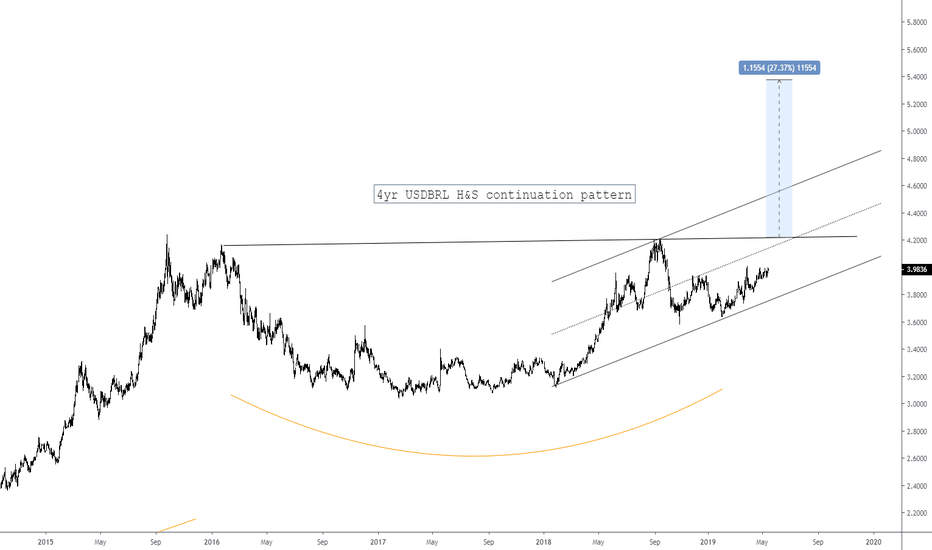

Following last years elections results BRL recovered against the US dollar, but despite a series of positive indicators, reports and overall better economical mood BRL failed to follow towards the target of the previous head and shoulders pattern, instead, encouraged by yet another corruption scandal, the price has been hiking strong, and has the potential to trigger a massive cup and handle pattern. Such a massive loss of value is not unheard of in South America, and has as a matter o fact befallen a neighboring country - Argentina - a few years ago.