EURUSD: Will Go Down! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The market is at an inflection zone and price has now reached an area around 1.15996 where previous reversals or breakouts have occurred.And a price reaction that we are seeing on multiple timeframes here could signal the next move down so we can enter on confirmation, and target the next key level of 1.15562..Stop-loss is recommended beyond the inflection zone.

❤️Sending you lots of Love and Hugs❤️

USDEUX trade ideas

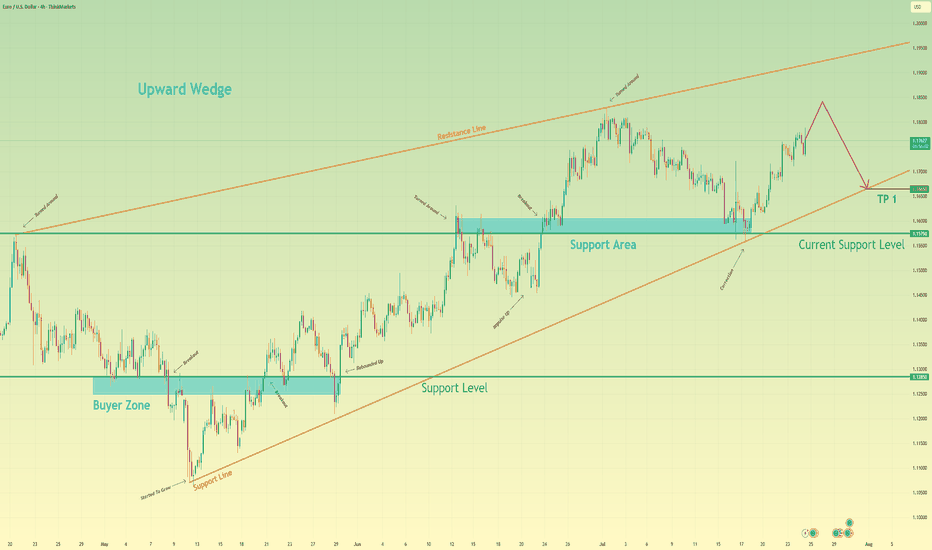

Euro will rise a little and then start to fall to support lineHello traders, I want share with you my opinion about Euro. After a prolonged consolidation period, a strong upward trend was initiated from the buyer zone around 1.1285, propelling the EUR significantly higher. This initial impulsive move has since transitioned into a more complex and mature phase, taking the shape of a large upward wedge formation, a pattern which often signals underlying exhaustion in the prevailing trend. Currently, the pair is operating within this defined market zone, characterized by a clear ascending support line and a corresponding resistance line. The price action inside the wedge has become corrective, with the most recent upward correction originating from the support area near 1.1575. The working hypothesis is centered on a short-term bearish scenario, which anticipates that this current rally will fail as it approaches the upper boundary of the wedge. A rejection from this resistance would confirm that selling pressure is increasing and that the bullish momentum is waning. This would likely trigger a significant downward rotation within the structure, with the immediate objective being a retest of the main ascending support line. For this reason, the TP is strategically and logically placed at the 1.1665 level, as this point lies directly on the trend line and serves as the most critical test for the existing uptrend's viability. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

EURUSD: Move Down Expected! Short!

My dear friends,

Today we will analyse EURUSD together☺️

The price is near a wide key level

and the pair is approaching a significant decision level of 1.15337 Therefore, a strong bullish reaction here could determine the next move up.We will watch for a confirmation candle, and then target the next key level of 1.15208.Recommend Stop-loss is beyond the current level.

❤️Sending you lots of Love and Hugs❤️

EURUSD(20250730) Today's AnalysisMarket News:

According to a Reuters/Ipsos poll, Trump's approval rating has fallen to 40%, the lowest level since his second term.

Technical Analysis:

Today's Buy/Sell Levels:

1.1554

Support and Resistance Levels:

1.1634

1.1604

1.1584

1.1523

1.1504

1.1474

Trading Strategy:

If the price breaks above 1.1584, consider entering a buy position, with the first target price at 1.1604. If the price breaks below 1.1554, consider entering a sell position, with the first target price at 1.1523.

EUR/USD SHOWING SIGNS OF WEAKNESS AND NEW TOP FORMATION!Hey traders so looking at the EUR/USD today and wow what a difference a day makes!

Just the other day I was Bullish this pair and was reccommending buying on pullback. All of sudden in the blink of an eye market completely flips over on a dime due to tariffs. Thats life in the big city of trading. 😁

If you are new to trading remember this you can't ever lose by taking profits. No matter how large or how small which is why in the last post I reccommended moving that stop up to 3 days behind the market because as you can see the market is unpredictable.

Ok so where does that leave us now well as a technical analyst I look for trading the trend or changes in the trend and now that I see what is a completed 123 top formation on the Euro. That is a significant sign that the market has almost changed from uptrend to downtrend imo. Look at the resistance 1.1833 then look at the failed rally that only made it to 1.1783 that is a sign that a top has now formed.

Therefore if the US Dollar is bottoming I would not reccommend EUR/USD longs anymore. So I am watching for a break below support at 1.1500. If market can close below that level on a daily close. Then I would look to sell the a rally back to resistance.

However if bullish would not consider buying unless market breaks above resistance at 1.1833 that way you know for sure the trend has resumed!

Good Luck & Always use Risk Management!

(Just in we are wrong in our analysis most experts recommend never to risk more than 2% of your account equity on any given trade.)

Hope This Helps Your Trading 😃

Clifford

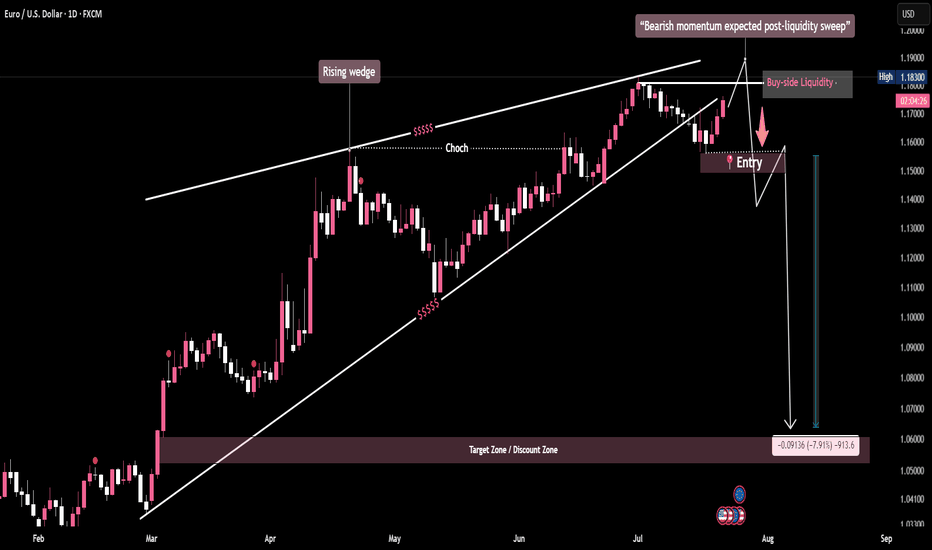

EUR/USD - Final Push Before Collapse?This EUR/USD daily chart highlights a bearish setup within a weakening rising wedge.

A Change of Character (CHoCH) confirms a potential shift in structure as price pushes toward buy-side liquidity above previous highs—where retail stops are likely resting.

Once this liquidity is swept, smart money is expected to reverse price sharply, breaking wedge support. The projected move targets the 1.03 zone, representing a 7% drop, aligning with internal liquidity and a return to the discount zone.

This setup illustrates classic SMC behavior: liquidity grabs, structural shifts, and institutional unloading before a major move.

EUR/USD – Final Push Before Collapse?

MARKET CONTEXT...#1 TOOL FOR PROFITABLE TRADING...EURUSD EXAMPLEHey hey TradingView family! Hope you are all doing amazing! I just wanted to come on and make a video speaking on market context, the #1 tool/idea that helped me go from struggling to profitable trader.

Understanding the bigger picture in trading, like TRULY understanding the higher timeframe perspective will work wonders in your analysis & trading whether you are a scalper or a position trader. It gives you the context for what market and the stage of market you are in whether in short term or longer term positions, which will IMMEDIATELY give you an edge.

Understanding=profitability in the markets. So does simplicity.

So watch this video as many times as you guys need, keep it simple, and watch this change your trading starting TODAY for the GOOD!

Cheers!

EUR/USD Elliott Wave: Corrective Pullback in Progress Wave ((4))EUR/USD 4H chart with Elliott Wave count. The pair remains in a steady downtrend after peaking at the wave (C) high, and is now in the middle of a larger wave iii decline. Bearish impulse waves dominate, with lower lows confirming the trend (mid-wave iii scenario). Now expecting a wave ((4)) relief bounce (corrective) within this wave iii. Price could rebound toward 1.15788–1.16153, the ~38.2–50% Fibonacci retracement zone of the prior drop.

This area is a likely resistance for the bounce, suggesting only a temporary uptick in an otherwise bearish move. After wave ((4)) completes, the downtrend should resume as wave ((5)) of iii kicks in. The next downside target is around 1.13974 (or lower) – near a 1.618 Fibonacci extension projection where wave ((5)) may complete. This would likely finish wave iii and aligns with the broader bearish Elliott Wave count.

EURUSD ahead of the FEDEURUSD remains below the 1,1600 level following the trade agreement between the US and the European Union.

Today, all eyes are on the FED’s decision regarding interest rates.

Watch for a reaction around the support zone, as it may present an opportunity for the trend to continue.

However, it's advisable to reduce risk and hold off on new entries until after the news is released.

TRADE UPDATE – LIVE SHORT IN PLAY⚠️ TRADE UPDATE – LIVE SHORT IN PLAY

📉 Pair: EUR/USD

🔹 Entry: 1.1665 (Short)

🔒 SL: 1.1800

🎯 TP1: 1.1500

📍 Current Price: 1.1633

🧮 Current R:R (TP1): 1.22:1

🧱 Renko Structure: Active inside Brick 16 (1.1600–1.1700)

📊 Bias: Bearish continuation confirmed

⸻

🧠 Why We’re In This Trade:

• The previous long thesis is invalidated — price closed below 1.1700 and rejected Brick 17

• We’re now inside Brick 16, actively rotating downward

• Momentum is cleanly bearish, with H1 confirming lower highs

• 1.1500 is the first Renko target, and macro structure favors continuation to 1.1400+

• All bricks beneath 1.1600 are clean — no support zones until TP1

⸻

🎯 NEXT TARGET ZONE: 1.1500 (TP1)

〰️ Brick 14 Confirm — High-probability completion zone for current leg

⸻

📌 Action Plan:

✅ If price breaks and closes below 1.1600:

→ Move SL to BE

→ Watch for fast drop toward 1.1500

❌ If price closes above 1.1700:

→ Structure is weakening — prepare to cut or re-evaluate

❌ If 1.1800 hits:

→ Full invalidation — trade thesis broken

⸻

📛 Reminder:

No new longs allowed unless Brick 17 (1.1700+) is fully reclaimed

No FOMO shorts — only add on rejection spikes or full brick closes

Bullish momentum to extend?The Fiber (EUR/USD) is falling towards the pivot, which acts as an overlap support and could rise to the 1st resistance, which has been identified as a swing high resistance.

Pivot: 1.1588

1st Support: 1.1447

1st Resistance: 1.1817

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/USD: A Fragile Rebound Within a Broader Bearish TrapEUR/USD has managed to stage a slight recovery after plunging through the key 1.1680 support — a level that had held firm for two weeks. The pair is now hovering just above 1.1500, but the bounce appears shallow and unconvincing. Volume remains low, momentum indicators offer little confirmation, and the broader structure still points to a prevailing downtrend.

On the H2 chart, price has rebounded from the 1.1505 area — a minor support formed during July's short-term consolidation. Yet, the EMA slope remains strongly negative, and RSI is struggling below the neutral 50 mark after exiting oversold territory. The structure continues to display classic lower highs and lower lows, with the 1.1585–1.1600 zone emerging as a potential resistance area for bears to re-enter.

From a macro perspective, the U.S. dollar remains supported by expectations that the Fed will maintain a hawkish stance, fueled by solid GDP, durable goods, and PCE data. In contrast, the Eurozone struggles with signs of stagnation, with both services and manufacturing PMIs deteriorating — most notably in Germany. This policy divergence continues to favor the greenback.

Unless bulls manage to decisively reclaim the 1.1600 zone with strong follow-through buying, any rebound risks being nothing more than a dead cat bounce. The downside target remains near 1.1460 – 1.1440 in the near term.

EURUSD – Post-FOMC Macro Compression in Play📉 EURUSD – Post-FOMC Macro Compression in Play

WaverVanir | VolanX Protocol | July 30, 2025

The recent Fed hold has added pressure to the euro as rate differentials remain in favor of the USD. On the chart, EURUSD failed to sustain above the 0.786 retracement level (~1.1476), with clear signs of exhaustion.

🧠 Thesis:

We may see a macro compression pullback with EURUSD potentially revisiting the baseline support zone at 1.08147, which previously acted as a long-term resistance-turned-support.

🔍 Technical Confluence:

Rejection near 0.786 Fib (1.1476)

No bullish breakout above 2023–2024 ceiling

Downside targets:

1.1070 → short-term support

🟡 1.0815 → baseline zone and decision point

🧠 Macro Overlay:

Fed is in pause-and-watch mode

ECB growth outlook is slowing

US inflation is stickier = USD strength persisting short term

📌 VolanX DSS Summary: Bearish structure developing. We favor tactical shorts on rallies toward 1.1470–1.15 with eyes on the 1.08 handle.

#EURUSD #FOMC #VolanX #WaverVanir #MacroTrading #ForexSignals #USD #ECB #RateDifferential #Fibonacci #SMC #Liquidity #ForexMacro

A POTENTIAL TREND REVERSAL Hello Traders 👋

What are your thoughts on EURUSD

Looking at the daily timeframe we can see that price action didn't take out the liquidity which is located with a blue rectangle which is also acting as the all-time high for EURUSD.

I'm seeing price retracing to reach the liquidity around that blue rectangle and then after start falling downwards.

Let's look at the fundamentals of EURUSD

Trump announced the conclusion of a trade agreement with the EU:

The EU will invest $600 billion more in the US than before

15% tariff on EU goods, including cars

All EU countries will open their markets to the US

EU to purchase hundreds of billions of dollars worth of military equipment

EU to purchase $750 billion worth of energy from the US. Energy is a key part of the agreement.

PS:

It is worth monitoring the market reaction from the opening. Pay attention to the market reaction during different sessions.

Markets may react ambiguously, but against the general backdrop, the following reaction should be expected:

USD → sharp rise (dollar strengthening due to capital inflows and growth in energy exports).

EUR → down, as the EU will bear the costs of tariffs and rising imports from the US.

Gold → down (correction or decline due to the strengthening of the dollar and reduced demand for hedging).

BTC → neutral or slight decline (due to USD strength):

If the agreement stimulates the economy and liquidity, this could be a bullish factor for BTC.

………………………………………….

Trend decision after the newsAfter the news, the price nearly reached the bottom of the higher time frame channel and paused. We need to see whether the price can break into the channel or not. Personally, I don’t think that will happen. I believe a range will form within the marked zone, and then the price will drop further.

EURUSD - 31/7/25Price has reached a zone that broke the structure - see BoS on the left. Now that price is here in the zone, im not comfortable entering a buy order yet. The full bearish candle into the zone, leaves me with an indication that price may go lower.

+ve:

1. Big bearish candle in to the BoS zone - price may drop lower

2. There is equal low liquidity on the left which sits just below the zone which is expected to be taken out

4. HTF direction is still bullish

-ve:

1. below the equal low liquidity is an efficient zone before some imbalance

2. that imbalance may draw price to it and stop me out

Second trade idea:

Assuming that the first trade does not hold, then my focus will be the extreme zone where i will place a buy limit.

TP: 8.86R