USDCNY trade ideas

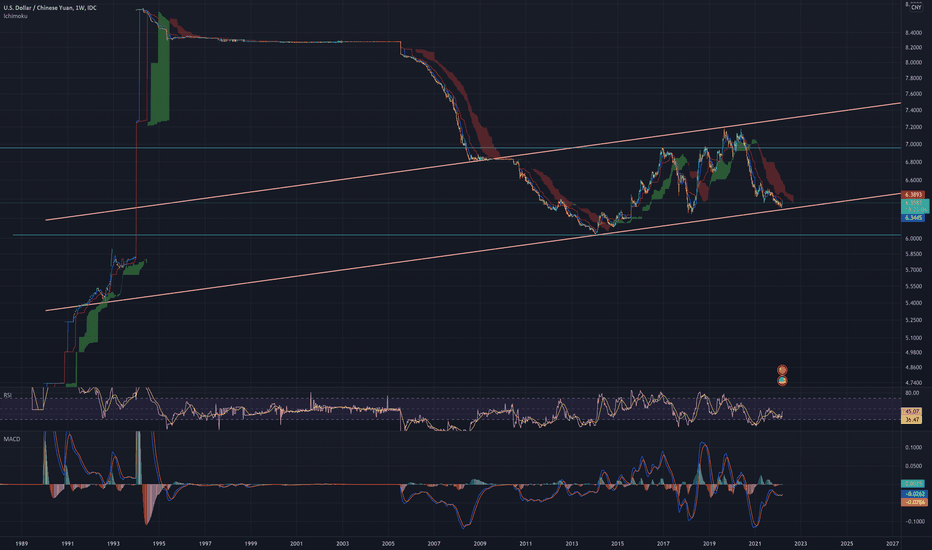

Speculating on CNY .. from a "distance"Looking at the CNY and its highest probable and most immediate index levels that we can theorize and speculate (using fundamentals and reason) the currency reaching in the seemingly distant future.

This is one, if not the most fascinating markets and charted data I have ever studied.

As the most powerful and fastest growing economy on earth, market performance in China will play increasingly more influential roles in the global marketplace and its participants. As the post-world war II global economy continues its evolution in the early 21st century, I will certainly be keeping my eye on the Juan.

On this publishing I am showing the theoretical levels on what would be a full retracement to the .618 of the already completed impulse down from the CNY's all-time high of 8.74. In order for this fibonacci retracement to be properly placed at these levels, the CNY would need to continue the monthly bullish uptrend to the golden pocket zone of around 7.7, where it would then need to break the trend or significantly consolidate.

Its not my most traditional, or most immediately useful piece of work, but, hopefully this is interesting to you like it is to me.

Happy trading, and good luck!

So, I looked at the CNY (Chinese Yuan or Juan) more, and..Check out my most recent publishing(s) referring to this particular exchange rate in the "Related Ideas" section below if your interested in the USDCNY.

I took a closer look at my in-depth analysis over the weekend and felt as though it needed some adjustments (additions*) + further complication..

but its for the better.. hear me out.

Ive been spending the last month or so, and will be spending as much time as necessary to catch up and become more and more familiar with what's appearing to become an even more disastrous real estate market than what we know to be the worst recorded event (in relativity) in capitalism history. ("the 2008 financial crisis")

This event could be worse, simply due to the fact that China is so powerful.. (which is good for us; the money managers!)

As a trader, its important to consider the recent upturn regarding political and socioeconomic gossip. IYKYK

There is plenty of public and freely available information on how to approach any market using fundamental risk management.

Save this, be patient, and ask questions.

Happy trading, and good luck!

Yuan devaluation imminentBy mid August the worldwide market crash will not only begin, but is very likely to already go past its acute phase. Some afterparty left for August and Sept, but the most dramatic action is going to unfold in the next few weeks.

During the crash USDCNY will definitely hit 7.32, but I expect it to go a lot higher. 7.80..7.90 is definitely on the radar.

8.20 is the ultimate target. It will get close, but unlikely to break above.

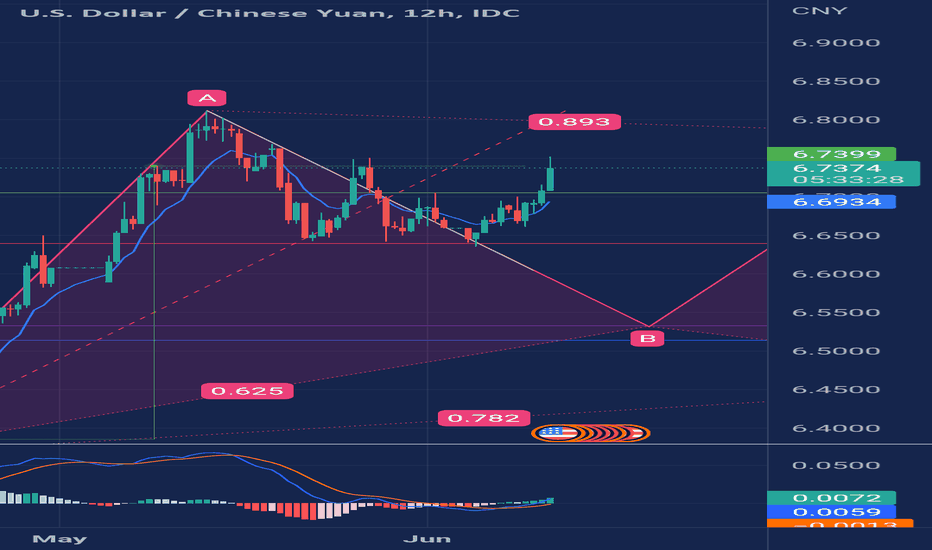

Chinese yuan rebounds on Shanghai reopening hopesThe Chinese yuan rose to one-week highs on Monday, fueled by expectations that Shanghai, the country’s financial hub, will soon emerge from a two-month lockdown that has crippled economic activities in the city and weighed on the country’s overall economic recovery.

The CNY traded at 0.1504 against the greenback on Monday, recovering further from an over one-week low of 0.1481 on Wednesday when the yuan weakened against a basket of 24 currencies tracked by the China Foreign Exchange Trade System (CFETS).

Still, the yuan has fallen below the 0.1570-mark against the USD since April as concerns over China’s economic recovery grew following Shanghai’s prolonged lockdown that has affected consumption, industrial production, lending, foreign trade, and other aspects of the economy. The RSI indicator is at least suggesting that this recovery in the yuan may not last.

Slowing economy

China’s zero COVID-19 policy has definitely taken a toll on the domestic economy. In April, China’s retail sales fell at the sharpest pace in over two years as the lockdowns in Shanghai hammered consumption and the supply of retail goods. There have been reports of food shortage in Shanghai, with state-run Xinhua News reporting that multiple botanists called on residents to stop digging and consuming wild vegetables.

Industrial output, meanwhile, unexpectedly fell in April versus a year earlier, reversing the modest gain in March. The drop in China’s factory output last month was the steepest since the height of the COVID-19 pandemic in February 2020. It came as lockdowns forced the closure of vital factories including those operated by local and domestic carmakers. Shanghai is one of China’s major auto production hubs and the lockdowns weighed on carmakers’ revenues in April.

All-out effort to stimulate economy

As investment banks and economists downgraded their outlook on the Chinese economy this year due to the lockdown’s impact, Beijing has vowed to all-out efforts to stabilize industrial and supply chains and boost infrastructure construction. On Friday, Chinese Premier Li Keqiang acknowledged that the country’s latest economic challenges are worse than those seen in 2020.

Li said the government is "at a critical juncture in determining the economic trend of the whole year.” He urged local governments to make every effort in bringing the economy back to its normal track.

Shanghai reopening

The Shanghai government is working to ease the city’s lockdown, issuing on Sunday an action plan that consists of 50 policies and measures to help stimulate the economy. The measures include relaxing the rules on resuming production starting June 1 and expanding the scope of subsidies for companies’ pandemic prevention and disinfection, state-run Xinhua News reported Sunday.

LongAs analyzed a long time ago, the crazy devaluation of the RMB has just begun. Do not invest in any Chinese assets, which may be cleared. This is not a warning, it is a definite risk. Chinese stocks listed in the United States could be taken off the shelves. Giants are leaving China, so retail investors should not die.

USDCNY - Strength set to continue following 5 Up WeeksSince 1981, the Chinese Renminbi has recorded 5 consecutive up weeks 17 times. Last week marked the 18th occasion. Weekly winning streaks of this length usually led to further gains over the next 7 weeks, providing an average gain of 1.51%, win rate 14 from 17, maximum 5.28%, median 1.52%, minimum -0.06%, standard deviation 1.44%.

Disclaimer: This data is not financial advice. Past performance is not a guide to future performance and may not be repeated. Past performance does not diminish the risk expectancy of any strategy. By its very nature ‘risk’ means you could and most likely will experience losses. No representation or warranty is given as to the accuracy or completeness of any information provided. Data is for educational and informational purposes only.

2022 the end of the Chinese era beginsThe devaluation cycle of RMB will resume. The first goal is 6.6, the second goal is 7.49, and the third goal is 10. With the aging population, the birth rate of China's economy has decreased and began to decline in an all-round way. The collapse of real estate, the withdrawal of foreign capital, debt default, the explosion of China concept shares, and Hong Kong's loss of its status as a financial center. Relations with neighboring countries and western developed economies have deteriorated in an all-round way. In the future, no assets in China are worth investing in, and the Chinese era is over.The world began to go Chinese.

Today's analysis on USDCNYDue to USA involved in the war between the Russia and Ukraine and declining economy according to various economic data, more people in the world show their preferrence to buy safe haven assets including CNY, because of China's stable development. With CNY rising, US dollar has kept falling.

bing chiling is melting downbing chilling!

i miss china so much, but who on earth would want to be there right now while the ccp is having a meltdown in international relations and covid mitigation.

keep it simple, keep it free.

just let the people be.

a little bit of my heart will forever belong to shenyang and dandong.

USDCNY Establishing a New Accumulation Range The price action of USDCNY is currently establishing a major Accumulation range, as postulated by the Wyckoff Method, between the support level at 6.3450 and the 23.6 per cent Fibonacci retracement level.

The completion of the preceding downtrend, underscored by the descending channel, is confirmed by the completion of a 1-5 Elliott impulse wave pattern.

A potential breakout above the upper limit of the channel could signify a subsequent test of the 23.6 per cent Fibonacci once more.