USDCAD.PRO.OTMS trade ideas

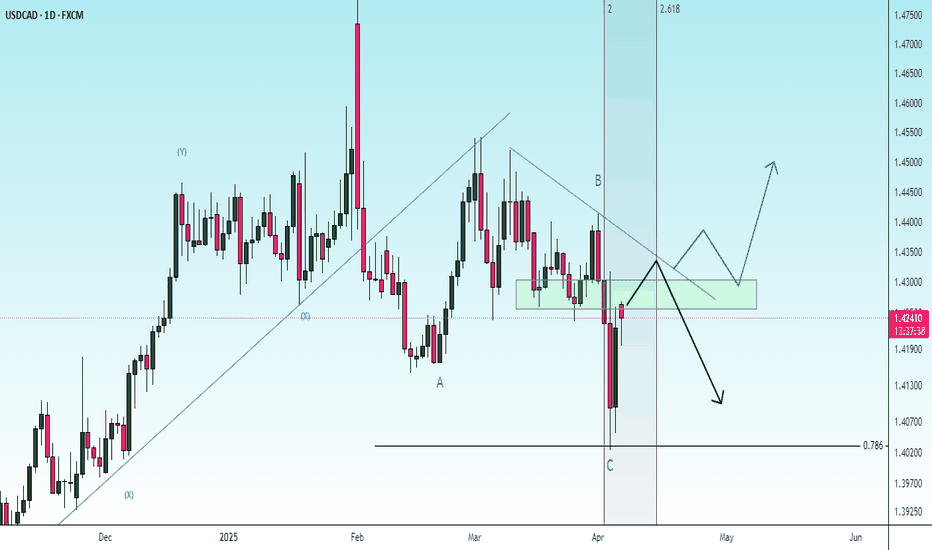

USDCAD downside target 1.3900On the daily chart, USDCAD fell back after testing the resistance near 1.430. The current market is running below the downward trend line. The current support below is around 1.4027. If it falls below, it will continue to fall. The support below is around 1.3900. At present, you can pay attention to the short-selling opportunities in the 1.4200-1.4220 area.

USDCAD Quick Trading Insight: Selling Opportunity AheadAnalyzing USDCAD using the EASY Trading AI strategy strongly indicates a short-term bearish move. Current analytics suggest entering a Sell order at 1.42422. The selected targets are strategically placed at a Take Profit level of 1.41816 with a Stop Loss set at 1.4299. This bearish perspective aligns with patterns identified by EASY Trading AI, predicting market correction following recent overextensions. Traders should closely monitor entry accuracy and maintain strict adherence to risk parameters.

Pullback-Confirmed Reversal with Structural RhythmSetup Type: Timing Synchronization Short Setup

Setup Overview

USD/CAD recently staged a short-term pullback against a dominant downtrend. The reflexive bounce met resistance and stalled. As of April 7 (Monday), price action has entered a clean sideways consolidation, confirming the hesitation required by the Timing Synchronization Rule. Tuesday’s session (April 8) becomes the key trigger window for re-entry in the direction of the original impulse—short.

COT & Sentiment Snapshot

• CAD sentiment recovering mildly amid crude oil stabilization

• USD momentum cooling post-rate expectations

• Leveraged funds mildly long USD, but waning positioning

• Open interest flattens—market indecision post-pullback

Market Structure & Technical Breakdown

• Downtrend impulse → Friday pullback (April 4)

• Monday (April 7) = confirmed consolidation day (neutral candle)

• Key structure: price stalling at prior rejection zone

• Clean technical symmetry unfolding

✅ Entry window opens April 8 on structural breakdown

🟡 Short only if price confirms break of consolidation zone

Behavioral Finance Layer

🧠 “The market must rest in proportion to how it moved.” – Watts

• Traders positioned aggressively long on Friday now trapped

• Monday's indecision fuels hesitation

• Tuesday’s breakdown = phase shift into emotional unwind

• Weak hands exiting as confirmation builds

Reflexivity Risk Model

• Phase 1: Pullback (April 4 – impulse bounce)

• Phase 2: Sideways pause (April 7)

• Phase 3: Short re-entry trigger (April 8)

• Phase 4: Position unwind + continuation phase

Tue 8th Apr 2025 USD/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/CAD Buy. Enjoy the day all. Cheers. Jim

USD/CAD(20250408)Today's AnalysisToday's buying and selling boundaries:

1.4240

Support and resistance levels:

1.4356

1.4312

1.4284

1.4195

1.4167

1.4124

Trading strategy:

If the price breaks through 1.4240, consider buying, the first target price is 1.4284

If the price breaks through 1.4195, consider selling, the first target price is 1.4167

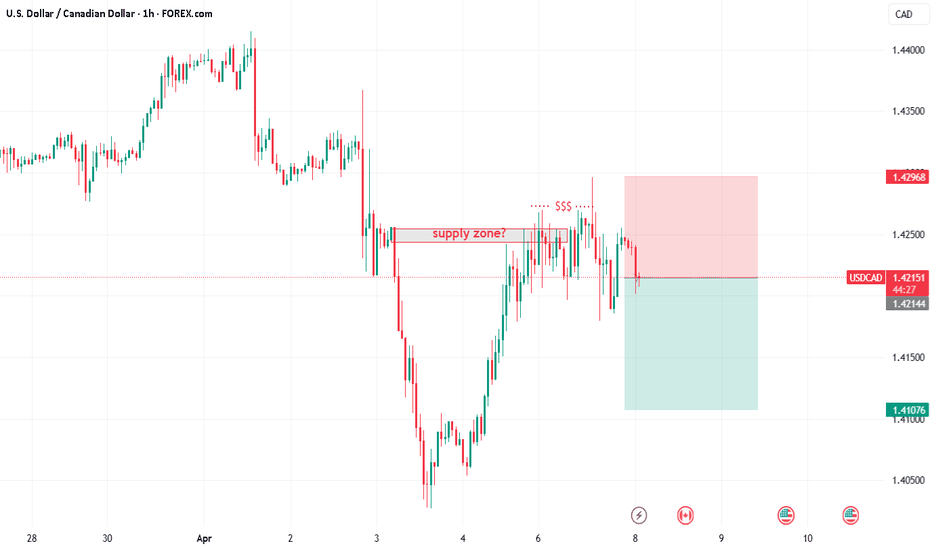

UsdCad Trade IdeaI personally took some shorts on UC with price coming back up into a major level of support that is now currently being used as resistance. With smaller time frames shifting structure at a major level and giving me a solid bearish candle confirmation after the retest, we could expect price to dump back down to 1.41553

Intraday Preview: Consolidation and waiting | Prospect: +100pipsThe View:

Although the possibility of further consolidation cannot be ruled out, it is expected to remain limited in scope. Market momentum remains subdued; however, there are signs of stabilization that support the likelihood of a gradual upward trend, provided no new negative developments emerge in the external environment.

Buy Scenario:

Although the possibility of further consolidation cannot be ruled out, it is expected to remain limited in scope. Market momentum remains subdued; however, there are signs of stabilization that support the likelihood of a gradual upward move, provided no new negative developments occur in the external environment. In this context, long positions are maintained above 1.4170, with targets at 1.4300 and 1.4340 in extension.

Sell Scenario:

Despite signs of potential stabilization, a break below the 1.4170 level may trigger renewed downward pressure. In such a scenario, the likelihood of further decline increases, with the next targets seen at 1.4100 and 1.4080. The inability to hold key support levels could act as a catalyst for short-term bearish momentum.

new value area high to start Mondaynew value area high to start Monday

my personal opinion is development towards resolution likely near,

but still need wait catalyst

upon resolution news published, a short may be entered due to this exhaustive move from this last momentum wave

EURO may be a better bet for more conservative entries

information created and published doesn't constitute investment advice!

NOT financial advice

updateThis Analysis Can Change At Anytime Without Notice And It Is Only For educational Purpose to Traders To Make Independent Investments Decisions.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView

USD/CAD(20250404)Today's AnalysisMarket news:

Countermeasures from many countries against the United States - ① It is reported that Europe will slow down the pace of tariff retaliation; EU member states will vote on countermeasures against US steel and aluminum tariffs on April 9; ② Macron said that the response to US tariffs will be larger than before, and called on French companies to suspend investment in the United States. France may plan to impose retaliatory tariffs on large US technology companies. ③ Canadian Prime Minister Carney: Canada will impose a 25% tariff on all cars imported from the United States that do not comply with the US-Mexico-Canada Agreement.

Technical analysis:

Today's buying and selling boundaries:

1.4147

Support and resistance levels:

1.4436

1.4328

1.4258

1.4036

1.3966

1.3858

Trading strategy:

If the price breaks through 1.4147, consider buying, the first target price is 1.4258

If the price breaks through 1.4036, consider selling, the first target price is 1.3966

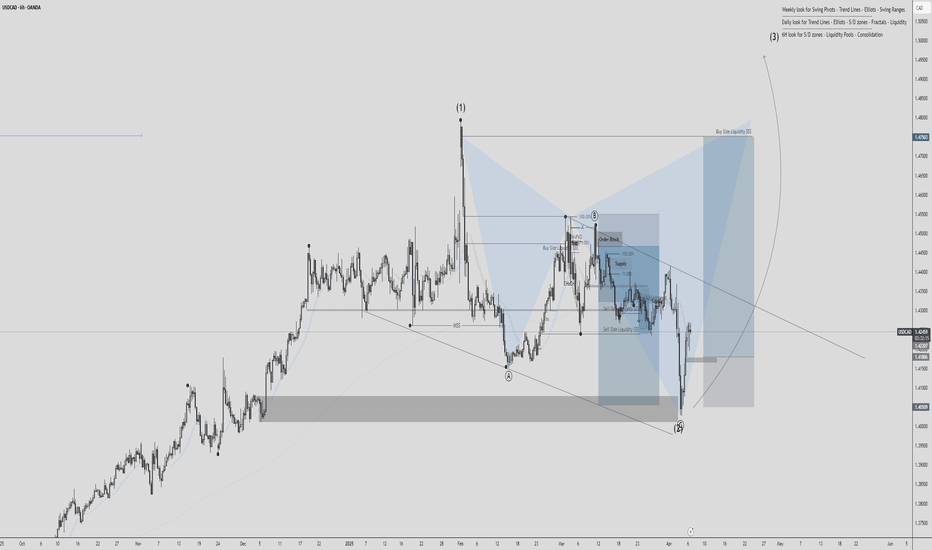

USDCAD WHAT TO LOOK FOROur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will fall to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Let’s master the market together. Please share your thoughts and encourage us to do more by liking this idea.

Tariff U-turn risk now part of the trade Yesterday, President Donald Trump announced his "Liberation Day" tariff strategy, introducing a universal 10% tariff on all imports, with higher rates for specific countries.

Despite Commerce Secretary Howard Lutnick’s claim that President Trump “won’t back off,” several pressures could still force a reversal before their April 9 implementation.

Markets have already reacted negatively, and trading partners are signalling how they might retaliate.

French President Emmanuel Macron has urged European companies to suspend investment in the U.S. In Canada, Prime Minister Mark Carney said he is planning to pivot toward more reliable partners like Australia, the U.K., and France.

A U-turn by the Trump administration would likely be framed as a strategic win rather than inconsistent policy making—but for traders, volatility may remain a welcome constant from this administration.