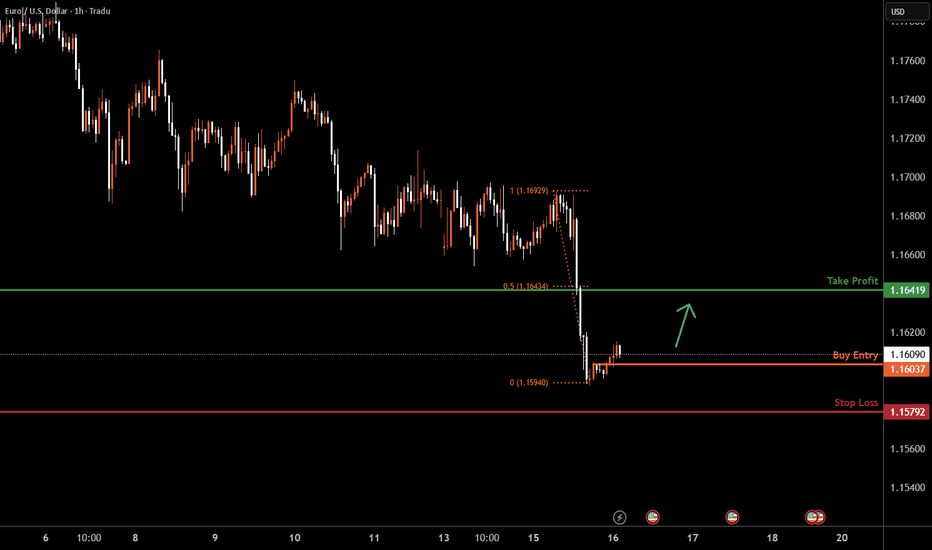

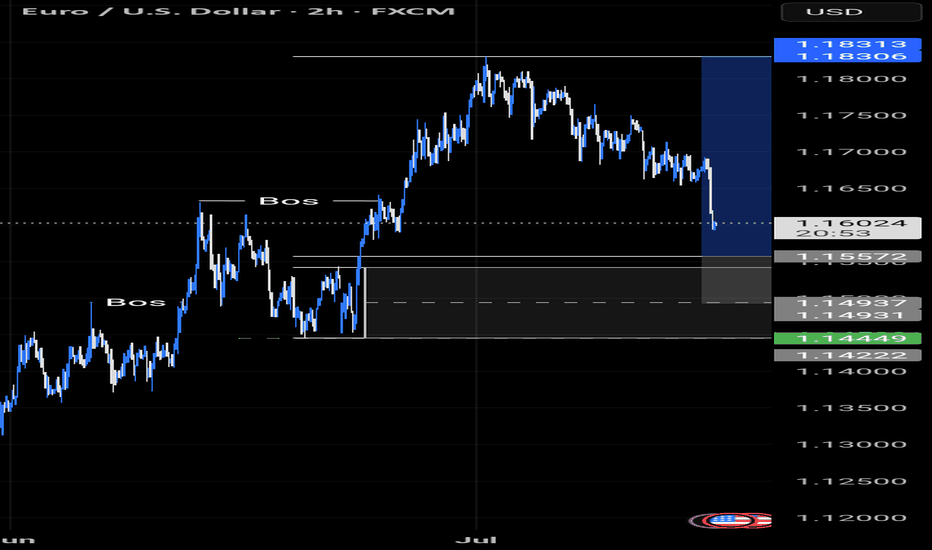

EURUSD H1 I Bullish Rise Based on the H1 chart analysis, the price is approaching our buy entry level at 1.1603, a pullback support.

Our take profit is set at 1.1641, a pullback resistance that aligns with the 50% Fib retracement.

The stop loss is placed at 1.1579, an overlap support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDEUX trade ideas

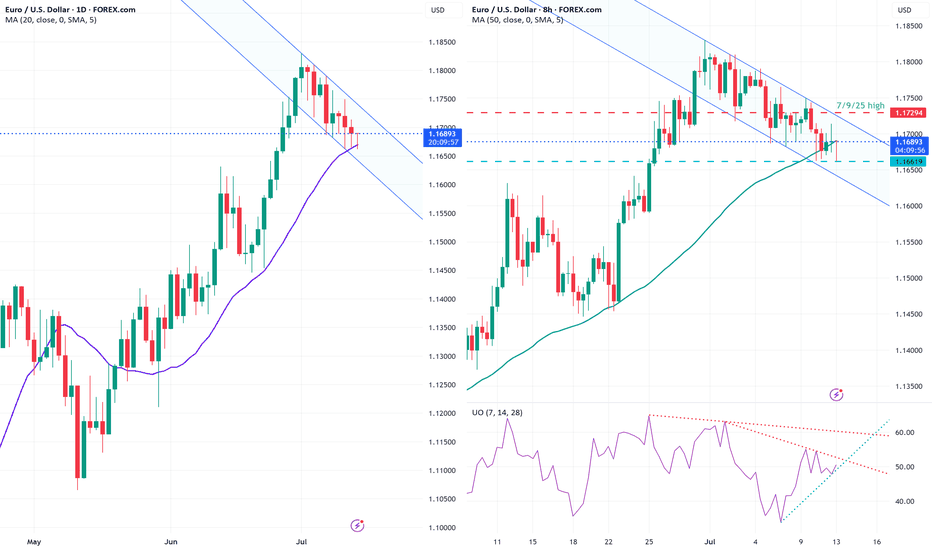

EURUSD – Bullish Momentum ReturnsEURUSD is gradually breaking free from downward pressure as it breaches the short-term accumulation structure, aiming for the resistance zone around 1.1720. On the chart, a clear bullish trend is emerging, supported by FVG signals reinforcing the recovery.

On the news front, expectations are rising that the European Central Bank will maintain a tighter policy stance for longer, as core inflation in the Eurozone remains elevated. Meanwhile, the USD is under corrective pressure following last week’s lower-than-expected U.S. CPI data. Upcoming statements from ECB and Fed officials today will be key in determining the next move for this currency pair.

Unless a surprise arises from the U.S. side, EURUSD is likely to sustain its short-term upward momentum and test the next technical resistance area.

EUR/USD long: Save the dateHello traders

I have entered into a long position at 1.1665.

The charts show a base being built right around that level.

DXY is ticking down but US 10Y yield is steady.

Bitcoin at an all time high is in my opinion not a sign of risk on but rather USD liquidation in favor of BTC.

Gold has just broken above the last daily high.

There are rumors making the rounds that FOMC Powell is considering resigning which will be negative for the USD. Keep in mind, Jerome Powell is the spokesperson for the FOMC, not the only voting member.

7/30/2025

FOMC rate decision

7/31/2025

The Federal Appeals Court starts hearing arguments for the use of IEEPA to impose sweeping tariffs that was declared unlawful by the Court of International Trade located in Manhattan, NY.

August 2025

More threatened tariffs may start.

Things are heating up.

Best of luck.

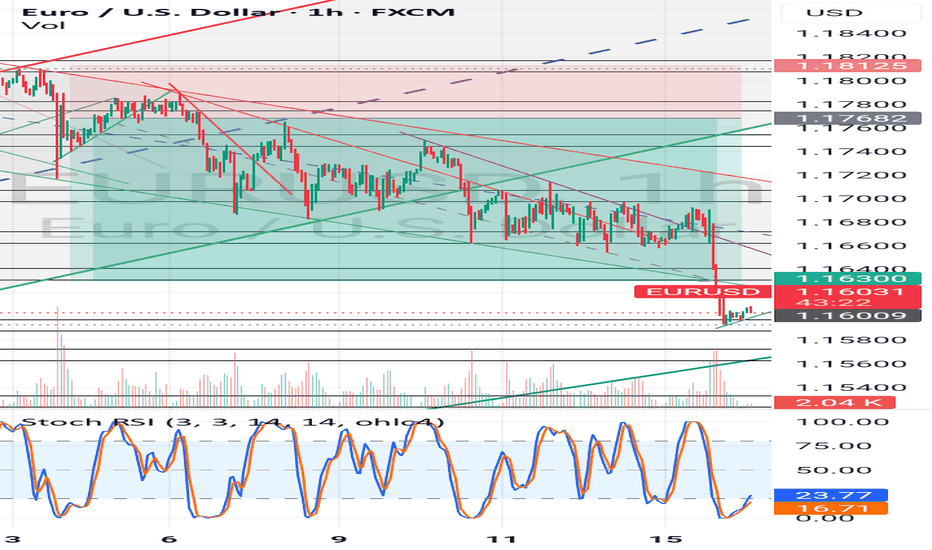

EURUSD – From Structure to Shift

1H Technical Outlook by MJTrading

EURUSD moved cleanly through a sequence of structural phases:

• Previous Base

• Multi-day Consolidation (potential quiet accumulation)

• Transition into a well-respected Descending Channel

Price has since shown repeated rejections from the upper boundary, including a decisive selloff from the 1.1750 zone, forming what we now label a "Pressure Gap" — a space where aggressive sellers overwhelmed price.

🧭 Key Scenarios Ahead:

🔻 Bearish Continuation:

Breakdown below 1.1700 opens room toward:

• 1.1640 (channel bottom)

• 1.1600 Liquidity Zone

Watch for impulsive sell candles + EMA rejection

🔁 Short-Term Bounce or Trap:

Holding above 1.1700 could spark a rebound toward 1.1750

This may serve as a final test before another leg lower

Only a clean break and hold above 1.1763 flips structure bullish

🔍 Bonus Confluence:

1D Chart shows broader bullish context (inset)

EMAs tightening = expect volatility burst

Well-defined structure gives clear invalidation and targets

Every trend tells a story — from base building to breakout, and now a possible breakdown. Trade the structure, not the prediction.

#EURUSD #Forex #TradingView #TechnicalAnalysis #PriceAction #DescendingChannel #LiquidityZone #SmartMoney #MJTrading

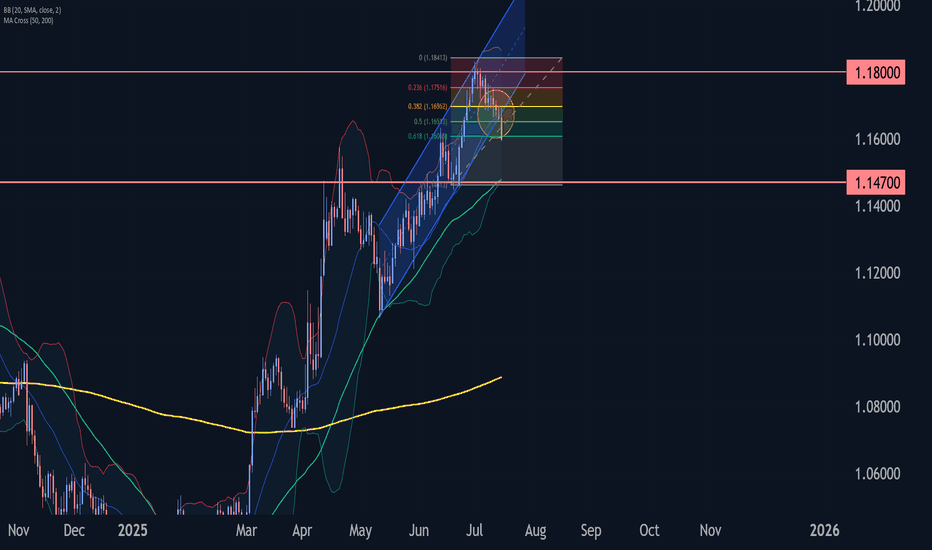

EURUSD Wave Analysis – 15 July 2025- EURUSD broke daily up channel

- Likely to fall to support level 1.1470

EURUSD currency pair recently broke the support area located at the intersection of the support trendline of the daily up channel from May and the 38.2% Fibonacci correction of the upward impulse from June.

The breakout of this support area accelerated the active short-term ABC correction 4.

Given the strongly bullish US dollar sentiment coupled with significant euro pessimism seen today, EURUSD currency pair can be expected to fall further to the next support level 1.1470 (low of former wave iv).

EURUSD is Bearish After Breaking Regression ChannelHello Traders

In This Chart EURUSD HOURLY Forex Forecast By FOREX PLANET

today EURUSD analysis 👆

🟢This Chart includes_ (EURUSD market update)

🟢What is The Next Opportunity on EURUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

EUR/USD Technical Outlook: Bearish Momentum Builds Below Key ResEUR/USD has broken down from its recent highs near the 1.1750 resistance area, which coincides with the 78.6% Fibonacci retracement level. The pair is now trading around the 1.1600 handle, slipping below a short-term support zone near 1.1576. This breakdown signals potential continuation of bearish pressure in the coming sessions.

The 50-day SMA (1.1477) remains upward sloping, but the price action has now decisively turned lower, with a series of lower highs forming after the July peak. The MACD histogram is fading, indicating waning bullish momentum, and the RSI has dropped to 47.7—losing the bullish bias and heading toward bearish territory.

If EUR/USD cannot reclaim the 1.1576–1.1600 zone quickly, a deeper pullback toward the 50-day SMA or even the 1.1450–1.1500 range may unfold. On the upside, bulls would need to push back above the 1.1750 resistance to regain control, but given the loss of momentum and structure, the near-term bias favors the bears.

-MW

EUR/USD Fibonacci Resistance - Rising Wedge BreakEUR/USD came into Q3 with a full head of steam, setting a fresh three-year high on the first day of the new quarter. But bulls couldn't make much progress after that and a key Fibonacci retracement continued to hold buyers at bay, until eventually sellers were able to take-over and make a more noticeable dent after this morning's CPI data.

The breakout in USD helped to prod a breakdown in EUR/USD, and bears now have an open door to run a short-term trend. There's now resistance potential at prior support of 1.1631 and 1.1663, and there's deeper support potential at 1.1543 and 1.1457. - js

EURUSD📉 EURUSD – 30min Short Plan

📊 Structure: LLs & LHs forming – bearish trend confirmed

🕯️ Pattern: Bearish Engulfing at Lower High

🎯 Entry: instant

📌 Trade 1

– 🎯 TP1: 1:1

– ⚠️ Risk: 1%

📌 Trade 2

– 🎯 TP2: larger reward

🛠️ Execution:

– Place both trades at same entry

– Trail SL after TP1 hit

📎 Bias: Bearish

EURUSD: Bigger Bearish Move is PossibleEURUSD: Bigger Bearish Move is Possible

EURUSD is positioned to fall further from the bearish pattern it is showing. The market is hesitant to fall further after we get the CPI data today. The US is expected to report a growth of 2.7% vs. 2.4% last month.

The impact of the data is unclear in my opinion because the market is not paying much attention to the data, but it should definitely increase the market volume which is decreasing in these summer days.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURUSD: Consolidation Phase Nearing the Main Trend!!Hey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.16100 zone, EURUSD is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 1.16100 support and resistance area.

Trade safe, Joe.

EURUSD OUTLOOK 15 - 18 JULYCore CPI m/m came in light which gave a mixed signal at first but CPI y/y was higher than expected which eventually moved EU lower.

The last two analysis that I posted were more longer term focused so this time I will be giving a more short term outlook.

Currently the dollar is stronger based on the recent news that has been coming out and because of that I am still looking to short this pair keeping in mind that it is only the internal structure that is bearish and the swing structure is still bullish

EURUSD AccumulationI am looking for some accumulation here. The model can already be complete, but i would only take it if it extends into a model 2 from extreme liquidity to create more liquidity for a reversal. The supply above, followed by the strong sell off lowers the quality of this model. A supply mitigation with a slow pullback into the POI would change that.

EURUSD BEARISH SETUP: 15 JULY 2025This is a 4-hour chart of the EUR/USD currency pair, and it includes several key technical elements:

---

🔍 Overall Market Context

The price is in a downtrend, clearly shown by the descending channel (highlighted with yellow lines).

The price just broke below the lower boundary of that channel, indicating potential bearish continuation.

The chart includes support/resistance levels, pivot points, and a projected path suggesting possible price behavior.

---

🔧 Key Technical Elements

1. Price Action & Structure

Recent price action shows a strong bearish move (large red candle), suggesting strong selling pressure.

The move bounced off S2, a weekly pivot support level, and entered a demand zone (green area).

2. Projected Scenario (Black Line Path)

A potential pullback to 1.16586 (key resistance).

If price fails to break above that resistance, it's expected to drop again.

Possible next supports:

1.15842

1.15228

Final target: 1.14550

3. Pivot Levels

Weekly Pivot: Near 1.17100 area (currently above the price — bearish implication).

S2 level: Around 1.15900 — presently acting as short-term support.

R1, R2, etc., are above and could act as resistance in a retracement.

---

📊 Summary of Trade Outlook

🔻 Bearish Bias (Short-Term to Medium-Term)

Main idea: This chart reflects a bearish breakout of a descending channel.

Entry Zones: After a potential pullback to resistance (1.16586)

Targets: 1.15842 → 1.15228 → 1.14550

Invalidation: A Bullish break above 1.16586 could invalidate the bearish setup.

---

✅ Trading Considerations

Wait for confirmation of rejection at 1.16129 or 1.16586 before shorting.

Watch for volume confirmation on the pullback.

Monitor fundamentals (e.g. ECB or Fed news) as they can drive sudden volatility.

EUR_USD BEARISH BREAKOUT|SHORT|

✅EUR_USD was trading along

The rising support line but

Now we are seeing a strong bearish

Breakout and the breakout is

Confirmed so we are bearish

Biased and we will be expecting

A further bearish move down

After the potential pullback

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.