The Day AheadWeekly Summary – Key Data & Earnings (Week Ending August 2, 2025):

Economic Data:

US Jobs Report: Job growth slowed slightly; unemployment ticked up. Supports Fed holding rates steady.

US Manufacturing (ISM): Sector still shrinking, showing weakness.

US Car Sales & Construction: Car sales rose; construction spending up, led by infrastructure.

China Manufacturing: Still contracting due to weak demand.

Japan Jobs Data: Job market remains tight and stable.

Italy: Manufacturing down, car sales slightly up, budget and retail sales steady.

Eurozone Inflation: Inflation slowed, increasing chances of ECB rate cuts.

Canada Manufacturing: Slipped into contraction.

Earnings Highlights:

Exxon & Chevron: Mixed—refining strong, but oil prices hurt results.

Linde: Solid growth from healthcare and clean energy demand.

Nintendo: Strong game and digital sales boosted profits.

AXA: Insurance strong, but investment income dipped.

Regeneron: Beat forecasts, thanks to strong drug sales.

Ares: Private credit demand lifted earnings.

Engie: Renewables helped balance weaker thermal output.

Daimler Truck: Demand steady, but profit margins hit by costs.

LyondellBasell: Missed targets due to weak chemicals demand.

Moderna: COVID sales down; focus now on future drug pipeline.

Takeaway:

The global economy is slowing, but US jobs and spending remain resilient. Companies reported mixed earnings. Central banks are likely to stay cautious, with possible rate cuts ahead if weakness continues.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDEUX trade ideas

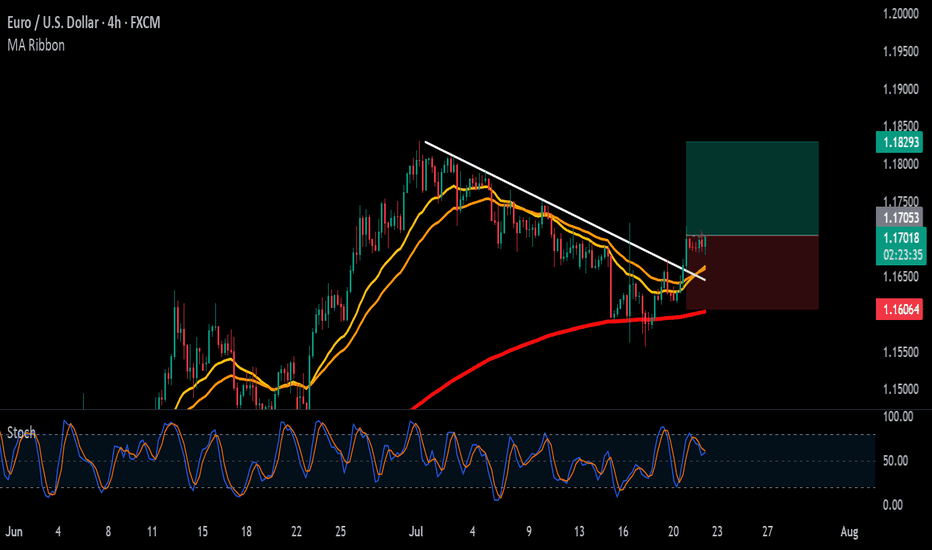

EURUSD 8H – 15% Yearly Channel Move, But Is This the Retest?EURUSD has been riding a clean parallel channel since early 2025, printing a steady +15.88% climb from the lower boundary to the upper resistance.

After mid-year rejection at the top of the range, we’re now testing the midline and eyeing the lower channel boundary. Structure still holds, but the next few candles may confirm if this is just a healthy retest or a bigger breakdown brewing.

Big macro structure. Simple levels. Watching for signs of momentum reclaim or deeper drift.

EURUSD REACHED THE TARGET.EURUSD REACHED THE TARGET.

EURUSD has reached the 1.14500 level and even broke it down. Currently the price consolidates slightly below this level. If the price forms a false breakout of 1.14500 level, this will mean the end of short-term decline in the pair. Stay cautious.

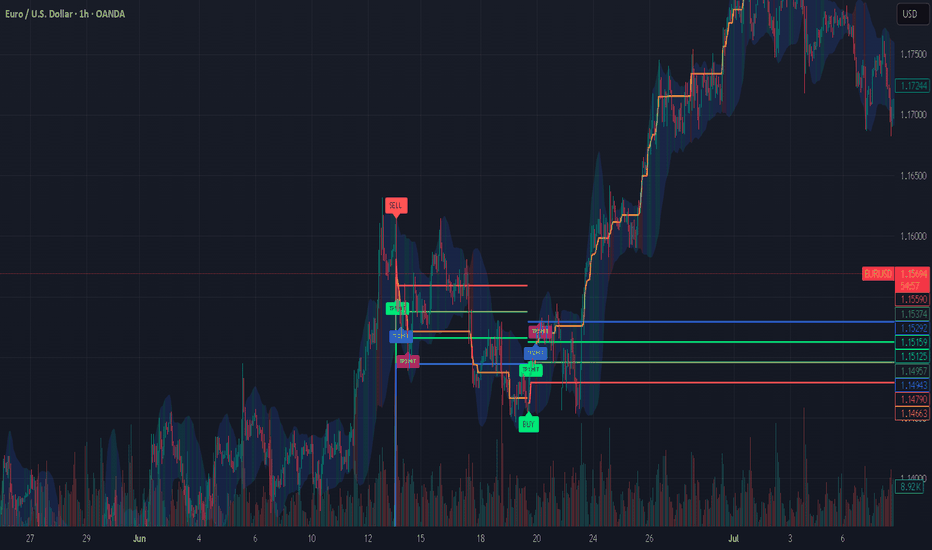

EURUSD 4H AnalysisAfter a strong bearish move, EURUSD has now tapped into the PD Low and shown a reaction. Structure remains bearish, but current price action near 1.1400 could lead to short-term retracement.

🔍 Key Levels:

PD High – 1.1560: Strong supply zone, key bearish continuation level

1.1500–1.1450: Broken support, may now act as resistance

PD Low – 1.1400: Demand zone, current price reacting from here

📌 Potential Scenarios:

Short-Term Bounce from PD Low:

Price reacting from 1.1400 demand.

Intraday retracement toward 1.1470–1.1500 possible.

Watch for bullish price action confirmation on lower timeframes.

Bearish Continuation if price retests 1.1500–1.1550:

Ideal area to look for fresh shorts.

Continuation move could target 1.1350 or lower.

🎯 Bias: Still bearish unless we break and hold above 1.1560 (PD High).

Patience is key. Let price test zone and wait for clear reaction before committing.

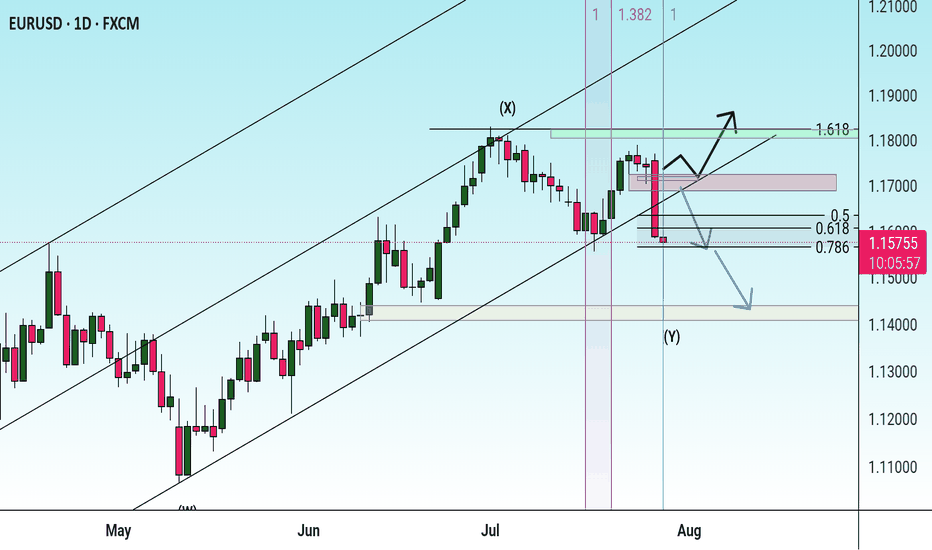

EURUSD Wave Analysis – 30 July 2025- EURUSD falling inside accelerated impulse wave c

- Likely fall to support level 1.1200

EURUSD currency pair recently broke the support trendline from February, coinciding with the 38.2% Fibonacci correction of the upward impulse 1 from May.

The breakout of these support levels accelerated the active impulse wave c, which then broke the support at 1.1460.

EURUSD currency pair can be expected to fall further to the next support level 1.1200 (former strong support from May).

EURUSD - quickly getting to major supportIn my view EUR reversed and will continue downtrend for few weeks. However the price is quickly getting to significant support at 1.13500. The cluster is created by FR 0.618 and One to One with previous correction. I expect the price to make correction from the support and go up even to 1.15500

Getting short on EUR/USD!The dollar has looked set for a reversal and coming into the week it didn't hang around at all. I had a bit of a short bias on EUR/USD and was looking for confirmation signal which pretty much came at market open.

Price pushed higher back into the key level taking out a short term high, but was unable to follow through to form a new higher high. Heading into Monday London session, momentum immediately took hold with a clear bearish change of character and price didn't look back > breaking structure and key levels with minimal effort.

I was waiting for a pull back to get short early which didn't occur. But no need to chase price, waiting and patience is part of the game.

Price has now broken another key support level and is set to retest it as resistance. This will be my entry point (see screenshot) > using the 70.5%-78.6% fib retracement level and my stop above Tuesdays high. Keep it simple.

s3.tradingview.com

Fundamental Market Analysis for July 30, 2025 EURUSDEvents to watch today:

30.07 15:30 EET. USD - Gross Domestic Product

30.07 21:30 EET. USD - FOMC Rate Decision

EURUSD:

Exclusive for our readers – a 202% bonus on deposits of $202 or more! Give the promo code PROFIT202 to customer support and start trading with TRIPLED capital.

EUR/USD remains under pressure amid stronger demand for the US Dollar ahead of the Federal Reserve decision (July 30, 2025). Market sentiment reflects the perception that the recent US–EU trade arrangements are relatively more favorable for the US economy, reinforcing expectations for stronger corporate earnings and a more supportive external balance in the coming months. Capital flows are skewed toward dollar-denominated assets, also because investors prefer to wait out key central‑bank communications in “quality” instruments.

A further driver is the divergence in macro momentum: the US economy shows greater resilience in consumption and labor markets, while the euro area faces constrained growth and a cautious ECB tone. With little reason for ECB tightening and with lingering risks for European industry and exports after tariff headlines, the euro’s fundamental support looks softer. Persisting uncertainty around the inflation path in the euro area adds to the preference for the USD.

Given these factors, the near‑term fundamental tilt remains to the downside for EURUSD. Risks to this view include unexpectedly dovish Fed communication, a pullback in US Treasury yields, and/or positive euro‑area data surprises that could improve growth expectations and support the euro.

Trading recommendation: SELL 1.15650, SL 1.16000, TP 1.15150

#AN022: Geopolitical Tensions and Forex Pressure

Hello, I'm Forex Trader Andrea Russo, and today I want to talk to you about this week's latest geopolitical tensions.

1. The Russian ruble in crisis, weakening against the USD and CNY

The ruble fell 1.5% against the dollar and 0.8% against the yuan, following a US ultimatum to Moscow for an immediate truce in Ukraine.

FX Impact: The ruble remains vulnerable, fueling demand for safe-haven currencies such as the USD, EUR, and CHF. Crosses against the RUB show potential technical short reversals.

2. Oil Rises: First Impacts on Energy Costs

Brent prices rose 3.5% to $72.50 a barrel following the announcement of possible US sanctions on buyers of Russian oil.

FX Impact: Oil-related currencies such as the CAD and NOK benefit; USD risks weakness if importing countries experience inflationary pressures.

3. Euro falls monthly for the first time, dollar strengthens

The euro is in the red on a monthly basis for the first time in 2025, while the dollar benefits from cautious Fed rate expectations and the EU-US trade deal perceived as biased toward Washington.

Forex Impact: EUR/USD is under structural pressure. Euro-commodity correlates (EUR/CAD, EUR/AUD) are showing signs of weakness.

4. IMF warns of US tariffs and rising global inflation

In its latest report, the IMF emphasized that US tariffs are slowing global growth and fueling persistent inflationary pressures.

FX Impact: Increased uncertainty favors the USD and CHF. Emerging economies and commodity-linked economies (MXN, ZAR, BRL) could weaken further.

5. India Strengthens: Growing Exports and Solid Reserves

India recorded a 7.2% increase in merchandise exports and maintains stable foreign exchange reserves, demonstrating macroeconomic resilience and the resilience of the rupee.

Forex Impact: The INR could strengthen or consolidate at robust levels, while USD/INR pairs signal potential support.

6. Global Digital Projects and Fragmentation of Payment Systems

The adoption of alternative systems to SWIFT such as mBridge or Project Agorá reflects a push toward global financial independence.

Forex Impact: The euro and dollar remain dominant, but the RMB is gaining ground in Asia-Pacific countries. RMB crosses (USD/CNH, EUR/CNH) require attention, especially from a long-term perspective.

EUR/USD: ECB Pauses Amid UncertaintyBy Ion Jauregui – Analyst at ActivTrades

The European Central Bank has decided to pause its rate-cutting cycle after seven consecutive reductions over the past twelve months, leaving the deposit rate at 2%, the refinancing rate at 2.15%, and the marginal lending facility at 2.4%. This move, largely priced in by the markets, reflects the ECB’s growing caution in the face of inflation that has officially reached its 2% target but may rebound if certain fiscal and geopolitical risks materialize.

Christine Lagarde’s message has been interpreted with a hawkish tone. Although both headline and core inflation have eased — the latter standing at 2.3% — the ECB warns that surprises may still occur. Massive defense spending, fiscal imbalances, and international trade tensions (such as tariffs recently signed by Trump with Japan) could disrupt the current equilibrium.

Markets have reacted calmly: the EUR/USD barely moved a tenth of a percent after the decision, while implied interest rates in the money markets have lowered the odds of another rate cut in September. Now, only a symbolic 5 basis point cut is priced in at most.

Technical Analysis

Overall trend: Sideways to bearish in the short term; bullish in the long term.

Key support levels:

1.1488: technical and psychological reference level

1.1275: recent July low

Key resistance levels:

1.8291: short-term high

1.2278: next resistance level

The pair attempted to break higher last week but failed, starting this week with a bearish tone. As long as the price holds above key support, the bullish trend may continue. A daily close below the first support could trigger a move toward the point of control (POC) zone at 1.0419. The daily RSI is in oversold territory at 38.95%, while the MACD shows signs of turning lower, indicating a loss of bullish momentum.

There is growing speculation that the ECB's rate-cutting cycle may be over. Within the ECB, figures like Isabel Schnabel are calling for patience, while others, such as Philip Lane and Luis de Guindos, still don’t rule out a final adjustment if September projections show economic weakness.

In this context, the price range that began from the point of control zone toward recent highs appears to be losing steam. Going forward, the evolution of the EUR/USD will depend on inflation trends, European fiscal policy, and the ECB’s response to tariff tensions with the United States and other global challenges as summer draws to a close.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

EUR/USD at Discount Level: Bullish Setup in FocusFenzoFx—EUR/USD bearish momentum extended to $1.154, the lower line of the flag. This is a support area backed by the Bullish FVG.

The immediate resistance is at $1.157. From a technical perspective, a close above this level can trigger an uptrend, targeting the bearish FVG at approximately $1.170 to $1.175.

Please note that the bullish outlook should be invalidated if EUR/USD falls below the main support level at $1.145.

Should You Still Sell Your USD for EUR? A 2025 PerspectiveWith currency markets in constant flux, the decision to hold USD or convert to EUR carries major financial implications for investors, expatriates, businesses, and frequent travelers. As of July 29, 2025, the USD/EUR exchange rate is around 0.86–0.87, with $1 buying roughly €0.86. Is now the right time to sell your US dollars for euros? Here’s a balanced look at the latest data and forecasts.

Current Market Context: Dollar Weakness and Euro Stabilization

USD Slide in 2025: The US dollar has experienced its steepest decline in over three years, falling nearly 10% year-to-date. This sustained weakness is attributed to policy volatility, capital flowing out of the US, and narrowing interest rate differentials.

Key Exchange Rate: Recent rates hover between 0.85 and 0.87, representing moderate stability following a period of volatility.

Euro’s Resilience: While the euro has had its own struggles, from slower economic growth to political uncertainty in Germany and France, analysts forecast no major sustained fall for the euro through 2025.

2025 Forecasts: USD/EUR Direction—What Do the Experts Say?

Year-End 2025 Outlook: Major banks and forecasting firms expect the EUR/USD rate could climb even higher by year-end, meaning the euro could gain modestly versus the dollar if current trends continue.

Factors to Watch:

Fed Rate Cuts: Potential US rate cuts in Q3–Q4 remain a key driver for further USD weakness.

Trade & Tariff Uncertainty: Ongoing US tariff announcements and global trade tensions add volatility but also support safe haven flows to the dollar.

Eurozone Politics: Any resolution of political uncertainty in Europe could buoy the euro.

Most Important One: Fed's Money Printer...

Strategic Considerations: Should You Sell Now?

Locking in Current Rates: If you need euros to make payments, pay salaries, or make investments in the short term, converting a portion now could reduce your exposure to further USD downside.

If You Can Wait: Analysts see some chance for USD recovery in late Q3 or early 2026, but this is contingent on US policy stability and Fed decisions.

Averaging In: For larger transfers, consider splitting your transaction over time (also called dollar-cost averaging), which can help mitigate volatility.

Bottom Line

If you have an immediate need for euros, current rates present a reasonable opportunity. The dollar’s weakness throughout 2025 is well documented, but much of the pessimism may already be priced in. If you’re flexible with timing, monitor central bank policy signals throughout Q3/Q4, a more dovish Fed or unexpected eurozone stability could push rates further in your favor, but event risks remain elevated. Ultimately, a phased or hedged approach may offer both protection and potential upside

*not investment advice*

#forex #fx #dollar #usd #euro #eur #economy #trade #tariff #trading #indicator

EUR/USD 30-MIN ANALYSISThis EURUSD setup showcases a clean bullish continuation scenario following a confirmed Break of Structure (BOS) and a sharp rally driven by momentum and liquidity imbalance.

After sweeping a key low (XXX), price impulsively broke structure to the upside, confirming a potential shift in market intent. A retracement is now expected to mitigate the Buy-Side Imbalance (BISI) zone.

BOS & SSS (Short-Term Structural Shift): Confirmed bullish intent.

Imbalance (BISI): Price left behind an unfilled imbalance zone a likely magnet for a pullback.

Re-Entry Zone: (BISI) provides a high probability area for long re-entry.

Upside Targets:

Target 1: 1.15483 – intermediate structural level.

Target 2: 1.16158 – premium supply / liquidity target.

#EURUSD 30M Technical Analysis Expected Move.

The Day AheadKey Data Releases

US:

JOLTS (June): Provides insight into labor market slack; a tighter reading could delay Fed rate cuts.

Advance Goods Trade Balance & Wholesale Inventories: Important for Q2 GDP revisions.

Consumer Confidence (July): A strong print would reflect continued consumer resilience, a weak one could pressure cyclicals.

Dallas Fed Services Activity (July): Regional business sentiment.

FHFA House Price Index (May): Monitors housing market health.

UK:

Consumer Credit & M4 (June): Key for BoE rate path.

France: Q2 total jobseekers – labor market stress indicator.

Sweden: June GDP indicator – recession risk watch.

Central Bank Focus

ECB Consumer Expectations (June): Watch for shifts in inflation expectations that could impact eurozone policy outlook.

Corporate Earnings

A major earnings deluge with over 25 high-profile companies, highlighting:

Tech/Payments: Visa, PayPal, Spotify, Electronic Arts

Consumer/Healthcare: Procter & Gamble, UnitedHealth, Starbucks, Mondelez, AstraZeneca, Merck & Co

Industrials/Travel: Boeing, UPS, Royal Caribbean, Stellantis

Luxury/Retail: Kering, L’Oreal

Financials: Barclays, Corning, Keyence

Sentiment hinges on guidance outlooks and margin commentary, particularly as investors watch for signs of consumer fatigue or pricing power erosion.

Auctions

US 2-year FRN & 7-year Notes: Will test demand amid shifting Fed expectations; weak uptake could push yields higher.

Conclusion for Today's Trading

Today is data- and earnings-heavy, setting up for potentially elevated volatility. The US JOLTS and consumer confidence data will be pivotal for shaping Fed expectations. Meanwhile, a massive cross-sector earnings lineup could lead to stock-specific dispersion, especially in tech, healthcare, and consumer sectors. Treasury auctions may steer yield curves and weigh on equity sentiment if demand is weak.

Trading Bias: Expect range-bound to choppy action in broader indices, with stock rotation driven by earnings surprises. Stay alert to macro data prints, particularly if they shift views on a September Fed move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.