EUR/USD| - Bullish BiasHTF Context: Noted a clear break of structure to the upside, signaling strong bullish intent. Originally expected a deeper liquidity grab, but price shifted before reaching lower zones.

MTF Refinement: Dropped down to the 30M for better alignment — spotted a liquidity sweep confirming smart money interest.

LTF Execution Plan: Now watching for mitigation of the 30M OB. Once tapped, I’ll look for internal structure shift (1M/5M BOS or CHoCH) to confirm continuation.

Mindset: Staying patient — if price wants higher, it should respect this OB and show its hand first.

Bless Trading!

USDEUR trade ideas

EUR/USD Holding Support — Watching for Bullish ReactionHi Everyone,

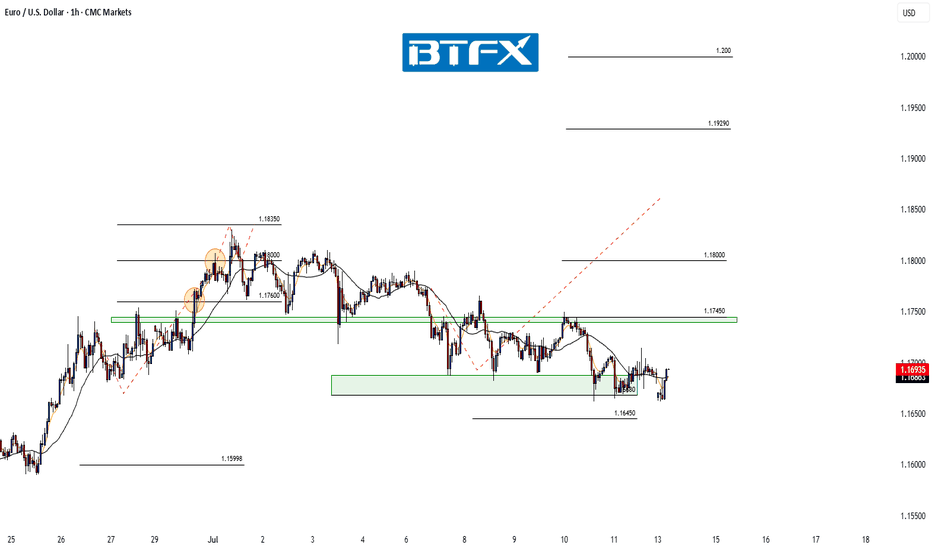

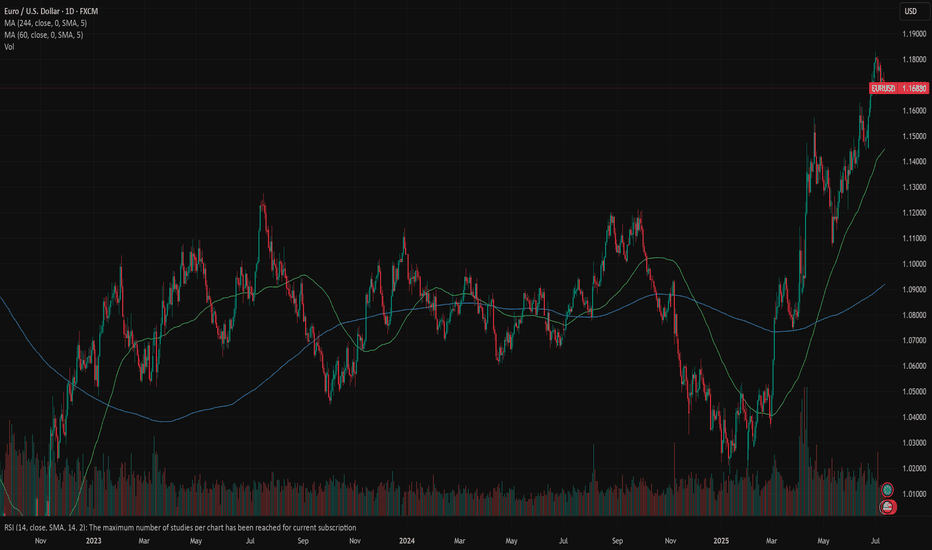

Since our last update, EUR/USD continues to range near the 1.16680 support level. We’re watching for buying interest to emerge above the key 1.16450 zone, which has acted as a critical level for the broader structure.

Should price manage to stabilise and form a base here, there’s potential for a move back towards the highlighted resistance area around 1.17450. A clear reaction from support could confirm renewed buying interest and set the stage for a retest of last week’s highs.

Our broader outlook remains unchanged: as long as price holds above 1.16450, we continue to look for the pair to build momentum for another move higher in the coming sessions. A decisive break above last week’s high could attract fresh buying interest, paving the way for a push towards the 1.19290 area and ultimately 1.20000.

We'll be watching closely to see if this recovery gains traction and whether buyers can sustain the move above resistance. The longer-term view remains bullish, provided price continues to respect the key support zone.

We’ll keep updating you through the week as the structure unfolds and share how we’re managing our active positions.

Thanks again for all the likes/boosts, comments and follows — we really appreciate the support!

All the best for the rest of the week. Trade safe.

BluetonaFX

EUR/USD Sells from 1.17200 back downWeekly Outlook: EUR/USD (EU)

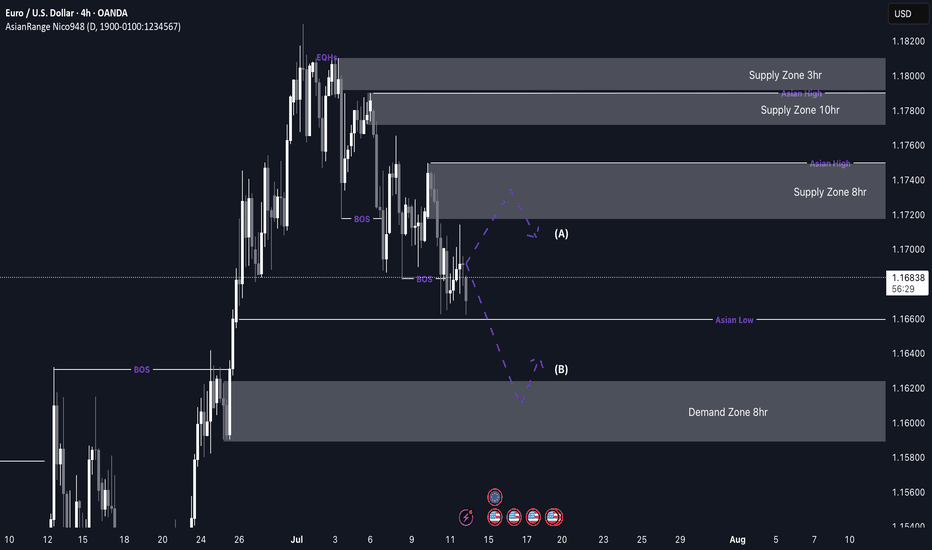

This week, my bias on EUR/USD is similar to GBP/USD, as both pairs have been following a consistent bearish trend. Based on this structure, I’ll be watching to see if price begins a retracement back into an area of supply.

I’ve marked out the 8-hour supply zone, which sits at a premium level and was responsible for the last break of structure to the downside. If price retraces into this zone, I’ll look for potential sell confirmations on the lower time frames.

If price doesn’t tap into the supply zone first, I’ll then shift my focus to the 8-hour demand zone below. In that case, I’ll watch closely for signs of accumulation and a bullish reaction from this level, which could signal the start of a rally.

Confluences for EUR/USD Sells:

✅ Bearish trend has been consistent for the past few weeks.

✅ Breaks of structure have formed new supply zones to trade from.

✅ Liquidity exists below current price, which may be targeted first.

✅ The lower demand zone remains unmitigated, suggesting further downside movement.

📌 On the way down toward demand, I expect price to form another break of structure to the downside. The plan is to ride the sells down into demand, then look for potential buy opportunities if price begins to accumulate and react.

Let’s stay sharp and disciplined — have a solid trading week, everyone! 📊

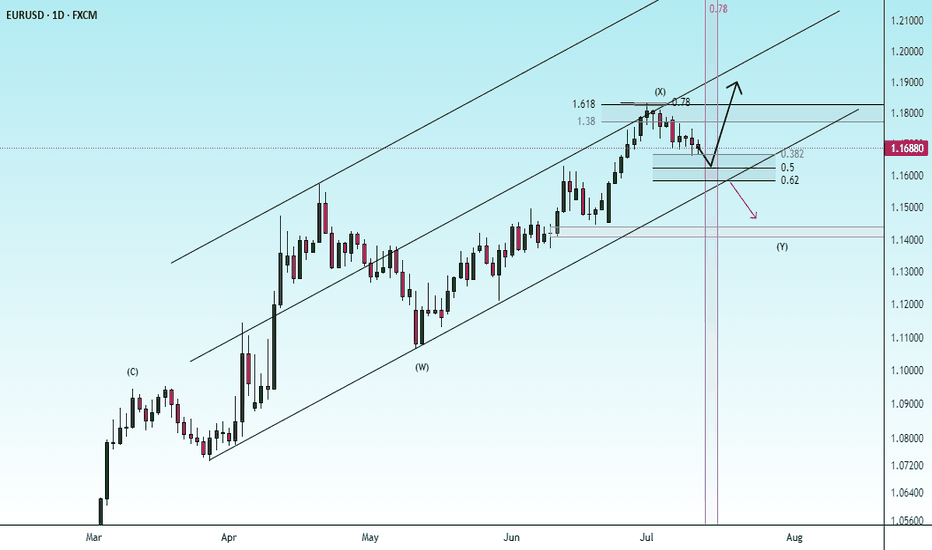

EURUSD BUY So we have nice weekly fvg below along with a strong pivot point we could possibly see price reach this level before the push to the upside. I’m pretty confident we will have a strong push to the upside due to the macroeconomics and positioning of key players as they are still very bullish on the euro as we still creating higher highs consistently. A lot of people are in sells right now so we could see them taken out before the move to the downside they the EurUsd buy will be in play .

Bullish continuation?The Fiber (EUR/USD) is falling towards the pivot, which has been identified as a pullback support and could bounce to the 1st resistance.

Pivot: 1.1589

1st Support: 1.1448

1st Resistance: 1.1815

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

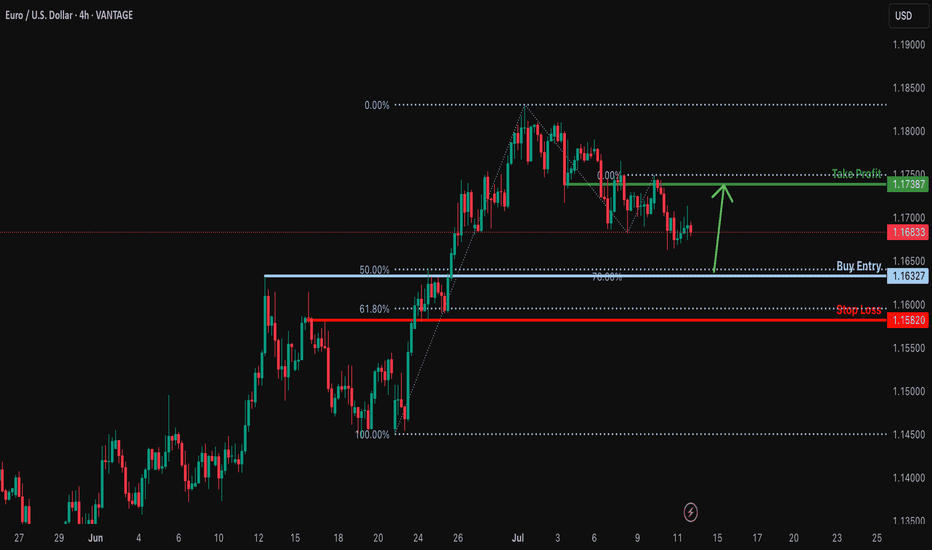

Bullish bounce off 50% Fibonacci support?EUR/USD is falling towards the support level which is a pullback support that lines up with the 50% Fibonacci support and could bounce from this level to our take profit.

Entry: 1.1632

Why we like it:

There is a pullback support that lines up with the 50% Fibonacci retracement.

Stop loss: 1.1582

Why we like it:

There is an overlap support that is slightly below the 61.8% Fibonacci retracement.

Take profit: 1.1738

Why we like it:

There is an overlap resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EURUSD: focus on inflationThis week was calm when it comes to currently important US macro data. The most important event was related to the release of the FOMC meeting minutes from the June session. There was no new information revealed in the Minutes, which has not already been communicated with the public. The Fed is aimed to maintain flexibility around future rate cuts. They will most probably remain on hold until the economic data more clearly supports a slowdown. Analysts continue to be of the opinion that the Fed will most probably make the next rate cut somewhere in late 2025 and into 2026. Such opinion is supported with ongoing risks of both rising inflation and unemployment due to introduced trade tariffs, putting challenge to Fed officials.

Industrial Production in Germany during May increased by 1,2% for the month, which was much better from estimated 0%. Retail Sales in the Euro Zone dropped in May by -0,7%, bringing the indicator to the yearly level of 1,8%. Balance of Trade in Germany in May reached euro 18,4B, better from expected euro 15,5B. Inflation rate in Germany, final for June, was standing at the level of 0% for the month and 2% for the year. Both figures were in line with market expectations. Wholesale prices in Germany in June were higher by 0,2% and 0,9% on a yearly basis.

Markets favored US Dollar during the previous week, where the eurusd was traded within a range from 1,1790 down to 1,1670. The RSI moved from the overbought market side, ending the week at the level of 57. As long as the indicator is holding above the level of 50, there will be no indication that the market has started to clearly eye the oversold market side. At the same time, the MA50 continues to strongly diverge from MA200, within an indication of a potential slowdown in the coming period, as well as potential crossovers.

Although this week was a relatively calm one, the week ahead brings some important US macro data, including June inflation, PPI and University of Michigan Consumer Sentiment data. Considering current market sensitivity on any negative movements in inflation figures, the week ahead might bring some increased volatility on financial markets. As per current charts, eurusd has some space for a further move toward the downside, at least till the level of 1,1650. There is also potential for a short term reversal indicated on charts, with some potential that 1,1750 might be tested during the week.

Important news to watch during the week ahead are:

EUR: Industrial Production in the Euro Zone in May, ZEW Economic Sentiment Index in July in the EuroZone and Germany,

USD: Inflation Rate in June, Producers Price Index in June, Retail Sales in June, Building Permits preliminary for June, Housing Starts in June, Michigan Consumer Sentiment preliminary for July.

EURUSD Weakened By New Tariff Tensions With US This is the Weekly FOREX Forecast for the week of July 14 - 18th.

In this video, we will analyze the following FX market: EURSUD

The latest headlines tell the story. The tariffs are triggering a slow run to the USD safe haven. The previous week showed the USD Index closed pretty strong. There's a good chance we'll see more of the same this coming week.

Look for the strength in USD to continue to be supported by fundamental news, and outperform the other major currencies, including the EURO.

Buy USD/xxx

Sell xxx/USD

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

ETHEREUM - ETH Weekly Recap & Projection 13.07.2025Current Structure

Ethereum is showing a clear bullish bias.

Last week’s price action broke above a significant weekly swing level with solid candle closures — suggesting continuation.

Short-Term Scenarios

We could see two potential outcomes:

• A consolidation range forming at current levels

• A short-term retracement influenced by Bitcoin’s movement

Due to ETH’s high correlation with BTC, traders should review Bitcoin’s chart to understand ETH’s likely path.

Trading Plan

Wait for Bitcoin to complete a retracement

Monitor ETH for LTF (lower timeframe) confirmation and bounce

Seek long setups below the CME Gap (pink line)

Step 2 will serve as the trigger to initiate any positions on ETH.

Macro Risk-On Catalyst – Powell Resignation?

There are growing rumors regarding Federal Reserve Chairman Jerome Powell potentially resigning.

If confirmed, this could result in a strong rally across risk assets, including ETH — likely pushing prices higher without traditional pullbacks.

Summary

• ETH broke major weekly structure

• Watch BTC for clues — correlation remains high

• Plan favors long entries after BTC retrace + ETH LTF confirmation

• Powell resignation rumors could accelerate bullish trend

EUR-USD Will Keep Growing! Buy!

Hello,Traders!

EUR-USD keep trading in

An uptrend along the rising support

So as the pair is approaching

A the support we will be

Expecting a bullish rebound

And a move up on Monday

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Ready to Swipe the Pips? | EUR/USD Heist Blueprint Unlocked🏴☠️💸 EUR/USD "Fiber Heist Plan" – Thief Trader Style 💸🏴☠️

The Vault is Open – Swipe the Bullish Bags! 🚀📈💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Welcome, Money Makers & Market Robbers! 🤑✨

Here’s the latest masterstroke based on our Thief Trading Style™—a tactical breakdown of EUR/USD primed for a bullish breakout robbery. We’re targeting the red zone 🎯—where the weak hands panic, and the real players win.

🔓 Entry Plan (Buy Setup):

🟢 "The vault is wide open!" — We’re planning bullish entries using 15m–30m timeframe swing levels.

✅ Buy Limit Orders: Plot them smartly around most recent swing lows/highs.

⚠️ Chart Alert Suggested: Eyes on the prize, don’t miss the break-in.

🛑 Risk Guard (SL Setup):

💼 Stop-Loss: Set at nearest 30-min swing low (based on your risk appetite).

Remember, it’s about preserving your loot, not just grabbing it.

🎯 Target Area:

🎯 Primary Target: 1.19000

🎯 Optional Trailing SL: Ride the wave, lock the profits as price moves.

🧲 Scalpers' Notice:

Only scalp long. Got big pockets? Jump in. Smaller bags? Swing along.

💡 Trailing stop advised—don’t let the market steal your gains.

💹 Current Market Outlook:

EUR/USD is moving bullish—supported by technical signals, macro news, COT insights, and intermarket vibes.

🧠 Use all tools: Fundamental 📊 + Sentiment 🧭 + Quant + Bias Score 📈.

📎 Want the full breakdown? Check the 👉.Liinkk.🔗

(Keep updated, conditions shift fast!)

⚠️ News Risk Alert:

🚨 Stay alert during news drops—avoid fresh trades then.

Use trailing SLs to lock profits & guard against reversal raids.

💖 Support the Robbery Plan!

💥 Hit that Boost Button 💥 if you're riding with the Thief Team!

We steal smart, we trade sharp — every day’s a new heist in this market.

See you on the next plan! Stay legendary 🐱👤💸🤑🔥

EURUSD: NEW WEEK TECHNICAL BIAS ( MARKET OPEN) Higher Timeframe Bias:

The Ascend Sequence on Monthly, Weekly, and Daily remains intact; current Descend Sequence is viewed as a pullback within bullish orderflow. HTF bullish stance is maintained unless invalidated.

Current Structure (Short-Term):

Descend Sequence is still active across Daily, 4H, 1H, and micro-timeframes—momentum favors sell-side flow for now.

Decision Range:

Defined Decision Zone: 1.17494 – 1.16624

▫︎ A break below 1.16624 strengthens the case for continuation of bearish leg.

▫︎ A break above 1.17494 would signal a bullish reclaim and potential Trend Signature Shift (TSS).

Execution Scenarios:

Scenario 1: If price trades into the 4H Order Clustering Zone (OCZ) from below and shows weakness, I’ll consider a short setup, ideally via Momentum Breach Entry (MBE) or a Retrace Precision Entry (RPE).

Scenario 2: If market opens with a sharp Impulse Drive to the downside without tapping into the OCZ, I may consider tactical short opportunities, but only with caution and reduced risk.

Target Zone for Shorts:

Primary short-term target: Discount Zone of the Weekly/Daily price leg, where a Weekly PIZ and Rally Origin align.

Bias Invalidation:

A strong reclaim and hold above the decision range will invalidate short bias and reposition me for long setups in alignment with the HTF bullish framework.

Summary:

Sell-side lean remains valid short-term. However, macro bullish context persists. Awaiting structural resolution from decision range to confirm directional intent.

EURUSD: Long Signal with Entry/SL/TP

EURUSD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long EURUSD

Entry - 1.1689

Sl - 1.1627

Tp - 1.1799

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

EUR/USD Bullish Continuation SetupMarket Structure Overview:

The market remains in a clear higher timeframe bullish trend, consistently forming higher highs and higher lows. Recently, price has entered a descending channel, resembling a bull flag formation — a classic continuation pattern that typically precedes a strong bullish breakout.

Key Observations:

✅ Descending Channel (Bull Flag): Price is respecting a downward-sloping channel while remaining above key demand zones.

💧 Liquidity Pools: Multiple liquidity highs have been left untouched above — suggesting fuel for a potential impulsive move upward.

🧹 Liquidity Sweep: On both H4 and H1, we see a clear sweep of previous equal lows, tapping into a significant demand zone.

📈 Reaction from Demand: Strong reaction from the demand zone suggests institutional buying interest.

🔵 Projection: A bullish breakout from the flag could target the liquidity above 1.1800, with immediate resistance near 1.1740–1.1760.

Bias:

🔼 Bullish — as long as price holds above the most recent demand zone (~1.1649), the bias remains bullish with expectations of a breakout and continuation toward previous highs.

Note: We must see how the market opens on Sunday night going into Monday. Based on the initial price action, we can determine the best trading opportunities and direction for the upcoming week.

Two Brains, One Trade: Why You Freeze Under PressureBy MJTrading:

In trading, your biggest opponent isn’t volatility.

It’s your own neural wiring.

Every trader operates with two main systems:

🧠 System 2 – Rational, deliberate, planning (Prefrontal Cortex)

🧠 System 1 – Emotional, instinctive, fast (Amygdala & Limbic Brain)

Before entry, System 2 is in control. You feel calm, logical.

But the moment money is at risk—especially in drawdown or after a missed TP—System 1 takes over.

💥 Stress hormones spike

💥 Focus narrows

💥 Long-term thinking disappears

💥 You freeze, or act impulsively

You knew what to do.

But you didn’t do it.

Because in that moment, your rational mind wasn’t driving anymore.

⚖️ Set & Forget vs. Floating Managers

Different trading personalities react differently under pressure:

🔹 Set & Forget Traders

Rely on automation or predefined exits to bypass emotional hijack.

They reduce cognitive load, but often feel regret when price goes “a little more.”

🔹 Floating Management Traders

Rely on intuition and live feeling. They stay with the chart, adjusting based on flow.

When calm and trained, they shine.

But under pressure, they’re more vulnerable to emotional loops:

– hesitation

– premature exits

– revenge tweaks

– system betrayal

🧘♂️ What can you do?

✔️ Pre-plan decisions

Make the hard calls before emotions kick in.

✔️ Mental rehearsal

Visualize trade management scenarios—yes, like athletes do.

✔️ Create fallback protocols

So if you freeze, your system still knows what to do.

🧠 For Those Who Want to Go Deeper:

“Thinking, Fast and Slow” by Daniel Kahneman

Understand System 1 & 2 thinking—and how cognitive bias shapes all decisions, not just trades.

“The Hour Between Dog and Wolf” by John Coates

A stunning look at how biology, hormones, and risk-taking collide in traders' brains.

🔓 Final Thought:

If your strategy works in theory, but breaks in real-time—

It’s time to work on your neural execution layer.

Because in trading, you don’t rise to your level of analysis—

you fall to your level of emotional wiring.

— MJTrading

#NeuroTrading #TraderTypes #TradingPsychology #SetAndForget #FloatingManagement #MindOverMarkets #EURUSD #MJTrading

Previous psychology Ideas: