Send this down to 1 and its over for USDBRICS composite basket index vs USD

BRICS currently accounts for 40%+ of the global population and 25%+ of global trade. Lessening reliance on USD will benefit their economies greatly regards cross border trade amongst members.

Current additional applications to join the bloc have been received from Saudi Arabia, Nigeria, Algeria, Venezuela, Kazakhstan (all major energy markets) amongst others.

All empires rise and fall, both economic and geographic... some more destructive than others.

One to keep an eye on over next century.

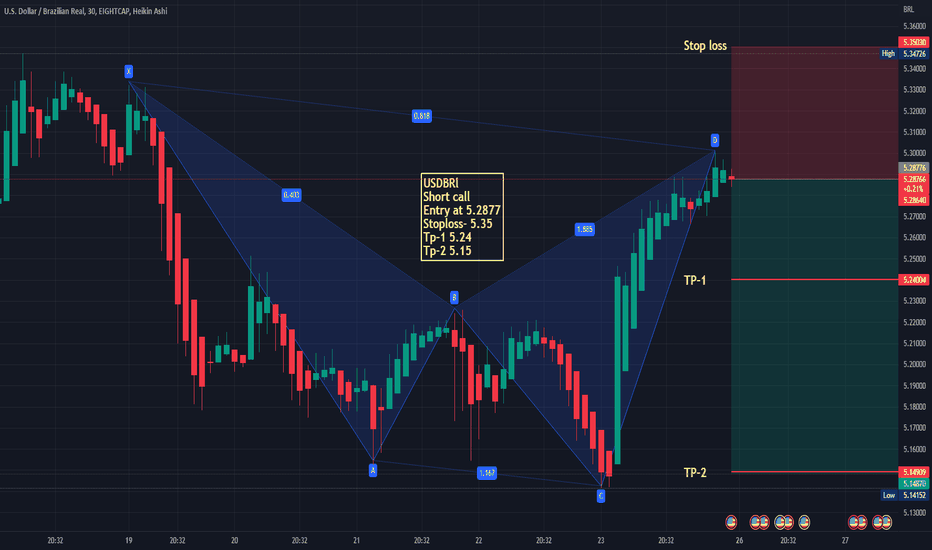

USDBRX trade ideas

USD/BRLFOREXCOM:USDBRL price is at a major resistance zone and seems to be forming a double top on the daily time frame. Price should start heading down. Worst case it breaks the daily zone and hits the Monthly descending trendline (red). Price is currently overbought on the RSI and Bollinger Bands so there is a high probability it will go down.

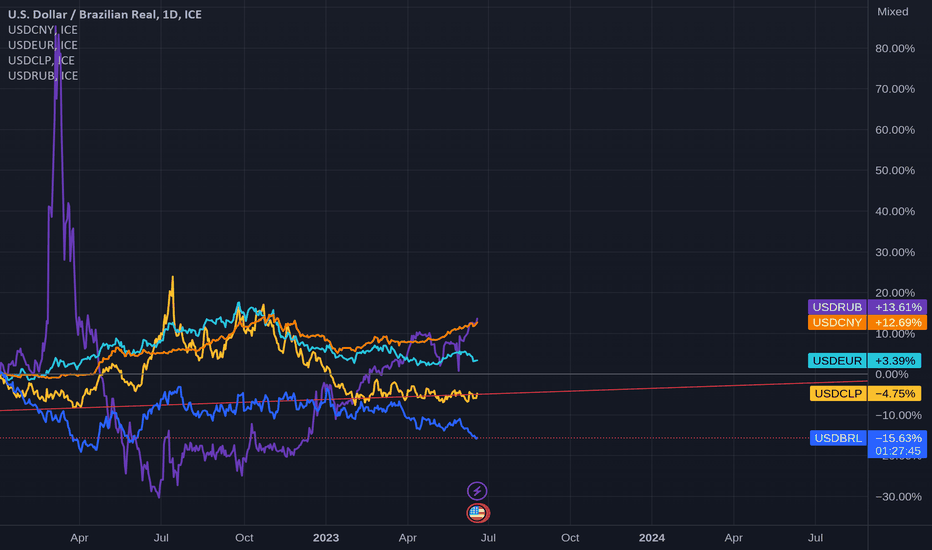

Dollar performance since 2022This is to demistify some ideas regarding the dollar:

1 - The yuan will replace the dollar as the universal legal tender.

It's true that the US government "printed" a lot of money during the Covid pandemic and since the beginning of the Russian invasion of Ukraine. Thus the dollar was weakened by inflation and the US national debt. But while that is true it has appreciated over the yuan and the ruble.

2 - The recent drop in USD/BRL is a long term trend.

The currency of non-aligned (regarding the war in Ukraine) countries slighted benefited from the recent comparative weakness of the dollar. What is special about Brazil is the high interest rate which puts the country ahed of the World in controlling inflation and makes the country super attractive to bond investors. But the Brazilian economy is plagued by internal issues and not growing as much as the rest of the World. So eventually the Central Bank of Brazil will reduce the interest rate because the inflation is getting under control and the dollar will recoup value due to the investments outflow.

Real vs Dollar = Infinite rise for the Dollar!-Comparing the Brazilian real with the US dollar means wasting time, as we know that the final result will always be an infinite increase in the US currency against the Brazilian currency.

-Below I leave the beautiful pattern "CUP And Handle" formed and consolidated.

-As Charles Dow said: "Prices discount everything".

-Things usually take time to materialize, but they will never stop happening at a given future moment.

-Also read the graphic analysis below!

-Do your analysis and good business.

-Be Aware, If You Buy, Use Stop!

-See below for other graphic reviews!

USD BRL chart Analysis EN and PT language

On a weekly time frame, the Brazilian Real has experienced a downward trend since 2011. There are several reasons that have contributed to the market's inflation and the weakening of the Brazilian economy against the US Dollar. These reasons include factors such as job vacancies, high crime rates, corruption, and a complex tax system.

The chart analysis indicates that the waves from 2011 to 2023 can be identified as five distinct waves, with wave 5 ending at 6 Brazilian Reals for 1 US Dollar. This signifies the continuous decline of the Brazilian economy over the years relative to the United States Dollars .

In 2020, the Brazilian Real reached its highest exchange rate of 6 Reals for 1 Dollar, primarily due to the impact of the COVID-19 pandemic. From a technical analysis perspective, this peak could be considered the end of wave 5, which had started in 2011 and lasted until 2020.

Following the peak of wave 5, a correction phase began, resulting in complex wave corrections known as WXYXZ waves. In my opinion, this correction was influenced by various economic problems in the United States, including the closure of many banks and a substantial increase in national debt, which exceeded 1.4 trillion dollars for the first time in 30 years. Additionally, the Ukrainian War also had an impact on the value of the US Dollar.

These factors are likely to have a positive effect on the Brazilian economy since Brazil stands in a different position from the United States in terms of economic conditions. Moreover, Brazil implemented several changes at the beginning of 2023, such as the decision made by BRICS members to use their local currencies for official transactions, reducing dependence on the US Dollar.

Considering the current exchange rate of around 5 Reals for 1 Dollar, it is possible that the price may experience a slight increase as part of the (x) wave. However, by the end of the year, it is expected to start moving downwards, reaching a range between 4.5 and 4.2 Reals for 1 Dollar. This downward movement would mark the completion of the Z wave, concluding the overall wave cycle.

It is important to note that further developments and news will shape the future chart for the Brazilian Real. Economic and geopolitical events can have significant impacts on currency exchange rates, and these factors should be carefully monitored to assess the potential direction of the Brazilian Real against the US Dollar.

BY Rami Rachid

HiddenTreausre

portuguese :

Em um período semanal, o Real Brasileiro tem experimentado uma tendência de queda desde 2011. Existem várias razões que têm contribuído para a inflação do mercado e o enfraquecimento da economia brasileira em relação ao Dólar Americano. Essas razões incluem fatores como vagas de emprego, altas taxas de criminalidade, corrupção e um sistema tributário complexo.

A análise do gráfico indica que as ondas de 2011 a 2023 podem ser identificadas como cinco ondas distintas, com a onda 5 terminando em 6 Reais Brasileiros por 1 Dólar Americano. Isso significa o declínio contínuo da economia brasileira ao longo dos anos em relação ao Dólar dos Estados Unidos.

Em 2020, o Real Brasileiro atingiu sua maior taxa de câmbio de 6 Reais por 1 Dólar, principalmente devido ao impacto da pandemia de COVID-19. Do ponto de vista da análise técnica, esse pico poderia ser considerado o fim da onda 5, que havia começado em 2011 e durado até 2020.

Após o pico da onda 5, uma fase de correção começou, resultando em correções complexas conhecidas como ondas WXYXZ. Na minha opinião, essa correção foi influenciada por diversos problemas econômicos nos Estados Unidos, incluindo o fechamento de muitos bancos e um aumento substancial na dívida nacional, que ultrapassou 1,4 trilhão de dólares pela primeira vez em 30 anos. Além disso, a Guerra da Ucrânia também teve impacto no valor do Dólar Americano.

Esses fatores provavelmente terão um efeito positivo na economia brasileira, uma vez que o Brasil ocupa uma posição diferente dos Estados Unidos em termos de condições econômicas. Além disso, o Brasil implementou várias mudanças no início de 2023, como a decisão dos membros do BRICS de utilizar suas moedas locais para transações oficiais, reduzindo a dependência do Dólar Americano.

Considerando a taxa de câmbio atual de cerca de 5 Reais por 1 Dólar, é possível que o preço possa ter um leve aumento como parte da onda (x). No entanto, até o final do ano, espera-se que comece a se mover para baixo, alcançando uma faixa entre 4,5 e 4,2 Reais por 1 Dólar. Esse movimento descendente marcaria a conclusão da onda Z, encerrando o ciclo geral de ondas.

É importante observar que desenvolvimentos e notícias futuras moldarão o gráfico futuro para o Real Brasileiro. Eventos econômicos e geopolíticos podem ter impactos significativos nas taxas de câmbio, e esses fatores devem ser monitorados cuidadosamente para avaliar a direção potencial do Real Brasileiro em relação ao Dólar Americano.

POR Rami Rachid

HiddenTreausre

Dollar / Real (Brazil) possible targetting higher levelsTarget one is reached. Usually after a beautiful cup and handle like this one, we see further upward price actions. Fundamentally, I don't think Real will sustain this trend of being valued, since the current president is a former prisioner charged for corruption and recently has been seen in Dubai with his 30y younger spouse in a hotel costing 60,000 reais per person by night, using public money to afford the expenses. Taxation is going nuts all over the country again, the previous president had cut them all, and now they are all being reinstalled. Inflation will hit and it's interesting to watch the DXY chart. I am keeping my earning in dollars as long as I follow the continuation here.

Save the banks!!!FED is saving the banks and the pivot is closer than ever.

The dollar will have a very bad 2023/24 and once the rates start to decline, everything will have already landed on the moon.

The pivot is just the "icing on the cake" as once it happens the markets will already have exploded (e.g; Bitcoin).

The Dollar against the Real could possibly enter an accumulation phase at around HKEX:4 which is approximately the price of the previous top (double top) and re-accumulation area for Wave III.

A massive bear market is waiting for the DJI, SPX, NQ1, Real, Bitcoin and all markets, but first, the 5th wave...

Bring on the BULLS!

Gold, China, BRICS vs. US Dollar HegemonyIn the contemporary global landscape, compelling arguments exist for a pro-Gold, pro-China, pro-BRICS case and a pro-US, pro-USD case. This extensive analysis will explore both perspectives, starting with the pro-Gold, pro-China, and pro-BRICS cases.

The global commodity supply and demand pricing dynamics reveal a shift in gold businesses from the US to China. Since 2013, gold demand in Asia has led to the migration of vaults, physical and financial trading operations, and even exchanges to the East. This shift signifies an increasing connection between oil, gold, and the Chinese Yuan, as evidenced by the gold-for-oil trade between Russia and China in 2017. Rumors of Saudi Arabia using renminbi from oil sales to buy gold on the Shanghai Exchange also indicate a growing connection between these commodities and the Chinese currency.

The BRICS coalition (Brazil, Russia, India, China, and South Africa) has formed to counter G7 control and assert their interests in the global landscape. The US freezing Russia's foreign currency reserves and cutting them off from the SWIFT system has catalyzed the emergence of Bretton Woods III, a new era of commodity-based neutral reserve currencies. As the US hegemony declines, a new world order with multiple powers based on commodities production and trade is emerging.

However, the pro-US, pro-USD case argues that despite concerns surrounding the dollar's hegemony, it remains a crucial player in global transactions. China's economy faces growing debt, an expanding real estate bubble, and potentially inflated GDP numbers. Moreover, the yuan (RMB) faces significant challenges in becoming a globally accepted reserve currency, primarily due to China's capital controls, illiquid markets, and authoritarian governance.

In contrast, the US dollar remains dominant in global central bank reserves and transactions. This is partly due to the dollar's resilience and the perception of the US's security and stability. Although reserves have shifted for countries with closer trade relations with China, the US dollar remains the world standard.

The push for de-dollarization has gained momentum recently, particularly after the Russia-Ukraine conflict and Western sanctions against Russia. However, moving away from the US dollar system is challenging for several reasons, including the US dollar's dominance in global markets, the yuan's limitations as a globally accepted alternative to the US dollar, OPEC members continuing to price their oil in US dollars, and the obstacles faced by BRICS nations in creating a new currency to facilitate trade and promote de-dollarization.

In conclusion, while there are signs of a shift in the balance of global reserve currencies, it is premature to predict the decline of the US dollar's dominance in international markets. The pro-Gold, pro-China, pro-BRICS case highlights the increasing role of gold and the emergence of a new world order with multiple powers based on commodities production and trade. However, the pro-US, pro-USD case emphasizes the resilience and stability of the US dollar and the challenges faced by alternative reserve currencies, such as the yuan, in replacing the US dollar on a large scale in the foreseeable future.

Emerging market currencies to outperform G10 in 2023With the global economy showing more resilience and the Fed slowing its pace of tightening, we believe EM currencies can outperform relative to G10 peer currencies this year. Attractive real yields should result in market participants accumulating exposure to developing currencies, while our assumption for contained banking sector stresses should lead to improved risk appetite

Let the printing begin!!! LULAThe charts never lie.

The Law of Large Numbers, by Jacob Bernoulli, defends that we can accurately predict an event when we utilise large numbers.

This chart has a precise bull flag formation that has been forming way before the election results.

Now we have the Brazilian people's decision, LULA has "won" and the left is back in power.

From my point of view, it is a disastrous moment for the country, LULA has numerous cases of very, I mean, extensive systemic corruption in his back.

Now he will have to deal with the current worldwide recession.

The printing will be massive.

This is the confirmation for the bull flag breakout.

Brazilian RealEverything else is headed back to preCOVID levels, it looks to me like Brazilian Real is doing the same. In this particular case, it's bullish.

The currency is headed up because oil is headed up and Brazil produces more oil than Iran. (#8 in the world)

Just posting this because I plotted it out for myself. EWZ is not currency hedged which means the currency impact influences price, and this is bullish for EWZ