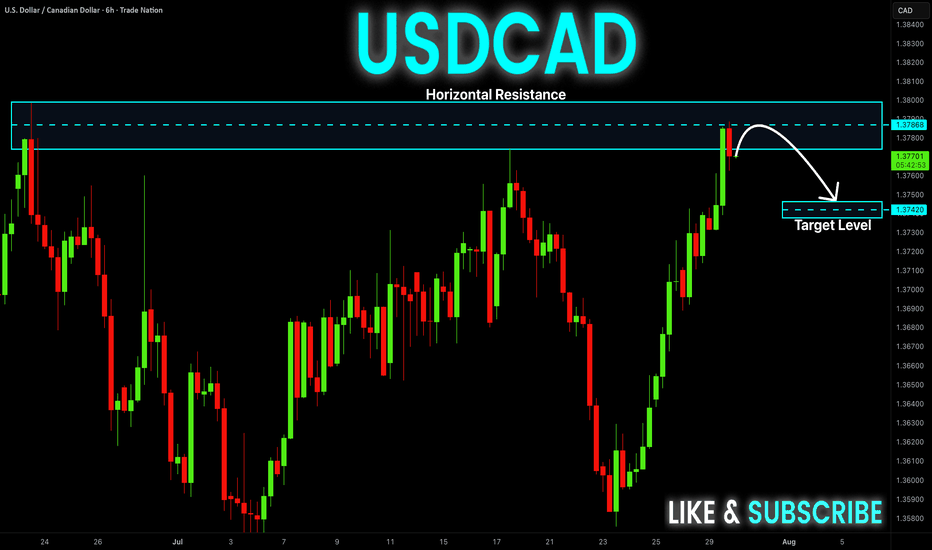

USDCAD Is Bearish! Sell!

Please, check our technical outlook for USDCAD.

Time Frame: 7h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 1.377.

The above observations make me that the market will inevitably achieve 1.369 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

USDCAD trade ideas

Bearish reversal off multi swing high resistance?USD/CAD is reacting off the resistance level, which is a multi-swing high resistance and could drop from this level to our take profit.

Entry: 1.3782

Why we like it:

There is a multi-swing high resistance.

Stop loss: 1.3855

Why we like it:

There is a swing high resistance that lines up with the 138.2% Fibonacci extension.

Take profit: 1.3702

Why we like it:

There is a pullback support that aligns with the 48.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

TradingView (www.tradingview.com)

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Heading into multi swing high resistance?The Loonie (USD/CAD) is rising towards the pivot, which has been identified as a swing high resistance and could reverse to the pullback support.

Pivot: 1.3782

1st Support: 1.3691

1st Resistance: 1.3855

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Heading into multi swing high resistance?The Loonie (USD/CAD) is rising towards the pivot and could reverse to the 1st support, which acts as a multi-swing high support.

Pivot: 1.3758

1st Support: 1.3574

1st Resistance: 1.3844

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

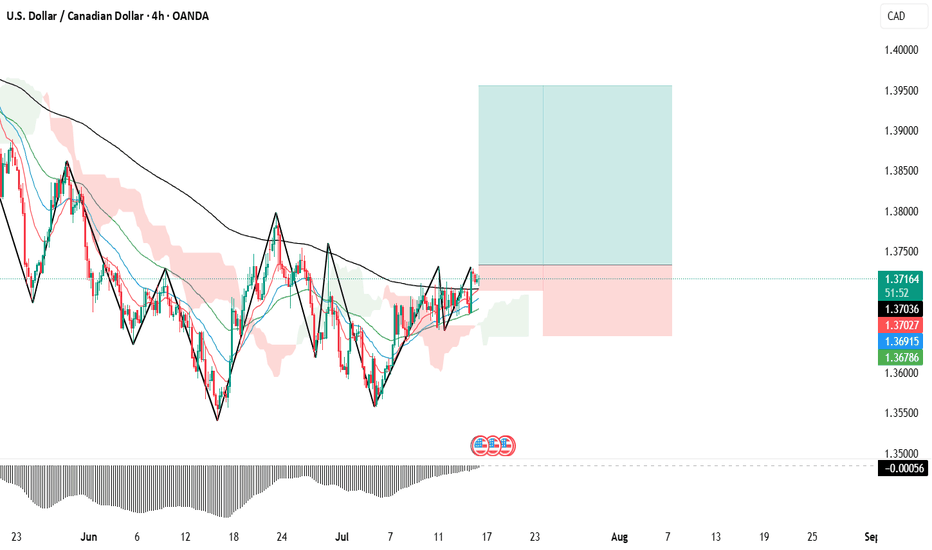

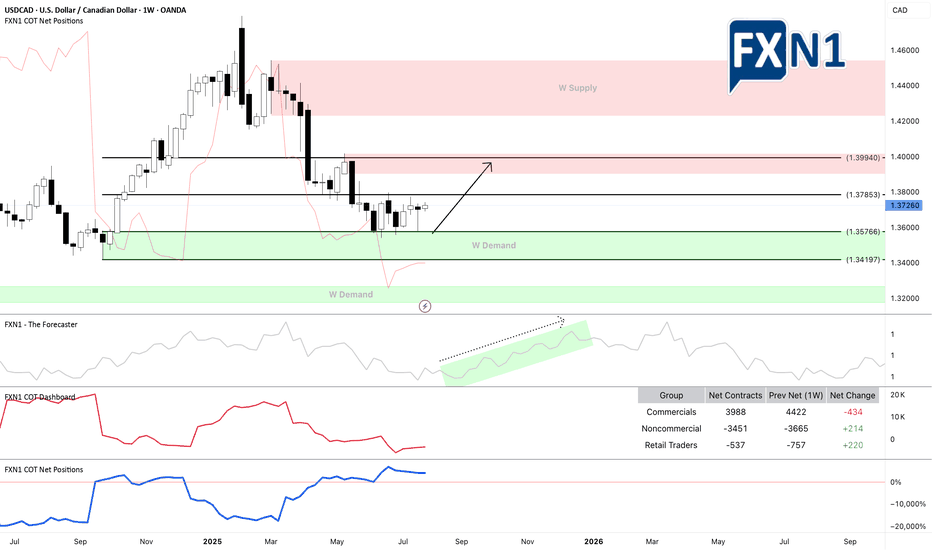

USDCAD Analysis – July 16, 2025

Following the ceasefire between Iran and Israel, oil prices have weakened, reducing support for the Canadian dollar, which is closely tied to crude. As a result, CAD could remain among the weaker currencies over the next two weeks.

Meanwhile, the US dollar may gain strength following the CPI data released on July 15, 2025, potentially setting up a favorable swing opportunity for USDCAD bulls.

🟥 High-Risk Setup – R:R 7.0

This aggressive setup targets a sharp upside move with a tight stop loss, aiming for a high reward relative to the risk. It's suitable for traders comfortable with volatility and willing to accept a lower probability for a higher payout.

🟦 Moderate-Risk Setup – R:R 2.5

A more balanced scenario with a wider stop and a closer target, offering a higher probability of success and smoother trade management. This setup aligns well with swing trading strategies seeking consistent results.

Both setups are based on the current price action structure visible on the chart.

Trade safe, manage your risk, and follow your plan. ✅

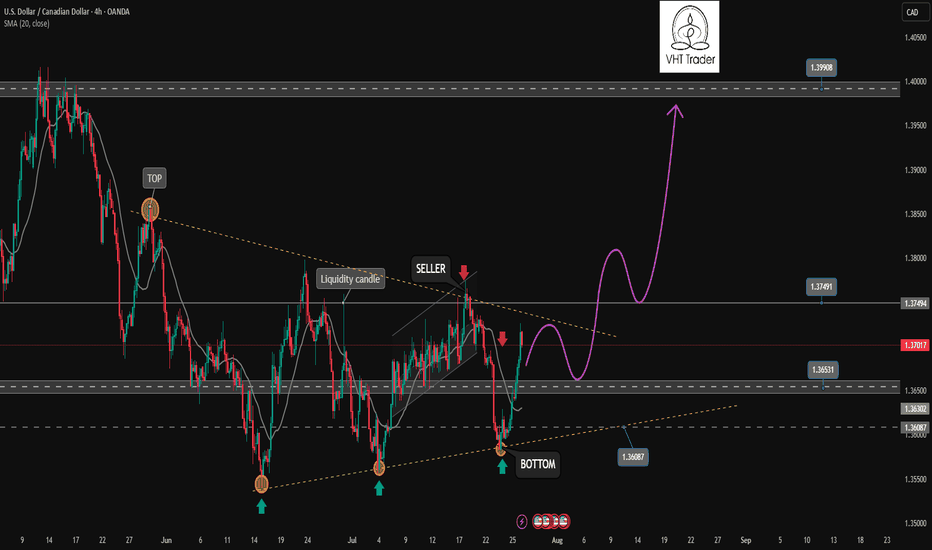

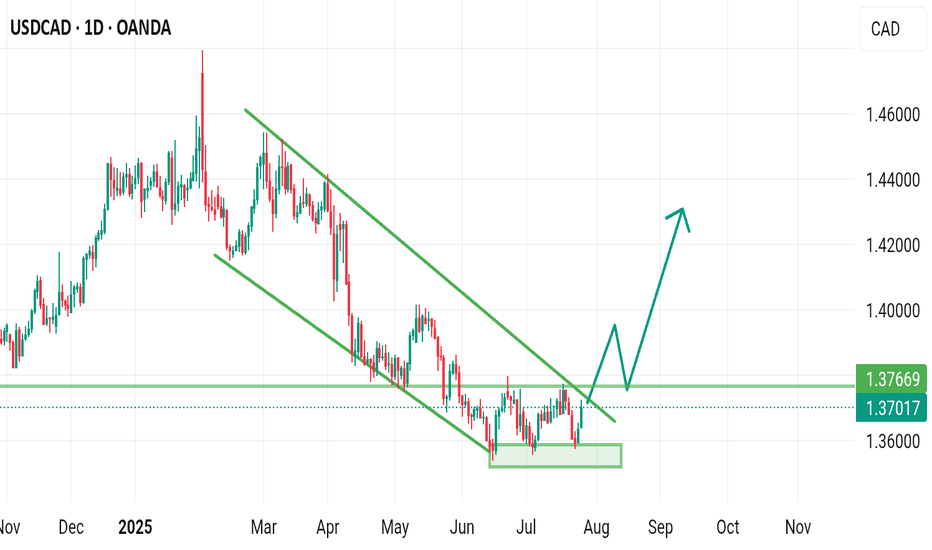

USD/CAD Unless oil rockets, then the pair has room to rise.From June till now, we’ve been in a range-bound market, with multiple failed attempts to break lower.

But now we’re seeing higher lows forming, and price is bouncing off my fvp zone @ 1.36600 . So if the Fed stays patient and oil stays weak or sideways, USD/CAD bulls have the upper hand. I am expecting a bearish retest soon to develop @ Key Bullish FVP Zone: 1.36600, but if 1.3577 gets violated with strength, then scratch the long idea — it might be time for CAD bulls to party instead.

Extreme Discount Zone: Just below at 1.36000,

If the price dips into this area, it could be a liquidity hunt. But if not, then the bulls will have to come in and drive the market to the

1st Take Profit Target: 1.38400

Uptrend is coming. Opportunity for buyers✏️ OANDA:USDCAD is trading close to the upper boundary of the triangle pattern. There is a high possibility that the current bullish momentum will break the upper boundary and form an uptrend for the USDCAD pair. The important price zone for the sellers at the moment is 1.075. If the buyers are strong enough to push the price above 1.075, the sellers will only be really interested in the price zone of 1.340, the high of the pair in May.

📉 Key Levels

Buy trigger: Reject and Trading above 1.365

BUY DCA Break 1.375

Target: 1.400

Leave your comments on the idea. I am happy to read your views.

USD_CAD BULLISH BREAKOUT|LONG|

✅USD_CAD is going up

Now and the pair made a bullish

Breakout of the key horizontal

Level of 1.3800 and the breakout

Is confirmed so we are bullish

Biased and we will be expecting

A further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USD/CAD(20250730)Today's AnalysisMarket News:

According to a Reuters/Ipsos poll, Trump's approval rating has fallen to 40%, the lowest level since his second term.

Technical Analysis:

Today's Buy/Sell Levels:

1.3762

Support and Resistance Levels:

1.3820

1.3798

1.3784

1.3739

1.3725

1.3704

Trading Strategy:

If the price breaks above 1.3784, consider a buy entry, with the first target price at 1.3798. If the price breaks below 1.3762, consider a sell entry, with the first target price at 1.3739.

USD-CAD Short From Resistance! Sell!

Hello,Traders!

USD-CAD went up and

Retested a horizontal

Resistance of 1.3800

From where we are

Already seeing a local

Bearish pullback and

As we are locally bearish

Biased so we will be

Expecting a local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDCAD's Opportunity Bell Is Ringing — Don’t Miss Out!Hey there, my valued friends!

I’ve prepared a fresh USDCAD analysis just for you.

📌 If the 1.37245 level breaks, the next target will be 1.38000.

Every single like you send my way is the biggest motivation behind sharing these analyses.

🙌 Huge thanks to each and every one of you who supports me!

Would you like to add a visual or a catchy headline to boost engagement even more? I can help with that too.

USD/CAD - 6C1! : Trade update FundamentalThe US dollar index (DXY) gained strength against major currencies on Monday following a landmark trade agreement between the United States and the European Union. During the meeting in Scotland on Sunday, President Donald Trump and European Commission President Ursula von der Leyen announced a new trade framework, which includes a 15% import tariff on EU goods—half of the 30% rate Trump had initially threatened to impose starting August 1.

The DXY opened higher at the start of the week, and it’s clear that most currencies are likely to see a decline in response. This trend also extends to pairs like the 6C1! (USDCAD), where the USD has been increasing its long positions. Last week, non-commercial traders added to their holdings, while commercial traders remain at their highest levels since 2021. Based on this setup, we are maintaining a bullish outlook and expect the continuation of our long position strategy.

Previous Idea :

✅ Please share your thoughts about USD/CAD in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Trade deal thread could pump USDCAD?USDCAD as with the bounce off the monthly support level, current is a strong uptrend.4H perspective, price is trading above 10ema since the cross over of 20ema and 10ema price is pushing back to the upside. With trade deal thread, including upcoming GDP on CAD could pump this price back to the resistance ?

As 10ema has not been tested since cross over, we may see the price to back to the upside with respecting the 10ema.

Buying on EMA is a high probability trade setup.

USD/CAD SHORT FROM RESISTANCE

Hello, Friends!

It makes sense for us to go short on USD/CAD right now from the resistance line above with the target of 1.376 because of the confluence of the two strong factors which are the general downtrend on the previous 1W candle and the overbought situation on the lower TF determined by it’s proximity to the upper BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

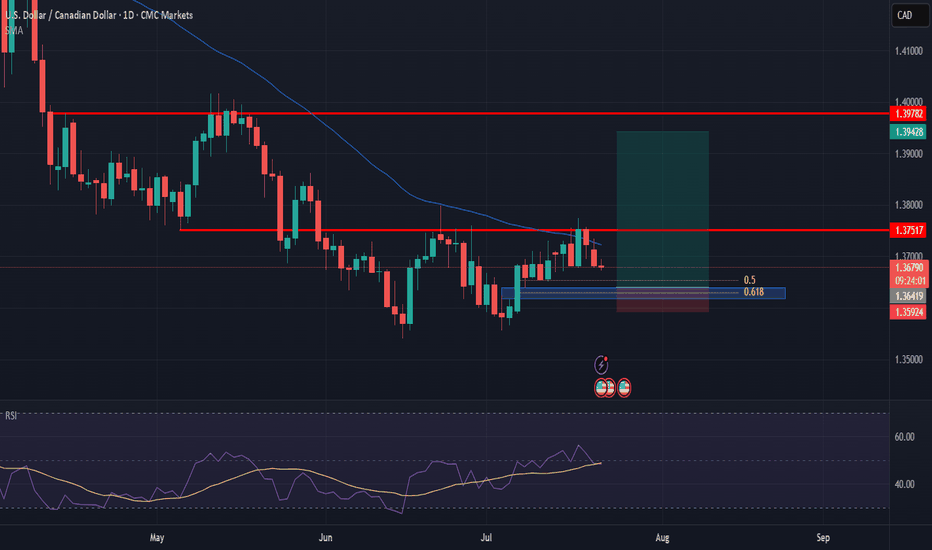

USD/CAD Ascending Triangle BreakoutUSD/CAD was hit hard during the Q2 sell-off in the USD. And with the almost decade long range still in-play for the pair, with the reversal around 1.4500 in February, that makes sense.

The problem quickly became sentiment as sellers jumped on the move so aggressively, and since mid-June bears have had trouble breaking down to any fresh lows.

We can even see an element of this from May, when prices found support at 1.3750 and sellers were suddenly stalled despite a clear downside trend.

This is a great illustration of why sentiment is so important - if anyone that wants to sell or that can sell the pair already has - even the worst news in the world would have trouble pushing fresh lows. Because if there's no supply coming into the market and there's more demand, well, then prices will go up just given basic supply/demand dynamics. And with a heavy built in short position following a clean downside trend, there will be some sellers looking to take profit which is what generates the start of that demand. And then more shorts will be motivated to take profit as they see price rising even with negative news flow, when prices should be falling.

This can continue all the way until we get to a point that is attractive again to draw fresh sellers into the market and in USD/CAD, that was the 1.4000 handle that held a clean show of resistance in mid-May, and that ushered in another wave of selling. But in mid-June, as price got close to the 1.3500 handle, a similar type of thing started to happen as sellers began to shy away from chasing the move.

Initially that allowed for pullback to that same 1.3750 level that was support in May. Sellers took another shot and even as the USD was setting fresh three-year-lows on the first day of Q3, USD/CAD was setting a higher-low above the prior swing. The trendline produced from those two lows came into play just last week - and when combined with the 1.3750 level made for a textbook ascending triangle formation.

Those setups are often tracked with aim of bullish breakout as it's essentially showing a line in the sand that sellers have defended, in this case at 1.3750; but there's a diminishing impact of that resistance as shown from the increasingly higher-lows. The thought is that, eventually, sellers will give way to the buyers that have been defending higher-lows and that will lead to a breakout and fresh highs.

This is what's taking place now in USD/CAD.

This doesn't necessarily mean that bears are done for, as the big question here is the same from back in May, whether we get to a resistance level that's appealing enough to draw fresh shorts into the market. From the chart attached, I've outlined three areas of interest for such, with 1.3900 nearby and 1.4000 above that. If we do see a prolonged push of USD-strength, there's a zone of support-turned-resistance around 1.4151-1.4178 that becomes of interest for bigger-picture scenarios. - js

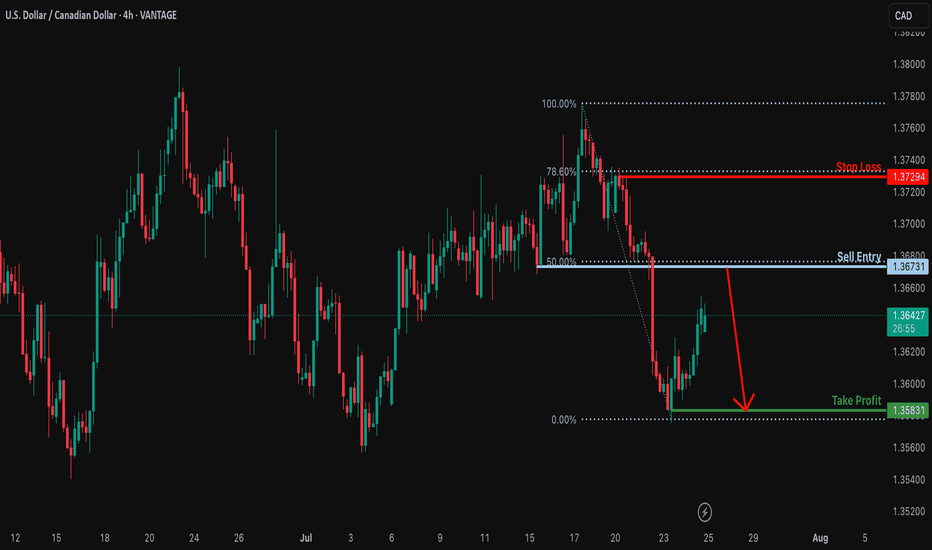

Heading into 50% Fibonacci resistance?USD/CAD is rising towards the resistance level, which serves as a pullback resistance that aligns with the 50% Fibonacci retracement and could reverse from this level to our take-profit target.

Entry: 1.3673

Why we like it:

There is a pullback resistance that lines up with the 50% Fibonacci retracement.

Stop loss: 1.3729

Why we like it:

There is a pullback resistance that lines up with the 78.6% Fibonacci retracement.

Take profit: 1.3583

Why we like it:

There is a swing low support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDCAD ~ Real Time Elliott Wave UpdatesThis is an update of a USDCAD chart I had previously posted. Wave 1(Red) completed and a Wave 2(Red) or Wave A(Grey) has a lso completed. This wave has two readings at the moment because it could be a completed Zigzag or the first Wave of a Flat formation. I will provide updates soon. Analysis remains the same as my previous post and can be used for references. Sentiment still remains buy.