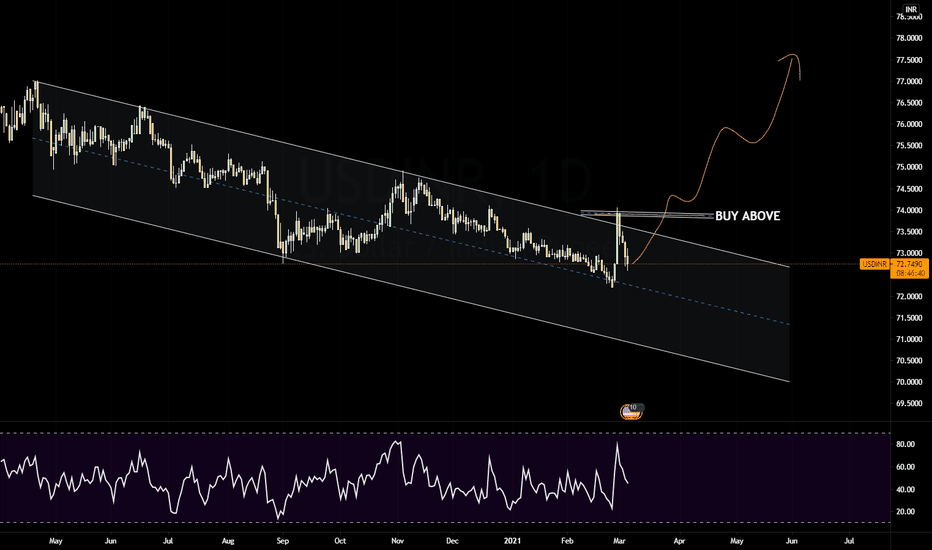

USDINR trade ideas

USDINR 75 CE 07 MAY 2021DATE: 29.4.21

Very high-risk trade

INSTRUMENT: USDINR

75.00 CE 07 MAY 21.

CMP.0525

BUY ABOVE: .0635

SL:.0400

TGT 01: .0705

TGT 02: .0878

TGT 03: .1050

RISK DISCLAIMER:

We are not SEBI registered analysts. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.

USD/INR short: section fast transactionsHi everyone! On the week chart USD/INR pair moves in an upside channel towards its lower bound. And also now the price overcame the important trend line down and tested it from below. Now some indicators indicate continuation of the movement down. Therefore I expect price movement down at least to two following supports (my purposes).

Short on 73.3470

TP1 = 72.76

TP2 = 72.52

Information provided is only educational and should not be used to take action in the market.

This section is intended for short-term speculation. Be ready to leave a position at any time.

USDINR at key support reversal to happenOn monthly chart USDINR is at key support and has higher chance of reversing up to 75 in coming months. The support is from 20 Month moving average and trendline from 2012 low. hence for long term traders better be on the buy side as dollar is also seen strengthening in coming months.

USDINR forecastThis one is for my friends in finance sector in India. By the looks of the chart, INR is going to strengthen against USD and if the pair breaks 72.60, it opens the door for 72 and if it breaks 72 then to 70 / 68. On the timelines, it may reach 72 by June / July 2021 and then 70 possibly by end of 2021.

Whether it is a double zigzag/motive wave it ends >72.2950The current corrective wave might be at wave 5 of motive wave A as shown below

OR

At wave C in Wave Y of a double zigzag as shown below

Whatever might be the count, it's end might be at 72.65 - 72.5

In either of the cases (whether wave C in Y or wave 5), if predicted correctly as an ending diagonal, this wave should end by 05 or 06 Feb/2021 but at not less than 72.2950. If the price crosses below 72.2950 then this wave count should be relooked.

Comments are welcome to answer whether this complete correction wave is a double zigzag or a motive wave A !!.