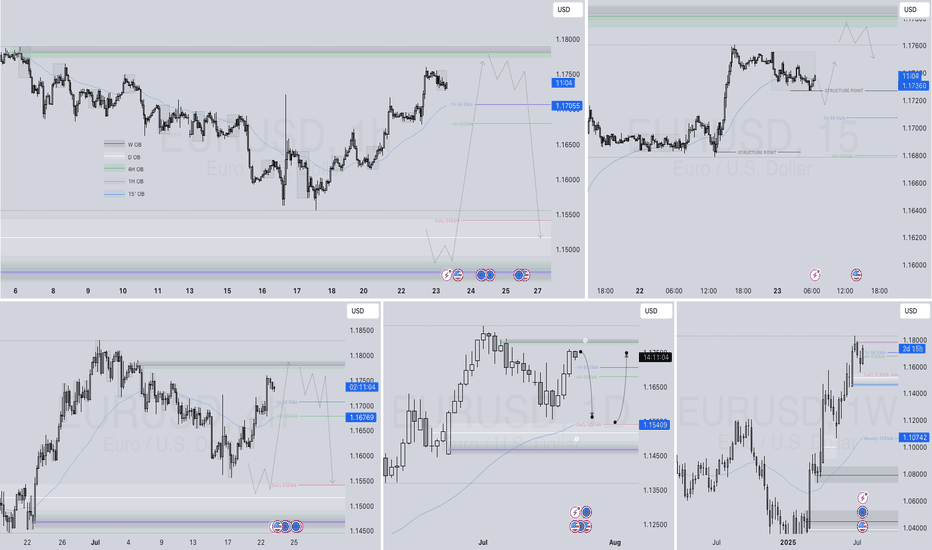

EURUSD Q3 | D23 | W30 | Y25📊EURUSD Q3 | D23 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

USDEUR trade ideas

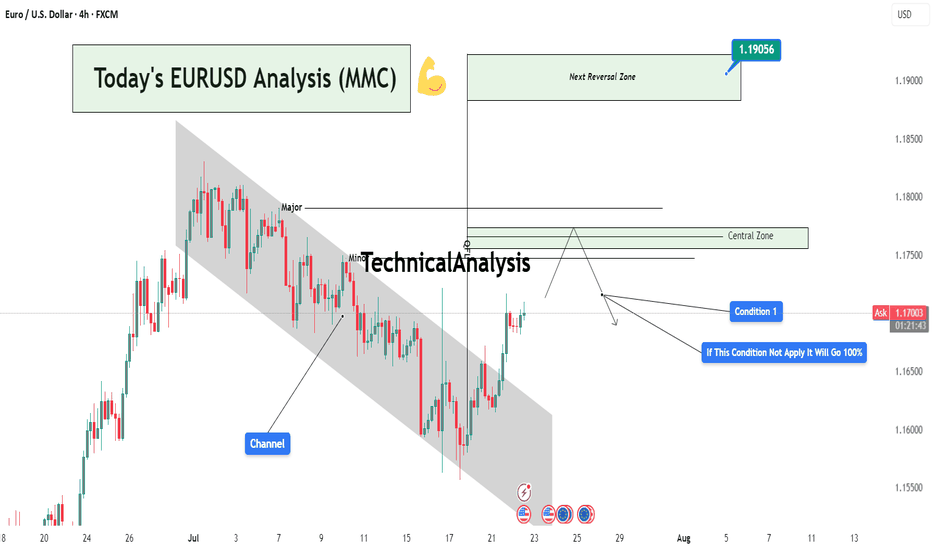

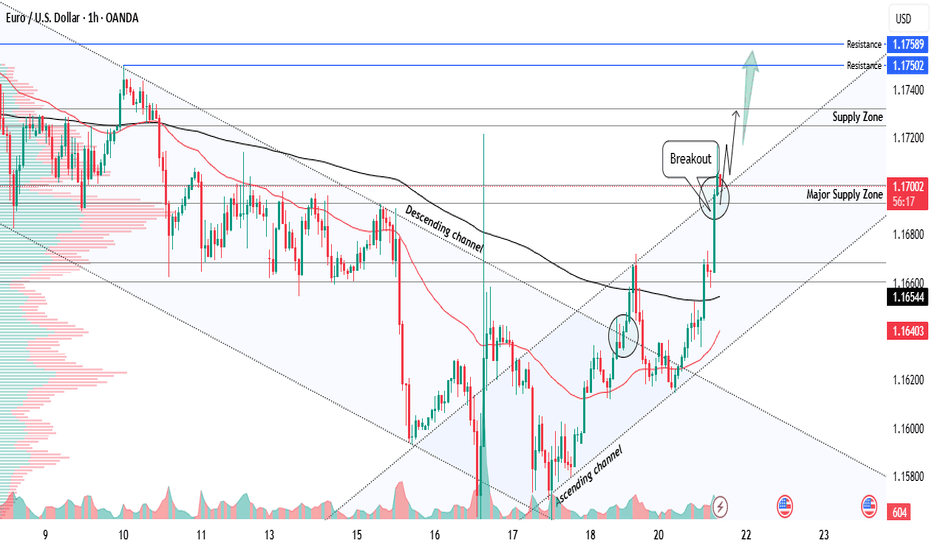

Today's EURUSD Analysis : Channel Break : EURUSD Eyes 1.19056Chart Overview:

The EURUSD pair has broken out of a well-defined descending channel, indicating a potential shift in momentum. Price has now approached a critical Central Zone that acts as a probable reaction or reversal area. This zone lies between minor and major supply levels.

🔍 Key Technical Highlights:

Descending Channel:

Price was previously trapped in a bearish channel. This channel was respected with multiple touches on both upper and lower bounds, showing controlled bearish structure.

Breakout & Momentum Shift:

The recent bullish breakout above the channel suggests buyers are gaining control. A strong candle has closed outside the structure, confirming the breakout.

Major & Minor Zones:

Two levels are marked just above the breakout:

Minor Resistance: First possible supply zone where price may pause.

Major Resistance: A stronger historical level and the top of the Central Zone.

Central Zone Reaction Area (CZRA):

This is the MMC's focus area — price is expected to react here. Either we see a rejection that could confirm a reversal setup, or price slices through, opening the door to the Next Reversal Zone around 1.19056.

📌 Strategic Condition (MMC Logic):

Condition 1:

If price respects the Central Zone and shows bearish signs (e.g., wick rejections, engulfing candles, divergence), we expect a strong pullback or reversal toward previous demand levels.

If Condition 1 Fails:

The annotation clearly states: “If this condition not apply, it will go 100%.”

Meaning: If price breaks and holds above the Central Zone, it confirms bullish strength, targeting 1.19056 — the Next Reversal Zone (NRZ).

📊 Trader's Mindset (MMC Application):

This setup is a classic MMC structure trap-break scenario:

The channel traps sellers,

The breakout invites buyers,

And the Central Zone becomes the battlefield.

Wait for confirmation, not assumption. Whether it's rejection or breakout, risk management and reaction-based trading are key.

How Do Traders Use the Pivot Points Indicator? How Do Traders Use the Pivot Points Indicator?

Pivot points are a popular technical analysis tool for spotting areas where the price is expected to react, i.e. pause or reverse. Calculated using the previous day’s high, low, and close, they’re projected onto the current session to highlight potential support and resistance levels, especially useful for intraday traders.

Alongside stock charts, pivot point levels can be used in a wide variety of markets, including forex, commodities, and cryptocurrencies*. As a versatile indicator, pivot points also come in many different types. This article breaks down the definition of pivot points, the variations traders use, and how they can fit into a broader trading strategy.

A Deeper Look at Pivot Points

A common question in technical analysis is, “What is a pivot point?” Pivot points trading, or pivot point theory, is a popular technical analysis concept used in a range of financial asset classes, including stocks, currencies, cryptocurrencies*, and commodities. The indicator assists traders in gauging overall market trends and determining possible support and resistance barriers.

How to Read Pivot Points

The pivot point indicator is static—it’s an average of the high, low, and close prices from the previous trading day. It includes three levels: pivot point (P), support (S), and resistance (R). If the price is above the pivot point, it is supposed to target resistance barriers. Conversely, if it’s below the pivot, it could move to support levels. Thus, support and resistance levels serve as targets or stop-loss zones. They remain constant throughout the period, enabling traders to plan ahead.

In the EURUSD daily chart below, the price is trading above R2; therefore, market sentiment is assumed to be bullish. R3 indicates the next possible price target. Should a shift below P occur, bearishness arises, and S1 becomes the upcoming support level.

Pivots are widely used with trend indicators such as moving averages and Fibonacci tools. In the chart below, Fibonacci retracements could be used to identify intermediate levels of support and resistance within widely placed pivots.

How to Calculate Pivot Points?

There are four key types of pivots, including standard, Woodie’s, Camarilla, and Fibonacci. While there’s no need to use a pivot points calculator—they’re calculated automatically when implemented on a price chart—it is worth looking at their formulas to understand how they differ from each other.

Note the labels for the following formulas:

P = pivot point

H = high price

L = low price

C = close price

Standard Pivot Points

Traders commonly use standard pivot points. Traditional pivots (P) identify potential levels of support (S) and resistance (R) by averaging the previous trading period's high, low, and close prices.

P = (H + L + C) / 3

S1 = (2 * P) - H

S2 = P - (H - L)

R1 = (2 * P) - L

R2 = P + (H -L)

Although they are popular among traders, they can produce false signals and lead to incorrect trades in ranging markets and during periods of high volatility.

Woodie’s Pivot Points

Woodie's pivots are similar to standard pivots but include a slight modification to the calculation. In Woodie's method, the close price is assigned more weight.

P = (H + L + 2 * C) / 4

R1 = (2 * P) - L

R2 = P + H - L

S1 = (2 * P) - H

S2 = P - H + L

However, their extra sensitivity can make them less reliable during choppy markets or when the price lacks a clear direction.

Camarilla Pivot Points

Camarilla pivots use a set formula to generate eight levels: four support and four resistance. They are based on the previous day’s close and range and multiplied by a certain multiplier. The inner levels (R3 and S3) often act as reversal zones, while R4 and S4 are watched for breakouts. Still, in trending markets, the reversals can fail frequently.

R4 = C + (H - L) x 1.5

R3 = C + (H - L) x 1.25

R2 = C + (H - L) x 1.1666

R1 = C + (H - L) x 1.0833

P = (High + Low + Close) / 3

S1 = C - (H - L) x 1.0833

S2 = C - (H - L) x 1.1666

S3 = C - (H - L) x 1.25

S4 = C - (H - L) x 1.5

Fibonacci Pivot Points

Fibonacci pivot points are based on the Fibonacci sequence, a popular mathematical concept in technical analysis.

They are calculated in the same way as the standard indicator. However, the levels of support and resistance are determined by including the Fibonacci sequence with a close monitoring of the 38.2% and 61.8% retracement levels as the primary price points.

P = (High + Low + Close) / 3

S1 = P - (0.382 * (H - L))

S2 = P - (0.618 * (H - L))

R1 = P + (0.382 * (H - L))

R2 = P + (0.618 * (H - L))

Despite their popularity, Fibonacci pivots can become less reliable when the price reacts to other fundamental drivers.

Trading with the Pivot Points

Although every trader develops their own trading approach, there are common rules of pivot point trading that are expected to improve their effectiveness.

Day Trading

Day trading with pivot points is usually implemented for hourly and shorter intraday timeframes. As pivot levels are updated daily and calculated on the previous day's high, low, and close prices, this allows traders to react promptly to market changes and adjust their strategies. Some traders prefer Camarilla pivots as their calculation takes into account the volatility of the previous trading period to produce pivot levels closer to the current price.

Medium-Term Trading

When looking at a medium-term analysis, weekly pivot levels are added to four-hour and daily charts. These are calculated using the previous week's high, low, and close prices, which remain unchanged until the start of the next week.

Long-Term Trading

For longer-term analysis, traders use monthly pivots on weekly charts. These levels, gathered from the previous month's data, offer a broader picture of market trends and price movements over time.

Pivot Point Trading Strategies

The pivot points indicator is typically used in two ways – breakout and reversal trading.

Breakout Trading Strategy

The breakout approach seeks to take advantage of market momentum by entering trades when prices break above or below significant levels of support and resistance.

- Bullish Breakout. When levels P and R1 are broken, and the price closes above either, it’s more likely a rise will occur.

- Bearish Breakout. When levels P and S1 are broken, and the price closes below either, it’s more likely the price fall will occur.

Strong momentum and high volume are two critical factors needed for a solid price movement in both cases.

Trading Conditions

If a breakout is confirmed, traders enter a trade in the breakout direction. A take-profit target might be placed at the next pivot level. A stop-loss level can be placed beyond the previous level or calculated according to a risk/reward ratio. Traders continuously monitor their trades and adjust their stop-loss levels to lock in potential returns if prices move in their favour.

Reversal Trading Strategy

The reversal strategy seeks to take advantage of a slowdown in market momentum by entering trades when prices stall at significant levels of support or resistance.

- Bullish Reversal. When levels S1 and S2 are not broken and the price stalls above either, a reversal is more likely to occur.

- Bearish Reversal. When levels R1 and R2 are not broken and the price stalls below either, a reversal is expected to happen.

Note: Reversals are always confirmed by another indicator or a chart pattern.

Trading Conditions

If a reversal is confirmed, traders consider entering a trade in its direction. The next level may be a take-profit target, which might be trailed to the next level if the market conditions signal a continuation of a price move. A stop-loss level is typically placed below a swing low or above a swing high, depending on the trade direction.

Pivot Points and Other Indicators

While pivots show where the price may reverse, there’s nothing to say a market won’t trade through these areas. Therefore, traders typically pair them with other technical indicators and patterns.

Candlestick and Chart Patterns

Traders often combine levels with specific reversal candlestick formations, like three black crows/three white soldiers or engulfing patterns, to confirm a change in market movements. For example, a bullish engulfing candle forming at S1 could reinforce the idea of a reversal at that level.

Moving Averages

When a pivot aligns with a major moving average, e.g. the 50-period or 200-period EMA, it strengthens the area. As moving averages act as dynamic support and resistance levels, an overlap can signal a strong area where a reversal might occur.

RSI and Stochastic Oscillator

Momentum indicators like RSI or Stochastic help judge whether the price is likely to bounce or break through a pivot. If it hits support and RSI is oversold, that adds conviction. But if momentum is still strong in one direction, it might get ignored.

Considerations

Even with strong confluence, these combinations can fail. Markets don’t always respect technical alignment, especially around data releases or sharp movements in sentiment. For instance, in stocks, pivot points may be ignored if an earnings release strongly beats analyst estimates. Instead, they are believed to work when treated as one piece of a broader technical framework.

Limitations

Pivot points are widely used, but like any tool, they have flaws. They’re based purely on past price data, so they don’t account for news, sentiment shifts, or broader market context.

- False signals in ranging markets: The price often oscillates around pivot zones in markets without a clear direction, meaning setups might not follow through.

- Less reliable during strong trends: In trending conditions, the price can blow past several levels without reacting.

- No built-in volatility filter: The points don’t adapt to changing volatility, so levels might be too close or too far apart to be useful.

- Lag in real-time shifts: Since pivots are pre-calculated, they don’t adjust mid-session as new data emerges.

Final Thoughts

Pivot points are widely used in stock trading as well as in commodity, cryptocurrency*, and currency markets. While they can be useful tools, their limitations cannot be overlooked. It is essential to conduct a comprehensive analysis and confirm the indicator signals with fundamental and technical analysis tools.

FAQ

What Is a Pivot Point in Trading?

The pivot point meaning refers to a technical analysis tool used to identify potential support and resistance levels. It’s calculated using the previous day’s high, low, and close prices, and helps traders find areas where the price may react during the current session.

What Is the Best Indicator for Pivot Points?

There isn’t one best indicator, but traders often pair pivot points with moving averages, RSI, or candlestick patterns to confirm a potential reversal. The most effective setup usually depends on the strategy and market conditions.

What Are the Pivot Points’ R1, R2, and R3?

R1, R2, and R3 are resistance levels above the central point. They represent increasingly stronger potential resistance zones where the price may stall or reverse.

Which Is Better, Fibonacci or Camarilla?

Fibonacci offers wider levels based on retracement ratios, useful in trending markets. Camarilla focuses on tighter reversal zones, which are mostly used for intraday strategies. Each suits different trading styles; neither is objectively better.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

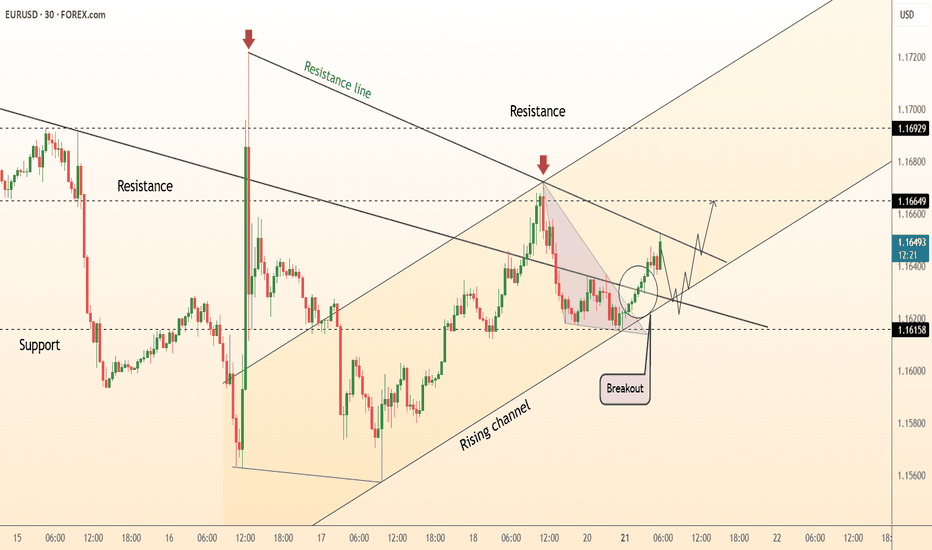

DeGRAM | EURUSD moving in an ascending channel📊 Technical Analysis

● Bulls punched through the 11-day descending trend-line (circled “breakout”) and immediately based on it, keeping the rising 30-min channel of higher-lows intact.

● The next confluence lies at 1.1665 where the channel mid-line meets the prior swing top; clearance unlocks the upper band / July supply at 1.1692-1.1700.

💡 Fundamental Analysis

● Friday’s slide in US 2-yr yields after soft existing-home-sales and mixed Fed speak trims dollar carry, while pre-ECB-meeting sources stress “data-dependent patience,” limiting euro downside.

✨ Summary

Long 1.1635-1.1650; hold above 1.1665 targets 1.1692 → 1.1700. Bias void on an H1 close below 1.1615.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

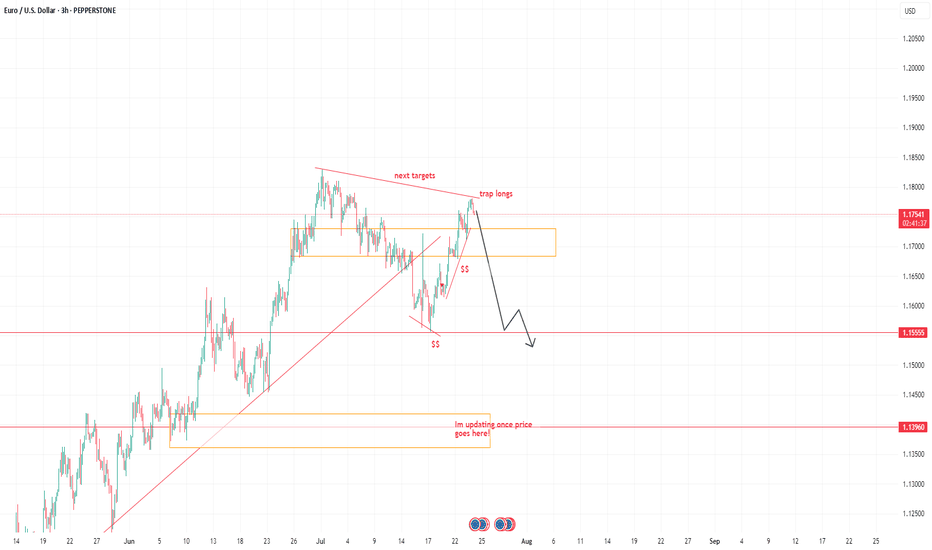

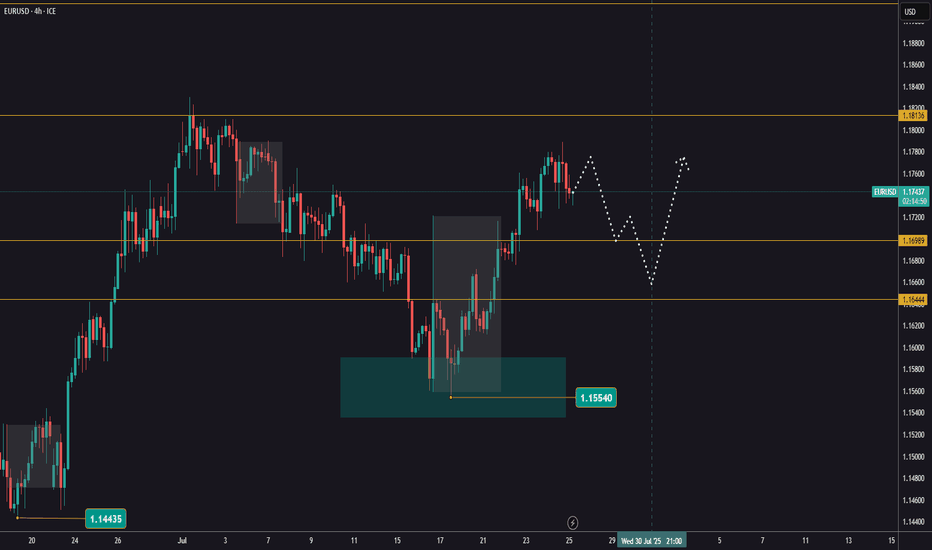

EURUSDHello Traders! 👋

What are your thoughts on EURUSD?

EURUSD has broken support level and its ascending trendline, indicating a possible shift in short-term market structure and growing bearish pressure.

In the short term, we expect a pullback toward the broken support/trendline zone.

If price fails to reclaim this level, a continued move lower toward the next identified support zone is likely.

As long as price remains below the broken structure, the short-term outlook stays bearish.

Don’t forget to like and share your thoughts in the comments! ❤️

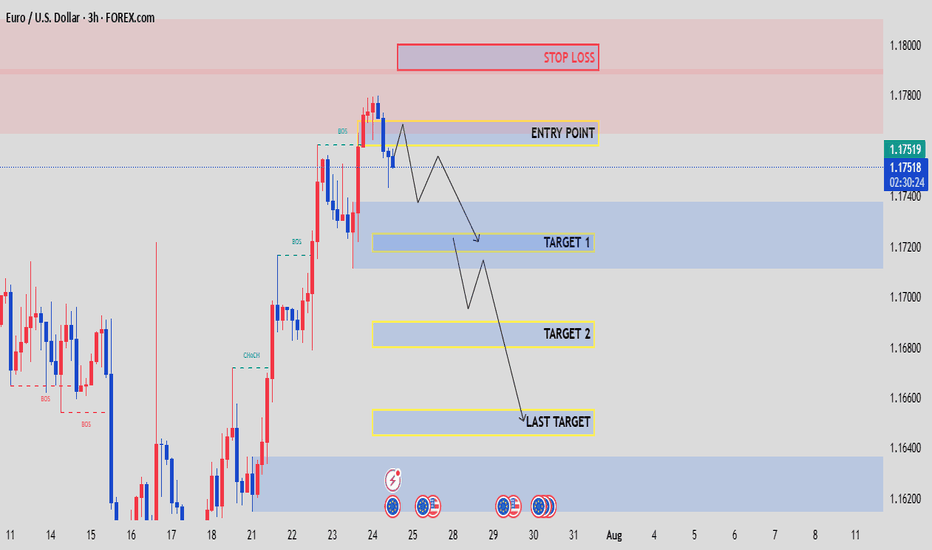

EURUSD NEW IDEASee the chart above, were on decling its momentum, I believe more trap longs this move.

SEE it in 2 days how things works. targets see charts.

I don't really explain to gain more tractions on how trading works.

I am here to understand the movement. Don't complicate too much, If you're a swing trader, take it a leap and have patience. stick to your own proper stoploss.

Trade it or leave it.

Goodluck folks.

EURUSD major resistance breakout bullish strong Readmore...📊EURUSD Analysis – 1H Timeframe

EURUSD has broken out of the descending channel with strength, shifting structure and showing clear bullish intent

📌 Breakout Confirmed:

✅ Major resistance at 1.16900 broken with strong momentum — now acting as support

Buy position activated from the 1.16900 breakout level

🎯 Next Resistance Targets / Supply Zones:

🔹 1.17200

🔹 1.17500

🔹 1.17600

Watching for reaction at these levels — trend continuation likely as long as structure holds

🧠Always follow your trading plan and risk rules — markets don’t promise, they move!

What’s your take on EURUSD’s breakout? Drop your thoughts below

#eurusd

👋Regards from expert Team

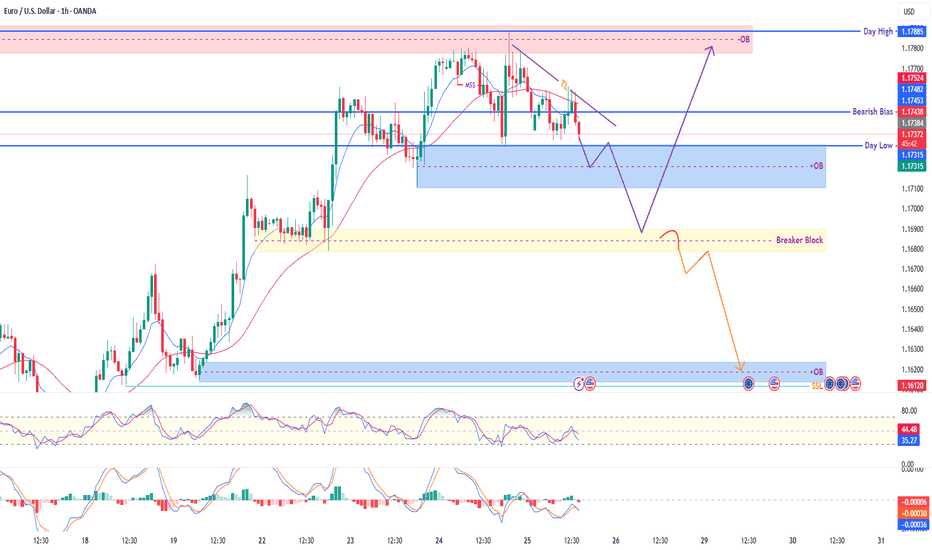

EUR/USD (1H) – Price Compression Near Decision Zone🔍 Market Insight:

The pair is hovering just above a fresh bullish OB zone, after forming a Market Structure Shift (MSS) and showing signs of bearish exhaustion. The chart outlines two clean scenarios – a potential reversal into premium OB or a deeper sweep toward the SSL below.

🧠 Smart Money Concepts Applied:

🔄 MSS + Trendline Liquidity (TL)

🧱 Order Blocks (OB) marked at high accuracy

⚡ Liquidity sweep potential toward SSL

🟨 Breaker Block acting as retest trap zone

📍 Key Price Zones:

🔴 Premium OB (Supply): 1.1752 – 1.1788

🔵 Demand OB (Buy Zone): 1.1731 – 1.1713

🟨 Breaker Block: ~1.1685 – 1.1700

🟦 Major Buy POI / SSL Trap Zone: 1.1612

🔵 Day High / Day Low: 1.1788 / 1.1733

📈 Scenario A – Bullish Reversal (Purple Path):

Price taps OB @ 1.1713 → reversal expected

First target: 1.1744 Bearish Bias Zone

Second target: 1.1788 OB

✅ Confirmation needed via bullish engulfing or BOS on LTF

📉 Scenario B – Liquidity Grab + Deeper Drop (Orange Path):

If OB fails, price may dive into the Breaker Block

Rejection from there can lead to the SSL sweep @ 1.1612

⚠️ This would trap breakout buyers & sweep below liquidity before bullish re-alignment

🎯 Trade Idea (Example – Scenario A):

Buy Limit: 1.1715

SL: 1.1695

TP1: 1.1744

TP2: 1.1785

Risk-Reward: ~1:3+

✅ Suggested TradingView Caption:

EUR/USD (1H) – Waiting for Liquidity Play

Price is consolidating near OB support with potential reversal to the premium zone. Two clean scenarios: a bullish break toward 1.1788 OB, or a liquidity sweep through the breaker block and into 1.1612 SSL.

RSI cooling off, MACD showing divergence. Staying patient for confirmation.

📘 Educational idea – not financial advice.

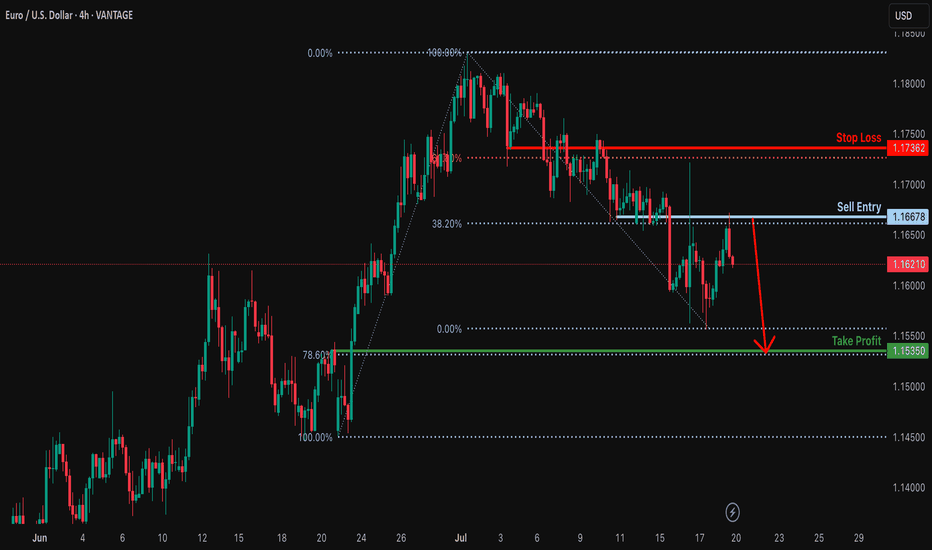

Bearish drop?EUR/USD has rejected off the resistance level which is a pullback resistance that lines up with the 38.2% Fibonacci retracement and could drop from this level to our tale profit.

Entry: 1.1667

Why we like it:

There is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Stop loss: 1.1736

Why we like it:

There is an overlap resistance that aligns with the 61.8% Fibonacci retracement.

Take profit: 1.1535

Why we like it:

There is a pullback support that lines up with the 78.6% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

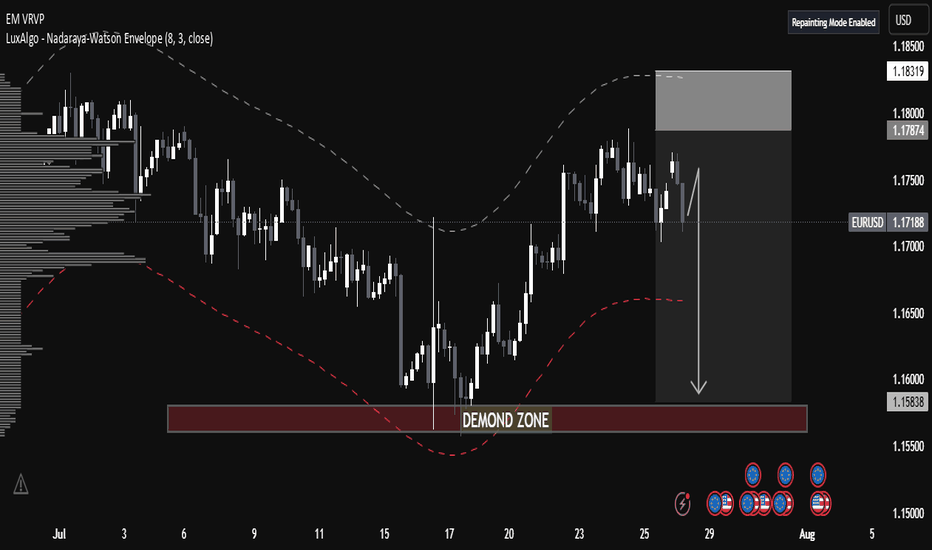

EUR/USD Technical Analysis📈 EUR/USD Technical Analysis

🔍 1. Market Structure

⚙ Trend Context

• The overall trend since mid-July has been bullish, with higher highs and higher lows forming after a bounce from a key demand zone (around 1.15380).

• However, recent candles show indecision and a potential reversal, suggesting weakening momentum.

⸻

🧱 2. Volume Profile Insight (VRVP)

• High Volume Nodes (HVNs):

• Significant trading activity occurred between 1.172–1.176, now acting as resistance.

• Low Volume Gaps:

• Thin liquidity zones exist between 1.165–1.158, which could result in swift price movement if selling pressure increases.

📘 Educational Insight: Thin volume areas on a profile typically allow for faster price transitions due to lack of order density.

⸻

📊 3. Envelope Indicator – Nadaraya-Watson (8,3)

• A mean-reversion tool estimating dynamic overbought and oversold areas.

• Price recently rejected the upper boundary, reinforcing the bearish outlook.

• The lower envelope, around 1.158–1.160, aligns with the projected bearish target.

⸻

🟫 4. Demand Zone Analysis

• Labeled “DEMAND ZONE” at 1.15380–1.15830

• Previously caused a strong bullish reversal, marking it as an area of institutional interest.

• A re-test of this zone may attract buyers once again, presenting a key support area.

📘 Educational Insight: Demand zones reflect

EURUSD: Will Go Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.15996 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.15562..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

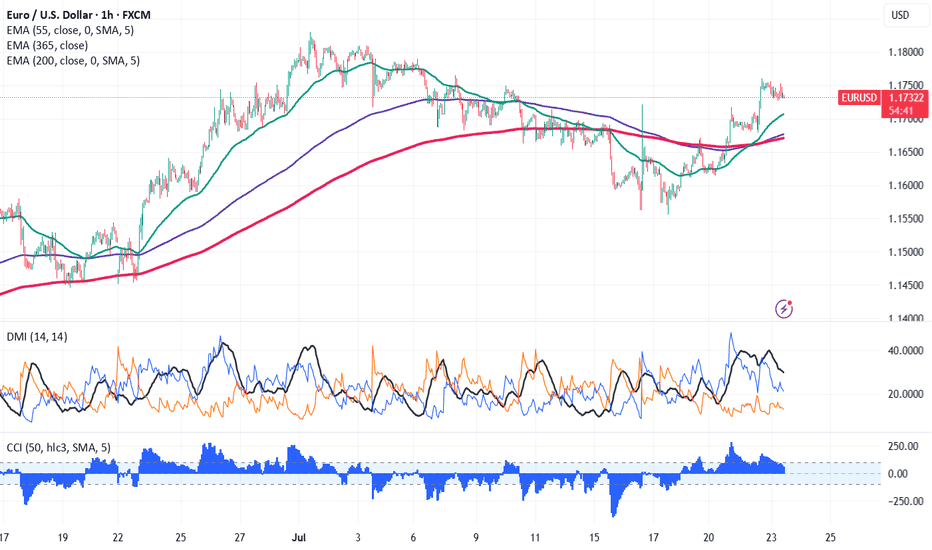

Euro Rallies Past 1.1750—Can the Uptrend Continue? EUR/USD surged above 1.1750 on easing trade tension. It hit an intraday low of 1.17604 and is currently trading around 1.117428. Overall trend remains bullish as long as support 1.1670 holds.

The pair is holding above the 55 EMA,above 200 EMA, and 365 EMA in the 1 -hour chart. Near-term resistance is seen at 1.1765, a break above this may push the pair to targets of 1.1800/1.1835/1.19090/1.1956/1.200. On the downside, support is seen at 1.1700; any violation below will drag the pair to 1.1670/1.1600/1.155.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Neutral

It is good to buy on dips around 1.1720 with a stop-loss at 1.1665 for a target price of 1.1835.

EURUSD ahead of the ECBYesterday, EURUSD continued its bullish movement, reaching 1,1780.

Today, the ECB will announce its decision on interest rates.

The news is scheduled for 1:15 PM, followed by a press conference 30 minutes later.

Expect possible sharp and misleading price movements — reduce your risk and avoid rushing into new positions!

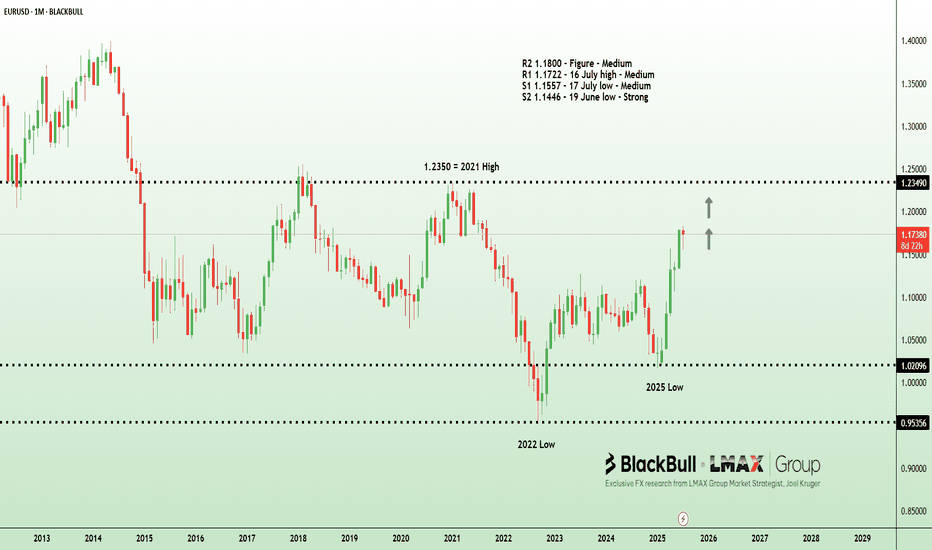

Dollar dips as politics cloud Fed picture | FX ResearchThe dollar extended its slide on Tuesday, weighed down by soft US regional data and renewed political pressure on the Fed, reinforcing the market's dovish bias. The Richmond Fed manufacturing index plunged to -20, far below expectations, while business conditions and the Philly Fed survey showed slight improvements but remained in contractionary territory.

Treasury Secretary Bessant added to the day's drama with mixed messaging, praising Fed Chair Powell's capabilities while simultaneously calling for an internal review and pressing for rate cuts, aligning with President Trump's stance that rates should be 300 basis points lower.

Trade headlines added to the noise with Bessant signaling a hard August 1 deadline for trade talks and Trump announcing a new deal with Indonesia, albeit one that still includes steep tariffs.

With the Fed in blackout mode ahead of its next meeting, markets are left to navigate a fog of political theatrics and economic uncertainty. The euro climbed to near one-month highs as the dollar softened. And traders now turn to upcoming US data and a heavy Treasury supply schedule for further direction.

Exclusive FX research from LMAX Group Market Strategist, Joel Kruger

Bullish momentum to extend?The Fiber (EUR/USD) is falling towards the pivot, which acts as an overlap support and could rise to the 1st resistance, which has been identified as a swing high resistance.

Pivot: 1.1588

1st Support: 1.1447

1st Resistance: 1.1817

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

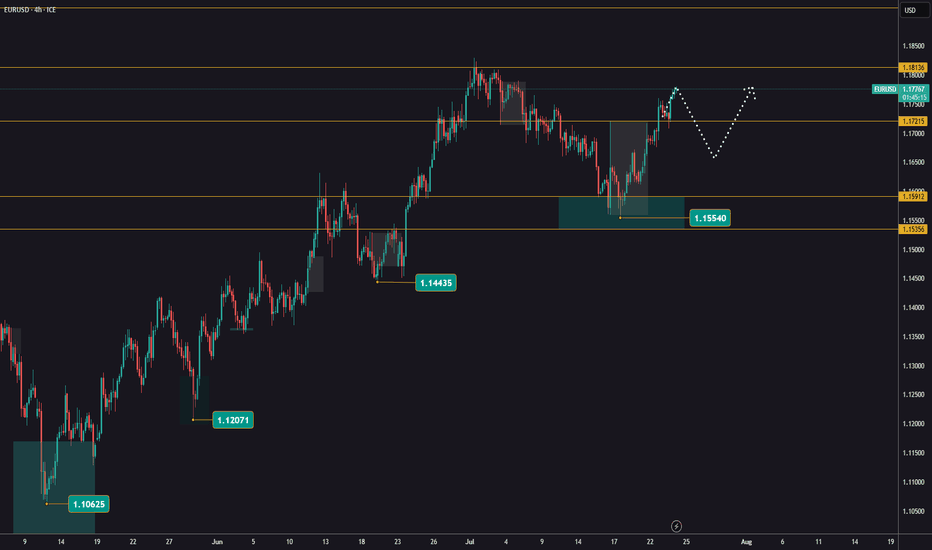

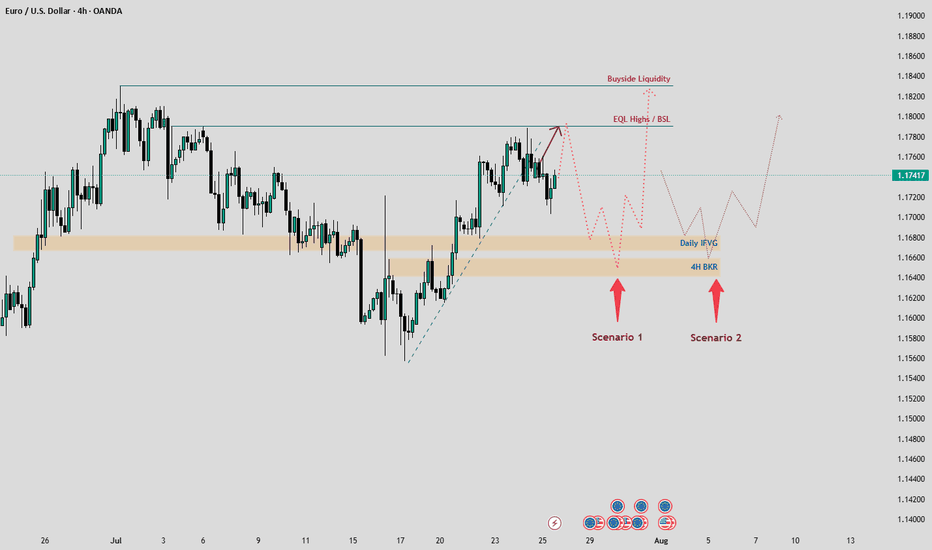

EURUSD Weekly Analysis: Key Levels and Scenarios to WatchHello, TradingView Community! 👋

Following our last EURUSD analysis, where we accurately predicted a bullish pullback from a key area within a descending channel, the price reacted as expected, delivering a solid move upward. Now, let’s dive into this week’s outlook, focusing on critical levels and two potential scenarios, keeping in mind the major economic events on the horizon. 📊

Current Market Context

EURUSD has recently reacted from a weekly Fair Value Gap (FVG) and is currently navigating the mid-range, with its sights set on Buyside Liquidity at the top. However, reaching this liquidity pool won’t be straightforward, as the price is likely to collect liquidity from lower Premium/Discount Arrays (PD Arrays) before making a significant move.

We’ve identified key levels to watch:

Daily Imbalance FVG (IFVG): A critical support zone where price could find buying interest.

4H Breaker Block: A high-probability reversal zone on the 4-hour chart.

Relative Equal Highs / Previous Week High (PWH) : Acting as a magnet for price action, especially early in the week.

With major economic events like the FED meeting and Non-Farm Payrolls (NFP) looming, volatility is expected. Let’s break down the two potential scenarios for EURUSD this week.

Scenario 1: Price Targets Equal Highs / PWH First 📈

In this scenario, we expect EURUSD to be drawn toward the relative equal highs or previous week’s high (PWH) early in the week, potentially on Monday, forming the high of the week. These levels act as a magnet for price due to trapped liquidity and stop orders.

What to Watch:

Price Action at Equal Highs / PWH: Look for rejection signals (e.g., bearish candlestick patterns, divergence, or liquidity sweeps) indicating a potential reversal.

Confirmation for Shorts: If the price reaches these highs and shows a strong bearish reaction, this could signal a drop toward the Daily IFVG or 4H Breaker Block.

Trading Plan:

Entry: Consider short positions if price rejects at equal highs or PWH with clear bearish confirmation.

Target: Aim for the Daily IFVG or 4H Breaker Block as initial downside targets.

Stop Loss: Place above the equal highs/PWH to protect against a breakout.

This scenario is more likely given the magnetic nature of equal highs and the upcoming economic catalysts driving volatility.

Scenario 2: Price Drops to Daily IFVG / 4H Breaker First 📉

Alternatively, EURUSD could move lower first, targeting the Daily IFVG and potentially the 4H Breaker Block. If the price fails to break above the equal highs and instead drops toward these lower PD Arrays, we could see the low of the week form by Monday or Tuesday.

What to Watch:

Price Action at PD Arrays: Monitor for bullish reversal signals (e.g., absorption, bullish engulfing, or liquidity grabs) at the Daily IFVG or 4H Breaker Block.

Confirmation for Longs: A strong bullish reaction at these levels could signal a move toward the Buyside Liquidity at the top.

Trading Plan:

Entry: Look for long positions if price reaches the Daily IFVG or 4H Breaker Block and shows bullish confirmation.

Target: Target the Buyside Liquidity or intermediate resistance levels.

Stop Loss: Place below the IFVG or Breaker Block to manage risk.

Risk Management: Stay Disciplined! ⚠️

With major economic events like the FED meeting and NFP this week, volatility could spike. Always prioritize risk management:

Position Sizing: Risk no more than 1-2% of your account per trade.

Stop Losses: Always use a stop loss to protect your capital.

Trade Confirmation: Wait for clear price action signals before entering trades.

Avoid Overtrading: Stick to high-probability setups and avoid chasing the market.

Call to Action (CTA) 📢

What do you think about these scenarios? Are you leaning toward Scenario 1 or Scenario 2? Drop your thoughts in the comments below, give this post a LIKE if you found it helpful, and FOLLOW for more weekly analyses! Let’s discuss and trade smarter together! 💬

Stay sharp, manage your risk, and let’s conquer the markets! 🚀

#EURUSD #Forex #TechnicalAnalysis #TradingView

EURUSD pullbackYesterday, EURUSD attempted to continue its bullish move but was rejected at 1,1788.

Keep an eye on whether it has the strength for another push higher. If it fails again, a correction is more likely to follow.

The first support levels to watch are 1,1699 and 1,1644.

Next week, the FED’s interest rate decision is due.

That news will likely determine both the direction and timing for entry.

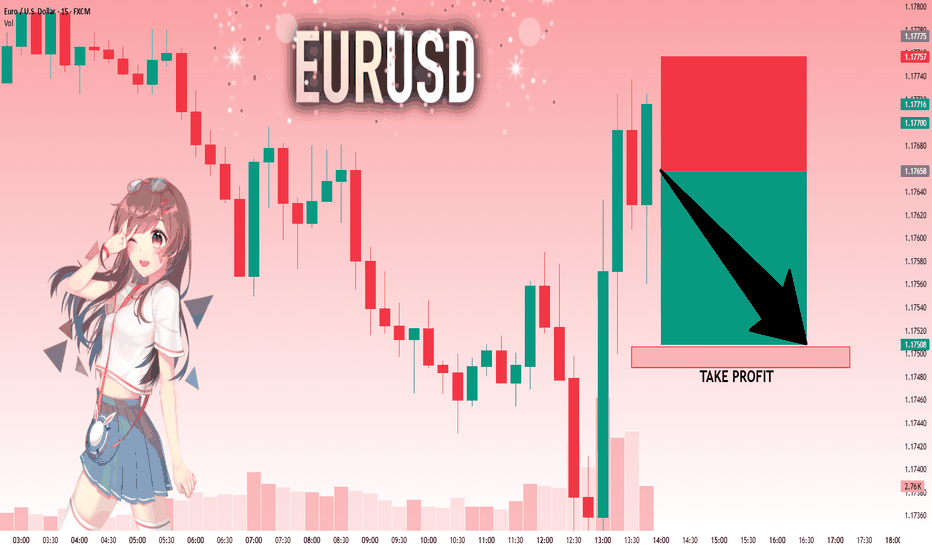

EURUSD: Next Move Is Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.17658 Therefore, a strong bearish reaction here could determine the next move down.We will watch for a confirmation candle, and then target the next key level of 1.17506..Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️