USDEUX trade ideas

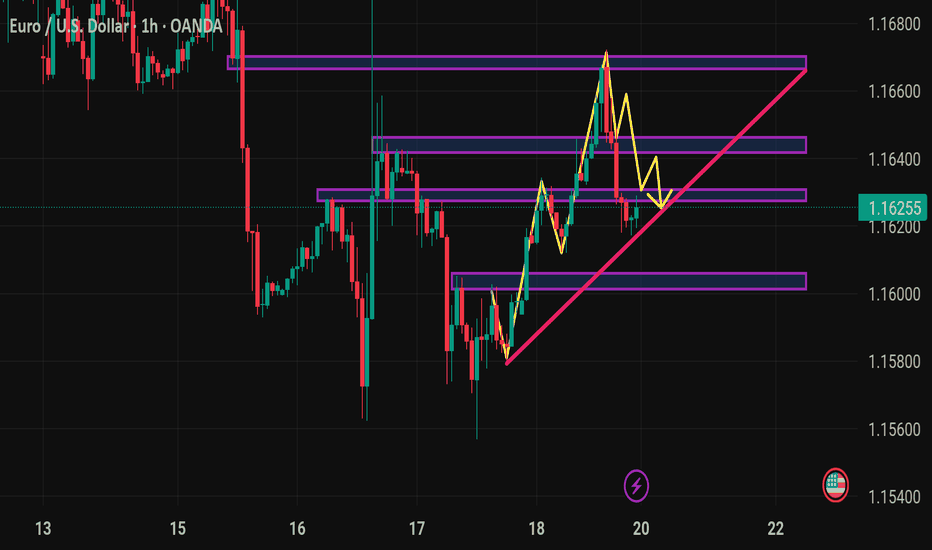

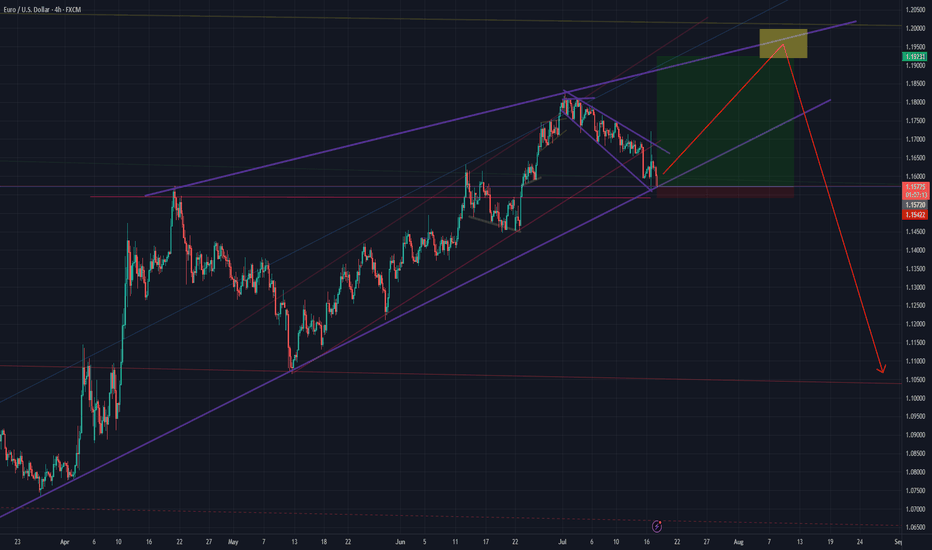

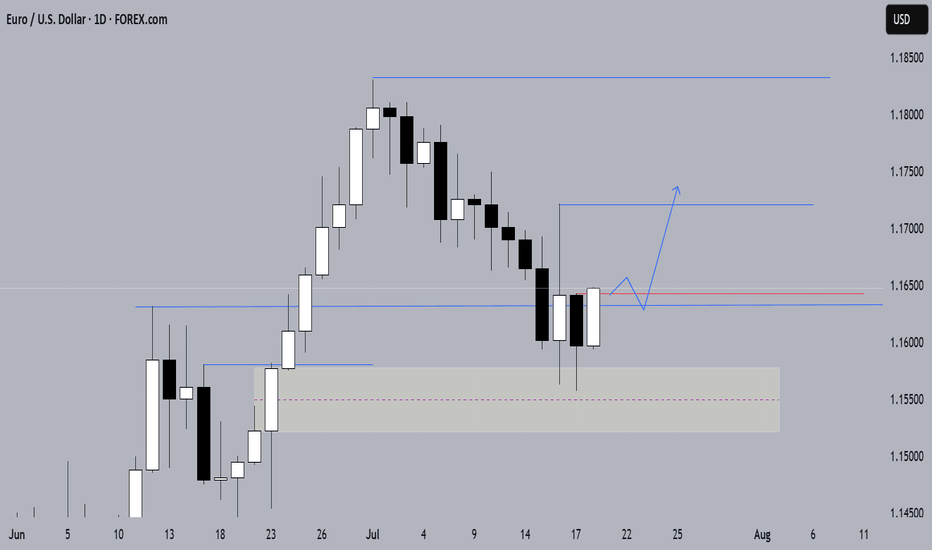

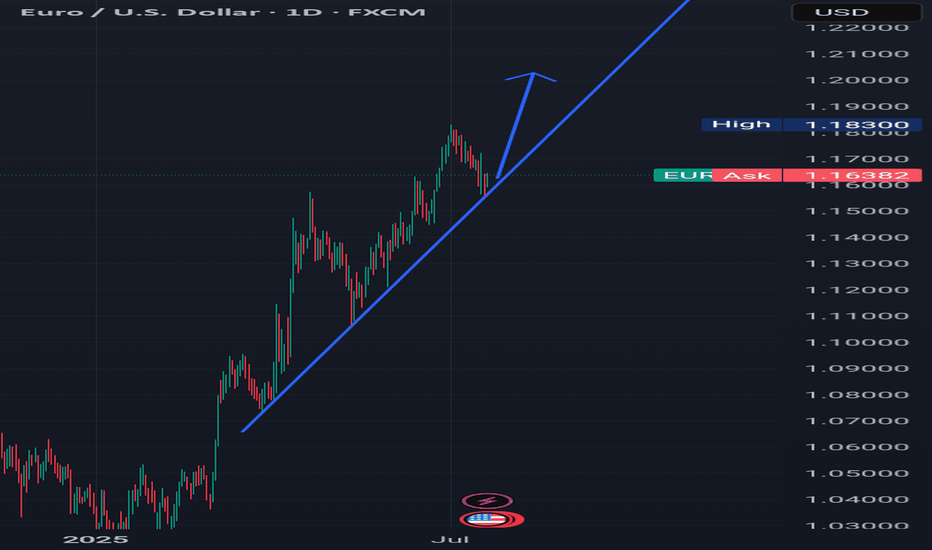

will it rise then fall or will it fall first then rise?Two different scenarios for EURUSD, is it a rise then a fall or a fall first then a rise.

To answer this question, we need to look at the economic data that was expected last week, especially on Friday, which shows short-term inflation. This path could be in the wake of a US interest rate cut.

EUR/USD Bearish Reversal Confirmed – Smart Money Distribution Ne📅 Posted July 18, 2025 | 🔍 VolanX Protocol Insight

📉 Market Outlook:

The EUR/USD pair has rejected the premium supply zone (1.17–1.18) after failing to maintain structure above the red trendline. Price is now breaking down with bearish pressure building toward equilibrium at 1.09544.

📊 VolanX DSS Breakdown:

🔴 Premium Rejection confirms distribution by institutional players.

📈 Trendline Violation + SMC BOS = Shift to markdown phase.

🧠 VolanX Signal Score: Neutral → Bearish

→ Favoring short plays targeting deeper liquidity blocks.

🌐 Macro Narrative (Q3 2025):

🇺🇸 USD Strength: Driven by sticky inflation and delayed Fed cuts (Q4 expected).

🇪🇺 Eurozone Softness: Germany's PMI fell below 50; ECB’s cautious tone continues.

🏦 Rate Divergence Play: US-EU real yield gap widening → capital flowing into USD.

🎯 Probabilistic Target Path (Yellow Line):

✅ 1.1500: First liquidity gap

✅ 1.1150: Midblock retrace

🎯 1.09544: Equilibrium & High-Confidence Institutional Re-entry Zone

🛡️ VolanX Protocol Note:

This forecast is part of the WaverVanir Smart Futures Playbook. All trades are structured with AI-defined probability zones, institutional positioning layers, and macro-event syncing. The VolanX engine will reassess upon retest of the 1.1500 mid-zone.

#EURUSD #Forex #SmartMoney #MacroFX #VolanX #WaverVanir #LiquidityZones #InstitutionalTrading #TechnicalAnalysis #ForexSignals #DXY #Eurozone #FED #ECB #OptionsFlow

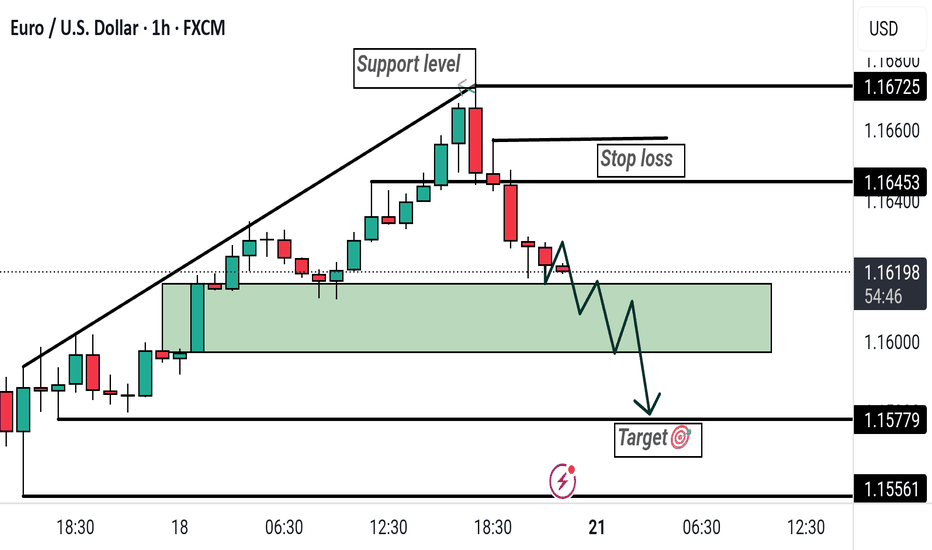

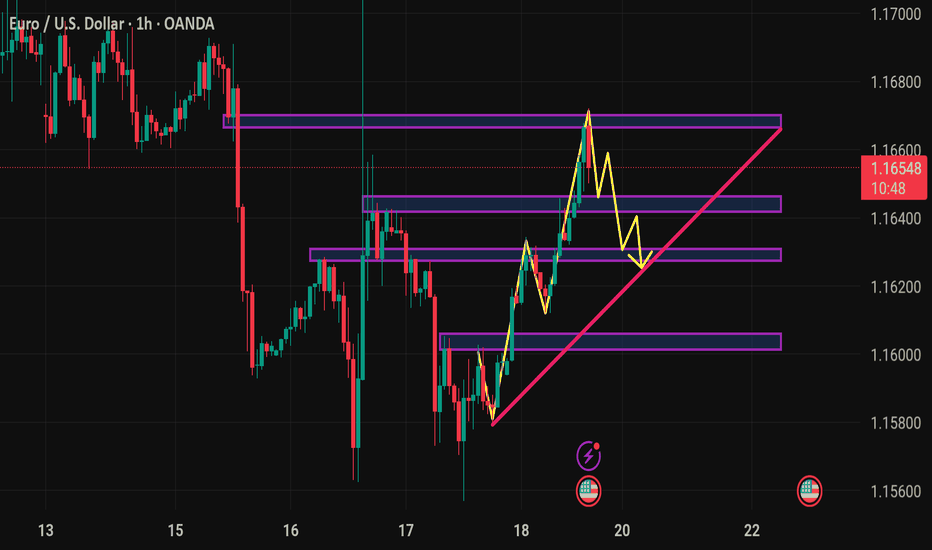

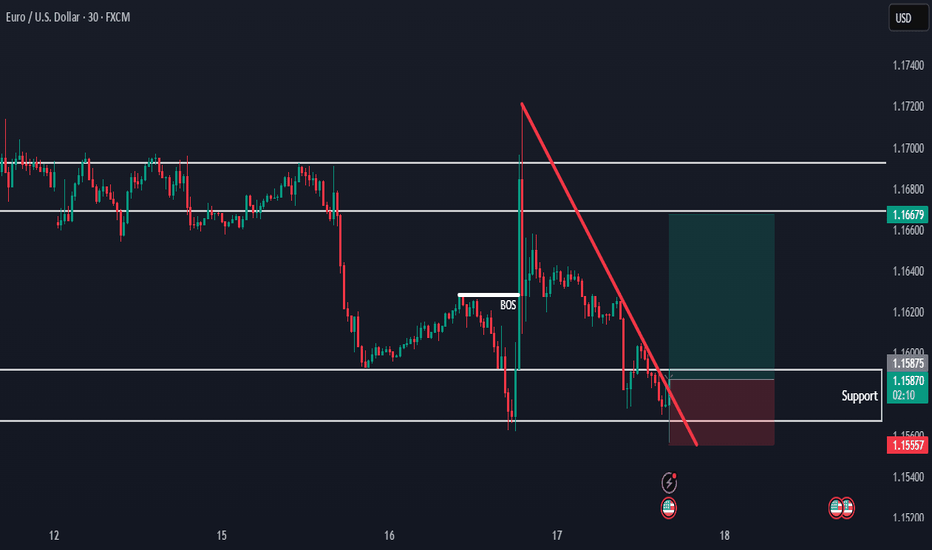

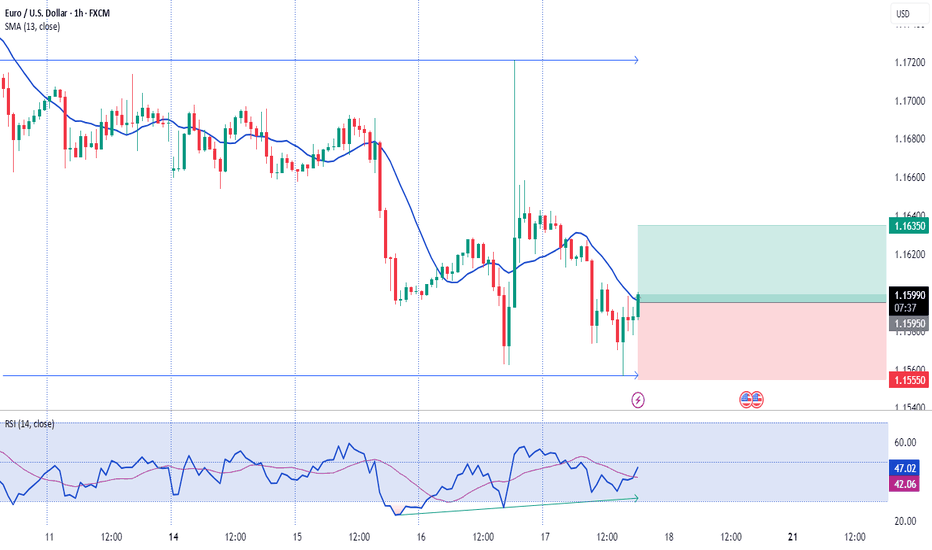

Bearish Breakdown on EUR/USD: Support Flip and Short SetupThis EUR/USD 1-hour chart shows a bearish setup after price breaks below a rising support trendline. A potential short trade is indicated, with a stop loss at 1.16453 and a target at 1.15779. The highlighted green zone marks a key support-turned-resistance area.

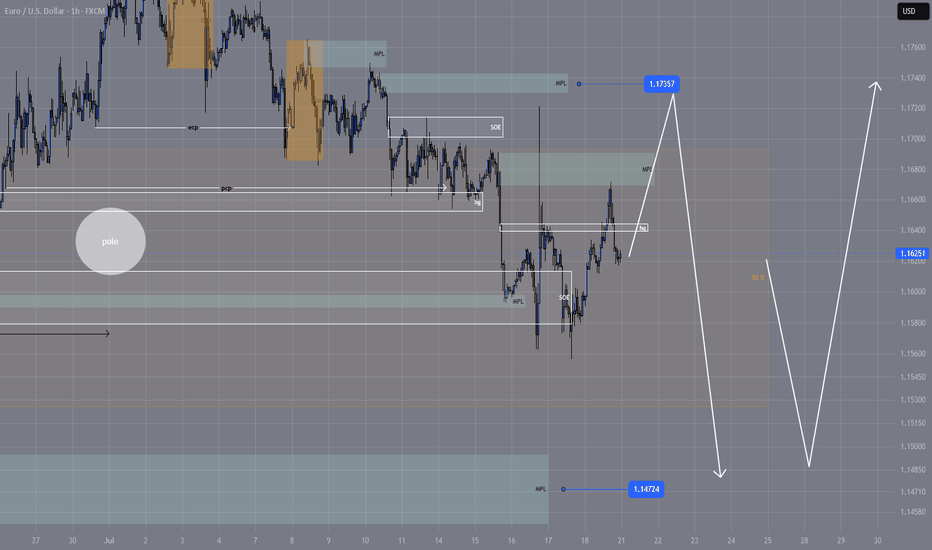

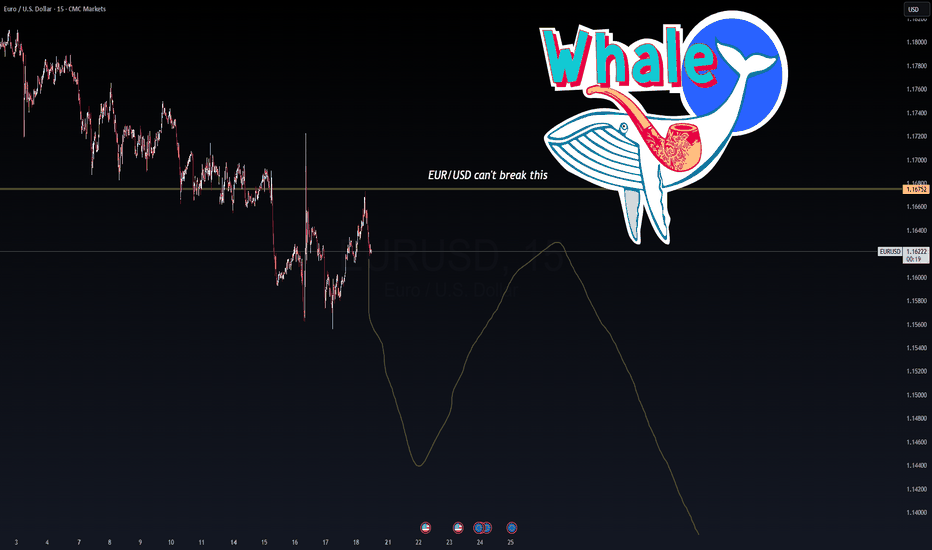

EURUSD: Can't break the whale line!📉 EUR/USD Whale Wall – 1.1675 Rejection Zone

🐋 Smart Money is guarding 1.1675 like it’s sacred.

Every test into this level has been slapped down—likely a whale-level supply zone where institutional sell orders are stacked. VolanX projection curve suggests a macro fade into late July, aligning with DXY strength and bond volatility signals.

Outlook:

As long as 1.1675 holds, momentum favors downside toward 1.1450–1.1400. Rate divergence + weak Eurozone prints fuel the short bias. Break above 1.1675 invalidates.

📊 VolanX Protocol – Predict. React. Dominate.

#WaverVanir #VolanX #EURUSD #Forex #SmartMoney #FXStrategy #MacroTrading

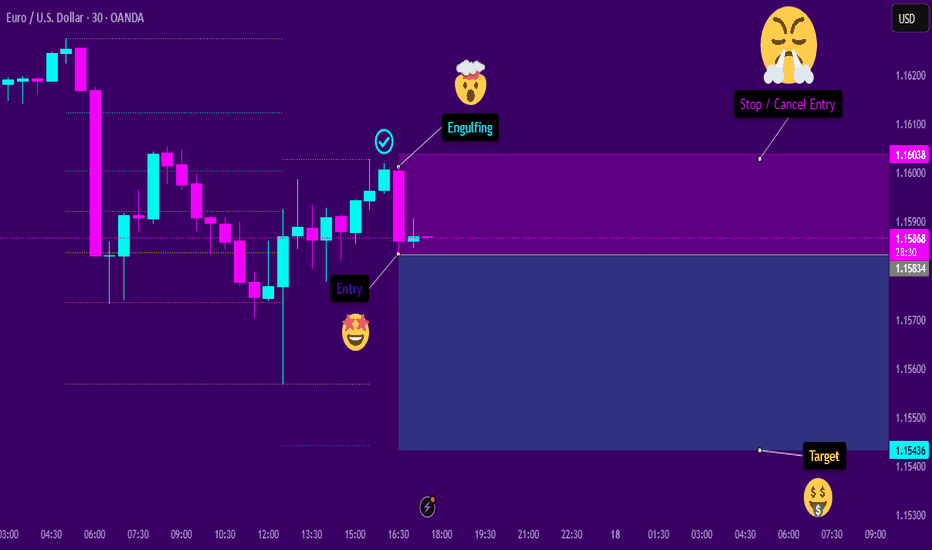

Engulfing SellThe asset shows signs of continuation in a downtrend. After a significant retracement at a favorable Fibonacci level, a bearish engulfing pattern appeared. This engulfing pattern resulted in a behavioral shift, causing the temporary pullback to resume its decline. I believe this will be the case, provided that the subsequent candlesticks confirm the entry signal.

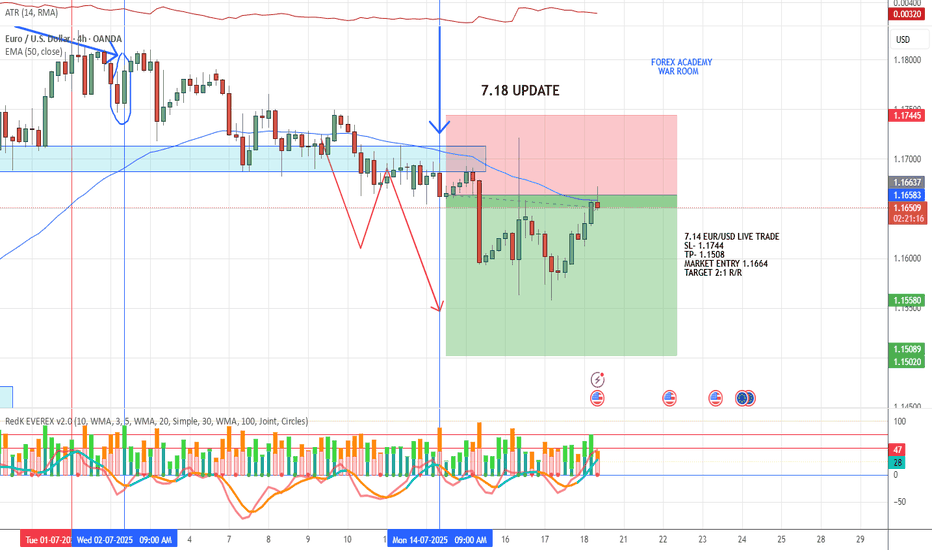

ATM_GS : We are nearing...

#EURUSD: Last Bullish Price Extension! Get Ready! EURUSD is approaching our buying zone, a key level, which suggests a smooth bullish reversal. As this is a swing trade, we advise keeping stop losses larger. There are two targets to keep an eye on. Remember, this is not a guaranteed move, and this is just our overview. Good luck and trade safely.

Team Setupsfx_

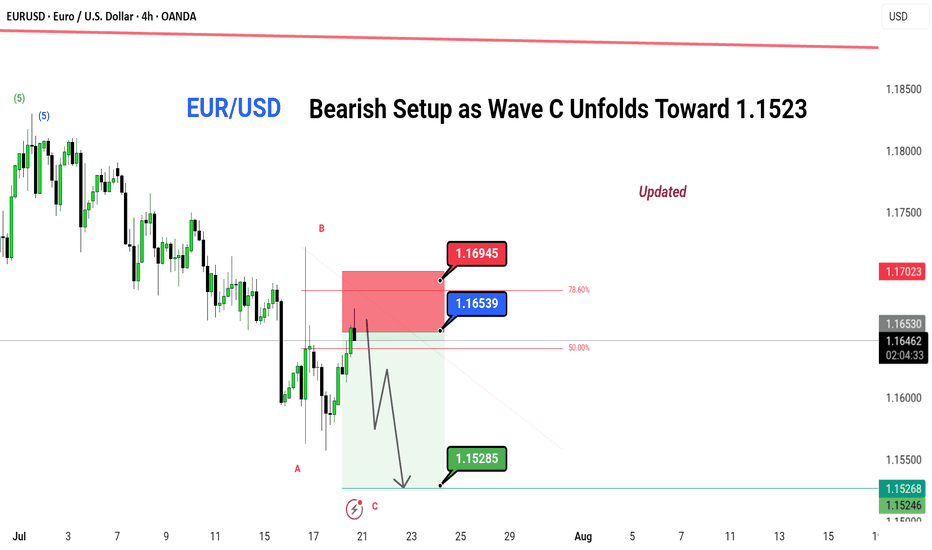

EUR/USD – Bearish Setup as Wave C Unfolds Toward 1.1523📉 EUR/USD – Bearish Setup as Wave C Unfolds Toward 1.1523

Price has retraced into the key 78.6% fib zone after completing Wave B. With clear rejection from the supply area and lower highs forming, Wave C is now in play. Expecting bearish continuation with potential downside targets around 1.1523.

🔻 SHORT BIAS (Wave C in Play)

📍 Entry Zone: 1.16530–1.16945

🎯 Target: 1.15285

⛔ Invalidation: Above 1.17023

📊 Timeframe: 4H

📈 Pattern: ABC Zig-Zag Correction

📌 Updated Analysis by: @greenfire_forex

🧠 Note: Wait for confirmation before entering. Risk management is key.

#EURUSD #ElliottWave #BearishSetup #ABCPattern #WaveC #PriceAction #ForexAnalysis #TradingView

---

Let me know if any correction , would like to suggest

EURUSD Will Collapse! SELL!

My dear subscribers,

This is my opinion on the EURUSD next move:

The instrument tests an important psychological level 1.1663

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 1.1632

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

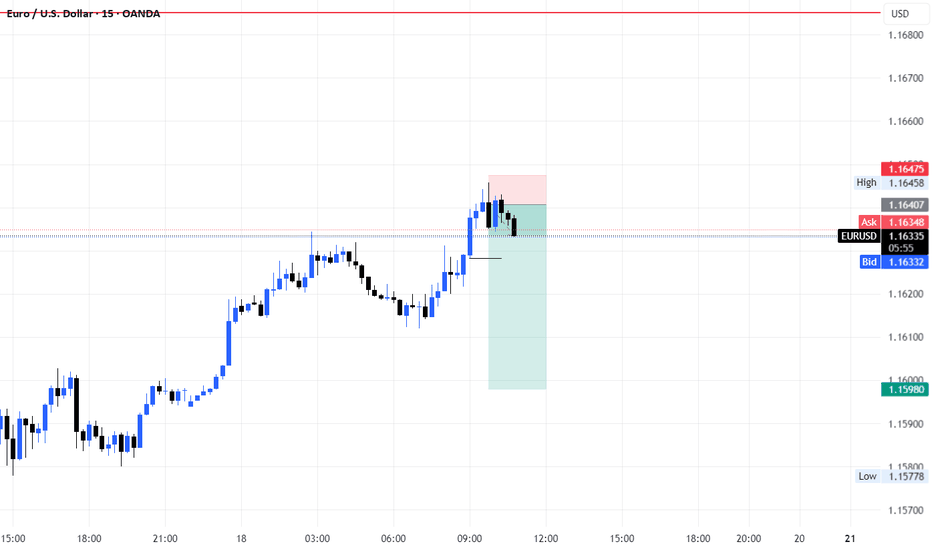

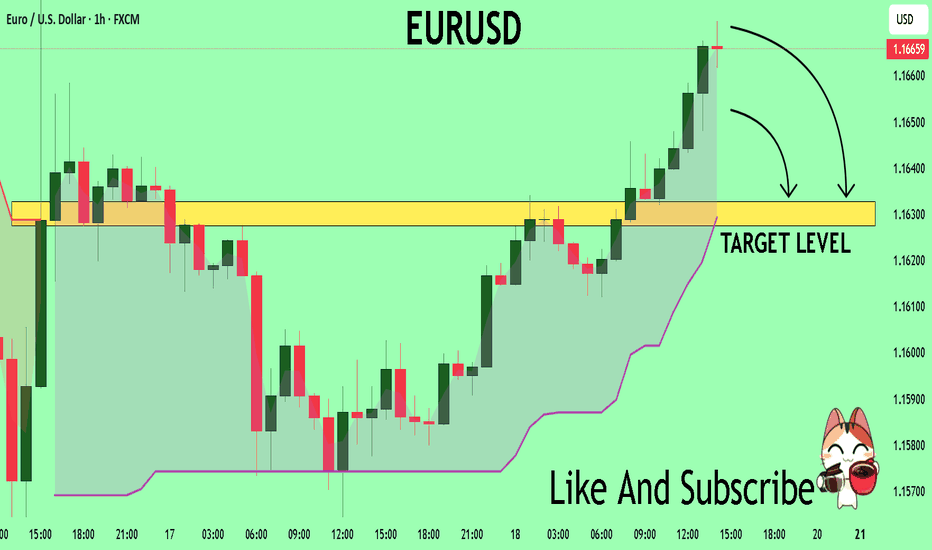

EURUSD Holding Support — Bullish Move in ProgressHello everybody!

There is a strong higher timeframe resistance now acting as support.

Price is respecting this area and starting to form a strong move to the upside.

We are looking to enter a buy position here, as the overall bullish trend is likely to continue.

EURUSD: Bears Are Winning! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.16557 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.16419..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

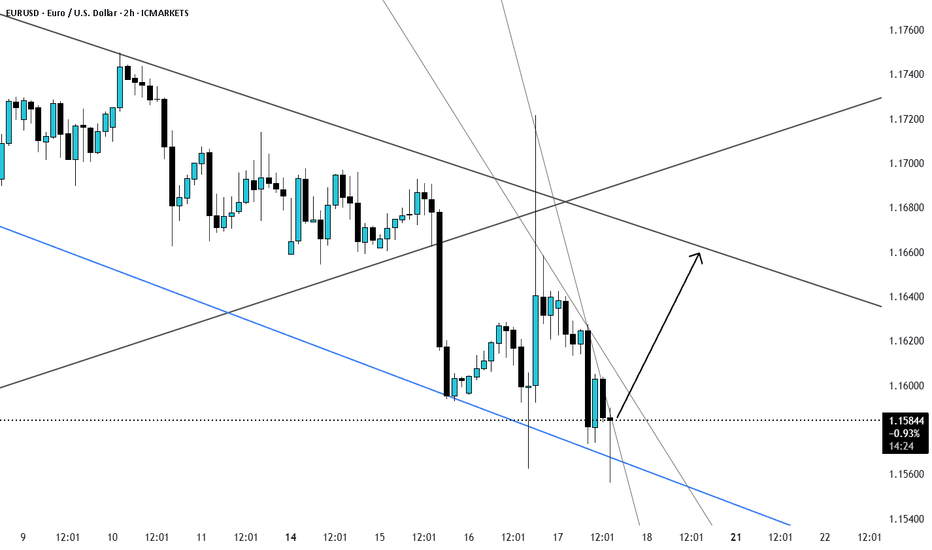

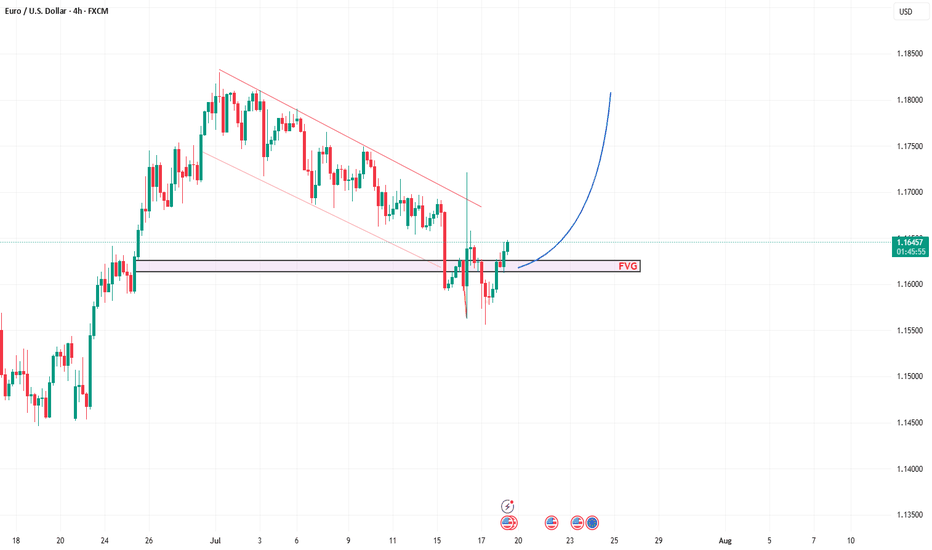

EURUSD Breakout Trade EUR/USD – Breakout Confirmation

🔹 Multi-Timeframe Bullish Setup by PULSETRADESFX

EUR/USD is showing a strong bullish shift after breaking out of a well-defined descending channel. Price reacted perfectly from the demand zone and is now pushing above descending trendline resistance across the 2H chart.

This signals early signs of trend reversal, backed by confluence across intraday and higher timeframes.

The structure is clean, the R:R is healthy, and momentum favors bulls after multiple rejections at key support.

---

✅ Confluences Supporting the Long:

Descending channel breakout (2H )

Triple demand zone rejection

Break and close above minor resistance

Clean bullish momentum candle

Economic catalysts ahead (watch USD data releases 📅)

📅 July 18, 2025

📊 FOREX.com | EUR/USD (2H)

#EURUSD #Forex #BreakoutTrade #BullishSetup #TechnicalAnalysis #TradingView #PULSETRADESFX

EURUSD Buy Trade Idea: Reversal Rocket Ready to Launch!Hey Fellow Traders! 👋

The EURUSD (EU) is setting up for a massive reversal that’s got me hyped! 🚀 After nailing the lows of that descending channel like a pro, price has retraced to our expected zone and is now bouncing hard. It’s time to gear up for a potential buy trade targeting the Buyside Liquidity! Let’s break down this fire setup and get ready to ride the wave! 🌊

📈 The Setup: Reversal in the Making!

EU hit the descending channel lows as predicted, and now it’s showing some serious bullish vibes with a strong bounce off a key weekly trendline support. This isn’t just a random move—price is reacting to a weekly demand zone and a trendline that’s holding like a fortress. 🏰 I’m expecting a reversal to kick in, aiming for that juicy Buyside Liquidity up top. But hold up—don’t just dive in blindly! Let’s talk strategy. 😎

🎯 Trade Details: How to Play It Smart

Entry Zone: Look for a calculated entry in this bounce area. Key setups to watch for:

FVG (Fair Value Gap) or IFVG (Imbalance Fair Value Gap) for precision entries.

Order Blocks (OB) for high-probability setups.

Trendlines/Support Zones: Use these for confluence, as EU is respecting that weekly trendline support.

Target: We’re gunning for the Buyside Liquidity—a high-probability target where price loves to gravitate.

Stop Loss: Place your stops below the recent lows or your chosen setup (FVG/OB) to keep risk tight.

👀 Keep an Eye on DXY for Confluence

The Dollar Index (DXY) is a key player here. A weakening DXY could supercharge this EU reversal, so monitor it closely for extra confirmation. If DXY starts to roll over, it’s like pouring rocket fuel on this trade! 🚀

🧠 Why This Reversal Makes Sense

Weekly Trendline Support: Price kissed this level and is bouncing like it means business.

Weekly Demand Zone: This area has historical strength, making it a prime reversal spot.

Channel Lows Conquered: EU smashed through the descending channel lows and is now retracing for the next leg up.

⚠️ Risk Management Reminder

Don’t YOLO this one! Use proper risk management—calculate your position size, set tight stops, and only enter when your setup aligns. Whether you’re using FVGs, OBs, trendlines, or classic support/resistance, make sure your entry is calculated to avoid getting caught in a fakeout. 💪

💬 Let’s Talk Trades!

What’s your take on this EU reversal? Are you jumping in with an FVG, OB, or something else? Drop your thoughts, setups, or questions in the comments below! 👇 If this idea gets you pumped, smash that LIKE button ❤️, follow for more banger trade ideas, and share your charts with the community! Let’s keep the vibes high and the profits higher! 💰

#EURUSD #ForexTrading #BuyTrade #Reversal #TradingView

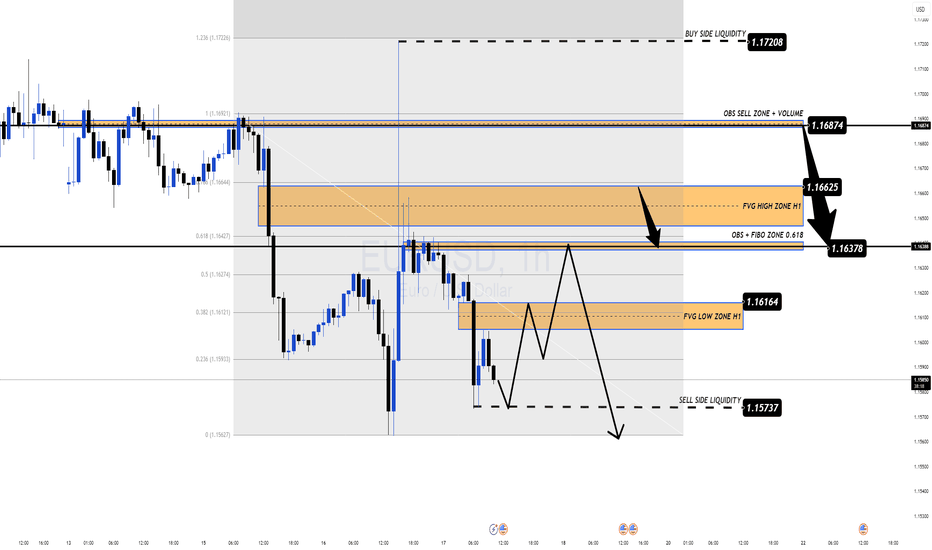

EUR/USD Forecast – Bears in Control Ahead of US Jobless DataEUR/USD Forecast – Bears in Control Ahead of US Jobless Data

🌐 Macro View: Dollar Regains Strength Amid Uncertainty

EUR/USD remains under selling pressure as the greenback finds renewed strength following midweek weakness. The market is bracing for fresh U.S. jobless claims data, expected to show a slight rise to 235K. A print below 220K could reignite USD demand, while a surprise above 240K may offer a temporary lifeline for the euro.

Amid geopolitical and economic turbulence, the euro continues to underperform as investors shift to the dollar for safety and yield advantage.

📉 Technical Outlook – MMF & Smart Money Perspective

The recent breakdown below 1.1600 confirms the bearish momentum. Based on the MMF (Market Momentum Flow) methodology, price action is currently moving within a controlled distribution structure, suggesting further downside potential.

Key zones identified from H1 structure:

OBS + FVG High Zone (1.1662 – 1.1687): Strong supply zone + volume imbalance.

1.1637: Mid-key level and possible liquidity magnet.

1.1616 – 1.1573: Ideal area for sweeping sell-side liquidity before any sustainable bounce.

If price reclaims 1.1662, intraday bullish correction may be in play. However, as long as 1.1687 holds, bears remain in control.

🧭 Trade Plan for Today

🔴 SELL ZONE: 1.1662 – 1.1687 (FVG + OBS Volume Zone)

SL: 1.1710

TP: 1.1637 → 1.1616 → 1.1590 → 1.1573

✅ Preferred entry zone aligned with high-volume imbalance & MMF rejection pattern.

🟢 BUY ZONE (Scalp Only): 1.1575 – 1.1580 (Sell-side Liquidity Zone)

SL: 1.1550

TP: 1.1612 → 1.1630 → 1.1645

⚠️ Use with caution — only upon clear price reaction at lower liquidity sweep area.

🔍 Strategy Insight

This is a classic scenario of a controlled pullback within a larger bearish structure. Patience is key — let price tap into imbalanced zones before executing. Given today's U.S. data, volatility may spike during the New York session, so risk management is crucial.

💬 What’s Your Take?

Do you expect EUR/USD to retest the 1.1550s zone, or could a surprise from U.S. job data flip the narrative?

👇 Drop your analysis below & follow for more MMF-based setups.