The Day AheadKey Data Releases:

US:

Philadelphia Fed non-manufacturing activity – A pulse-check on services sector strength. Positive surprise could boost USD and Treasury yields.

Richmond Fed manufacturing & business conditions – Insight into regional factory health; any contraction signals broader economic weakness.

UK:

June Public Finances – Higher borrowing may raise concerns about fiscal headroom, putting pressure on gilts and GBP.

France:

June Retail Sales – A soft read may point to waning consumer demand, affecting Eurozone growth expectations.

Central Banks:

Fed Chair Powell Speaks:

Market-sensitive. Traders will watch closely for clues on rate cut timing—September odds remain high.

ECB Lending Survey:

Tightening credit standards may reinforce the case for ECB to hold or ease. Could weigh on EUR if dovish tones dominate.

BoE Governor Bailey Speaks:

Could guide GBP volatility. Hawkish lean might delay rate cut pricing.

RBA July Minutes:

Will reveal internal debate over inflation and growth. May impact AUD if dovish or hint at hikes.

Earnings to Watch:

Tech & Industrials:

SAP, Texas Instruments, RTX, Lockheed Martin, Northrop Grumman – Key for assessing global capex and defense spending cycles.

Texas Instruments: A bellwether for chip demand—guidance will drive semiconductor sentiment.

Lockheed/Northrop: Defense outlook in focus amid geopolitical tensions.

Consumer & Financials:

Coca-Cola, Capital One, Equifax, General Motors, Sherwin-Williams – Consumer strength, credit conditions, and input cost pressures in focus.

Capital One, Equifax: Loan growth and credit quality trends will signal consumer resilience or stress.

GM: Comments on EV outlook and pricing will be market-moving.

Healthcare & Industrials:

Intuitive Surgical, Danaher, Sartorius: Indicators of medtech demand and R&D cycles.

Trading Implications:

Expect rate-sensitive assets (USD, US yields, GBP) to move on central bank commentary.

Risk sentiment may shift post-earnings depending on guidance, especially from tech and defense names.

Watch EUR reaction to ECB lending data; dovish tilt may push EUR/USD lower.

AUD volatility possible if RBA minutes are unexpectedly hawkish or dovish.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

USDEUX trade ideas

The EUR & the USD. Events that can affect the move this weekThis week we are monitoring EUR and USD carefully, as we could see some interesting moves, due to some events on the economic calendar. Let's dig in.

FX_IDC:EURUSD

MARKETSCOM:EURUSD

TVC:DXY

MARKETSCOM:DOLLARINDEX

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

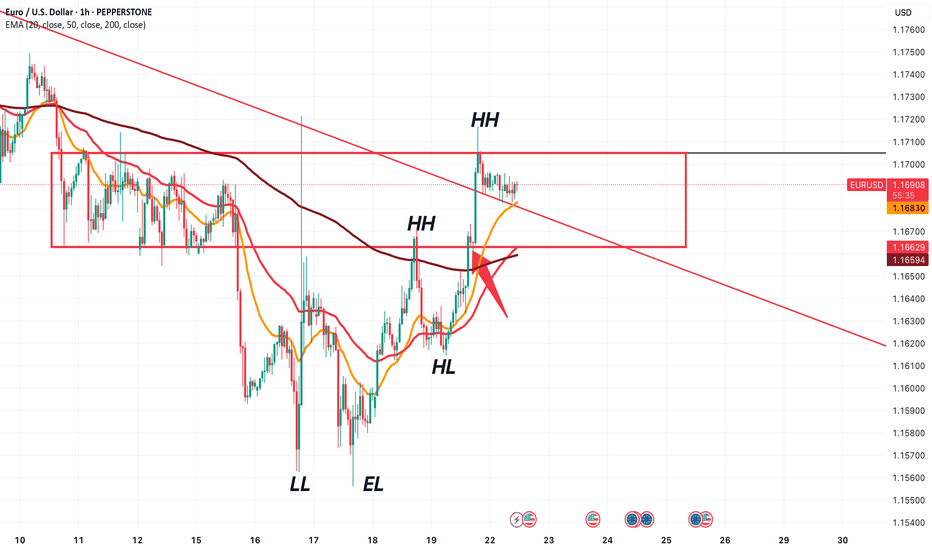

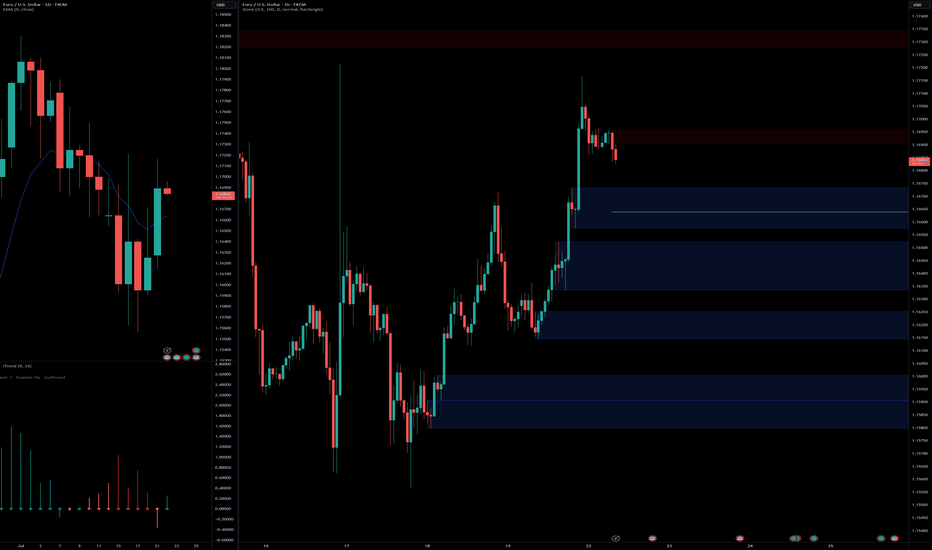

EURUSD Consolidating now, but soon may reveal a new trend!!!EURUSD is consolidating between the red box shown. Previously, it can be seen that, this whole area between 1.17050 and 1.16630 is very choppy, and not the best area to place any trades.

Look at the market structure latest HH. If price pushes above 1.17050, we will continue in an uptrend, and then we will look for BUYS.

Now, look at the red trendline drawn. It is interacting with the consolidation zone. We have a very small pullback at the red arrow drawn. It exactly sits at 1.16630.

The point is, if price goes below that level, we will know that price is respecting the trendline and would most likely continue moving down. Therefore, we look for SELLS.

Obviously, we dont want to get caught in any fakeouts. So we will further look at how the candles are being formed later and what story they tell.

Now we wait and watch.

Fundamental Market Analysis for July 22, 2025 EURUSDThe euro is trading near 1.1700, having retreated from an intraday high of 1.1720 after the release of the final June U.S. CPI figures, which confirmed a slowdown in inflation to 2.7% y/y and 0.1% m/m while keeping the core reading steady at 3.1%. The brief rise in risk appetite quickly gave way to stronger demand for the dollar as the probability of the Fed’s first rate cut in September fell from 65% to 55%.

Additional pressure on the euro comes from the yield differential: 10-year U.S. Treasuries hover around 4.45%, while German Bunds yield only 2.30%. The gap of more than 215 bp encourages capital to flow from the eurozone into dollar assets, supporting USD demand.

Fundamentally, risks for the euro remain tilted to the downside: after June’s rate cut the ECB said further moves depend on price dynamics, and the eurozone composite PMI dropped to 50.1 – the brink of stagnation. Against the backdrop of weak continental activity and moderate yet persistent U.S. inflation, the pair may test support at 1.1615 in the coming sessions, especially if U.S. durable-goods orders exceed forecasts.

Trading recommendation: SELL 1.1700, SL 1.1720, TP 1.1615

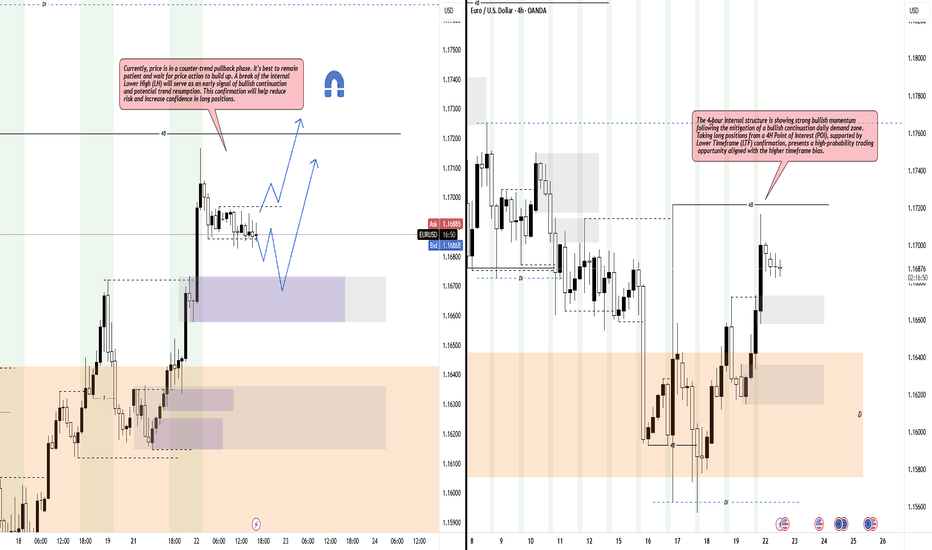

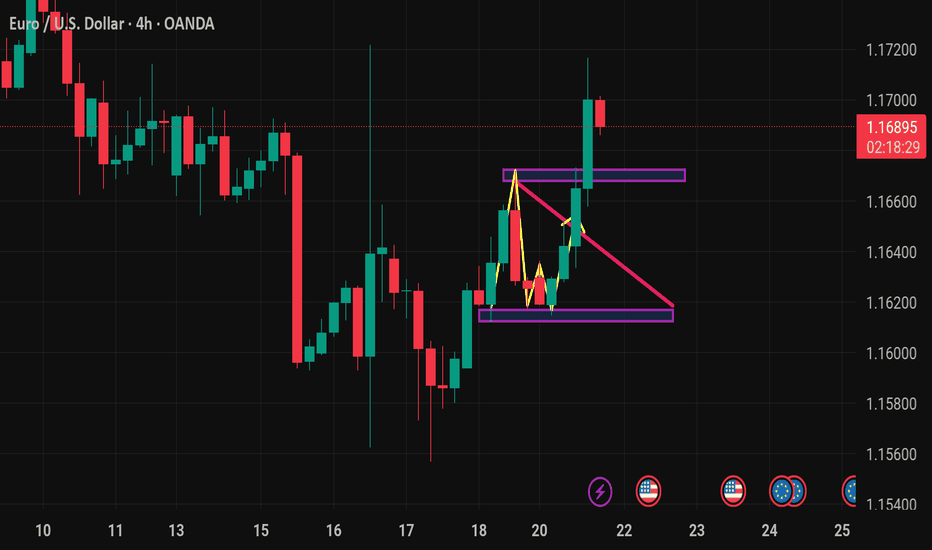

Bullish Setup Loading: Watching Structure & Confirmation ZonesHello Traders,

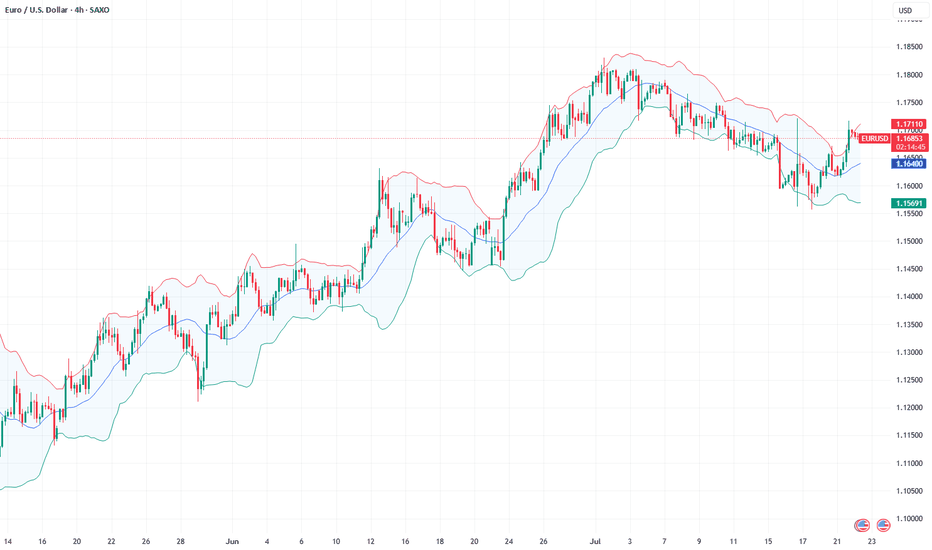

Price is currently in a counter-trend pullback phase, showing signs of temporary weakness within a larger bullish context. Patience is key as we wait for price to build structure and break the internal Lower High (LH), which would act as an early signal of bullish continuation.

The 4-hour internal structure remains strongly bullish, following a clean mitigation of the daily bullish continuation demand zone. A long setup from a 4H Point of Interest (POI), backed by Lower Timeframe (LTF) confirmation, offers a high-probability trade aligned with the higher timeframe trend. Confirmation through structural shifts will reduce risk and increase confidence in directional bias.

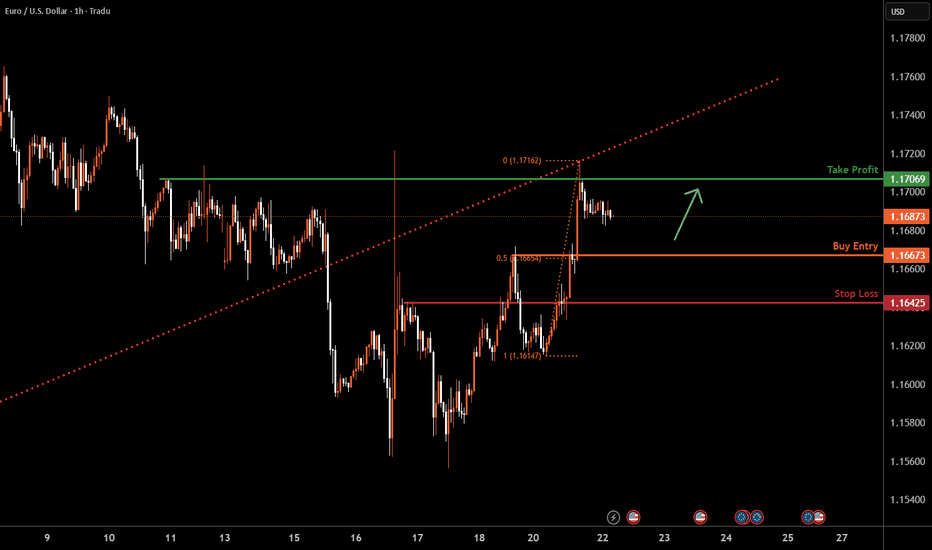

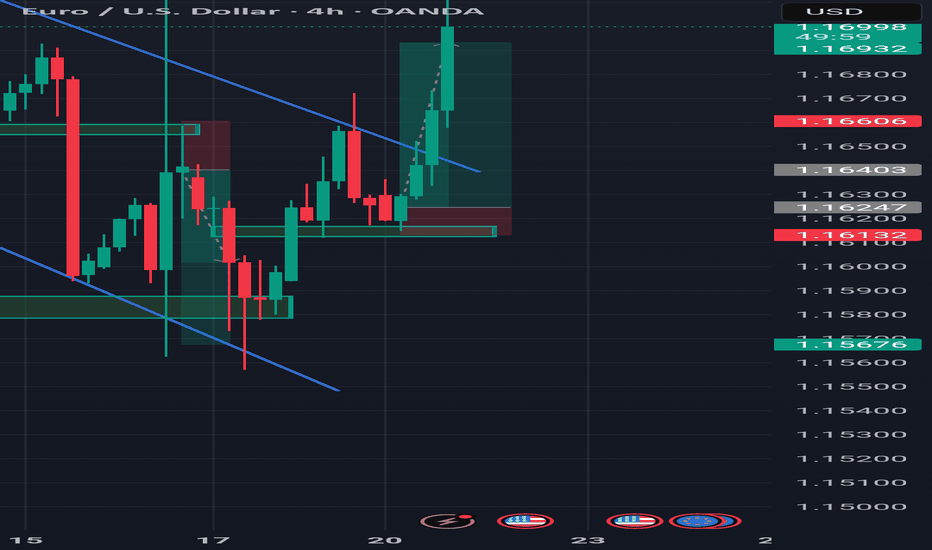

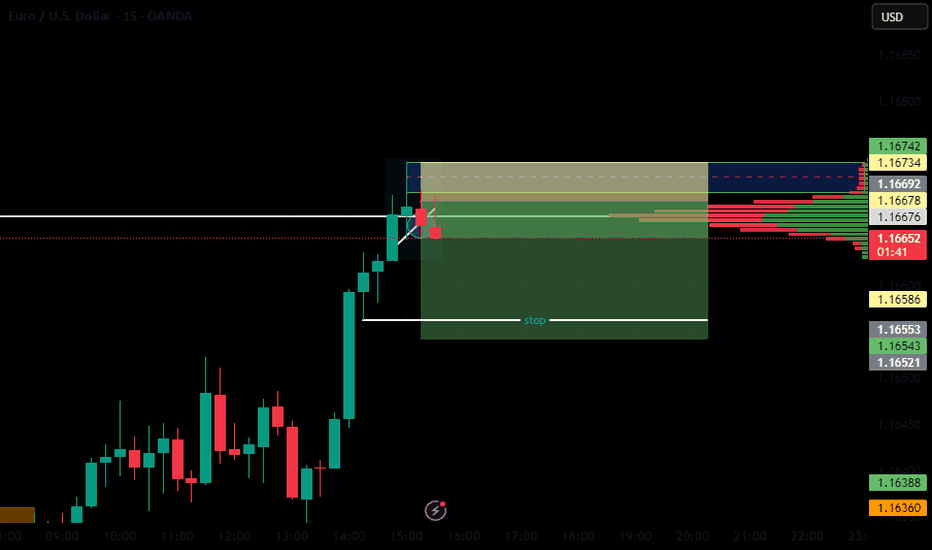

EURUSD H1 I Bullish Bounce Off Based on the H1 chart analysis, the price is falling toward our buy entry level at 1.1667 a pullback support that aligns with the 50% Fib retracement.

Our take profit is set at 1.1706, a swing high resistance.

The stop loss is placed at 1.1642, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EUR/USD Holds Firm Near 1.1700 Amid Trade TensionsFundamental analysis

The EUR/USD pair remains buoyant near 1.1700 in todays Asian session, extending monday’s gains as the US Dollar weakens sharply amid renewed US-EU trade tensions.

The US Dollar Index (DXY) is treading water around 97.88, down from its recent one month high of 99.00, as risk sentiment deteriorates following reports that President Trump is pushing for tariffs of 15%-20%, above the previously discussed 10%. Additionally, his unwillingness to ease the 25% auto levy has triggered a more aggressive EU stance, with Germany joining France in calling for retaliatory measures.

On the monetary policy front, markets are focused on the European Central Bank (ECB), which is widely expected to keep rates unchanged on Thursday. However, President Christine Lagarde’s guidance will be crucial for gauging the euro’s direction in the second half of the year.

Meanwhile, traders in the US remain confident that the Federal Reserve will leave its benchmark rate at 4.25%–4.50% in next week’s meeting, further limiting upside for the dollar.

Technical analysis

EUR/USD remains caught within a pivotal range, with directional conviction still lacking as momentum indicators remain subdued.

Upside Potential

The pair must vault above the 2025 high of 1.1830 (July 1) to open the path toward the June 2018 peak at 1.1852. A sustained break above this dual resistance zone would likely encourage a bullish continuation, targeting fresh multi-year highs.

Downside Risk

Conversely, a breach of July’s base at 1.1556 would weaken the current structure and potentially trigger a deeper pullback:

Initial support emerges at the 55-day moving average near 1.1485. Below that, the May 29 weekly low at 1.1210 offers the next significant floor. A failure to hold these levels could expose the psychologically critical 1.1000 handle, a key long-term support.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

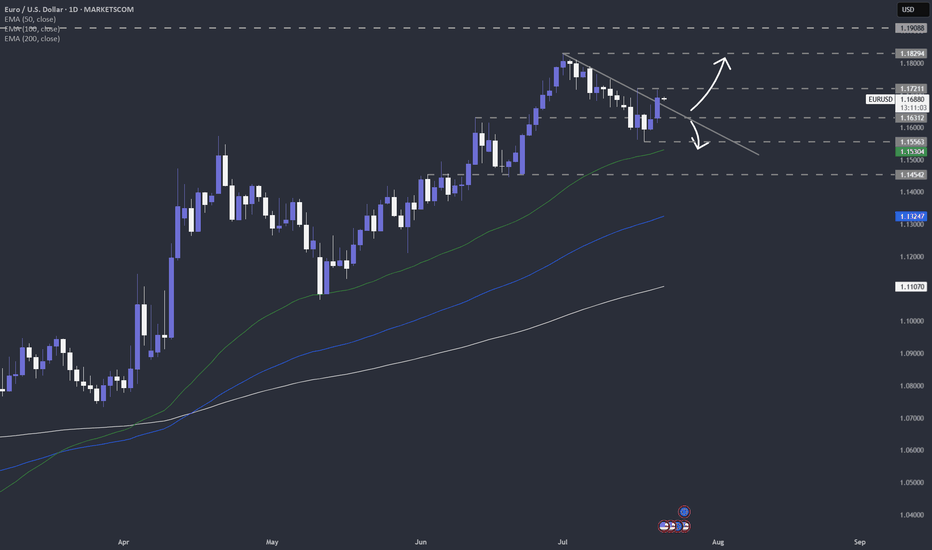

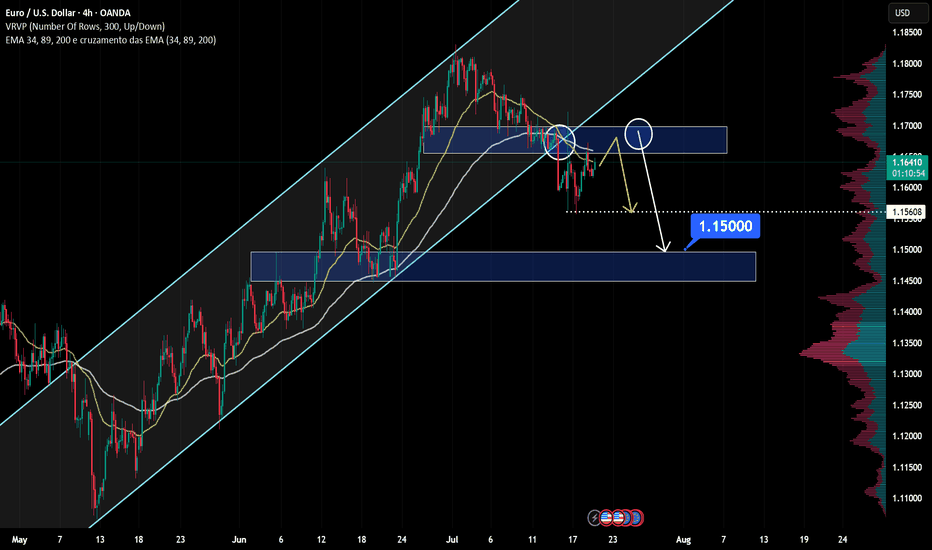

EUR/USD at Resistance – Will Sellers Push Price Down to 1.15000?Hello fellow traders! What’s your take on EUR/USD?

From Brian’s personal perspective:

This currency pair is approaching a key resistance zone, which previously acted as a strong support level. This area aligns with historical price reactions and could serve as a solid foundation for potential bearish movements.

If sellers confirm their presence through bearish price action, I anticipate the price could move toward 1.15000. However, a clear break above this resistance level may signal the possibility of further bullish continuation.

Let me know your thoughts or any additional insights you might have!

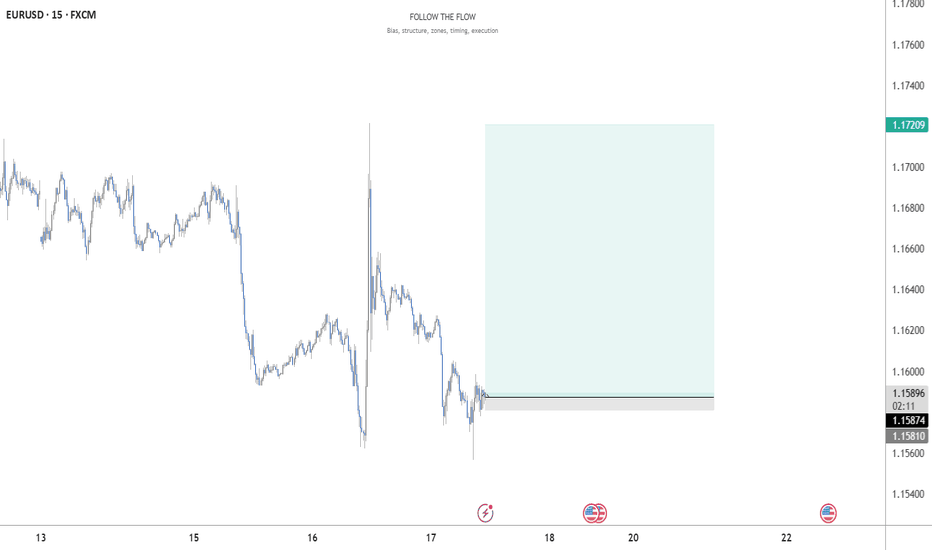

EUR/USD AccumulationOn the 5-minute timeframe, buying activity initiates, signaling the potential end of the downtrend. The first indication of upward momentum appears following the formation of a range and a subsequent liquidity sweep. Price then retests the prior low with diminished volume but fails to break below it, suggesting that selling pressure is being absorbed by buyers. This behavior reflects accumulation by informed participants positioning for a move higher. As demand begins to outweigh supply, clear signs of strength emerge

Entry: 1.15765

Take Profit: 1.16279

Stop Loss: 1.15621

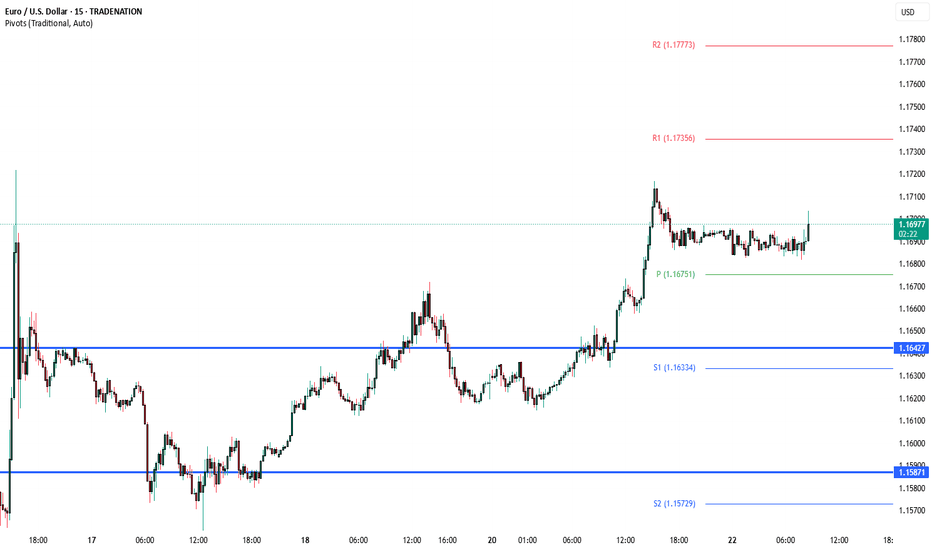

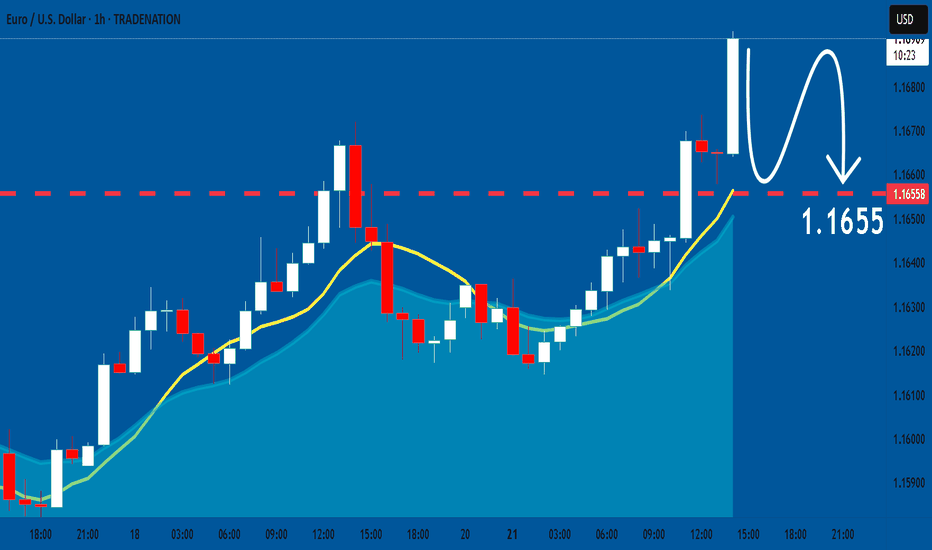

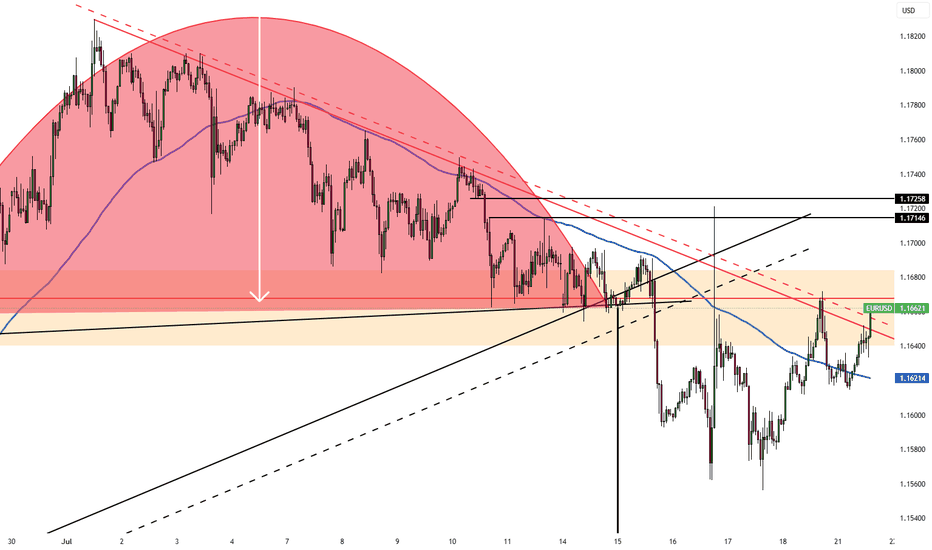

EURUSD: Expecting Bearish Movement! Here is Why:

Balance of buyers and sellers on the EURUSD pair, that is best felt when all the timeframes are analyzed properly is shifting in favor of the sellers, therefore is it only natural that we go short on the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

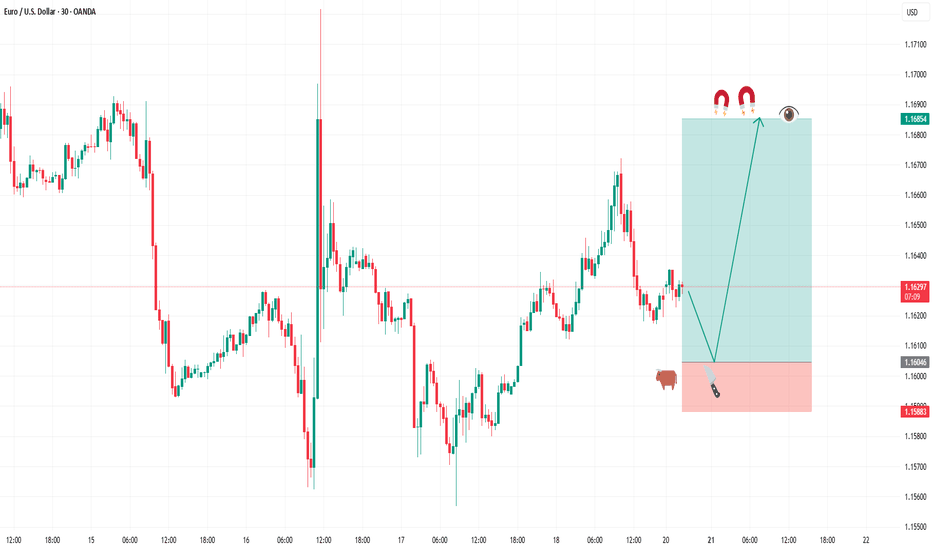

BUY FIBERGreetings traders, today we are looking for buys on EURUSD. Our first entry is at 1.16288 and second entry will be lower at 1.16046 our target is 1.16854 and stops are below 1.15883. use proper risk management and best of luck.

This trade is based on a fine tuned DAILY approach to the algo. Be careful and risk wisely.

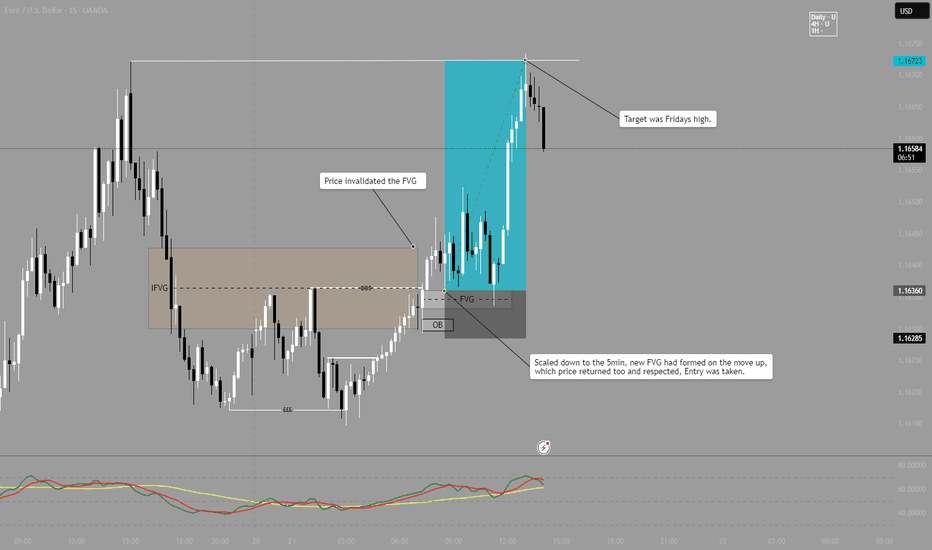

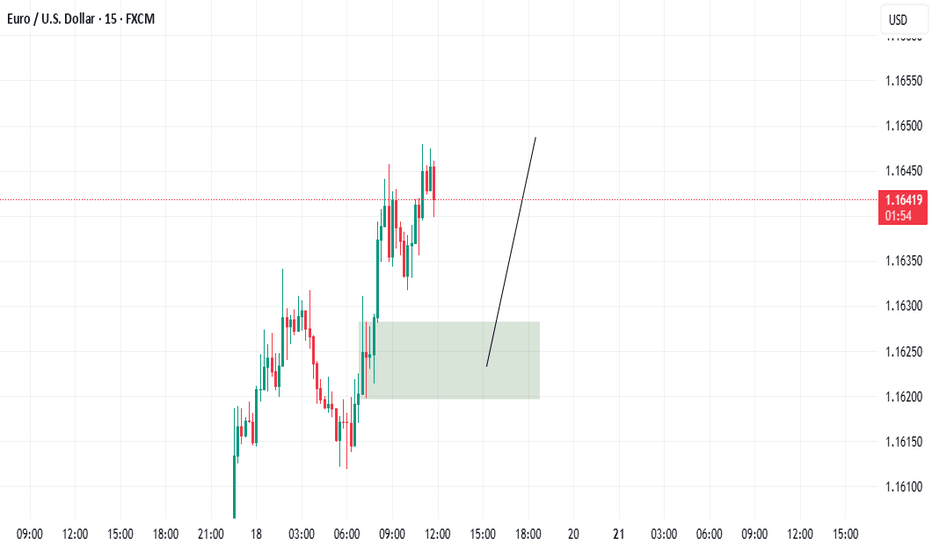

EUR/USD LONG - Follow upAs can be seen, Price invalidated the FVG, indicating a bullish momentum.

After price broke, I then look at the 5 minute for a precise entry.

On the 5m an FVG had been created on the initial move up, price then returned to this area and an entry long was taken.

Target was Fridays Highs.

Note - This is published on the 15m as it wont allow to post with 5m timeframe.

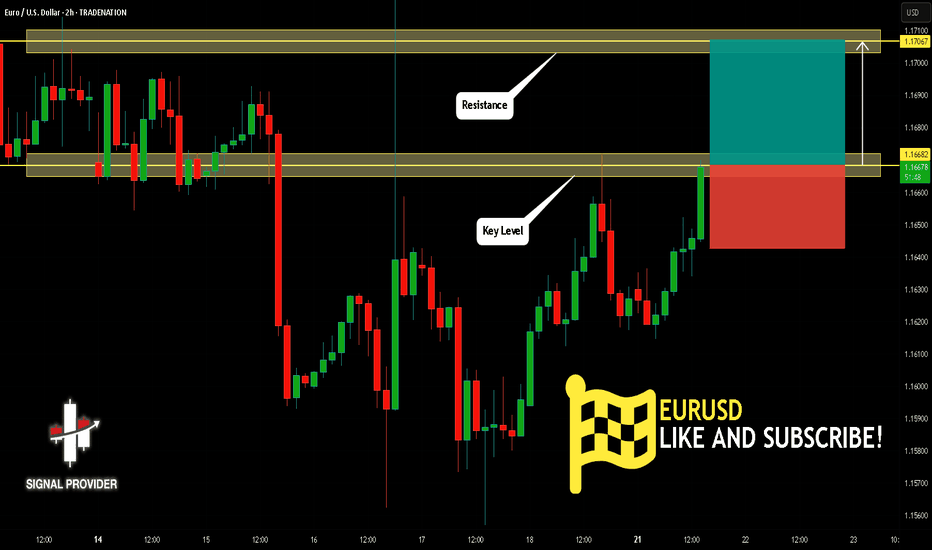

EURUSD Will Go Up! Long!

Please, check our technical outlook for EURUSD.

Time Frame: 2h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a significant support area 1.166.

The underlined horizontal cluster clearly indicates a highly probable bullish movement with target 1.170 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

EUR/USD Analysis by zForex Research Team - 07.21.2025EUR/USD Pulls Back Amid Trade Deal Uncertainty

EUR/USD edged down to 1.1620 during Monday’s Asian session, after gains in the previous session, as the US Dollar stayed firm and traders remained cautious ahead of the August 1 tariff deadline.

US Commerce Secretary Howard Lutnick said the Trump administration expects to finalize trade deals with major partners in the coming weeks, calling the next two weeks “historic.” He expressed optimism about reaching an agreement with the EU but confirmed that August 1 remains a firm deadline for new tariffs.

Resistance levels for EUR/USD are set at 1.1670, followed by 1.1700, and extend up to 1.1750. On the downside, support is found at 1.1580, with additional levels at 1.1540 and 1.1500.

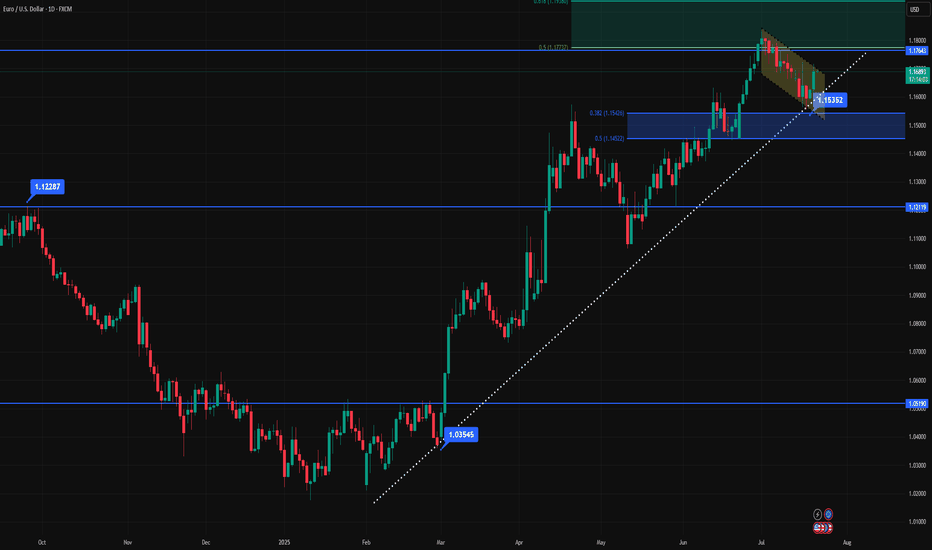

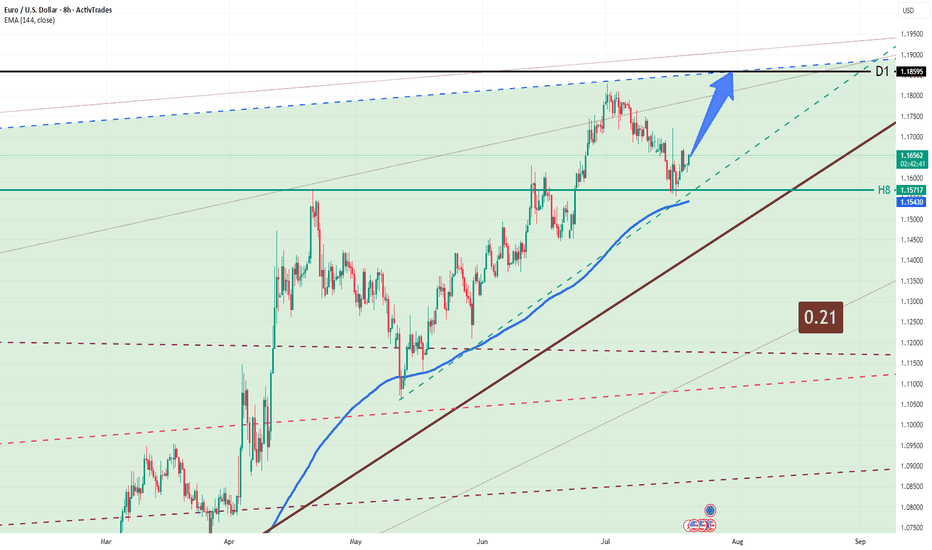

EUR/USD 21.07.25EUR/USD: Uptrend Continues — Targeting 1.1859**

Market Overview:

EUR/USD has bounced off the 1.1570–1.1540 support zone, confirming the integrity of the uptrend. The pair remains inside a rising channel and is approaching key resistance on the D1 level.

Technical Signals & Formations:

— EMA(144) on 8H acts as dynamic support

— Key support at 1.1570–1.1540 held strong

— Bullish momentum targets the 1.1859 resistance (D1)

— Bullish candlestick pattern formed on rebound

Key Levels:

Support: 1.1570, 1.1540

Resistance: 1.1859 (D1)

Scenario:

Primary: continuation toward 1.1859

Alternative: if 1.1540 breaks, possible retracement to 1.1450

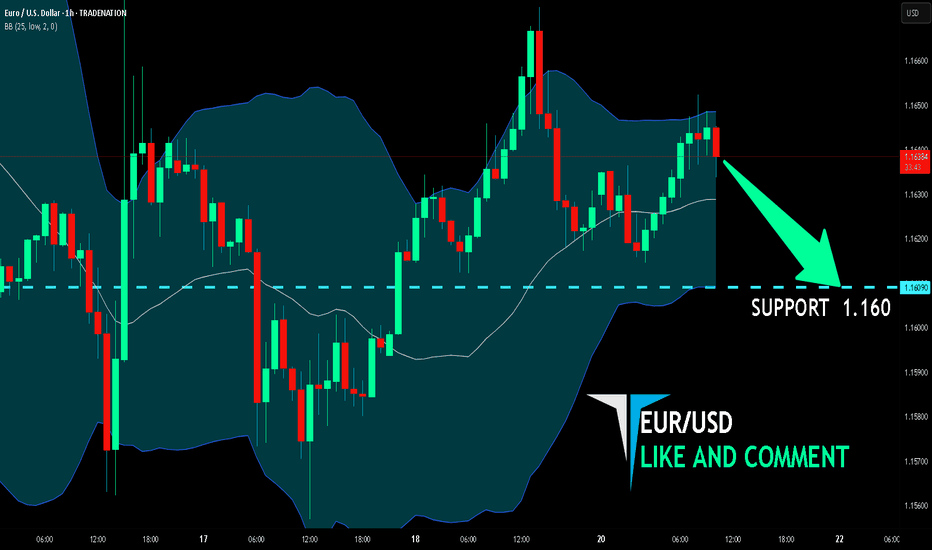

EUR/USD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

EUR/USD is making a bullish rebound on the 1H TF and is nearing the resistance line above while we are generally bearish biased on the pair due to our previous 1W candle analysis, thus making a trend-following short a good option for us with the target being the 1.160level.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅