Eurousd techinical analysis.This chart shows the EUR/USD currency pair on a 1-hour timeframe. Here's a breakdown of the key technical elements:

Key Features:

1. Purple Zones (Rectangles):

Top Rectangle (~1.1695 - 1.1700): Resistance zone.

Bottom Rectangle (~1.1660): Support zone.

2. Pink Descending Trendline:

Represents a downtrend or dynamic resistance.

Price recently approached or tested this trendline from below.

3. Yellow Zigzag and Arrow:

Illustrates potential price movement—an anticipated rejection from the trendline and a move down toward support.

4. Current Price:

1.16858, sitting just below the trendline and within the resistance zone.

---

Interpretation:

Bearish Bias: The chart suggests a potential short opportunity if the price fails to break

USDEUX trade ideas

Important News for EURUSDYesterday, EURUSD continued moving sideways as the market waits for upcoming news.

Today at 1:30 PM London time, U.S. inflation data will be released.

This report has a strong impact and is likely to set the next direction for the pair.

It’s advisable to reduce your risk and avoid opening new positions before the news comes out.

The goal is to follow the trend once it resumes!

EURUSD – Bearish Pressure Mounts Ahead of Triangle Breakout EURUSD is trading within a contracting triangle and currently leans toward a bearish bias. After several failed attempts to break the upper boundary, momentum is weakening, and the pair is showing signs of a potential breakdown toward lower support levels.

With several key events ahead, the euro may face additional pressure if upcoming Eurozone inflation data disappoints or if the Fed maintains a hawkish tone through upcoming speeches by U.S. officials. Unless there is a strong bullish catalyst, EURUSD is likely to correct further to the downside.

EURUSD H1 I Bearish Reversal Based on the H1 chart analysis, we can see that the price is rising toward our sell entry at 1.1681, which is a pullback resistance.

Our take profit will be at .1642, an overlap support level.

The stop loss will be placed at 1.1714, a swing-high resistance level.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EURUSD(20250715) Today's AnalysisMarket news:

Sources said that after Trump's latest trade tax threat, the European Central Bank will discuss a more negative scenario next week than expected in June. The ECB is still expected to keep interest rates unchanged at its meeting on July 24. Discussions on rate cuts are still postponed to September.

Technical analysis:

Today's buying and selling boundaries:

1.1671

Support and resistance levels:

1.1714

1.1698

1.1687

1.1654

1.1644

1.1628

Trading strategy:

If it breaks through 1.1671, consider buying in, the first target price is 1.1687

If it breaks through 1.1654, consider selling in, the first target price is 1.1644

Market Watch UPDATES! FOREX Major PairsWelcome to the Market Watch Updates for Monday, July 14th.

In this video, we will give the forecast updates for the following markets:

USD Index, EURUSD, GBPUSD, AUDUSD, NZDUSD, USDCAD, USDCHF and USDJPY.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

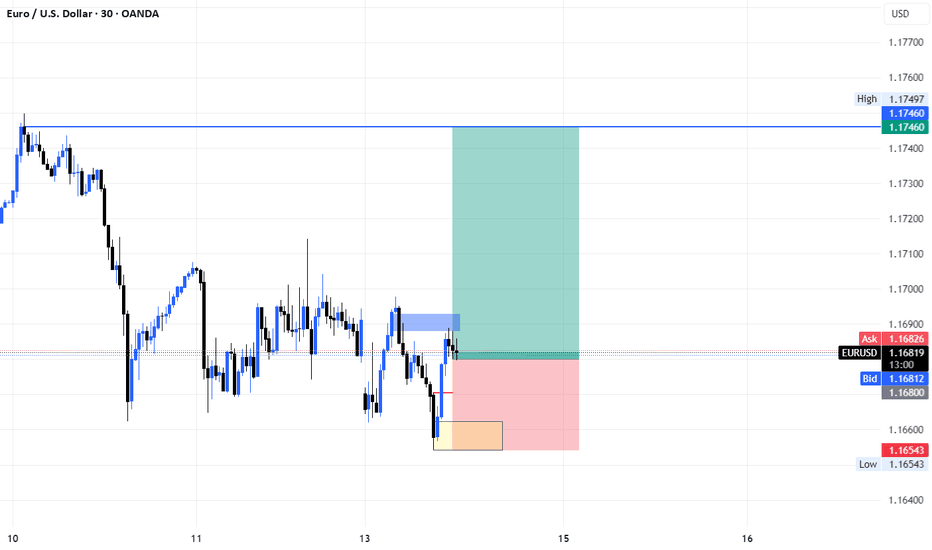

LONG | EUR/USD | 1DCurrent Level: ~1.1662

Revised Entry Zone: 🔄 Buy the dip around 1.1660–1.1670

This aligns with 50-day EMA and daily/4H pivot (~1.1630–1.1670) acting as support.

Stop Loss: 1.1630 (just below 50 EMA & recent low)

Target: 1.1750 → 1.1800 (range high/resistance)

Risk:Reward: ~1:3.8

✅ Institutional Rationale:

Momentum remains bullish, though momentum indicators are cooling—price retesting structural support (mid-BB, pivot zone).

Weekly outlook still favors bulls while above 1.1637–1.1670—suggesting accumulated buy orders in this zone.

Event risk: U.S. employment and Fed speakers imminent—creates ideal buy-on-dip opportunities with tight stops.

Bullish bounce for the Fiber?The price is falling towards the pivot, which acts as a pullback support and could bounce to the 1st resistance, a swing high resistance.

Pivot: 1.1612

1st Support: 1.1538

1st Resistance: 1.1803

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Eurousd techinical analysis.This chart displays the EUR/USD (Euro/US Dollar) currency pair on a 1-hour timeframe, with a technical analysis setup that includes:

1. Downward Trendline (Pink): This suggests a prevailing bearish trend, with price respecting lower highs.

2. Support and Resistance Zones (Purple Boxes):

Several horizontal purple rectangles highlight areas of previous support and resistance.

These zones represent price levels where buying or selling pressure has historically emerged.

3. Price Action & Pattern (Yellow Line):

A clear "M" shape or double-top pattern formed, indicating potential bearish reversal.

The pattern breaks down below a key support zone, suggesting a continuation to the downside.

4. Projection Arrow (Yellow Arrow):

The yellow arrow

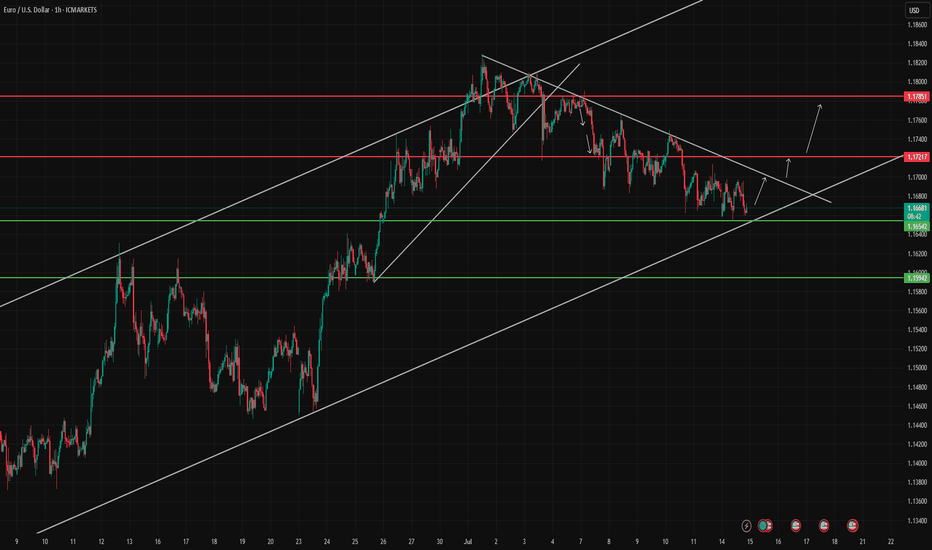

Internal Summary EURUSD Pair: EURUSD

Bias: Bullish

Timeframe: 1H

Trigger: Support test within triangle pattern

Targets:

TP1: 1.17217

TP2: 1.17851

Invalidation: Below 1.15942

Comment: Price is compressing inside a symmetrical triangle, holding above a key ascending trendline. A breakout to the upside looks probable as long as price holds current support.

EURUSD(20250714) Today's AnalysisMarket news:

① Fed's Goolsbee: The latest tariff threat may delay rate cuts. ② The Fed responded to the White House's "accusations": The increase in building renovation costs partly reflects unforeseen construction conditions. ③ "Fed's megaphone": The dispute over building renovations has challenged the Fed's independence again, and it is expected that no rate cuts will be made this month. ④ Hassett: Whether Trump fires Powell or not, the Fed's answer to the headquarters renovation is the key.

Technical analysis:

Today's buying and selling boundaries:

1.1689

Support and resistance levels:

1.1738

1.1719

1.1707

1.1670

1.1658

1.1640

Trading strategy:

If the price breaks through 1.1689, consider buying in, with the first target price of 1.1707

If the price breaks through 1.1670, consider selling in, with the first target price of 1.1658

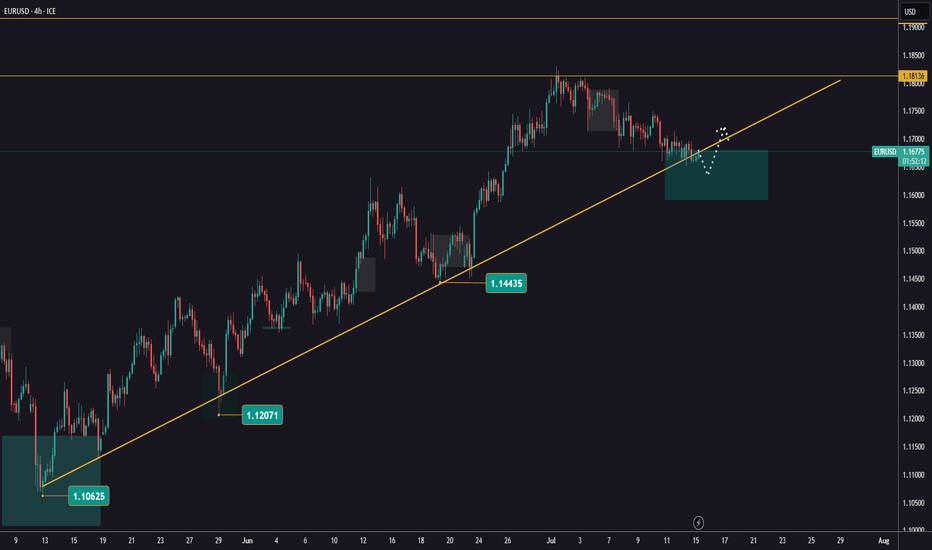

EURUSD The 4H MA200 distinguishes bullish from bearish.The EURUSD pair has been trading within a (blue) 2-month Channel Up since the May 12 Low and it just broke below its 4H MA100 (green trend-line). The previous two Bearish Legs of this pattern bottomed (made a Higher Low) on or just above the 0.5 Fibonacci retracement level.

As a result, the price is very close to the most optimal buy level of this pattern and as long as it holds, we expect to start the new Bullish Leg and target the 1.5 Fibonacci extension (1.20000 our Target just below), which is in line with the previous two Bullish Legs.

If however the 4H MA200 (orange trend-line) breaks, we will take the loss on that long and go short as technically the price should seek the bottom of the (dotted) wider Channel Up. Our Target on that occasion will be 1.14000, right at the top of the High Volatility Zone.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

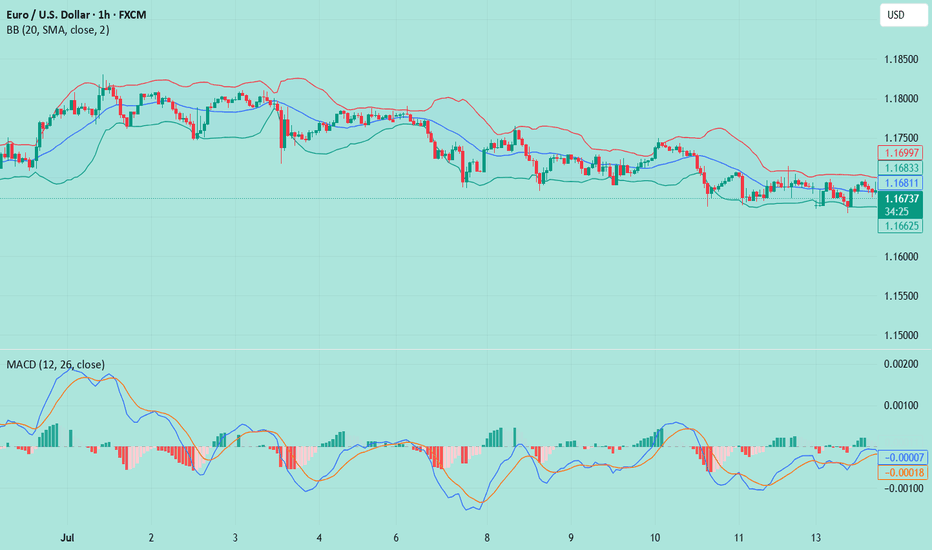

The euro's bearish structure remains unchanged.EUR/USD rebounded from around the three-week low of 1.1655 during the European session. However, the overall trend of the exchange rate remains within the descending channel that has been in place since early July. Market concerns over the U.S. government's new 30% tariff measures have dampened risk appetite, limiting the room for the exchange rate to rebound.

In the short term, the exchange rate is expected to contend within the 1.1650-1.1700 range. Analysts believe that if the euro fails to break through and stabilize above the 1.1700 threshold, the bearish structure will remain intact, and the exchange rate will continue to test lower support levels such as 1.1630 and 1.1600. A breakdown below these levels could open up further downside space, with the target pointing to around the lower Bollinger Band at 1.1387.

you are currently struggling with losses,or are unsure which of the numerous trading strategies to follow,You have the option to join our VIP program. I will assist you and provide you with accurate trading signals, enabling you to navigate the financial markets with greater confidence and potentially achieve optimal trading results.

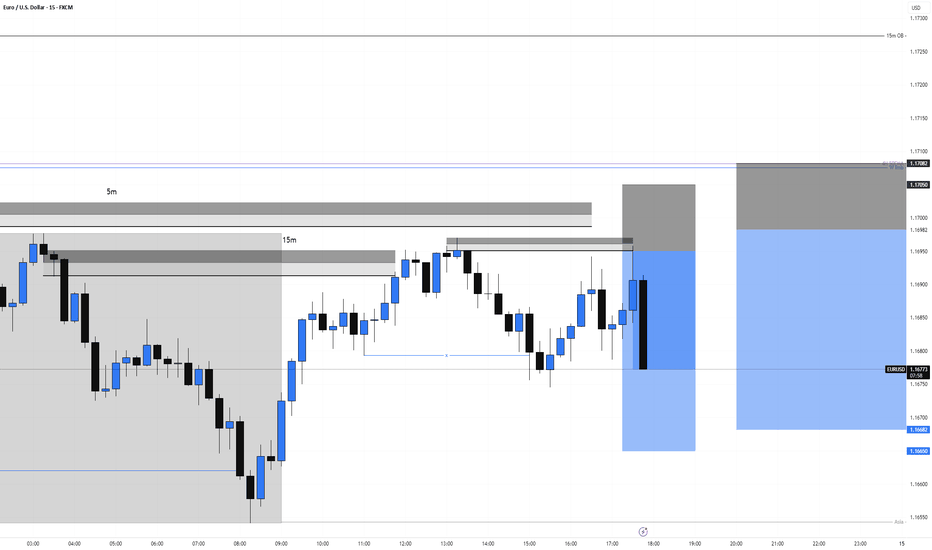

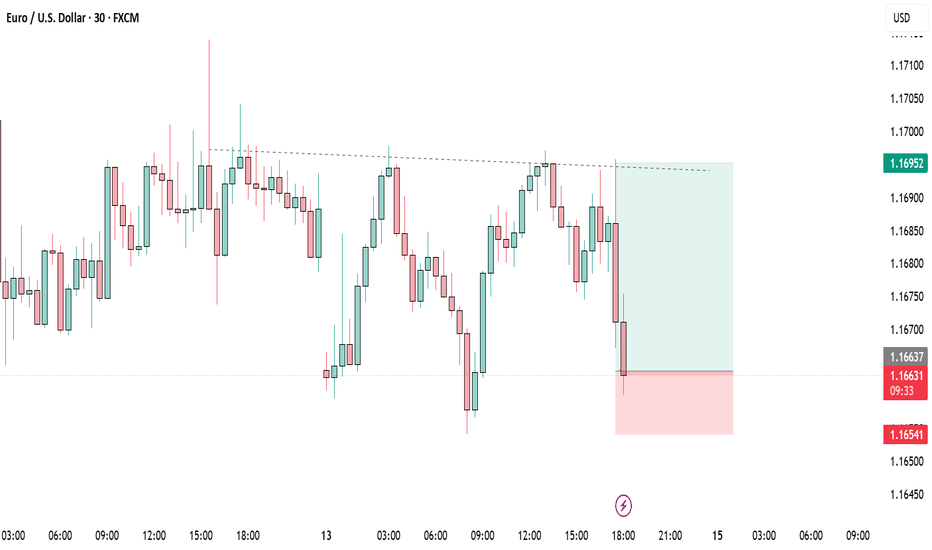

EURUSD Short re entry, 14 JulyHTF Downtrend with Clean LTF Setup

Bias remains bearish with HTF downtrend, W imbalance resting above, and 4H 50EMA close to our zone.

📉 Confluence:

Textbook LTF structure, expecting LH → LL

DXY reacting from 15m POI + Asia low to fill

15m Extreme OB + 5m OB as entry zone

Clean 1m BOS confirming sellers stepping in → add another 50%

🎯 Entry: 50% tap of 5m OB after 1m BOS

🛡️ SL: Above LH structure

📌 TP: At least 1:3 RR down to Asia low

⚠️ Minor risk with W imbalance above, but strong trend and confirmations to support the trade.

3 hours ago

Trade active

We got an 1mBOS from the 15m POI

Got 2 entry points now : The one from the 5m OB marked out on the photo and one at the lower 5m that created the break. Will see what happens

EURUSD Sellers In Panic! BUY!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.1684

Bias - Bullish

Safe Stop Loss - 1.1633

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1776

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

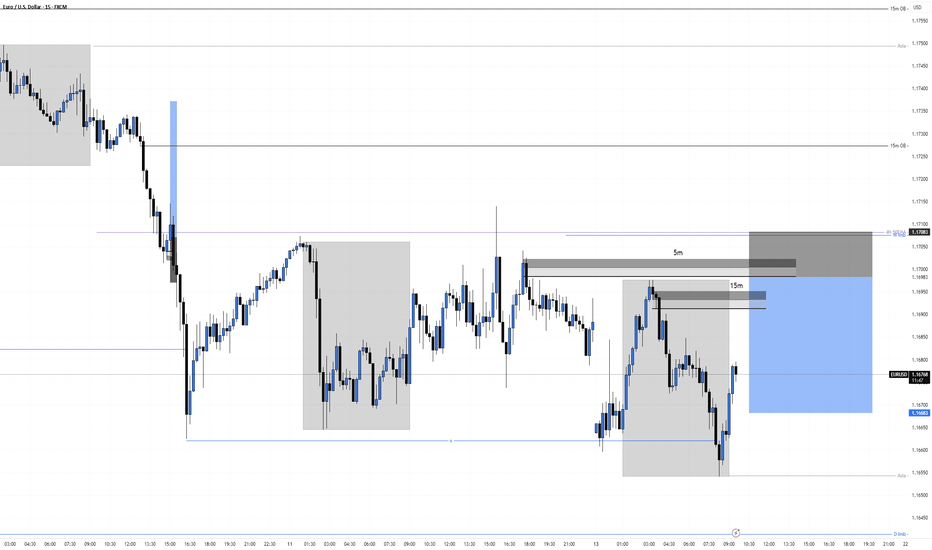

EURUSD Short, 14 JulyHTF Downtrend with Clean LTF Setup

Bias remains bearish with HTF downtrend, W imbalance resting above, and 4H 50EMA close to our zone.

📉 Confluence:

Textbook LTF structure, expecting LH → LL

DXY reacting from 15m POI + Asia low to fill

15m Extreme OB + 5m OB as entry zone

Clean 1m BOS confirming sellers stepping in → add another 50%

🎯 Entry: 50% tap of 5m OB after 1m BOS

🛡️ SL: Above LH structure

📌 TP: At least 1:3 RR down to Asia low

⚠️ Minor risk with W imbalance above, but strong trend and confirmations to support the trade.

EURUSD: Will Go Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The recent price action suggests a shift in mid-term momentum. A break below the current local range around 1.16802 will confirm the new direction downwards with the target being the next key level of 1.16684.and a reconvened placement of a stop-loss beyond the range.

❤️Sending you lots of Love and Hugs❤️