USDEUX trade ideas

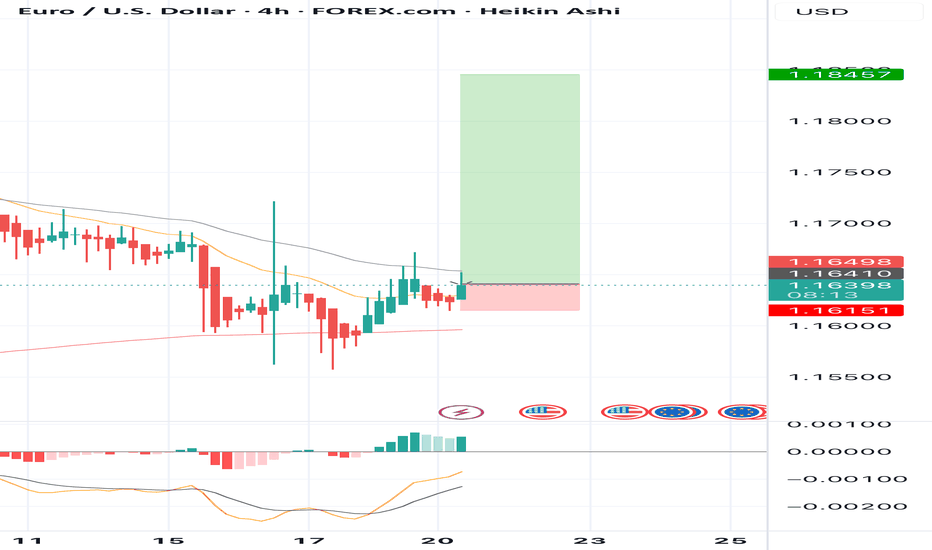

BUY EURUSD now for 4h time frame bullish trend continuation BUY EURUSD now for 4h time frame bullish trend continuation ...............

STOP LOSS: 1.1615

This buy trade setup is based on hidden bullish divergence trend continuation trading pattern ...

Always remember, the trend is your friend, so whenever you can get a signal that the trend will continue, then good for you to be part of it

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything...

Remember to risk only what you are comfortable with... trading with the trend, patient and good risk management is the key to success here

EURUSD: the ECB weekThe focus of the previous week was on US inflation figures. Posted data showed relatively stable figures for June, as inflation was standing at 0,3% for the month and 2,7% on a yearly basis. Both figures were in line with market expectations. Core inflation remained elevated and reached 0,2% for June and 2,9% y/y. At the same time, core inflation was by 0,1pp lower from market forecasts. The Producers Price Index in June was standing at 0%, same as core PPI. Compared to the year before, PPI was increased by 2,3%, while core PPI was higher by 2,6%. Retail sales in June were higher by 0,6%, and were better from market estimates of 0,1%. Building permits preliminary for June reached 1,397M and housing starts were standing at 1,321M in line with market expectations. The University of Michigan Consumer Sentiment preliminary for June was at the level of 61,8 in line with forecasts. Five year inflation expectations cooled a bit to 3,6%, from previous 4%. This year inflation expectations also eased to 4,4% from previous 5%.

The Industrial Production in the Euro Zone in May was higher by 1,7% for the month, bringing the indicator to the level of 3,7% on a yearly basis. Both figures were much higher from market forecasts of 0,9% for the month and 2,4% for the year. The ZEW Economic Sentiment Index in July for Germany reached the level of 52,7 a bit higher from forecasted. The final CPI in the Euro Zone in June was 2,3% y/y and core CPI at 2,3%, without change from the previous estimates.

For the second week in a row markets favored the US Dollar, which strengthened to the level of 1,1570 against euro. The currency pair ended the week at the level of 1,1626. The RSI continues to move around the level of 50 and is still not ready for a move toward the oversold market side. The MA50 continues to diverge from MA200, without an indication of a potential change in course in a near term period.

With a move toward the 1,1560, the eurusd tested the short term support line. At this level, the currency pair peaked in April this year. Charts are pointing to a potential for the short term reversal in the coming period. In this sense, levels modestly above the 1,17 resistance could be shortly tested. On the opposite side, 1,1560 might be tested for one more time at the start of the week, before the move toward upside. It should be considered that the ECB meeting will be held in a week ahead, where ECB members will draw the interest rate decision. A pause in rate cuts is overwhelmingly expected by market participants.

Important news to watch during the week ahead are:

EUR: GfK Consumer Confidence in august in Germany, HCOB manufacturing PMI flash for July for both Germany and Euro Zone, ECB meeting and interest rate decision will be held on Thursday, July 24th, Ifo Business Climate in July in Germany,

USD: Existing Home Sales in June, Durable Goods Orders in June.

DeGRAM | EURUSD reached the resistance line📊 Technical Analysis

● EUR/USD has reclaimed the inner resistance of the 8-day descending channel after a V-shaped rebound from the lower rail; candles are now riding a fresh micro up-sloper.

● A 30 min close above 1.1666 (channel roof / prior pivot) confirms trend reversal and projects the measured move to the higher congestion band at 1.1690-1.1700.

💡 Fundamental Analysis

● Yesterday’s dip in US 2-yr yields after weaker Philly-Fed new-orders and higher jobless claims softens dollar demand, while ECB minutes signalled no rush to ease further, supporting the euro.

✨ Summary

Long 1.1630-1.1650; break of 1.1666 targets 1.1690 → 1.1700. Invalidate on an H1 close below 1.1585.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

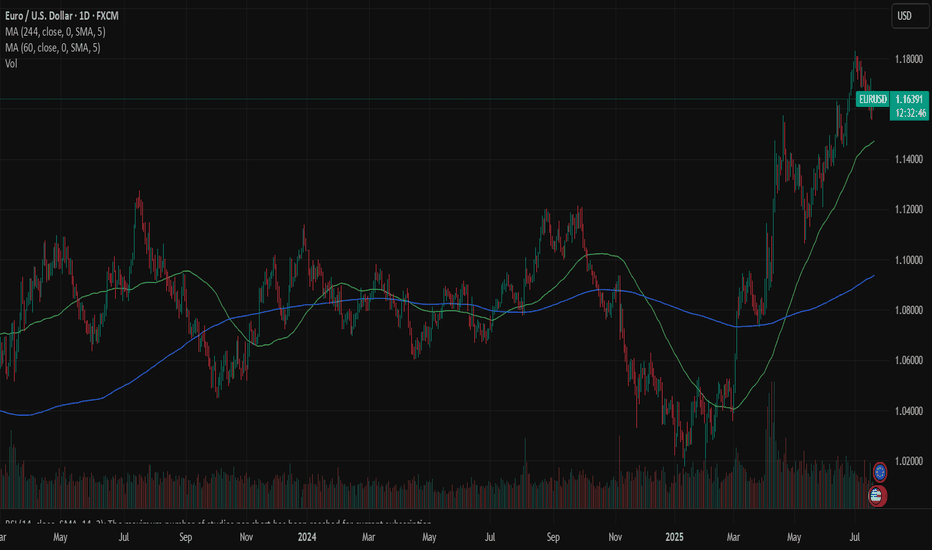

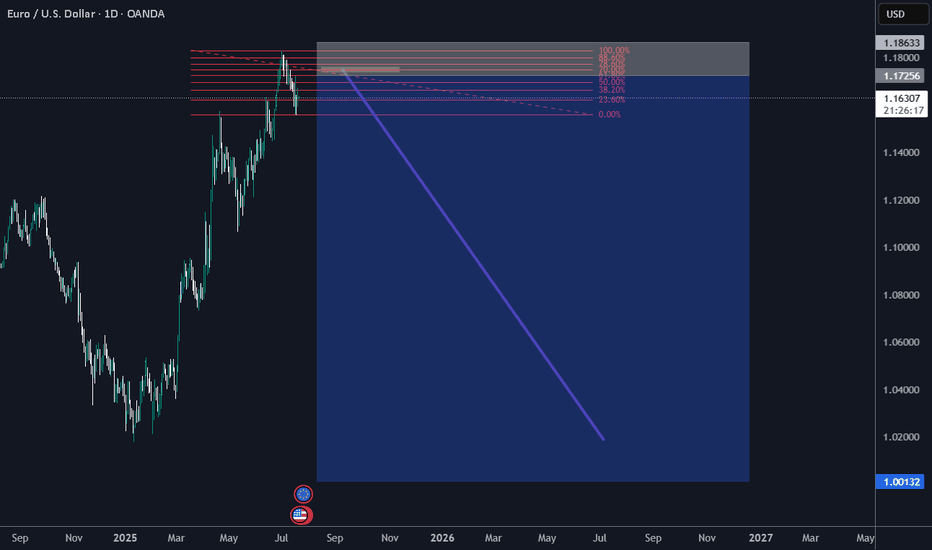

3-Year Euro Uptrend — An Absurdity Amid a Weak EconomyCMCMARKETS:EURUSD

The euro is climbing, hitting its highest levels since late 2021 near $1.18. This surge is driven by diverging central bank policies—with the ECB holding rates steady while the Fed leans dovish—amid global tensions that push gold higher and rattle markets, weakening the dollar even though the eurozone economy remains fragile.

📉 1️⃣ Dollar Weakness Takes Center Stage

Since its January 2025 peak, the U.S. Dollar Index (DXY) has fallen by over 11% 📉—one of its worst starts in decades, comparable to the slumps of 1986 and 1989. As inflation cools, markets are betting on Fed rate cuts, pulling U.S. Treasury yields lower. Coupled with monetary policy divergence and tariff drama, the dollar’s usual safe-haven appeal is fading, even amid ongoing geopolitical tensions.

📊 2️⃣ Fed–ECB Policy Divergence

While the ECB has signaled the possibility of one or two cuts this year, markets are pricing in a milder path. By contrast, the Fed is tilting dovish, with swaps markets expecting a rate cut in September and another by December 🗓️. This widening yield differential supports EUR/USD, even though eurozone growth remains soft.

⚖️ 3️⃣ Trump Tariff Risks and Sentiment Shift

Uncertainty around U.S. trade policy—especially the threat of renewed tariffs—has weighed more heavily on USD sentiment than on eurozone currencies. Markets view these tariffs as inflationary and damaging to U.S. growth prospects. Speculative positioning data confirms record bearish sentiment on the dollar, with funds underweight USD for the first time in 20 years 💼.

💶 4️⃣ Eurozone’s Fiscal Shift

Germany has begun spending and borrowing, marking a dramatic pivot from years of fiscal restraint. This has raised hopes for an investment-driven recovery across the eurozone. Meanwhile, ECB President Christine Lagarde is avoiding signaling aggressive cuts, stabilizing market expectations and maintaining a sense of monetary calm—for now 🛡️.

🛡️ 5️⃣ Safe-Haven Flows Shifting

Traditionally, geopolitical stress boosts the USD as a safe haven. This cycle is different: investors are increasingly turning to gold, the Swiss franc, and the yen as defensive assets, indirectly supporting the euro. In April, when Trump delayed tariff plans, safe-haven USD flows unwound further, fueling euro gains 💰.

⚠️ Risks Ahead for EUR/USD:

💔 Weak Eurozone Fundamentals:

The eurozone economy is not booming. The IMF projects just 0.9% growth for 2025, with Germany, France, and Italy struggling to regain momentum. The ECB’s Financial Stability Review flags worsening credit conditions, weak private investment, and deteriorating balance sheets, none of which support sustained euro appreciation 📉.

🚢 A Strong Euro Hurts Exports:

Eurozone exporters in machinery, chemicals, and autos are already facing squeezed margins from rising input costs and global protectionism. A stronger euro makes exports less competitive, shrinking the eurozone’s current account surplus, which dropped sharply from €50.9 billion in March to €19.8 billion in April, according to the ECB 📊.

⚡ Political Risks Looming:

Fragile coalitions in Germany, budget battles in France, and rising anti-EU sentiment in Italy and the Netherlands could swiftly unwind euro gains if tensions escalate. Should the ECB turn dovish to support a weakening labor market, the euro’s rally could reverse quickly 🗳️.

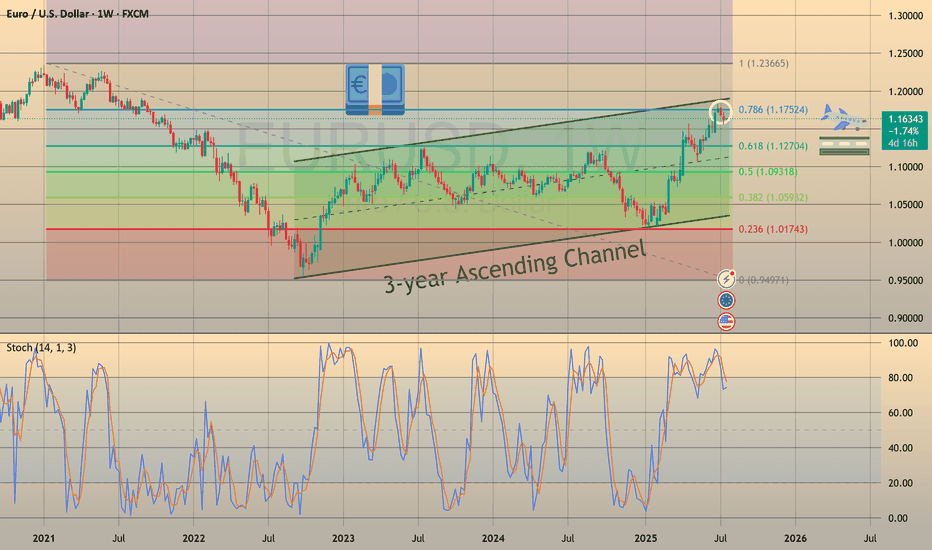

📈 7️⃣ Technical Picture: Overextension Warning

In addition to the macro drivers, EUR/USD is now technically overextended. The pair has already retraced exactly 78.6% of its major bearish trend that started in January 2021 and ended in September of that year. Ahead lies a strong resistance zone at 1.18000–1.20000, which will be difficult to break without a significant catalyst.

Notably, the daily chart shows bearish RSI divergence, indicating fading momentum beneath the surface of this rally. A pullback toward the 1.13000 level would not be surprising, even as near-term momentum remains strong. This technical setup calls for caution while the pair tests these critical levels.

📈 Technical Outlook: EUR/USD Showing Signs of Overextension

Beyond macroeconomic factors, EUR/USD is currently technically overextended. The pair has retraced exactly 78.6% of its major bearish trend that began in January 2021 and concluded in September the same year. It is now approaching the upper boundary of a 3-year ascending channel, facing a significant resistance zone between 1.18000 and 1.20000—a hurdle unlikely to be crossed without a strong catalyst.

Additionally, the weekly chart reveals a bearish RSI divergence, signaling that underlying momentum is weakening despite the recent rally. Given this, a pullback toward the 1.13000 level is plausible, even as short-term momentum remains robust. This technical setup advises caution as the pair navigates these critical resistance levels.

EURUSD InsightWelcome to all our subscribers.

Please feel free to share your personal opinions in the comments. Don’t forget to like and subscribe.

Key Points

- Christopher Waller, a member of the Federal Reserve Board, commented on interest rate cuts, saying, “Why wait until September? It's only six weeks away and not that significant.”

- With the August 1st negotiation deadline approaching, Trump reportedly wants to impose tariffs on most EU goods at a level higher than the minimum 10%. Negotiations with the EU are said to be facing difficulties due to the U.S.’s hardline stance. The EU is expected to take retaliatory measures if the talks fail.

- Japan’s NHK reported that the ruling coalition of the Liberal Democratic Party (LDP) and Komeito is certain to fail to secure the 50 seats needed for a majority. As a result, Prime Minister Ishiba is likely to face difficulties in implementing his policies following a victory by the opposition.

This Week’s Key Economic Events

+ July 22: Speech by Fed Chair Jerome Powell

+ July 24: ECB Interest Rate Decision

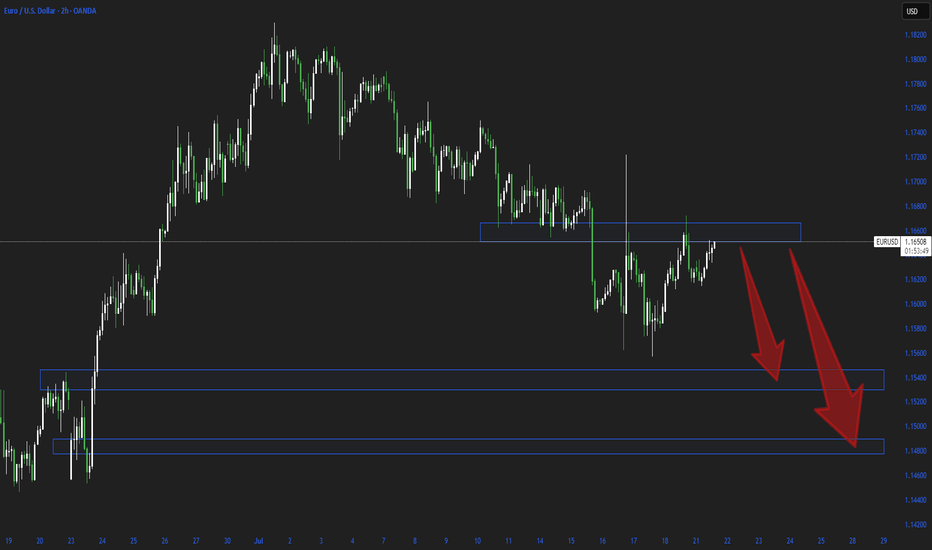

EURUSD Chart Analysis

The downtrend continues, with the pair having dropped to the 1.16000 level. A further decline toward the 1.15000 area is possible if this level is breached, though a rebound from this zone is also a possibility. If a bounce occurs, attention should be paid to how the price behaves around the 1.18000 level. Conversely, if the pair drops to 1.15000 and then successfully rebounds, an upward move toward 1.19500 could be expected.

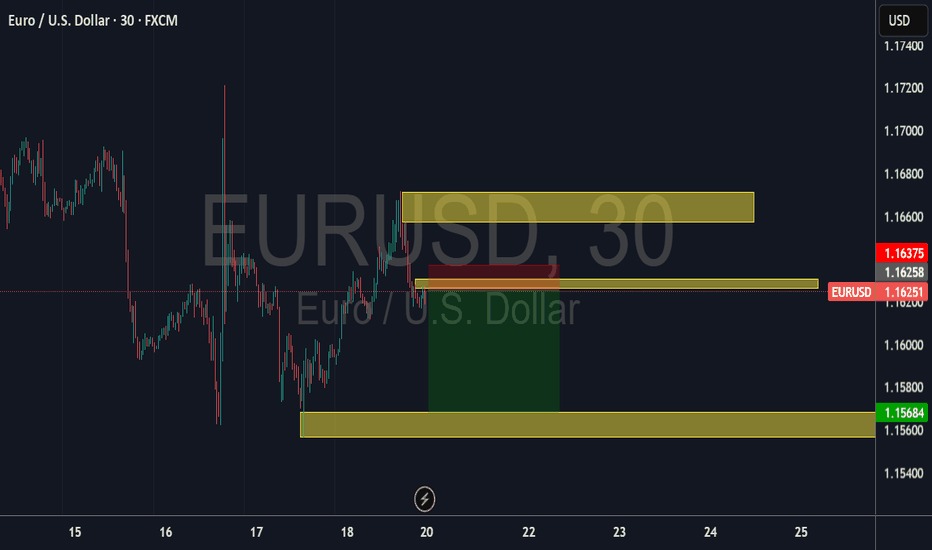

Am selling........Currency Pair: Euro / U.S. Dollar (EUR/USD)

Timeframe: 30-minute intervals (H1)

Data Source: FXCM

Price Data:

Open: 1.16265

High: 1.16275

Low: 1.16189

Close: 1.16251

Change: -0.00014 (-0.01%)

Price Levels:

The chart displays price levels ranging from 1.17400 (highest) to 1.15400 (lowest), with the current price near 1.16251.

Notable levels include 1.16258 (near the close) and 1.15684 (support level).

Time Axis:

The horizontal axis shows time intervals, likely for July 20, 2025, with labels at 15, 16, 17, 18, 20, 22, 23, 24, and 25 (possibly representing hours in UTC).

Chart Type:

The chart appears to be a candlestick or line chart, though the specific type isn't visible in the provided data.

Observations:

The EUR/USD pair showed minimal movement during this period, with a slight decline of -0.01%.

The price traded in a tight range between 1.16189 (low) and 1.16275 (high).

The close (1.16251) was slightly below the open (1.16265), indicating minor bearish pressure.

SELL EURUSD for bullish divergence trend reversal STOP LOSS: 1.1SELL EURUSD for bullish divergence trend reversal STOP LOSS: 1.1655

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....

TAKE PROFIT: take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with........

EURUSD Long FX:EURUSD Long trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

This is good trade, don't overload your risk like greedy, be disciplined trader, this is good trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

EUR/USD TRADE IDEA — MEMORY LADDER SETUPEUR/USD TRADE IDEA — MEMORY LADDER SETUP

Entry Strategy:

Buy Stop @ 1.1596 (ghost memory trap zone confirmation)

Position Sizing:

• Anchor position: 0.10 lot

• Add-ons: 0.01–0.02 lots every +10 pips

• No SL on add-ons

• SL only on anchor (optional, 14 pips below entry)

Trade Structure:

• Stack long positions every 10 pips above 1.1596

• Begin trailing SL once 3 bricks print (target ~1.1626)

• If price drops below 1.1582 early → anchor SL triggers

• No trade if 1.1596 is never broken

Target Zones:

• 1.1600 → Add-on 1

• 1.1630 → Trail SL to entry

• 1.1730 → First major echo

• 1.2000 → Macro drift target

• 1.2500 / 1.3000 → Long-term Codex zones

Market Context:

• BTC strength + DXY weakness = synthetic gravity alignment

• Ghost memory active from prior cycle (21–45 day echo)

• Price has respected trap coil on lower timeframes

• Awaiting detonation through 1.1596 to activate the trail

Note:

Stacking begins only after a confirmed break of 1.1596.

No SLs on add-ons. Only the anchor is exposed to initial risk.

This setup aims to trail the memory spiral — brick by brick — toward the next epoch zone.

#forex #eurusd #trailstrategy #stacking #renko #codex #fxladder #ghostbrick #dxy #btc

EURUSD SWING SHORT DAILY CHART SETUP - 4 AUGUST 2025📊 Trade Plan: EUR/USD – August 2025

🧠 Summary:

EUR/USD has recently broken a strong ascending channel, confirmed a double top, and dropped into a sell zone. Fundamentals, sentiment, and projection data align for further downside potential targeting the 1.11948 area.

1. Technical Analysis

Pattern: Double Top at ~1.18 with a confirmed neckline break.

Channel: Uptrend channel broken to the downside.

Sell Zone: Between 1.1587–1.1615 (marked on chart).

TP Target: 1.11948 support (next major demand zone).

Indicators:

Price is below pivot level and in bearish structure.

Strong rejection from R1 and monthly pivot.

🔔 Technical Bias: Bearish

2. COT (Commitment of Traders) Sentiment

EUR:

66.48% long, but slightly declined (-0.43%).

USD:

56.48% short, which increased (bullish for USD).

This shows institutions are still net long EUR, but that conviction is weakening. Meanwhile, bearish positions on USD are reducing, signaling a shift in favor of USD strength.

🔔 COT Bias: Shifting in favor of USD (bearish for EUR/USD)

3. Retail Sentiment

Retail:

60% are long EUR/USD, 40% short.

Retail traders are often on the wrong side of the market, so this contrarian signal supports a short bias.

🔔 Retail Bias: Bearish

4. Labor Market Data (NFP)

Actual: 73k vs Forecast: 110k → -37k miss

This is bad for the USD, but the market has already priced in weakness (seen in past days’ movement).

Short-term reaction could be bullish EUR, but broader trend still supports downside.

🔔 NFP Bias: Mixed (short-term bounce possible, but not trend-changing)

5. Trend Projection

All trend projections suggest:

August 3–7: EUR/USD heads lower towards 1.1–1.12, with strongest bearish scenarios reaching 1.1 by Aug 7.

Only the most optimistic scenario keeps it around 1.2, which is now technically invalidated after the neckline break.

🔔 Projection Bias: Bearish

✅ Trade Setup

Primary Trade (Swing Short)

Entry: 1.1587–1.1615 (sell zone)

Stop Loss: 1.1808 (above double top)

Take Profit: 1.1195

Risk:Reward Ratio: ~1:2

Alternative Setup (if missed entry):

Re-entry on pullback: Look for bearish rejection on retest of 1.1580–1.1600 zone.

Confirmation: Bearish engulfing candle or pivot level rejection.

⚠️ Risk Factors:

Unexpected USD weakness due to further poor economic data.

Possible short-term retracement due to oversold conditions post-NFP.

Intervention from ECB or Fed comments.

📌 Final Bias:

Short EUR/USD from resistance zones targeting 1.1195, based on a confluence of bearish technicals, sentiment, and projections.

EU|Bullish Structure Holding| 4H OB + Inducement Sweep Lining Up(Refined & Structured):

• Pair: EURUSD

• Bias: Bullish

• 4H Overview: Clean bullish structure is intact with bullish intent already shown. After breaking a recent high, price swept sell-side liquidity and inducement, tapping directly into a 4H order block.

• 30M Structure: Watching for a clear change of character—specifically a break of a 30M lower high. Once that happens and price sweeps internal liquidity into the 30M OB, I’ll begin hunting confirmation.

• Entry Zone: After internal OB mitigation, I’ll drop to the 5M for a strong church-level confirmation. Execution follows once the story completes.

• Targets: 5M to 30M highs depending on delivery.

• Mindset Note: Right now it’s analysis mode. Structure is unfolding beautifully. Patience, precision, and price reading—this is where the game’s won.

Week of 8/3/25: EURUSD AnalysisPrice was bearish all of last week until NFP, resulting in a shift in 4h and 1h market structure to be bullish.

Focus this week is being bullish and following 1h order flow until it reaches the extreme of the daily bearish structure to then be cautious and seeing where price wants to go from there.

Major News:

Tuesday: PMI

Thursday: Unemployment Claims

EU Long, Then, ShortM: Downtrend, made a new low

W: Uptrend, respecting the lows

D: Uptrend, price bbroke and retested trendline

4H: Downtrend, price retraced 78.6% and hit -61.8 on 4H fib and reversed to go long

1H: Downtrend, price broke and retested trendline. Aggressively long on NFP news (-jobs)

DXY is show bullish divergence

EU minor trend is showing bearish divergence.

CURRENTLY: I'm looking for price to go long to retest the 4H trendline @ the 1H support/resistance, then continue short.

EURUSD. Weekly and Daily AnalysisHi traders and investors!

This analysis is based on the Initiative Analysis concept (IA).

Weekly TF

Price has tapped the 50 % level of the last buyer initiative at 1.14477 and run a manipulation around 1.15569.

Daily TF

We’ve seen a manipulation of the lower boundary of the buyer initiative, and an IKC candle has printed.

Buyer targets on the daily chart: 1.17110, 1.17888, 1.18299.

Before aiming for those, buyers first need to clear the potential sell zones at 1.15994 and 1.16108.

Conservative long setup:

Wait for buyers to defend 1.15994 (or a higher level).

Alternatively, watch the 1-hour support at 1.15165; if buyers hold it, there’s scope for a move toward 1.15994 — and potentially higher after that.

Wishing you profitable trades!

EURUSD SMC ANALYSIS H1 TIME FRAME📉 EURUSD 1H SMC CHART – SHORT BIAS ZONE ACTIVE!

🔶 GOLDEN ZONE REACHED

📍 Zone: 1.15912 – 1.16369

– Previous CHoCH + Clean OB + Premium zone

– Likely area for Smart Money to initiate sell positions

– Price reacting aggressively upon entry

📌 Trade Idea:

– Look for 15M / 5M CHoCH or bearish FVG inside the golden zone

– Ideal sniper entry setup forming soon

– SL above 1.17043 or OB high 1.17692

– TP: Break of structure low and imbalance fill near 1.1450–1.1400

🧠 Bias:

– Order Flow is Bearish

– Strong IDM structure already mitigated

– We anticipate price will grab liquidity and reverse from premium zone

⛔️ Avoid early entries – let Smart Money give the signal. Precision = Power 🎯

#EURUSD #SMC #SniperEntry #SmartMoneyConcept #OrderBlock #GoldenZone #DCBFXTRADING

EURUSD Showing Reversal Signs After 7-Month Bullish TrendHello everybody!

After holding bullish momentum for a long time (7 months), EURUSD is starting to show signs of reversal:

1. It has been rejected from a strong resistance area.

2. It broke a support area, which is now expected to act as resistance.

3. It broke a solid upward trendline with a strong downward move.

If this area holds and price doesn't go above 1.18000, we can look to sell from here.

In that case, the most likely target will be around 1.12000.

Manage your risk and trade safe!

Are the EUR re-gained its bullish strength?My technical view on EURUSD Daily:

Trend Direction: Bullish

Stochastic Direction: Stochastic Crossed UP

Daily Resistance: 1.18298

Daily Support: .13871

note: My resistance and Support are based on the last 30 bars, so it may be different form others.

PA Type: Rejection at Support or Resistance

Fundamental News: On Tuesday, 5th, the USD PMI; On Wed, the EUR Retail Sales(YoY)

Conclusion: Due the very bad return from the NFP last Friday we saw all USD pairs change direction. Also the EUR has been in bullish mode since middle of January but couldn't break the 1.1830 Daily Resistance but now it may will continue its upward move heading to re-test the resistance again.

Just note that the technical view on this pair does not mean it will happens. We never know what "pearl" Trump will bring during the week, specially after the NFP results, so trade safe.