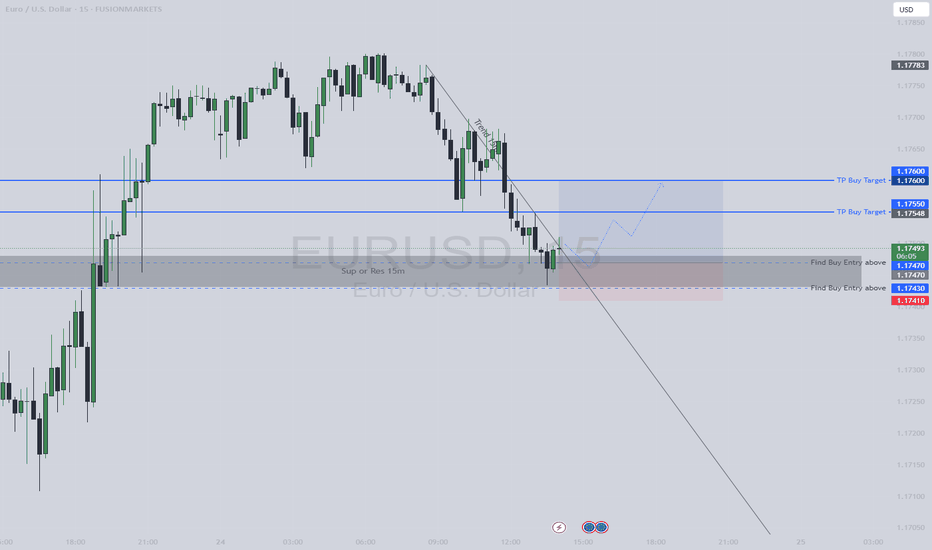

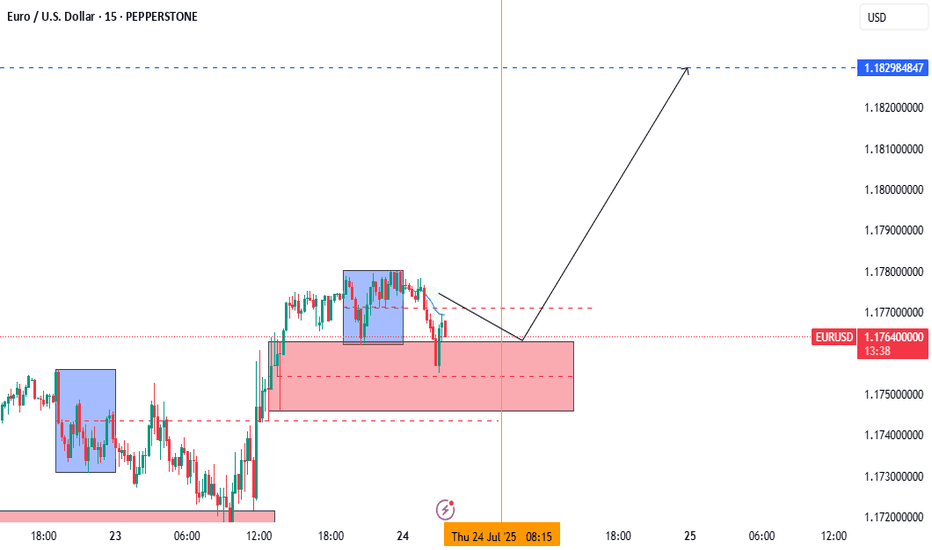

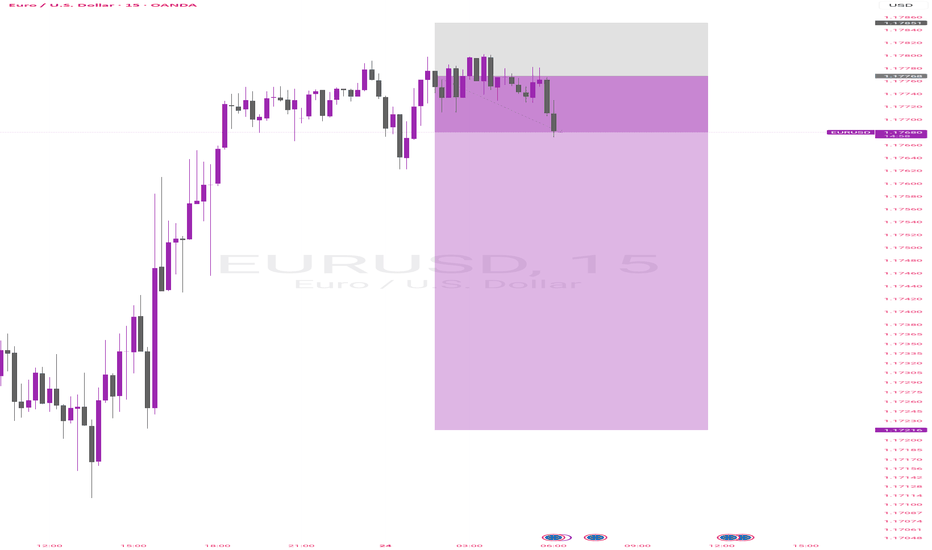

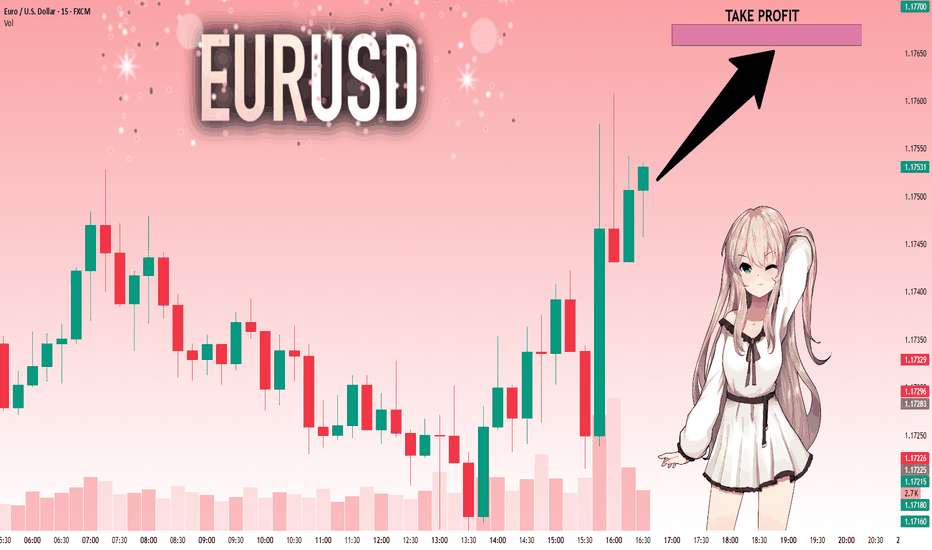

Buy Entry EURUSD🎯 Suggested Trade Setup — Bullish Bias Scalping Opportunity

✅ Buy Entry (Aggressive Intra-Day Play)

📍 Entry Zone: Between 1.17430 and 1.17470 (just above SSL and EQL zones)

🎯 Target: 1.17550 (Day High / minor resistance), with potential extension to 1.17600

🛡️ Stop Loss: Below 1.17410 or the lowest OB (~10-15 pips risk)

🔁 Risk-to-Reward Ratio: Aim for at least 1:2 to 1:3

💡 Why this works: You're buying near liquidity pools with minimal downside. If the breaker block holds and momentum picks up, this could be a swift move.

USDEUX trade ideas

ECB Interest Rate Decision: What to Expect and How Could React📊 ECB Interest Rate Decision: What to Expect and How EURUSD Could React

This week’s spotlight is on the European Central Bank (ECB) Interest Rate Decision — a key market driver that could shape the near-term direction of the euro and broader European markets. Here's what to expect. 👇

🔔 Key Event to Watch

📅 ECB Interest Rate Decision

🕐 Date: July 24

⏰ Time: 12:15 p.m. UTC

📉 Forecast: Hold at 2.15%

📌 Economic Context

The European Central Bank is expected to hold interest rates steady on Thursday, likely marking the end of its current easing cycle after eight consecutive cuts that brought borrowing costs to their lowest levels since November 2022.

🔒 Main refinancing rate: 2.15%

💰 Deposit facility rate: 2.00%

Policymakers are likely to adopt a wait-and-see approach as they monitor the impact of persistent trade uncertaintyand potential U.S. tariffs on economic growth and inflation.

Adding to the cautious stance, inflation finally reached the ECB’s 2% target in June, and is now forecast to dip belowthat level later this year. This drop is expected to be sustained over the next 18 months, driven by:

A strong euro 💶

Falling energy prices 🛢️

Cheaper imports from China 🇨🇳

Markets are currently pricing in just one more rate cut by December, with around a 50% probability of that happening in September, before a possible tightening cycle resumes in late 2026.

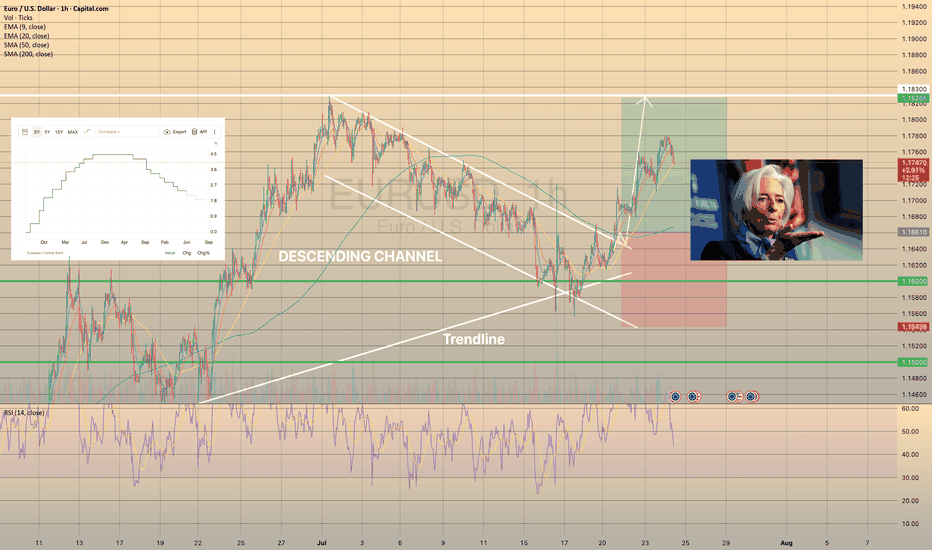

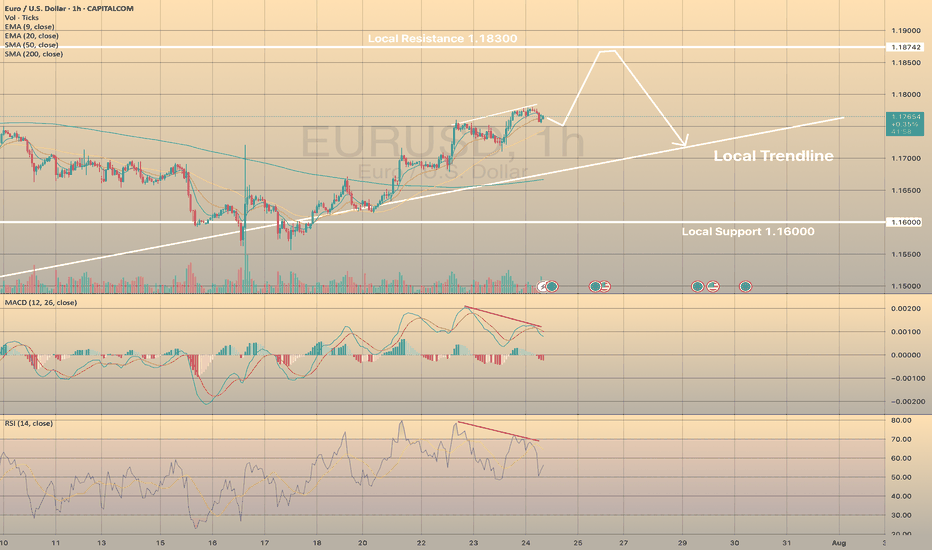

📈 EURUSD Technical Outlook

EURUSD has been trading within a descending channel since early July. However, it recently rebounded from trendline support, backed by bullish RSI divergence. The pair is approaching a breakout above the 1-hour SMA200, signaling a potential continuation of the uptrend. 🔼

A minor pullback is possible before a stronger move

Bullish momentum may continue if resistance is cleared

🎯 Target range: 1.18250 – 1.18300

🧩 Summary

The ECB is likely to keep rates unchanged at 2.15%, adopting a cautious tone amid easing inflation and global trade risks. This outcome could support the euro, particularly if U.S. rate expectations soften.

With technical indicators aligning with fundamental stability, EURUSD may be setting up for a bullish continuationin the coming sessions. 📊💶

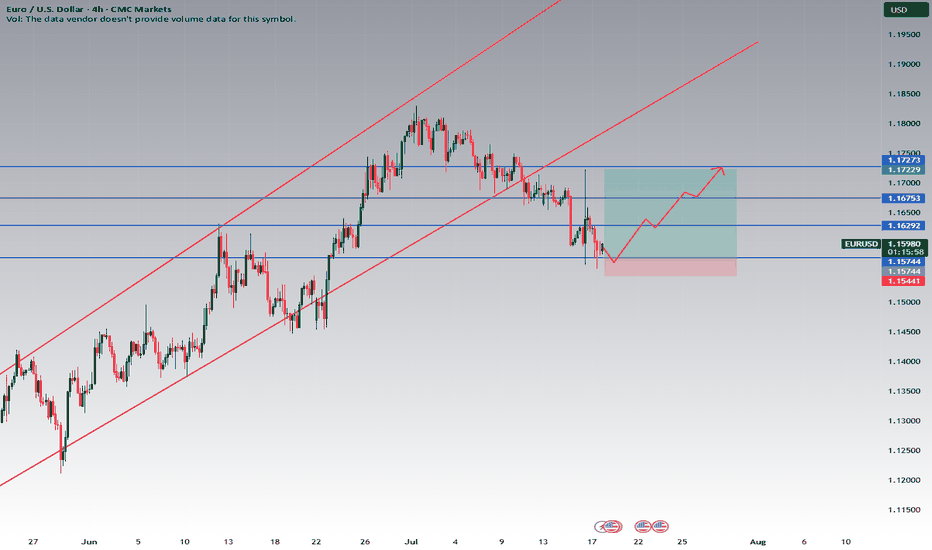

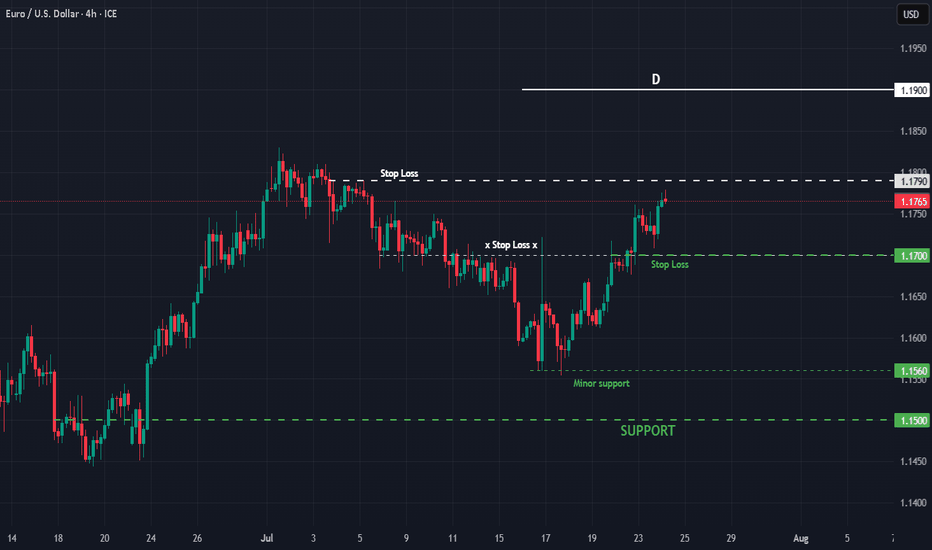

EURUSD – Watch for Bullish Reaction Near 1.15744Description:

EURUSD is approaching a major support zone at 1.15744, as shown on the 4H chart. This level lines up with prior structure and could act as a springboard for a bullish move if buyers step in.

Trade Plan:

Do NOT enter immediately at 1.15744.

Wait for clear bullish confirmation at or just above 1.15744 (examples: bullish engulfing, strong pin bar, multiple rejections, or your trusted indicator).

If confirmation is seen, consider a long trade targeting the next resistance levels at 1.16292, 1.16753, and 1.17229.

Place your stop-loss slightly below the swing low (around 1.15441 or according to your risk).

Why Wait for Confirmation?

1.15744 is an area to monitor, not a trigger!

Price may slice through the level or fake out before reversing—waiting for confirmation increases your edge and reduces risk.

Levels to Watch:

Support (monitor for entry): 1.15744

Stop Loss: Below 1.15441

Targets: 1.16292, 1.16753, 1.17229

Extra Tips:

Ignore the entry level if price shows no bullish reaction or momentum.

Watch for news/events that could create volatility and invalidate this setup.

Summary:

Wait for the market to show its hand at 1.15744. Only enter on solid bullish evidence!

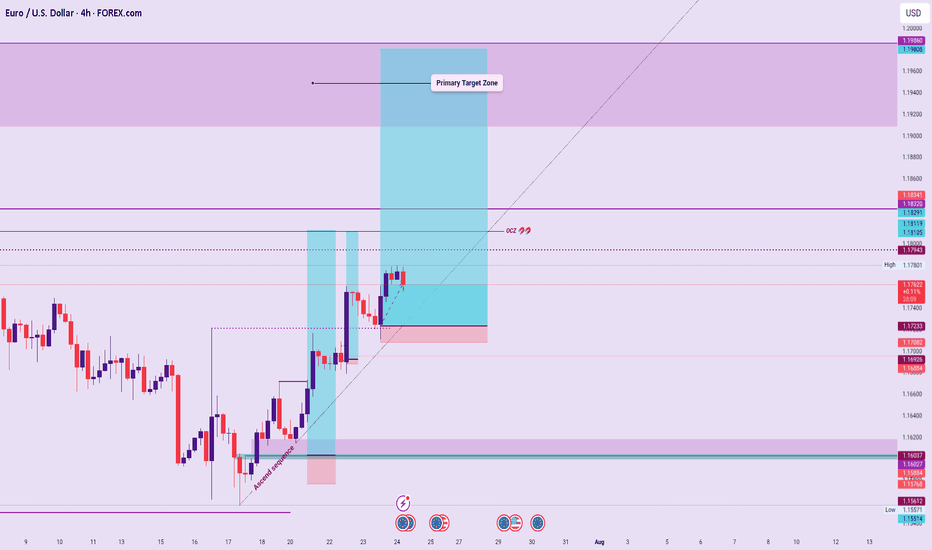

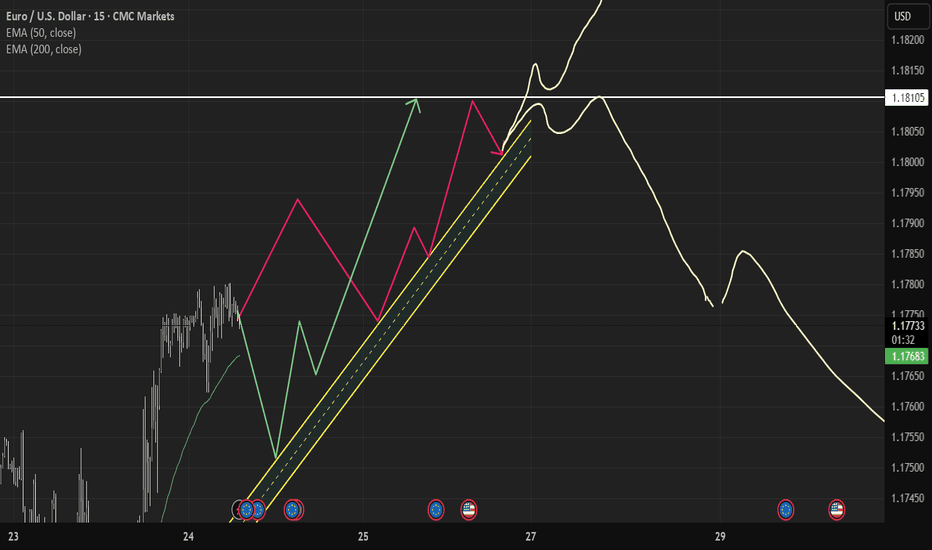

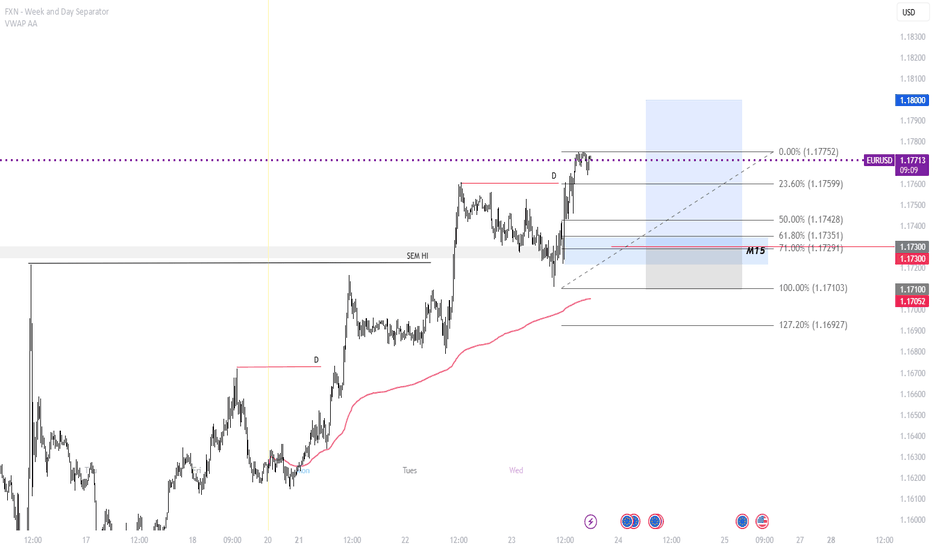

EURUSD – Trade Continuation Outlook: Technical BiasSequence Expectation:

If the current Ascend Sequence structure holds, I anticipate price extending toward or above the target zone, aligned with the directional flow.

Liquidity Magnet:

The OCZ remains a strong attraction point for buy-side flows, given its repeated gravitational pull on price.

Invalidation Criteria:

A structural breach of the Sequence Line would invalidate the bullish outlook, exposing price to the mid-range of the Ascend Sequence or potentially deeper pullbacks below.

Caution Note:

Upcoming U.S. data releases may inject volatility, likely acting as a directional driver.

Wait for clear confirmations before engaging. Trade setups must align with structure and show decisive intent.

Summary Tactical Lean:

Bullish bias stands as long as the Sequence remains intact. OCZ remains in sight. Trade cautiously, adapt to new data flow, and validate every trigger.

🔒 Disclaimer:

This content is for educational and strategic insights only. It is not financial advice. Always confirm with your personal trading plan and manage risk appropriately.

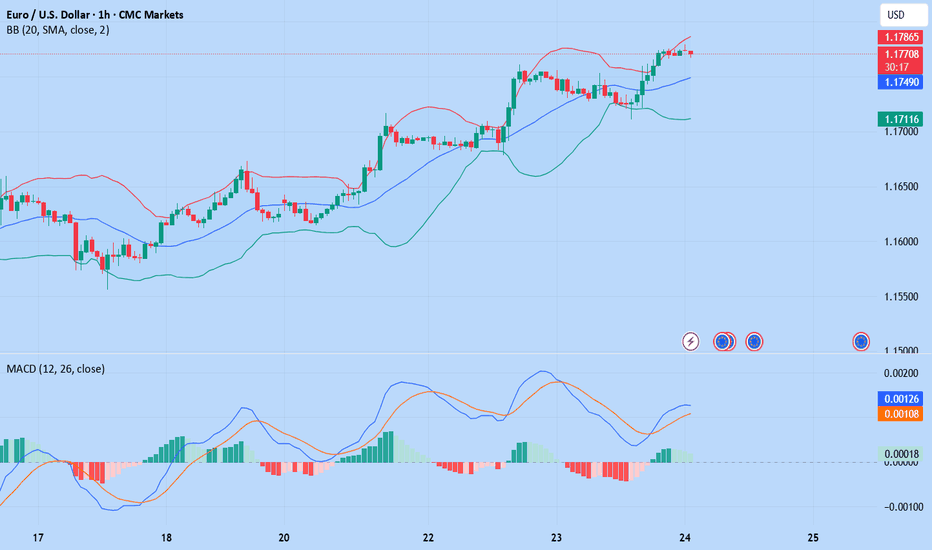

EURUSD IS ON ITS WAY TO LOCAL HIGHSEURUSD IS ON ITS WAY TO LOCAL HIGHS

EURUSD successfully rebounded from local support of 1.16000 and since then continues to rise towards local resistance of 1.18300. Recently the price has started to show the bearish divergence on RSI and Macd indicators. MACD went into the red zone.

What is the bearish divergence?

Bearish divergence is a technical analysis pattern where the price makes higher highs in an uptrend, but a momentum indicator (e.g., RSI, MACD) forms lower highs, signaling weakening bullish momentum and a potential downward reversal. To trade, identify the divergence in a clear uptrend with the indicator showing lower highs (e.g., RSI above 70). Sell or short when the price confirms a reversal (e.g., breaks below a support level or trendline) with increased volume. Set a stop-loss above the recent high. Target the next support level.

Generally speaking, it doesn't necessarily mean that EURUSD will drop immediately, the price may even grow a bit. However, it highlights some short opportunities.

EURUSD LONG AND EDUCATIONAL BREAKDOWN ECB INTRESTRATE RELEASE The European Central Bank is expected to hold key rates for the first time in over a year on Thursday.

The Eurozone inflation rate has hit the ECB’s 2% target as the US-EU trade deal uncertainty lingers.

The EUR/USD pair could experience intense volatility following the ECB policy announcements.

The European Central Bank (ECB) is on track to leave its key interest rates unchanged after its July policy meeting, after having reduced rates at each of its last seven meetings. The decision will be announced on Thursday at 12:15 GMT.

The interest rate decision will be followed by ECB President Christine Lagarde’s press conference at 12:45 GMT.

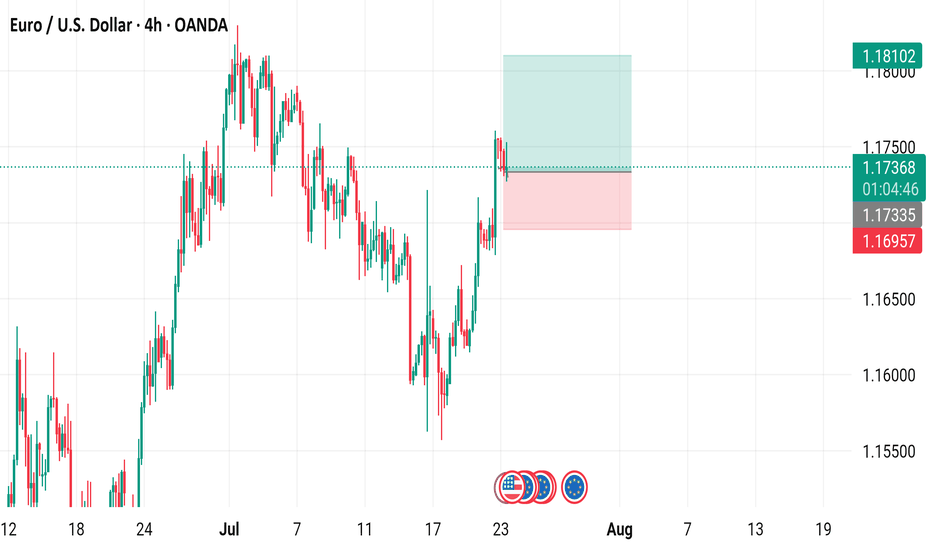

EUR/USD 4-Hour Candlestick Chart (OANDA)4-hour candlestick pattern for the Euro/US Dollar (EUR/USD) currency pair on the OANDA platform, covering the period from mid-July to mid-August 2025. The current price is 1.17358, reflecting a 0.16% decrease (-0.00186). Key levels include a sell signal at 1.17350 and a buy signal at 1.17366, with a highlighted resistance zone around 1.18102 and support near 1.16957. The chart includes technical indicators and price movements over the specified timeframe.

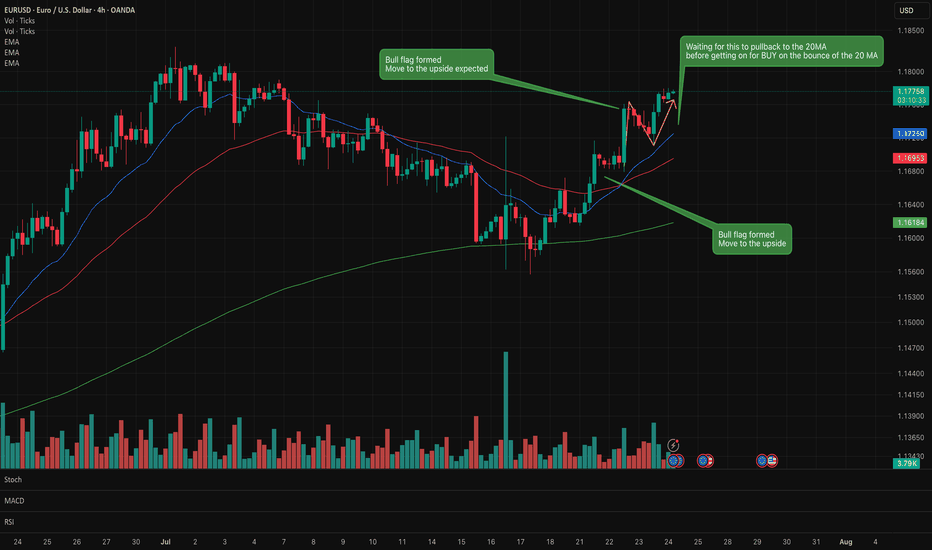

EUR/USD Lots of bull flags formed on the recent chart. Buy/Long Lots of bull flags on this chart which confirmed a move to the upside.

Waiting for a little pullback to the 20MA before considering a buy long order

Waiting to see if this small bear flag forms.

A very interesting instrument to watch at the moment. Full of various signals.

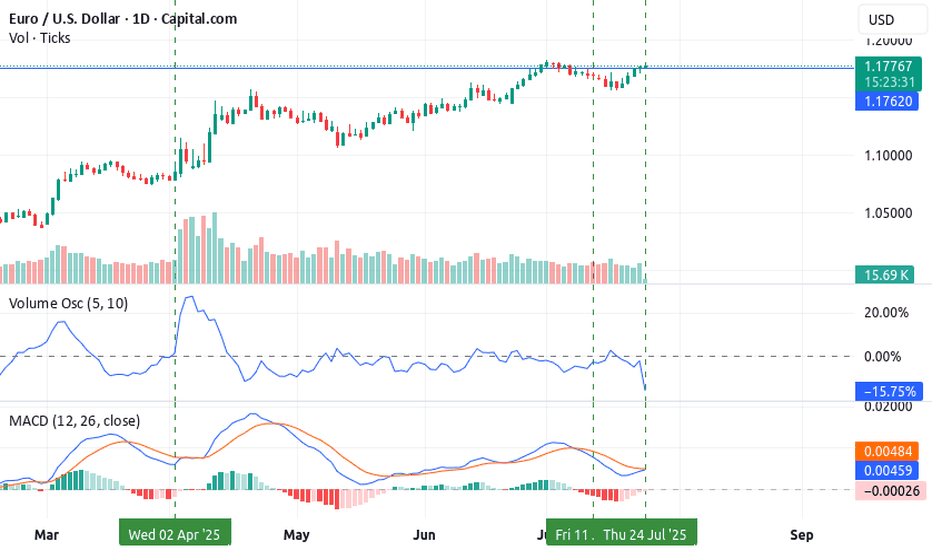

Top 3 Steps to Trading EUR/USD Long-Term✅ Top 3 Steps to Trading EUR/USD Long-Term – Rocket Booster Buy Setup 🚀

Pair: EUR/USD

Timeframe: Daily

Trade Type: Long-Term Swing / Investment

Direction: BUY

Looking for a high-confidence swing trade? EUR/USD has triggered all 3 key steps for a long-term bullish entry using the proven Rocket Booster Strategy.

Here’s the breakdown:

🔑 Step 1: Volume Oscillator – Buy Rating

Volume is trending above the zero line, showing signs of accumulation and increasing demand. This suggests smart money may be entering quietly.

🔑 Step 2: MACD – Bullish Momentum

A bullish MACD crossover above the zero line on the daily timeframe confirms that momentum has shifted in favor of the bulls. Histogram bars are expanding—classic trend continuation behavior.

🔑 Step 3: Rocket Booster Strategy – Fully Aligned

All three pillars of the strategy are locked in:

✅ Price is above the 50 EMA

✅ Price is above the 200 EMA

✅ Volume spike confirms momentum ignition

This setup shows strong potential for trend continuation on the higher timeframe.

🧠 Trade Perspective:

This is a long-term investment-grade signal, not a short-term scalp. Patience and disciplined trade management are key.

🛑 Disclaimer:

This post is for educational and informational purposes only. It does not constitute financial advice. Always do your own research and manage risk appropriately. Use a simulation trading account before you trade with real money

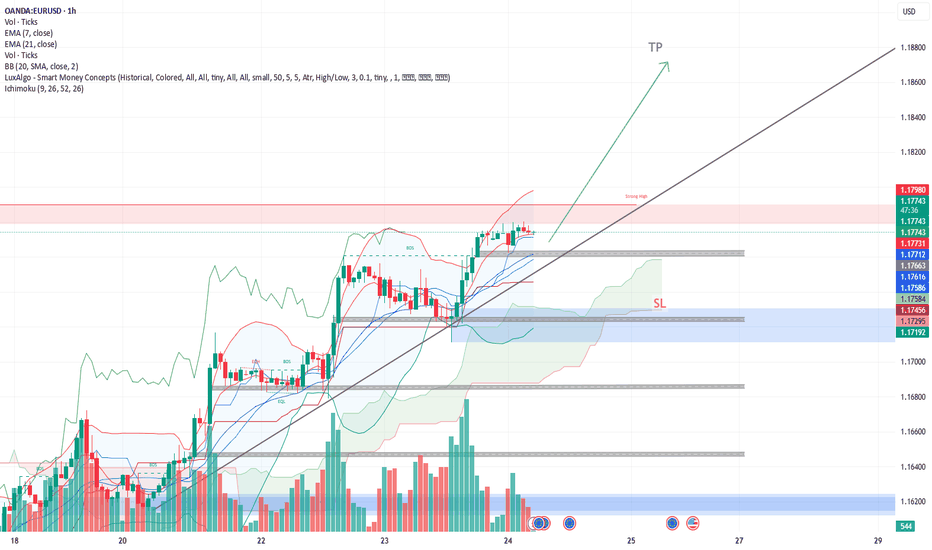

EUR/USD – Buy Setup Analysis (1H Chart)EUR/USD – Buy Setup Analysis (1H Chart)

📈 **Trend**: Uptrend

The pair is respecting the ascending trendline and is trading above both the EMA 7 and EMA 21, indicating bullish momentum.

**🔹 Long Setup**

* **Entry:** Around 1.1774 (current price)

* **Stop-Loss (SL):** 1.1731 (below trendline & EMAs)

* **Take-Profit (TP):** 1.1872 (based on recent swing high)

**🔎 Technical Signals**

* Price is forming higher highs and higher lows.

* Strong volume surge on bullish candles.

* EMA crossover (7 > 21) supports continuation.

**Conclusion**

As long as EUR/USD holds above the trendline and the EMAs, the bullish setup remains valid. A break below 1.1730 would invalidate this outlook.

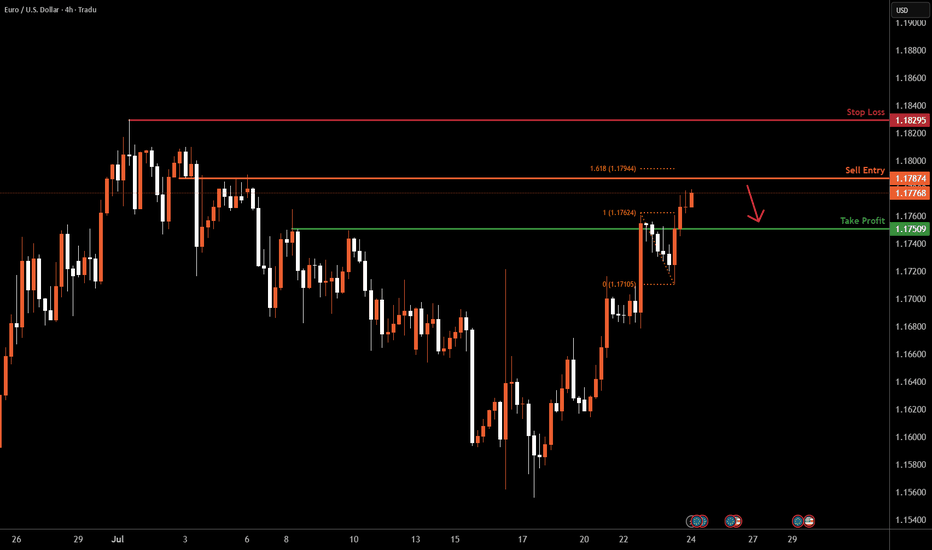

EURUSD H4 I Bearish Reversal Based on the H4 chart analysis, we can see that the price is rising toward our sell entry at 1.1787, which is a pullback resistance aligning close to the 161.8% Fibo extension.

Our take profit will be at 1.1750, a pullback support level.

The stop loss will be placed at 1.1829, a swing-high resistance level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

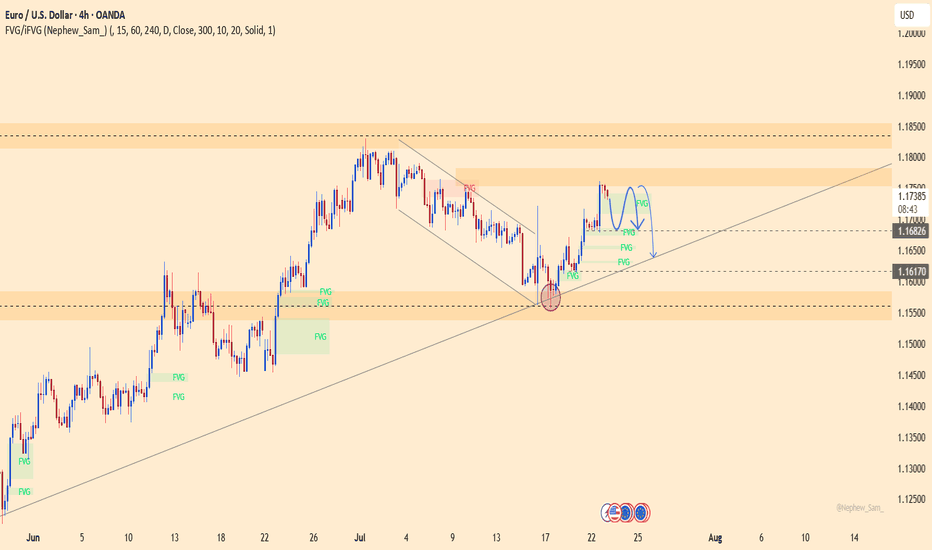

EURUSD – Recovery losing steam, correction risk is risingAfter rebounding from the trendline support, EURUSD is now approaching the key resistance area around 1.17500 — a zone that has historically triggered multiple rejections. However, with French and German PMI figures coming in below expectations and the ECB holding rates steady without providing any fresh policy guidance, the euro lacks the momentum for a sustained move higher.

On the H4 chart, price action is showing signs of exhaustion as it tests resistance. If buyers fail to break through convincingly, a pullback toward the 1.16800 support zone — or even deeper toward 1.16400 — becomes increasingly likely.

Preferred strategy: Watch for bearish rejection patterns near 1.17500. If confirmed, this could be a favorable opportunity to initiate short positions in anticipation of a correction.

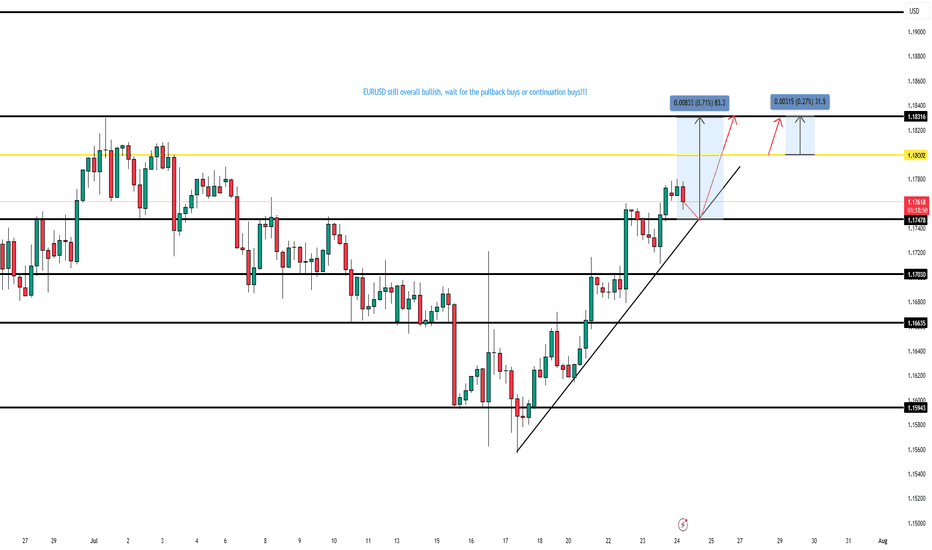

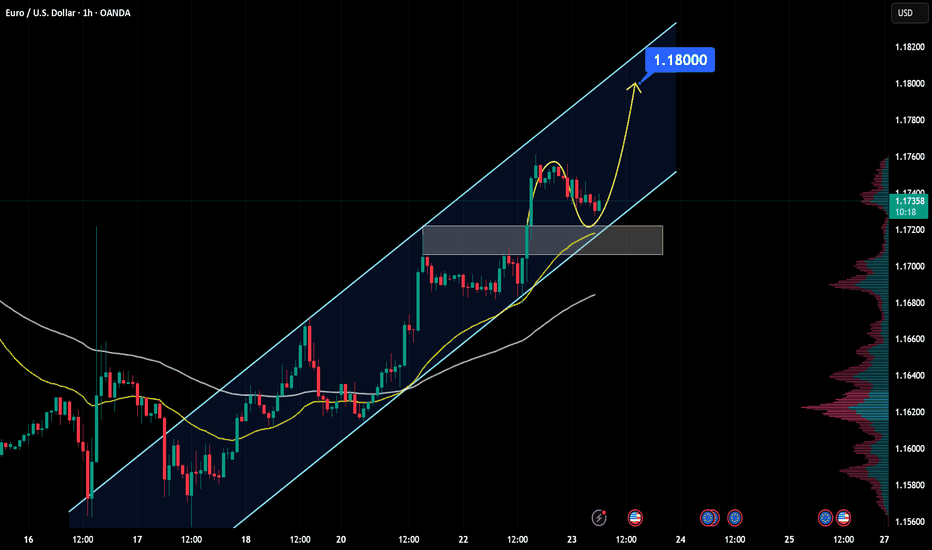

EURUSD Analysis - Can Buyers Push Price To $1.18000?Hello all dear traders!

EURUSD is trading within a clear bullish channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum shows that buyers are in control, suggesting further upside.

The price recently broke above a key resistance zone and is now coming back to retest it. If this level holds as support, it will consolidate the bullish structure and increase the likelihood of a move towards the 1.18000 target, which is in line with the upper boundary of the channel.

As long as the price remains above this support zone, the bullish outlook remains intact. However, a failure to hold this level could invalidate the bullish scenario and increase the likelihood of a deeper pullback.

Remember, always validate your setups and use appropriate risk management.

EURUSD : Status @ 23/7Direction: Buy

Signal triggered: 23/7/2025

Stop when:

a) Stop Loss @ 1.1700 ; or if

b) Sell signal triggered

Action:

Buy the dip

Good luck.

P/S: Note that the Buyer finally won the battle. But it did so, fighting the Seller all the way to the top. Now, they are at 1.1790 resistance with a potential to reach the long-term D @ 1.1900/30. My preference is not to buy. Instead, wait for a SELL as it is a bit late now to buy.

EURUSD(20250724) Today's AnalysisMarket news:

U.S. President Trump continued to lash out at the Federal Reserve on Tuesday, but seemed to back off from the remaining plan to fire Chairman Powell. "I think he's doing a bad job, but he's going to be out of office soon anyway," Trump said in an exchange with reporters at the White House. "In eight months, he'll be out of office."

Technical analysis:

Today's buying and selling boundaries:

1.1751

Support and resistance levels:

1.1814

1.1791

1.1775

1.1726

1.1711

1.1687

Trading strategy:

If the price breaks through 1.1775, consider buying in, with the first target price at 1.1791

If the price breaks through 1.1751, consider selling in, with the first target price at 1.1726

EURUSD Weekly Technical Analysis – Major Downtrend Line in Focus📈 EURUSD Weekly Technical Analysis – Major Downtrend Line in Focus

As seen on the chart, EURUSD is currently approaching a long-term descending trendline on the weekly timeframe. This trendline has historically acted as a strong supply zone, so it’s crucial to have it drawn on your chart.

🔸 If price manages to break above the resistance at 1.17545, we could see a bullish continuation toward the next targets at 1.17900, 1.18545, and potentially 1.19000.

🔻 However, if price gets rejected around the resistance zone (1.17500–1.17800), key supports to watch are 1.16960, 1.16500, and the major support at 1.14900.

⏳ A move toward the downtrend line is highly likely, but it may take time. Stay patient and monitor these key zones closely.

💬 Follow for more real-time analysis and updates!

EURUSD: Strong Growth Ahead! Long!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.17463 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move up so we can enter on confirmation, and target the next key level of 1.17589.Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️