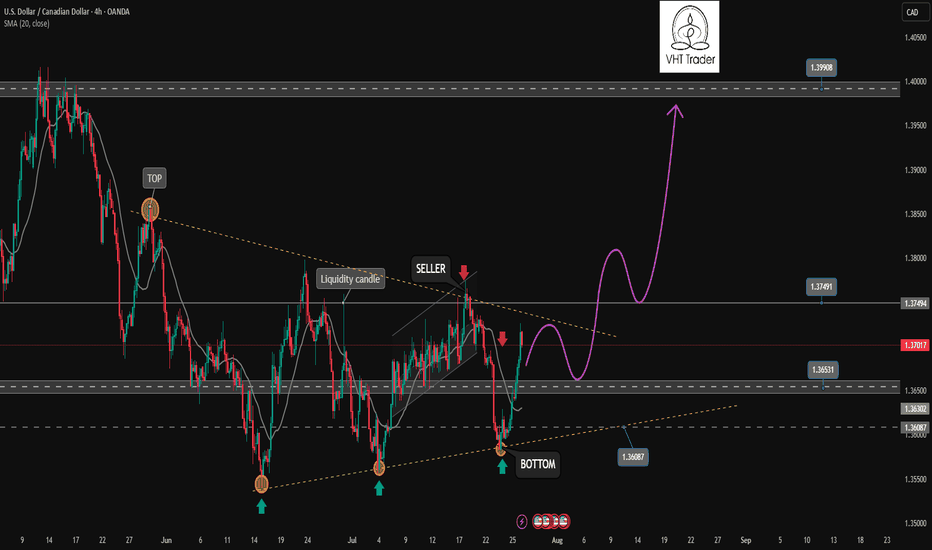

USDCAD bounced from Support and can continue higherLooking at the chart and the overall structure, I think we can favor the continuation setup with a emphasis on price action at key zones, particularly when price breaks out then can revisit this structure for a retest.

This bounce off support has been accomplished in my previous analysis:

Here, if price breaks with strength and dips back into the area and holds with bullish confirmation (likely a wick rejection or bullish engulfing on lower timeframes), that would be the cue to get in.

I am projecting the next target to 1.38600 that makes sense as a logical level for trend continuation and that I find achievable.

USDCAD trade ideas

USDCAD: a long positionHello guys.

Divergence:

A bullish RSI divergence is noted, price made lower lows while RSI formed higher lows, signaling a potential bullish reversal.

Price Action:

Price has bounced strongly from around the 1.3570–1.3580 zone and is now approaching a descending trendline resistance.

Trade Setup:

Entry: 1.3718

Stop Loss: Below the breakout candle, near 1.3686

Take Profit: Around 1.3782

Risk-to-Reward: 1:3

USD/CAD Breaks Triangle: Bullish Target in SightHello guys!

USD/CAD has broken out of a clear triangle formation, signaling strong bullish momentum. The breakout above the top line of the triangle, supported by earlier bullish divergence, confirms that buyers are now in control.

Triangle breakout confirmed

Strong bullish impulse post-breakout

Retest of the broken trendline expected

Target: 1.38791

A clean retest of the breakout level could provide another entry opportunity before price reaches the target zone highlighted in blue.

A New Day, A New Opportunity: USDCAD Buy StrategyGood morning Traders,

USDCAD has reached a key support zone between 1.37531 and 1.37592.

I'm opening a buy position from this level, aiming for the 1.37887 target.

Feel free to adjust your stop-loss based on your own margin and risk tolerance.

Your likes are my biggest source of motivation when sharing analysis. Thanks to everyone who supports with a simple like!

USD/CAD Rises to 2-Month HighUSD/CAD Rises to 2-Month High

Today, the USD/CAD exchange rate briefly exceeded the 1.3870 mark – the highest level seen this summer. In less than ten days, the US dollar has strengthened by over 2% against the Canadian dollar.

Why Is USD/CAD Rising?

Given that both the Federal Reserve and the Bank of Canada left interest rates unchanged on Wednesday (as expected), the primary driver behind the pair’s recent rally appears to be US President Donald Trump's decision to impose tariffs on several countries – including Canada:

→ Despite efforts by Prime Minister of Canada Mark Carney to reach an agreement with Trump, no deal was achieved;

→ Canadian goods exported to the US will now be subject to a 35% tariff;

→ The tariffs take effect from 1 August;

→ Goods compliant with the United States-Mexico-Canada Agreement (USMCA) are exempt.

Media analysts note that the tariffs are likely to increase pressure on the Canadian economy, as approximately 75% of the country's exports are destined for the United States.

USD/CAD Technical Analysis

At the end of July, the price formed a steep ascending channel (A-B), with bullish momentum confirmed by a decisive breakout above the 1.3790 resistance level, as illustrated by the arrow:

→ the pullback before the breakout was relatively shallow;

→ the bullish breakout was marked by a long bullish candlestick with a close near the session high;

→ following the breakout, the price confidently consolidated above 1.3790.

Provided that the fundamental backdrop does not undergo a major shift, bulls might attempt to maintain control in the market. However, the likelihood of a correction is also increasing, as the RSI indicator has entered extreme overbought territory.

Should USD/CAD show signs of a correction after its steep ascent, support might be found at:

→ line C, drawn parallel to the A-B channel at a distance of its width;

→ the previously mentioned 1.3790 level, which now acts as a support following the breakout.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

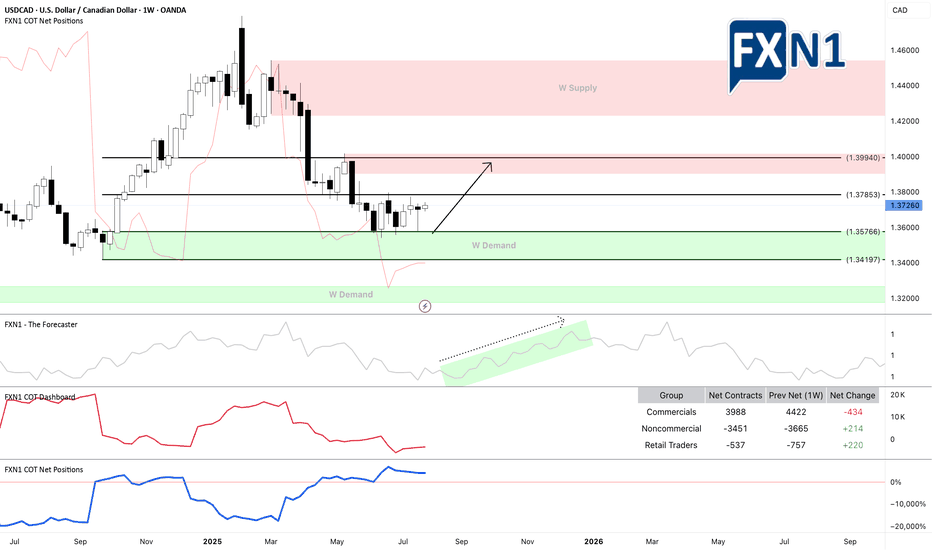

Will the Canada-US Trade Tension Continue to Impair CAD?Fundamental approach:

- USDCAD advanced this week, supported by broad US dollar strength and renewed trade tensions as the US announced higher tariffs on Canadian imports.

- The pair was further buoyed after the BoC left rates unchanged and signaled caution amid persistent core inflation and ongoing trade negotiations.

- Meanwhile, US labor data indicated that job openings were moderating growth while tariff-related uncertainty weighed on risk sentiment.

- The BoC’s decision to keep its policy rate at 2.75% cited domestic economic resilience and the unpredictable US trade policy outlook.

- At the same time, negotiations between Canada and the US over trade terms remained in an “intense” phase, with additional tariffs entering effect 1 Aug, adding to downside risks for the Canadian economy.

- USDCAD may remain elevated next week as markets monitor follow-through from new tariffs and assess further data on US jobs and Canadian trade. Potential progress or setbacks in Canada-US trade talks and upcoming economic releases could influence direction, while central bank policy signals and risk appetite will remain key catalysts.

Technical approach:

- USDCAD formed a Triple-bottom pattern at around 1.3567 and bounced up to break the neckline at 1.3755. The price also broke the descending trendline and closed higher than both EMAs, indicating a potential trend reversal.

- If USDCAD remains above the support at 1.3755 and both EMAs, the price may retest the resistance at 1.3980.

- On the contrary, closing below the support at 1.3755 and both EMAs may lead USDCAD to retest the key support at 1.3567.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

Uptrend is coming. Opportunity for buyers✏️ OANDA:USDCAD is trading close to the upper boundary of the triangle pattern. There is a high possibility that the current bullish momentum will break the upper boundary and form an uptrend for the USDCAD pair. The important price zone for the sellers at the moment is 1.075. If the buyers are strong enough to push the price above 1.075, the sellers will only be really interested in the price zone of 1.340, the high of the pair in May.

📉 Key Levels

Buy trigger: Reject and Trading above 1.365

BUY DCA Break 1.375

Target: 1.400

Leave your comments on the idea. I am happy to read your views.

USD/CAD - 6C1! : Trade update FundamentalThe US dollar index (DXY) gained strength against major currencies on Monday following a landmark trade agreement between the United States and the European Union. During the meeting in Scotland on Sunday, President Donald Trump and European Commission President Ursula von der Leyen announced a new trade framework, which includes a 15% import tariff on EU goods—half of the 30% rate Trump had initially threatened to impose starting August 1.

The DXY opened higher at the start of the week, and it’s clear that most currencies are likely to see a decline in response. This trend also extends to pairs like the 6C1! (USDCAD), where the USD has been increasing its long positions. Last week, non-commercial traders added to their holdings, while commercial traders remain at their highest levels since 2021. Based on this setup, we are maintaining a bullish outlook and expect the continuation of our long position strategy.

Previous Idea :

✅ Please share your thoughts about USD/CAD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

USD/CAD – Possible Pullback on the RadarThis pair is forming a potential pullback setup that we’re keeping a close eye on.

The support zone is decent, but not ideal — which means we’ll need to see extra confirmation from both volume and momentum before considering a trade.

As always, every part of the VMS strategy must align before we take action. Until then, it stays on the watchlist.

Discipline over impulse. Patience over prediction.

USDCAD Will Go Down! Short!

Take a look at our analysis for USDCAD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 1.378.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 1.362 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCADSupport Zone: Price has retested a strong support area

Price Action: The retest held — buyers defended it, showing rejection wicks / bullish candles.

Bias: Bullish while support holds → look for continuation to next resistance.

Invalidation: Bias weakens if support breaks and closes below the zone.

So as long as price stays above the retested support, USD/CAD remains bullish.

Bearish reversal off multi swing high resistance?USD/CAD is reacting off the resistance level, which is a multi-swing high resistance and could drop from this level to our take profit.

Entry: 1.3782

Why we like it:

There is a multi-swing high resistance.

Stop loss: 1.3855

Why we like it:

There is a swing high resistance that lines up with the 138.2% Fibonacci extension.

Take profit: 1.3702

Why we like it:

There is a pullback support that aligns with the 48.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

TradingView (www.tradingview.com)

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USD/CAD Daily - Triple Bottom Breakout PatternUSD/CAD Daily – Triple Bottom Breakout

The USD/CAD pair on the 1D chart has formed a Triple Bottom pattern, a classic bullish reversal setup after a downtrend. This pattern suggests that sellers were unable to push the price below the established support zone on three separate occasions, signaling strong buying interest.

🔍 Chart Highlights:

Three distinct lows at a consistent support level

Strong bounce after each test of support, confirming bullish defense

Neckline (resistance line) successfully broken, indicating a breakout

Price target projected from the height of the pattern added to the breakout level

📈 Pattern: Triple Bottom

📍 Breakout Level (Neckline): Around 1.37800

🎯 Target: Approx. 1.42000

🛑 Invalidation: A daily close back below the neckline

This breakout may indicate the beginning of a bullish trend continuation, with momentum favoring the bulls as long as price holds above the neckline.

Potential BEARSAfter a prolonged and a complex correction, it looks out to be a FLAT CORRECTION with wave B producing a flat correction as well in a lower degree hence making it all complex. But at the moment we have a perfect channel AB=CD correction which prompts a continuation to the south. Fingers crossed 🤞 as the market rejects a resistance of the channel.

Market Insights with Gary Thomson: 4 - 8 AugustMarket Insights with Gary Thomson: BoE Interest Rate, Canada Jobs Data & Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you navigate the week ahead. Let’s dive in!

In this episode of Market Insights, Gary Thomson unpacks the strategic implications of the week’s most critical events driving global markets.

👉 Key topics covered in this episode:

— BoE Interest Rate Decision

— Unemployment Rate in Canada

— Corporate Earnings Statements

— Trade Tensions

Gain insights to strengthen your trading knowledge.

This video represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Canada's GDP contracts, US nonfarm payrolls misses forecastThe Canadian dollar continues to lose ground against its US counterpart and is trading at two-month lows. In the European session, the Canadian dollar is trading at 1.3875, down 0.13% on the day. USD/CAD has risen for six straight days, climbing 1.9% during that time.

US nonfarm payrolls for July were softer than expected at 73 thousand, compared to the forecast of 110 thousand. The June report was revised sharply downwards to 14 thousand from an initial 147 thousand.

Canada's GDP posted a small decline of 0.1% m/m in May, matching the market estimate. This followed an identical reading in April, as the economy is essentially treading water. A drop in retail trade was a significant factor in the weak GDP reading, particularly in motor vehicles and parts.

The decline in GDP in April and May can be squarely blamed on the trade war with the US, which has put a chill in economic activity. The markets are expecting a slight improvement in June, with an estimate of a 0.1% gain.

The Bank of Canada held the benchmark rate at 2.75% on Thursday for a third consecutive meeting. The rate statement noted that US trade policy remains "unpredictable" and Governor Macklem reiterated this at his press conference, saying that "some level of uncertainty will continue" until the US and Canada reach a trade agreement.

Meanwhile, the trade war between the two sides is heating up. President Trump announced on Thursday that the US was slapping 35% tariffs on Canadian products, effective Aug. 1. The new tariff will not apply to goods covered under the US-Mexico-Canada Agreement.

Canada's Prime Minister Mark Carney said he was "disappointed" with the US decision and vowed that "Canadians will be our own best customer". These are brave words, but Carney will be under pressure to reach a deal with the US, as 75% of Canadian exports are shipped to the US and Canada can ill-afford a protracted trade war with its giant southern neighbor.

USDCAD Update: Don’t Sleep on This Uptrend’s First LegYo traders, Skeptic from Skeptic Lab here! 🚀 USDCAD’s serving a hot long trigger for pattern traders chasing the first leg of a big uptrend! We’ve got an ascending triangle breakout on the daily, with bullish candles stacking up, hinting at a return to the weekly bullish trend. Too early to confirm, but the momentum’s fire.

📈 Today’s FOMC meeting’s got everyone buzzing—will Powell cut, hold, or drop resignation hints? Check the full setup in the video, but with crazy news like Federal Funds Rate

, s tick to high-probability trades, keep risk low, and no FOMO or revenge trading! Drop your thoughts, boost if it vibes <3