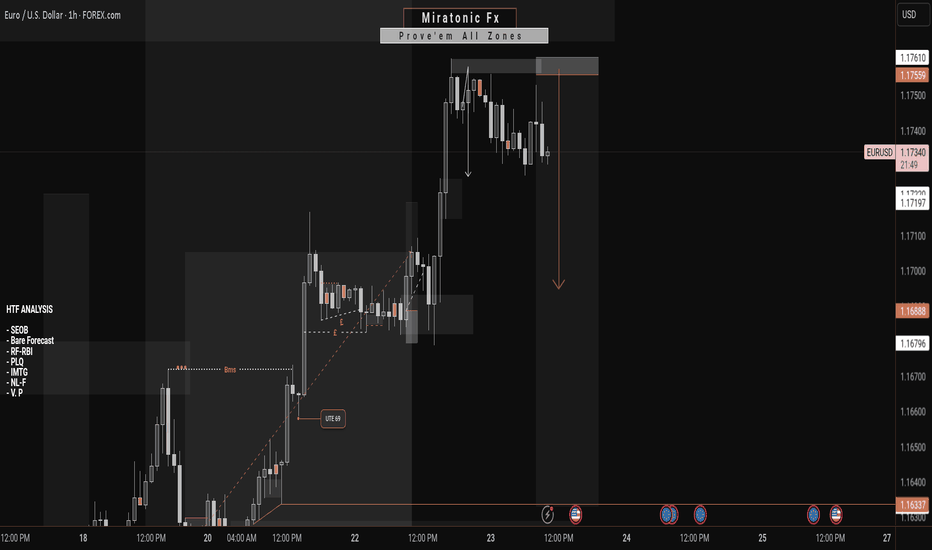

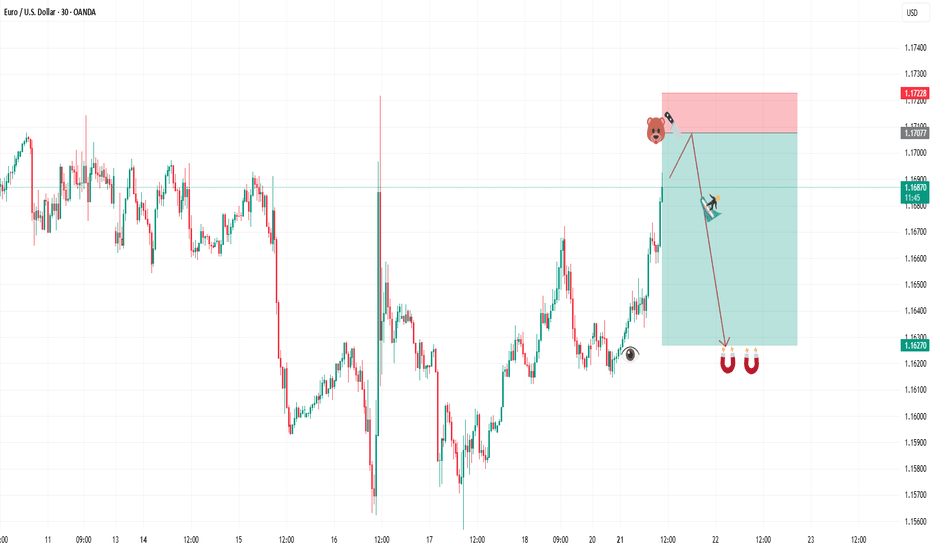

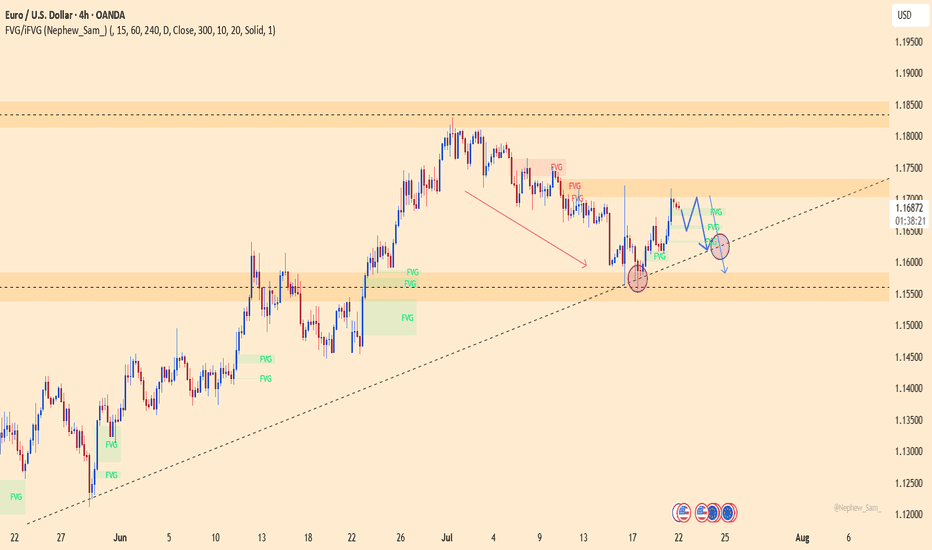

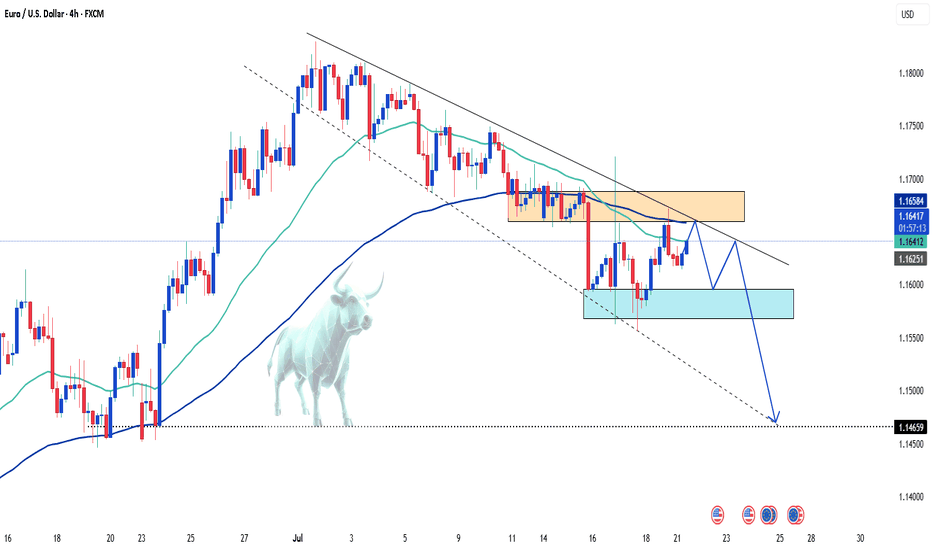

What's Next On EURUSDPrice currently leans toward a bearish pullback after a series of impulsive bullish moves. So far, we haven’t seen any significant retracement since the rally began. As we anticipate a potential correction, could this be the awaited moment for the bears to step in—especially with only weaker structures left behind and bearish pressure building?

Regardless, every market scenario demands discipline and proper risk management.

Thinking of taking this outlook? Be sure to wait for strong confirmation before jumping in.

Good luck, traders, as we watch price unfold.

👉 Follow for more updates. See you in the next one 😉.

USDEUX trade ideas

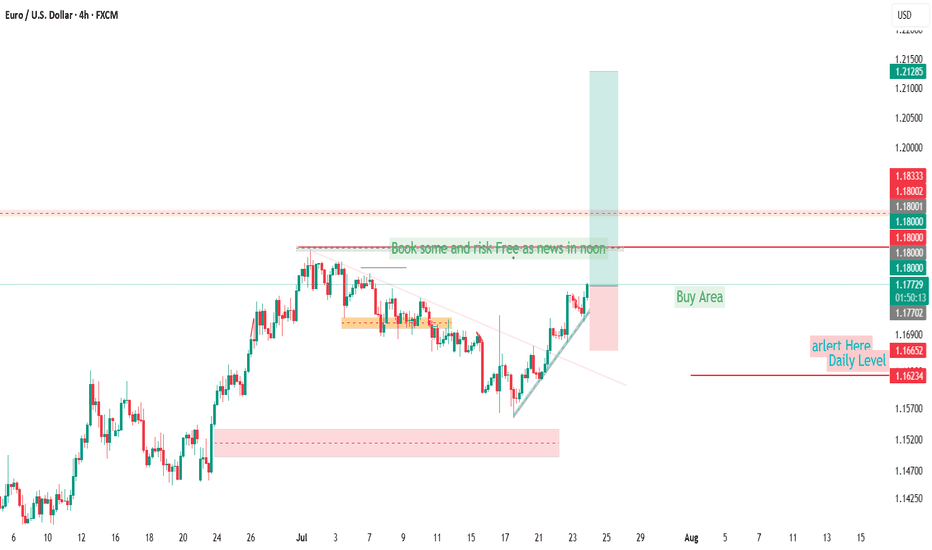

EURUSD ahead of the ECBYesterday, EURUSD continued its bullish movement, reaching 1,1780.

Today, the ECB will announce its decision on interest rates.

The news is scheduled for 1:15 PM, followed by a press conference 30 minutes later.

Expect possible sharp and misleading price movements — reduce your risk and avoid rushing into new positions!

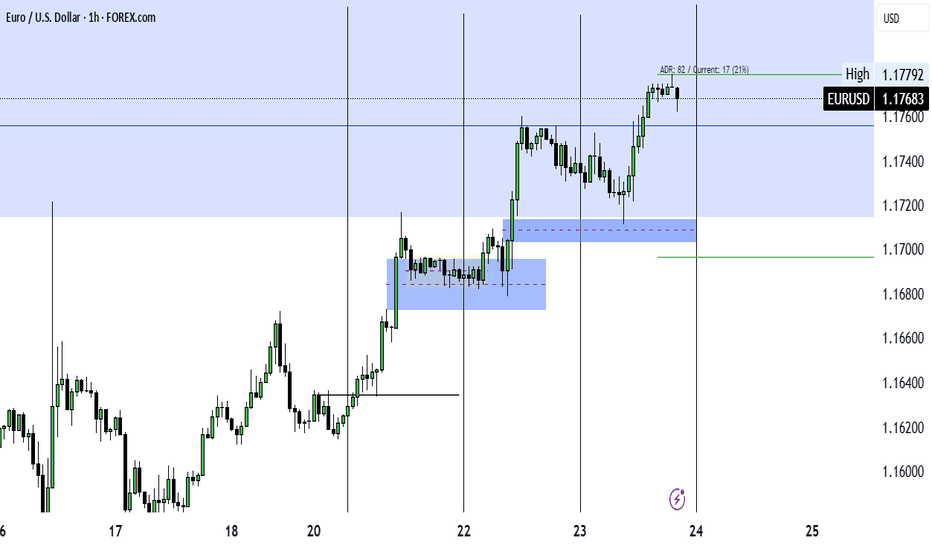

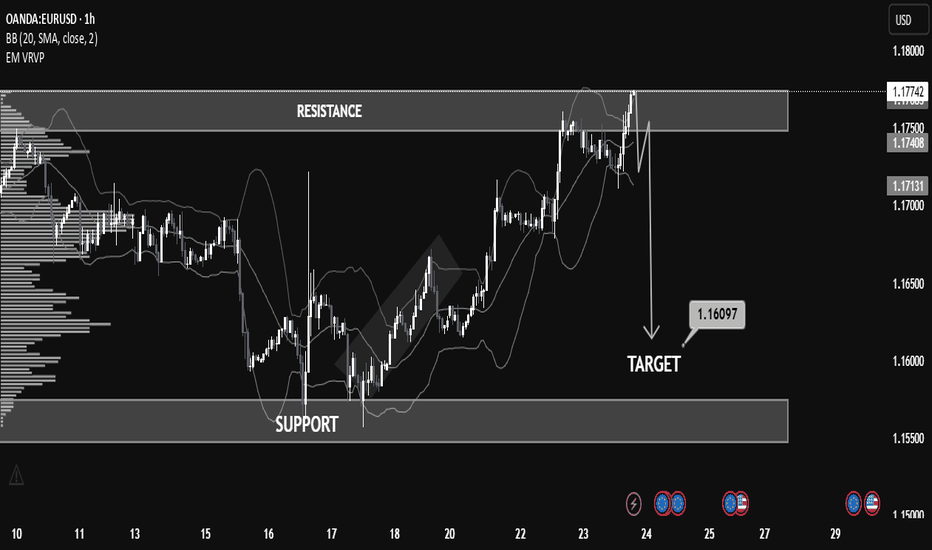

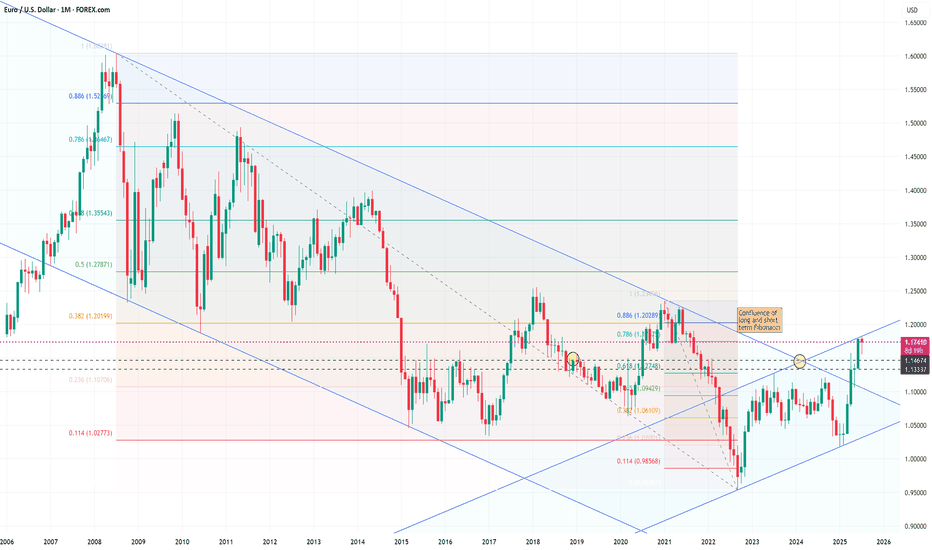

Educational EUR/USD Chart Breakdown – Price Action at Key LevelsEducational EUR/USD Chart Breakdown – Price Action at Key Levels

This EUR/USD (1-hour) chart provides a great example of how support and resistance zones, combined with price action and indicators like Bollinger Bands, can help anticipate market moves.

🔹 Resistance Zone Tested:

The pair recently approached the 1.17500–1.17800 resistance zone. This level had previously acted as a supply zone, and price once again showed rejection here, indicating selling pressure.

🔹 Bollinger Band Overextension:

Notice how the price extended beyond the upper Bollinger Band—this often signals that the market is overbought in the short term, leading to a potential reversal or correction.

🔹 Bearish Reaction & Target:

After rejection from resistance, the chart outlines a bearish move with a target at 1.16097. This level lies just above the next strong support zone (1.15500–1.16100), offering a realistic area for price to stabilize if the downtrend continues.

🔹 What to Learn:

Support & Resistance: Prices often react at key zones; previous resistance can turn into support and vice versa.

Confluence Tools: Use indicators like Bollinger Bands with price structure to increase confidence.

Target Planning: Identify likely reaction zones for risk management and profit-taking.

📚 Summary

This setup is a clean example of trading within a range and using technical confluence to plan entries and exits. If price breaks below 1.17130 with strong momentum, the probability increases for the market to reach the 1.16097 target.

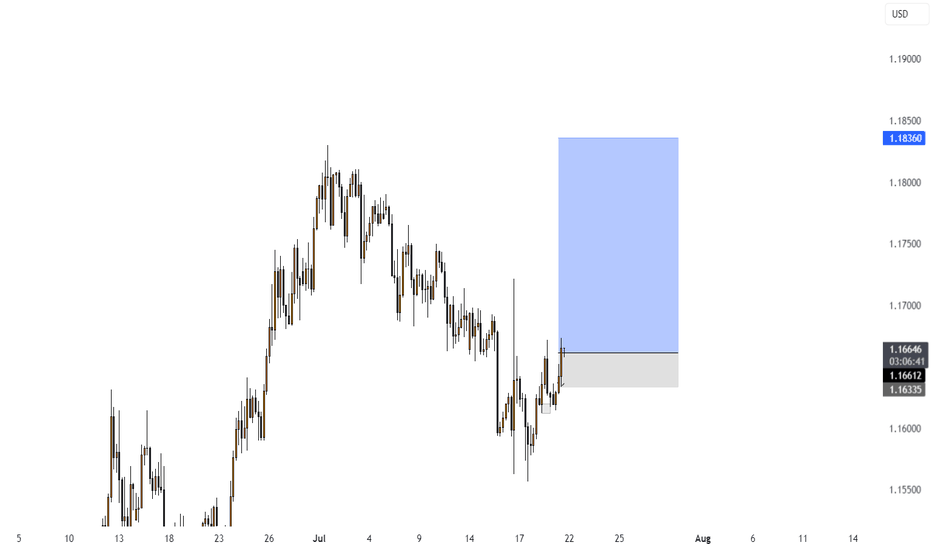

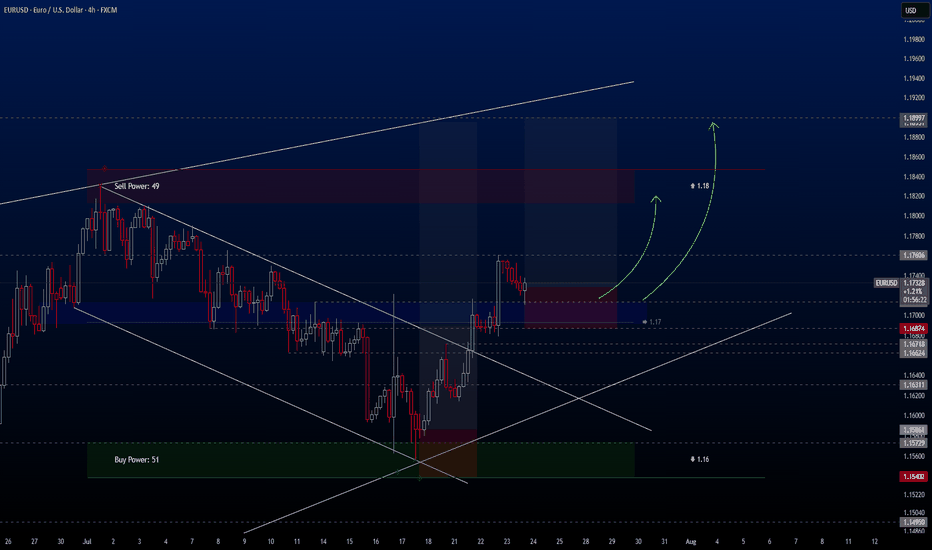

EURUSDHello traders,

I've been closely monitoring the **EURUSD** pair for a while, and it’s now offering an ideal entry opportunity. It has presented several great setups for swing trading, and I’d like to share one of them with you today.

🔍 **Trade Details**

✔️ **Timeframe**: H4/D

✔️ **Risk-to-Reward Ratio**: 1:4.22

✔️ **Trade Direction**: Buy

✔️ **Entry Price**: 1.17281

✔️ **Take Profit**: 1.18997

✔️ **Stop Loss**: 1.16874

🔔 **Disclaimer**: This is not financial advice. I’m simply sharing a trade I’ve taken based on my personal trading system, strictly for educational and illustrative purposes.

📌 Interested in a systematic, data-driven trading approach?

💡 Follow the page and turn on notifications to stay updated on future trade setups and advanced market insights.

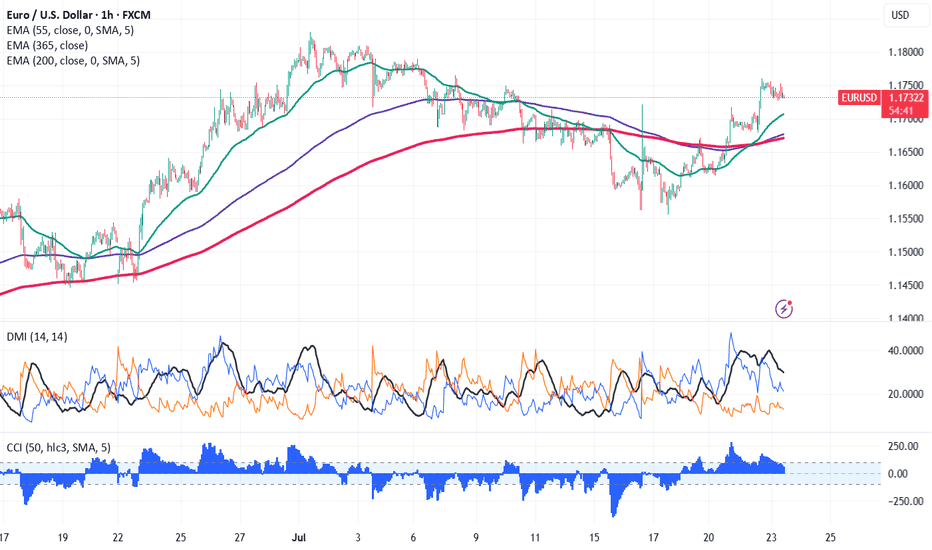

Euro Rallies Past 1.1750—Can the Uptrend Continue? EUR/USD surged above 1.1750 on easing trade tension. It hit an intraday low of 1.17604 and is currently trading around 1.117428. Overall trend remains bullish as long as support 1.1670 holds.

The pair is holding above the 55 EMA,above 200 EMA, and 365 EMA in the 1 -hour chart. Near-term resistance is seen at 1.1765, a break above this may push the pair to targets of 1.1800/1.1835/1.19090/1.1956/1.200. On the downside, support is seen at 1.1700; any violation below will drag the pair to 1.1670/1.1600/1.155.

Market Indicators and Trading Strategy

Commodity Channel Index (CCI)- Bullish

Average Directional Movement Index (ADX) - Neutral

It is good to buy on dips around 1.1720 with a stop-loss at 1.1665 for a target price of 1.1835.

EURUSD – Is the rally over? Time for a collapse?The technical picture reveals that EURUSD is losing momentum after a brief rebound. The 1.1700 level stands as a key resistance – if bulls fail to break it, the bears will take the wheel! A clear scenario is forming: lower highs, FVGs filled, and a potential drop toward the 1.1580 support zone this week.

The bad news for the euro isn’t over: yesterday’s Eurozone PMI data disappointed heavily, signaling stagnating growth. Meanwhile, the USD is gaining traction from strong labor data and hawkish Fed remarks, putting EURUSD under double pressure.

If the ascending trendline breaks, EURUSD could plunge even further – get ready for a potential breakdown!

Suggested strategy: Prioritize SELL below 1.1700, with a short-term target at 1.1580.

Stop-loss: Above 1.1720 – a breakout here would invalidate the bearish setup.

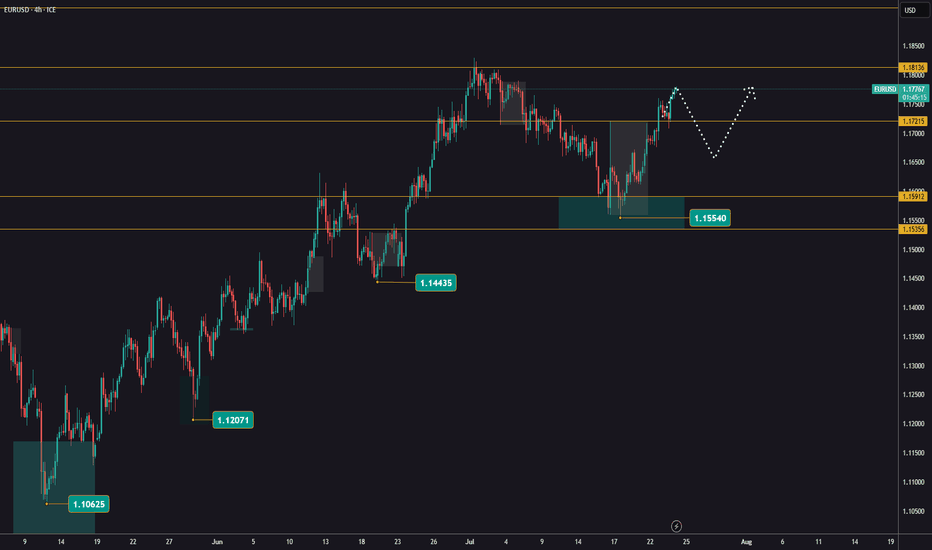

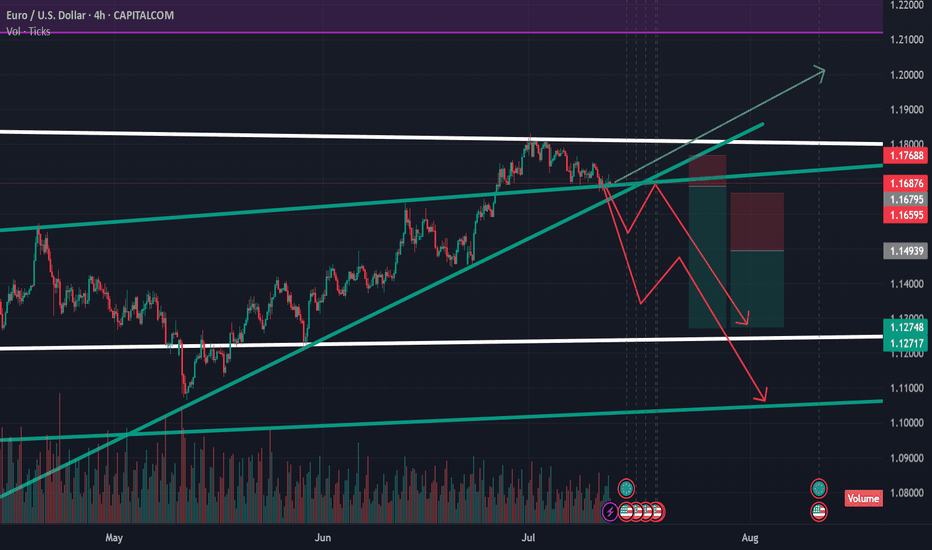

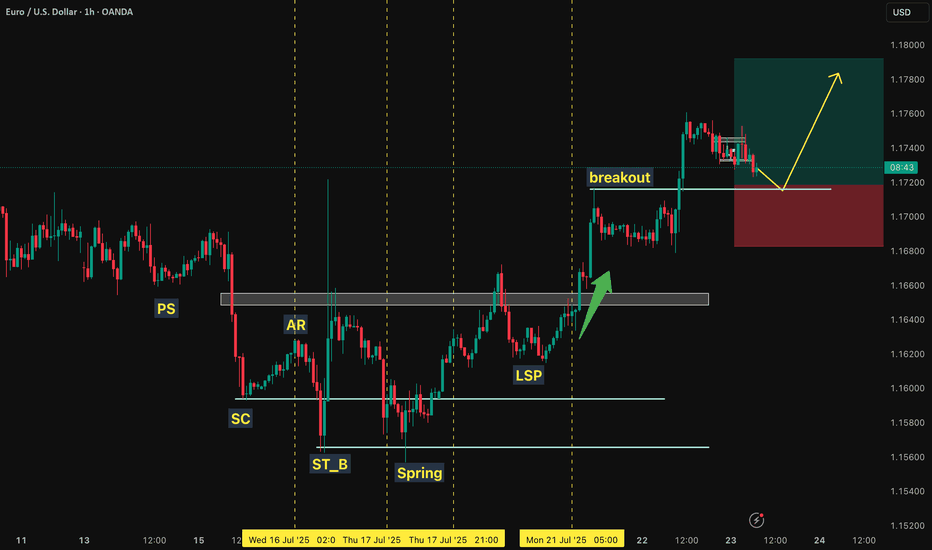

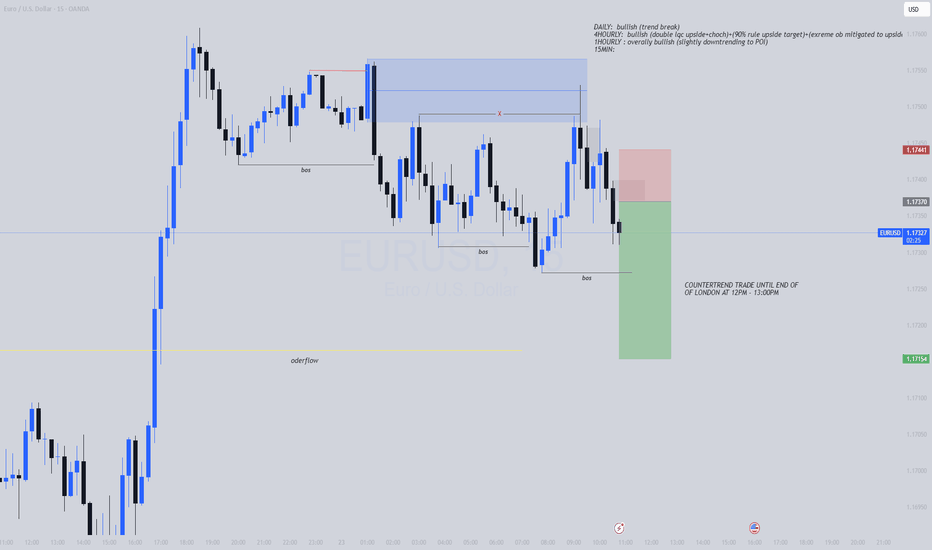

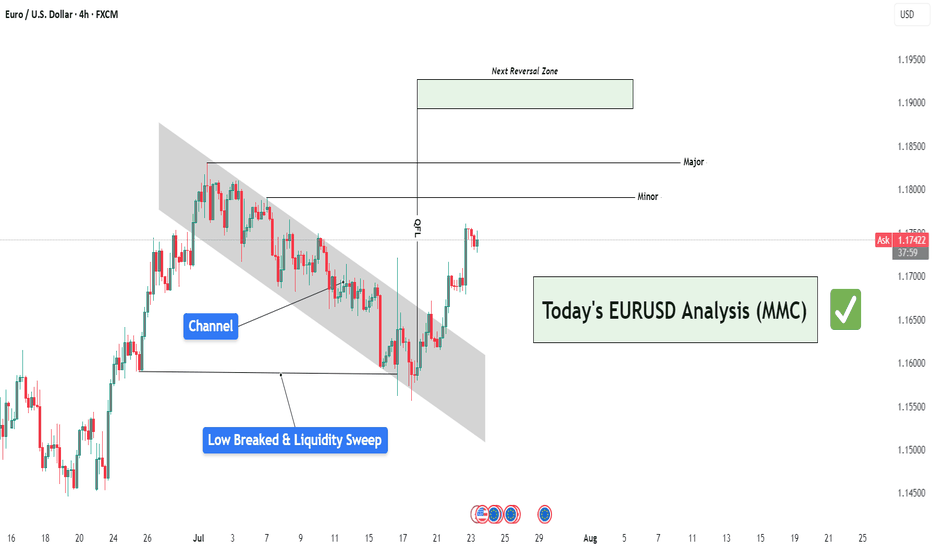

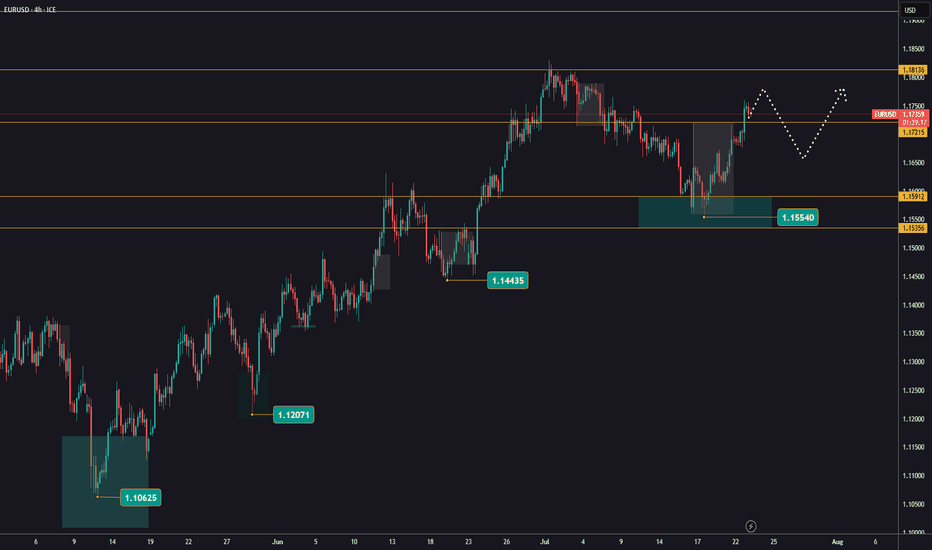

EURUSD Analysis : Liquidity Sweep – EURUSD Targets TO Reversal🧠 Institutional Context & Big Picture

EURUSD has been in a tightly controlled descending channel for several weeks—a classic sign of a market being engineered for liquidity collection. Rather than a naturally trending bearish market, this price action reflects stealth accumulation and market maker manipulation.

The channel structure was used to:

Establish a visible bearish trend (to trap sellers)

Trigger emotional bias for continued shorting

Build up stop orders below swing lows

This phase was about building energy, not continuation.

🔍 Detailed Breakdown of the Chart Elements

📌 1. Descending Channel – Controlled Manipulation

The pair moved within a well-defined bearish channel for multiple weeks.

Each touch respected the top and bottom perfectly—not random, but institutional structure.

It fostered retail confidence in the downtrend while market makers prepared for a reversal.

💥 2. Liquidity Sweep & Trap (Low Breaked & Liquidity Grabbed)

Price spiked below the previous low, clearly sweeping liquidity on July 21.

This is the "engineered breakdown", meant to trigger breakout sellers and stop out early longs.

Immediately after the sweep, the price violently reversed—clear evidence of a liquidity trap.

This is classic MMC logic: induce, trap, reverse.

🟩 3. QFL Base Formed – Bullish Engine Ignited

At the point of reversal, the chart shows the formation of a QFL (Qualified Liquidation Failure) zone.

This QFL base is the core of smart money accumulation—price broke below a base, then quickly reclaimed it.

It's not just support—it’s the true origin of the reversal and an optimal entry point.

📈 4. Breakout from the Channel – Structure Shift Confirmed

Price broke out of the descending channel with strong momentum, confirming:

Structure shift from lower lows → higher highs

Momentum shift in favor of bulls

Entry confirmation for MMC-based long setups

This breakout invalidates the bearish trend and signals a fresh leg up, likely toward unmitigated supply zones.

🟨 5. Current Price Action – Healthy Bullish Consolidation

After the breakout, price is consolidating just above the broken channel, forming a mini-flag or base.

This indicates:

Smart money is accumulating more

No significant selling pressure

Likely continuation toward next supply

🎯 6. Next Targets – Reversal Zones

Minor Resistance: ~1.1800

Major Resistance: ~1.1850 – 1.1880

Next Reversal Zone: 1.1900–1.1950

This zone is highlighted as a potential sell-off area where institutions may offload positions or create new traps.

Watch for signs of exhaustion or redistribution here.

📌 Trade Plan Based on MMC Structure

✅ Bullish Scenario (Currently Active)

Entry Area: Ideally at QFL base or breakout retest (~1.1700–1.1720 zone)

Confirmation: Bullish price action (engulfing, flag break, or liquidity wick)

Targets:

🎯 TP1: 1.1800

🎯 TP2: 1.1850

🎯 TP3: 1.1950 (Reversal Supply Zone)

❌ Invalidation:

A break below the QFL base (~1.1670) with bearish volume would invalidate the bullish MMC structure.

🧠 Smart Money Insight & Logic Recap

This entire move reflects a classic Market Maker Strategy:

Build a trend (descending channel) to shape trader bias

Trigger liquidity events (false breakdown)

Accumulate at the lows via QFL logic

Shift structure (channel breakout)

Target unfilled institutional supply (1.1850–1.1950)

This isn’t random—it’s engineered movement. Your job as a trader is to identify footprints, not follow the crowd.

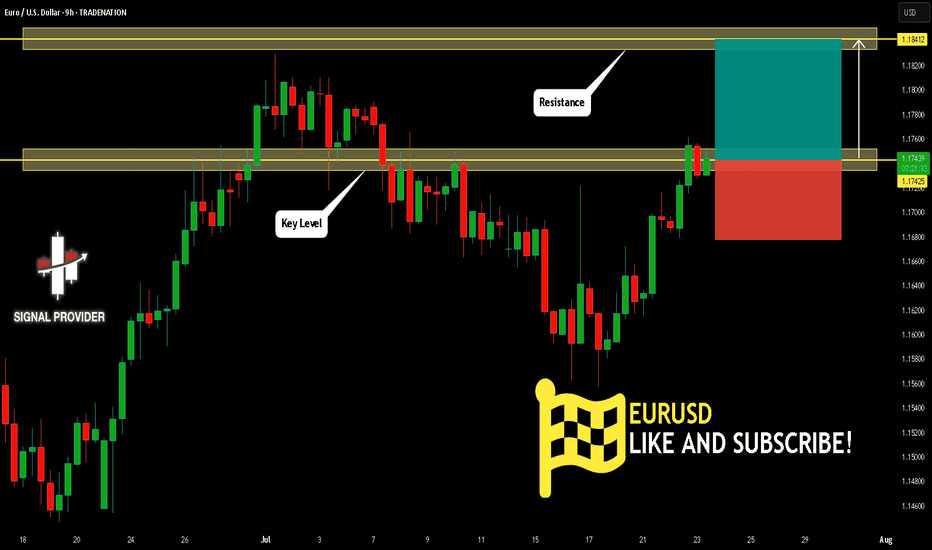

EURUSD Will Move Higher! Long!

Here is our detailed technical review for EURUSD.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 1.174.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.184 level soon.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

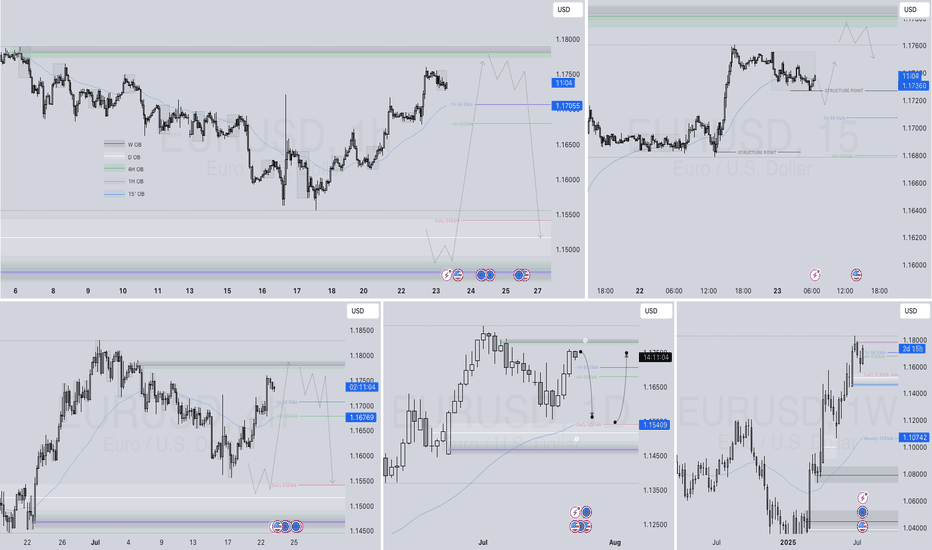

EURUSD Q3 | D23 | W30 | Y25📊EURUSD Q3 | D23 | W30 | Y25

Daily Forecast🔍📅

Here’s a short diagnosis of the current chart setup 🧠📈

Higher time frame order blocks have been identified — these are our patient points of interest 🎯🧭.

It’s crucial to wait for a confirmed break of structure 🧱✅ before forming a directional bias.

This keeps us disciplined and aligned with what price action is truly telling us.

📈 Risk Management Protocols

🔑 Core principles:

Max 1% risk per trade

Only execute at pre-identified levels

Use alerts, not emotion

Stick to your RR plan — minimum 1:2

🧠 You’re not paid for how many trades you take, you’re paid for how well you manage risk.

🧠 Weekly FRGNT Insight

"Trade what the market gives, not what your ego wants."

Stay mechanical. Stay focused. Let the probabilities work.

FRGNT

EUR/USD: Bearish Trend in FocusHello everyone, what are your thoughts on EUR/USD?

From my personal analysis, it's clear that EUR/USD is extending its downtrend. The pair is trading around 1.164 and is under pressure from sellers after breaking below both the EMA 34 and EMA 89, with EMA 34 already turning downward — a classic bearish signal.

On the macro side, the European Central Bank is set to announce its monetary policy decision on Thursday. Meanwhile, U.S. President Donald Trump's ongoing trade tensions may add further uncertainty to the market. This corrective downtrend in EUR/USD could very well continue in the weeks ahead.

What do you think — will EUR/USD keep falling?

EURUSD on the riseYesterday, EURUSD broke through the 1,1720 resistance level with strong momentum.

This confirms the uptrend and opens up opportunities for buying.

The ECB is set to announce interest rates tomorrow, which could trigger increased market volatility.

Keep an eye out for higher lows and signs of the uptrend continuing.

EUR/USD neutral: Proceed with cautionHello traders

My short was short lived and not too damaging.

This powerful EUR/USD bounce is not unusual but perhaps a little bit of a head scratcher.

No economic data of note.

Maybe some positioning before the ECB rate decision?

I don't know what time this morning Senator Mike Lee(R) of Utah decided it was a good idea to repost a clearly fake resignation letter from Chairman Jerome Powell on X, so perhaps that was a factor.

Once again, Scott Bessent calmed the markets by stating that he does not see any reason for Chair Powell to resign.

The technical picture is clear. The pair has broken and closed above a long term downtrend line/channel but is at the upper boundary of the short term channel.

I have noticed several ideas and minds looking for a decline to 1.1450. The intersection of the up and downtrend lines identifies that as a possible level to go long.

However, I take it one day at a time and I am generally hesitant to make long term predictions, so use your own best judgment.

The current economic environment is rife with uncertainty, so keep the risk small. To diversify,

I have been looking for potential growth stocks to dip my toes back into the stock market.

JOBY or ACHR anyone?

Best of luck

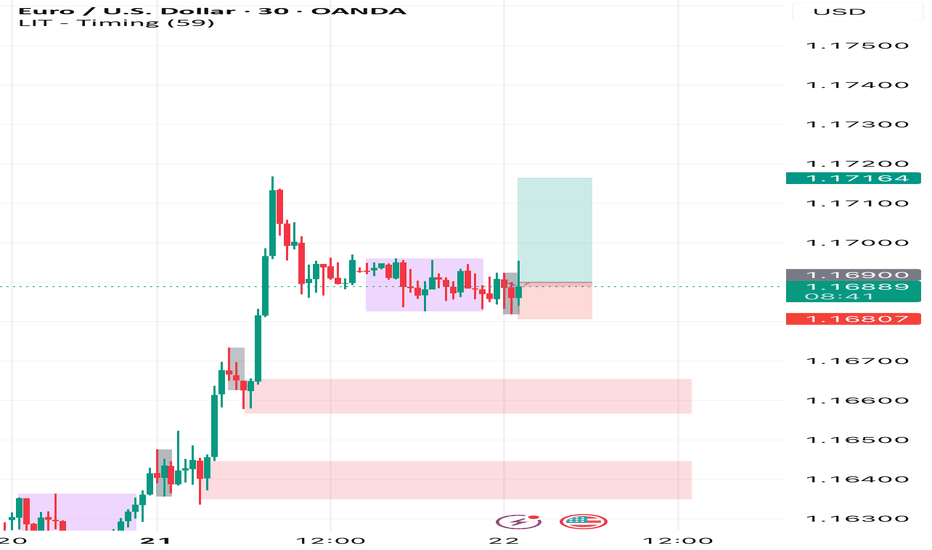

2025.07.22 LONG EURUSDThis is a long trade on EURUSD utilizing smart money concepts.

There are multiple areas of liquidity pooling above, and now that trendline liquidity has been broken, trade management parameters are in place.

Orders have been transmitted, and this is a swing trade potentially lasting 4-8 weeks.

happy trading all

-kevin