USDDKK trade ideas

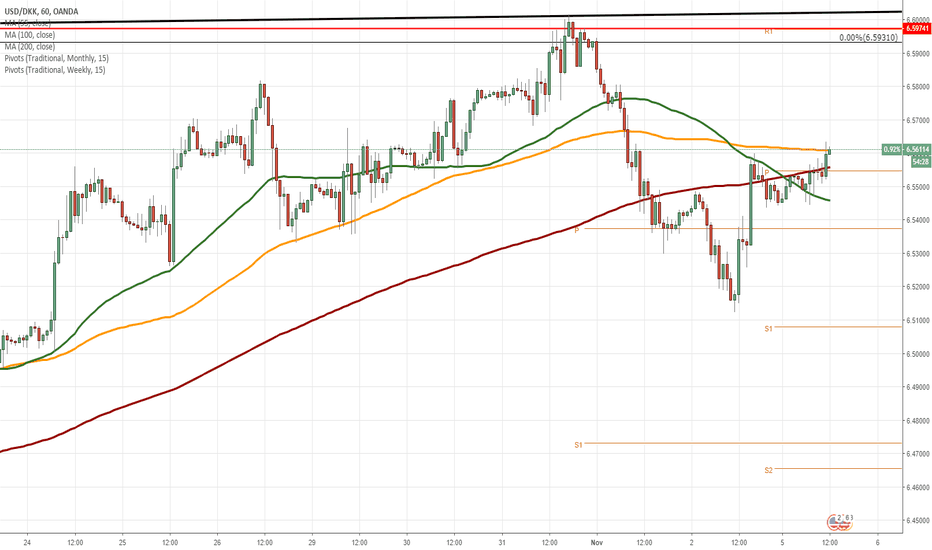

USD/DKK 1H Chart: Previous forecast at workThe previous forecast worked, and the USD/DKK currency pair has reached the upper boundary of a long-term ascending channel located circa 6.6000.

As apparent on the chart, the exchange rate reversed south from the upper channel line at the beginning of November. From a theoretical point of view, it is expected that the pair goes downwards. A potential target is the Fibonacci 23.60% retracement at 6.4443.

However, technical indicators for the long run suggest that bullish momentum should continue to prevail. In this case, it is likely that the pair re-tests the upper channel line in the nearest future. If given channel does not hold, a breakout north occurs within the following sessions.

USD/DKK 1H Chart: Bulls likely to prevailThe US Dollar has been appreciating against the Danish Krone after the currency pair reversed from the lower boundary of a long-term ascending channel at 6.3200.

Currently, the exchange rate is trading in a short-term ascending channel as well. It is expected that the pair will breach the junior trend and will aim for the upper boundary of the senior channel located circa 6.6000. An important level to look out for is the 2018 high at 6.5691.

It is the unlikely case that some bearish pressure still prevails in the market, the US Dollar should not exceed the 100– and 200-period SMAs (4H), currently located near 6.4140.

USD/DKK 1H Chart: Bulls likely to prevailThe US Dollar is appreciating against the Danish Krone in a short term ascending channel. This gradual increase in price began when the rate reversed from the 6.3600 mark.

Currently, the rate is being supported by the 55– and 100-hour SMAs on the 1H time-frame. It is expected that the rate eventually gathers the necessary momentum to breach the junior channel.

However, it should be taken into account that the pair is pressured by the 200-hour SMA at 6.4126 and this advance might not be immediate.

An important level to look out for is the monthly R1 at 6.4312.

Reaction from 50 weekly Fib retracementPrice was pushed off weekly 50 Fibonacci level forming a shooting star on daily. Half of the move already took place and this is how far we can short on hourly after Fib extension (there is cloud support on 4 hours | weekly | monthly and daily tenkan-sen at that extension).

New bullish leg initiated. Long.USDDKK has preserved the long term Channel Up on 1W (RSI = 69.995, MACD = 0.069, Highs/Lows = 0.1019, B/BP = 0.3423) as it broke the previous consolidation on 1D to the upside. As you see on the chart there are recurring patterns on 1D (Channel Up after Rectangle) so the pair will now most likely print a Channel Up (RSI = 67.432, ADX = 34.541) on 1D towards the next Monthly Resistace = 6.69018. Our long's TP is 6.67021.