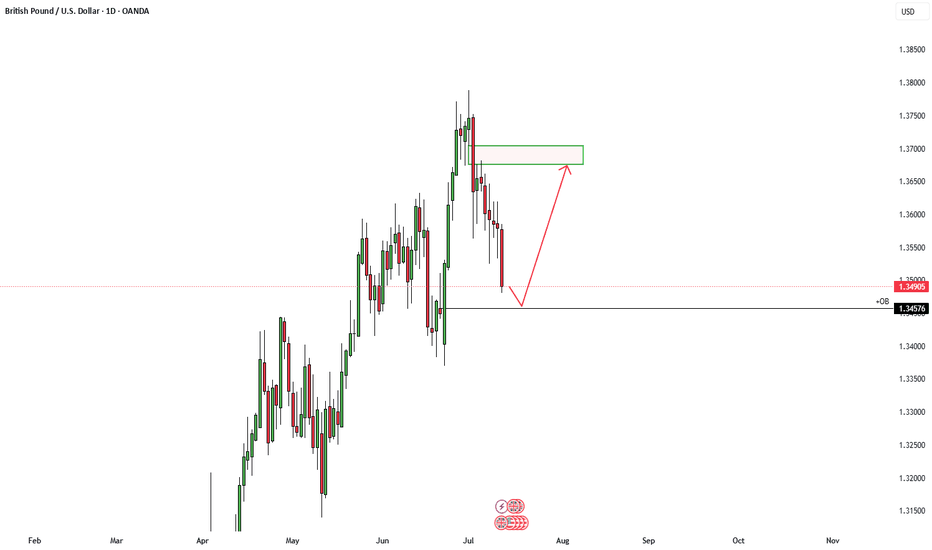

Falling towards major support?The Cable (GBP/USD) is falling towards the support which is an overlap support that lines up with the 78.6% Fibonacci projection and could bounce from this level to our take profit.

Entry: 1.3396

Why we like it:

There is an overlap support that lines up with the 78.6% Fibonacci projection.

Stop loss: 1.3318

Why we like it:

There is a pullback support.

Take profit: 1.3503

Why we like it:

There is a pullback support.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

USDGBP trade ideas

GBPUSD is in the Selling DirectionHello Traders

In This Chart GBPUSD HOURLY Forex Forecast By FOREX PLANET

today GBPUSD analysis 👆

🟢This Chart includes_ (GBPUSD market update)

🟢What is The Next Opportunity on GBPUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

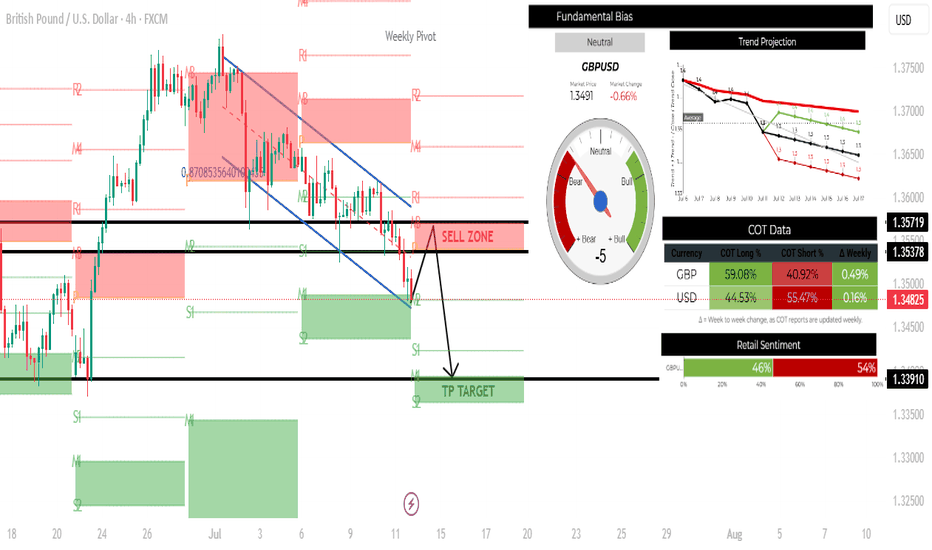

GBPUSD: Poised for more decline next weekGBPUSD: Poised for more decline next week

GBPUSD completed another bearish pattern on Friday and fell again.

In my personal opinion, it is a bit unclear all this bearish momentum in many GBP pairs, however, GBPUSD remains well positioned for further declines.

Over the coming week, the focus should be on inflation data from the UK and the US. Perhaps this could be enough of a catalyst and support the downward movement in the same way that the pattern indicates.

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

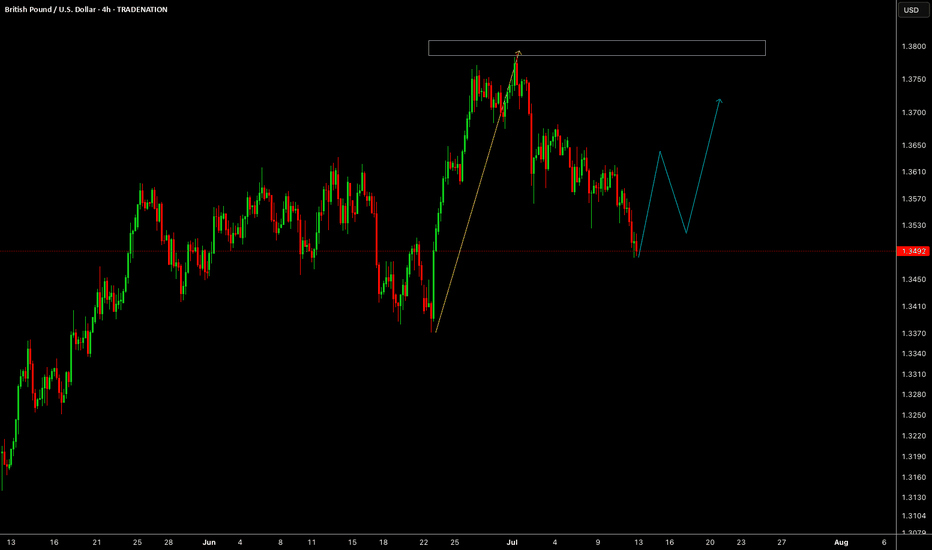

USD Strengthens Against GBP With New Tariff AnnouncementsThis is the Weekly FOREX Forecast for the week of July 14 - 18th.

In this video, we will analyze the following FX market: GBPUSD

The latest headlines tell the story. The tariffs are triggering a slow run to the USD safe haven. The previous week showed the USD Index closed pretty strong, while GBPUSD weakened.

There's a good chance we'll see more of the same this coming week.

Look for the strength in USD to continue to be supported by fundamental news, and outperform the other major currencies, including the GBP.

Buy USD/xxx

Sell xxx/USD

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

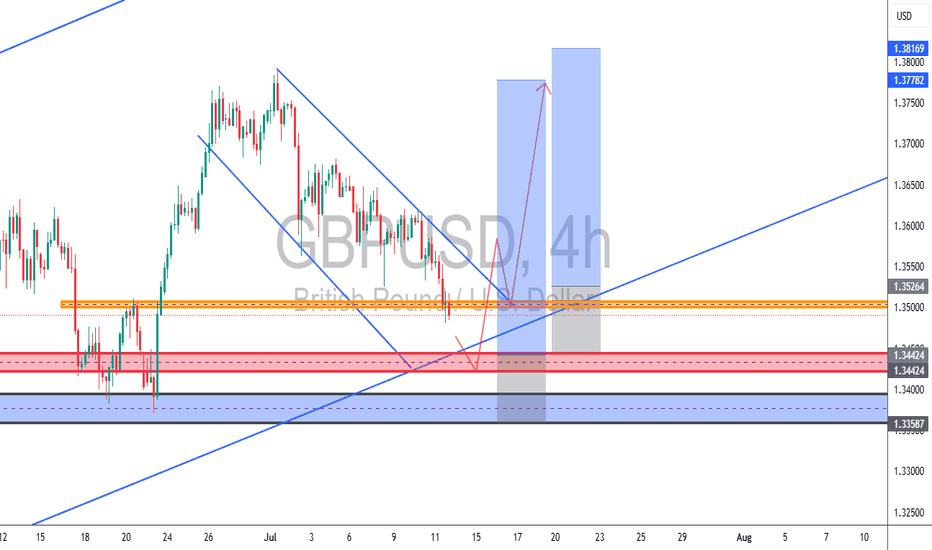

GBPUSD – Countertrend Wedge Setup Near Key Demand (TCB Strategy📈 GBPUSD – Countertrend Wedge Setup Near Key Demand (TCB Strategy Setup in Progress)

Timeframe: 4H

Strategy Phase: ✅ Countertrend Phase (Falling Wedge + Liquidity Sweep Potential)

🔍 Analysis:

GBPUSD is currently forming a falling wedge correction within a higher-timeframe bullish trend. Price is approaching a major confluence zone between 1.3442 and 1.3358, which includes:

Stacked demand zones (HTF support)

A rising trendline from the previous bullish leg

The wedge’s lower boundary

Potential liquidity pockets below recent lows

If price sweeps the zone and gives a bullish engulfing or reversal candle, this would trigger a TCB Countertrend entry targeting a breakout and continuation to the upside.

📌 Watchlist Trade Setup:

Entry Zone: 1.3442 – 1.3358 (awaiting confirmation)

Stop Loss: Below 1.3358

Take Profit 1: 1.3526

Take Profit 2: 1.3778

Take Profit 3 (extended): 1.3816

Risk-to-Reward: Potential 1:3 – 1:4+

📋 TCB Strategy Confluences:

Falling Wedge Structure ✅

Demand Zone Support ✅

Trendline Support ✅

Liquidity Trap Potential ✅

Clean Structure to TP ✅

🧠 Waiting for:

Bullish candle confirmation (engulfing/pin bar)

Breakout of wedge or sweep-reversal scenario

Final check for news before entry

📚 Strategy: TCB (Trend – Countertrend – Breakout)

Looking for clean, high-RR reversals from structure with momentum confirmation.

#GBPUSD #Forex #TCB #Breakout #Trend #Countertrend #ForexTrading #TradeSetup #TechnicalAnalysis

GBPUSD MULTI TIME FRAME ANALYSISHello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

🧠💡 Share your unique analysis, thoughts, and ideas in the comments section below. I'm excited to hear your perspective on this pair .

💭🔍 Don't hesitate to comment if you have any questions or queries regarding this analysis.

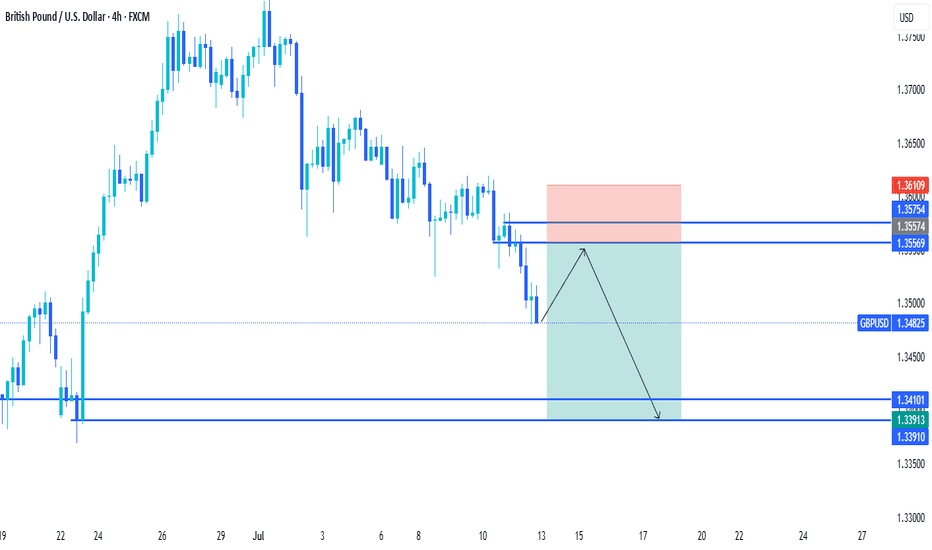

GBPUSD H4 SHORT SETUP: 14-18 JULY 2025TECHNICAL ANALYSIS

Price and market both bearish, with price currently at support. This pair will have to pull back to the resistance level before bears can look to short.

FUNDAMENTAL ANALYSIS

The currency pair GBPUSD has a score of -3, indicating that the base currency is weaker than the quote currency. The trend projection also shows further downside.

The COT report is slightly neutral for both currency pairs, and retail sentiment is 54% bearish. Although the COT is neutral, in a trade like this, the trend is your friend until technical indicators suggest otherwise.

GBPUSD LONG TERM GBPUSD Live Trading Session/ GBPUSD analysis #forex #forextraining #forexHello Traders

In This Video GBPUSD HOURLY Forecast By World of Forex

today GBPUSD Analysis

This Video includes_ (GBPUSD market update)

GBPUSD Analysis today | Technical and Order Flow

#usdjpy #usdchftechnicalanalysis #usdjpytoday #gold

What is The Next Opportunity on GBPUSD Market

how to Enter to the Valid Entry With Assurance Profit?

This Video is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts.

Disclaimer: Financial Trading Has Large Potential Rewards, But Also Large Potential Risk. You must be aware of the Risk and Be Welling to Accept Them in order to Trade the Financial Market . Please be Carefully With Your Money.

We are talking about future market, anything can Happen,Markets are Always like that.dnt Risky more Than 2% of your account

Now you can join with our "vip premium" service

Join us and let's make trading together

GBPUSD - Also continued downside continuationLooking at GU. This is a little bit ahead of its time in comparison to EU.

And what i mean by that is EU is a lot further away from its 4H demand zone compared to GBP so it will be super interesting to see how we react at the level we are fast approaching on GU.

I am in a short position as of Friday. I will be posting a video tomorrow showing exactly how and why i got short on GU so stay tuned for that one.

As always if there is anything else i can be of assistance with give me a message and i will be happy to answer any questions you may have

GBP/USD - Potential TargetsDear Friends in Trading,

How I see it,

PIVOT @ 1.35300

High TF Bullish:

1) The Daily bullish trend is still intact at this time.

2) We need a strong bounce/breach and hold above PIVOT

for 1D trend to continue.

Potential for more downside:

1) If price remains below PIVOT, potential for further downside

remains high.

Keynote:

Monitor price action closely around 1,34000 area.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time to study my analysis.

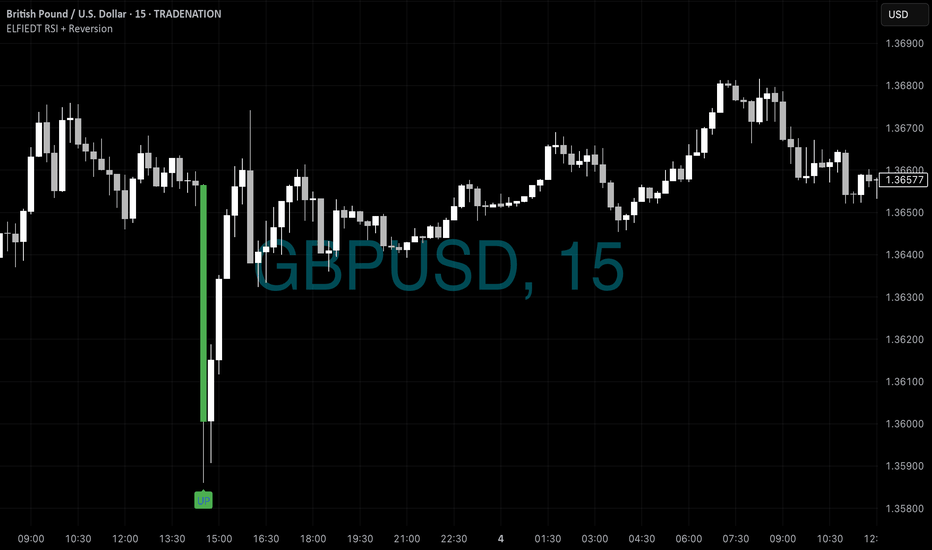

GU - Longs📉📈 GBPUSD 15min – ELFIEDT RSI + Reversion Catches the Knife

🧠 Precision Signal | Zero Delay | Real Trade Example

The ELFIEDT RSI + Reversion indicator once again proves its edge — this time on a sharp GBPUSD selloff, where it called the bottom within a single bar of the low.

🟩 Perfect “UP” Signal After Flash Crash

During the NY session, GBPUSD experienced a sudden and aggressive selloff, dropping nearly 80 pips within a few candles.

While many traders panic or chase the move, the indicator calmly printed a high-conviction UP signal at the bottom wick of the final dump candle.

🔹 Hypothetical Trade Idea:

Entry: On candle close after the UP signal

Stop-loss: Just a few pips below the signal wick (tight risk)

Reward: Price rallied over 100 pips in the following hours — perfect mean reversion setup with minimal drawdown

✅ No delay.

✅ No repaint.

✅ No guesswork.

🔍 Why It Matters

Most indicators react late — this one anticipated exhaustion right at the turn.

The result: a low-risk, high-reward setup, spotted live, not in hindsight.

💼 Want access to more advanced versions?

This is only the public edition of ELFIEDT RSI + Reversion.

Advanced builds include:

Multi-timeframe confirmation

RSI trendline breakouts

Hidden divergences

3SD band expansions

Smart signal stacking logic

📩 Message now to apply for access — limited seats for serious traders only.

#GBPUSD #ReversalTrade #ELFIEDT #SmartSignals #ForexTrading #15mChart #MeanReversion #PrecisionTools #TradingView

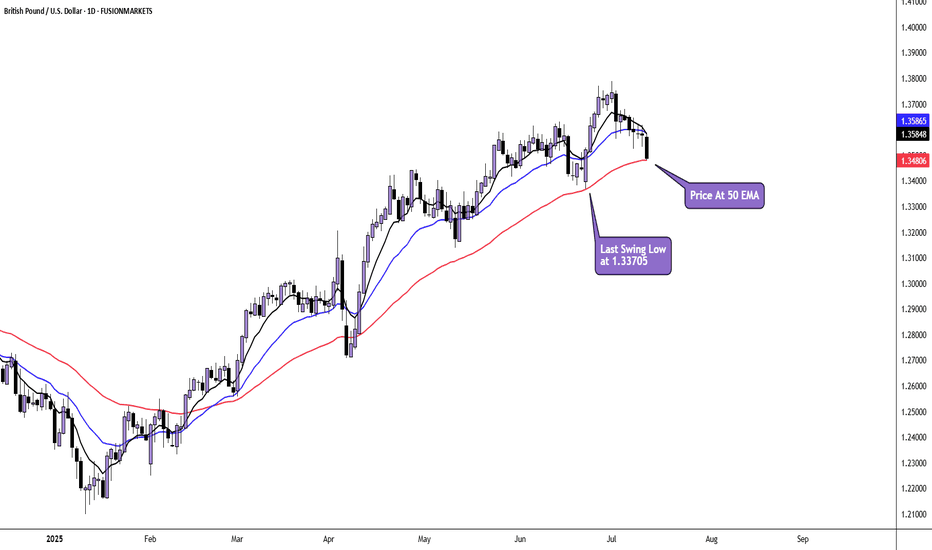

GBP/USD Daily AnalysisPrice is in a daily uptrend and has pulled back to the 50 moving average.

Here, price may find support and set up for another bullish impulse.

However, if price breaks the last swing low at 1.33705, we may have seen a top formed and a change in sentiment.

If you agree with this analysis. look for a trade that meets your strategy rules.

GBP/USD BULLS ARE GAINING STRENGTH|LONG

Hello, Friends!

It makes sense for us to go long on GBP/USD right now from the support line below with the target of 1.361 because of the confluence of the two strong factors which are the general uptrend on the previous 1W candle and the oversold situation on the lower TF determined by it’s proximity to the lower BB band.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅