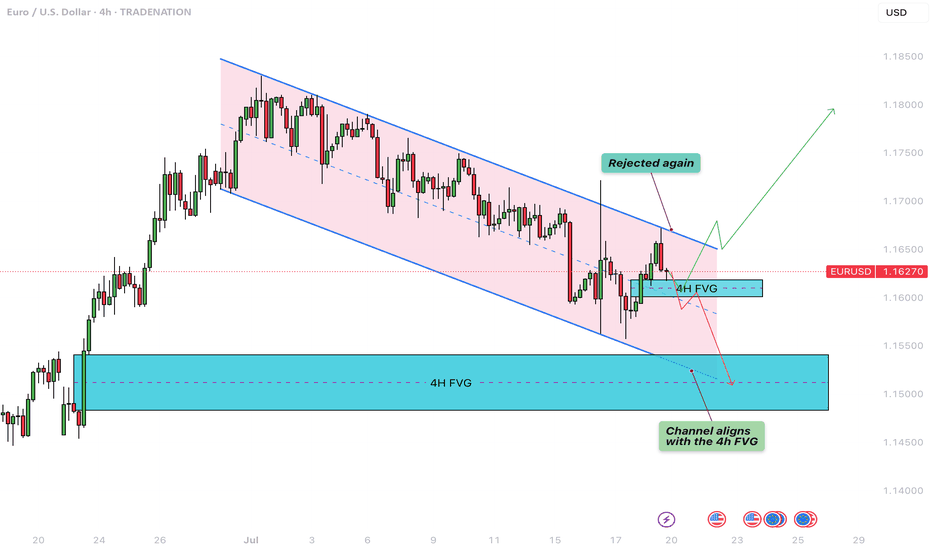

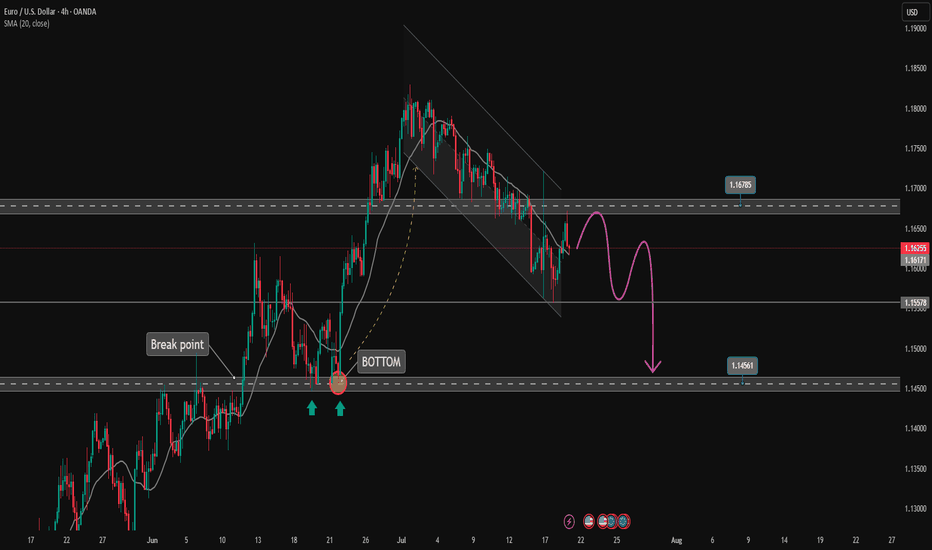

EURUSD - Parallel channel in play!The following chart offers a closer look at the current structure of the EUR/USD pair on the 4-hour timeframe. Price action has been respecting a well-defined bearish parallel channel, which has provided clear boundaries for both resistance and support. Based on the ongoing reaction to these levels, we outline both bullish and bearish scenarios that could unfold in the coming sessions.

Bearish Parallel Channel

Since June 30, EUR/USD has been consistently moving within a downward-sloping bearish parallel channel. Each attempt to break above the upper boundary of the channel has been rejected, while the lower boundary continues to act as dynamic support. This sustained rejection from the upper trendline confirms the strength of the bearish momentum currently at play. The pair remains structurally weak unless a clean breakout to the upside occurs, accompanied by strong bullish confirmation.

Bullish Scenario

A potential bullish reversal could materialize if EUR/USD manages to hold above the 4-hour Fair Value Gap (FVG) located between 1.1620 and 1.1600. This zone may provide the necessary support for the bulls to step in. If the price maintains strength within or just above this FVG and buyers begin to show dominance, a rebound toward the upper boundary of the channel could occur. A successful breakout above the channel could then trigger a stronger rally, possibly targeting the 1.1750–1.1800 region, marking a clear shift in short-term momentum.

Bearish Scenario

Conversely, if the pair fails to hold the 4-hour FVG between 1.1620 and 1.1600 and closes a strong bearish 4-hour candle below this zone, the market may be setting up for further downside. This would suggest a rejection of the FVG as resistance and open the path for a drop toward the lower end of the channel. Interestingly, this area also aligns with a previously established larger 4-hour FVG. A move into this deeper FVG could present a more favorable zone for a longer-term bullish reversal, as it offers a stronger liquidity pool and potential demand area.

Final Thoughts

The EUR/USD pair is at a critical juncture. Price is hovering near a key support zone within a bearish channel that has defined its movement for several weeks. Whether bulls can hold this support and break above the channel, or bears take control and push it lower toward the broader 4-hour FVG, will determine the next major directional move. Traders should closely monitor price action around the 1.1620–1.1600 level for clues on the likely breakout direction.

--------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like and leave a comment, I’d love to hear your thoughts!

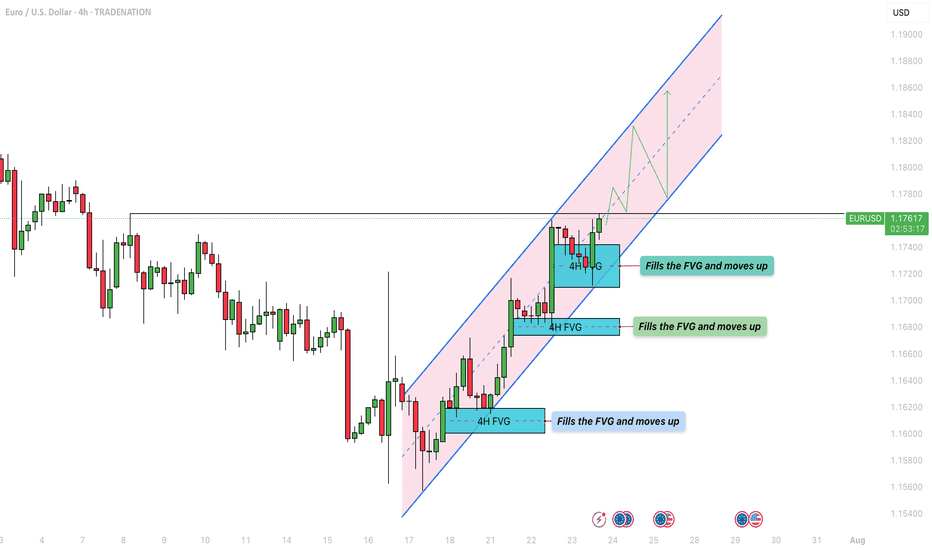

USDEUR trade ideas

EUR/USD - Bullish parallel channel formation!The EUR/USD currency pair is currently exhibiting a bullish market structure on the 4-hour timeframe, moving steadily within a well-defined ascending parallel channel. Price action has consistently bounced between the lower and upper boundaries of the channel, with each dip finding support at the lower trendline and each rally meeting resistance near the upper trendline. This ongoing pattern suggests a strong and orderly bullish trend as the pair continues to make higher highs and higher lows within the channel.

The Market’s Upward Momentum

One notable feature of this trend is the recurring formation of 4-hour Fair Value Gaps (FVGs) during each upward leg. These FVGs act as temporary inefficiencies in the price movement, which the market consistently returns to fill before resuming its bullish momentum. As shown in the chart, the EUR/USD has filled multiple FVGs over the past week. Today, the pair once again retraced to fill a newly formed 4H FVG and has since continued its move higher. This repeated behavior reinforces the strength of the uptrend, as the market efficiently corrects itself and then propels further in the direction of the overall trend.

Bullish Outlook

From a bullish perspective, the key level to watch is the horizontal resistance zone around 1.1766. A confirmed break and hold above this level would signal a strong continuation of the current uptrend. Should the price sustain itself above this level, it could initiate a renewed push toward the upper boundary of the ascending channel, potentially targeting levels near 1.1820 and beyond. This scenario would confirm market confidence and open the door for further gains.

Bearish Risk

On the flip side, the bearish case would involve a false breakout above the 1.1766 resistance level, followed by a sharp rejection and a break below the rising lower trendline of the channel. Such a move would invalidate the current structure and shift the bias to the downside. In that case, the 4-hour FVG located between approximately 1.1710 and 1.1740 will act as a critical support zone. If this area fails to hold, it could trigger a deeper retracement and potentially lead to a more prolonged bearish correction.

Final thoughts

In summary, the EUR/USD is currently respecting a bullish parallel channel on the 4-hour timeframe, with upward moves consistently leaving and then filling 4H FVGs before continuing higher. The 1.1766 level is pivotal, a sustained break above it favors continued bullish momentum, while a rejection and breakdown from the channel could signal a bearish reversal. Traders should closely monitor price behavior around this key level and the integrity of the ascending channel to anticipate the next significant move.

-------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

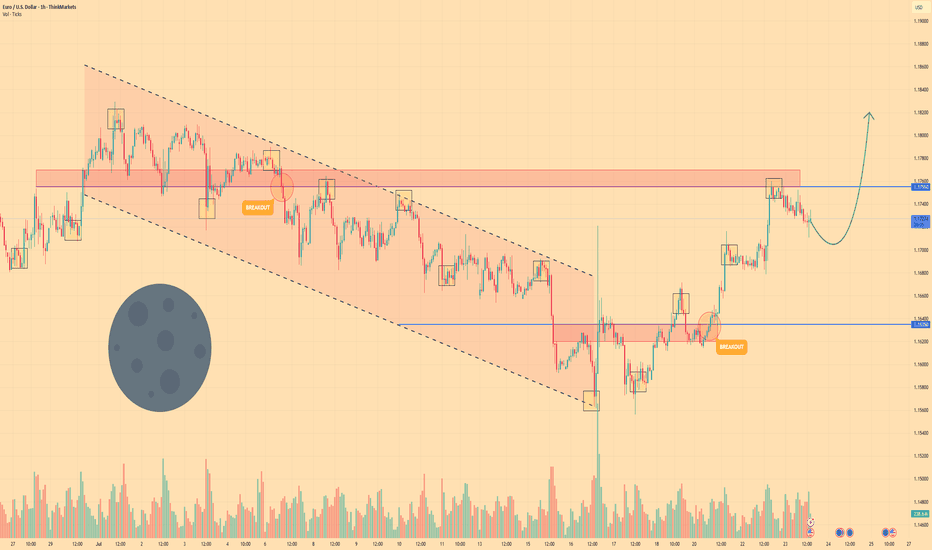

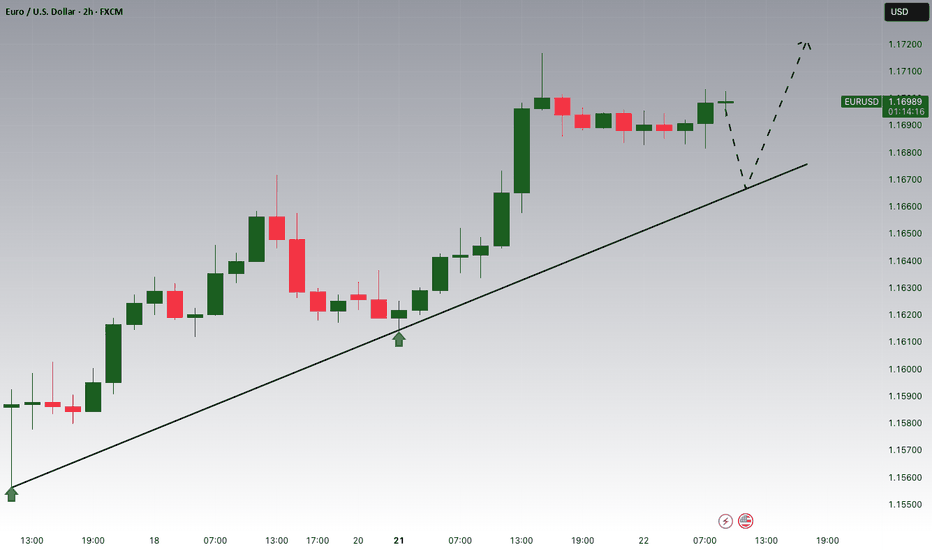

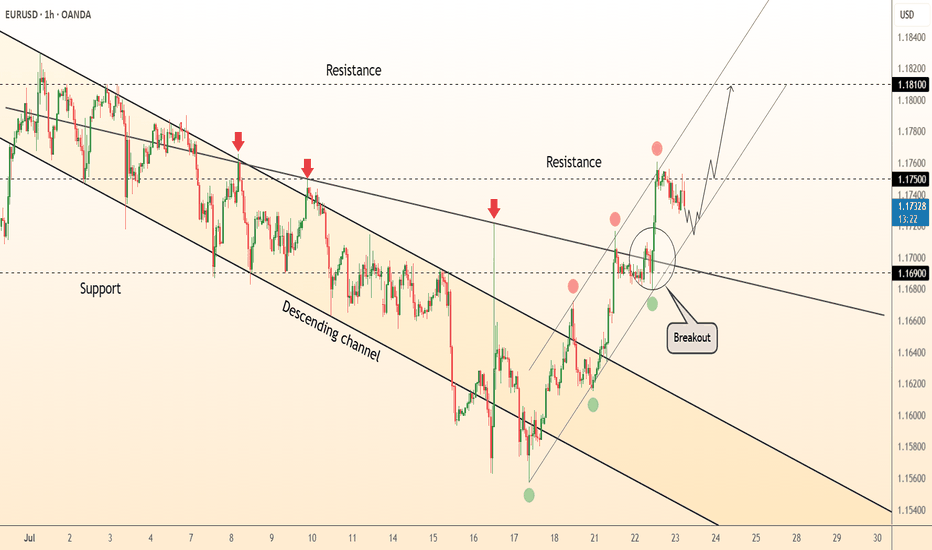

Euro may reach resistance level, break it and continue to growHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

For an extended period, the price was dictated by a descending channel, with each rally attempt failing at its upper boundary.

The downward trend culminated in a test of the crucial support level at $1.1635, where sellers were unable to secure a foothold, signaling a potential momentum shift.

This shift was confirmed when buyers took control, launching an upward impulse that decisively breached the long-standing resistance of the channel's upper trendline.

After the breakout, the price established a new local support base above the former channel, solidifying the change in market structure.

The subsequent rally carried the asset's price to the significant horizontal resistance zone around $1.1755, where the upward advance has temporarily stalled.

I expect that after a brief consolidation, bullish pressure will resume, enabling the price to break the $1.1755 barrier and continue towards the $1.1820 target.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

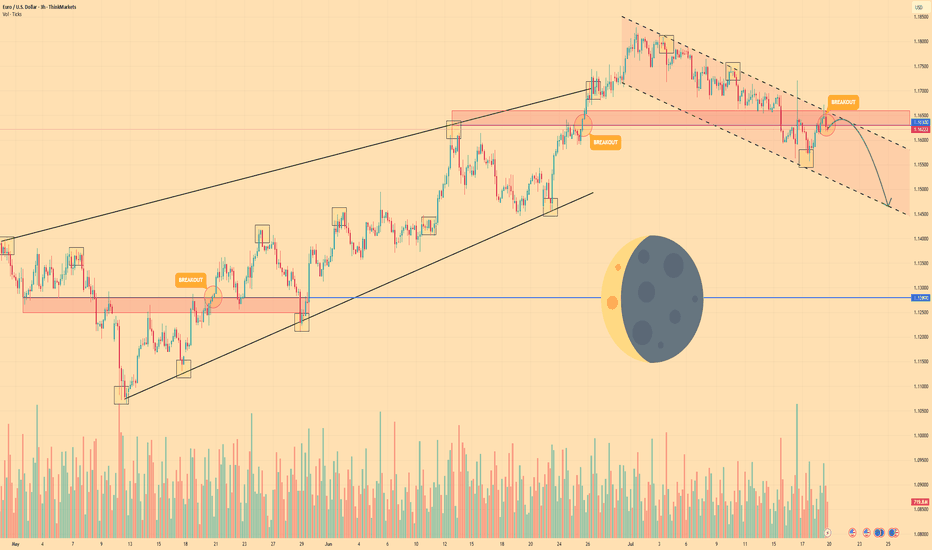

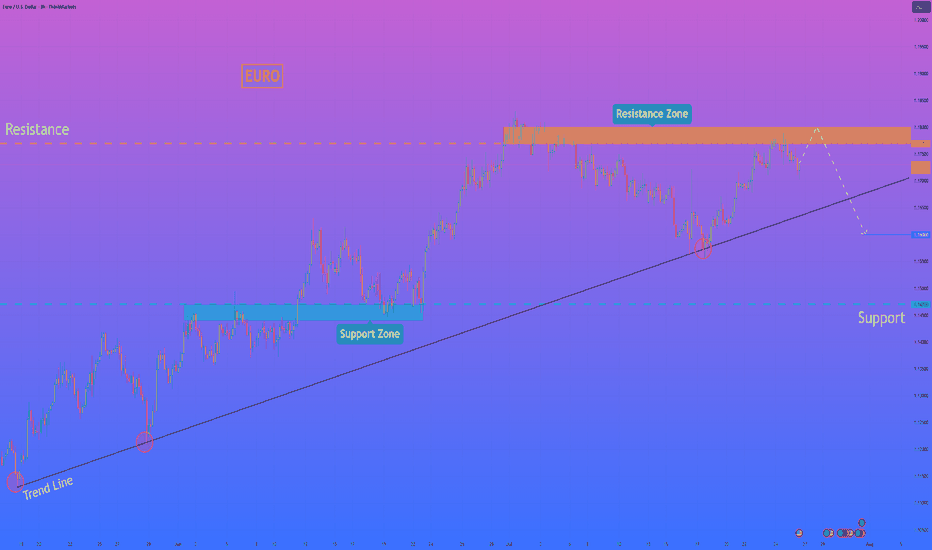

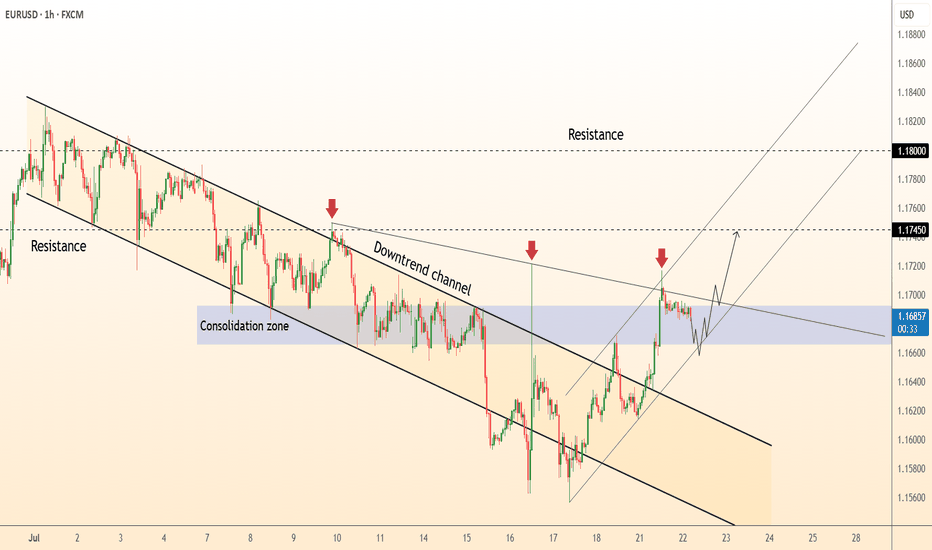

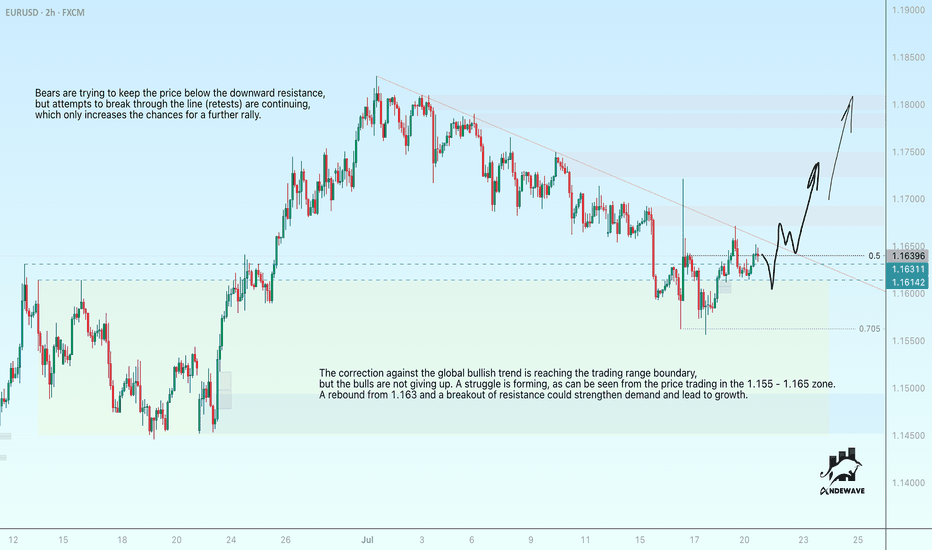

EURO - Price can continue to decline in falling channelHi guys, this is my overview for EURUSD, feel free to check it and write your feedback in comments👊

For a long time, the price was moving within a large ascending wedge, showing a gradual upward trend.

However, buyers failed to maintain momentum, and the price made a decisive breakout below the wedge's support line.

Following the breakout, the instrument established a new structure, a local falling channel, and has been trading within its boundaries since.

Currently, the price is in a corrective upward move, approaching the key resistance area of $1.1630 - $1.1660.

This zone is significant as it aligns with a previous support level and the upper boundary of the current falling channel.

I expect that the price will face rejection from this resistance area and will then continue its decline towards the channel's support line, targeting the $1.1465 level.

If this post is useful to you, you can support me with like/boost and advice in comments❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

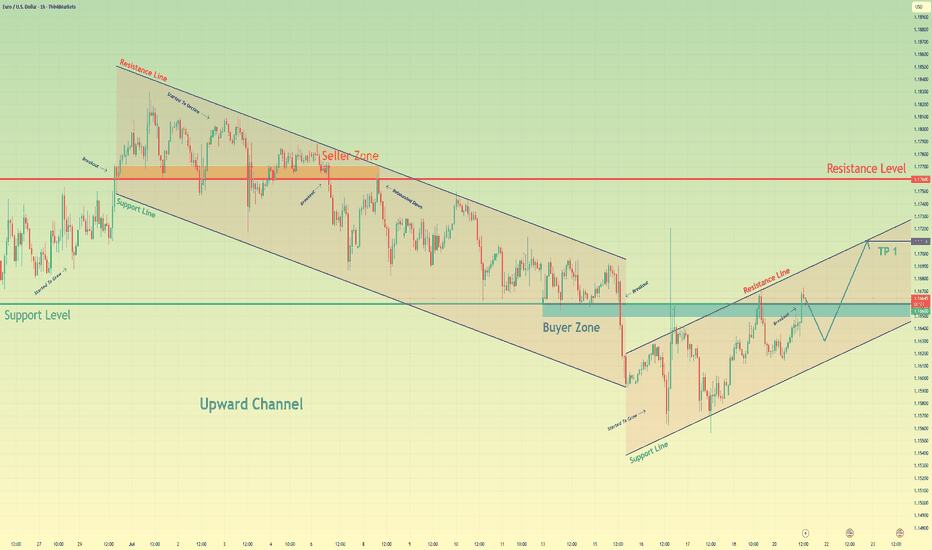

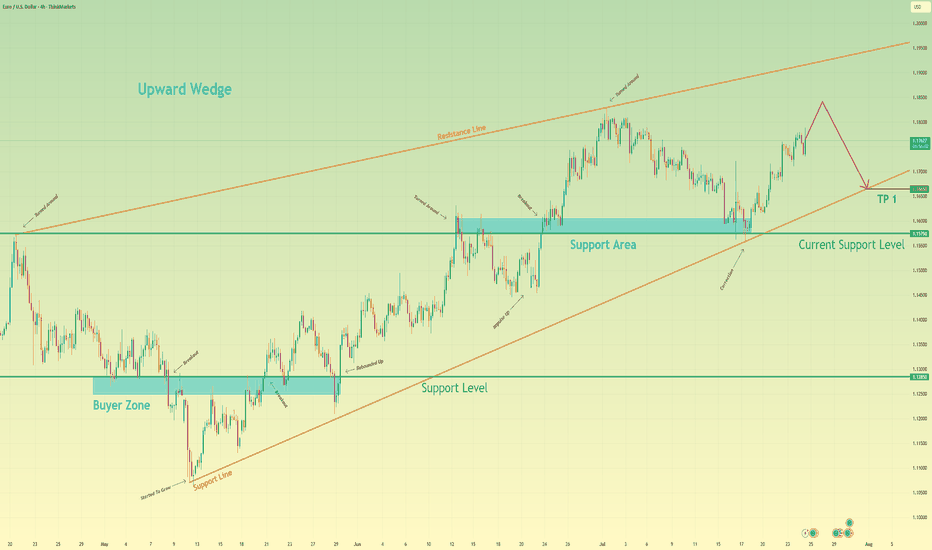

Euro may correct a little and then continue to rise in channelHello traders, I want share with you my opinion about Euro. Observing the recent price action, we can map out a clear transition in market structure. Previously, the pair was contained within a well-defined downward channel, where the seller zone around the 1.1760 resistance level consistently capped rallies, leading to multiple breakdowns and correctional movements. However, after a final push lower, the dynamic shifted, with the price action showing a clear downtrend-to-uptrend reversal. Currently, the euro has established a new upward channel, finding solid ground in the buyer zone around the 1.1660 support level. The price is now engaged in a constructive upward movement within the boundaries of this new channel. The prevailing hypothesis is that after a potential minor correction towards the channel's support line, the pair will resume its ascent. Therefore, the take-profit target for this scenario, tp 1, is strategically placed at 1.1710, as this level directly corresponds with the resistance line of the current upward channel, representing a logical point for price to react. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

123 Quick Learn Trading Tips - Tip #7 - The Dual Power of Math123 Quick Learn Trading Tips - Tip #7

The Dual Power of Math: Logic for Analysis, Willpower for Victory

✅ An ideal trader is a mix of a sharp analyst and a tough fighter .

To succeed in the financial markets, you need both logical decision-making and the willpower to stay on track.

Mathematics is the perfect gym to develop both of these key skills at the same time.

From a logical standpoint, math turns your mind into a powerful analysis tool. It teaches you how to break down complex problems into smaller parts, recognize patterns, and build your trading strategies with step-by-step thinking.

This is the exact skill you need to deeply understand probabilities and accurately calculate risk-to-reward ratios. 🧠

But the power of math doesn't end with logic. Wrestling with a difficult problem and not giving up builds a steel-like fighting spirit. This mental strength helps you stay calm during drawdowns and stick to your trading plan.

"Analyze with the precision of a mathematician and trade with the fighting spirit of a mathematician 👨🏻🎓,

not with the excitement of a gambler 🎲. "

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader.

Look forward to the next one! 🌟

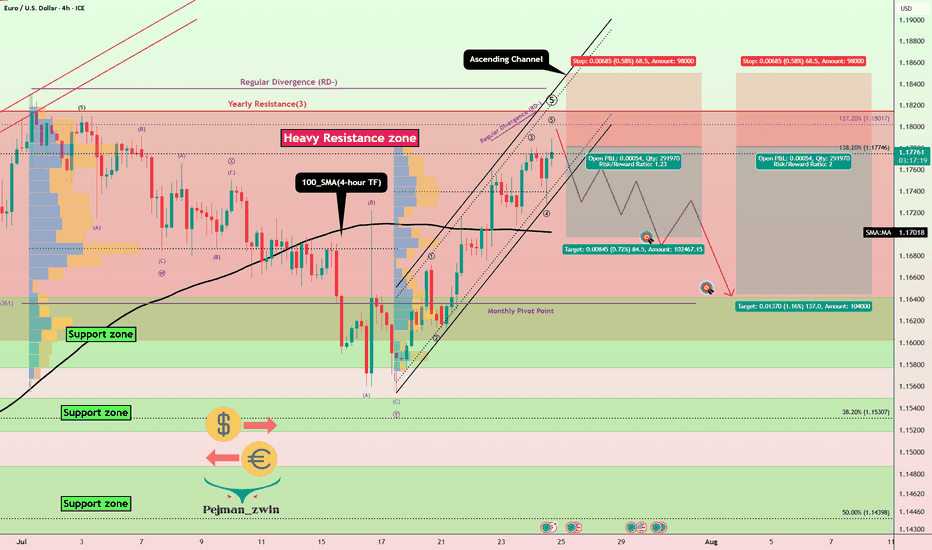

EURUSD at Make-or-Break Zone: Time to Short?EURUSD – Key Data Out Today, Short Setup Confirmed?

Today, several important economic indexes were released for both the Euro(EUR) and the Dollar(USD) . Let’s break them down in a simple way:

Eurozone PMI Data: Mixed to Weak

France:

Manufacturing PMI: 48.4 (slightly lower than forecast)

Services PMI : 49.7 (flat, but below 50 = contraction)

Germany:

Manufacturing PMI: 49.2 (weaker than expected)

Services PMI : 50.1(slightly expansionary)

Eurozone Overall:

Manufacturing PMI: 49.8 (still below 50)

Services PMI : 51.2 (slightly stronger than forecast)

ECB left the Main Refinancing Rate unchanged at 2.15% , which was widely expected.

U.S. Data( TVC:DXY ): Strong and Surprising

Unemployment Claims: 217K (better than expected 227K)

Manufacturing PMI: 49.5 (below forecast of 52.7 – a negative surprise)

Services PMI: 55.2 (well above forecast and previous – bullish for USD)

Interpretation :

The Eurozone's growth remains sluggish, especially in France and Germany.

Despite a drop in U.S. manufacturing, the services sector remains strong, and unemployment data confirms labor market resilience.

This mixed picture slightly tilts the balance in favor of the U.S. dollar, especially as the ECB remains on hold while the Fed may still consider being restrictive.

Bias: Short EURUSD ( FX:EURUSD )

Fundamentals support a Short position in EURUSD, in line with the current technical setup.

---------------------------------

Now let's take a look at the EURUSD chart on the 4-hour time frame to find the best Short position .

EURUSD is currently trading in an Ascending Channel and at a Heavy Resistance zone($1.1845-$1.1602) .

Also, in terms of Elliott wave theory , it seems that EURUSD is completing a microwave 5 of the main wave 5 .

One of the most important supports ahead for EURUSD could be the 100_SMA(4-hour TF) .

If the currently 4-hour candlestick forms a Shooting Star Candlestick Pattern , it is a better sign for EURUSD to fall .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks .

I expect EURUSD to decline to at least $1.169 AFTER breaking the lower line of the ascending channel .

Second Target: Support zone($1.1642-$1.158) and Monthly Pivot Point.

Note: Stop Loss(SL)= $1.1850

Please respect each other's ideas and express them politely if you agree or disagree.

Euro/U.S. Dollar Analyze (EURUSD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

HelenP. I Euro can reach resistance zone and then dropHi folks today I'm prepared for you Euro analytics. If we look at the chart, we can observe a mature uptrend that has been supported by a major ascending trend line for an extended period. However, the momentum of this trend appears to be waning, as evidenced by the price's recent failure to establish new highs. The asset is currently trading below the critical resistance zone of 1.1770 - 1.1800, an area that has proven to be a significant barrier for buyers. My analysis for a short position is based on the condition of a final retest of this resistance zone. I believe the price will make another attempt to rally into this area, and a forceful rejection from this zone would serve as the confirmation that sellers are taking definitive control of the market. Such a rejection would likely initiate a strong downward impulse with sufficient momentum to break the long-standing ascending trend line, a pivotal event that would shift the market structure. Therefore, the primary goal for this bearish scenario is set at the 1.1600 level, a logical target for the price to reach after such a significant structural break. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

Trading Divergences With Wedges in ForexTrading Divergences With Wedges in Forex

Divergence trading in forex is a powerful technique for analysing market movements, as is observing rising and falling wedges. This article explores the synergy between divergence trading and wedges in forex, offering insights into how traders can leverage these signals. From the basics to advanced strategies, learn how you could utilise this approach effectively, potentially enhancing your trading skills in the dynamic forex market.

Understanding Divergences

In forex trading, the concept of divergence plays a pivotal role in identifying potential market shifts. A divergence in forex, meaning a situation where price action and a technical indicator like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) move in opposite directions, often signals a weakening trend. This discrepancy is a valuable tool in divergence chart trading, as it may indicate a possible reversal or continuation of the current trend.

There are two primary types of divergence in forex—regular and hidden. Regular divergence occurs when the price makes higher highs or lower lows while the indicator does the opposite, often signalling a reversal. Hidden divergence, on the other hand, happens when the price makes lower highs or higher lows while the indicator shows higher highs or lower lows, typically suggesting a continuation of the current trend.

Trading Rising and Falling Wedges

Rising and falling wedges are significant patterns in forex trading, often signalling potential trend reversals. A rising wedge, formed by converging upward trendlines, often indicates a bearish reversal if it appears in an uptrend. Conversely, a falling wedge, characterised by converging downward trendlines, typically reflects a bullish reversal if it occurs in a downtrend.

Traders often look for a breakout from these patterns as a signal to enter trades. For rising wedges, a downward breakout can be seen as a sell signal, while an upward breakout from a falling wedge is often interpreted as a buy signal. When combined with divergences, this chart pattern can add confirmation and precede strong movements.

Best Practices for Trading Divergences

Trading divergence patterns in forex requires a keen eye for detail and a disciplined, holistic approach. Here are key practices for effective trading:

- Comprehensive Analysis: Before trading on divergence and wedges, be sure to analyse overall market conditions.

- Selecting the Right Indicator: Choose a forex divergence indicator that suits your trading style. Common choices include RSI, MACD, and Stochastic.

- Confirmation Is Key: It’s best to watch for additional confirmation from price action or other technical tools before entering a trade.

- Risk Management: Traders always set stop-loss orders to manage risk effectively. Divergence trading isn't foolproof; protecting your capital is crucial.

- Patience in Entry and Exit: Be patient as the divergence develops and confirm with your chosen indicators before entering or exiting a trade.

Strategy 1: RSI and Wedge Divergence

Traders focus on regular divergence patterns when the RSI is above 70 (overbought) or below 30 (oversold), combined with a rising or falling wedge pattern. The strategy hinges on identifying highs or lows within these RSI extremes. It's not crucial if the RSI remains consistently overbought or oversold, or if it fluctuates in and out of these zones.

Entry

- Traders may observe a regular divergence where both the price highs/lows and RSI readings are above 70 or below 30.

- After the formation of a lower high (in an overbought zone) or a higher low (in an oversold zone) in the RSI, traders typically watch as the RSI crosses back below 70 or above 30. This is accompanied by a breakout from a rising or falling wedge, acting as a potential signal to enter.

Stop Loss

- Stop losses might be set just beyond the high or low of the wedge.

Take Profit

- Profit targets may be established at suitable support/resistance levels.

- Another potential approach is to exit when the RSI crosses back into the opposite overbought/oversold territory.

Strategy 2: MACD and Wedge Divergence

Regarded as one of the best divergence trading strategies, MACD divergence focuses on the discrepancy between price action and the MACD histogram. The strategy is particularly potent when combined with a rising or falling wedge pattern in price.

Entry

- Traders typically observe for the MACD histogram to diverge from the price. This divergence manifests as the price reaching new highs or lows while the MACD histogram fails to do the same.

- The strategy involves waiting for the MACD signal line to cross over the MACD line in the direction of the anticipated reversal. This crossover should coincide with a breakout from the rising or falling wedge.

- After these conditions are met, traders may consider entering a trade in anticipation of a trend reversal.

Stop Loss

- Stop losses may be set beyond the high or low of the wedge, which may help traders manage risk by identifying a clear exit point if the anticipated reversal does not materialise.

Take Profit

- Profit targets might be established at nearby support or resistance levels, allowing traders to capitalise on the expected move while managing potential downside.

Strategy 3: Stochastic and Wedge Divergence

Stochastic divergence is a key technique for divergence day trading in forex, especially useful for identifying potential trend reversals. This strategy typically employs the Stochastic Oscillator with settings of 14, 3, 3.

Entry

- Traders may look for divergence scenarios where the Stochastic readings are above 80 or below 20, mirroring the RSI approach.

- This divergence is observed in conjunction with price action, forming a rising or falling wedge.

- Entry may be considered following a breakout from the wedge, which signals a potential shift in market direction.

Stop Loss

- Setting stop losses just beyond the high or low of the wedge might be an effective approach.

Take Profit

- Profit targets may be set at key support/resistance levels.

The Bottom Line

Divergence trading, coupled with the analysis of rising and falling wedges, offers a comprehensive approach to navigating the forex market. By integrating the discussed strategies with sound risk management and market analysis, traders may potentially enhance their ability to make informed decisions in the dynamic world of forex.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Euro will rise a little and then start to fall to support lineHello traders, I want share with you my opinion about Euro. After a prolonged consolidation period, a strong upward trend was initiated from the buyer zone around 1.1285, propelling the EUR significantly higher. This initial impulsive move has since transitioned into a more complex and mature phase, taking the shape of a large upward wedge formation, a pattern which often signals underlying exhaustion in the prevailing trend. Currently, the pair is operating within this defined market zone, characterized by a clear ascending support line and a corresponding resistance line. The price action inside the wedge has become corrective, with the most recent upward correction originating from the support area near 1.1575. The working hypothesis is centered on a short-term bearish scenario, which anticipates that this current rally will fail as it approaches the upper boundary of the wedge. A rejection from this resistance would confirm that selling pressure is increasing and that the bullish momentum is waning. This would likely trigger a significant downward rotation within the structure, with the immediate objective being a retest of the main ascending support line. For this reason, the TP is strategically and logically placed at the 1.1665 level, as this point lies directly on the trend line and serves as the most critical test for the existing uptrend's viability. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

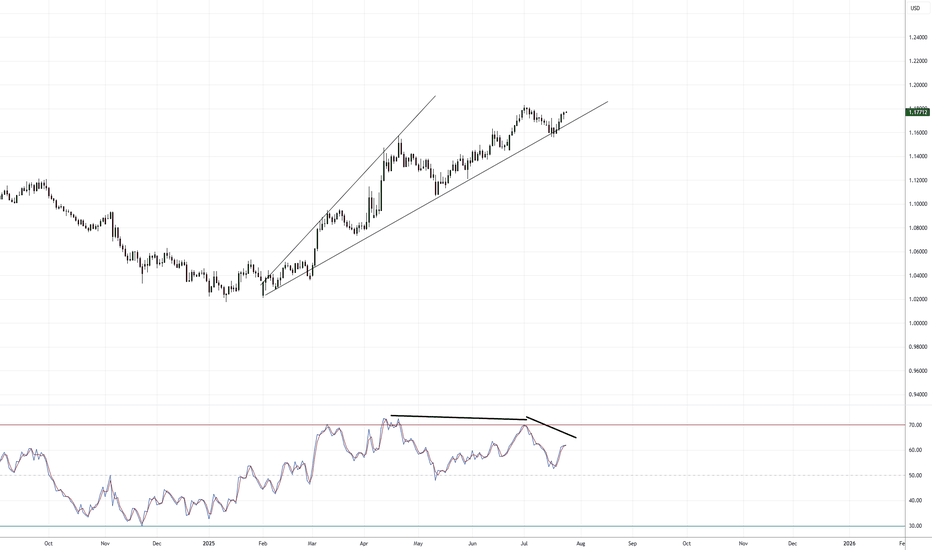

EUR/USD: The Last Bear Standing...As indicated on my previous EUR/USD idea ( that's still currently open ), I remain short EUR/USD given the technical aspect of things are still valid.

Divergences are still in play along with a rising broadening pattern and the fact that we're trading at the yearly R3 level ( which is rare ).

I suspect we will have some volatility with the ECB press conference tomorrow, so that should get things moving hopefully in the bearish direction. If we begin trading aggressively above 1.1800+, that will invalidate the short idea overall.

If we roll over, I'm still looking for 1.13000 - 1.12000 as the target range for Q3 going into Q4.

We'll see how this all develops.

As always, Good Luck & Trade Safe!

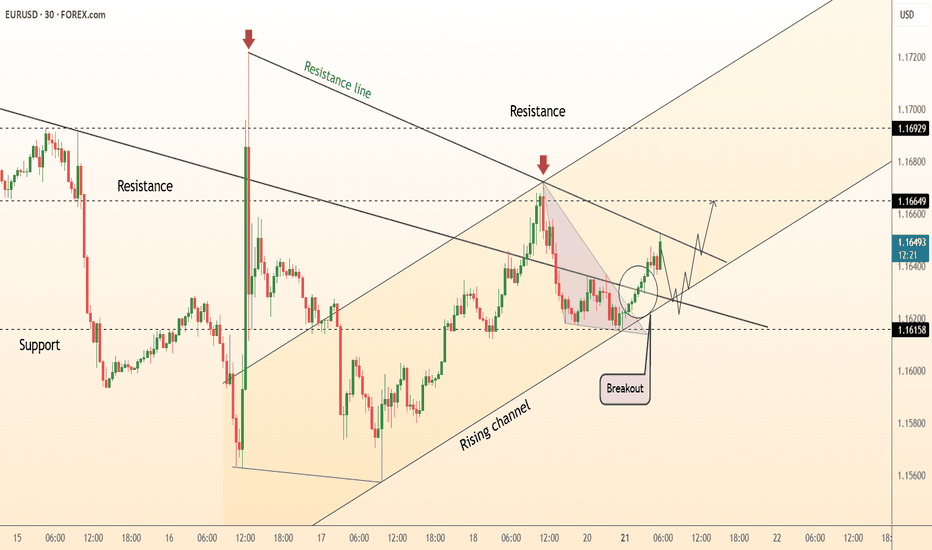

DeGRAM | EURUSD moving in an ascending channel📊 Technical Analysis

● Bulls punched through the 11-day descending trend-line (circled “breakout”) and immediately based on it, keeping the rising 30-min channel of higher-lows intact.

● The next confluence lies at 1.1665 where the channel mid-line meets the prior swing top; clearance unlocks the upper band / July supply at 1.1692-1.1700.

💡 Fundamental Analysis

● Friday’s slide in US 2-yr yields after soft existing-home-sales and mixed Fed speak trims dollar carry, while pre-ECB-meeting sources stress “data-dependent patience,” limiting euro downside.

✨ Summary

Long 1.1635-1.1650; hold above 1.1665 targets 1.1692 → 1.1700. Bias void on an H1 close below 1.1615.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | EURUSD in the consolidation zone📊 Technical Analysis

● Price broke the month-long bearish channel and is now basing inside the 1.165-1.169 consolidation block; repeated intraday retests (blue zone) turn the former cap into fresh support.

● A steep hourly up-sloper is carving successive higher-lows; its width and the prior channel depth project follow-through toward 1.1745 (mid-July pivot) with room to the next swing line at 1.1800.

💡 Fundamental Analysis

● FXStreet highlights softer US PMIs and a pull-back in 2-yr yields, while ECB sources flag “data-dependent patience” rather than imminent cuts—narrowing the short-rate gap and favouring the euro.

✨ Summary

Long 1.1650-1.1680; hold above the blue base targets 1.1745 ➜ 1.1800. Long view void on an H1 close below 1.1615.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

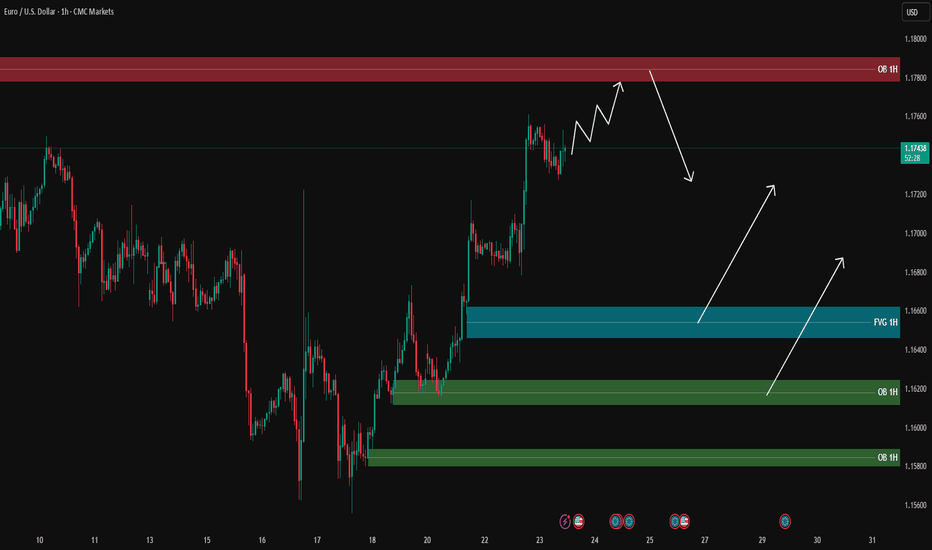

EURUSD analysis - 1H FVG and OB setupsOn the 1H timeframe, price is moving strongly towards the 1H supply zone (around 1.1780), and it is likely to reach this area first before pulling back.

During the pullback, the blue FVG and green OB zones below are key areas for potential long entries:

🔹 FVG 1H around 1.1660

🔹 OB 1H around 1.1620

🔹 OB 1H around 1.1580

📌 Plan:

1️⃣ If the price reaches the upper supply zone, we will look for short scalps with confirmation on the lower timeframe (5M/3M).

2️⃣ After the pullback to lower zones, we will look for long opportunities with PA confirmation.

🎯 Long targets after pullback: 1.1700 – 1.1720, potentially 1.1750.

❌ No entry without confirmation.

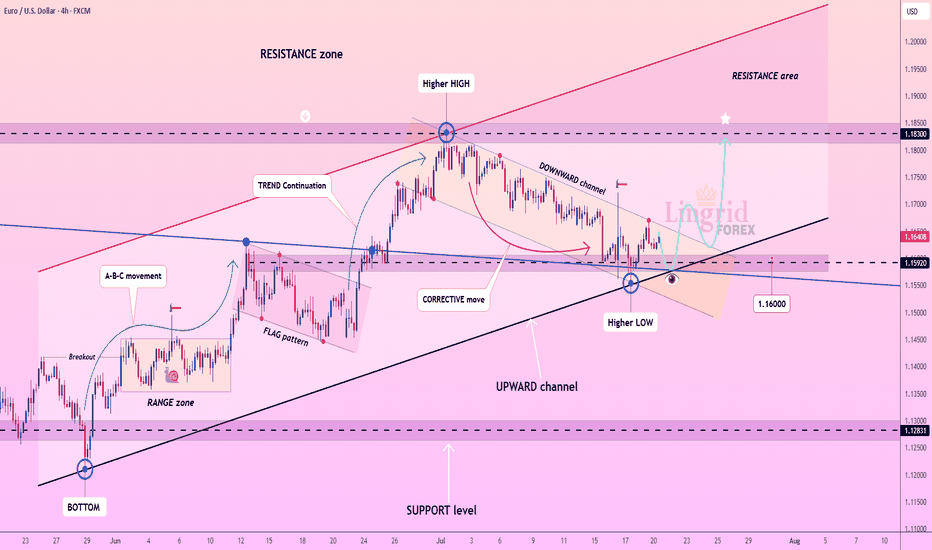

Lingrid | EURUSD Potential Surge Following Channel BreakoutFX:EURUSD is consolidating after bouncing from a key confluence of support around 1.16000 and forming a higher low within the upward channel. The recent corrective pullback through a downward channel now appears complete, with bullish structure resuming. Price is likely to advance toward the 1.18300 resistance as long as the 1.15900 zone holds. Momentum favors a continuation of the A-B-C and trend continuation sequences already established.

📉 Key Levels

Buy trigger: Break above 1.16500

Buy zone: 1.16000–1.16250

Target: 1.18300

Invalidation: Close below 1.14500

💡 Risks

Failure to break the corrective channel resistance

Bearish divergence on lower timeframes

Broader USD strength reversal

If this idea resonates with you or you have your own opinion, traders, hit the comments. I’m excited to read your thoughts!

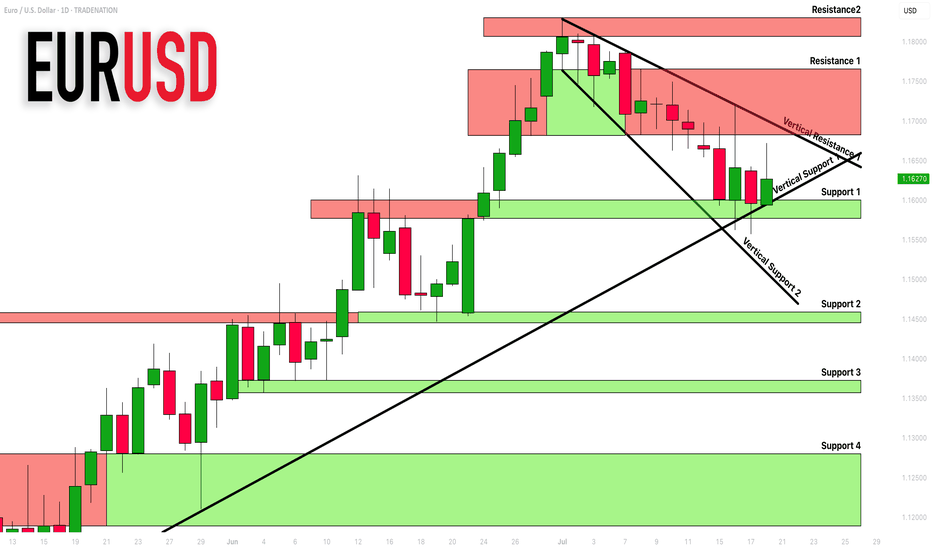

EURUSD: Support & Resistance Analysis For Next Week 🇪🇺🇺🇸

Here is my latest structure analysis and important supports/resistances

for EURUSD for next week.

Consider these structures for pullback/breakout trading.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

DeGRAM | EURUSD breakout📊 Technical Analysis

● Breakout – candles have closed twice above the channel roof (black), then retested 1.1690 as support (blue circled zone); the pull-back printed higher-lows along the intraday trend-line, confirming a bullish transition.

● The flag forming beneath 1.1750 measures toward the confluence of the July swing high and rising fork top at 1.1810; invalidation rests at the last swing-low 1.1615.

💡 Fundamental Analysis

● Euro sentiment improves after Euro-area core CPI edged up to 2.9 % y/y while soft US durable-goods orders trimmed 2-yr Treasury yields, narrowing the rate gap.

✨ Summary

Buy 1.1685-1.1700; hold above 1.169 targets 1.175 ➜ 1.181. Exit on an H1 close below 1.1615.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

EURUSD – Bulls Still in Control, Trend ResumesIn my previous EURUSD analysis, I pointed out that the pair was nearing an important confluence support around 1.1620, and that – given the overall bullish trend – this zone could offer solid long opportunities.

What followed?

The market briefly dipped below that zone, even challenging the psychological 1.1600 round number. But instead of breaking down, bulls regrouped, stepped in with force, and pushed the pair aggressively higher.

📍 At the time of writing, EURUSD is trading at 1.1770, and my long trade is running with a comfortable 150 pips profit.

🔍 W hat’s Next?

The current structure suggests a continuation of the uptrend, and the logical technical target is the recent high at 1.1830.

Until proven otherwise, this is still a buy-the-dip market.

✅ Buying around 1.1700 could be a valid setup, especially if we see buying power on the intraday chart

⚠️ The Warning Sign

Despite the bullish bias, keep in mind:

If EURUSD drops and closes below 1.1670, the structure begins to shift — and this could signal a deeper correction or even trend reversal.

📌 Until then, the bias remains bullish, dips are to be watched for entries, and 1.1830 is the next checkpoint.

D isclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

One last rally in EUR/USDIn the right bottom you can see the Daily chart for EUR/USD:

The chart shows the EUR/USD on a daily timeframe.

There was an initial strong rise of 1,700 pips, marked as a 100% move.

After this, the price corrected downward by 1,084 pips, which is 61.8% of the previous rise.

The 61.8% retracement is a common Fibonacci level, often signaling a reversal or pause.

Now, the price is moving up again, following a similar path as the first rise.

The chart suggests a possible new upward move of another 1,700 pips (100%).

A "take profits zone" is marked at the top, indicating a target area for traders.

This pattern reflects how markets often move in waves: trend, correction, and trend continuation.

Fibonacci levels help traders identify potential reversal points.

The chart is used to project future moves based on past price behavior.

The MAIN CHART shows a clear uptrend for EURUSD and the current correction with a flag.

The combination of both patterns give us a clear BUY zone in the channel and using the trend as support or once the channel break upwards.

This is a very good risk reward ratio trade situation where all traders should be!

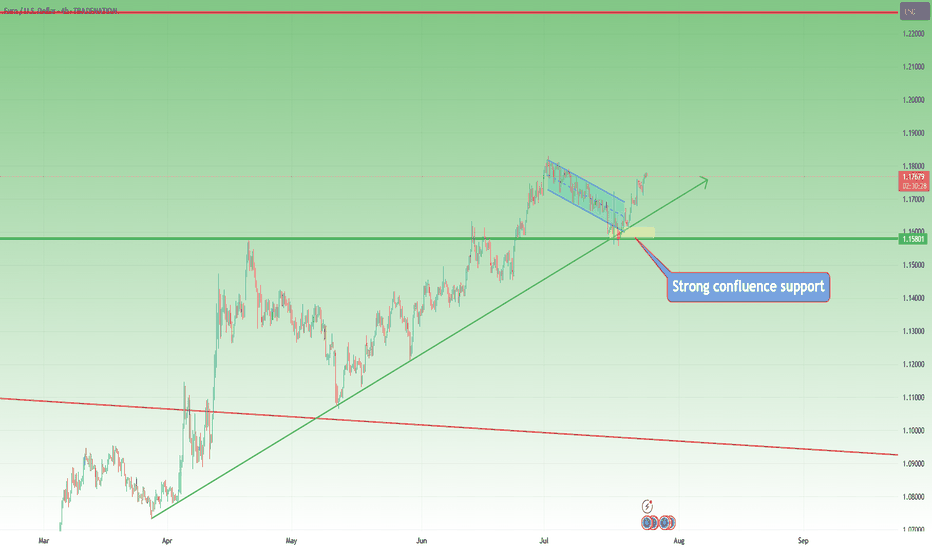

EURUSD may rally after breaking through resistanceThe correction against the global bullish trend is reaching the trading range boundary, but the bulls are not giving up. A struggle is forming, as can be seen from the price trading in the 1.155 - 1.165 zone. A rebound from 1.163 and a breakout of resistance could strengthen demand and lead to growth.

Bears are trying to keep the price below the downward resistance, but attempts to break through the line (retests) are continuing, which only increases the chances for a further rally.

The following fundamental nuances are equally important: prices are rising amid preparations by the EU for possible retaliatory measures in response to Trump's threat to impose 30% tariffs. Tomorrow, Fed Chairman Powell will speak (hints on interest rates), and on Thursday, the ECB will announce its decision (interest rates are likely to remain unchanged).

EURUSD Trading Price Channel, SELL Strategy✏️ OANDA:EURUSD H4 Timeframe EURUSD is trading in a bearish channel. This bearish channel may extend to the important support at 1.145. A break of this important support will form a Downtrend. Further upside recovery will remain limited by the channel, with the notable upper boundary at 1.16800.

📉 Key Levels

Sell trigger: rejection from 1.168 with bearish confirmation

Sell DCA: Break 1.155

Target: 1.145

Leave your comments on the idea. I am happy to read your views.

EURUSD Bearish Ahead as US Resilience Meets Eurozone FragilityEURUSD has shifted into bearish territory, pressured by growing divergence between a resilient US economy and a struggling Eurozone. The pair recently rejected the 1.1700 zone, forming multiple bearish structures on the 4H chart. With sticky US inflation, Trump’s renewed tariff agenda, and a dovish ECB, EUR/USD appears poised for a deeper move toward 1.1527 and possibly 1.1445 in the coming sessions. This setup is both technically and fundamentally aligned, but key event risk remains.

🔸 Technical Structure (4H)

Clear rejection from the 1.1700–1.1710 zone.

Bearish pennants and wedge patterns confirm continuation lower.

Downside targets:

🔹 First: 1.1637

🔹 Second: 1.1527

🔹 Final: 1.1445

Risk zone: Above 1.1785 (invalidates short bias if broken cleanly).

🧭 Key Fundamentals

🇺🇸 Dollar Strength: Sticky inflation, stable labor market, and geopolitical risk all favor USD demand.

🇪🇺 Euro Weakness: ECB dovish tone persists amid weak data, soft PMIs, and stagnating growth.

Yield Spread: US-Euro real yield spread supports further EUR/USD downside.

Tariff Pressure: Trump’s 50% tariff plan and tensions with the EU weigh on EUR.

⚠️ Risks to Watch

A surprise dovish pivot from the Fed.

Weak US CPI or disappointing retail sales.

Major risk-on flows that trigger broad USD weakness.

New EU fiscal stimulus or Germany/France recovery surprises.

📆 Key Events Ahead

🇺🇸 US Core CPI – A hot print supports USD strength.

🇺🇸 Retail Sales & Powell testimony – Watch tone on rate cuts.

🇪🇺 German ZEW Sentiment, Eurozone HICP inflation – Weak readings would further drag EUR.

🔄 Leader or Lagger?

EUR/USD is a lagger to GBP/USD, often following UK-driven USD moves.

Acts as a leader for EUR/JPY, EUR/AUD, EUR/CHF – weakness here cascades across EUR crosses.

Tracks broad USD sentiment – dovish Fed pricing boosts EURUSD, while rate hike fears drag it.

✅ Summary: Bias and Watchpoints

EUR/USD is bearish below 1.1700 as economic divergence, sticky US inflation, and rising geopolitical tensions favor the dollar. ECB policy remains soft, offering little support to the euro. Key risk lies in a dovish Fed pivot or softer US data. Watch US CPI and Powell for clues. This pair is likely to lag GBP/USD moves, but will lead EUR crosses lower if the downside momentum continues.